|

市場調查報告書

商品編碼

1906179

歐洲建築板材市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Europe Building And Construction Sheets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

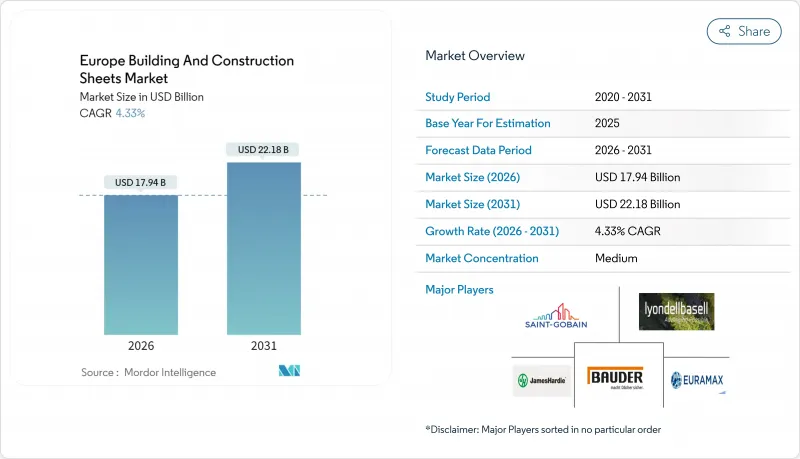

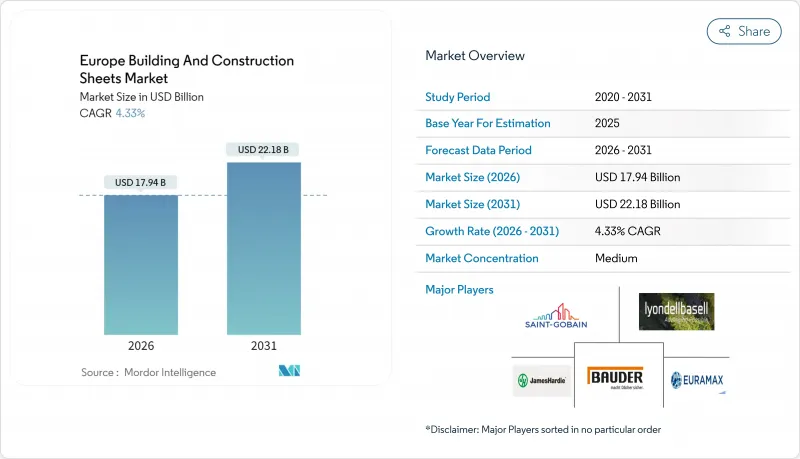

預計到 2026 年,歐洲建築板材市場規模將達到 179.4 億美元,從 2025 年的 172 億美元成長到 2031 年的 221.8 億美元,2026 年至 2031 年的複合年成長率為 4.33%。

這項展望證實了市場在動盪的宏觀環境下永續性,並符合歐盟氣候指令的要求——該指令規定到2030年實現零排放建築。監管壓力正推動板材市場轉型為兼具結構性能、太陽能光電發電能力或增強隔熱性能的板材。同時,每年1,562.3億美元的公共資金刺激了對維修板材系統的需求,而蓬勃發展的資料中心產業和模組化建築方法則拓展了商業機會。供應商之間的整合加速,尤其是在數位監控和低碳生產融合的領域,正在重塑歐洲建築板材市場的競爭格局。

歐洲建築板材市場趨勢與洞察

收緊建築圍護結構的節能法規

在嚴格的法規和永續性目標的推動下,歐洲建築板材市場正經歷顯著的變革時期。根據修訂後的《建築能源性能指令》,成員國必須在2030年前實現零排放建築。這項要求迫使設計師優先選擇兼具結構強度和高隔熱性能或光伏層的板材。此外,計劃於2030年前引入生命週期溫室氣體排放評估,也推動了對再生材料和低碳製造的需求。德國設立5,207.8億美元的氣候基金,並撥款至少1,041.5億美元用於建築業的脫碳,這項重大措施也刺激了市場需求。這些立法動力推高了價格溢價,並促進了市場研發活動的活性化。擁有低碳認證的供應商正努力成為公共項目的首選競標,並抓住長期成長機會。

增加公共資金用於維修項目

受節能維修投資不斷成長的推動,歐洲建築板材市場正經歷顯著成長。歐盟每年津貼1,562.3億美元用於節能維修項目,該項目旨在升級外牆、屋頂和覆層系統,而無需改變建築主體結構。西班牙國家能源效率基金每年撥款3.8億美元,優先扶持弱勢家庭和節能性能欠佳的建築。該計劃重點推廣經濟高效的聚合物和混合板材,以實現切實可見的節能效果。法國重新推出了節能維修的免息貸款和稅收優惠政策,即使新建項目成長放緩,也刺激了市場需求。資金籌措指南要求提供檢驗的性能證明,建築商也擴大選擇內建感測器的智慧板材,以提供即時熱數據。這些因素共同支撐了該地區對專業維修產品的需求。

能源價格波動推高生產成本

由於能源價格波動和監管壓力,歐洲建築板材市場目前面臨挑戰。儘管天然氣批發價格已從2023年的高點回落,但製造業用電價格仍高於歷史平均水平,這給鋼鐵、鋁和聚合物板材製造商的利潤率帶來了壓力。歐盟排放交易體系的潛在延期將進一步推高碳排放成本,尤其是高爐作業的成本。為了應對這些挑戰,企業正在實施現場太陽能光電解決方案和購電協議(PPA),但這需要大量的資本投資和漫長的核准流程。成本上漲也影響計劃競標,導致授標週期延長和材料替代。儘管存在這些障礙,但隨著企業適應不斷變化的能源和監管環境,市場預計將趨於穩定。

細分市場分析

到2025年,金屬板材將佔總收入的32.65%,鞏固其作為歐洲建築鋼材市場結構基礎的地位。市場需求依賴鋼材的承載性能和鋁材的耐腐蝕性,而這兩種材料擴大採用低碳製程生產,例如使用再生能源運作的電弧爐。安賽樂米塔爾和塔塔鋼鐵歐洲公司正積極推廣可減少高達40%排放的再生鋼材。同時,建築一體化光伏(BIPV)正在採用鋁板作為薄膜電池的無框載體,從而將金屬需求與綠色能源目標直接聯繫起來。

到2031年,聚合物板材將以5.29%的複合年成長率成為成長最快的細分市場,因為建築商在維修工程中更傾向於使用輕質板材,以避免結構加固。添加阻燃劑和紫外線穩定劑的配方可以延長使用壽命,而生物基樹脂則提供了低碳替代方案。混合系統將軟性太陽能電池層壓板和相變材料整合到多層聚合物薄膜中,從而拓展了其功能範圍。瀝青和橡膠仍將在防水和隔振領域發揮作用,但揮發性化合物法規的日益嚴格將對其市場佔有率構成挑戰。總體而言,材料創新正在增強歐洲建築板材市場供應商之間的差異化優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場趨勢與動態

- 市場概覽

- 市場促進因素

- 更嚴格的建築圍護結構能源效率法規

- 增加公共資金用於維修項目

- 資料中心建設的增加推動了對結構鋪板的需求。

- 模組化和異地建造方法的日益普及

- 將太陽光電技術整合到屋頂和牆體系統中

- 過渡到使用本地採購的低碳板材

- 市場限制

- 能源價格波動推高了生產成本。

- 限制低成本進口產品的貿易措施

- 熟練安裝工人短缺

- 信貸環境收緊抑制了新建設。

- 價值/供應鏈分析

- 監管情勢(歐盟綠色交易與能源績效指令)

- 技術展望

- 永續性和循環經濟

- 數位化和異地建造的影響

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 材料

- 瀝青

- 橡皮

- 金屬

- 聚合物

- 其他

- 依建築類型

- 新建工程

- 維修

- 最終用戶

- 住宅

- 商業的

- 基礎設施

- 按國家/地區

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Saint-Gobain

- LyondellBasell

- James Hardie Industries plc

- Paul Bauder GmbH

- Euramax International

- Celotex Limited

- Rauch Spanplattenwerk GmbH

- Rizolin LLC

- Icopal(BMI Group)

- CBG Composites GmbH

- Kingspan Group plc

- Tata Steel Europe

- ArcelorMittal Construction

- Sika AG

- Soprema Group

- Firestone Building Products(Holcim Elevate)

- IKO Industries

- Owens Corning

- BASF SE

- Knauf Insulation

- Coroplast Fritz Muller GmbH

第7章 市場機會與未來展望

The Europe Building & Construction Sheets Market size in 2026 is estimated at USD 17.94 billion, growing from 2025 value of USD 17.2 billion with 2031 projections showing USD 22.18 billion, growing at 4.33% CAGR over 2026-2031.

This outlook underscores the market's durability in a volatile macro environment and its alignment with European Union climate directives that mandate zero-emission buildings by 2030. Regulatory pressure is redirecting specifications toward sheets that combine structural performance with solar harvesting or enhanced thermal insulation. Simultaneously, USD 156.23 billion in annual public funding is stimulating demand for renovation-focused sheet systems, while the fast-rising data-centre sector and modular construction practices are widening commercial opportunities. Intensifying consolidation, particularly among suppliers that fuse digital monitoring with low-carbon production, is reshaping competitive dynamics across the Europe building construction sheets market.

Europe Building And Construction Sheets Market Trends and Insights

Stricter Energy-Efficiency Regulations for Building Envelopes

The European building and construction sheets market is undergoing a significant transformation driven by stringent regulations and sustainability goals. Under the revised Energy Performance of Buildings Directive, member states must achieve zero-emission building status by 2030. This mandate pushes specifiers to prioritize sheets that combine structural strength with high thermal resistance or photovoltaic layers. Additionally, life-cycle warming potential assessments, also due by 2030, are driving up the demand for recycled inputs and low-carbon manufacturing. Germany is making a significant move with its USD 520.78 billion climate fund, dedicating at least USD 104.15 billion to decarbonizing construction, which in turn amplifies volume requirements. This legislative momentum is boosting premium pricing and intensifying R&D efforts in the market. Suppliers with certified low embodied-carbon footprints are now securing preferred-bidder status on public projects, positioning themselves for long-term growth opportunities.

Expanded Public Funding for Renovation Programmes

The Europe building construction sheets market is witnessing significant growth, driven by increasing investments in energy-efficient retrofits. Annual EU grants of USD 156.23 billion are driving energy retrofits, upgrading facades, roofs, and cladding systems without major structural changes. Spain's National Energy Efficiency Fund allocates USD 380 million annually, prioritising vulnerable households and underperforming buildings. This focus leans towards cost-effective polymer and hybrid sheets, ensuring tangible kilowatt-hour savings. France has reintroduced zero-interest loans and tax breaks for energy-efficient upgrades, boosting demand even as new construction activity slows. Financing guidelines mandate verifiable performance, leading builders to opt for smart sheets with integrated sensors that provide real-time thermal data. These factors collectively sustain the demand for specialised renovation-grade products in the region.

Volatile Energy Prices Elevating Production Costs

The Europe building and construction sheets market is currently navigating challenges stemming from energy price volatility and regulatory pressures. While wholesale gas rates have retreated from their 2023 highs, electricity tariffs for manufacturers remain above historical averages, squeezing profit margins for steel, aluminium, and polymer sheet producers. The potential extension of the EU Emissions Trading System is further elevating carbon costs, particularly for blast-furnace operations. Companies are adopting on-site solar solutions and power-purchase agreements to mitigate these challenges, but these require significant capital investments and lengthy permitting processes. Cost inflation is also impacting project bids, causing delays in award cycles or material substitutions. Despite these hurdles, the market is expected to stabilize as firms adapt to evolving energy and regulatory landscapes.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Data-Centre Construction Increasing Demand for Structural Decking

- Rising Adoption of Modular and Off-Site Construction Methods

- Shortage of Skilled Installation Labour

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metal sheets secured 32.65% of 2025 revenue, reinforcing their status as the structural backbone of the Europe building construction sheets market. Demand leans on steel's load-bearing capacity and aluminium's corrosion resistance, both increasingly produced through low-carbon pathways such as electric arc furnaces powered by renewable electricity. ArcelorMittal and Tata Steel Europe actively promote recycled-content grades that cut embodied emissions by up to 40%. In parallel, building-integrated photovoltaics adopt aluminium skins as frameless carriers for thin-film cells, linking metal demand directly to green-energy targets.

Polymer sheets deliver the fastest segment CAGR of 5.29% toward 2031 as contractors favour lightweight panels for retrofits that avoid structural reinforcement. Formulations incorporating fire retardants and UV stabilisers extend service life, while bio-based resins open a lower-carbon alternative. Hybrid systems embed flexible solar laminates or phase-change materials within multilayer polymer membranes, broadening functional scope. Bitumen and rubber maintain roles in waterproofing and vibration damping, yet continual regulatory tightening on volatile compounds challenges their market presence. Overall, material innovation strengthens supply-side differentiation across the Europe building construction sheets market.

The Europe Building and Construction Sheets Market Report is Segmented by Material (Bitumen, Rubber, Metal, Polymer and Others), by Construction Type (New Construction and Renovation), by End-User (Residential, Commercial and Infrastructure), and by Country (United Kingdom, Germany, France, Italy, Spain and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Saint-Gobain

- LyondellBasell

- James Hardie Industries plc

- Paul Bauder GmbH

- Euramax International

- Celotex Limited

- Rauch Spanplattenwerk GmbH

- Rizolin LLC

- Icopal (BMI Group)

- CBG Composites GmbH

- Kingspan Group plc

- Tata Steel Europe

- ArcelorMittal Construction

- Sika AG

- Soprema Group

- Firestone Building Products (Holcim Elevate)

- IKO Industries

- Owens Corning

- BASF SE

- Knauf Insulation

- Coroplast Fritz Muller GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter energy-efficiency regulations for building envelopes

- 4.2.2 Expanded public funding for renovation programmes

- 4.2.3 Growth in data-centre construction increasing demand for structural decking

- 4.2.4 Rising adoption of modular and off-site construction methods

- 4.2.5 Integration of solar technologies into roofing and cladding systems

- 4.2.6 Shift toward locally sourced, low-carbon sheet materials

- 4.3 Market Restraints

- 4.3.1 Volatile energy prices elevating production costs

- 4.3.2 Trade measures limiting access to low-cost imports

- 4.3.3 Shortage of skilled installation labour

- 4.3.4 Tighter credit conditions damping new-build pipelines

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape (EU Green Deal & EPBD)

- 4.6 Technological Outlook

- 4.7 Sustainability & Circularity Initiatives

- 4.8 Digitalisation & Off-site Construction Impact

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Material

- 5.1.1 Bitumen

- 5.1.2 Rubber

- 5.1.3 Metal

- 5.1.4 Polymer

- 5.1.5 Others

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By End-user

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Infrastructure

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Saint-Gobain

- 6.4.2 LyondellBasell

- 6.4.3 James Hardie Industries plc

- 6.4.4 Paul Bauder GmbH

- 6.4.5 Euramax International

- 6.4.6 Celotex Limited

- 6.4.7 Rauch Spanplattenwerk GmbH

- 6.4.8 Rizolin LLC

- 6.4.9 Icopal (BMI Group)

- 6.4.10 CBG Composites GmbH

- 6.4.11 Kingspan Group plc

- 6.4.12 Tata Steel Europe

- 6.4.13 ArcelorMittal Construction

- 6.4.14 Sika AG

- 6.4.15 Soprema Group

- 6.4.16 Firestone Building Products (Holcim Elevate)

- 6.4.17 IKO Industries

- 6.4.18 Owens Corning

- 6.4.19 BASF SE

- 6.4.20 Knauf Insulation

- 6.4.21 Coroplast Fritz Muller GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment