|

市場調查報告書

商品編碼

1906154

身分管治與管理:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Identity Governance And Administration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

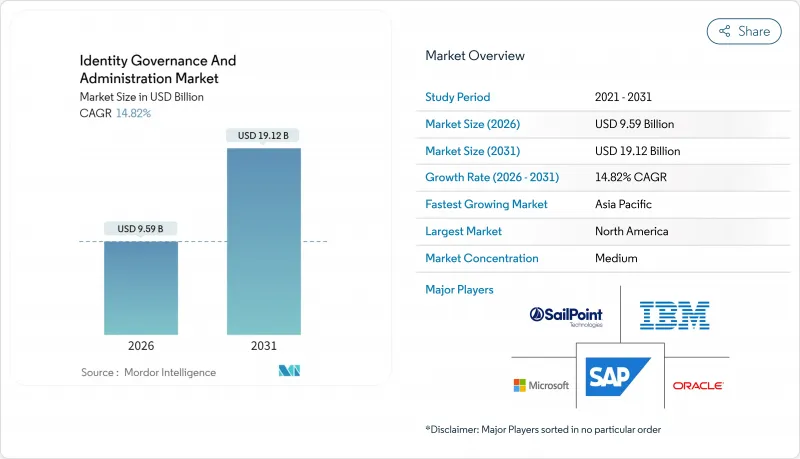

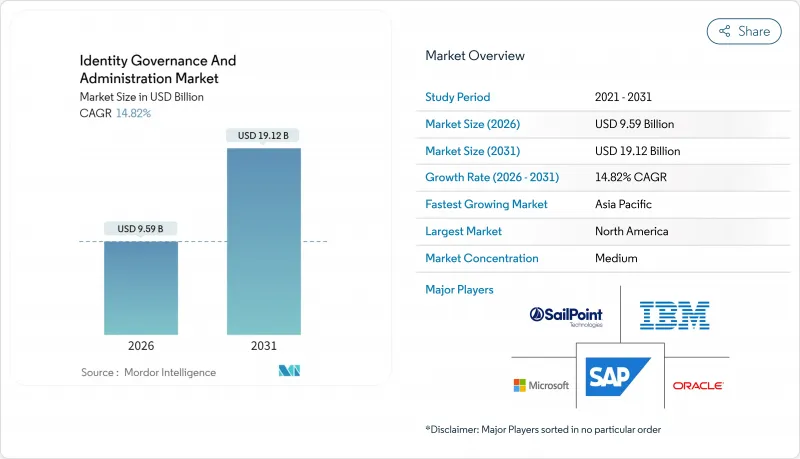

預計到 2026 年,身分管治和管理市場價值將達到 95.9 億美元,高於 2025 年的 83.6 億美元,預計到 2031 年將達到 191.2 億美元。

預計2026年至2031年年複合成長率(CAGR)為14.82%。

對混合IT環境日益成長的依賴,加上身分盜竊詐騙激增82%,正推動安全支出轉向以身分為中心的控制措施。雲端交付模式目前為大多數新部署提供支持,這反映了彈性擴展和快速實現價值的需求。區域支出模式日益分散。北美憑藉著成熟的零信任計畫引領著採用速度,而亞洲則憑藉著當地企業加速數位化和快速轉向雲端原生工具,推動了整體成長。服務仍然是最大的收入來源,這反映出技能差距阻礙了企業內部採用,以及對託管身分專業知識的需求不斷成長。同時,供應商正擴大將機器學習融入身分驗證工作流程,以實現權限審查自動化並提高偵測準確性。這種轉變正在迅速改變競爭格局,並拓展特權存取和非人類身分等鄰近領域的市場機會。

全球身分管治與管理市場趨勢及洞察

AI驅動的IGA在持續存取認證的應用日益廣泛

人工智慧驅動的工具現在可以近乎即時地檢查使用者和非人類權限,透過識別高風險異常情況來最大限度地減少身份驗證疲勞。採用這些功能的組織報告稱,風險檢測的準確性有所提高,管理成本降低,這種組合能夠擴展管治,覆蓋龐大的多重雲端環境。生成式人工智慧還可以將複雜的權限說明說明為自然語言,從而提高業務經理的參與度並縮短服務台回應週期。金融服務和技術領域的早期應用表明,這種模式非常適合全球分散式辦公環境,因為人工審核在這種環境下已變得不切實際。隨著越來越多的組織對可解釋的人工智慧審核引擎建立信任,預計成長動能將加速。

歐洲高度監管產業中 PAM 和 IGA 套件的融合

金融機構和關鍵基礎設施營運商正透過將特權存取控制與更廣泛的生命週期管治相結合,來簡化工具的臃腫化問題。整合套件減少了管理員權限和普通使用者權限之間的重疊,從而堵住了攻擊者的漏洞。領先的特權存取管理 (PAM) 供應商近期的收購凸顯了整合管治模組並交付符合歐洲數位業務彈性法規的合規工作流程的競爭。早期採用者報告稱,審核發現的問題更少,證據收集速度更快,這進一步增強了在全球子公司部署統一架構的商業價值。

身份工程人才短缺限制了複雜部署。

對精通目錄架構、權限模型設計和法規映射的專家的需求持續超過供應。大多數公司都認為人才短缺是大規模部署的主要障礙。這種人才缺口導致更高的薪資和更長的計劃週期,尤其是在網路安全人才稀缺的新興市場。儘管供應商提供了標準化的模板和託管服務來應對這一需求,但由於缺乏內部專業知識,許多組織仍然遲遲不願採用策略自動化等高級功能。

細分市場分析

到2025年,服務將佔身分管治和管理市場收入的56.42%,這反映了整合各種應用環境所需的諮詢和實施工作。跨本地部署、SaaS和操作技術層映射權限需要實施方面的負責人,尤其是在需要審核層級證據的受監管行業。 SaaS管治平台的出現正在將部分支出轉向基於結果的託管服務,服務提供者將軟體訂閱和日常管理整合到固定費用模式中。

然而,軟體訂閱的成長速度超過了服務。人工智慧增強的使用者配置、持續身份驗證和特權會話分析正推動軟體訂閱市場以 17.25% 的複合年成長率成長,從而吸引用戶將預算從獨立的存取管理工具中轉移出來。透過將自動化融入每個工作流程並減少人工操作環節,供應商正在中端市場開闢新的機遇,而複雜性歷來是中端市場採用軟體的障礙。隨著客戶尋求長期成本效益,這一趨勢正為軟體贏得市場佔有率鋪平道路。

預計到2025年,雲端採用將佔身分管治和管理市場規模的60.74%,在所有細分市場中複合年成長率最高,達到16.02%。企業優先考慮快速上線、彈性擴充和即時取得功能版本。在多重雲端環境中,跨IaaS、SaaS和平台服務的管治已成為必需,因此集中式架構成為首選。

在資料主權法規或空氣間隙環境要求本地管理的情況下,本地部署仍然不可或缺。主權雲端建置透過提供滿足居住規則且不影響訂閱經濟性的專用區域實例,正在彌合這一差距。混合模式(策略引擎在雲端運行,但敏感身分儲存保留在本地)為擁有大規模傳統環境的組織提供了一條遷移路徑。

區域分析

北美地區將佔2025年總收入的32.54%,這主要得益於日趨成熟的零信任計畫以及眾多平台供應商在人工智慧驅動分析領域持續創新。金融服務和醫療保健特定產業法規正在推動基礎設施需求,而政府機構則在推動大規模的示範部署,從而幫助私人企業降低部署風險。

亞太地區預計將以16.75%的複合年成長率成長,這主要得益於中國、印度和東南亞國協積極的數位經濟政策。通訊業者的整合、主權雲端投資以及行動優先消費者服務的普及,正迫使企業快速實現身分管理的現代化。國內軟體供應商正利用其在地化優勢,積極拓展受國家技術發展指令影響的客戶群,進而加劇市場競爭。

歐洲仍然是關鍵戰場,GDPR(一般資料保護規則)、產業指令和ESG(環境、社會和管治)採購法規迫使企業實施符合審核要求的管治。北歐國家在供應商評估方面日益嚴格,並將道德身分驗證納入採購清單。同時,中東地區優先考慮符合居住法規的雲端實例,將大規模電子化政府計劃與資料主權要求相協調。在南美和非洲,市場准入正透過銀行、電信和公共部門的試點計畫實現,電子政府計畫展現了快速的投資回報率,並鼓勵更廣泛地採用。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 人工智慧驅動的IGA在持續存取認證的應用日益廣泛

- PAM 和 IGA 套件在高度監管的歐洲產業的融合

- 零信任和無密碼計劃加速了北美角色挖掘工具的普及

- 亞太地區通訊業者間的併購活動正在推動通訊業者採用IGA(集團政府協議)。

- 主權雲端指令推動中東地區本土IGA平台發展

- 在北歐國家,與環境、社會及公司治理(ESG)相關的供應商評估要求推動了審核層級的驗證。

- 市場限制

- 身分工程技能短缺限制了複雜部署的發展。

- 現有IT環境中API的蔓延會推高整合成本。

- 資料居住法的分散化阻礙了跨國公司的全球擴張

- 傳統ERP環境中的角色為基礎的進入許可權控制會降低投資報酬率。

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 存取授權和審查

- 使用者配置/取消配置

- 特權管治

- 密碼管理

- 服務

- 專業服務

- 託管服務

- 解決方案

- 透過部署模式

- 本地部署

- 雲

- 按公司規模

- 主要企業

- 小型企業

- 按最終用戶行業分類

- 銀行、金融服務和保險

- 資訊科技和電信

- 醫療保健和生命科學

- 能源與公共產業

- 政府與公共國防

- 製造業

- 零售與電子商務

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 北歐國家(瑞典、挪威、丹麥、芬蘭)

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東協(新加坡、印尼、馬來西亞、泰國、越南、菲律賓)

- 亞太其他地區

- 中東

- 海灣合作理事會(沙烏地阿拉伯、阿拉伯聯合大公國、卡達、阿曼、科威特、巴林)

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- SailPoint Technologies Holdings Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Broadcom Inc.(CA Technologies)

- SAP SE

- Okta Inc.

- One Identity LLC

- Saviynt Inc.

- CyberArk Software Ltd.

- Ping Identity Holding Corp.

- ForgeRock(Thales Group)

- Hitachi ID Systems

- Evidian(Atos)

- Quest Software Inc.

- Micro Focus(OpenText)

- RSA Security LLC

- Wipro Limited

- Cognizant Technology Solutions Corp.

- Omada Identity

- Zilla Security

- SecZetta

第7章 市場機會與未來展望

The identity governance and administration market size in 2026 is estimated at USD 9.59 billion, growing from 2025 value of USD 8.36 billion with 2031 projections showing USD 19.12 billion, growing at 14.82% CAGR over 2026-2031.

Heightened reliance on hybrid IT estates combined with an 82% surge in impersonation-led fraud is steering security spending toward identity-centric controls.Cloud delivery models now anchor most new deployments, reflecting the need for elastic scaling and quicker time-to-value. Regional spending patterns are fragmenting: North America sets the adoption pace through mature zero-trust programs, while Asia propels overall growth as local enterprises accelerate digitization and leapfrog to cloud-native tools. Services retain the largest revenue pool, mirroring the skills gap that hampers in-house roll-outs and drives demand for managed identity expertise. Meanwhile, vendors are embedding machine learning into certification workflows, automating entitlement reviews and raising detection accuracy, a shift that is rapidly altering competitive positioning and widening addressable opportunities in adjacent privileged access and non-human identity segments.

Global Identity Governance And Administration Market Trends and Insights

Rising Adoption of AI-Driven IGA for Continuous Access Certification

AI-enabled tools now inspect user and non-human entitlements in near real time, minimizing certification fatigue by spotlighting high-risk anomalies. Enterprises deploying these capabilities report sharper risk detection and administrative cost relief, a combination that scales governance to sprawling multicloud estates. Generative AI is also rewriting complex entitlement descriptions into natural language, widening participation among business managers and reducing help-desk cycles. Early roll-outs in financial services and tech verticals suggest the model is suited for globally dispersed workforces where manual reviews have become impractical. Growth momentum is therefore expected to intensify as more organizations build trust in explainable AI review engines.

Convergence of PAM & IGA Suites Among Highly-Regulated Sectors in Europe

Financial institutions and critical infrastructure operators are rationalizing tool sprawl by fusing privileged access controls with broader lifecycle governance. Unified suites reduce overlap between administrator and standard user entitlements, closing gaps that attackers target. Recent acquisitions by leading PAM providers underscore a race to integrate governance modules and to deliver compliance-ready workflows aligned with Europe's Digital Operational Resilience Act. Early adopters report fewer audit findings and faster evidence gathering, reinforcing the business case for integrated architectures across global subsidiaries.

Skill Shortage in Identity Engineering Limiting Complex Deployments

Demand for specialists versed in directory architecture, entitlement modelling, and regulatory mapping continues to outstrip supply. A majority of enterprises cite talent scarcity as the principal hurdle to large-scale implementations. The gap drives wage inflation and elongates project timelines, especially in emerging markets where cybersecurity skill pools remain shallow. Vendors are responding with prescriptive templates and managed offerings, yet many organizations still defer advanced features such as policy automation because internal expertise is absent.

Other drivers and restraints analyzed in the detailed report include:

- Zero-Trust & Passwordless Initiatives Accelerating Role Mining Tools in North America

- M&A Activity Among Telcos Driving Telco-Grade IGA Roll-Outs in APAC

- API-Sprawl Elevating Integration Cost for Brownfield IT Environments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services generated 56.42% of 2025 revenue in the identity governance and administration market, reflecting the consulting and integration effort needed to harmonize diverse application estates. Implementers remain indispensable for mapping entitlements across on-premises, SaaS, and operational technology layers, particularly in regulated sectors that demand audit-grade evidence. The arrival of SaaS-delivered governance platforms is shifting some expenditure toward outcome-based managed services, with providers bundling software subscriptions and day-to-day administration into fixed-fee models.

Software subscriptions are, however, outpacing services in growth terms. AI-enhanced user provisioning, continuous certification, and privileged session analytics underpin a 17.25% CAGR outlook, drawing budget from stand-alone access management tools. Vendors are weaving automation into every workflow, shrinking manual touchpoints, and opening mid-market opportunities where previous complexity deterred adoption. This dynamic positions software to capture incremental share as customers seek long-term cost efficiencies.

Cloud deployments accounted for 60.74% of the identity governance and administration market size in 2025 and are projected to register the segment's steepest 16.02% CAGR. Enterprises value rapid onboarding, elastic scaling, and instant access to feature releases. Multicloud realities now require governance that spans infrastructure-as-a-service, SaaS, and platform services, making centrally-hosted architectures the preferred option.

On-premises installations persist where data-sovereignty statutes or air-gapped environments dictate local control. Sovereign-cloud constructs are narrowing this divide by offering dedicated regional instances that satisfy residency rules without sacrificing subscription economics. Hybrid models, in which policy engines run in the cloud while sensitive identity stores remain on-site, provide transitional paths for organizations with large legacy footprints.

The Identity Governance and Administration Market Report is Segmented by Component (Solutions, Services), Deployment Mode (On Premise, Cloud), Enterprise Size (Large Enterprises, Small and Medium Enterprises), End User Vertical (Banking, Financial Services, and Insurance, IT and Telecom, Energy and Utilities, Government and Public Defense, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 32.54% of 2025 revenue, underpinned by mature zero-trust initiatives and a concentration of platform vendors that continually innovate around AI-driven analytics. Sector-specific mandates in financial services and healthcare boost baseline demand, while government agencies sponsor large-scale reference deployments that de-risk adoption for private firms.

Asia-Pacific is projected to expand at a 16.75% CAGR, buoyed by aggressive digital-economy policies in China, India, and key ASEAN states. Telco consolidation, sovereign-cloud investments, and widespread mobile-first consumer services force enterprises to modernize identity controls rapidly. Domestic software suppliers leverage localisation advantages to penetrate accounts subject to national technology-development directives, amplifying competitive intensity.

Europe remains a pivotal battleground where GDPR, sectoral directives, and ESG-linked procurement rules compel organisations to adopt audit-ready governance. The Nordics push vendor assessment rigor even further, embedding ethical identity verification into sourcing checklists. Meanwhile, the Middle East prioritises residency-compliant cloud instances to harmonise expansive e-government projects with data-sovereignty imperatives. South America and Africa enter the market through banking, telecom, and public-sector pilots that demonstrate rapid ROI and spur broader adoption.

- SailPoint Technologies Holdings Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Broadcom Inc. (CA Technologies)

- SAP SE

- Okta Inc.

- One Identity LLC

- Saviynt Inc.

- CyberArk Software Ltd.

- Ping Identity Holding Corp.

- ForgeRock (Thales Group)

- Hitachi ID Systems

- Evidian (Atos)

- Quest Software Inc.

- Micro Focus (OpenText)

- RSA Security LLC

- Wipro Limited

- Cognizant Technology Solutions Corp.

- Omada Identity

- Zilla Security

- SecZetta

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of AI-driven IGA for Continuous Access Certification

- 4.2.2 Convergence of PAM and IGA Suites Among Highly-Regulated Sectors in Europe

- 4.2.3 Zero-Trust and Passwordless Initiatives Accelerating Role Mining Tools in North America

- 4.2.4 MandA Activity Among Telcos Driving Telco-grade IGA Roll-outs in APAC

- 4.2.5 Sovereign-Cloud Mandates Fueling Domestic IGA Platforms in Middle East

- 4.2.6 ESG-Linked Vendor Assessment Requirements Pushing Audit-grade Identity Proof in Nordics

- 4.3 Market Restraints

- 4.3.1 Skill Shortage in Identity Engineering Limiting Complex Deployments

- 4.3.2 API-Sprawl Elevating Integration Cost for Brownfield IT Environments

- 4.3.3 Fragmented Data-Residency Laws Slowing Global Rollouts for Multinationals

- 4.3.4 Delayed ROI from Role-Based Access Clean-ups in Legacy ERP Estates

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Access Certification and Review

- 5.1.1.2 User Provisioning / De-provisioning

- 5.1.1.3 Privileged Governance

- 5.1.1.4 Password Management

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises

- 5.4 By End-user Vertical

- 5.4.1 Banking, Financial Services and Insurance

- 5.4.2 IT and Telecom

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Energy and Utilities

- 5.4.5 Government and Public Defense

- 5.4.6 Manufacturing

- 5.4.7 Retail and e-Commerce

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Nordics (Sweden, Norway, Denmark, Finland)

- 5.5.3.6 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN (Singapore, Indonesia, Malaysia, Thailand, Vietnam, Philippines)

- 5.5.4.6 Rest of APAC

- 5.5.5 Middle East

- 5.5.5.1 GCC (Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain)

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 SailPoint Technologies Holdings Inc.

- 6.4.2 IBM Corporation

- 6.4.3 Microsoft Corporation

- 6.4.4 Oracle Corporation

- 6.4.5 Broadcom Inc. (CA Technologies)

- 6.4.6 SAP SE

- 6.4.7 Okta Inc.

- 6.4.8 One Identity LLC

- 6.4.9 Saviynt Inc.

- 6.4.10 CyberArk Software Ltd.

- 6.4.11 Ping Identity Holding Corp.

- 6.4.12 ForgeRock (Thales Group)

- 6.4.13 Hitachi ID Systems

- 6.4.14 Evidian (Atos)

- 6.4.15 Quest Software Inc.

- 6.4.16 Micro Focus (OpenText)

- 6.4.17 RSA Security LLC

- 6.4.18 Wipro Limited

- 6.4.19 Cognizant Technology Solutions Corp.

- 6.4.20 Omada Identity

- 6.4.21 Zilla Security

- 6.4.22 SecZetta

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment