|

市場調查報告書

商品編碼

1906135

鄰苯二甲酸二異壬酯 (DINP):市場佔有率分析、產業趨勢與統計、成長預測 (2026-2031)Diisononyl Phthalate (DINP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

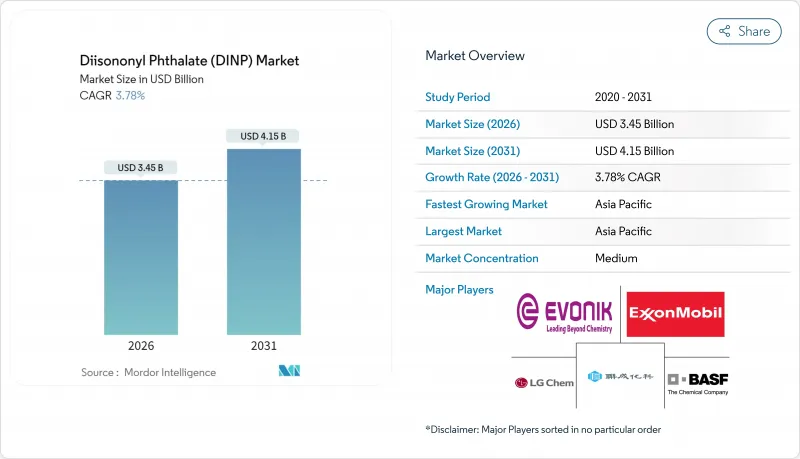

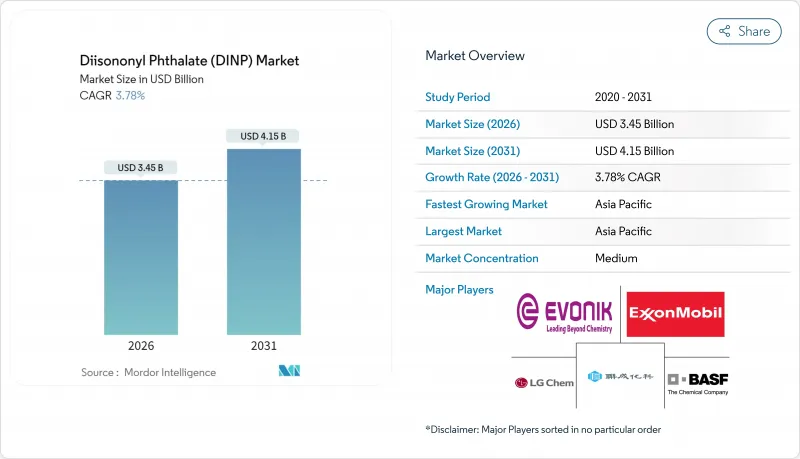

2025 年鄰苯二甲酸二異壬酯 (DINP) 市值為 33.2 億美元,預計到 2031 年將達到 41.5 億美元,高於 2026 年的 34.5 億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 3.78%。

主要消費地區日益嚴格的監管措施被穩定的基礎設施支出、對柔軟性PVC的強勁需求以及現有供應鏈的韌性所抵消。製造商正轉向更安全的應用部署和可追溯的原料以確保產量,而建築和電氣行業注重成本的買家則繼續看重DINP優異的成本績效。亞太地區保持著需求主導地位,其增速高於全球平均水平,這得益於大規模的石化投資,這些投資確保了樹脂的長期供應。在北美和歐洲,美國環保署(EPA)將於2025年1月發布的風險評估報告正促使企業加快永續產品的部署,並投資於以合規為導向的流程改善。

全球鄰苯二甲酸二異壬酯 (DINP) 市場趨勢及洞察

對柔軟性PVC的需求不斷成長

2025年,全球PVC消費量將以5.96%的複合年成長率成長,從而確保中期內鄰苯二甲酸二異壬酯(DINP)的穩定需求。 DINP在地板材料和電纜應用中長達5至30年的使用壽命,使其更換需求可預測。同時,再生PVC技術的進步(利用熱解衍生原料,可將二氧化碳排放減少50%)正促使生產商在不犧牲規模的前提下提供報廢解決方案。這些發展使得鄰苯二甲酸二異壬酯市場能夠在維持產量的同時,提升永續性能力。

建築和建設產業的擴張

建築需求的復甦推動了鄰苯二甲酸二異壬酯(DINP)在乙烯基(PVC)地板材料、壁材和屋頂防水卷材中的應用,這些材料需要具備柔軟性和耐候性。北美地區住宅維修活動的活性化和亞洲都市化的加快支撐了這一需求,而台塑和信達近期產能的擴張也有助於抑制PVC價格的上漲壓力。從柔軟性LVT(層壓乙烯基瓷磚)到剛性SPC(石塑複合材料)的轉變增加了加工的複雜性,促使生產商開發耐熱性更高的DINP產品。鄰苯二甲酸二異壬酯市場正受益於此專業化趨勢,但利潤率取決於能否在每平方英尺的價格上與低成本進口產品保持競爭力。

監理監督與健康風險評估

美國環保署 (EPA) 於 2025 年 1 月發布的一項風險評估得出結論:鄰苯二甲酸二異壬酯 (DINP) 在某些噴塗產品和消費地板材料中構成不合理的風險,因此觸發了強制性風險控制措施,這些措施可能會限制其某些用途。加州 65 號提案將其列入禁用物質清單,以及美國消費品安全委員會 (CPSC) 禁止將其用於玩具,進一步增加了限制。這些法規導致市場需求分散,迫使製造商更改配方,並增加了合規成本。鑑於歐盟持續的審查以及其他司法管轄區計劃實施類似 REACH 法規,監管風險仍然是鄰苯二甲酸二異壬酯市場參與企業的首要關注點。

細分市場分析

預計到2025年,聚氯乙烯樹脂(PVC)將佔總收入的86.62%,並在2031年之前以3.96%的複合年成長率成長。這一規模確保了對鄰苯二甲酸二異壬酯(DINP)原料的持續需求,使一體化生產商能夠利用現有資產保持成本優勢。新興的再生PVC樹脂有助於維持產量並確保未來的合規性,從而將鄰苯二甲酸二異壬酯(DINP)市場牢牢地建立在這一基材之上。

丙烯酸和聚氨酯的細分市場將佔據剩餘的收入。丙烯酸塗料利用DINP的溶解性來提高薄膜在惡劣天氣條件下的柔軟性,而一些聚氨酯泡棉製造商則選擇DINP來增強座椅的回彈壽命,從而提升舒適度。非異氰酸酯聚氨酯的研發存在未來被替代的風險,但預計在預測期內商業性應用將受到限制。

區域分析

預計到2025年,亞太地區將佔全球營收的58.83%,並在2031年之前以4.07%的複合年成長率成長。中國在全球PVC產量中佔比高達50%,這得益於BASF對一體化生產系統的100億歐元投資,也構成了該地區的供應基礎;而印度的建築業蓬勃發展則推動了新增需求。諸如中國對部分美國進口產品徵收43.5%的反傾銷稅等貿易措施,造成了暫時的價格扭曲,而本土DINP生產商正利用這些扭曲來保護其國內市場。

在北美,美國環保署 (EPA) 的風險評估促成了政策主導的轉變,加速了塗料生產商向更安全塗料的轉型,並促使他們儘早採用國際標準認證委員會 (ISCC) 認證的等級產品。受頁岩原料主導地位的推動,預計美國國內化工產業在 2023 年將保持低迷,並在 2024 年小幅成長 1.5%。在歐洲,REACH 法規和強制回收目標正在推動循環經濟的發展,同時對韓國產 DOTP 徵收的反傾銷稅也在重塑競爭格局。預計這將間接支撐對符合不斷發展標準的本地生產的 DINP 等級產品的需求。

南美洲和中東及非洲的基本客群小規模但成長迅速,這主要得益於產業多元化計劃和較低的監管阻力。然而,薄弱的回收系統和較低的回收率也帶來了未來可能受到干涉的風險,這與經合組織(OECD)的調查結果相呼應:2019年有2,200萬噸塑膠被排放到環境中。面向這些地區的生產商正優先研發價格合理的DINP配方,同時也為最終與經合組織標準接軌做準備。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對柔軟性PVC的需求不斷成長

- 建築和建設產業的擴張

- 對電線電纜絕緣材料的需求不斷成長

- 汽車生產和輕量化內部裝潢建材的恢復

- 可作為5G通訊電纜的絕緣材料

- 市場限制

- 監理監督與健康風險評估

- 加速向生物基/非鄰苯二甲酸酯塑化劑的過渡

- 溶劑型PVC回收技術的進步減少了原生DINP的使用。

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按聚合物類型

- PVC

- 丙烯酸纖維

- 聚氨酯

- 透過使用

- 地板材料和牆壁材料

- 塗層織物

- 消費品

- 薄膜和片材

- 電線電纜

- 其他用途

- 按最終用戶行業分類

- 建築/施工

- 電氣和電子設備

- 汽車/運輸設備

- 包裝和食品接觸材料

- 醫療和醫療設備

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Azelis Group NV

- BASF SE

- Evonik Industries AG

- Exxon Mobil Corporation

- GM Chemie Pvt Ltd

- Hanwha Solutions Chemical Division Corporation

- KLJ Group

- LG Chem Ltd

- Mitsubishi Chemical Group Corporation

- NAN YA PLASTICS CORPORATION

- Polynt SpA

- Shandong Qilu Plasticizers Co Ltd

- UPC Group

第7章 市場機會與未來展望

The Diisononyl Phthalate Market was valued at USD 3.32 billion in 2025 and estimated to grow from USD 3.45 billion in 2026 to reach USD 4.15 billion by 2031, at a CAGR of 3.78% during the forecast period (2026-2031).

Steady infrastructure spending, entrenched demand for flexible PVC, and the resilience of established supply chains offset rising regulatory scrutiny in key consuming regions. Manufacturers are pivoting toward safer application routes and traceable feedstocks to safeguard volume, while cost-focused buyers in construction and electrical sectors continue to value DINP's proven price-performance balance. Asia-Pacific maintains demand leadership and posts faster growth than the global average, helped by large-scale petrochemical investments that secure long-term resin availability. In North America and Europe, the January 2025 EPA risk evaluation forces companies to speed up sustainable product rollouts and invest in compliance-centric process upgrades.

Global Diisononyl Phthalate (DINP) Market Trends and Insights

Growing Demand for Flexible PVC

DINP remains indispensable because about 95% of global output plasticizes flexible PVC products that serve construction, automotive, and wire markets. Global PVC consumption is advancing at a 5.96% CAGR to 2025, ensuring a steady pull for DINP over the medium term. Long service lives of between 5 and 30 years in flooring and cable applications add predictable replacement demand. Parallel progress in circular PVC, where pyrolysis-sourced feedstocks cut CO2 emissions by 50%, pushes producers to demonstrate end-of-life solutions without sacrificing scale. Such developments allow the Diisononyl Phthalate market to preserve volume while improving sustainability credentials.

Expanding Building and Construction Industry

Construction rebound drives elevated use of vinyl flooring, wall cladding, and roofing membranes that require DINP for flexibility and weather resistance. Residential renovation levels in North America and ongoing urbanization in Asia sustain demand, even as recent capacity additions by Formosa and Shintech temper PVC pricing power. The shift from flexible LVT to rigid SPC formats increases processing complexity and encourages producers to refine DINP grades for higher heat stability. The Diisononyl Phthalate market benefits from this specialization, yet margins hinge on keeping cost-per-square-foot competitive with low-cost imports.

Regulatory Scrutiny and Health-Risk Assessments

The January 2025 EPA risk evaluation concluded that DINP presents unreasonable risks for certain spray-applied products and consumer floor coverings, triggering mandatory risk management that may limit specific uses. California's Proposition 65 listing and the CPSC ban in toys add further constraints. These rules fragment demand, force manufacturer reformulation, and increase compliance costs. Persistent oversight in the EU and forthcoming reach-style legislation in other jurisdictions keep regulatory risk at the forefront for participants in the Diisononyl Phthalate market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand in Electrical Wire and Cable Insulation

- Recovery in Automotive Production and Lightweight Interiors

- Accelerating Switch to Bio-/Non-Phthalate Plasticizers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PVC commanded 86.62% of revenue in 2025 and is forecast to grow at a 3.96% CAGR through 2031. This scale secures continuous feedstock offtake for DINP while integrated producers leverage existing assets for cost leadership. Emerging circular PVC resins help maintain volume and future-proof compliance, keeping the Diisononyl Phthalate market anchored in this substrate.

Acrylic and polyurethane niches together occupy the balance of revenue. Acrylic coatings exploit DINP's solvency to enhance film flexibility in demanding climatic conditions, whereas select polyurethane foam producers choose DINP to improve rebound life in seating. Non-isocyanate polyurethane R&D introduces future substitution risk, although commercial adoption remains limited through the forecast horizon.

The Diisononyl Phthalate (DINP) Market Report is Segmented by Polymer Type (PVC, Acrylic, and Polyurethane), Application (Floor and Wall Coverings, Coated Fabrics, and More), End-User Industry (Building and Construction, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 58.83% of 2025 revenue and is forecast to expand at a 4.07% CAGR to 2031. China's 50% global share in PVC output, supported by BASF's EUR 10 billion Verbund investment, anchors supply while India's construction boom pulls incremental tonnage. Trade actions, such as China's 43.5% anti-dumping duties on select U.S. imports, create episodic price distortions that local DINP producers exploit to defend home markets.

North America experiences policy-driven transitions following the EPA risk verdict, prompting formulators to shift toward safer coatings and to fast-track ISCC-certified grades. The domestic chemical sector ekes out a 1.5% gain in 2024 after a subdued 2023, aided by shale-advantaged feedstocks. Europe pushes circularity through REACH and mandatory recycling targets; anti-dumping duties on Korean DOTP also shape the competitive field, indirectly sustaining demand for locally made DINP grades that remain compliant with evolving standards.

South America, the Middle East, and Africa together provide a small but rising customer base driven by industrial diversification projects and limited regulatory friction. Weak collection systems and low recycling rates, however, risk future intervention, echoing the OECD finding that 22 million t of plastics leaked into the environment in 2019. Producers eyeing these regions emphasize affordable DINP formulations while preparing for eventual policy convergence with OECD norms.

- Azelis Group NV

- BASF SE

- Evonik Industries AG

- Exxon Mobil Corporation

- GM Chemie Pvt Ltd

- Hanwha Solutions Chemical Division Corporation

- KLJ Group

- LG Chem Ltd

- Mitsubishi Chemical Group Corporation

- NAN YA PLASTICS CORPORATION

- Polynt SpA

- Shandong Qilu Plasticizers Co Ltd

- UPC Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Flexible PVC

- 4.2.2 Expanding Building and Construction Industry

- 4.2.3 Rising Demand in Electrical Wire and Cable Insulation

- 4.2.4 Recovery in Automotive Production and Lightweight Interiors

- 4.2.5 Adoption in 5G Telecom Cable Insulation

- 4.3 Market Restraints

- 4.3.1 Regulatory Scrutiny and Health-Risk Assessments

- 4.3.2 Accelerating Switch to Bio-/Non-Phthalate Plasticizers

- 4.3.3 Emerging Solvent-Based PVC Recycling Cuts Virgin DINP Use

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Polymer Type

- 5.1.1 PVC

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.2 By Application

- 5.2.1 Floor and Wall Coverings

- 5.2.2 Coated Fabrics

- 5.2.3 Consumer Goods

- 5.2.4 Films and Sheets

- 5.2.5 Wires and Cables

- 5.2.6 Other Applications

- 5.3 By End-User Industry

- 5.3.1 Building and Construction

- 5.3.2 Electrical and Electronics

- 5.3.3 Automotive and Transportation

- 5.3.4 Packaging and Food Contact Materials

- 5.3.5 Healthcare and Medical Devices

- 5.3.6 Other End-Use Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Azelis Group NV

- 6.4.2 BASF SE

- 6.4.3 Evonik Industries AG

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 GM Chemie Pvt Ltd

- 6.4.6 Hanwha Solutions Chemical Division Corporation

- 6.4.7 KLJ Group

- 6.4.8 LG Chem Ltd

- 6.4.9 Mitsubishi Chemical Group Corporation

- 6.4.10 NAN YA PLASTICS CORPORATION

- 6.4.11 Polynt SpA

- 6.4.12 Shandong Qilu Plasticizers Co Ltd

- 6.4.13 UPC Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment