|

市場調查報告書

商品編碼

1906180

實驗室設備及耗材:全球市場佔有率分析、產業趨勢及統計、成長預測(2026-2031)Global Laboratory Equipment And Disposables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

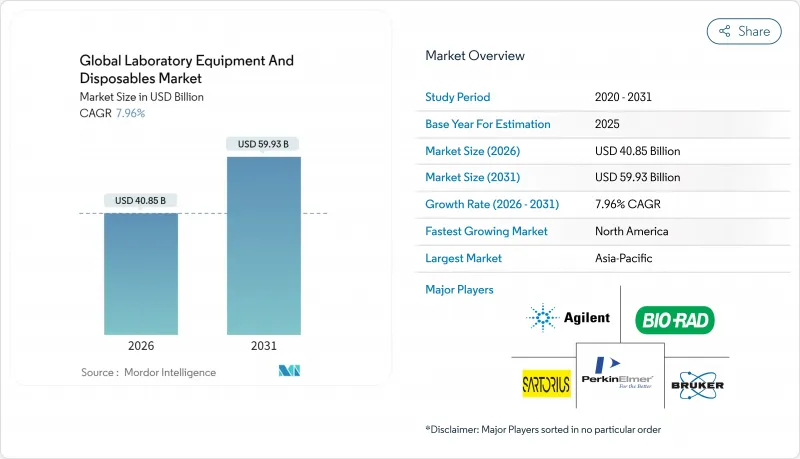

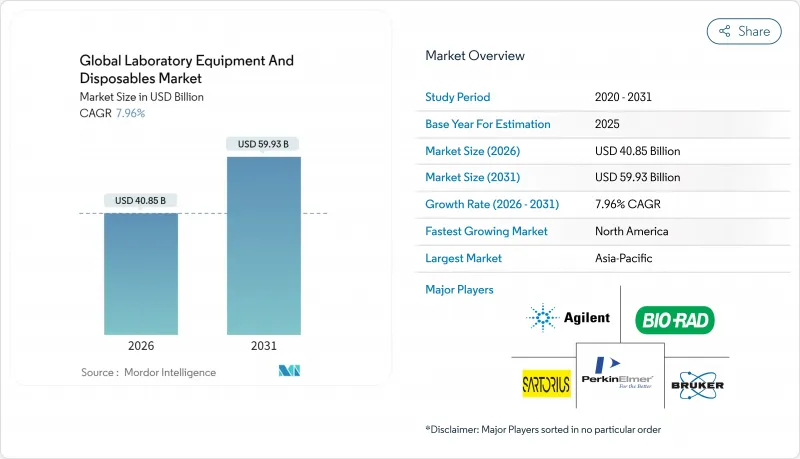

實驗室設備和耗材市場預計到 2026 年價值 408.5 億美元,高於 2025 年的 378.4 億美元,預計到 2031 年將達到 599.3 億美元。

預計2026年至2031年年複合成長率(CAGR)為7.96%。

生物製藥研發投入的持續成長、基因組學工作流程的快速擴張(需要高通量自動化)以及嚴格的污染控制通訊協定(鼓勵使用一次性耗材)推動了該產業的持續發展。供應商正在增加人工智慧驅動的預測性維護功能,以最大限度地延長儀器的運轉率,而綠色實驗室認證計畫則促使實驗室減少能源和材料廢棄物。供應鏈韌性措施和回流政策持續影響採購決策,尤其是在北美和歐洲,而政府主導的生物技術投資在亞太地區也正在加速發展。日益激烈的競爭促使大型現有企業透過併購尋求規模經濟,而新興參與企業則透過模組化機器人和永續發展服務脫穎而出。

全球實驗室設備及耗材市場趨勢與洞察

不斷擴大的醫藥品研究開發費用

預計到2024年,製藥研發支出將達到2,880億美元,到2030年將增加3,400億美元,這將持續推動先進分析設備的強勁需求。美國創業融資的年投資額超過500億美元,歐洲的研發管線依然強勁,為實驗室基礎設施的長期資本流入提供了支撐。 FDA對生物製藥的核准增加,促進了設備利用率的提高和耗材的持續銷售。隨著研發管線擴展到包括細胞和基因療法在內的多種治療方式,實驗室正在升級到封閉式隔離器和數位化文件平台,這將推動整合供應商的市場佔有率成長。

高通量定序設施的快速擴張

全球次世代定序設施的擴張正在加速對基因組樣本製備、微流體晶片和雲端資料管道的需求。生命科學工具市場預計將以10.9%的複合年成長率成長,其中定序工作流程是關鍵促進因素。貝克曼庫爾特的TruSight Oncology 500和凱傑即將推出的QIAsymphony Connect是自動化技術的典型代表,它們在減少人工工時的同時提高了通量。中國的「十四五」規劃將加強基因組學能力建設列為優先事項,本土製造商正利用補貼政策部署台式定序儀。腫瘤研究人員正在將人工智慧演算法應用於突變檢測,從而推動了對高容量伺服器和實驗室資訊管理系統(LIMS)的需求。整體而言,定序實驗室是重要的客戶群,推動了各種耗材和資本設備的需求。

醫用樹脂價格波動

聚丙烯和聚四氟乙烯價格的快速波動正在擠壓耗材製造商的利潤空間,並迫使設備供應商重新談判供貨合約。地緣政治緊張局勢導致的化學品供應瓶頸延長了前置作業時間,迫使買家建立安全庫存,並增加了營運資金需求。伊士曼公司投資22.5億美元用於分子回收,旨在確保原料可回收並降低投入成本風險。然而,現貨價格波動依然存在,尤其對購買力有限的小規模實驗室影響更大。預算的不確定性可能會推遲非必要設備升級,並促使實驗室對玻璃器皿進行重新消毒,預計這將限制實驗室設備和耗材市場一次性使用類別的短期成長。

細分市場分析

耗材將成為主導品類,2025年將佔據實驗室設備和耗材市場佔有率的51.62%,主要得益於一次性無菌性和工作流程效率的提升。預計到2031年,該品類將以8.53%的複合年成長率成長,實現持續的收入成長,超過原料成本的波動。生物製藥和診斷實驗室傾向於使用即用型微量吸管尖、過濾組件和微流體晶片,這些產品能夠最大限度地減少交叉污染,並簡化合規性文件。潔淨室服裝仍然是無菌生產必不可少的,而閉合迴路回收試點計畫正在積極應對日益嚴格的環境、社會和治理(ESG)審查。

實驗室設備,包括分析儀、光譜儀、離心機和培養箱等,持續為利用物聯網連接實現基礎設施現代化的機構帶來穩定的資本投資需求。整合到高價值系統中的預測性維護模組可提供持續的服務收入,從而抵消較長的更換週期。供應商透過開放式架構軟體、可擴展的機器人技術以及將耗材與設備使用掛鉤的試劑租賃套餐來脫穎而出。在成熟的實驗室中,分析即服務 (AaaS) 合約將預算從資本支出 (CapEx) 轉移到營運支出 (OpEx),從而平滑收入波動,並支援實驗室設備和耗材市場的整體成長。

區域分析

到2025年,北美將佔據最大的收入佔有率,達到37.68%,這主要得益於持續的生物製藥研發投入(超過1300億美元)以及精準醫療的加速普及。該地區受益於美國食品藥物管理局(FDA)明確的指導方針,降低了採購風險;此外,《晶片與科學法案》(CHIPS & Science Act)下的協調一致的回流激勵措施,也增強了設備製造所需半導體元件的供應。臨床檢查室長期存在的13%的人才缺口,推動了自動化設備的採購,鞏固了北美在實驗室設備和耗材市場的核心地位。

亞太地區將成為成長最快的地區,到2031年複合年成長率將達到9.18%,這主要得益於中國「十四五」規劃下慷慨的生物技術補貼以及預計到2027年將達到1380億美元的醫療衛生基礎設施計劃。像安捷倫生工生物工程這樣的戰略合作夥伴關係正在根據國內需求調整核酸技術,而日本、韓國和澳洲則透過先進的臨床研究舉措來維持需求。

在監管協調和永續性需求的推動下,歐洲市場維持了5%左右的穩定成長。德國佔了21%的市場佔有率,並在綠色實驗室實踐方面引領創新。歐洲藥品管理局(EMA)的藥品短缺監測平台正在推動對合規性監測設備的需求。南美洲以及中東和非洲市場尚不成熟,但極具吸引力。巴西和海灣合作理事會(GCC)國家正在投資建造公共衛生實驗室和學術中心,為其未來在實驗室設備和耗材市場的發展奠定基礎。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 生物製藥領域研發成本增加

- 高通量定序實驗室的快速擴張

- 一次性潔淨室塑膠製品的需求激增

- 利用人工智慧進行醫療設備預測性維護(新)

- 過渡到“綠色實驗室”認證(新增)

- 市場限制

- 醫用樹脂價格波動

- 新設備平台的檢驗週期越來越長。

- ESG(環境、社會和治理)對一次性塑膠製品的抵抗情緒日益高漲(新)

- 自動化和數據分析專家短缺(新增)

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(以金額為準,2024-2030 年)

- 依產品類型

- 實驗室設備

- 分析和測量設備

- 光譜分析儀

- 層析法系統

- 顯微鏡

- 其他

- 通用實驗室設備

- 離心機

- 培養箱

- 高壓釜和消毒器

- 其他

- 分析和測量設備

- 實驗室耗材

- 塑膠和玻璃製品

- 移液管和吸頭

- 培養皿

- 試管

- 其他

- 過濾和分離材料

- 薄膜過濾器

- 注射器過濾器

- 潔淨室耗材

- 手套

- 罩衣和口罩

- 塑膠和玻璃製品

- 實驗室設備

- 透過使用

- 臨床診斷

- 藥物發現與開發

- 基因組學和蛋白質組學

- 學術和研究機構

- 工業和環境測試

- 最終用戶

- 醫院和診所

- 製藥和生物技術公司

- 學術和研究機構

- 合約研究機構

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 市佔率分析

- 公司簡介

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Agilent Technologies Inc.

- Merck KGaA

- F. Hoffmann-La Roche Ltd

- Becton, Dickinson and Company

- Sartorius AG

- PerkinElmer Inc.

- Bio-Rad Laboratories Inc.

- Eppendorf SE

- Bruker Corporation

- Corning Incorporated

- 3M Company

- GE Healthcare(Cytiva)

- Waters Corporation

- Shimadzu Corporation

- Illumina Inc.

- Abbott Laboratories

- Mettler-Toledo International Inc.

- Tecan Group Ltd

第7章 市場機會與未來展望

The laboratory equipment and disposables market size in 2026 is estimated at USD 40.85 billion, growing from 2025 value of USD 37.84 billion with 2031 projections showing USD 59.93 billion, growing at 7.96% CAGR over 2026-2031.

Sustained growth stems from rising biopharma R&D outlays, fast-growing genomics workflows that require high-throughput automation, and tighter contamination-control protocols that favor single-use supplies. Vendors are adding AI-enabled predictive maintenance to maximize instrument uptime, while green-lab certification programs pressure laboratories to cut energy and material waste. Supply-chain resilience initiatives and reshoring policies continue to influence purchasing decisions, especially in North America and Europe, whereas Asia-Pacific gains momentum from government-backed biotech investments. Intensifying competition encourages large incumbents to pursue scale economies through M&A, while niche entrants differentiate on modular robotics and sustainability services.

Global Laboratory Equipment And Disposables Market Trends and Insights

Growing Biopharma R&D Expenditure

Pharmaceutical R&D spending reached USD 288 billion in 2024 and is projected to climb toward USD 340 billion by 2030, sustaining strong demand for advanced analytical instrumentation. Venture funding in biotech surpasses USD 50 billion annually in the United States, while Europe's pipeline remains robust, reinforcing long-term capital flows into laboratory infrastructure. Increased biologics approvals by the FDA validate greater instrument utilization and recurring consumables sales. As pipelines diversify into cell- and gene-therapy modalities, laboratories upgrade to closed-system isolators and digital documentation platforms, thereby deepening wallet share for integrated vendors.

Rapid Expansion of High-Throughput Sequencing Labs

Global build-out of next-generation sequencing facilities accelerates demand for genomic sample preparation, microfluidic chips, and cloud-based data pipelines. The life-science tools market is forecast at a 10.9% CAGR, with sequencing workflows as a primary catalyst. Beckman Coulter's TruSight Oncology 500 and QIAGEN's forthcoming QIAsymphony Connect exemplify automation aimed at reducing hands-on time while scaling throughput. China's 14th Five-Year Plan prioritizes genomic capabilities, and regional manufacturers leverage local subsidies to deploy bench-top sequencers. Oncology researchers integrate AI algorithms for variant calling, expanding concomitant demand for high-capacity servers and laboratory information management systems. Overall, sequencing labs act as anchor customers that pull through a broad basket of disposables and capital equipment.

Volatility in Medical-Grade Resin Prices

Sharp swings in polypropylene and PTFE pricing compress margins for consumables makers and force instrument vendors to renegotiate supplier contracts. Chemical-supply bottlenecks stemming from geopolitical tensions have extended lead times and compelled buyers to hold higher safety stocks, raising working-capital needs. Eastman's USD 2.25 billion molecular-recycling investment aims to secure circular feedstocks and mitigate input-cost risk. However, spot-price volatility persists and disproportionately impacts small-volume labs with limited purchasing clout. Budget uncertainty can delay discretionary equipment upgrades and prompt laboratories to re-sterilize glassware, tempering near-term growth in single-use categories of the laboratory equipment and disposables market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Demand for Single-Use Clean-Room Plastics

- AI-Enabled Predictive Maintenance of Instruments

- Lengthy Validation Cycles for Novel Instrument Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Disposables represent the dominant 51.62% slice of the laboratory equipment and disposables market share in 2025, a position underpinned by their single-use sterility and workflow efficiency. The same category is forecast to grow at an 8.53% CAGR to 2031, ensuring sustained revenue momentum that outweighs raw-material cost volatility. Laboratories in biopharma and diagnostics favor ready-to-use pipette tips, filtration assemblies, and micro-fluidic plates that minimize cross-contamination and simplify compliance documentation. Clean-room apparel remains indispensable for aseptic manufacturing, while closed-loop recycling pilots address rising ESG scrutiny.

Laboratory equipment-including analyzers, spectrometers, centrifuges, and incubators-continues to generate steady capital orders as institutions modernize infrastructure with IoT connectivity. Predictive maintenance modules embedded in high-value systems offer recurring-service income streams that compensate for extended replacement cycles. Vendors differentiate through open-architecture software, scalable robotics, and reagent-rental bundles that tie consumables to instrument use. In mature labs, analytics-as-a-service contracts shift budgets from capex to opex, smoothing revenue and supporting the overarching growth trajectory of the laboratory equipment and disposables market.

The Laboratory Equipment and Disposables Market Report is Segmented by Product Type (Laboratory Equipment, Laboratory Disposables), Application (Clinical Diagnostics, Drug Discovery & Development, and More), End User (Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributes the largest 37.68% revenue slice in 2025 due to sustained biopharma R&D exceeding USD 130 billion and accelerated precision-medicine adoption. The region benefits from clear FDA guidance that reduces procurement risk and from concerted reshoring incentives under the CHIPS & Science Act, which strengthen semiconductor component supply critical for instrument manufacturing. Persistent 13% staffing shortages in clinical labs catalyze automation purchases, solidifying North America's central role in the laboratory equipment and disposables market.

Asia-Pacific is the fastest-expanding territory with a 9.18% CAGR through 2031, propelled by China's generous biotech subsidies under its 14th Five-Year Plan and healthcare-infrastructure projects slated to hit USD 138 billion by 2027. Strategic alliances like Agilent-Sangon Biotech tailor nucleic-acid technologies to domestic requirements, while Japan, South Korea, and Australia sustain demand through advanced clinical research initiatives.

Europe delivers steady mid-single-digit growth amid regulatory harmonization and sustainability imperatives. Germany holds a 21% share and drives innovation in green-lab practices, while EMA's Shortages Monitoring Platform heightens demand for compliance-monitoring instruments. South America and Middle East & Africa remain nascent but attractive, with Brazil and GCC nations investing in public-health labs and academic centers, laying the groundwork for elevated future contributions to the laboratory equipment and disposables market.

- Thermo Fisher Scientific

- Danaher

- Agilent Technologies

- Merck

- Roche

- Beckton Dickinson

- Sartorius

- PerkinElmer

- Bio-Rad Laboratories

- Eppendorf

- Bruker

- Corning

- 3M

- GE Healthcare (Cytiva)

- Waters Corporation

- Shimadzu

- Illumina

- Abbott Laboratories

- Mettler Toledo

- Tecan Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing biopharma R&D expenditure

- 4.2.2 Rapid expansion of high-throughput sequencing labs

- 4.2.3 Surge in demand for single-use clean-room plastics

- 4.2.4 AI-enabled predictive maintenance of instruments (fresh)

- 4.2.5 Shift toward "green lab" certifications (fresh)

- 4.3 Market Restraints

- 4.3.1 Volatility in medical-grade resin prices

- 4.3.2 Lengthy validation cycles for novel instrument platforms

- 4.3.3 Growing ESG backlash against single-use plastics (fresh)

- 4.3.4 Talent crunch for automation & data-analytics specialists (fresh)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2024-2030)

- 5.1 By Product Type

- 5.1.1 Laboratory Equipment

- 5.1.1.1 Analyzers & Instruments

- 5.1.1.1.1 Spectroscopy Equipment

- 5.1.1.1.2 Chromatography Systems

- 5.1.1.1.3 Microscopes

- 5.1.1.1.4 Others

- 5.1.1.2 General Lab Equipment

- 5.1.1.2.1 Centrifuges

- 5.1.1.2.2 Incubators

- 5.1.1.2.3 Autoclaves & Sterilizers

- 5.1.1.2.4 Others

- 5.1.1.1 Analyzers & Instruments

- 5.1.2 Laboratory Disposables

- 5.1.2.1 Plasticware & Glassware

- 5.1.2.1.1 Pipettes & Tips

- 5.1.2.1.2 Petri Dishes

- 5.1.2.1.3 Test Tubes

- 5.1.2.1.4 Others

- 5.1.2.2 Filtration & Separation Supplies

- 5.1.2.2.1 Membrane Filters

- 5.1.2.2.2 Syringe Filters

- 5.1.2.3 Clean-room Consumables

- 5.1.2.3.1 Gloves

- 5.1.2.3.2 Gowns & Masks

- 5.1.2.1 Plasticware & Glassware

- 5.1.1 Laboratory Equipment

- 5.2 By Application

- 5.2.1 Clinical Diagnostics

- 5.2.2 Drug Discovery & Development

- 5.2.3 Genomics & Proteomics

- 5.2.4 Academic & Research

- 5.2.5 Industrial & Environmental Testing

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Pharmaceutical & Biotechnology Companies

- 5.3.3 Academic & Research Institutes

- 5.3.4 Contract Research Organizations

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Danaher Corporation

- 6.3.3 Agilent Technologies Inc.

- 6.3.4 Merck KGaA

- 6.3.5 F. Hoffmann-La Roche Ltd

- 6.3.6 Becton, Dickinson and Company

- 6.3.7 Sartorius AG

- 6.3.8 PerkinElmer Inc.

- 6.3.9 Bio-Rad Laboratories Inc.

- 6.3.10 Eppendorf SE

- 6.3.11 Bruker Corporation

- 6.3.12 Corning Incorporated

- 6.3.13 3M Company

- 6.3.14 GE Healthcare (Cytiva)

- 6.3.15 Waters Corporation

- 6.3.16 Shimadzu Corporation

- 6.3.17 Illumina Inc.

- 6.3.18 Abbott Laboratories

- 6.3.19 Mettler-Toledo International Inc.

- 6.3.20 Tecan Group Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment