|

市場調查報告書

商品編碼

1906189

歐洲路燈市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Europe Street Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

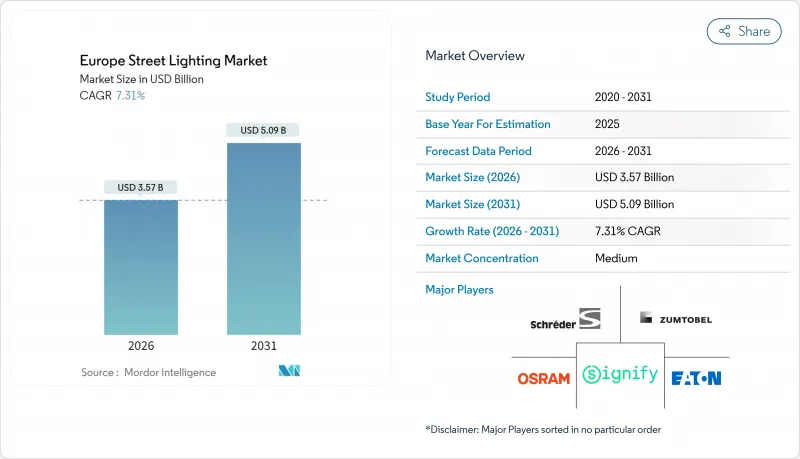

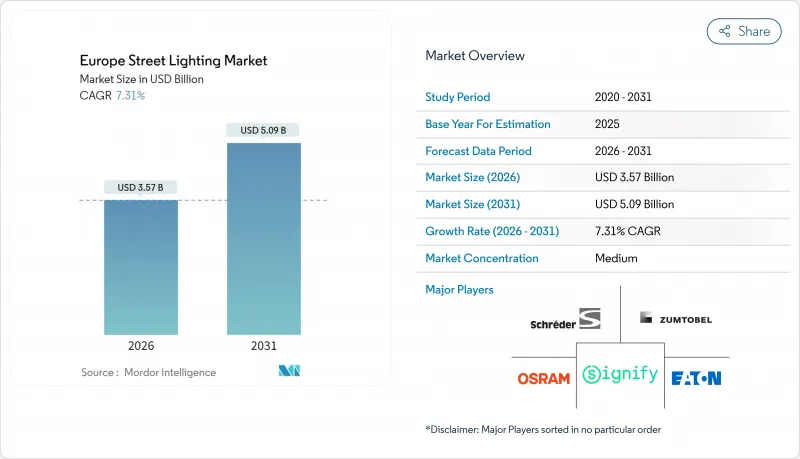

2025 年歐洲路燈市場價值 33.3 億美元,預計從 2026 年的 35.7 億美元成長到 2031 年的 50.9 億美元,在預測期(2026-2031 年)內複合年成長率為 7.31%。

歐盟範圍內的螢光禁令、更嚴格的高壓放電燈泡汞含量限制以及強制性的公共部門能源效率目標等政策促進因素,正在推動對智慧LED燈具的需求。與傳統燈具相比,智慧LED燈具可減少50%至80%的電力消耗。德國透過大規模維修計畫主導智慧照明的普及,而義大利則利用其國家復甦和韌性計畫的資金來加速智慧照明的推廣。雖然硬體仍佔銷售額的大部分,但隨著市政當局轉向基於績效的採購模式,軟體和服務相關的合約正以每年約9%的速度成長。 LED、感測器和無線模組成本的下降,正在鞏固歐洲路燈市場作為5G小型基地台和城市物聯網感測器網路基礎層的地位。

歐洲路燈市場趨勢與洞察

歐盟禁止螢光並制定嚴格的能源效率目標

RoHS指令的逐步淘汰將於2023年8月終止緊湊型螢光和T5/T8燈管的銷售,這將促使約110億盞燈具即時維修,從而加速歐洲路燈市場的發展。此外,市政當局也依法有義務在2030年前將公共部門的能源消費量降低11.7%,因此,使用連網LED燈具是合規的強制性要求。 Signify估計,如果歐洲大陸所有剩餘的傳統路燈都進行改造,則可將整體電力需求降低13%至8%,相當於關閉267座中等規模的發電廠。修訂後的能源效率指令現在對不合規行為處以罰款,這使得採購工作更加緊迫。

智慧城市政策加速智慧照明的普及

歐盟智慧城市市場已承諾將在100個計劃投入9.24億歐元(約10.76億美元),將智慧照明設備定位為5G和物聯網的基礎設施節點。坦佩雷的試驗計畫採用BrightSites燈桿,以比埋地光纖安裝低40%的成本提供高速無線回程傳輸。慕尼黑正在升級4.8萬盞LED燈,採用自適應調光系統,可將離峰時段的能源消耗降低93%。巴塞隆納是歐盟100個承諾在2030年前實現氣候中和的城市之一,目前已透過中央監控系統管理其14.6萬個照明點中的一半以上,並將照度維持在20-30勒克斯的安全標準。

智慧維修需要較高的前期投資

一套完整的智慧化改造方案每套成本為 300 至 500 歐元,而基本的 LED 改造方案成本僅為 150 至 200 歐元。這減緩了資金緊張的市政當局的採用速度,也阻礙了歐洲路燈市場的成長。歐盟的證據表明,儘管存在津貼,但資金籌措缺口依然存在,迫使供應商提案「照明即服務」契約,將投資從資產負債表中移除。然而,一些成員國的採購規則仍然難以適應基於結果的模式,導致合約授予延遲。

細分市場分析

儘管到2025年,傳統路燈仍將佔據歐洲路燈市場59.45%的佔有率,但隨著城市管理者對更高連接性和能源分析能力的需求日益成長,智慧路燈系統正以9.11%的複合年成長率快速發展。德國慕尼黑4.8萬根燈桿的維修標誌著一個轉折點,自適應調光技術的應用使夜間電力消耗降低了93%,這一數據對整個歐洲路燈行業的規劃產生了重大影響。

在巴塞隆納,透過對 146,000 個地點進行集中控制,遠端控制 20-30 勒克斯的照度,同時降低即時負荷,證明了擴充性,增強了歐洲路燈市場對智慧路燈的信心。

已經改用LED照明的市政當局正在考慮第二階段的維修,重點是安裝感測器、交通監控系統和5G小型基地台,並在建立業務收益基礎方面取得進展。在斯特拉斯堡,透過在凌晨1點至5點之間關閉部分路燈,在確保安全的前提下實現了30%的節能,這表明調光策略可以與安全措施兼顧。智慧城市市場平台的資金籌措計畫將使智慧照明試點計畫也能在中等規模的城市中實施,預計未來需求將會擴大。

根據汞燈逐步淘汰計劃,預計到 2025 年,LED 燈將佔歐洲路燈市場的 69.10%,到 2031 年將以 8.56% 的複合年成長率成長。傳統的螢光和 HID 產品僅在預算限制導致更換延遲或沒有其他高功率燈具替代方案的地區仍然保留。

由於性能顯著提升(從 35 lm/W 提升至 100 lm/W)以及長達 50,000 小時的使用壽命,LED 照明如今已成為大多數競標的預設配置,鞏固了其市場主導。昕諾飛 (Signify) 90% 的銷售額來自 LED 產品,這表明市場已趨於成熟,儘管可靠性問題仍在推動散熱解決方案的研發。歐盟 2040 年氣候法規要求排放90%,因此對於旨在實現淨零排放的市政當局而言,採用 LED 照明勢在必行。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟禁止螢光並制定嚴格的能源效率目標

- 智慧城市政策加速智慧照明的普及

- 降低LED、感測器和連接成本

- 由歐盟復甦與韌性基金資助

- 第二波第一代LED燈更換浪潮(2024-2030年)

- 利用路燈桿作為邊緣物聯網房地產

- 市場限制

- 智慧維修需要較高的初始資本投資成本

- LED驅動器可靠性與熱故障問題

- 網路安全與GDPR合規性障礙

- 半導體級元件的供應波動

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 依照明類型

- 傳統照明

- 智慧照明

- 透過光源

- LED

- 螢光

- HID燈

- 報價

- 硬體

- 燈具和燈泡

- 照明設備

- 控制系統

- 軟體和服務

- 硬體

- 透過連接技術

- 有線連接(PLC、DALI、乙太網路)

- 無線(Zigbee、LoRa-WAN、NB-IoT、5G)

- 按安裝類型

- 新安裝

- 維修/二次更換

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Signify NV

- Zumtobel Group AG

- Schreder SA

- Eaton Corporation plc(Cooper Lighting)

- OSRAM GmbH

- Acuity Brands Inc.

- Cree Lighting, a division of IDEAL Industries

- Itron Inc.

- Telensa Ltd.

- Sensus, a Xylem Brand

- Flashnet SRL

- Lucy Zodion Ltd.

- Gelighting Solutions LLC

- Thorn Lighting Ltd.(Zumtobel)

- Le-Tehnika doo(Luxtella)

- Hubbell Incorporated

- Urban Control Ltd.

- Flashnet Smart-City

- AEC Illuminazione Srl

第7章 市場機會與未來展望

The European street lighting market was valued at USD 3.33 billion in 2025 and estimated to grow from USD 3.57 billion in 2026 to reach USD 5.09 billion by 2031, at a CAGR of 7.31% during the forecast period (2026-2031).

Policy drivers-including the EU-wide fluorescent-lamp ban, looming mercury restrictions on high-pressure discharge lamps, and binding public-sector energy-efficiency targets-anchor demand for connected LED luminaires that can cut electricity use by 50-80% versus legacy fixtures. Germany leads adoption through large-scale retrofit programs, while Italy leverages National Recovery and Resilience Plan funds to accelerate smart lighting roll-outs. Hardware still dominates sales, yet software- and service-centric contracts are growing almost 9% annually as municipalities shift toward outcomes-based purchasing. Cost declines in LEDs, sensors, and wireless modules reinforce the European street lighting market as a foundational layer for 5G small cells and city-wide IoT sensor networks.

Europe Street Lighting Market Trends and Insights

EU Ban on Fluorescent Lamps and Strict Efficiency Targets

RoHS phase-outs removed compact fluorescent and T5/T8 tubes from sale in August 2023, triggering immediate retrofits across an estimated 11 billion lamp points and accelerating the European street lighting market. Municipalities also face binding 11.7% public-sector energy-consumption cuts by 2030, turning connected LED luminaires into compliance essentials. Signify calculates that converting the continent's remaining conventional streetlights would trim overall electricity demand from 13% to 8%, roughly equal to shutting 267 average power plants. Procurement urgency has intensified because non-compliance now attracts financial penalties under updated Energy Efficiency Directive rules.

Smart-City Stimulus Accelerating Smart-Lighting Roll-Outs

The EU Smart Cities Marketplace has channeled EUR 924 million (USD 1.076 billion) into 100 projects, positioning intelligent luminaires as foundational 5G and IoT nodes. Tampere's pilot used BrightSites poles to deliver high-speed wireless backhaul at 40% lower cost than trenching fiber. Munich's 48,000-unit LED upgrade includes adaptive dimming that slashes energy use by 93% during off-peak hours. As one of 100 EU cities pledged to be climate-neutral by 2030, Barcelona centrally monitors more than half of its 146,000 lighting points while upholding 20-30 lux safety levels.

High Upfront CAPEX for Smart Retrofits

Full smart-ready replacements cost EUR 300-500 per pole versus EUR 150-200 for basic LED swaps, delaying adoption in cash-constrained municipalities and tempering the European street lighting market trajectory. EU evidence calls highlight a financing gap, even though grants exist, pushing vendors to propose light-as-a-service contracts that shift investment off balance sheet. Yet procurement codes in several member states still struggle to accommodate outcome-based models, slowing deal closure.

Other drivers and restraints analyzed in the detailed report include:

- Falling LED, Sensor and Connectivity Costs

- EU Recovery and Resilience Facility Funding

- LED Driver Reliability and Thermal Failure Issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional luminaires still represented 59.45% of the Europe street lighting market in 2025, but smart systems are accelerating at a 9.11% CAGR as city managers chase connectivity and energy analytics. Germany's Munich retrofit illustrates the pivot: 48,000 upgraded poles use adaptive dimming to save 93% of overnight power, a data point that resonates across the European street lighting industry planning.

Barcelona's centralized control over 146,000 points shows scalability; remote commands keep illumination at 20-30 lux while trimming real-time load, reinforcing confidence in smart upgrades within the European street lighting market.

Municipalities that already switched to LEDs now consider a second wave focused on sensors, traffic monitoring, and 5G small-cell attachment, underpinning service revenue streams. Strasbourg proves dimming policies can coexist with safety by timing partial shut-offs between 01:00-05:00 and cutting energy by 30%. Funding schemes under the Smart Cities Marketplace keep smart-lighting pilots within reach for mid-sized cities, boosting future demand.

LEDs captured 69.10% share of the European street lighting market size in 2025 and are on track for an 8.56% CAGR through 2031 under the mercury-phase-out timetable. Legacy fluorescent and HID products linger only where budgets delay retrofits or where extreme-output fixtures remain unmatched.

Performance leaps - from 35 lm/W to 100 lm/W - plus 50,000-hour durability mean most tenders now specify LEDs by default, locking in market leadership. Signify already derives 90% of sales from LED products, signaling maturity even as reliability concerns spur R&D on thermal solutions. EU 2040 climate rules requiring a 90% emissions cut make LED roll-outs non-negotiable for municipalities pursuing net-zero pathways.

The Europe Street Lighting Market Report is Segmented by Lighting Type (Conventional Lighting, and Smart Lighting), Light Source (LEDs, Fluorescent Lamps, and HID Lamps), Offering (Hardware, and Software, and Services), Connectivity Technology (Wired, and Wireless), Installation Type (New Installation, and Retrofit), and Country (Germany, United Kingdom, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Signify N.V.

- Zumtobel Group AG

- Schreder SA

- Eaton Corporation plc (Cooper Lighting)

- OSRAM GmbH

- Acuity Brands Inc.

- Cree Lighting, a division of IDEAL Industries

- Itron Inc.

- Telensa Ltd.

- Sensus, a Xylem Brand

- Flashnet SRL

- Lucy Zodion Ltd.

- Gelighting Solutions LLC

- Thorn Lighting Ltd. (Zumtobel)

- Le-Tehnika d.o.o. (Luxtella)

- Hubbell Incorporated

- Urban Control Ltd.

- Flashnet Smart-City

- AEC Illuminazione Srl

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU ban on fluorescent lamps and strict efficiency targets

- 4.2.2 Smart-city stimulus accelerating smart-lighting roll-outs

- 4.2.3 Falling LED, sensor and connectivity costs

- 4.2.4 EU Recovery and Resilience Facility funding

- 4.2.5 Secondary-replacement wave for first-gen LEDs (2024-30)

- 4.2.6 Street-light poles as edge-IoT real-estate

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX for smart retrofits

- 4.3.2 LED driver reliability and thermal failure issues

- 4.3.3 Cyber-security and GDPR compliance hurdles

- 4.3.4 Semiconductor-grade component supply volatility

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Lighting Type

- 5.1.1 Conventional Lighting

- 5.1.2 Smart Lighting

- 5.2 By Light Source

- 5.2.1 LEDs

- 5.2.2 Fluorescent Lamps

- 5.2.3 HID Lamps

- 5.3 By Offering

- 5.3.1 Hardware

- 5.3.1.1 Lights and Bulbs

- 5.3.1.2 Luminaires

- 5.3.1.3 Control Systems

- 5.3.2 Software and Services

- 5.3.1 Hardware

- 5.4 By Connectivity Technology

- 5.4.1 Wired (PLC, DALI, Ethernet)

- 5.4.2 Wireless (Zigbee, LoRa-WAN, NB-IoT, 5G)

- 5.5 By Installation Type

- 5.5.1 New Installation

- 5.5.2 Retrofit / Secondary Replacement

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Signify N.V.

- 6.4.2 Zumtobel Group AG

- 6.4.3 Schreder SA

- 6.4.4 Eaton Corporation plc (Cooper Lighting)

- 6.4.5 OSRAM GmbH

- 6.4.6 Acuity Brands Inc.

- 6.4.7 Cree Lighting, a division of IDEAL Industries

- 6.4.8 Itron Inc.

- 6.4.9 Telensa Ltd.

- 6.4.10 Sensus, a Xylem Brand

- 6.4.11 Flashnet SRL

- 6.4.12 Lucy Zodion Ltd.

- 6.4.13 Gelighting Solutions LLC

- 6.4.14 Thorn Lighting Ltd. (Zumtobel)

- 6.4.15 Le-Tehnika d.o.o. (Luxtella)

- 6.4.16 Hubbell Incorporated

- 6.4.17 Urban Control Ltd.

- 6.4.18 Flashnet Smart-City

- 6.4.19 AEC Illuminazione Srl

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment