|

市場調查報告書

商品編碼

1906195

金屬粉末:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Metal Powder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

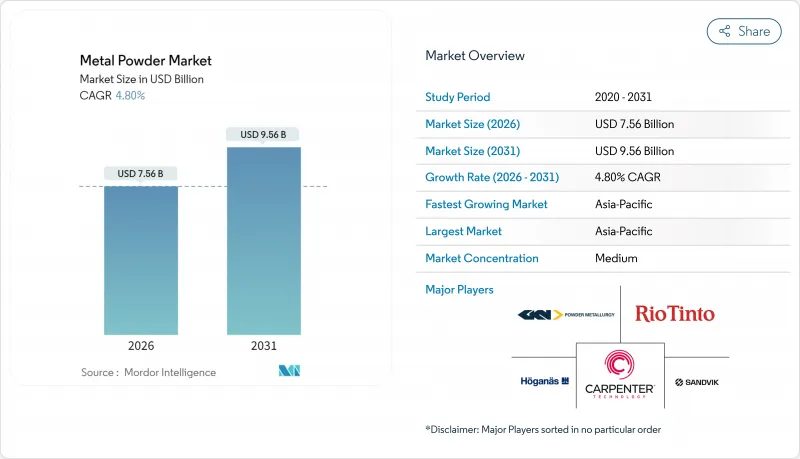

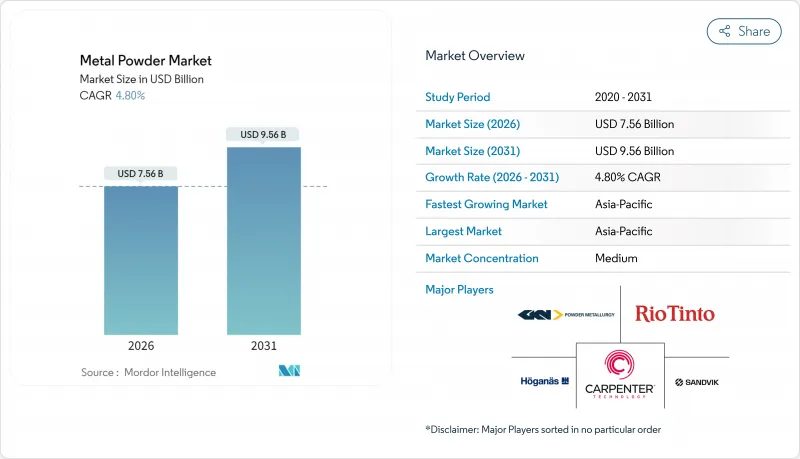

預計到 2026 年,金屬粉末市值將達到 75.6 億美元,高於 2025 年的 72.1 億美元,預計到 2031 年將達到 95.6 億美元。

預計從 2026 年到 2031 年,其複合年成長率將達到 4.8%。

汽車電氣化、航太業現代化以及積層製造技術的產業化推動了粉末需求的成長,這些因素共同催生了對各種粉末的需求,從低合金鐵基粉末到客製化的鎳鈦基粉末。車輛和飛機的輕量化計劃、電動動力系統的日益普及以及3D列印結構件的應用,都進一步推動了消費量的成長趨勢。同時,粉末生產商面臨原料價格波動和日益嚴格的環境法規,這不僅推高了合規成本,也促使他們投資於更清潔的噴塗技術。能夠靈活應對大批量壓制燒結契約和小批量、高利潤積層製造訂單的供應商,其競爭優勢正在不斷增強,這也進一步凸顯了工藝多元化的必要性。

全球金屬粉末市場趨勢及展望

促進汽車和航空領域的減重

汽車製造商持續致力於減輕車身重量,以延長電動車的續航里程並符合歐盟7排放氣體標準。這推動了專為軟磁複合複合材料設計的高密度鐵基和鋁基粉末的廣泛應用。安賽樂米塔爾新開發的鋼粉旨在用於低排放煞車系統,而美國國家航空暨太空總署(NASA)和普蘭西股份公司(Plansee AG)的TiAl薄板專案則標誌著航空業的轉型,其目標是與傳統的鎳基高溫合金相比減重25%至35%。北美地區的出貨量也印證了這一趨勢,70%的鐵基粉末訂單與汽車訂單相關,儘管航太合金在渦輪盤和結構支架應用方面仍然價格昂貴。

積層製造技術的應用日益廣泛

金屬粉末市場日益受到積層製造技術的影響,這些技術對粉末的球形度和流動穩定性提出了更高的要求。 NanoDimension 收購 Desktop Metal 後,整合了其 2.46 億美元的營收基礎,該公司專注於粉末層熔融和黏著劑噴塗技術。 Tecna 正在將專為 60µm 和 90µm 層厚客製化的粗粒Ti64 粉末商業化,以加速航太原型產品的生產。由美國能源局(DOE) 支持的 AMAZEMET rePowder 技術可將不規則的回收金屬轉化為球形原料,擴大了可用廢料的範圍。 Hoganas 的 CustomAM 平台結合了等離子體和氮氣霧化技術,使醫療植入設計人員能夠將定製粉末的生產規模從實驗室規模擴大到噸級。 ASTM 和 ASME 的認證工作表明,安全關鍵型核能部件的粉末規範日趨成熟。

職業和環境危害

美國職業安全與健康管理局 (OSHA) 的《可燃粉塵指南》要求金屬粉末加工場所配備完善的通風系統、對工人進行培訓並做好相關文件記錄,這增加了企業的資本成本和營運成本。美國消防協會 (NFPA) 正在將多項文件過渡到 NFPA 660,這是一項涵蓋可燃金屬處理、精加工和回收的統一標準。美國排放標準要求在過濾過程中進行過濾,並在研磨過程中減少粉塵,粉末塗裝室必須配備持續運作的噴灌,以降低閃燃風險。這些法規限制了執法嚴格地區的產能擴張,並加速了向封閉回路型低排放霧化器的過渡。

細分市場分析

2025年,鐵粉在金屬粉末市場中佔據43.46%的佔有率,這主要得益於其在汽車同步器、齒輪和結構件等領域的成熟應用。壓制和鐵基仍將主導生產,太平洋金屬公司每月1.5萬噸的不銹鋼產能為其提供了有力支撐。然而,特種合金預計將以更快的速度成長,到2031年將維持5.55%的複合年成長率,這主要得益於航太、醫療和國防項目對鈦、鎳和耐火合金高強度重量比的需求。 IperionX公司與美國簽訂的價值4710萬美元的契約,旨在實施氫輔助熱還原技術,這凸顯了美國致力於實現鈦供應鏈本土化的決心。印度鋁業投資 100 億美元擴建鋁業,其中包括將其位於奧裡薩邦的冶煉廠的年產能擴大 20 萬噸,這將確保產能能夠滿足電動車機殼和可再生能源電纜的需求。

鋼材原料的經濟性以及高價值合金的價格,正迫使粉末生產商重新調整其產品組合。供應商正在擴大預合金原料的牌號範圍,並減少壓制後的混合工序,以提高機械性能的一致性。這為下游用戶提供了安全關鍵零件所需的重複性,金屬粉末市場也持續向高利潤產品轉型。

到2025年,霧化製程仍將佔總收入的69.10%,因為氣體、水和等離子體製程各自滿足不同的流動性和純度要求。 VDM Metals公司新推出的真空惰性氣體霧化器體現了該公司持續的資本投入,旨在確保為高溫合金粉末層熔融提供航太級產品。濕式冶金製程雖然小規模,年複合成長率僅5.2%,但其能夠回收含鋅殘渣及含鎳污泥,符合循環經濟的目標。

新興技術縮小了顆粒尺寸分佈範圍並降低了能耗。金屬粉末加工廠無需熔化即可將棒材轉化為均勻的碎屑,從而降低了廢品率和碳排放。電極誘導氣體霧化技術比傳統的真空感應方法能夠生產出更細小、更球形的顆粒,為超薄印刷層開闢了新的前景。同時,電解和還原製程在用於硬面堆焊和硬焊焊膏的高純度粉末領域仍然佔據著一席之地。

區域分析

預計到2025年,亞太地區將佔全球營收的44.05%,並在2031年之前維持5.3%的年複合成長率,成為成長最快的地區。中國陰極銅產量年增14.27%,鋁產量增加2.6%,印證了其豐富的資源。印度正透過JSW鋼鐵公司投資78億美元的奧裡薩邦工廠以及與JFE合資投資6.6億美元的電工鋼項目擴大產能,創造了3萬個就業機會。日本和韓國在電子和精密加工領域保持領先地位,同時區域政策鼓勵基礎設施投資和回收(例如,三井物產對MTC Business的投資)。

在北美,創新主導訂單保持穩定。 IperionX的鈦合約確保了策略自主性,而GE航空航太公司積層製造業務的擴張將使粉末需求集中在噴射引擎組裝廠附近。加拿大供應鎳和鈷精礦,墨西哥仍然是美國OEM項目變速箱和傳動裝置粉末部件的重要供應商。

歐洲正努力平衡嚴格的排放法規與高價值製造業的發展。芬蘭的一家氫化直接還原鐵(DRI)工廠正在塑造低碳鋼粉的未來。德國正在資助輕量化傳動系統粉末的研究,法國則在推動渦輪葉片熱等靜壓(HIP)計畫。 Hoganas公司報告稱,自2018年以來,其範圍1+2碳排放減少了46%,並且已將其51%的原料轉向再生材料。中東歐正在成為汽車產業的二次燒結中心,而英國正在為航太制定積層製造標準。

南美洲和中東/非洲仍是新興市場。巴西的鐵礦石蘊藏量為燒結礦粉末提供了支撐,但基礎設施的匱乏將減緩高附加價值產品的普及。海灣國家正在考慮投資氫能和太陽能,這可能會帶動對特種合金粉末的需求。非洲國家正在探索電池金屬的開採,但物流和政策穩定性將決定投資的時間表。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 促進汽車和航空領域的減重

- 積層製造技術的應用激增

- 對小型化電子設備的需求不斷成長

- 對可再生能源組件的需求不斷成長

- 對高超音速防禦合金的需求不斷成長

- 市場限制

- 職業和環境危害

- 原物料價格波動

- 關鍵部件中粉末均勻性的局限性

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 類型

- 鐵

- 青銅

- 鋁

- 矽

- 鎳

- 其他類型(鈦等)

- 過程

- 原子化

- 化合物還原

- 電解

- 其他製程(例如濕式冶金)

- 製造方法

- 壓制燒結(傳統粉末冶金)

- 金屬射出成型

- 積層製造/3D列印

- 其他方法(熱等向性靜壓等)

- 終端用戶產業

- 運輸

- 電氣和電子設備

- 醫療保健

- 化學/冶金

- 防禦

- 建造

- 其他終端用戶產業(例如,積層製造服務機構)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 印尼

- 越南

- 馬來西亞

- 菲律賓

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 土耳其

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 南非

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Advanced Technology & Materials Co., Ltd.

- Alcoa Corporation

- ATI

- Aubert & Duval

- BASF

- CNPC Powder

- CRS Holdings, LLC.

- Erasteel

- GKN Powder Metallurgy

- HC Starck Tungsten GmbH

- Hitachi High-Tech India Private Limited

- Hoganas AB

- JFE Steel Corporation

- Kymera International

- Metalysis Ltd.

- Polema

- Linde Plc

- Outokumpu

- Rio Tinto Metal Powders

- Sandvik AB

- Seiko Epson Corporation

- Tekna

- Valimet

第7章 市場機會與未來展望

Metal Powder Market size in 2026 is estimated at USD 7.56 billion, growing from 2025 value of USD 7.21 billion with 2031 projections showing USD 9.56 billion, growing at 4.8% CAGR over 2026-2031.

Demand is anchored in automotive electrification, aerospace modernization, and the industrialization of additive manufacturing, which together create a broad pull for powders ranging from low-alloy iron grades to bespoke nickel- and titanium-based compositions. Light-weighting programs in vehicles and aircraft, the proliferation of electric drive trains, and the rising adoption of 3D-printed structural parts keep consumption on an upward track. At the same time, powder makers face raw-material price swings and tightening environmental rules that boost compliance costs yet also spur investments in cleaner atomization technologies. Competitive momentum is tilting toward suppliers that can flex between high-volume press-and-sinter contracts and low-volume, high-margin additive jobs, reinforcing the need for process diversity.

Global Metal Powder Market Trends and Insights

Light-weighting Push in Auto & Aero Sectors

Automotive OEMs continue to cut vehicle mass to extend electric-vehicle range and meet Euro 7 brake-emission norms, prompting broader uptake of high-density ferrous and aluminum powders designed for soft-magnetic composites. ArcelorMittal's newly developed steel powders target low-emission braking systems, while NASA and Plansee AG's TiAl sheet program shows aviation's pivot toward 25-35% weight savings over legacy Ni-base superalloys. North American shipments underscore the trend, with 70% of ferrous powder tonnage tied to automotive orders, even as aerospace alloys command premium pricing in turbine disk and structural bracket applications.

Surge in Additive Manufacturing Adoption

The metal powder market is increasingly shaped by additive manufacturing, which demands highly spherical, flow-stable powders. Nano Dimension's agreement to acquire Desktop Metal consolidates a USD 246 million revenue base devoted to powder-bed fusion and binder-jet technologies. Tekna has commercialized coarse Ti64 fractions tailored for 60 µm and 90 µm layers to cut build times in aerospace prototypes. DOE-backed AMAZEMET rePowder converts irregular reclaimed metal into spherical feedstock, widening the usable scrap pool. Hoganas' CustomAM platform, combining plasma and nitrogen atomization, lets medical-implant designers scale bespoke powders from lab batches to tons. ASTM and ASME qualification workstream signals the maturing of powder specifications for safety-critical nuclear parts.

Occupational & Environmental Hazards

OSHA combustible-dust guidelines mandate extensive ventilation, worker training, and documentation for metal-powder sites, lifting both capital and operating spend. NFPA is transitioning multiple documents into the unified NFPA 660 standard to cover handling, finishing, and recycling of combustible metals. EPA effluent limits now require filtration on abrasive blasting plus dust minimization during grinding, while powder-coating booths must install continuous-duty sprinklers to address flash-fire risk. Collectively, these rules constrain capacity expansions in regions with stringent enforcement and speed the shift toward closed-loop, low-emission atomizers.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand for Electronics Miniaturization

- Growing Demand for Renewable-Energy Components

- Raw-Material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Iron powders carried 43.46% of metal powder market share in 2025, aided by entrenched use in automotive synchronizers, gears, and structural parts. Volumetric heft still stems from press-and-sinter ferrous grades, supported by Pacific Metals' 15,000 t/month stainless capacity. Specialty alloys, however, claim faster growth at 5.55% CAGR through 2031 as aerospace, medical, and defense programs specify titanium, nickel, and refractory blends for elevated strength-to-weight ratios. IperionX's USD 47.1 million DoD contract to deploy Hydrogen-Assisted Metallothermic Reduction validates US ambitions for a native titanium supply chain. Hindalco's USD 10 billion aluminum build-out, including a 200,000 TPA Odisha smelter step-up, ensures capacity for electric-vehicle housings and renewable-energy cabling.

The interplay of commodity iron economics and premium alloy pricing encourages powder makers to balance output portfolios. Suppliers widen grade catalogs with pre-alloyed feeds that reduce post-press blending, improving mechanical consistency. In turn, downstream users gain repeatability essential for safety-critical parts, keeping the metal powder market in structural transition toward higher-margin mix.

Atomization retained 69.10% revenue in 2025, as gas, water, and plasma routes satisfy divergent flowability and purity demands. VDM Metals' new vacuum inert gas atomizer demonstrates ongoing capital deployment to secure aerospace-grade outputs for superalloy powder-bed fusion. Hydrometallurgical processing, while only a 5.2% CAGR pocket, recovers zinc-rich residues and nickel-bearing sludges, dovetailing with circular-economy targets.

Emergent techniques tighten particle-size bands and cut energy use. Metal Powder Works converts barstock into uniform chips without melting, trimming scrap rates and carbon footprints. Electrode-induction gas atomization yields finer spheres than legacy vacuum induction, opening new territories for ultra-thin printable layers. Meanwhile, electrolysis and reduction processes keep niche footholds for high-purity powders required in hard-facing and brazing pastes.

The Metal Powder Market Report is Segmented by Type (Iron, Bronze, Aluminum, and More), Process (Atomization, Reduction of Compounds, and More), Manufacturing Method (Press and Sinter, and More), End-User Industry (Transportation, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 44.05% revenue in 2025 and is projected to post the fastest 5.3% CAGR to 2031. China's copper-cathode output grew 14.27% year on year, and aluminum production rose 2.6%, underscoring resource depth. India widens capacity through JSW Steel's USD 7.8 billion Odisha complex plus a USD 660 million electrical-steel joint venture with JFE that adds 30,000 jobs. Japan and South Korea sustain electronics and precision machining leadership, while regional policy favors infrastructure investment and recycling ventures exemplified by Mitsui's stake in MTC Business.

North America shows steady, innovation-driven orders. IperionX's titanium contract secures strategic autonomy, while GE Aerospace's additive build-out clusters powder demand near jet-engine assembly hubs. Canada supplies nickel and cobalt concentrates, and Mexico remains integral for gearbox and transmission powder parts shipped into US OEM programs.

Europe balances stringent emissions rules with high-value manufacturing. Finland's hydrogen-DRI plant signals a low-carbon future for steel powders. Germany funds lightweight drivetrain powder research; France pushes turbine-blade HIP programs. Hoganas documents a 46% drop in scope 1+2 carbon since 2018, shifting 51% of feedstock to secondary streams. Central and Eastern Europe host automotive tier-2 sintering hubs, while the UK advances aerospace additive standards.

South America, the Middle East, and Africa remain emergent. Brazil's iron-ore reserves support sinter-base powders, yet infrastructure gaps slow additive uptake. Gulf nations eye hydrogen and solar investments that may translate into demand for specialty alloy powders. African states explore battery-metal mining, though logistics and policy stability condition investment timelines.

- Advanced Technology & Materials Co., Ltd.

- Alcoa Corporation

- ATI

- Aubert & Duval

- BASF

- CNPC Powder

- CRS Holdings, LLC.

- Erasteel

- GKN Powder Metallurgy

- H.C. Starck Tungsten GmbH

- Hitachi High-Tech India Private Limited

- Hoganas AB

- JFE Steel Corporation

- Kymera International

- Metalysis Ltd.

- Polema

- Linde Plc

- Outokumpu

- Rio Tinto Metal Powders

- Sandvik AB

- Seiko Epson Corporation

- Tekna

- Valimet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Light-weighting push in auto & aero sectors

- 4.2.2 Surge in additive manufacturing adoption

- 4.2.3 Increasing demand for electronics miniaturization

- 4.2.4 Growing demand for renewable-energy components

- 4.2.5 Increasing requirement for defense hypersonics alloy demand

- 4.3 Market Restraints

- 4.3.1 Occupational & environmental hazards

- 4.3.2 Raw-material price volatility

- 4.3.3 Powder consistency limits in critical parts

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 Type

- 5.1.1 Iron

- 5.1.2 Bronze

- 5.1.3 Aluminum

- 5.1.4 Silicon

- 5.1.5 Nickel

- 5.1.6 Other Types (Titanium, etc.)

- 5.2 Process

- 5.2.1 Atomization

- 5.2.2 Reduction of Compounds

- 5.2.3 Electrolysis

- 5.2.4 Other Processes (Hydrometallurgical Routes, etc.)

- 5.3 Manufacturing Method

- 5.3.1 Press and Sinter (Conventional PM)

- 5.3.2 Metal Injection Molding

- 5.3.3 Additive Manufacturing / 3D Printing

- 5.3.4 Other Methods (Hot Isostatic Pressing, etc.)

- 5.4 End-User Industry

- 5.4.1 Transportation

- 5.4.2 Electrical and Electronics

- 5.4.3 Medical

- 5.4.4 Chemical and Metallurgical

- 5.4.5 Defense

- 5.4.6 Construction

- 5.4.7 Other End-User Industries (Additive Manufacturing Service Bureaus, etc.)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Thailand

- 5.5.1.6 Indonesia

- 5.5.1.7 Vietnam

- 5.5.1.8 Malaysia

- 5.5.1.9 Philippines

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Turkey

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Advanced Technology & Materials Co., Ltd.

- 6.4.2 Alcoa Corporation

- 6.4.3 ATI

- 6.4.4 Aubert & Duval

- 6.4.5 BASF

- 6.4.6 CNPC Powder

- 6.4.7 CRS Holdings, LLC.

- 6.4.8 Erasteel

- 6.4.9 GKN Powder Metallurgy

- 6.4.10 H.C. Starck Tungsten GmbH

- 6.4.11 Hitachi High-Tech India Private Limited

- 6.4.12 Hoganas AB

- 6.4.13 JFE Steel Corporation

- 6.4.14 Kymera International

- 6.4.15 Metalysis Ltd.

- 6.4.16 Polema

- 6.4.17 Linde Plc

- 6.4.18 Outokumpu

- 6.4.19 Rio Tinto Metal Powders

- 6.4.20 Sandvik AB

- 6.4.21 Seiko Epson Corporation

- 6.4.22 Tekna

- 6.4.23 Valimet

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Increasing Developments in Healthcare Industries