|

市場調查報告書

商品編碼

1906147

聚酯短纖維(PSF):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Polyester Staple Fiber (PSF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

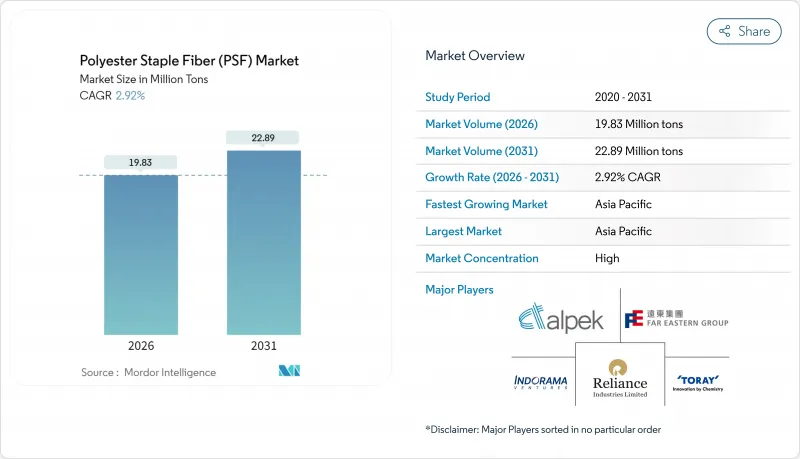

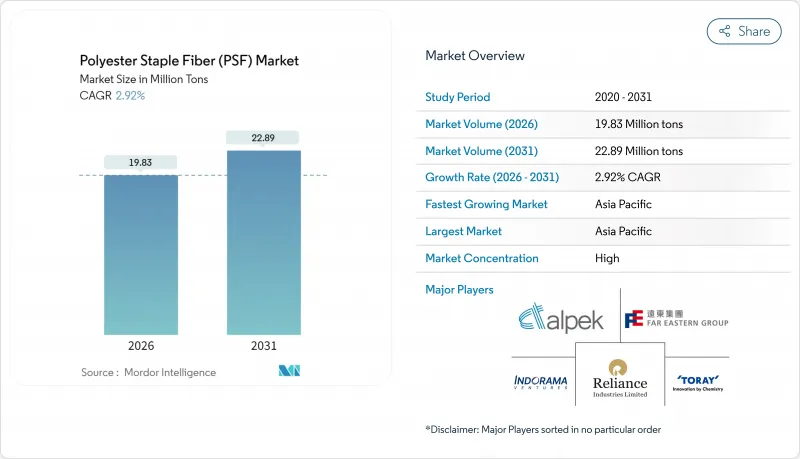

2025年聚酯短纖維(PSF)市值為1,927萬噸,預計2031年將達到2,289萬噸,高於2026年的1,983萬噸。

預計在預測期(2026-2031 年)內,複合年成長率將達到 2.92%。

這種穩定成長反映了該材料在服飾、家居用品、不織布衛生用品、汽車聲學零件以及不斷擴展的技術應用領域的應用範圍日益擴大。對經濟實惠的合成纖維的需求不斷成長,棉花消費結構逐漸被淘汰,以及對閉合迴路回收的投資,都在增強市場抵禦原油價格波動和貿易壁壘帶來的衝擊。隨著全球時尚零售商、汽車製造商和衛生用品生產商將永續性投資轉向下游纖維供應協議,對再生纖維的競爭日益激烈。能夠將規模、化學創新和可追溯的原料來源結合的生產商,預計在未來十年內提高利潤率。

全球聚酯短纖維(PSF)市場趨勢與洞察

快時尚品牌對再生聚苯乙烯泡沫塑膠的需求迅速成長

消費者日益嚴格的監管以及歐洲新推出的數位產品護照計劃,正迫使全球零售商用再生纖維取代原生聚酯纖維。 H&M 已向擁有閉迴路聚合物再生技術的 Syre 公司投資 6 億美元,標誌著其原料來源永久地從寶特瓶轉向其他材料。 Shein 推出了一項專有的解聚工藝,並計劃在達到每年 3000 噸的試點產能後,將其授權給合作工廠。各大品牌紛紛簽署多年採購協議,導致優質再生短纖維供應緊張,並推動了歐洲和亞洲先進化學回收中心的擴張。隨著可追溯性成為一項必要條件,擁有檢驗的監管鏈數據的纖維生產商有望獲得長期批量合約和價格溢價,從而推動整個聚酯短纖維市場的成長。

價格波動下棉滌混紡的替代。

棉花價格的持續波動促使服裝製造商將目光轉向合成纖維替代品,因為合成纖維能夠確保成本和供應的可預測性。美國農業部 (USDA) 發布的 2024/25 年展望報告顯示,儘管全球棉花面積不斷增加,但美國工廠棉花消費量仍處於多年來的低位,這凸顯了聚酯纖維相對的經濟穩定性。紡織加工商透過提供手感類似棉且具有抗縮水性的聚酯紗線,正在丹寧布料混紡、休閒和大眾時尚市場中不斷擴大佔有率。這種轉變在印度和中國尤為明顯,兩國布料製造商正在擴大用於針織 T 恤和 Polo 衫的拉伸變形紗線生產線。這種結構性轉變正在推動基準需求,並為 2030 年前的聚酯短纖維市場奠定基礎。

原物料價格波動與原油價格波動有關

對二甲苯 (PX) 和對苯二甲酸 (PTA) 的價格與布蘭特原油價格密切相關,使聚酯產業面臨能源市場波動的風險。 2024 年,煉油廠的趨勢(被稱為「汽油效應」)導致北美 PX 的交易價格高於亞洲,擴大了交付成本差異。儘管中國石油化學公司(中石化)在江蘇省的 300 萬噸 PTA 工廠有助於緩解供應壓力,但價格飆升迫使纖維生產商調整庫存管理和避險策略,並常常因利潤率收窄而推遲產能擴張。預計這種波動將使聚酯短纖維市場的複合年成長率 (CAGR) 下降約 0.6 個百分點。

細分市場分析

截至2025年,實心纖維佔總佔有率的59.35%,這主要得益於其在服飾、家用紡織品和填充材料等領域的廣泛應用。中空纖維佔據了剩餘的市場佔有率,預計到2031年將以每年5.62%的速度成長,顯著超過聚酯短纖維(PSF)市場的整體成長速度。這一優異表現歸功於中空纖維的隔熱和吸濕排汗性能,使其成為休閒、睡袋和被子填充物的理想選擇。

生產技術的進步有效防止了纖維崩壞,從而實現了輕質高蓬鬆度。汽車內部裝潢建材、空氣過濾器和衛生面巾等產品均採用雙組分中空纖維產品,並輔以親水整理,以促進流體輸送。亞洲中空不織布提供克重從13克/平方公尺到100克/平方公尺的熱黏合網,展現出廣泛的應用潛力。隨著技術客戶對輕量化和節能性的日益重視,中空纖維預計將在隔熱材料和過濾應用領域佔據聚酯短纖維市場越來越大的佔有率。

區域分析

預計到2025年,亞太地區將引領市場,佔據全球整體72.40%的佔有率,主要得益於中國PTA、MEG和纖維一體化資產以及印度泰米爾納德邦針織業的擴張。全部區域拉伸變形紗和中空紗生產線的普及率預計將推動亞太地區以5.18%的複合年成長率成長,成為各區域中最快的成長速度。中國石油化學股份有限公司(中石化)的300萬噸PTA工廠正在提升上游供應安全,並降低下游紡紗企業的損益平衡點。

印度繼續利用績效激勵措施擴大人造纖維出口,同時該國不斷加快的都市化也推動了家用紡織品消費的成長。越南、印尼和泰國正在吸引對衛生不織布的投資,這帶動了樹脂進口,並促使紡粘廠與新的短纖維生產線推出。這些趨勢共同為區域聚酯短纖維市場注入了新的活力。

北美和歐洲的產量小規模,但其生產的纖維附加價值很高,主要用於汽車、家具和過濾等領域。這兩個地區的反傾銷訴訟正在改變貿易格局。拉丁美洲和土耳其正在接收來自亞洲的傳輸出貨,而歐洲生產商則將目標客戶鎖定在價格敏感度較低的技術型客戶。在預測期內,對回收基礎設施(例如西班牙、法國和美國東部的化學解聚工廠)的額外投資預計將減緩原生原料的生產成長,同時提高再生材料在聚酯短纖維(PSF)市場的滲透率。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 快時尚品牌對再生聚苯乙烯泡沫塑膠的需求激增

- 擴大東南亞不織布衛生用品的生產能力

- 由於價格波動,棉花被聚酯纖維替代

- 輕量化NVH汽車零件的成長

- 印度和中國的都市化推動了家用紡織品的繁榮。

- 市場限制

- 原物料價格波動與原油價格波動有關

- 美國和歐盟對聚酯短纖維(PSF)徵收反傾銷稅

- 嚴格的法律和政治規章

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 固體的

- 中空的

- 起源

- 處女

- 混合物

- 生殖

- 透過使用

- 紡織品

- 家居佈置

- 車

- 過濾

- 建造

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Alpek Polyester

- Barnet

- Bombay Dyeing

- BoReTech Environmental Engineering Co., Ltd.

- Diyou Fibre(M)Sdn Bhd

- Far Eastern Group

- Hang Zhou Benma Chemfibre and Spinning Co.,Ltd.

- Huvis Corp

- Indorama Ventures Public Company Limited.

- Komal Fibres

- Nirmal Fibres(P)Ltd.

- Reliance Industries Limited

- Sanfame Group

- Shubhalakshmi

- SINOPEC YIZHENG CHEMICAL FIBRE LIMITED

- Thai polyester Co., Ltd.

- Tongkun Holding Group

- TORAY INDUSTRIES, INC.

- XINDA

第7章 市場機會與未來展望

The Polyester Staple Fiber (PSF) Market was valued at 19.27 Million tons in 2025 and estimated to grow from 19.83 Million tons in 2026 to reach 22.89 Million tons by 2031, at a CAGR of 2.92% during the forecast period (2026-2031).

This steady rise mirrors the material's expanding footprint in apparel, home furnishings, non-woven hygiene products, automotive noise-control parts, and a growing range of technical uses. Rising demand for cost-effective synthetics, the structural shift away from cotton, and investment in closed-loop recycling are reinforcing the market's resilience even as oil-linked raw-material costs and trade barriers add volatility. Competition is intensifying around recycled grades as global fashion retailers, automakers, and hygiene converters move sustainability spending downstream into fiber supply contracts. Producers able to blend scale, chemistry innovation, and traceable feedstocks are positioned to strengthen margins over the decade.

Global Polyester Staple Fiber (PSF) Market Trends and Insights

Surge in Demand for Recycled PSF from Fast-Fashion Brands

Mounting consumer scrutiny and new European Digital Product Passports are compelling global retailers to replace virgin polyester with textile-to-textile recycled alternatives. H&M has committed USD 600 million to Syre for closed-loop polymer regeneration, signalling a permanent shift away from bottle-based feedstock. Shein has introduced a proprietary depolymerisation process and intends to license it to partner mills once pilot output scales to 3,000 tons per year. Brands are also locking multi-year offtake agreements, which is tightening supply of high-quality recycled staple and encouraging expansion of advanced chemical recycling hubs in Europe and Asia. As traceability becomes non-negotiable, fiber producers able to validate chain-of-custody data stand to win long-term volume contracts and price premiums, lifting overall growth in the polyester staple fiber market.

Substitution of Cotton with Polyester amid Price Volatility

Persistent swings in cotton prices have sharpened apparel makers' focus on synthetic alternatives that guarantee predictable cost and supply. USDA's 2024 and 25 outlook shows U.S. mill cotton use at multi-year lows even as global cotton crops rise, underscoring polyester's relative economic security. Fiber converters are capturing share in denim blends, athleisure and mass-market fashion by offering polyester yarns that mimic cotton's hand feel while resisting shrinkage. The shift is most pronounced in India and China where fabric mills are scaling draw-texturised yarn lines dedicated to knitted t-shirt and polo production. This structural migration lifts baseline demand, underpinning the polyester staple fiber market through 2030.

Raw-Material Price Volatility Linked to Crude-Oil Swings

Paraxylene and PTA prices mirror Brent movements, exposing polyester economics to energy market turbulence. In 2024 North American PX traded at premiums to Asia because of refinery dynamics referred to as the "gasoline effect," widening delivered-cost gaps. Although Sinopec's 3 million-ton PTA unit in Jiangsu eases supply pressure, price spikes compel fiber makers to juggle inventory cover and hedging, often deferring capacity upgrades when margins compress. Volatility therefore subtracts an estimated 0.6 percentage points from the polyester staple fiber market CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Urbanisation-Led Home-Textile Boom in India & China

- Growth of Lightweight NVH Automotive Components

- Anti-Dumping Duties on PSF in United States and European Union

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solid fibers accounted for 59.35% of volume in 2025, underpinned by broad usage in apparel, home textiles and stuffing materials. In the same year hollow grades captured the remaining share yet are predicted to expand 5.62% annually to 2031-well above the overall polyester staple fiber (PSF) market. Performance stems from the thermal-insulation value of hollow cores and their ability to wick moisture, essential for athleisure, sleeping bags and quilt fillings.

Production advances now prevent fiber collapse, allowing higher loft at lower weight. Automotive interior trims, air filters and hygiene topsheets are specifying bi-component hollow products designed with hydrophilic finishes that speed liquid transport. Thermal-bonded webs between 13-100 gsm supplied by Asian non-woven converters demonstrate the breadth of end-use possibilities. As technical customers prioritize weight savings and energy efficiency, hollow variants are set to capture a larger slice of the polyester staple fiber market size for insulation and filtration sub-segments.

The Polyester Staple Fiber (PSF) Market Report Segments the Industry by Product Type (Solid, Hollow), Origin (Virgin, Blended, Recycled), Application (Textile, Home Furnishing, Automotive, Filtration, Construction, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominated global volume with a 72.40% share in 2025, propelled by China's integrated PTA, MEG and fiber assets and India's expanding knitwear hub in Tamil Nadu. Region-wide adoption of draw-texturised yarns and hollow variant lines positions APAC to grow at a 5.18% CAGR, the fastest regional rate. Sinopec's megascale 3 million-ton PTA plant improves upstream security, lowering break-even costs for downstream spinners.

India continues to leverage the Performance-Linked Incentive scheme to boost man-made fiber exports while domestic urbanisation lifts household textile consumption. Vietnam, Indonesia, and Thailand attract hygiene-non-woven investments, drawing resin imports and sparking new staple lines co-located with spunbond units. Together, these trends inject momentum into the regional polyester staple fiber market.

North America and Europe account for a smaller volume, yet fibre engineered for automotive, furniture, and filtration draws premium margins. Anti-dumping cases in both regions alter trade flows: Latin America and Turkiye receive redirected Asian shipments while European producers target technical customers less sensitive to price. Over the forecast horizon, incremental investments in recycling infrastructure-such as chemical depolymerisation plants in Spain, France and the eastern United States, will taper virgin volume growth but raise recycled penetration within the polyester staple fiber (PSF) market.

- Alpek Polyester

- Barnet

- Bombay Dyeing

- BoReTech Environmental Engineering Co., Ltd.

- Diyou Fibre (M) Sdn Bhd

- Far Eastern Group

- Hang Zhou Benma Chemfibre and Spinning Co.,Ltd.

- Huvis Corp

- Indorama Ventures Public Company Limited.

- Komal Fibres

- Nirmal Fibres (P) Ltd.

- Reliance Industries Limited

- Sanfame Group

- Shubhalakshmi

- SINOPEC YIZHENG CHEMICAL FIBRE LIMITED

- Thai polyester Co., Ltd.

- Tongkun Holding Group

- TORAY INDUSTRIES, INC.

- XINDA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Demand for Recycled PSF from FastFashion Brands

- 4.2.2 Expansion of Nonwoven Hygiene Capacity in Southeast Asia

- 4.2.3 Substitution of Cotton with Polyester amid Price Volatility

- 4.2.4 Growth of Lightweight NVH Automotive Components

- 4.2.5 UrbanisationLed Home Textile Boom in India & China

- 4.3 Market Restraints

- 4.3.1 RawMaterial Price Volatility Linked to CrudeOil Swings

- 4.3.2 Anti Dumping Duties on PSF in United States & EU

- 4.3.3 Stringent Legal and Political Regulations

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Solid

- 5.1.2 Hollow

- 5.2 By Origin

- 5.2.1 Virgin

- 5.2.2 Blended

- 5.2.3 Recycled

- 5.3 By Application

- 5.3.1 Textile

- 5.3.2 Home Furnishing

- 5.3.3 Automotive

- 5.3.4 Filtration

- 5.3.5 Construction

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank / Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Alpek Polyester

- 6.4.2 Barnet

- 6.4.3 Bombay Dyeing

- 6.4.4 BoReTech Environmental Engineering Co., Ltd.

- 6.4.5 Diyou Fibre (M) Sdn Bhd

- 6.4.6 Far Eastern Group

- 6.4.7 Hang Zhou Benma Chemfibre and Spinning Co.,Ltd.

- 6.4.8 Huvis Corp

- 6.4.9 Indorama Ventures Public Company Limited.

- 6.4.10 Komal Fibres

- 6.4.11 Nirmal Fibres (P) Ltd.

- 6.4.12 Reliance Industries Limited

- 6.4.13 Sanfame Group

- 6.4.14 Shubhalakshmi

- 6.4.15 SINOPEC YIZHENG CHEMICAL FIBRE LIMITED

- 6.4.16 Thai polyester Co., Ltd.

- 6.4.17 Tongkun Holding Group

- 6.4.18 TORAY INDUSTRIES, INC.

- 6.4.19 XINDA

7 Market Opportunities & Future Outlook

- 7.1 Whitespace & UnmetNeed Assessment

- 7.2 Growing Awareness Regarding Recycled Polyester Staple Fiber