|

市場調查報告書

商品編碼

1906261

數位信任:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Digital Trust - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

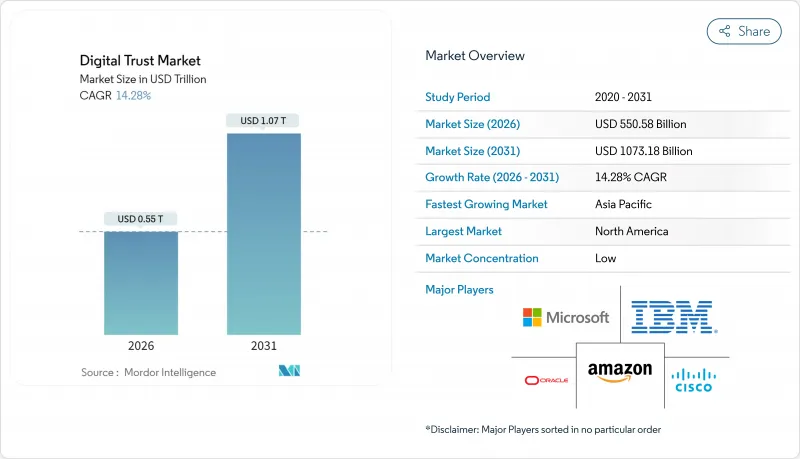

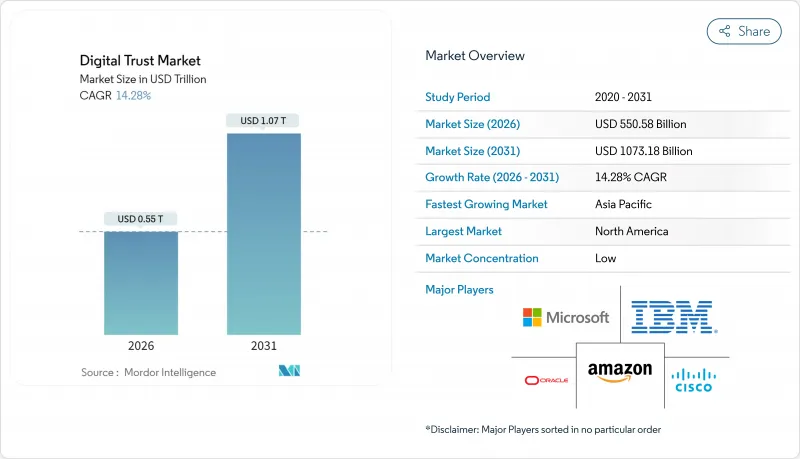

數位信任市場預計將從 2025 年的 4,817.9 億美元成長到 2026 年的 5,505.8 億美元,預計到 2031 年將達到 10731.8 億美元,2026 年至 2031 年的複合年成長率為 14.28%。

網路攻擊日益頻繁,資料外洩成本預計到2024年將平均達到488萬美元,全球隱私法規也日趨嚴格,這些因素迫使企業優先考慮在身分、裝置、應用程式和資料流等各個層面檢驗的信任機制。雲端遷移、人工智慧驅動的威脅偵測以及零信任架構的採用正在加速相關支出,而可攜式數位身分錢包和機器間信任要求則擴大了這一領域的機會。隨著平台供應商透過收購和合作整合自身能力,打造能夠降低客戶營運複雜性的整合解決方案,競爭格局仍在不斷變化。

全球數位信任市場趨勢與洞察

資料外洩事件的發生頻率和成本日益增加

網路犯罪日益猖獗,全球平均每11秒就會發生一起勒索軟體攻擊。醫療機構遭受的網路攻擊平均每次損失高達1,093萬美元,而金融機構每次損失則高達604萬美元。已實施人工智慧驅動的安全防護和自動化技術的機構已將資料外洩成本降低了220萬美元,這不僅體現了該技術的保護優勢,也揭示了其風險因素。中小企業仍然十分脆弱,60%的企業在遭受嚴重網路攻擊後的六個月內破產,而43%的網路攻擊事件的目標正是它們。

全球範圍內不斷擴大隱私權保護和電子身分識別法規

到2025年,全球75%的人口將生活在現代資料隱私法律的保護之下。歐盟的eIDAS 2.0要求所有成員國在2026年前實施數位身分錢包,並強制私部門在2027年12月前接受數位身分錢包。美國、歐盟和亞太地區(APAC)不同的框架正在增加跨國公司的遵循成本。隨著行動優先策略在新興經濟體的普及,預計到2024年,數位身分平台的用戶數量將達到50億。

消費者「同意疲勞」正在降低用戶參與度。

儘管97%的消費者關注線上資料隱私,但只有8%的人完全信任品牌,一年內下降了2個百分點。 89%的使用者感到密碼疲勞,54%的使用者會放棄需要繁瑣登入流程的服務。簡化的無密碼流程可以在不犧牲安全性的前提下提高使用者滿意度。

細分市場分析

到2025年,解決方案業務將佔總收入的61.85%,這主要得益於身分驗證平台、認證服務和詐欺偵測引擎的推動,這些產品和服務構成了數位信任基礎的核心。然而,到2031年,託管服務和專業服務將以14.72%的複合年成長率成長,這反映出企業越來越依賴第三方在零信任設計、監管審核和加密敏捷轉型方面的專業知識。人才短缺迫使企業將保全行動,導致與資安管理服務提供者 (MSSP) 的合作日益增加。此外,由於74%的安全漏洞仍與人為錯誤有關,因此對培訓服務的需求也不斷成長。

供應商整合計劃推動了對服務的需求。整合專家確保企業在逐步淘汰冗餘的即插即用工具的過程中,業務連續性和資料完整性。託管安全服務填補了中小企業的人才缺口,而大型企業則聘請顧問公司建造威脅情報融合中心。平台供應商將諮詢服務打包出售,以促進用戶採納並降低解約率,從而增強基本客群留存率。

截至2025年,由於受監管產業將關鍵金鑰和日誌保存在實體資料中心,本地部署仍將維持65.05%的市場佔有率。然而,隨著超大規模資料中心業者資料中心將高階威脅情報來源和彈性處理功能整合到其原生安全套件中,到2031年,雲端解決方案的複合年成長率將達到15.96%。與僅採用本地部署的競爭對手相比,部署了雲端控制措施的組織可節省222萬美元的安全漏洞成本。

混合部署將成為主流,加密密集型工作負載仍保留在本地,而分析和策略引擎則遷移到SaaS平台。受滿足資料居住要求的自主雲端計畫的推動,雲端採用中的數位信任市場規模預計將以15.96%的複合年成長率成長。同時,工廠和零售店的邊緣運算將需要在設備附近實施分散式信任,從而催生對輕量級、無代理架構的需求。

全球數位信任市場按組件(解決方案和服務)、部署模式(雲端、本地部署)、企業規模(大型企業、中小企業)、終端用戶行業(銀行、金融服務和保險 (BFSI)、醫療保健等)以及地區進行細分。產業預測以美元計價,並包含成長趨勢、分析等內容。

區域分析

北美地區將繼續保持領先地位,預計到2025年將佔據34.85%的收入佔有率,這主要得益於各州隱私法(2023年美國國會提出了超過350項相關法案)以及遠超世界其他地區的企業預算。平均每次資料外洩造成的損失高達980萬美元,凸顯了採用人工智慧驅動的偵測技術和零信任架構的必要性。隨著大型企業選擇能夠提供證書、身分和存取管理 (IAM) 以及符合統一服務等級協定 (SLA) 的持續合規性的平台供應商,供應商整合正在加速進行。

亞太地區是成長最快的區域,預計到2031年將以14.31%的複合年成長率成長,這主要得益於行動網際網路的大規模應用和政府主導的電子識別項目。中國、日本和印度的製造業集群正在採用機器身分框架來保護工業4.0資產。印尼、菲律賓和越南對兼顧成本和快速部署的雲端原生信任層的需求日益成長。該地區的多元化發展也要求採用在地化的生物識別解決方案和支援多種語言的風險分析。

歐洲正受惠於eIDAS 2.0,該法案旨在建立通用的數位身分基礎,並力爭2030年實現80%的公民錢包普及率。由於金融監管機構敦促加快密碼學技術的應用,歐洲的後量子密碼試驗比其他地區更為先進。同時,與美國的資料傳輸限制提高了合規要求,歐盟內部的硬體安全模組(HSM)容量正成為信任服務供應商的競爭優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 資料外洩事件的發生頻率和成本日益增加

- 全球範圍內不斷擴大的隱私和電子識別法規

- 快速採用雲端技術推動零信任部署

- 利用人工智慧/機器學習進行詐欺檢測正變得越來越必要。

- 可重複使用/可攜式數位身分的出現

- 智慧工廠中機器間可靠度的必要性

- 市場限制

- 初始整合和授權成本

- 監管和標準化格局分散

- 消費者對同意機制的疲勞會導致參與度下降。

- 缺乏高品質的標註數據,這會影響人工智慧的可靠性和安全性。

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 對影響市場的宏觀經濟因素進行評估

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 服務

- 透過部署模式

- 基於雲端的

- 本地部署

- 按組織規模

- 主要企業

- 中小企業

- 按最終用戶行業分類

- 銀行、金融服務和保險(BFSI)

- 衛生保健

- 資訊科技/通訊

- 政府和公共部門

- 零售與電子商務

- 能源與公共產業

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Microsoft

- IBM

- Cisco Systems

- Amazon Web Services(AWS)

- Oracle

- Thales

- Entrust

- DigiCert

- Symantec(Broadcom)

- Okta

- DocuSign

- Ping Identity

- OneTrust

- Trulioo

- Jumio

- Mitek Systems

- Onfido

- CyberArk

- Palo Alto Networks

- Sift

- White-Space and Unmet-Need Assessment

The digital trust market is expected to grow from USD 481.79 billion in 2025 to USD 550.58 billion in 2026 and is forecast to reach USD 1073.18 billion by 2031 at 14.28% CAGR over 2026-2031.

Heightened cyber-attack frequency, rising data-breach costs averaging USD 4.88 million in 2024, and stringent global privacy regulations are compelling enterprises to prioritize verifiable trust mechanisms across identities, devices, applications, and data flows. Cloud migration, AI-enabled threat detection, and Zero-Trust architecture adoption collectively accelerate spending, while portable digital identity wallets and machine-to-machine trust requirements enlarge the addressable opportunity. Competitive dynamics remain fluid as platform vendors consolidate capabilities through acquisitions and alliances, enabling integrated offerings that reduce operational complexity for customers.

Global Digital Trust Market Trends and Insights

Rising frequency and cost of data breaches

Cybercrime are growing significantly, and ransomware attacks occur every 11 seconds worldwide. Healthcare incidents average USD 10.93 million per breach, while financial institutions face USD 6.04 million per event. Organizations that deploy AI-driven security and automation shave USD 2.2 million off breach expenses, illustrating technology's dual protective and risk factors. SMEs remain vulnerable; 60% fail within six months of a serious cyberattack, yet 43% of incidents already target them.

Expanding global privacy and e-ID regulations

Seventy-five percent of the world's population will live under modern data-privacy laws by 2025. The European Union's eIDAS 2.0 mandates digital identity wallets for all member states by 2026 and compels private-sector acceptance by December 2027. Divergent frameworks across the US, EU, and APAC increase compliance expense for multinationals. Digital identity platform usage is expected to reach 5 billion people in 2024 as mobile-first schemes proliferate in emerging economies.

Consumer "consent fatigue" eroding engagement

Ninety-seven percent of consumers worry about online data privacy, yet just 8% fully trust brands - down two percentage points in a year. Password exhaustion affects 89% of users; 54% abandon services that require cumbersome log-ins. Streamlined, passwordless flows lift satisfaction without sacrificing security.

Other drivers and restraints analyzed in the detailed report include:

- Rapid cloud adoption triggering Zero-Trust roll-outs

- AI/ML-powered fraud detection becoming table-stakes

- Fragmented regulatory and standards landscape

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions retained 61.85% of 2025 revenue, anchored by identity verification platforms, certificates, and fraud-detection engines that form the core of digital trust infrastructure. Yet managed and professional services will grow 14.72% CAGR through 2031, reflecting organizations' reliance on third-party expertise for Zero-Trust design, regulatory audits, and crypto-agile transitions. Staffing shortages press enterprises to outsource security operations, pushing MSSP partnerships higher. Training services expand because 74% of breaches still involve human error.

Vendor-consolidation programs amplify services demand; as organizations retire overlapping point tools, integration specialists ensure continuity and data integrity. Among SMEs, managed security offsets talent scarcity, while large enterprises engage consultancies to orchestrate threat-intelligence fusion centers. Platform vendors bundle advisory packages to boost adoption and reduce churn, reinforcing stickiness across their customer base.

On-premises deployments preserved 65.05% share in 2025 as regulated verticals retain critical keys and logs in physical data centers. However, cloud options will log a 15.96% CAGR to 2031 as hyperscalers embed sophisticated threat-intel feeds and elastic processing into native security suites. Organizations implementing cloud controls report USD 2.22 million lower breach costs than purely on-prem rivals.

Hybrid patterns prevail; encryption-intensive workloads remain on-premises, while analytics and policy engines shift to SaaS. Digital trust market size for cloud deployments is projected to advance at 15.96% CAGR, catalyzed by sovereign-cloud initiatives that satisfy data-residency demands. Meanwhile, edge computing in factories and retail branches necessitates distributed trust enforcement close to devices, creating openings for lightweight agentless architectures.

Global Digital Trust Market is Segmented by Component (Solutions and Services), Deployment Mode (Cloud, On-Premises), Enterprise Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), End-User Industry (Banking, Financial Services and Insurance (BFSI), Healthcare, and More) and by Geography. The Industry Forecasts are Provided in Terms of Value (USD). Covers Growth Trends, Analysis and More.

Geography Analysis

North America led with 34.85% revenue share in 2025, strengthened by state privacy laws - more than 350 bills tabled in US legislatures during 2023 - alongside enterprise budgets that dwarf global peers. Average breach costs of USD 9.8 million justify strategic adoption of AI-powered detection and zero-trust blueprints. Vendor consolidation accelerates as large firms select platform providers able to bundle certificates, IAM, and continuous compliance under unified SLAs.

Asia-Pacific is the fastest-growing region at 14.31% CAGR through 2031, riding on mass-scale mobile internet usage and government-backed e-ID programs. Manufacturing corridors in China, Japan, and India deploy machine-identity frameworks to secure Industry 4.0 assets. Indonesia, the Philippines, and Vietnam drive demand for cloud-native trust layers that balance cost with rapid rollout. Variability across the region necessitates localized biometric solutions and language-aware risk analytics.

Europe benefits from eIDAS 2.0, which sets a common digital-identity baseline and targets 80% citizen-wallet adoption by 2030. Post-quantum cryptography pilots are more advanced here than in any other region, as financial watchdogs urge crypto-agile readiness. Meanwhile, data-transfer restrictions with the US add compliance layers, making on-EU-soil HSM capacity a competitive differentiator for trust-service providers.

- Microsoft

- IBM

- Cisco Systems

- Amazon Web Services (AWS)

- Oracle

- Thales

- Entrust

- DigiCert

- Symantec (Broadcom)

- Okta

- DocuSign

- Ping Identity

- OneTrust

- Trulioo

- Jumio

- Mitek Systems

- Onfido

- CyberArk

- Palo Alto Networks

- Sift

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising frequency and cost of data breaches

- 4.2.2 Expanding global privacy and e-ID regulations

- 4.2.3 Rapid cloud adoption triggering Zero-Trust roll-outs

- 4.2.4 AI/ML-powered fraud detection becoming table-stakes

- 4.2.5 Emergence of reusable / portable digital identitiesf

- 4.2.6 Machine-to-machine trust needs in smart factories

- 4.3 Market Restraints

- 4.3.1 Up-front integration and licensing costs

- 4.3.2 Fragmented regulatory and standards landscape

- 4.3.3 Consumer consent fatigue eroding engagement

- 4.3.4 Limited high-quality labelled data for Trust-and-Safety AI

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud-Based

- 5.2.2 On-Premises

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium-sized Enterprises (SMEs)

- 5.4 By End-User Industry

- 5.4.1 Banking, Financial Services and Insurance (BFSI)

- 5.4.2 Healthcare

- 5.4.3 IT and Telecommunications

- 5.4.4 Government and Public Sector

- 5.4.5 Retail and E-Commerce

- 5.4.6 Energy and Utilities

- 5.4.7 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft

- 6.4.2 IBM

- 6.4.3 Cisco Systems

- 6.4.4 Amazon Web Services (AWS)

- 6.4.5 Oracle

- 6.4.6 Thales

- 6.4.7 Entrust

- 6.4.8 DigiCert

- 6.4.9 Symantec (Broadcom)

- 6.4.10 Okta

- 6.4.11 DocuSign

- 6.4.12 Ping Identity

- 6.4.13 OneTrust

- 6.4.14 Trulioo

- 6.4.15 Jumio

- 6.4.16 Mitek Systems

- 6.4.17 Onfido

- 6.4.18 CyberArk

- 6.4.19 Palo Alto Networks

- 6.4.20 Sift

- 6.5 White-Space and Unmet-Need Assessment