|

市場調查報告書

商品編碼

1906227

歐洲建築幕牆:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Europe Facade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

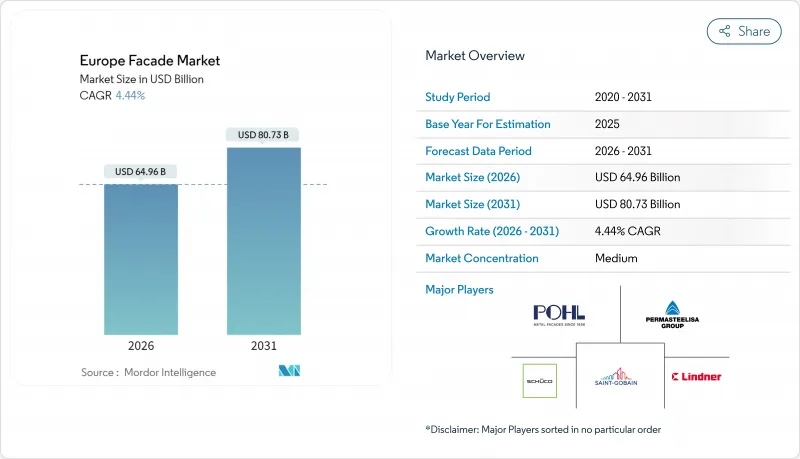

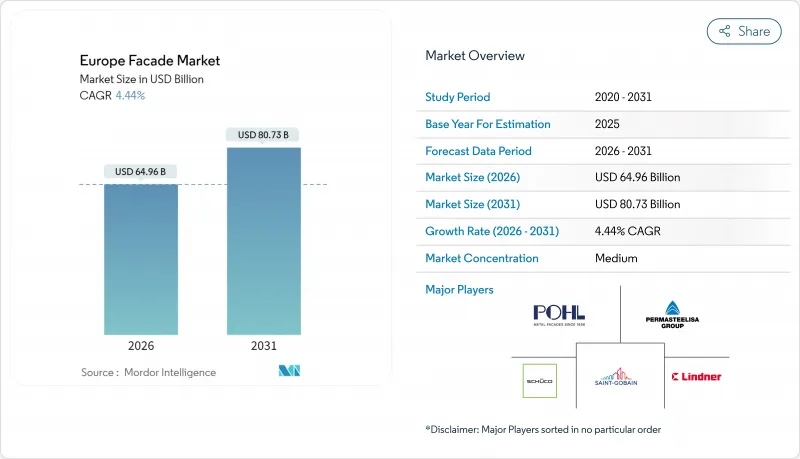

2025年歐洲建築幕牆市場價值為622億美元,預計2031年將達到807.3億美元,高於2026年的649.6億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.44%。

受格倫費爾大廈火災後的相關法規以及歐盟「Fit-for-55」能源目標(該目標強制要求對建築外圍護結構維修)的推動,維修和改造需求佔據主導地位。雖然商業客戶仍佔支出的大部分,但隨著超大規模資料中心叢集和模組化異地建造重塑住宅供應鏈,住宅的活動也在加速成長。競爭格局不再以規模取勝,而是以技術差異化為特徵,建築幕牆專家們正在整合低碳鋁材、建築一體化光伏(BIPV)和人工智慧自適應面板,以滿足商業碳排放上限的要求。儘管材料成本波動和安裝人員短缺限制了短期發展勢頭,但持續的政策壓力使歐洲主要經濟體的訂單量保持強勁。

歐洲建築幕牆市場趨勢與洞察

格倫費爾大火後,歐盟高層建築進行外觀維修。

2017年的悲劇發生後,消防安全法規收緊,強制要求18公尺以上建築物的業主更換易燃系統。保險公司停止承保現有覆材覆層,使合規成為強制性要求。 2024年瓦倫西亞公寓火災後,德國效仿英國的做法,法國則透過更新《建築產品法規》加強了建築幕牆測試。強制更換外牆覆層保護了歐洲建築幕牆市場免受建設業整體衰退的影響,並確保了維修訂單的穩定成長,因為法律責任比成本考量更為重要。

2050 年淨零建築法規“適合 55 歲及以上人群”

《建築能源性能指令》要求新建築在2030年前實現零排放,現有建築在2050年前進行大規模維修。法國的RE2020將二氧化碳當量排放量上限設定為每平方公尺640公斤,並已開始強制進行產品重新設計。一波維修旨在升級3,500萬棟建築,其中建築幕牆約佔潛在節能的35%。德國最新的建築規範強制要求採用無熱橋連接,並提出了日益複雜的技術規範,尤其強調先進的帷幕牆和通風牆技術。

鋁和浮法玻璃價格波動

2024年,鋁價預計為每噸2300至2600美元,浮法玻璃價格上漲了10%至15%。特種超大面板的交貨期已延長至20週,嚴重擾亂了計劃進度。承包商在合約中加入價格上漲條款,將成本風險轉移給業主,這可能導致核准延遲並壓縮利潤空間。

細分市場分析

預計到2025年,通風式解決方案將佔總收入的50.35%,複合年成長率達4.78%。這主要歸功於空氣層的形成,可降低高達25%的冷卻負荷。這一主導市場佔有率表明,性能與法規合規性在歐洲建築幕牆市場中已充分整合。隨著監管機構收緊熱橋法規,採用自然通風和排濕排放的通風組件克服了困擾實心覆層層的冷凝風險。與固體建築一體化(BIPV)組件的兼容性提升了其吸引力,使安裝人員能夠散發光伏熱量並保護電池效率。非通風式面板在結構改造受限的歷史建築維修中仍然有用,但其成長率低於歐洲建築幕牆市場的平均水平。

這種先進的設計融合了智慧百葉窗、動態遮陽系統和感測器控制的氣流風門。工廠預製的通風盒符合異地趨勢,提高了品質保證並縮短了現場施工流程。消防法規也支持這種結構,因為模腔可以起到隔熱緩衝作用,減緩火焰蔓延——在格倫費爾大火之後,這一特性尤其重要。總而言之,這種配置鞏固了通風解決方案作為辦公大樓、學校和高層住宅達到歐盟近零能耗建築(nZEB)標準的最佳選擇的地位。

2025年,帷幕牆組裝佔市場佔有率的44.60%,但雨幕牆正在迎頭趕上,預計到2031年將以4.83%的複合年成長率成長,因為越來越多的建築師在維修工程中指定使用多功能幕牆。歐洲雨幕牆市場正在成長,這得益於材料的靈活性,從陶瓷磚到支持苔蘚生長的生物響應混凝土,後者有助於促進城市生物多樣性。幕牆對於需要全景玻璃、氣密性和抗震性能的天際線計劃仍然至關重要。

市場創新包括電致變色玻璃、整合式光伏發電系統以及可現場安裝的模組化系統,這些系統可作為樓層高的面板使用。 ISO 12631 和 EN 13830 標準主導製造商提升隔熱和隔音性能。因此,雨幕系統供應商正在嘗試使用模組化副框架和可回收支架,力求將該領域定位為永續性的基礎,而不僅僅是降低成本的手段。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 格倫費爾大廈火災後,歐盟高層建築外牆維修激增。

- 2050 年淨零建築法規“適合 55 歲及以上人群”

- 模組化異地建築幕牆製造的普及

- FLAP-D叢集超大規模資料中心建置熱潮

- 透過增值稅減免和上網電價補貼(FIT)促進建築整合太陽能建築幕牆的普及

- 透過碳邊境調節機制(CBAM)實現低碳鋁的國內回流

- 市場限制

- 鋁和浮法玻璃價格波動

- 合格的建築幕牆施工人員人手不足

- 易燃系統的保險除外責任

- 歐盟分類法和區域計畫中的碳蘊藏量限額

- 歐洲建築幕牆結構體系概述

- 定價分析

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 消費行為分析(建築師、建造商、開發商、業主)

- 永續發展趨勢

第5章 市場規模與成長預測

- 按類型

- 通風

- 不通風的

- 其他

- 建築幕牆系統類型

- 防風雨外牆

- 帷幕牆系統

- 其他

- 材料

- 玻璃

- 金屬

- 塑膠和纖維

- 石頭

- 其他

- 透過安裝

- 新建工程

- 維修和改造工程

- 最終用戶

- 商業的

- 住宅

- 其他

- 按地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 北歐國家(瑞典、丹麥、挪威、芬蘭)

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Permasteelisa Group

- Schuco International KG

- Saint-Gobain SA

- Lindner Group

- Reynaers Aluminium NV

- Kawneer(Arconic)Europe

- AluK Group

- Kingspan Group(Facade & Insulated Panels)

- Hydro Building Systems(Technal, Wicona)

- Yuanda Europe

- STO SE & Co. KGaA

- Etex Group-EOS Facades

- Sapa Building Systems

- Gartner(Permasteelisa)

- Trimo doo

- Glas Trosch Group

- AGC Glass Europe

- Focchi SpA

- Josef Gartner GmbH

- Alucraft Systems

第7章 市場機會與未來展望

The Europe facade market was valued at USD 62.2 billion in 2025 and estimated to grow from USD 64.96 billion in 2026 to reach USD 80.73 billion by 2031, at a CAGR of 4.44% during the forecast period (2026-2031).

Renovation and retrofit demand dominate because post-Grenfell regulations and EU "Fit-for-55" energy targets impose mandatory envelope upgrades. Commercial clients still account for most spending, yet residential activity is accelerating as hyperscale data-center clusters and modular off-site construction reshape housing supply chains. Technological differentiation rather than raw scale defines competition, with facade specialists integrating low-carbon aluminum, building-integrated photovoltaics (BIPV), and AI-enabled adaptive panels to satisfy embodied-carbon caps. Material cost swings and installer shortages temper near-term momentum, but sustained policy pressure keeps the order pipeline resilient across core European economies.

Europe Facade Market Trends and Insights

Post-Grenfell Recladding Surge Across EU High-Rise Stock

Heightened fire-safety scrutiny after the 2017 tragedy forces owners of buildings above 18 m to replace combustible systems. Insurers have removed coverage for legacy cladding, making compliance non-negotiable. Germany mirrored the UK's stance following the 2024 Valencia apartment blaze, and France upgraded facade testing under Construction Products Regulation updates. The compulsory nature of replacement shields the Europe facade market from macro construction downturns because legal liability overrides cost concerns, ensuring steady retrofit orders.

Net-Zero-2050 Envelope Mandates Under "Fit-for-55"

The Energy Performance of Buildings Directive calls for all new structures to reach zero-emission status by 2030 and for deep retrofits of existing stock by 2050. France's RE2020 sets a 640 kg CO2eq/m2 ceiling that is already forcing product redesign. The renovation wave aims to upgrade 35 million buildings, with facades responsible for roughly 35% of potential energy savings. Germany's latest building code now requires thermal-bridge-free connections, raising specification complexity and favoring sophisticated curtain-wall and ventilated concepts.

Aluminum and Float-Glass Price Volatility

Aluminum traded between USD 2,300-2,600 per ton during 2024, while float-glass quotes soared 10-15%. Specialized jumbo-pane lead times stretched to 20 weeks, disrupting project schedules. Contractors incorporate escalation clauses that transfer cost risk to owners, which can stall approvals and compress margins.

Other drivers and restraints analyzed in the detailed report include:

- Modular Off-Site Facade Manufacturing Uptake

- Hyperscale Data-Center Build Boom in FLAP-D Clusters

- Certified Facade-Installer Labor Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ventilated solutions captured 50.35% of 2025 revenue and will expand at a 4.78% CAGR because they create an air cavity that lowers cooling loads by up to 25%. This dominant share underlines how the Europe facade market integrates performance and compliance. As regulators tighten thermal-bridge rules, ventilated assemblies, with natural airflow and moisture outflow, overcome condensation risks that plague solid claddings. Their compatibility with BIPV modules strengthens appeal, letting installers dissipate photovoltaic heat and protect cell efficiency. Non-ventilated panels still serve heritage retrofits where structural intervention is limited, but growth lags the Europe facade market average.

Advanced designs now embed smart louvers, kinetic shading, and sensor-driven airflow dampers. Factory-built ventilated cassettes dovetail with off-site trends, boosting quality assurance and shortening site programs. Fire-safety codes further support this architecture because the cavity acts as a thermal buffer that limits flame spread, a coveted attribute after Grenfell. Collectively, the configuration cements ventilated solutions as the go-to choice for meeting EU nZEB criteria in offices, schools, and high-rise housing.

Curtain-wall assemblies owned 44.60% of 2025 value, yet rainscreen cladding outpaces them with a 4.83% CAGR through 2031 as architects specify versatile skins for retrofits. The Europe facade market size for rainscreens is growing on the back of material freedom that stretches from ceramic tiles to bio-receptive concrete that nurtures moss for urban biodiversity. Curtain-wall incumbents remain indispensable in skyline projects that demand panoramic glazing, airtightness, and seismic tolerance.

Market innovations include electrochromic glazing, integrated photovoltaics, and unitized systems that arrive on site as complete story-height panels. ISO 12631 and EN 13830 standards steer performance testing, pushing makers to refine thermal and acoustic metrics. Consequently, rainscreen vendors now experiment with modular sub-frames and recyclable brackets, positioning the category as a sustainability platform rather than value engineering fallback.

The Europe Facade Market Report is Segmented by Type (Ventilated, Non-Ventilated, Others), Facade System Type (Rainscreen Cladding, Curtain-Wall Systems, Others), Material (Glass, Metal, Plastic & Fibers, and More), Installation (New Construction, Renovation & Retrofit), End-User (Commercial, Residential, Others), and Geography (Germany, UK, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Permasteelisa Group

- Schuco International KG

- Saint-Gobain S.A.

- Lindner Group

- Reynaers Aluminium NV

- Kawneer (Arconic) Europe

- AluK Group

- Kingspan Group (Facade & Insulated Panels)

- Hydro Building Systems (Technal, Wicona)

- Yuanda Europe

- STO SE & Co. KGaA

- Etex Group - EOS Facades

- Sapa Building Systems

- Gartner (Permasteelisa)

- Trimo d.o.o.

- Glas Trosch Group

- AGC Glass Europe

- Focchi SpA

- Josef Gartner GmbH

- Alucraft Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Grenfell style recladding surge across EU high-rise stock

- 4.2.2 Net-zero-2050 envelope mandates under "Fit-for-55"

- 4.2.3 Modular off-site facade manufacturing uptake

- 4.2.4 Hyperscale data-centre build boom in FLAP-D clusters

- 4.2.5 VAT-relief & feed-in tariffs accelerating BIPV facades

- 4.2.6 CBAM-driven reshoring of low-carbon aluminium

- 4.3 Market Restraints

- 4.3.1 Aluminium & float-glass price volatility

- 4.3.2 Certified facade-installer labor shortage

- 4.3.3 Insurance exclusions for combustible systems

- 4.3.4 Embodied-carbon caps in EU taxonomy & local plans

- 4.4 Brief on Structural Systems Used in European Facades

- 4.5 Pricing Analysis

- 4.6 Value / Supply-Chain Analysis

- 4.7 Regulatory Landscape

- 4.8 Technological Outlook

- 4.9 Porter's Five Forces

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

- 4.10 Consumer Behaviour Analysis (Architects, Contractors, Developers, Owners)

- 4.11 Sustainability Trends

5 Market Size & Growth Forecasts (Value, € billion)

- 5.1 By Type

- 5.1.1 Ventilated

- 5.1.2 Non-Ventilated

- 5.1.3 Others

- 5.2 By Facade System Type

- 5.2.1 Rainscreen Cladding

- 5.2.2 Curtain-Wall Systems

- 5.2.3 Others

- 5.3 By Material

- 5.3.1 Glass

- 5.3.2 Metal

- 5.3.3 Plastic & Fibres

- 5.3.4 Stone

- 5.3.5 Others

- 5.4 By Installation

- 5.4.1 New Construction

- 5.4.2 Renovation & Retrofit

- 5.5 By End-User

- 5.5.1 Commercial

- 5.5.2 Residential

- 5.5.3 Others

- 5.6 By Region

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Nordics (Sweden, Denmark, Norway, Finland)

- 5.6.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Permasteelisa Group

- 6.4.2 Schuco International KG

- 6.4.3 Saint-Gobain S.A.

- 6.4.4 Lindner Group

- 6.4.5 Reynaers Aluminium NV

- 6.4.6 Kawneer (Arconic) Europe

- 6.4.7 AluK Group

- 6.4.8 Kingspan Group (Facade & Insulated Panels)

- 6.4.9 Hydro Building Systems (Technal, Wicona)

- 6.4.10 Yuanda Europe

- 6.4.11 STO SE & Co. KGaA

- 6.4.12 Etex Group - EOS Facades

- 6.4.13 Sapa Building Systems

- 6.4.14 Gartner (Permasteelisa)

- 6.4.15 Trimo d.o.o.

- 6.4.16 Glas Trosch Group

- 6.4.17 AGC Glass Europe

- 6.4.18 Focchi SpA

- 6.4.19 Josef Gartner GmbH

- 6.4.20 Alucraft Systems

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment