|

市場調查報告書

商品編碼

1906142

聚合物塗層織物:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Polymer Coated Fabric - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

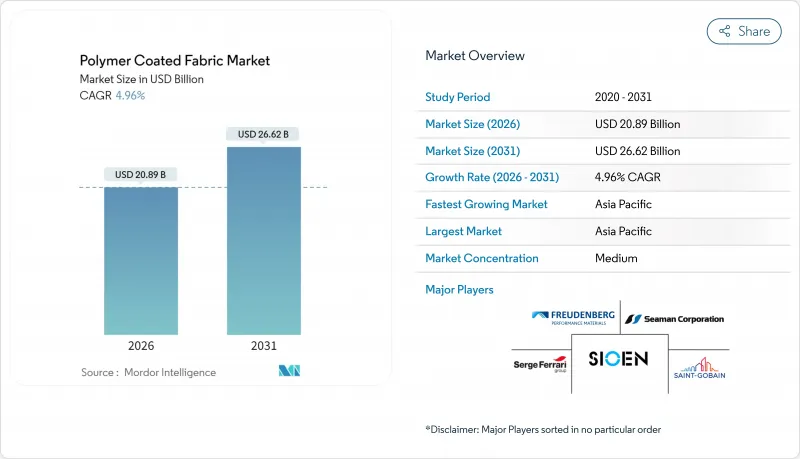

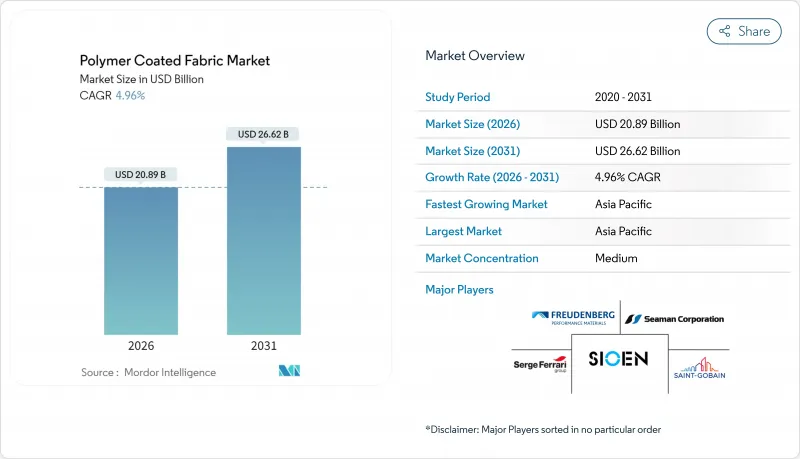

預計到 2026 年,聚合物塗層織物市場價值將達到 208.9 億美元,高於 2025 年的 199 億美元。

預計到 2031 年將達到 266.2 億美元,2026 年至 2031 年的複合年成長率為 4.96%。

這一前景反映了對輕質高性能材料的持續投資,這些材料既符合更嚴格的化學品法規,又能實現脫碳目標。受交通運輸內飾、防護衣和氣候適應型建築等領域需求趨同的推動,聚合物塗層織物市場保持穩定的成長動能。製造商正在利用兼具耐用性和可回收性的塗層技術,使終端用戶能夠滿足生命週期成本和資訊揭露義務。雖然競爭程度適中,但策略性收購、區域產能擴張以及不含 PFAS 的創新正在使產品線之間形成明顯的差異化。

全球聚合物塗層織物市場趨勢及洞察

投資軟性太陽能背襯材料

太陽能資源豐富的經濟體正在推廣可適應曲面和輕型結構的織物光伏技術。聚四氟乙烯(PTFE)塗層玻璃纖維基板具有良好的耐候性,使軟性組件的運作可達20-25年,加速了其在建築一體成型太陽能建築幕牆中的應用。在中國,紡織業與光電產業的協同效應正在推動其商業化規模應用;而在歐盟,建築師正在指定使用符合淨零能耗建築標準的輕質太陽能薄膜。

對輕質和永續內部裝潢建材的需求日益成長

透過以聚合物塗層織物取代厚重的基材,汽車和航太原始設備製造商 (OEM) 可以實現 15-20% 的減重,從而直接提高燃油經濟性。大陸集團已將稻殼二氧化矽和天然橡膠融入其塗層織物系列產品中,證明了可再生填料如何在不增加成本的情況下滿足耐久性要求。

供應鏈區域化改變了國際貿易流向

地緣政治緊張局勢加劇,推動生產區域化,增加了跨洲重疊塗裝生產線的資本需求,並降低了規模經濟效益。美國買家正將採購來源多元化,轉向印度和東南亞,以降低關稅風險。

細分市場分析

到2025年,聚氯乙烯(PVC)將佔據聚合物塗層織物市場41.55%的佔有率,這反映了其強大的成本和加工優勢。然而,受加工商響應鄰苯二甲酸酯限制和回收強制性要求的推動,聚氨酯預計到2031年將以5.88%的複合年成長率成長。路博潤的ESTANE RNW TPU在保持耐磨性的同時,碳足跡降低了59%,這表明綠色化學正在從利基市場走向主流市場。

儘管矽酮和聚乙烯在極端溫度和化學惰性應用領域仍發揮其特殊作用,但生物基混合材料正在消費電子產品機殼和高階配件領域嶄露頭角。技術藍圖顯示,領先的供應商正在將塗層創新與基材設計結合。弗羅伊登貝格的細絲紡粘技術能夠實現更薄、更輕的薄膜,減少溶劑吸收,並提高塗裝線的生產效率。這種整合方法表明,性能的提升既可以源自於聚合物技術的進步,也可以源自於織物結構的改進。

本聚合物塗層織物報告按產品類型(聚氯乙烯 (聚氯乙烯)、聚氨酯 (PU)、聚乙烯及其他)、應用領域(運輸設備、工業設備罩、屋頂及遮陽篷、防護衣、家具、運動休閒及其他)和地區(亞太地區、北美地區、歐洲地區、南美地區、中東和非洲地區)進行分析。市場預測以美元以金額為準。

區域分析

預計到2025年,亞太地區將佔聚合物塗層織物市場46.10%的佔有率,並在2031年之前以5.72%的複合年成長率成長。印度的紡織使命計畫(2025年預算為6.29億美元)已撥款用於技術紡織品的研發和塗層試點設施建設。從地鐵到防洪屋頂等公共基礎設施項目,將這些產能轉化為對永續塗層織物的需求。

在北美,以技術主導的細分市場已經形成,航太和醫療設備製造商需要低揮發性有機化合物(VOC)和不含全氟烷基和多氟烷基物質(PFAS)的材料。電動車生產的回流推動了座椅布料和電池組外殼的本地在地採購增加。供應商正在美國待開發區工廠進行投資,旨在實現碳中和運營,特瑞堡位於盧瑟福縣的計劃(計劃獲得LEED認證)就是一個例證。

歐洲是一個受監管主導的市場,鼓勵使用符合工業排放指令的無溶劑和水性塗料。原始設備製造商 (OEM) 重視材料資訊的全面揭露,這有利於獲得認證的供應商,從而使高度合規的產品價格更具韌性。中東和非洲地區雖然規模較小,但正經歷高於平均的成長,這主要得益於沿岸地區對氣候適應型建築的需求以及南非的產業多元化。有限的國內塗料生產線為願意投資區域服務中心的成熟企業提供了外包機會。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對輕質和永續內部裝潢建材的需求日益成長

- 亞太地區製造業防護衣標準的提升

- 氣候適應基礎設施中建築張拉結構的廣泛應用

- 醫用家具中抗菌塗層的應用

- 對軟性光伏背板材料的投資

- 市場限制

- 原油衍生聚合物價格波動

- 聚氯乙烯和鄰苯二甲酸酯的環境法規

- 供應鏈區域化阻礙了全球貿易流動

- 價值鏈分析

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 聚氯乙烯(PVC)

- 聚氨酯(PU)

- 聚乙烯

- 矽酮

- 其他

- 透過使用

- 運輸

- 工業設備罩

- 屋頂材料和遮陽設施

- 防護衣

- 家具

- 運動與休閒

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Continental AG

- Cooley Group

- Freudenberg Performance Materials Holding GmbH

- Heytex Gruppe

- OMNOVA North America Inc.

- Saint-Gobain

- Seaman Corporation

- Serge Ferrari Group

- Sioen Industries NV

- SPRADLING INTERNATIONAL GmbH

- SRF Limited

- Trelleborg AB

第7章 市場機會與未來展望

Polymer Coated Fabric Market size in 2026 is estimated at USD 20.89 billion, growing from 2025 value of USD 19.90 billion with 2031 projections showing USD 26.62 billion, growing at 4.96% CAGR over 2026-2031.

The outlook mirrors sustained investments in lightweight, high-performance materials that meet decarbonization targets while complying with more stringent chemical regulations. Demand consolidation in transportation interiors, protective clothing, and climate-resilient construction keeps the polymer coated fabric market on a steady growth track. Producers leverage coating chemistries that fuse durability with recyclability, allowing end-users to meet lifecycle cost and disclosure mandates. Competitive intensity remains moderate, yet strategic acquisitions, regional capacity expansion, and PFAS-free innovation sharpen differentiation across product lines.

Global Polymer Coated Fabric Market Trends and Insights

Investments in Flexible Photovoltaic Back-Sheet Fabrics

Solar-rich economies champion fabric-based photovoltaics that conform to curved or lightweight structures. PTFE-coated glass fiber substrates deliver weather tolerance and enable 20-25-year operating life of flexible modules, accelerating adoption in building-integrated solar facades. Chinese textile-solar synergies underpin commercial scale, while EU architects specify low-mass solar membranes to meet net-zero building codes.

Increasing Demand for Lightweight, Sustainable Interior Materials

Automotive and aerospace OEMs see 15-20% weight savings when polymer coated fabrics replace heavier substrates, translating directly to fuel efficiency gains. Continental AG integrates rice-husk silica and natural rubber into its coated fabric range, demonstrating how renewable fillers meet durability specifications without cost penalties.

Supply-Chain Localization Disrupting Global Trade Flows

Geopolitical tensions spur regionalized production, raising capital needs for duplicate coating lines across continents and compressing economies of scale. U.S. buyers diversify sourcing toward India and Southeast Asia to mitigate tariff exposure.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Protective-Clothing Standards Across APAC Manufacturing

- Adoption of Antimicrobial Coatings in Healthcare Furnishings

- Environmental Scrutiny of PVC and Phthalates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PVC held 41.55% polymer-coated fabric market share in 2025, reflecting entrenched cost and processing advantages. Polyurethane, however, is projected to post a 5.88% CAGR to 2031 as converters adapt to phthalate restrictions and recyclability mandates. Lubrizol's ESTANE RNW TPU offers a 59% lower carbon footprint while maintaining abrasion resistance, illustrating how greener chemistries transition from niche to mainstream.

Silicone and polyethylene retain specialized roles in extreme-temperature or chemically inert uses, whereas bio-based hybrids gain traction in consumer electronics casings and luxury accessories. Technological roadmaps reveal that leading suppliers pair coating innovation with substrate engineering. Freudenberg's fine-filament spunbond supports thinner, lighter membranes, lowering solvent uptake and boosting coating line throughput. This integrated approach underscores how performance gains derive from both polymer advances and fabric architecture.

The Polymer Coated Fabric Report is Segmented by Product Type (PVC (Polyvinyl Chloride), Polyurethane (PU), Polyethylene, and Others), Application (Transportation, Industrial Equipment Covers, Roofing and Awning, Protective Clothing, Furniture, Sports and Leisure, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 46.10% polymer-coated fabric market share in 2025 and is projected to register a 5.72% CAGR through 2031. India's Textile Mission, backed by USD 629 million in 2025 budget allocations, earmarks funds for technical-textile research and development and pilot coating facilities. Public infrastructure programs, from metro rail to flood-resilient roofing, convert this capacity into sustained coated fabric off-take.

North America secures a technology-driven niche where aerospace and medical OEMs demand low-VOC, PFAS-free materials. Reshoring of electric-vehicle production amplifies local sourcing for seat fabrics and battery-pack covers. The polymer-coated fabric market sees suppliers investing in U.S. greenfield plants built for carbon-neutral operation, as evidenced by Trelleborg's Rutherford County project, slated for LEED certification

Europe remains a regulation-led market incubating solvent-free, waterborne coatings aligned with the Industrial Emissions Directive. OEM preference for full material disclosure favors certified suppliers, creating price resilience for high-compliance products. Middle East and Africa, though smaller, post above-average growth on the back of climate-resilient construction in the Gulf and industrial diversification in South Africa. Limited domestic coating lines present outsourcing opportunities for incumbents willing to invest in regional service hubs.

- Continental AG

- Cooley Group

- Freudenberg Performance Materials Holding GmbH

- Heytex Gruppe

- OMNOVA North America Inc.

- Saint-Gobain

- Seaman Corporation

- Serge Ferrari Group

- Sioen Industries NV

- SPRADLING INTERNATIONAL GmbH

- SRF Limited

- Trelleborg AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Lightweight, Sustainable Interior Materials

- 4.2.2 Growth in Protective-Clothing Standards Across APAC Manufacturing

- 4.2.3 Surge in Architectural Tensile Structures for Climate-Resilient Infrastructure

- 4.2.4 Adoption of Antimicrobial Coatings in Healthcare Furnishings

- 4.2.5 Investments in Flexible PV Back-Sheet Fabrics

- 4.3 Market Restraints

- 4.3.1 Volatility of Crude-Derived Polymer Prices

- 4.3.2 Environmental Scrutiny of PVC and Phthalates

- 4.3.3 Supply-Chain Localization Disrupting Global Trade Flows

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 PVC (Polyvinyl Chloride)

- 5.1.2 PU (Polyurethane)

- 5.1.3 Polyethylene

- 5.1.4 Silicone

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Transportation

- 5.2.2 Industrial Equipment Covers

- 5.2.3 Roofing and Awning

- 5.2.4 Protective Clothing

- 5.2.5 Furniture

- 5.2.6 Sports and Leisure

- 5.2.7 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 Cooley Group

- 6.4.3 Freudenberg Performance Materials Holding GmbH

- 6.4.4 Heytex Gruppe

- 6.4.5 OMNOVA North America Inc.

- 6.4.6 Saint-Gobain

- 6.4.7 Seaman Corporation

- 6.4.8 Serge Ferrari Group

- 6.4.9 Sioen Industries NV

- 6.4.10 SPRADLING INTERNATIONAL GmbH

- 6.4.11 SRF Limited

- 6.4.12 Trelleborg AB

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment