|

市場調查報告書

商品編碼

1906193

織布機:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Weaving Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

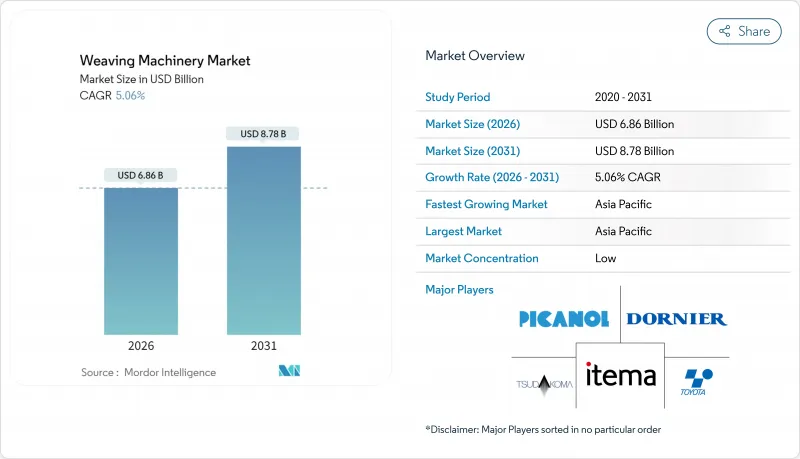

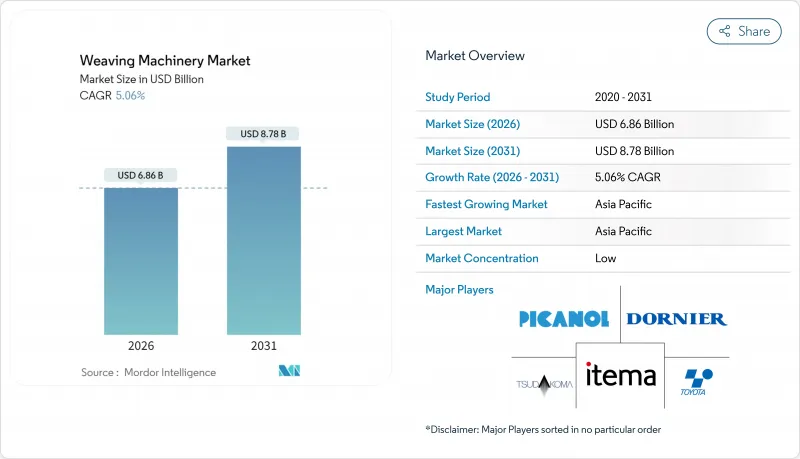

預計到 2026 年,織布機市場規模將達到 68.6 億美元,高於 2025 年的 65.3 億美元。預計到 2031 年,該市場規模將達到 87.8 億美元,2026 年至 2031 年的複合年成長率為 5.06%。

儘管面臨週期性不利因素,工業4.0平台的快速普及、對技術和工業紡織品日益成長的需求以及政策主導的現代化項目,正推動強勁的資本投資。對噴射和水刀技術的投資正在提升效率,而數位化改造套件則使即使是中小製造商也能負擔得起先進的監控設備。生產向亞太地區的轉移支撐了設備訂單,而歐洲和日本的供應商則透過結合物聯網儀錶板和預測性維護服務,保持其技術優勢。原料價格的波動以及已開發國家熟練操作人員的短缺,正在加速自動化投資,因為工廠希望減少廢棄物並提高運轉率。

全球織布機市場趨勢與洞察

技術紡織品和工業紡織品的需求不斷成長

內部裝潢建材、醫療拋棄式產品、地工織物和防護工具的技術布料,對能夠處理高性能紗線的織造機需求旺盛,訂單也隨之成長。印度國家技術紡織任務署(National Technical Textile Mission)核准了168個計劃,總價值達6,100萬美元,是推動這一趨勢的主要促進者。紡織廠採用水刀和噴射平台來控制合成長絲的張力,從而降低缺陷率。電子提花機則用於處理過濾介質和複合纖維所需的複雜圖案。供應商正抓住這一趨勢,提升銷售數位化張力控制模組。設備成本的增加,得益於返工率的降低和產品利潤率的提高。基礎設施和醫療應用領域的強勁需求,預示著中期內市場將持續成長。

向自動化和高速織布機過渡(工業4.0)

全球製造商正將物聯網感測器、機器資料介面和邊緣分析板整合到新型織機中,以提高生產速度並實現預測性維護。羅克韋爾自動化公司報告稱,整合驅動架構在試點工廠將計劃外停機時間減少了20%。即時儀錶板可通知技術人員張力漂移和氣壓異常情況,進而減少廢棄物。模組化維修套件可將這些優勢擴展到現有工廠(棕地),從而將織造市場擴展到新建設(待開發區)之外。雲端連接的高品質視覺攝影機可在不到一秒的時間內檢測到緯紗斷裂,並防止捲筒缺陷。在勞動力短缺日益嚴重的背景下,高速織布機與自動拆線系統的結合,在經合組織成員國和新興經濟體中均能帶來可觀的投資報酬率 (ROI)。

高昂的資本投資和維護成本

無梭織機通常價格昂貴,每台售價超過50萬美元,這給佔印度紡織品生產能力約80%的微型、小型和中型企業(MSMEs)造成了資金籌措障礙。由於技術週期縮短,設備的實際價值(超過標價的部分)迅速下降,銀行在放款方面較為謹慎。此外,紡織廠還需要為年度維護合約、專用軟體更新和培訓模組累計,這些費用加起來可能佔購置成本的8%。歐盟機械指令2023/1230對具有內建軟體的機器增加了額外的文件和網路安全成本。租賃和供應商管理服務模式可以緩解部分融資壓力,但這些模式在新興市場仍處於發展階段。在折舊免稅額期延長或補貼資金擴大之前,成本壓力可能會限制設備更換的速度。

細分市場分析

由於噴射織布機技術適用於棉、混紡和合成纖維等多種布料,預計2025年將佔據織布機市場38.35%的佔有率。客戶非常欣賞其無需對機器進行重大改造即可快速更換款式的特性,這對於每週都有訂單的服裝製造商來說至關重要。數位張力控制模組能夠在不犧牲品質的前提下,將織布機速度提升至每分鐘1200緯以上,預計將穩定擴大噴射織機市場。同時,由於水在聚酯纖維和尼龍加工中能夠有效控制纖維,因此預計到2031年,水噴織機的複合年成長率將達到6.78%。中國製造商正在擴大合成纖維服飾的生產,並採用水噴生產線來提高布料光澤度和減少斷線。劍桿織布機在家用紡織品和羊毛混紡領域仍然佔據重要地位,因為這些領域需要輕柔地轉移緯紗,以適應各種紗線類型。對於需要高密度編織的裝飾性織物,梭梭式和片梭式仍然有效,但隨著小眾需求趨於穩定,更換週期正在延長。

噴射切割機供應商正在擴展其物聯網入門套件,這些套件可以記錄氣流消費量並預測噴嘴磨損,從而增強其相對於新興亞洲供應商的競爭優勢。改裝套件正在將這些分析功能擴展到劍桿切割機生產線,擴大潛在的售後市場客戶群。水刀切割機製造商正在投資封閉回路型過濾系統,以應對嚴格的污水排放法規,這被認為是歐洲的一大障礙。區域工具機合作夥伴關係正在建立本地服務網路,這對於越南和孟加拉的工廠至關重要,因為它們無法承受長時間的停機。隨著合成纖維的消費成長速度超過天然纖維,水刀切割機的速度優勢和織物後整理品質預計將略微削弱噴氣式切割機的優勢,但這兩種平台仍將在多線工廠中共存,以最佳化紗線混合和訂單模式。

區域分析

預計到2025年,亞太地區將佔全球收入的52.05%,並在2031年之前以5.47%的複合年成長率成長,這主要得益於政府對現代化項目的投入以及品牌在地採購的增加。在印度,生產關聯獎勵計畫(PLI)、噴射織布機補貼計畫(ATUFS)和國家技術紡織品任務(NTTM)共投入14.8億美元,直接補貼噴射織布機和劍桿織布機的購置,使許多工廠的投資回收期縮短至四年以內。中國在合成長絲織造領域保持主導,地方政府為符合數位連接標準的高速設備提供稅收優惠。在越南、印尼和孟加拉國,隨著品牌供應鏈多元化,外商直接投資(FDI)不斷湧入,推動了配備物聯網硬體的新型多生產線工廠的建設。

歐洲雖然面積較小,卻保持著技術領先的市場佔有率,其中德國、義大利和西班牙是核心。歐盟機械指令2023/1230迫使工廠投資符合規範且具備網路安全功能的織造機,這在消費成長放緩的情況下催生了更新換代的需求。 VDMA成員企業透過整合安全的PLC架構和降噪套件,獲得了這部分支出的大部分佔有率。奢侈時尚生產回歸葡萄牙和法國,進一步推動了對靈活的小批量生產機械的需求。波蘭和羅馬尼亞的東歐企業正在利用歐盟凝聚基金安裝專門用於再生聚酯纖維的水刀生產線,以回應「綠色交易」的優先事項。

在北美,技術和國防紡織品的重要性日益凸顯,這得益於近岸外包戰略,該戰略有利於墨西哥巴希奧地區和美國東南部的紡織廠。政府對防護設備的採購維持了基本訂單,而汽車座椅布料合約則推動了高密度織布機的升級換代。在南美,服裝和家用紡織品穩步成長,巴西正透過混合融資機制對其老舊的梭織機進行現代化改造。中東和非洲地區雖然仍在發展中,但其戰略意義重大,這主要得益於土耳其的橋樑作用以及沙烏地阿拉伯的「2030願景」產業多元化戰略(為紡織產業叢集提供資金)。這些多元化的區域趨勢正在為織造機械市場建立廣泛的需求基礎。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 技術紡織品和工業紡織品的需求不斷成長

- 邁向自動化與高速織布機(工業4.0)

- 新興經濟體服飾消費不斷成長

- 政府對紡織製造業的獎勵措施

- 織布數位雙胞胎最佳化技術簡介

- 對再生纖維織造生產線的需求

- 市場限制

- 高昂的資本投資和維護成本

- 原物料價格波動

- 熟練操作先進織布機的工人短缺

- 經合組織市場遵守噪音和振動法規的成本

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 全球紡織品市場洞察

- 地緣政治事件如何影響供應鏈

第5章 市場規模及成長預測(價值,單位:十億美元)

- 按模型

- 梭織機

- 劍桿織布機

- 噴射織布機

- 噴水織布機

- 彈射織布機

- 其他(圓織布機、窄幅織布機、輔助設備)

- 透過脫落/圖形化

- 凸輪(挺桿)

- 多比(機械、電子)

- 提花(電子;針跡密度/鉤針數量)

- 透過使用

- 服裝與時尚

- 家用紡織品及家具布料

- 汽車紡織品

- 工業、技術和過濾紡織品

- 其他(標籤、膠帶等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東協(印尼、泰國、菲律賓、馬來西亞、越南)

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 土耳其

- 埃及

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Picanol

- Itema SpA

- Toyota Industries

- Dornier GmbH

- Tsudakoma Corp.

- Staubli Group

- SMIT Textile Machinery

- Van de Wiele

- Bonas

- Rieter

- Trutzschler

- Oerlikon

- JP Extrusiontech

- Jingwei

- Erfangji

- Zhejiang Tongda Textile Machinery

- Qingdao Tianyi Red Flag Machinery

- Lakshmi Machine Works

- Benninger AG

- Yantra Looms

- Cyber Mill

第7章 市場機會與未來展望

The Weaving Machinery Market size in 2026 is estimated at USD 6.86 billion, growing from 2025 value of USD 6.53 billion with 2031 projections showing USD 8.78 billion, growing at 5.06% CAGR over 2026-2031.

Rapid uptake of Industry 4.0 platforms, rising demand for technical and industrial textiles, and policy-driven modernization programs keep capital expenditure robust despite cyclical headwinds. Investments in air-jet and water-jet technologies underpin efficiency gains, while digital-retrofit kits make advanced monitoring affordable for small and medium manufacturers. Regional production shifts toward Asia-Pacific sustain equipment orders, yet European and Japanese suppliers retain technology leadership by bundling IoT dashboards and predictive maintenance services. Volatility in raw-material prices and shortages of skilled operators in developed economies accelerate automation spending as mills target lower waste and higher uptime.

Global Weaving Machinery Market Trends and Insights

Rising Demand for Technical & Industrial Textiles

Technical fabrics for automotive interiors, medical disposables, geotextiles, and protective gear create premium orders for looms that can handle high-performance yarns. India's National Technical Textiles Mission, which cleared 168 projects worth USD 61 million, is a major catalyst. Mills adopt water-jet and air-jet platforms that manage synthetic filament tension with low defect rates. Electronic jacquards cater to intricate patterns needed in filtration and composite fabrics. Suppliers leverage this shift to upsell digital tension-control modules, justifying equipment costs with lower rework and higher margin products. The strong pipeline of infrastructure and medical applications signals sustained demand through the medium term.

Shift Toward Automation & High-Speed Looms (Industry 4.0)

Global manufacturers embed IoT sensors, machine-data interfaces, and edge-analytics boards in new looms to boost output speed and predictive maintenance. Rockwell Automation reports that integrated drive architectures trimmed unscheduled downtime by 20% in pilot mills. Real-time dashboards alert technicians to tension drift and air-pressure anomalies, curbing waste. Modular retrofit kits extend these gains to brownfield sites, expanding the weaving machinery market beyond greenfield builds. Cloud-linked quality vision cameras now spot weft breaks in under one second, preventing roll defects. As labor scarcity grows more acute, high-speed looms paired with automated doffing systems deliver measurable returns on investment across both OECD and emerging economies.

High Capital Investment & Maintenance Costs

Shuttle-less looms typically cost more than USD 500,000 per unit, creating steep financing barriers for micro and small enterprises that represent nearly 80% of India's textile capacity. Banks remain cautious because resale values drop quickly when technology cycles shorten beyond the sticker price, mills budget for annual maintenance contracts, specialized software updates, and training modules that together can reach 8% of acquisition cost. EU Machinery Regulation 2023/1230 adds documentation and cybersecurity expenses to any machine with embedded software. Leasing and vendor-managed-service models partly relieve cash-flow strain but are still nascent in emerging markets. Until depreciation periods lengthen or subsidy pools grow, cost pressures will curb the pace of equipment replacement.

Other drivers and restraints analyzed in the detailed report include:

- Growing Apparel Consumption in Emerging Economies

- Government Incentives for Textile Manufacturing

- Volatile Raw-Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-jet technology held a 38.35% weaving machinery market share in 2025, thanks to versatility across cotton, blends, and artificial fibers. Customers value its ability to switch styles quickly without major mechanical changes, a critical factor for fashion mills managing weekly order cycles. The weaving machinery market size attributed to air-jet units is set to climb steadily as digital tension-control modules boost speed beyond 1,200 picks per minute without compromising quality. However, water-jet models are projected to grow at a 6.78% CAGR through 2031 by excelling in polyester and nylon processing, where moisture aids filament control. Chinese mills expanding synthetic apparel output adopt water-jet lines to achieve higher fabric luster and reduced yarn breakage. Rapier systems maintain a loyal base in home textiles and wool blends, where yarn variety demands gentle weft transfer. Projectile and shuttle formats stay relevant for decor fabrics requiring dense weaves, though their replacement cycle lengthens as niche demand stabilizes.

Air-jet suppliers increasingly bundle IoT starter packs that record airflow consumption and predict nozzle wear, enhancing competitive positioning against emerging Asian vendors. Retrofit kits extend these analytics to rapier lines, enlarging the total addressable aftermarket. Water-jet manufacturers invest in closed-loop filtration systems to comply with stricter wastewater norms, addressing a perceived barrier in Europe. Regional machine-tool alliances enable localized service networks, a decisive factor for mills in Vietnam and Bangladesh that cannot afford prolonged downtime. As synthetic fiber consumption grows faster than natural fibers, water-jet's speed advantage and fabric finish quality are expected to erode air-jet's dominance marginally, yet both platforms will co-exist in multi-line factories optimizing for yarn mix and order profile.

The Weaving Machinery Market Report is Segmented by Machine Type (Shuttle Loom, Rapier Loom, Air-Jet Loom, Water-Jet Loom, and More), by Shedding/Patterning (Cam, Dobby and Jacquard), by Application (Apparel & Fashion, Home Textiles & Upholstery, Automotive Textiles, and More), and by Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured 52.05% of 2025 revenue and is forecast to grow at a 5.47% CAGR through 2031 as governments bankroll modernization programs and brands localize sourcing. India's combined allocation of USD 1.48 billion across PLI, ATUFS, and the National Technical Textiles Mission directly subsidizes air-jet and rapier purchases, compressing payback to under four years for many mills. China maintains leadership in synthetic filament weaving, with regional provinces offering tax rebates on high-speed equipment that meets digital-connectivity standards. Vietnam, Indonesia, and Bangladesh attract foreign direct investment as brands diversify supply chains, stimulating multi-line greenfield plants that standardize on IoT-ready hardware.

Europe holds a smaller yet technologically sophisticated share, anchored by Germany, Italy, and Spain. The EU Machinery Regulation 2023/1230 compels mills to invest in compliant, cyber-secure looms, creating replacement demand despite modest consumption growth. VDMA member firms capture much of this spend by integrating safety-PLC architectures and noise-attenuation kits. Reshoring of premium fashion production to Portugal and France further boosts demand for flexible, short-run machines. Eastern European players in Poland and Romania leverage EU cohesion funds to install water-jet lines dedicated to recycled polyester, aligning with Green Deal priorities.

North America emphasizes technical and defense textiles, leveraging nearshoring strategies that favor mills in Mexico's Bajio region and the U.S. Southeast. Government procurement of protective equipment maintains baseline orders, while automotive seat-fabric contracts spur high-density weaving upgrades. South America experiences steady apparel and home-textile growth, with Brazil modernizing older shuttle fleets via blended-finance mechanisms. Middle East and Africa remain nascent but strategic, driven by Turkey's bridging role and Saudi Arabia's Vision 2030 diversification that earmarks funds for textile clusters. Collectively, these varied regional trajectories secure a broad demand base for the weaving machinery market.

- Picanol

- Itema S.p.A.

- Toyota Industries

- Dornier GmbH

- Tsudakoma Corp.

- Staubli Group

- SMIT Textile Machinery

- Van de Wiele

- Bonas

- Rieter

- Trutzschler

- Oerlikon

- J P Extrusiontech

- Jingwei

- Erfangji

- Zhejiang Tongda Textile Machinery

- Qingdao Tianyi Red Flag Machinery

- Lakshmi Machine Works

- Benninger AG

- Yantra Looms

- Cyber Mill

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for technical & industrial textiles

- 4.2.2 Shift toward automation & high-speed looms (Industry 4.0)

- 4.2.3 Growing apparel consumption in emerging economies

- 4.2.4 Government incentives for textile manufacturing

- 4.2.5 Adoption of digital-twin optimisation for looms

- 4.2.6 Demand for recycled-fibre capable weaving lines

- 4.3 Market Restraints

- 4.3.1 High capital investment & maintenance costs

- 4.3.2 Volatile raw-material prices

- 4.3.3 Skilled-operator shortage for advanced looms

- 4.3.4 Noise & vibration compliance costs in OECD markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Insights on the Global Textile Market

- 4.9 Impact of Geopolitical Events on Supply Chains

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Machine Type

- 5.1.1 Shuttle Loom

- 5.1.2 Rapier Loom

- 5.1.3 Air-Jet Loom

- 5.1.4 Water-Jet Loom

- 5.1.5 Projectile Loom

- 5.1.6 Others (Circular Loom, Narrow-fabric looms, Auxiliaries)

- 5.2 By Shedding / Patterning

- 5.2.1 Cam (Tappet)

- 5.2.2 Dobby (Mechanical, Electronic)

- 5.2.3 Jacquard (Electronic; Stitch Density/Number of Hooks)

- 5.3 By Application

- 5.3.1 Apparel & Fashion

- 5.3.2 Home Textiles & Upholstery

- 5.3.3 Automotive Textiles

- 5.3.4 Industrial, Technical & Filtration Textiles

- 5.3.5 Others (labesl, tapes, etc.)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Kuwait

- 5.4.5.5 Turkey

- 5.4.5.6 Egypt

- 5.4.5.7 South Africa

- 5.4.5.8 Nigeria

- 5.4.5.9 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.4.1 Picanol

- 6.4.2 Itema S.p.A.

- 6.4.3 Toyota Industries

- 6.4.4 Dornier GmbH

- 6.4.5 Tsudakoma Corp.

- 6.4.6 Staubli Group

- 6.4.7 SMIT Textile Machinery

- 6.4.8 Van de Wiele

- 6.4.9 Bonas

- 6.4.10 Rieter

- 6.4.11 Trutzschler

- 6.4.12 Oerlikon

- 6.4.13 J P Extrusiontech

- 6.4.14 Jingwei

- 6.4.15 Erfangji

- 6.4.16 Zhejiang Tongda Textile Machinery

- 6.4.17 Qingdao Tianyi Red Flag Machinery

- 6.4.18 Lakshmi Machine Works

- 6.4.19 Benninger AG

- 6.4.20 Yantra Looms

- 6.4.21 Cyber Mill

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment