|

市場調查報告書

商品編碼

1906252

油脂化學品:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Oleochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

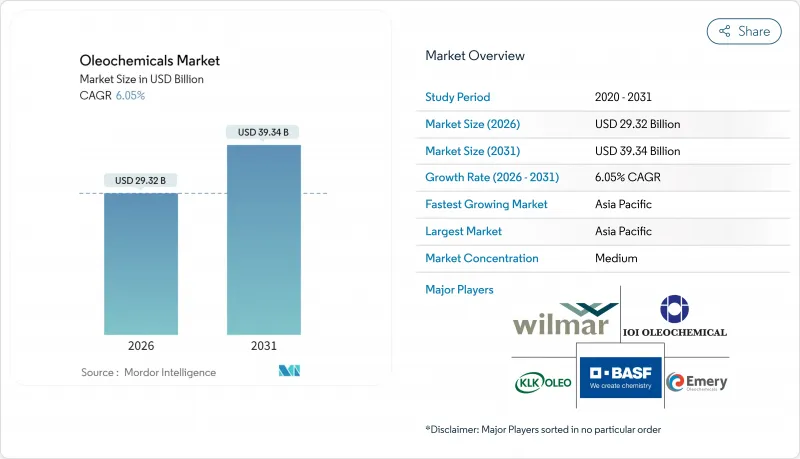

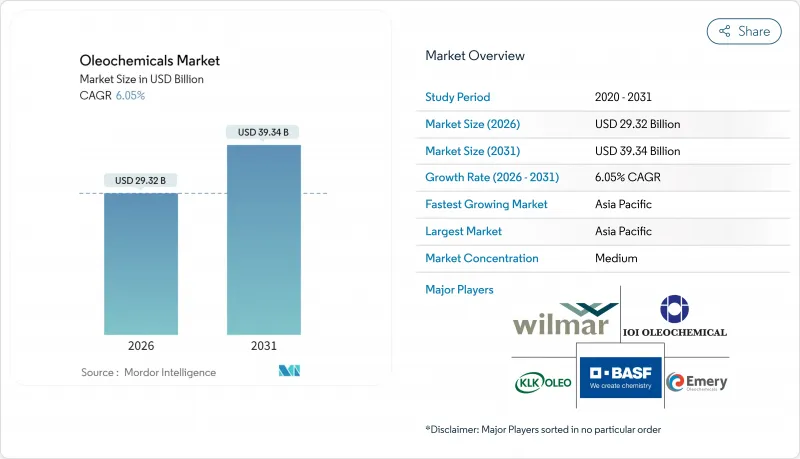

2025年油脂化學品市值為276.5億美元,預計2031年將達到393.4億美元,高於2026年的293.2億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 6.05%。

目前的擴張反映了政策主導的生物基表面活性劑需求、生物柴油摻混強制規定以及消費者對家用和個人護理產品中天然成分日益成長的偏好。光是印尼的B40計畫就已將超過1500萬千升棕櫚油衍生的甲酯用於能源用途,加劇了傳統化學應用領域的供應緊張。同時,歐盟的森林砍伐法規提高了合規成本,刺激了可追溯和認證供應鏈的投資。利用合成生物學方法將醣類和甲醇轉化為脂肪酸和醇類的新興技術正在興起,預計將實現原料多樣化並減少土地利用的影響。亞太地區仍然是生產和需求的重點,這得益於完善的棕櫚油基礎設施以及中國和東南亞個人護理產品消費的快速成長。

全球油脂化學品市場趨勢及展望

擴大亞太地區的界面活性劑生產能力

中國、印尼和馬來西亞界面活性劑生產計劃的快速擴張,推動了對C12-C18脂肪酸和醇類的基準需求。 KLK OLEO在張家港新增20萬噸年產能,反映了該地區在原料採購和物流方面的優勢。本土個人護理品牌正積極採用天然乳化劑,以滿足國內「清潔美容」標準並提升產品檔次。油價上漲推高了合成界面活性劑的價格,促使出口型生產商贏得對成本敏感的歐洲製造商的訂單。世界各國政府正根據增值藍圖推動特種化學品的位置,進一步支持新建油脂化學品工廠。這些協同效應從根本上推動了油脂化學品市場的基礎需求,並為緩解經濟波動的影響奠定了基礎。

個人護理和化妝品需求不斷成長

預計2024年全球護膚零售額將成長9%,配方化學家們正擴大指定使用植物來源潤膚劑、酯類和乳化劑。BASF的Verdesense產品線展示了蠟質植物性聚合物如何在不影響使用者體驗的前提下取代微塑膠。北美消費者將可生物分解性視為最重要的購買因素,僅次於功效,這促使品牌商重新調整現有庫存單位(SKU)的配方。亞洲跨國公司也反映了這一轉變,正為其旗艦產品線尋求ECOCERT和COSMOS認證。基於鼠李醣脂的生物表面活性劑的商業試驗顯示出兩位數的成長潛力,表明其有望在中期內取代合成乙氧基化物。由於優質化和永續性,特種油脂化學品的價格彈性仍然良好。

原物料價格波動

2024年,受厄爾尼諾現象導致產量下降的影響,原棕櫚油期貨價格在每噸780美元至970美元之間波動,對分離器和蒸餾器的毛利率帶來壓力。颱風對菲律賓種植園的破壞也導致椰子油價格飆升,進而推高了月桂酸衍生物的成本。北美買家轉向巴西牛油,但出口量激增377%,導致當地油價上漲18%。生產商的應對措施是縮短合約期限並引入價格上漲條款。持續的價格波動使庫存計劃更加複雜,如果成本超過終端用戶價格水平,則可能導致需求下降。

細分市場分析

到2025年,脂肪酸在全球油脂化學品市場將維持37.65%的佔有率,主要得益於清潔劑和個人護理產品的強勁需求。然而,在印尼、巴西和歐盟強制生質柴油計畫的推動下,甲酯的油脂化學品市場規模預計將以7.68%的複合年成長率成長。透過發酵技術改進脂醇類可望重新調整成本曲線,但商業規模生產預計在2020年代末之前仍將受到限制。生物柴油生產造成的甘油供應過剩正在對價格構成下行壓力,推動其在醫藥和食品領域的應用。政策主導的能源需求往往缺乏價格彈性,即使在經濟放緩時期,也能支撐對甲酯的持續需求。同時,壬二酸和癸二酸等特種脂肪酸衍生物將以溢價交易,這將使能夠為特定產品增值的綜合生產商受益。

甲基酯的快速成長導致消費品價格上漲,在某些情況下,由於原料從肥皂成分轉向其他用途,價格上漲不得不轉嫁到消費品上。這促使市場參與企業尋求協同效應其市場通路的綜效。擁有壓榨、生質柴油和油脂化學品資產的綜合農產品正在不斷最佳化其資源配置。脂醇類的需求與無硫酸鹽化妝品日益成長的趨勢相交織,儘管酯類需求加速成長,但醇類的重要性依然凸顯。由此形成了一個複雜的競爭格局,產品類型並非孤立運作,而是透過原料和產品特定的經濟因素在更廣泛的油脂化學品市場中相互關聯。

區域分析

到2025年,亞太地區將佔據油脂化學品市場47.12%的佔有率,這主要得益於棕櫚油產業叢集的一體化發展和成本效益高的物流網路。該地區的複合年成長率預計將繼續保持在7.92%,這主要受中國表面活性劑綜合體業務運作和東南亞地區可支配收入成長的推動。然而,如果出口型企業未能達到歐盟和北美的永續性標準,則可能面臨價格折扣,從而擠壓利潤空間。印尼生質柴油的普及正在推動原料轉移和國內煉油廠投資,從而提升本地價值取得。馬來西亞的特種化學品發展藍圖旨在2030年實現下游收入翻番,但技術純熟勞工短缺可能會阻礙這一目標的實現。在南亞,肥皂需求正在成長,但其品質標準仍落後於經濟合作暨發展組織市場,這限制了其價格的實現。

北美和歐洲正在努力平衡成熟的消費模式與技術創新。歐盟的政策已禁止使用間歇性二氧化碳排放量高的棕櫚油,並鼓勵使用廢油和動物脂肪生產油脂化學品。同時,由創投支持的發酵Start-Ups已與跨國化妝品公司簽訂了銷售合約。美國可再生柴油的成長吸收了部分動物脂肪,促使當地油脂化學品生產商不顧運費溢價,進口月桂酸油。在巴西的主導,南美洲是繼亞太地區之後成長最快的地區。雖然不斷擴大的壓榨能力確保了大豆油的供應,但國內對生質柴油的需求仍佔據相當大的比例。中東和非洲的產能落後,但需求正在成長。海灣國家正在鼓勵在海事和採礦業中使用生物潤滑劑,這為出口商創造了穩定成長的需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大亞太地區的界面活性劑生產能力

- 個人護理和化妝品需求不斷成長

- 脂肪酸甲酯生質柴油強制生產政策

- 向可生物分解和植物來源化學品過渡

- 利用合成生物學方法製備低成本脂醇類

- 市場限制

- 原物料價格波動

- 非政府組織和監管機構對不永續棕櫚油施加壓力

- 在大宗應用領域,石油化學產品競爭激烈

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 產品類型

- 脂肪酸

- 脂醇類

- 甲酯

- 甘油

- 其他產品類型

- 原料來源

- 植物油

- 動物脂肪

- 終端用戶產業

- 個人護理和化妝品

- 肥皂和清潔劑

- 食品/飲料

- 製藥

- 聚合物

- 其他終端用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BASF

- Berg+Schmidt GmbH & Co. KG

- Cargill Inc.

- Croda International Plc

- Emery Oleochemicals

- Evonik Industries AG

- Godrej Industries Group

- IOI Oleochemical

- Kao Corporation

- KLK OLEO

- Kraton Corporation

- Musim Mas Group

- Oleon NV

- Procter & Gamble

- PT Ecogreen Oleochemicals

- VVF Ltd.

- Wilmar International Ltd.

第7章 市場機會與未來展望

The Oleochemicals Market was valued at USD 27.65 billion in 2025 and estimated to grow from USD 29.32 billion in 2026 to reach USD 39.34 billion by 2031, at a CAGR of 6.05% during the forecast period (2026-2031).

Current expansion reflects policy-driven demand for bio-based surfactants, biodiesel blending mandates, and accelerating consumer preference for natural ingredients across home and personal care applications. Indonesia's B40 program alone redirects more than 15 Million kilolitres of palm-based methyl esters into energy use, tightening supply for conventional chemical uses. Concurrently, the European Union (EU) Deforestation Regulation raises compliance costs and spurs investment in traceable, certified supply chains. Synthetic-biology routes that convert sugars or methanol into fatty acids and alcohols are emerging, promising feedstock diversification and lower land-use impacts. Asia-Pacific remains the focus of production and demand, supported by integrated palm infrastructure and fast-growing personal-care consumption in China and Southeast Asia.

Global Oleochemicals Market Trends and Insights

Growing Surfactants Capacity in Asia-Pacific

Surfactant manufacturing projects in China, Indonesia, and Malaysia are scaling rapidly, lifting baseline demand for C12-C18 fatty acids and alcohols. KLK OLEO's recent 200 ktpa expansion in Zhangjiagang underscores the region's feedstock and logistics advantage. Local personal-care brands are moving upmarket, incorporating naturally derived emulsifiers to meet domestic "clean beauty" standards. Export-oriented producers capture cost-sensitive orders from Europe as petro-inflation raises synthetic surfactant prices. Governments are promoting specialty chemicals under value-addition roadmaps, further anchoring new oleochemical units. The cumulative effect is a structural uplift in baseline offtake that cushions the oleochemicals market against cyclical swings.

Expanding Personal-Care and Cosmetics Demand

Global retail skin-care sales rose 9% in 2024, and formulating chemists increasingly specify plant-based emollients, esters, and emulsifiers. BASF's Verdessence line illustrates how waxy plant polymers replace microplastics without compromising sensory profiles . North American consumers rank biodegradability second only to efficacy in purchase drivers, pushing brand owners to reformulate legacy stock keeping unit (SKUs). Asian multinationals mirror this shift, aiming for ECOCERT and COSMOS accreditation on flagship lines. Bio-surfactant commercial trials using rhamnolipids show double-digit growth potential, signalling a medium-term substitution of synthetic ethoxylates. Collectively, premiumisation and sustainability converge to keep price elasticity favourable for specialty oleochemicals.

Feedstock Price Volatility

Crude palm oil futures swung between USD 780 and USD 970 per ton in 2024 following El Nino-linked yield drops, eroding gross margins for splitters and distillers. Coconut oil prices also spiked after typhoon damage to Philippine plantations, pressuring lauric acid derivative costs. North American buyers turned to Brazilian tallow, but a 377% export surge lifted local fat prices by 18%. Producers responded by shortening contract tenors and introducing price-escalation clauses. Persistent volatility complicates inventory planning and can trigger demand destruction when costs overshoot end-use price points.

Other drivers and restraints analyzed in the detailed report include:

- Biodiesel Mandates for Fatty Acid Methyl Esters

- Shift Toward Biodegradable, Plant-Based Chemicals

- NGO and Regulatory Pressure on Unsustainable Palm Oil

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Global fatty acids retained 37.65% Oleochemicals market share in 2025 on the back of solid detergent and personal-care demand. The Oleochemicals market size for methyl esters, however, is projected to rise at a 7.68% CAGR, supported by mandatory biodiesel programs across Indonesia, Brazil, and the EU. Fatty alcohol innovation through fermentation could recalibrate cost curves, yet commercial volumes will remain limited until late decade. Glycerine oversupply from biodiesel yields downward price pressure, encouraging its uptake in pharma and food applications. As policy-driven energy demand is largely price-inelastic, methyl ester offtake continues even during economic slowdowns. Conversely, specialty fatty acid derivatives such as azelaic and sebacic acids enjoy premium streams, benefiting integrated producers able to valorise by-products.

Methyl esters' rapid growth diverts feedstock away from soap noodles, occasionally forcing price pass-throughs in consumer staples. Market participants thus explore route-to-market synergies: integrated agribusinesses with crushing, biodiesel, and oleochemical assets optimise allocation daily. Fatty alcohol demand intersects with rising sulfate-free cosmetic trends, reinforcing alcohol's relevance despite ester acceleration. Net effect is a nuanced competitive landscape where product categories no longer operate in silos, but rather interlink through feedstock and coproduct economics within the wider Oleochemicals market.

The Oleochemicals Market Report is Segmented by Product Type (Fatty Acids, Fatty Alcohols, Methyl Esters, Glycerine, and More), Feedstock Source (Vegetable Oils and Animal Fats), End-User Industry (Personal Care and Cosmetics, Food and Beverages, Pharmaceuticals, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 47.12% Oleochemicals market share in 2025, anchoring the Oleochemicals market courtesy of integrated palm clusters and cost-efficient logistics. Regional CAGR of 7.92% will continue as China's surfactant complexes ramp up and Southeast Asian disposable incomes climb. Yet export-centric players must meet EU and North American sustainability thresholds or risk margin-eroding discounts. Indonesian biodiesel uptake diverts feedstock and fosters domestic refinery investments that lift local value capture. Malaysia's specialty chemicals roadmap aims to double downstream revenue by 2030, though skilled-labour shortages could constrain execution. South Asia shows rising demand for soap noodles, but quality specifications still lag the Organization for Economic Cooperation and Development (OECD) markets, tempering price realization.

North America and Europe balance mature consumption with technological innovation. EU policy bans high-ILUC palm, incentivising waste-oil and animal fat-based oleochemicals, while venture-backed fermentation start-ups secure offtake agreements with cosmetic multinationals. US renewable diesel growth sequesters tallows, prompting local oleochemical players to import lauric oils despite freight premiums. South America, led by Brazil, grows fastest after Asia-Pacific (APAC); expanding crush capacity ensures ready soybean oil supply, although domestic biodiesel uptake absorbs a significant slice. Middle East and Africa lag in production capacity but present incremental demand, with Gulf states encouraging bio-lubricant uptake in marine and mining sectors, offering gradual yet stable pull for exporters.

- BASF

- Berg+Schmidt GmbH & Co. KG

- Cargill Inc.

- Croda International Plc

- Emery Oleochemicals

- Evonik Industries AG

- Godrej Industries Group

- IOI Oleochemical

- Kao Corporation

- KLK OLEO

- Kraton Corporation

- Musim Mas Group

- Oleon NV

- Procter & Gamble

- PT Ecogreen Oleochemicals

- VVF Ltd.

- Wilmar International Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Surfactants Capacity in Asia-Pacific

- 4.2.2 Expanding Personal-care and Cosmetics Demand

- 4.2.3 Biodiesel Mandates for Fatty Acid Methyl Esters

- 4.2.4 Shift Toward Biodegradable, Plant-based Chemicals

- 4.2.5 Synthetic-biology Routes to Low-cost Fatty Alcohols

- 4.3 Market Restraints

- 4.3.1 Feedstock Price Volatility

- 4.3.2 NGO and Regulatory Pressure on Unsustainable Palm Oil

- 4.3.3 Petrochemical Price Competition in Bulk Applications

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 Product Type

- 5.1.1 Fatty Acids

- 5.1.2 Fatty Alcohols

- 5.1.3 Methyl Esters

- 5.1.4 Glycerine

- 5.1.5 Other Product Types

- 5.2 Feedstock Source

- 5.2.1 Vegetable Oils

- 5.2.2 Animal Fats

- 5.3 End-user Industry

- 5.3.1 Personal Care and Cosmetics

- 5.3.2 Soap and Detergent

- 5.3.3 Food and Beverages

- 5.3.4 Pharmaceuticals

- 5.3.5 Polymers

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Berg+Schmidt GmbH & Co. KG

- 6.4.3 Cargill Inc.

- 6.4.4 Croda International Plc

- 6.4.5 Emery Oleochemicals

- 6.4.6 Evonik Industries AG

- 6.4.7 Godrej Industries Group

- 6.4.8 IOI Oleochemical

- 6.4.9 Kao Corporation

- 6.4.10 KLK OLEO

- 6.4.11 Kraton Corporation

- 6.4.12 Musim Mas Group

- 6.4.13 Oleon NV

- 6.4.14 Procter & Gamble

- 6.4.15 PT Ecogreen Oleochemicals

- 6.4.16 VVF Ltd.

- 6.4.17 Wilmar International Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Increased Use of Biofuels