|

市場調查報告書

商品編碼

1906191

聚酯輪胎簾布簾布:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Polyester Tire Cord Fabrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

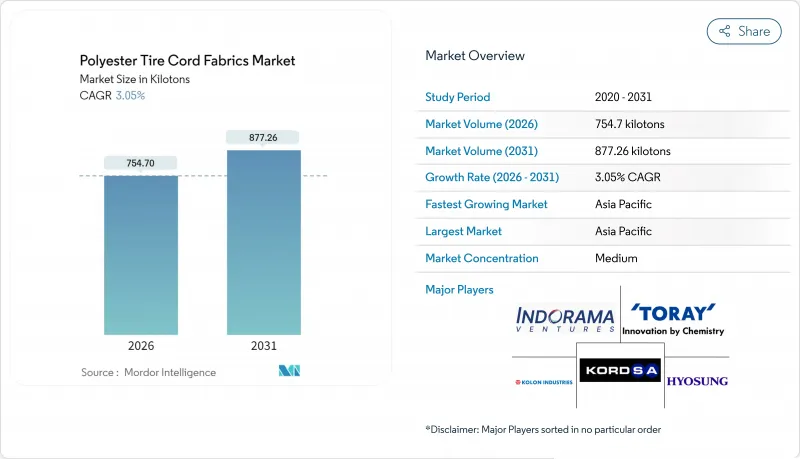

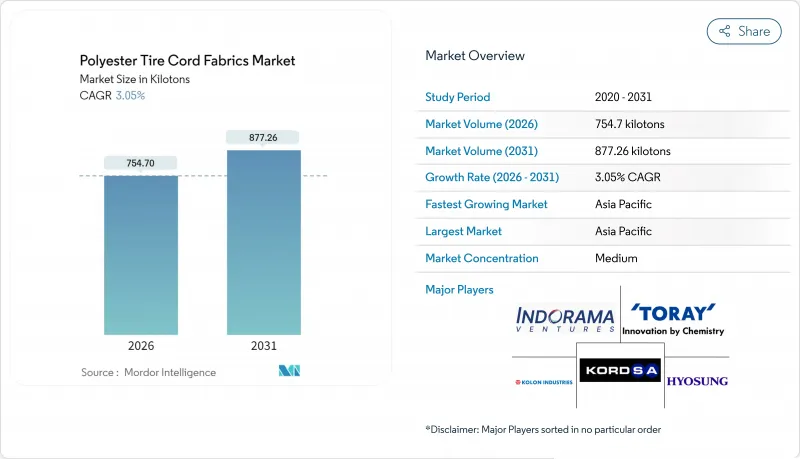

預計到 2026 年,聚酯輪胎簾布簾子佈市場規模將達到 754.7 千噸,從 2025 年的 732.37 千噸成長到 2031 年的 877.26 千噸,2026 年至 2031 年的複合年成長率為 3.05%。

亞太地區子午線輪胎的日益普及、高模量低收縮率(HMLS)紗線的加速應用以及電動車(EV)產量的擴張,共同支撐了這一穩步成長。曉星和科隆等公司接近滿載運作、PTA/MEG價格的長期波動以及歐盟和美國日益嚴格的甲醛法規,都在推動成本結構和競爭策略的重組。供應正轉向具備再生PET加工能力的一體化生產商,而中小加工商則專注於研發無甲醛黏合劑技術以獲得監管部門的批准。區域需求熱點包括印度卡車子午線輪胎加工量的激增以及越南以出口為導向的乘用車輪胎叢集,儘管其他地區斜交輪胎的使用量有所下降,但這兩個地區仍然推動了對高分子量聚酯(HMLS)的需求。

全球聚酯輪胎簾布簾子佈市場趨勢及展望

亞太地區子午線輪胎的快速普及

2024年,子午線輪胎在亞太地區的乘用車中廣泛應用,與前一年相比顯著成長。這項變更主要源自於中國和印度汽車製造商為應對燃油經濟性法規而採取的措施,這些法規在滾動阻力測試中對斜交輪胎的設計提出了不利評價。子午線輪胎需要比斜交輪胎更多的聚酯簾布層以承受更高的充氣壓力,這推動了對高模量、低收縮率(HMLS)聚酯的需求,即便斜交輪胎的需求有所下降。在中東,新建輪胎工廠的計劃全部專注於子午線輪胎生產線,這將推動聚酯消費量的長期成長。雖然東南亞國協商用車車隊採用子午線輪胎的速度較為緩慢,但柴油價格的飆升有力地支撐了子午線輪胎的整體擁有成本優勢。預計此一趨勢將持續惠及發展中地區後採用者所採用的聚酯輪胎簾布層市場。

OEM廠商正迅速轉向使用HMLS紗線並淘汰PCI。

輪胎製造商正從標準強度聚酯纖維轉向高密度低強度(HMLS)聚酯纖維。這些新型纖維可透過減少汽車胎體簾布層數來減輕重量。 HMLS紗線的低熱收縮率使其適用於無需後壓插入(PCI)的生產線,從而降低工廠能耗並縮短生產週期。Bridgestone和米其林已試行了無PCI生產線,但全面推廣應用將取決於改良型RFL化學製程的規模化應用,以控制廢品率。高強度紗線和消除PCI的雙重優勢可降低輪胎單位成本並提升永續性指標,進一步增強了原始設備製造商(OEM)對HMLS聚酯纖維的偏好。

PTA/MEG原物料價格波動

布蘭特原油價格對對苯二甲酸單乙酯(PTA)和乙二醇單乙酯(MEG)的價格影響顯著,這兩種原料合計約佔聚酯成本的70%,導致加工商的利潤率每月波動。 2024年亞洲PTA現貨價格的大幅波動擾亂了非一體化加工商的預算。雖然像曉星這樣的一體化企業能夠利用自有單體來緩解這種波動,但規模較小的加工商卻被迫每季與原始設備製造商(OEM)重新談判,導致擴張計劃停滯,研發支出削減。

細分市場分析

到2025年,子午線輪胎的需求量將佔57.31%,預計到2031年將成長4.05%。這一成長速度超過了斜交輪胎的產量成長,從而推動了該細分市場聚酯輪胎簾布層市場規模的擴大。子午線輪胎在巡航速度下運轉溫度比斜交輪胎低15-20°C,使電動車平台能夠在不增加汽車胎體重量的情況下有效應對電池產生的熱量。斜交輪胎在農業和非公路應用領域仍然佔據主導地位,但其較低的初始價格並不能彌補其在公路行駛中更高的燃油經濟性。中國乘用車子午線輪胎的普及率已超過臨界值,預計2024年,商用車也將達到相當高的普及率。這兩種趨勢都導致每條輪胎的簾布層用量增加,而這主要是由於更高的充氣壓力所致。這項變化是聚酯輪胎簾布層市場成長最主要的促進因素。

儘管成熟經濟體的斜交輪胎產量正在下降,但在撒哈拉以南非洲地區,由於可修復性比總成本更為重要,斜交輪胎的產量卻在上升。然而,由於中東地區的新工廠傾向於只生產子午線輪胎,全球斜交輪胎市場佔有率持續下降。韓泰輪胎的iON輪胎將化學回收的HMLS紗線與鋼絲帶束層結合,實現了永續性和強度之間的平衡。它展示了混合結構如何降低長途運輸應用中子午線輪胎的溢價。這項創新將促進子午線輪胎的成長,同時防止聚酯纖維在主流速度等級輪胎中被芳香聚醯胺取代。

聚酯輪胎簾布簾子佈市場報告按輪胎類型(子午線輪胎和斜交輪胎)、應用領域(乘用車、商用車及其他應用)和地區(亞太地區、北美地區、歐洲地區、南美地區以及中東和非洲地區)進行細分。市場預測以噸為單位。

區域分析

到2025年,亞太地區將佔全球市場佔有率的49.07%,並在2031年之前以每年3.95%的速度成長。這一成長主要得益於中國乘用車輪胎工廠的高產運轉率以及印度作為主要汽車市場的崛起。科隆公司近期在越南的投資旨在提升工廠產能,以滿足錦湖輪胎、賽龍輪胎和Bridgestone等產業巨頭的需求。越南的乘用車輪胎出口量和聚酯簾布層年消費量印證了該國在聚酯輪胎簾布層市場的重要地位。

北美和歐洲在全球整體產量中佔據相當大的佔有率,但成長速度正在放緩。這種停滯歸因於輪胎行駛里程趨於穩定以及胎面壽命延長。為響應歐盟的甲醛限制規定,市場已顯著轉向使用無甲醛黏合劑,其中Cocoon公司主導地位。為響應供應鏈區域化的趨勢,錦湖化工正在考慮在歐洲待開發區工廠,以符合美墨加協定(USMCA)的原產地規則。同時,大陸集團的永續聚酯計劃鼓勵當地加工商對再生材料含量進行認證,這使得市場格局更加複雜,並提高了聚酯輪胎簾布簾子佈市場的准入門檻。

南美洲和中東/非洲地區合計佔據了相當大的市場佔有率,並持續穩定成長。倍耐力已在沙烏地阿拉伯開設了一家工廠,其位於摩洛哥的世紀工廠預計將有助於提高輪胎產量。此次產量激增預計將滿足高模量、低直徑(HMLS)簾線的需求。 2024年,土耳其的Cordoza公司推出了一條聚酯紗線生產線,旨在為當地原始設備製造商(OEM)提供策略性供應。雖然巴西的輪胎產量正在復甦,但國內簾線產能不足,只好依賴從台灣台塑集團進口。這些區域動態凸顯了局部供不應求可能擴大聚酯輪胎簾布簾線市場,即使在輪胎產量不高的地區也是如此。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 子午線輪胎的普及率正在飆升,尤其是在亞太地區。

- 原始設備製造商正在迅速轉向高強度HMLS PET紗線

- 電動車(EV)產量加速成長,推動了對低滾動阻力汽車胎體的需求。

- 消除固化後膨脹(PCI)帶來的潛在節能效果

- OEM對再生/生物基PET繩材的永續性要求

- 市場限制

- PTA/MEG原物料價格波動

- 歐盟和美國黏合劑的甲醛含量(RFL)實施更嚴格的監管

- 在超高速應用中,芳香聚醯胺線的性能差異

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按輪胎類型

- 子午線輪胎

- 斜交輪胎

- 透過使用

- 搭乘用車

- 商用車輛

- 其他應用

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 土耳其

- 俄羅斯

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Bekaert

- Century Enka Limited

- CORDENKA GmbH & Co. KG

- Far Eastern New Century Corporation

- Firestone Fibers & Textiles

- FORMOSA TAFFETA CO., LTD.

- HYOSUNG

- Indorama Ventures Public Company Limited

- Jiangsu Taiji Industry New Materials Co., Ltd.

- Junma Group

- Kolon Industries Inc.

- KORDARNA Plus as

- Kordsa Teknik Tekstil AS

- Madura Industrial Textiles Ltd.

- Shandong Helon Polytex Chemical Fibre

- SRF Limited

- TEIJIN FRONTIER(USA),INC.

- TORAY INDUSTRIES,INC.

- Zhejiang Hailide New Material Co., Ltd.

第7章 市場機會與未來展望

Polyester Tire Cord Fabrics Market size in 2026 is estimated at 754.7 kilotons, growing from 2025 value of 732.37 kilotons with 2031 projections showing 877.26 kilotons, growing at 3.05% CAGR over 2026-2031.

Rising radial-tire penetration across Asia-Pacific, the accelerating shift to high-modulus low-shrinkage (HMLS) yarns, and expanding electric-vehicle (EV) output underpin this steady headline growth. Hyosung's and Kolon's near-full plant utilization, along with chronic PTA/MEG price swings, and the tightening of EU and U.S. formaldehyde rules are reshaping cost structures and competitive strategies. Supply is tilting toward integrated producers with recycled-PET capability, while smaller converters focus on formaldehyde-free bonding to secure regulatory clearance. Regional demand hot spots include India's surging truck radial conversion and Vietnam's export-oriented passenger-tire cluster, each lifting HMLS polyester volumes despite bias-tire contraction elsewhere.

Global Polyester Tire Cord Fabrics Market Trends and Insights

Surging Radial-Tire Penetration in Asia-Pacific

In 2024, passenger cars in the Asia-Pacific region widely adopted radial tires, marking a significant increase from previous years. This shift was largely driven by Chinese and Indian OEMs adapting to fuel-economy regulations that penalized bias designs in rolling-resistance tests. Radial tires, requiring more polyester cord than their bias counterparts to manage heightened inflation pressures, have consequently boosted demand for High Modulus Low Shrinkage (HMLS) polyester, even as bias tire volumes decline. In the Middle East, greenfield tire projects have committed exclusively to radial lines, ensuring a long-term increase in polyester consumption. While commercial vehicle fleets in ASEAN nations have been slow to adopt, surging diesel prices are making a compelling case for the total cost of ownership in favor of radial tires. This trend positions the polyester tire cord fabrics market to steadily benefit from late adopters in developing regions.

Rapid OEM Shift to HMLS Yarns and PCI Elimination

Tire manufacturers are shifting from standard-tenacity polyester to HMLS grades. These new grades allow for carcass-ply cuts that reduce weight. The lower thermal shrinkage of HMLS yarns also supports production lines that skip post-cure inflation (PCI), cutting plant energy use and shortening cycle times. Bridgestone and Michelin have piloted PCI-free lines, but widespread rollout hinges on scaling modified RFL chemistries that control scrap rates. Combined, higher-tenacity yarns and PCI elimination improve cost per tire and sustainability metrics, reinforcing OEM preference for HMLS polyester.

Volatile PTA/MEG Feedstock Prices

Brent crude prices heavily influence PTA and MEG, which together account for nearly 70% of polyester costs, causing converter margins to fluctuate within months. In 2024, Asian PTA spot prices experienced significant changes, disrupting budgets for non-integrated converters. While integrated players like Hyosung mitigate this volatility using captive monomers, smaller firms find themselves renegotiating quarterly with OEMs, leading to stalled expansion plans and reduced research and development spending.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating EV Production Demanding Low-Rolling-Resistance Carcasses

- OEM Sustainability Mandates for Recycled/Bio-Based PET Cords

- Formaldehyde Restrictions and Performance Limits in Premium Tires

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Radial designs represented 57.31% of 2025 demand and are expected to grow at 4.05% to 2031, outpacing the growth of bias output, thereby increasing the size of the polyester tire cord fabrics market for this segment. Radials run 15-20 °C cooler at cruising speed, enabling EV platforms to manage battery-induced heat loads without adding extra weight to the carcass. Bias tires continue to dominate in agricultural and off-road niches, yet their lower upfront price fails to offset the higher fuel consumption on the road. In China, passenger cars have seen radial adoption surpassing a significant level. Meanwhile, by 2024, commercial vehicles reached a notable penetration rate. Each of these transitions has led to an increase in cord usage per tire, attributed to heightened inflation pressure. This shift stands as the most significant volume driver for the growth of the polyester tire cord fabrics market.

Bias volumes are contracting in mature economies but growing in sub-Saharan Africa, where repairability is prioritized over total cost. Even so, the global bias share continues to shrink as Middle East greenfield plants specify radial-only lines. Hankook's iON tire combines chemically recycled HMLS yarn with steel belts to strike a balance between sustainability and strength, demonstrating how hybrid constructions can reduce the radial premium in long-haul applications. Such innovations sustain radial growth while preventing the displacement of polyester by aramid in mainstream speed ratings.

The Polyester Tire Cord Fabrics Market Report is Segmented by Tire Type (Radial Tire and Bias Tire), Application (Passenger Cars, Commercial Vehicles, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific contributed 49.07% of global volume in 2025 and is expanding at 3.95% to 2031. This growth is largely driven by China's passenger-tire plants operating at high capacity and India emerging as a major car market. Kolon's recent investment in Vietnam aims to boost the plant's capacity, aligning with the demands of industry giants like Kumho, Sailun, and Bridgestone. Vietnam's passenger tire exports and its annual consumption of polyester cord underscore the market's significance for polyester tire cord fabrics.

North America and Europe together represent a notable share of the global volume but are experiencing slower growth. This stagnation is attributed to plateauing vehicle miles and extended tread life. In response to the EU's formaldehyde caps, there's a noticeable shift towards formaldehyde-free adhesives, with Cokoon leading the charge. Reflecting a trend of supply-chain regionalization, Kumho is eyeing a greenfield site in Europe to align with USMCA's rules of origin. Meanwhile, Continental's ambition for sustainable polyester is pushing local converters to authenticate their recycled content, complicating the landscape but simultaneously raising entry barriers in the polyester tire cord fabrics market.

South America, the Middle East, and Africa collectively hold a significant market share, with steady growth. Pirelli has established a facility in Saudi Arabia, while Morocco's Sentury factory is set to contribute additional tire production. This surge in production is expected to meet the demand for HMLS cord. In 2024, Turkey's Kordsa unveiled a polyester yarn line, strategically catering to nearby OEMs. Although Brazil's tire production is on the mend, the country struggles with insufficient domestic cord capacity, resulting in a reliance on imports from Taiwan's Formosa Taffeta. Such inter-regional dynamics highlight how localized shortages can amplify the polyester tire cord fabrics market, even in regions with modest tire production.

- Bekaert

- Century Enka Limited

- CORDENKA GmbH & Co. KG

- Far Eastern New Century Corporation

- Firestone Fibers & Textiles

- FORMOSA TAFFETA CO., LTD.

- HYOSUNG

- Indorama Ventures Public Company Limited

- Jiangsu Taiji Industry New Materials Co., Ltd.

- Junma Group

- Kolon Industries Inc.

- KORDARNA Plus a.s.

- Kordsa Teknik Tekstil A.S.

- Madura Industrial Textiles Ltd.

- Shandong Helon Polytex Chemical Fibre

- SRF Limited

- TEIJIN FRONTIER(U.S.A.),INC.

- TORAY INDUSTRIES,INC.

- Zhejiang Hailide New Material Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging radial-tire penetration, especially in Asia-Pacific

- 4.2.2 Rapid OEM shift to high-tenacity HMLS PET yarns

- 4.2.3 Accelerating EV production demanding low-rolling-resistance carcasses

- 4.2.4 Energy-saving potential from eliminating post-cure inflation (PCI)

- 4.2.5 OEM sustainability mandates for recycled / bio-based PET cords

- 4.3 Market Restraints

- 4.3.1 Volatile PTA/MEG feed-stock prices

- 4.3.2 Adhesive (RFL) formaldehyde restrictions tightening in EU and U.S.

- 4.3.3 Performance gap vs. aramid cords for ultra-high-speed applications

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Tire Type

- 5.1.1 Radial Tire

- 5.1.2 Bias Tire

- 5.2 By Application

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.2.3 Other Application

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bekaert

- 6.4.2 Century Enka Limited

- 6.4.3 CORDENKA GmbH & Co. KG

- 6.4.4 Far Eastern New Century Corporation

- 6.4.5 Firestone Fibers & Textiles

- 6.4.6 FORMOSA TAFFETA CO., LTD.

- 6.4.7 HYOSUNG

- 6.4.8 Indorama Ventures Public Company Limited

- 6.4.9 Jiangsu Taiji Industry New Materials Co., Ltd.

- 6.4.10 Junma Group

- 6.4.11 Kolon Industries Inc.

- 6.4.12 KORDARNA Plus a.s.

- 6.4.13 Kordsa Teknik Tekstil A.S.

- 6.4.14 Madura Industrial Textiles Ltd.

- 6.4.15 Shandong Helon Polytex Chemical Fibre

- 6.4.16 SRF Limited

- 6.4.17 TEIJIN FRONTIER(U.S.A.),INC.

- 6.4.18 TORAY INDUSTRIES,INC.

- 6.4.19 Zhejiang Hailide New Material Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment