|

市場調查報告書

商品編碼

1906196

透水混凝土:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Pervious Concrete - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

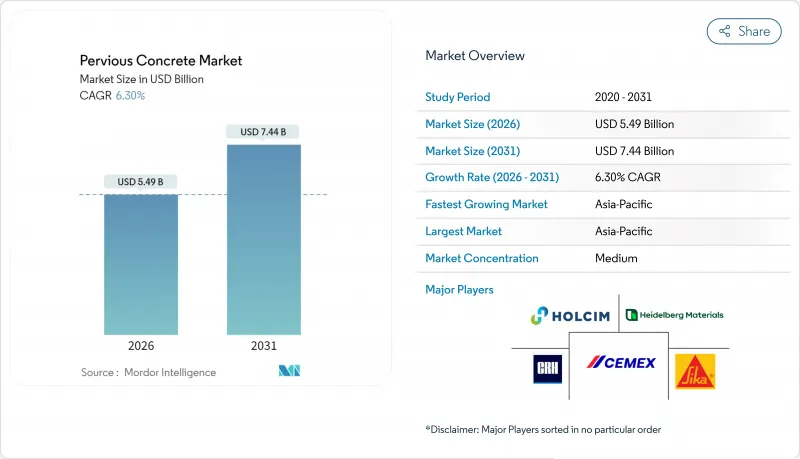

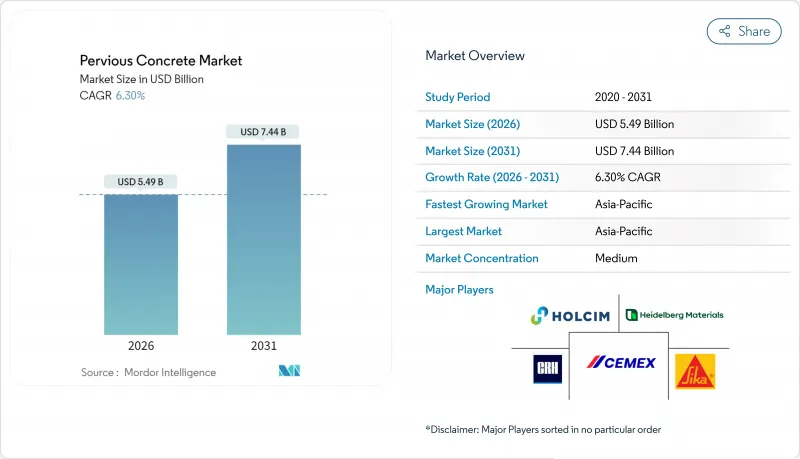

預計到 2026 年,透水混凝土市場規模將達到 54.9 億美元,高於 2025 年的 51.6 億美元。預計到 2031 年,透水混凝土市場規模將達到 74.4 億美元,2026 年至 2031 年的複合年成長率為 6.3%。

都市區突發性內澇日益增多、強制性低影響開發(LID)標準以及企業對永續建築的承諾,共同支撐著住宅、商業和公共基礎設施計劃中對透水混凝土的穩定需求。地方政府的稅收優惠和「海綿城市」計畫進一步加速了透水混凝土的普及,而混凝土配合比設計和聚合物改質技術的進步則拓展了其在結構應用領域的應用範圍。由於跨國水泥生產商將透水解決方案納入其低碳產品組合,以及區域建築商投資專用澆築設備,市場競爭仍溫和。儘管技術純熟勞工短缺和大都會圈骨材不足等供應方面的挑戰仍然限制市場成長前景,但尚未阻礙透水混凝土市場的整體上升趨勢。

全球透水混凝土市場趨勢與洞察

都市區暴雨造成的損失加劇

市政當局正擴大採用透水混凝土進行雨水徑流源頭管理,以減少高峰流量,減輕老舊下水道網路的壓力。透水混凝土的滲透能力高達每平方英尺每分鐘8加侖(約30公升),其在暴雨期間減少徑流的能力已在中國各大都市超過1萬個「海綿城市」計劃中得到驗證。氣候變遷導致降雨強度增加,使路面從被動式表面轉變為主動式排水設施,從而提升了路面的提案。地方政府重視透水混凝土的雙重功能,使其能夠將路面和雨水基礎設施整合到單一的資本支出中。其在中等降雨氣候下的出色現場表現進一步鞏固了其作為具成本效益的灰色基礎設施管道替代方案的地位。

強制性低影響開發(LID)分區法規

監管趨勢正推動透水路面從一項可選的永續性措施轉變為一項強制性要求。洛杉磯2024年的低影響開發(LID)條例強制規定,新建和改造的大規模不透水區域必須達到現場儲存目標,並將透水混凝土定位為一站式解決方案。紐約市的《統一雨水管理規範》也採用了優先考慮儲存的層級結構,同樣提升了透水混凝土在更廣泛的綠色基礎設施框架中的重要性。開發商青睞透水混凝土,因為它只需單一規範即可滿足多項要求(雨水管理、緩解熱島效應和獲得LEED認證積分)。隨著更多地區頒布類似法規,預計到本十年末,透水混凝土市場前景將持續走強。

需要有資格的承包商和專用澆築設備

保持適當的孔隙率和均勻壓實度是成功施工的關鍵,這與傳統混凝土施工有顯著差異。雖然NRMCA認證系統能夠確保質量,但它限制了合格安裝人員的數量,尤其是在培訓資源匱乏的新興市場。專用攤舖機和路面檢測設備會增加承包商的初始成本,並減緩產能擴張,即使在政策支援較大的地區也是如此。這種人力和設備瓶頸會帶來計劃進度風險,並可能推高競標價格,從而威脅到透水混凝土市場近期的成長。

細分市場分析

至2025年,水硬性透水混凝土將佔透水混凝土市場57.20%的佔有率,成為停車場、人行道和廣場等場所雨水管理的重要工具。市政低影響開發(LID)條例和海綿城市計劃持續推動對這種設計風格的新需求,鞏固了其在透水混凝土市場的主導地位。表面滲透測試技術和混合料最佳化技術的進步降低了維護成本,進一步增強了其對預算有限的公共部門負責人的吸引力。

目前結構性透水混凝土的絕對市場規模較小,但預計到2031年將以6.59%的複合年成長率成長,這主要得益於聚合物改質黏合劑的廣泛應用。這種黏合劑能夠在不影響孔隙連通性的前提下提高抗壓強度。研究表明,水灰比為0.3是強度和水力性能同時提升的關鍵點,這促使工程師在低速道路路肩、停車場和公車站等場所採用透水結構路面。隨著現場數據不斷驗證這些承載性能的提升,透水結構混凝土的市場規模預計將擴展到中型交通運輸和輕工業應用領域。

區域分析

亞太地區預計將以6.78%的複合年成長率實現最快成長,佔36.05%的最大市場。這主要得益於中國的「海綿城市」計劃,該計劃已在易澇都市區鋪設了數千公里的透水性路面。印度Ultratech等製造商正在在地化生產透水添加劑,以滿足季風季節的排水需求。同時,日本工程師正在利用預製模組化結構來縮短現場施工週期。這些技術創新表明,到預測期中期,該地區的市場規模預計將超過北美。

北美市場擁有成熟的法規結構、健全的承包商認證體系和豐厚的政府獎勵。美國環保署 (EPA) 已將透水性路面列為最佳管理實踐,這表明聯邦政府的支持最終落實到各州的採購指南中。

在歐洲,隨著成員國不斷完善透水路面指南並融入循環經濟原則(包括再生骨材的使用),監管主導的需求持續保持穩定。德國於2024年發布的透水路面設計標準正式確立了水力性能基準,消除了先前阻礙透水路面廣泛應用的技術模糊之處。儘管南美洲和中東/非洲目前市場佔有率較小,但預計加速的都市化和氣候變遷調適資金將推動透水路面試點計畫的發展,逐步擴大這些新興地區的透水混凝土市場。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 都市區突發性洪水災害加劇

- 強制性低影響開發(LID)分區標準

- 北美對透水性路面的稅收優惠

- 資料中心園區快速擴張(緩解熱島效應)

- 電氣化的最後一公里倉庫更喜歡涼爽的路面

- 市場限制

- 對認證安裝人員和專用安裝設備的需求

- 與傳統混凝土相比,其結構承載能力有限。

- 主要城市開級骨材短缺

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 有意為之

- 水文

- 結構

- 透過使用

- 硬質景觀

- 地板材料

- 其他用途

- 按最終用戶行業分類

- 住宅

- 商業的

- 基礎設施

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AG Peltz Group

- Cementos Moctezuma

- Cemex SAB de CV

- Chaney Enterprises

- Concreto Ecologico de Mexico

- CRH

- Empire Blended Products

- Frank J. Fazzio and Sons Inc.

- Harmak

- Heidelberg Materials

- Holcim

- Raffin Construction

- Sika AG

- Ultra Ready-Mix Concrete

- UltraTech Cement Ltd.

第7章 市場機會與未來展望

Pervious Concrete market size in 2026 is estimated at USD 5.49 billion, growing from 2025 value of USD 5.16 billion with 2031 projections showing USD 7.44 billion, growing at 6.3% CAGR over 2026-2031.

Rising urban flash-flood events, mandatory low-impact-development (LID) codes, and corporate commitments to sustainable construction underpin steady demand for pervious concrete across residential, commercial, and public infrastructure projects. Municipal tax incentives and sponge-city programs further accelerate adoption, while advances in mix design and polymer modification are widening the material's structural use cases. Competitive intensity remains moderate as multinational cement producers integrate permeable solutions into low-carbon portfolios and regional contractors invest in specialized placement equipment. Supply-side challenges, such as chiefly skilled-labor shortages and aggregate scarcity in megacities, continue to temper growth prospects but have not derailed the broader upward trajectory of the pervious concrete market.

Global Pervious Concrete Market Trends and Insights

Growing Urban Flash-Flood Incidents

Municipalities increasingly deploy pervious concrete to manage stormwater at its source, thereby reducing peak flows that overload aging sewer networks. The material's ability to infiltrate up to 8 gallons per square foot per minute lowers runoff volumes during cloudbursts, as evidenced by sponge-city projects that now exceed 10 000 installations across Chinese metropolitan areas. Escalating precipitation intensities linked to climate change enhance the value proposition by turning pavements into active drainage assets rather than passive surfaces. Local governments favor the dual-functionality of pervious concrete because it consolidates pavement and stormwater infrastructure into one capital outlay. Proven field performance in moderate-rainfall climates further cements its status as a cost-effective alternative to oversized gray-infrastructure pipes.

Mandatory Low-Impact-Development (LID) Zoning Codes

Regulatory momentum is shifting permeable pavements from optional sustainability features to prescriptive requirements. Los Angeles' 2024 LID Ordinance obliges sites adding or replacing large impervious expanses to meet on-parcel retention targets, positioning pervious concrete as a turnkey compliance pathway. New York City's Unified Stormwater Rule pursues a retention-first hierarchy that equally elevates the material within broader green-infrastructure frameworks. Developers gravitate toward pervious concrete because it satisfies multiple mandates-stormwater, heat-island mitigation, and LEED credits-within one specification. As more jurisdictions draft parallel codes, forecast visibility for the pervious concrete market strengthens through the end of the decade.

Need for Certified Contractors and Specialized Placement Equipment

Successful installations rely on maintaining correct void ratios and uniform compaction, tasks that differ markedly from conventional concrete practice. The NRMCA's certification framework ensures quality but restricts the pool of qualified installers, especially in emerging markets where training resources are thin. Specialized roller screeds and pavement testers elevate start-up costs for contractors, slowing capacity expansion even in regions with strong policy tailwinds. This talent and equipment bottleneck imposes project scheduling risks and can inflate bid prices, dampening near-term growth in the pervious concrete market.

Other drivers and restraints analyzed in the detailed report include:

- Tax Incentives for Porous Pavements in North America

- Rapid Expansion of Data-Center Campuses (Heat-Island Mitigation)

- Scarcity of Open-Graded Aggregates in Megacities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydrological specifications accounted for 57.20% of pervious concrete market share in 2025, anchoring the category's role as an on-site stormwater management tool for parking lots, sidewalks, and plazas. Municipal LID ordinances and sponge-city projects continue to funnel new demand into this design archetype, reinforcing its dominance in the pervious concrete market. Advances in surface infiltration testing and mix optimization are also reducing maintenance costs, preserving the appeal for public-sector buyers that operate on constrained budgets.

Structural designs, while currently smaller in absolute terms, are on course for a 6.59% CAGR to 2031, propelled by polymer-modified binders that elevate compressive strength without sacrificing void connectivity. Research pinpoints a 0.3 water-cement ratio as an inflection point where strength gains and hydraulic performance intersect, encouraging engineers to specify structural pervious pavements for low-speed roadway shoulders, parking garages, and bus stops. As field data validate these load-bearing enhancements, the pervious concrete market size for structural mixes is expected to broaden into mid-duty transit and light-industrial applications.

The Pervious Concrete Market Report is Segmented by Design (Hydrological and Structural), Application (Hardscape, Floors, and Other Applications), End-User Industry (Residential, Commercial, and Infrastructure), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific is the fastest-growing territory with a CAGR of 6.78% and also holds the largest share of 36.05%, spearheaded by China's sponge-city initiative, which alone accounts for thousands of pervious pavement kilometers across flood-prone urban districts. Indian manufacturers such as UltraTech are localizing permeable mixes to align with monsoon-drainage needs, while Japanese engineers leverage precast modular formats that shorten site installation cycles. Collectively, these innovations underscore the region's potential to eclipse North American volume midway through the forecast period.

North America's market is characterized by mature regulatory frameworks, robust contractor certification programs, and generous municipal incentives. The U.S. Environmental Protection Agency lists permeable pavements among its best-management practices, signaling federal endorsement that filters down to state procurement guidelines.

Europe posts steady, regulation-led demand as member states refine permeable pavement guidelines and integrate circular-economy principles, including recycled aggregates. German design codes published in 2024 formalize hydraulic-performance benchmarks, removing technical ambiguities that previously hampered adoption. While South America and the Middle-East and Africa contribute smaller shares for now, accelerating urbanization and climate-adaptation funding are expected to catalyze permeable-pavement pilots that will gradually scale the pervious concrete market across these emerging regions.

- A.G. Peltz Group

- Cementos Moctezuma

- Cemex S.A.B. de C.V.

- Chaney Enterprises

- Concreto Ecologico de Mexico

- CRH

- Empire Blended Products

- Frank J. Fazzio and Sons Inc.

- Harmak

- Heidelberg Materials

- Holcim

- Raffin Construction

- Sika AG

- Ultra Ready-Mix Concrete

- UltraTech Cement Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing urban flash-flood incidents

- 4.2.2 Mandatory low-impact-development (LID) zoning codes

- 4.2.3 Tax incentives for porous pavements in North America

- 4.2.4 Rapid expansion of data-centre campuses (heat-island mitigation)

- 4.2.5 Electrified last-mile warehouses favour cool pavements

- 4.3 Market Restraints

- 4.3.1 Need for certified contractors and specialised placement equipment

- 4.3.2 Limited structural load-bearing versus conventional concrete

- 4.3.3 Scarcity of open-graded aggregates in megacities

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Design

- 5.1.1 Hydrological

- 5.1.2 Structural

- 5.2 By Application

- 5.2.1 Hardscape

- 5.2.2 Floors

- 5.2.3 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Infrastructure

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 A.G. Peltz Group

- 6.4.2 Cementos Moctezuma

- 6.4.3 Cemex S.A.B. de C.V.

- 6.4.4 Chaney Enterprises

- 6.4.5 Concreto Ecologico de Mexico

- 6.4.6 CRH

- 6.4.7 Empire Blended Products

- 6.4.8 Frank J. Fazzio and Sons Inc.

- 6.4.9 Harmak

- 6.4.10 Heidelberg Materials

- 6.4.11 Holcim

- 6.4.12 Raffin Construction

- 6.4.13 Sika AG

- 6.4.14 Ultra Ready-Mix Concrete

- 6.4.15 UltraTech Cement Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment