|

市場調查報告書

商品編碼

1906254

塑膠托盤:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Plastic Pallets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

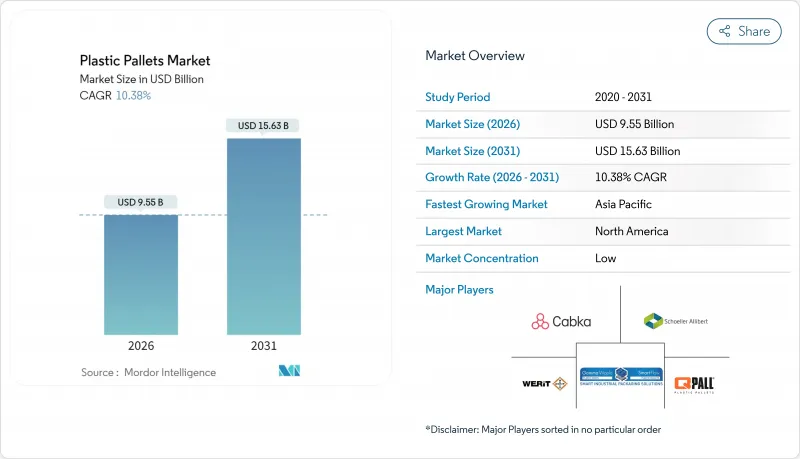

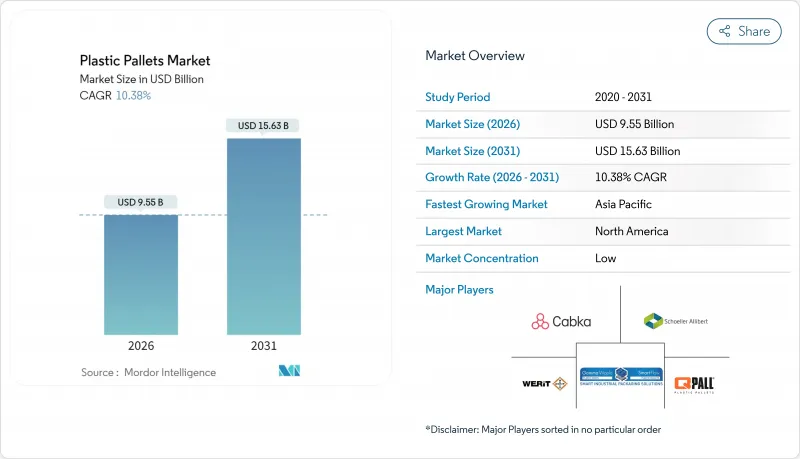

預計塑膠托盤市場將從 2025 年的 86.5 億美元成長到 2026 年的 95.5 億美元,到 2031 年將達到 156.3 億美元,2026 年至 2031 年的複合年成長率為 10.38%。

藥品低溫運輸衛生標準的加強、木材符合ISPM-15標準的成本以及自動化倉庫設計是推動塑膠托盤市場成長要素。將資本支出轉化為營運成本的共享系統也促進了需求的成長,使共用資產對第三方物流公司更具吸引力。歐盟範圍內的聚烯樹脂回收計畫進一步推動了市場發展,使托盤符合循環經濟目標。同時,與原油價格相關的樹脂價格波動給製造商的短期利潤率帶來了壓力。

全球塑膠托盤市場趨勢與洞察

在藥品低溫運輸中採用衛生塑膠托盤

根據美國食品藥物管理局 (FDA) 的規定,托盤被歸類為運輸設備,因此其可清洗、無孔的設計對於藥品物流至關重要。塑膠托盤具有防潮性能,並且在溫度波動期間能夠保持結構穩定,與木質托盤相比,降低了污染風險。歐洲製造商,例如 Schoeller Allibert,提供專為無菌藥品生產設計的無塵室相容型托盤。由於產品召回成本不斷攀升,塑膠托盤正逐漸成為受監管低溫運輸的標準基礎設施。北美地區對塑膠托盤的需求強勁,這主要得益於疫苗的持續高需求,而類似的衛生標準也正在歐洲各地推廣。

ISPM-15合規性要求推動木材向塑膠的轉型

國際植物檢疫措施標準第15號(ISPM-15)要求木質包裝必須經過熱處理或燻蒸,增加了亞洲出口的成本和延誤。塑膠托盤符合豁免條件,在中國、越南和泰國等國家/地區具有即時的合規優勢。出口商可以避免每個托盤12至15美元的加工費,進而提高大宗貨物的利潤率。美國木材標準委員會嚴格的審核程序增加了行政負擔,進一步抑制了木材的使用。隨著貿易路線前置作業時間的縮短,塑膠托盤在已簽署ISPM-15的182個國家提供了確定性,並加快了清關速度。

新興東南亞中小企業面臨的初始資本成本障礙

塑膠托盤的成本是木製托盤的三到五倍,這給融資緊張的中小型企業帶來了沉重的負擔,而中小型企業佔該地區企業總數的98.7%。雖然有補貼貸款,但這些貸款很少能涵蓋如此大規模的營運資金升級。在印度尼西亞,小規模加工商主導塑膠生產,投資回收期遠超過一般的規劃週期。如果沒有成本分攤機制,採用塑膠托盤的將僅限於大型出口商和那些能夠透過高周轉率攤銷投資的企業。目前,製造商提供價格較低的再生材料托盤,但資金籌措缺口依然存在。

細分市場分析

截至2025年,高密度聚乙烯(HDPE)憑藉其優異的耐化學腐蝕性能,在塑膠托盤市場佔據了66.03%的佔有率,深受製藥和食品生產商的青睞。目前,塑膠托盤市場高度重視再生樹脂,受歐盟強化的再生材料含量要求影響,預計到2031年,再生材料市場將以12.29%的複合年成長率成長。由於原生樹脂價格與原油價格密切相關,波動性較大,再生HDPE更具經濟吸引力,能有效降低生產商的原料成本。 Q-Pall等製造商已開始生產98%再生材料製成的托盤,證明了大規模生產的技術可行性。隨著歐洲市場需求的激增,持續的監管壓力預計將進一步縮小再生材料與原生材料之間的價格差距。

再生聚合物也符合企業ESG政策,因此,運輸包裝領域對審核的永續性認證的需求日益成長。塑膠托盤市場受益於其可反覆破碎和重塑而不劣化的特性,這使其能夠融入木棧板無法實現的循環經濟模式。生產商正在投資建造清洗生產線,以確保去除污染物,使再生高密度聚乙烯(HDPE)達到食品級標準。北美買家正在試用再生材料產品,以對沖樹脂價格上漲的風險,而亞洲出口商則積極採用此類產品,以在競標中凸顯其低碳足跡。

到2025年,可堆疊托盤將佔全球收入的42.10%,這主要得益於其能夠將空載回運成本降低高達80%。然而,貨架式托盤市場預計將以11.62%的複合年成長率成長。這是因為自動化倉庫對托盤撓度有嚴格的要求,而可堆疊托盤往往無法滿足這項要求。採用自動化立體倉庫(AS/RS)系統的零售商更傾向於使用貨架式托盤,因為這種托盤在承受一噸靜態負載的情況下,撓度可以保持在6毫米或以下,從而確保輸送機的運作。製造商正在利用玻璃纖維增強高密度聚乙烯(HDPE)來解決這個問題,這種材料可以在不增加重量的情況下提高托盤的剛度。

可堆疊托盤在重工業應用中仍佔有一席之地,這些應用需要堅固的平台來實現兩層或三層的堆疊,但其成長速度低於貨架式托盤。展示托盤是一個細分市場,主要用於大型零售商店的促銷活動,但其獨特的尺寸限制了需求的波動。塑膠托盤市場仍在努力平衡嵌套式設計(強調節省空間的運輸)和貨架式托盤(適用於自動化物流),許多貨運公司透過結合使用這兩種托盤形式來最佳化其供應鏈。

區域分析

到2025年,北美將佔全球收入的29.20%,這得益於成熟的托盤池網路和FDA的衛生法規(推動了可重複使用和可清洗托盤平台的發展)。 ORBIS位於德克薩斯州格林維爾的新工廠表明,該公司將繼續投資以滿足當地對自動化相容托盤的需求。零售配送中心的自動化進一步推動了托盤的普及,塑膠托盤的尺寸公差比木質托盤更小,從而減少了輸送機的停機時間。

亞太地區是成長最快的地區,預計到2031年將維持14.10%的複合年成長率,這主要得益於出口導向企業為規避ISPM-15規定的加工成本而轉向使用塑膠。中國鋰電池產業的蓬勃發展刺激了對防靜電托盤的需求,而泰國和越南正在試行Roscam公司設計的跨境,以促進區域間物流。然而,資金籌措缺口和有限的回收管道仍然阻礙東南亞中小企業採用塑膠托盤。

在歐洲,嚴格的包裝和包裝廢棄物配額制度(要求到2030年40%的運輸包裝必須可回收)正在推動耐用塑膠托盤的普及。現有的托盤共享業者可以利用其現有的逆向物流網路,以經濟高效的方式實現這些目標。中東、非洲和南美洲的回收網路薄弱,營運複雜性和遺失風險抵消了塑膠托盤相對於木質托盤在生命週期成本上的優勢,因此在這些地區,塑膠托盤的普及程度相對落後。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 北美和歐洲醫藥低溫運輸中衛生塑膠托盤的應用

- 強制性ISPM-15合規性推動亞洲出口中心從木材轉向塑膠

- 一種降低歐洲第三方物流業者整體擁有成本的資源共享模式

- 美國零售自動化(自動化倉庫系統和輸送系統)需要尺寸穩定的托盤

- 歐盟循環經濟目標推動了對再生高密度聚乙烯托盤的需求。

- 中國電池和化工鋰供應鏈首選防靜電塑膠托盤

- 市場限制

- 高昂的初始資本成本是新興東南亞地區中小企業面臨的一大障礙。

- 非洲和南美洲缺乏用於大宗托盤退貨的逆向物流基礎設施

- 原油價格波動導致原生聚烯樹脂價格波動

- 建設產業重型用戶普遍認為,與硬木托盤相比,塑膠托盤的有效載荷能力較低。

- 供應鏈分析

- 技術展望

- 塑膠托盤的永續性和回收/再利用性

- 法規結構和標準

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依材料類型

- 高密度聚苯乙烯(HDPE)

- 聚丙烯(PP)

- 回收材料

- 按托盤類型

- 可嵌套

- 可拆卸

- 可堆疊

- 查看/自訂

- 按最終用戶行業分類

- 食品/飲料

- 化學

- 製藥和醫療保健

- 零售與電子商務

- 物流和倉儲管理

- 車

- 其他終端用戶產業

- 按負載容量

- 輕型托盤

- 中型托盤

- 高耐久性托盤

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Brambles Limited(CHEP)

- CABKA Group GmbH

- Orbis Corporation(Menasha)

- Schoeller Allibert Group BV

- Rehrig Pacific Company

- Tosca Services, LLC

- Loscam International Holdings

- Craemer Holding GmbH

- Gamma-Wopla NV/Smart-Flow NV

- Q-Pall BV

- Plasgad Plastic Products ACS Ltd.

- NAECO SL

- Polymer Solutions International Inc.

- RPP Containers

- IPS Plastics Pallets(IPS Group)

- Shandong Huaxiang Plastic Co., Ltd.

- Beijing Jingliang United Plastic Products Co., Ltd.

- TranPak Inc.

- Allied Plastics, Inc.

- Falkenhahn AG

- Buckhorn Inc.

- iGPS Logistics LLC

第7章 市場機會與未來展望

The plastic pallets market is expected to grow from USD 8.65 billion in 2025 to USD 9.55 billion in 2026 and is forecast to reach USD 15.63 billion by 2031 at 10.38% CAGR over 2026-2031.

Rising hygiene rules in pharmaceutical cold chains, ISPM-15 compliance costs for wood, and automation-ready warehouse designs are the central growth catalysts shaping the plastic pallets market. Demand also benefits from pooling systems that convert capital expenditure into an operating fee, making shared assets attractive to third-party logistics firms. Polyolefin resin recycling initiatives across the EU add further momentum by aligning pallets with circular-economy targets. Conversely, resin price swings tied to crude oil pose near-term margin pressure for manufacturers.

Global Plastic Pallets Market Trends and Insights

Adoption of Hygienic Plastic Pallets in Pharmaceutical Cold Chains

FDA rules classify pallets as transportation equipment, making cleanable, non-porous designs mandatory in pharma logistics. Plastic pallets resist moisture and maintain structure during temperature swings, lowering contamination risk compared with wood. European producers such as Schoeller Allibert now supply cleanroom-grade pallets tailored to sterile drug manufacturing. The rising cost of product recalls cements adoption, turning plastic units into standard infrastructure for regulated cold chains. As vaccine volumes stay elevated, North American demand remains strong, and similar hygienic standards are spreading across Europe.

Mandates for ISPM-15 Compliance Driving Shift from Wood to Plastic

ISPM-15 requires heat treatment or fumigation for wooden packaging, adding cost and delays to Asia's exports. Plastic pallets are exempt, giving them an immediate compliance advantage in China, Vietnam, and Thailand. Exporters avoid the USD 12-15 per-pallet treatment fee, improving margin on high-volume shipments. The American Lumber Standard Committee's rigorous audit schedule further dissuades wood use by raising administrative burde. As trade lanes tighten lead-time windows, plastic pallets offer certainty, speeding clearance in 182 ISPM-15-signatory nations.

High Upfront Capital Cost Barrier for SMEs in Emerging Southeast Asia

Plastic pallets cost three-to-five times more than wood, deterring cash-constrained SMEs that represent 98.7% of firms in the region. Subsidized loans exist but rarely cover working-capital upgrades of this scale. In Indonesia, where small processors dominate local plastics output, payback periods exceed typical planning horizons. Without cost-sharing pools, adoption remains limited to large exporters who can amortize investment over high rotation counts. Manufacturers now market lower-priced recycled-content pallets, yet financing gaps persist.

Other drivers and restraints analyzed in the detailed report include:

- Pooling Models Reducing Total Cost of Ownership for 3PLs

- Retail Automation Requiring Dimensionally Stable Pallets

- Limited Reverse Logistics Infrastructure for Bulk Return of Pallets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

HDPE retained 66.03% plastic pallets market share in 2025 thanks to chemical resistance demanded by pharma and food handlers. The plastic pallets market now places premium value on recycled resin, pushing the recycled materials segment toward a 12.29% CAGR through 2031 as EU content mandates tighten. Virgin-resin volatility tied to crude prices makes recycled HDPE more financially attractive, smoothing input costs for manufacturers. Producers such as Q-Pall already manufacture pallets using 98% recycled feedstock, demonstrating technical feasibility at scale.Continued regulatory pressure will likely narrow the cost delta between recycled and virgin grades as demand spikes across Europe.

Recycled polymers also appeal to corporate ESG agendas, which increasingly require transport packaging to carry audited sustainability credentials. The plastic pallets market benefits because pallets can be ground and remolded repeatedly without degrading performance, fitting circular-economy loops that wooden pallets cannot replicate. Producers invest in wash-line capacity to guarantee contaminant removal, thereby meeting food-grade standards for recycled HDPE. North American buyers also test recycled-content offerings to hedge against resin price spikes, while Asian exporters adopt them to highlight low-carbon credentials in tender bids.

Nestable pallets accounted for 42.10% of global revenue in 2025 owing to their ability to cut empty-return freight by up to 80%. Yet the rackable segment will expand at an 11.62% CAGR because automated warehouses demand stable deflection limits that nestable designs seldom meet. Retailers installing AS/RS systems prefer rackable pallets that keep load sag below 6 mm under 1 ton static loads, safeguarding conveyor uptime. Producers answer with glass-fiber-reinforced HDPE to boost stiffness without adding weight.

Stackable pallets hold share in heavy manufacturing where columns two or three loads high demand rigid decks, but growth remains slower than rackable units. Display pallets, a niche sub-group, support promotional formats in big-box retail yet face limited churn due to specialized dimensions. The plastic pallets market continues to balance space-saving nestable designs for transport against rack-ready units for automated fulfillment, with many shippers dual-sourcing both formats to optimize supply chain nodes.

The Plastic Pallets Market Report is Segmented by Material Type (High-Density Polyethylene, and More), Pallet Type (Nestable, Rackable, Stackable, Display/Custom), End-User Industry (Food and Beverage, Chemical, and More), Load Capacity (Light-Duty, Medium-Duty, High-Duty), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 29.20% of global revenue in 2025, supported by mature pooling networks and FDA hygiene regulations that encourage reusable, cleanable platforms. ORBIS's new Greenville, Texas plant shows continuing investment to meet local demand for automation-ready pallets. Retail DC automation further boosts adoption because plastic units maintain tighter dimensional tolerances than wood, reducing conveyor downtime.

Asia-Pacific is the fastest-growing territory, posting a 14.10% CAGR to 2031 as export-oriented firms switch to plastic to avoid ISPM-15 treatment fees. China's lithium battery boom spurs demand for anti-static pallets, while Thailand and Vietnam test cross-border designs launched by Loscam to ease regional flows. Yet financing gaps and limited return loops continue to slow adoption among Southeast Asian SMEs.

Europe benefits from stringent Packaging and Packaging Waste Regulation quotas, which require 40% reusability for transport packaging by 2030, furthering the shift to durable plastic pallets. Established pooling operators can exploit existing reverse-logistics density to hit those targets cost-effectively. Middle East & Africa and South America trail due to weaker retrieval networks, adding operational complexity and loss risk that undercut the life-cycle savings plastic offers over wood.

- Brambles Limited (CHEP)

- CABKA Group GmbH

- Orbis Corporation (Menasha)

- Schoeller Allibert Group BV

- Rehrig Pacific Company

- Tosca Services, LLC

- Loscam International Holdings

- Craemer Holding GmbH

- Gamma-Wopla NV / Smart-Flow NV

- Q-Pall BV

- Plasgad Plastic Products ACS Ltd.

- NAECO S.L.

- Polymer Solutions International Inc.

- RPP Containers

- IPS Plastics Pallets (IPS Group)

- Shandong Huaxiang Plastic Co., Ltd.

- Beijing Jingliang United Plastic Products Co., Ltd.

- TranPak Inc.

- Allied Plastics, Inc.

- Falkenhahn AG

- Buckhorn Inc.

- iGPS Logistics LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of Hygienic Plastic Pallets in Pharmaceutical Cold Chains across North America and Europe

- 4.2.2 Mandates for ISPM-15 Compliance Driving Shift from Wood to Plastic in Asia Export Hubs

- 4.2.3 Pooling Models Reducing Total Cost of Ownership for 3PLs in Europe

- 4.2.4 Retail Automation (AS/RS and Conveyor Systems) Requiring Dimensionally Stable Pallets in the U.S.

- 4.2.5 Circular Economy Targets Pushing Demand for Recyclate-Based HDPE Pallets in the EU

- 4.2.6 Battery and Chemical Lithium Supply Chains Preferring Anti-Static Plastic Pallets in China

- 4.3 Market Restraints

- 4.3.1 High Upfront Capital Cost Barrier for SMEs in Emerging Southeast Asia

- 4.3.2 Limited Reverse Logistics Infrastructure for Bulk Return of Pallets in Africa and South America

- 4.3.3 Price Volatility of Virgin Polyolefin Resins Linked to Crude-Oil Swings

- 4.3.4 Perception of Lower Load Capacity Versus Hardwood Pallets Among Heavy-Duty Users in Construction

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Sustainability and Recycling/Reusability of Plastic Pallets

- 4.7 Regulatory Framework and Standards

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 High-Density Polyethylene (HDPE)

- 5.1.2 Polypropylene (PP)

- 5.1.3 Recycled Materials

- 5.2 By Pallet Type

- 5.2.1 Nestable

- 5.2.2 Rackable

- 5.2.3 Stackable

- 5.2.4 Display / Custom

- 5.3 By End-User Industry

- 5.3.1 Food and Beverage

- 5.3.2 Chemical

- 5.3.3 Pharmaceutical and Healthcare

- 5.3.4 Retail and E-Commerce

- 5.3.5 Logistics and Warehousing

- 5.3.6 Automotive

- 5.3.7 Other End-User Industry

- 5.4 By Load Capacity

- 5.4.1 Light - Duty Pallets

- 5.4.2 Medium - Duty Pallets

- 5.4.3 High - Duty Pallets

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Brambles Limited (CHEP)

- 6.4.2 CABKA Group GmbH

- 6.4.3 Orbis Corporation (Menasha)

- 6.4.4 Schoeller Allibert Group BV

- 6.4.5 Rehrig Pacific Company

- 6.4.6 Tosca Services, LLC

- 6.4.7 Loscam International Holdings

- 6.4.8 Craemer Holding GmbH

- 6.4.9 Gamma-Wopla NV / Smart-Flow NV

- 6.4.10 Q-Pall BV

- 6.4.11 Plasgad Plastic Products ACS Ltd.

- 6.4.12 NAECO S.L.

- 6.4.13 Polymer Solutions International Inc.

- 6.4.14 RPP Containers

- 6.4.15 IPS Plastics Pallets (IPS Group)

- 6.4.16 Shandong Huaxiang Plastic Co., Ltd.

- 6.4.17 Beijing Jingliang United Plastic Products Co., Ltd.

- 6.4.18 TranPak Inc.

- 6.4.19 Allied Plastics, Inc.

- 6.4.20 Falkenhahn AG

- 6.4.21 Buckhorn Inc.

- 6.4.22 iGPS Logistics LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment