|

市場調查報告書

商品編碼

1906132

高嶺土:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Kaolin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

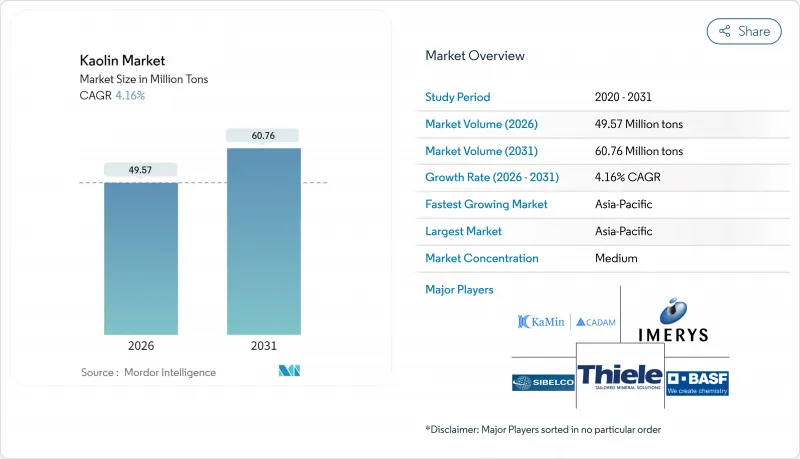

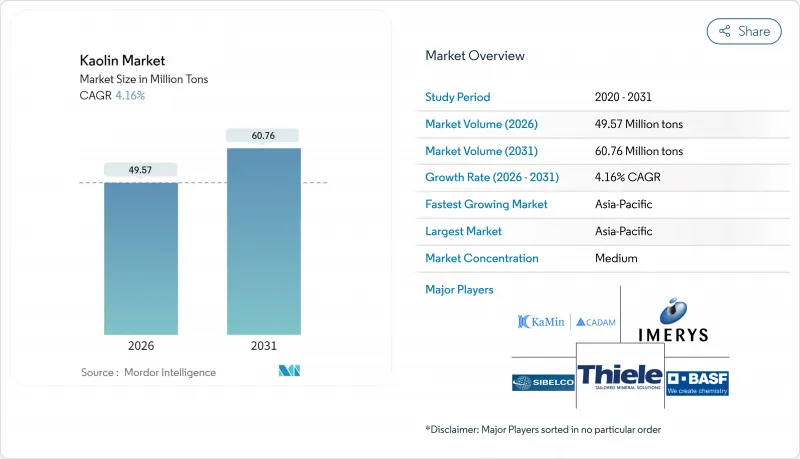

預計高嶺土市場將從 2025 年的 4,759 萬噸成長到 2026 年的 4,957 萬噸,預計到 2031 年將達到 6,076 萬噸,2026 年至 2031 年的複合年成長率為 4.16%。

需求正從傳統的陶瓷應用擴展到電池隔膜、特殊紙張和潔淨標示化妝品等領域,這些領域都重視高嶺土的潔白度、化學惰性和低導電性。亞太地區的產能擴張、北美和歐洲對優質包裝級高嶺土需求的成長,以及對電動車電池的煅燒產品的投資,都推動了這一積極的市場前景。擁有綜合採礦、高效煅燒和特定應用加工技術的生產商已簽訂了多年供應協議。儘管燃料價格上漲和成熟地區複雜的採礦許可程序帶來的短期成本壓力抑制了整體成長勢頭,但在大多數終端應用領域,高嶺土憑藉其明顯的性能優勢,正日益被替代。

全球高嶺土市場趨勢及展望

亞太地區衛浴設備和瓷磚製造業快速成長

受都市化和住宅升級的推動,中國、印度、越南和印尼的瓷磚和衛浴設備生產顯著成長。國內製造商正在擴大窯爐產能,以燒製大型瓷板,這需要高亮度高嶺土來達到一致的美學標準。區域製造商也優先發展本地供應鏈,以控制投入成本並縮短交貨時間,並與廣西、福建和古吉拉突邦的高嶺土礦山簽訂長期供應協議。現代隧道窯設計提高了燒製均勻性,同時對流變性能和熱穩定性的要求不斷提高,推動了高嶺土品種的優質化。政府支持的住宅開工和公共基礎設施建設進一步鞏固了陶瓷供應基礎,確保了高嶺土市場需求的持續穩定。

北美和歐洲轉向使用高亮度包裝紙

品牌擁有者正透過將未漂白牛皮紙外層與亮白色或粉彩色內襯搭配,來打造差異化的電商包裝,並提升開箱體驗。這種設計趨勢推動了超細高嶺土作為塗料顏料的消費量成長,以在不影響可回收性的前提下實現高遮蓋力。造紙廠正透過最佳化刮刀塗佈環節和升級分散系統來解決顆粒分佈更細的問題。產業整合,例如國際紙業收購DS Smith,標誌著包裝產業策略向高附加價值方向轉變,並加強了與特種高嶺土生產商的緊密供應關係。無法穩定獲得高亮度高嶺土的造紙廠將面臨產量比率下降和塗層缺陷的風險,這進一步凸顯了高嶺土在高檔紙板生產中的重要性。

烘焙過程能耗高、成本不斷上漲

煅燒過程需要650°C至1200°C的溫度,因此燃料成本是主要的成本促進因素。預計2024年至2025年歐洲天然氣價格將大幅上漲,這將使區域生產商的現金成本曲線出現兩位數的成長。閃式煅燒和旋轉式煅燒設計可將停留時間縮短高達30%,並回收顯熱,但每條生產線近1500萬美元的資本預算限制了其應用,只有大型綜合企業才能採用。 Calix公司已試行一種電力驅動的間接煅燒初步試驗,該工藝可將二氧化碳排放強度降低30%,但其商業規模應用能力仍在評估中。缺乏低成本燃料或製程創新的小型礦業公司面臨利潤率壓縮的風險,這可能會推動高嶺土市場的整合。

細分市場分析

到2025年,加工高嶺土將佔高嶺土市場的69.35%,鞏固了其在高階陶瓷、高光紙和工程聚合物領域的關鍵地位。選礦製程(篩分、磁選、浮選和化學漂白)可使高嶺土的白度達到ISO 90以上,並去除二氧化鈦和鐵等雜質。終端用戶願意為這些優異的性能支付更高的價格,這反映了其優於原土的性能標準。由於加工高嶺土在電池隔膜塗層和節能建築用絕緣砂漿中的應用日益廣泛,預計其市場規模將持續成長。

預計到2031年,原土市場將以4.72%的複合年成長率成長,這主要得益於亞洲陶瓷叢集將修整和研磨工序外包給當地的代工加工商。泰國和馬來西亞的生產商正在礦床附近建造簡易洗選廠,以降低物流成本。隨著區域加工商投資柱式浮選和高梯度磁選設備,部分原料供應預計將逐步轉向半成品和成品,從而推動高嶺土市場價值鏈向上游轉移。

本高嶺土市場報告按類型(原高嶺土/加工高嶺土)、等級(水合高嶺土、煅燒高嶺土、膨脹高嶺土及其他)、應用領域(陶瓷、水泥、造紙、耐火材料、油漆塗料、塑膠及其他)和地區(亞太地區、北美、歐洲、南美、中東和非洲)進行分析。市場預測以噸為單位。

區域分析

預計到2025年,亞太地區將佔全球高嶺土市場佔有率的42.55%,並在2031年之前以4.70%的複合年成長率成長。中國廣東和山東兩省的瓷磚產業走廊支撐著區域需求,而印度正在莫爾比和拉賈斯坦邦擴大其衛浴設備叢集。政府基礎設施項目和穩定的出口訂單維持了窯爐的運轉率,並有力地支撐了對水合高嶺土和煅燒高嶺土的需求。東南亞,特別是越南和印尼的產能擴張,正在深化區域內貿易,並鞏固亞洲的主導地位。

北美是一個成熟且技術先進的產業中心。 2025年,美國將開採711萬噸高嶺土,其中大部分來自喬治亞的白堊紀礦藏。對電池煅燒高嶺地工廠的投資生產國內超級工廠,這些工廠利用現有的鐵路和港口基礎設施,快速實現關鍵礦產資源的本地化供應。環境法規提高了基本營運成本,促使生產商安裝再生式熱氧化器和封閉回路型水循環系統,以維持其營運許可證。

在歐洲,捷克和英國擁有高品位礦床。排放交易體系下更嚴格的碳政策正加速低能耗加工方法的研發。生產商正在探索乾燥機的部分電氣化以及在燃燒器生產線中使用生質能燃料。特種應用(先進耐火材料、過濾介質、環保水泥)正在抵消傳統紙張需求放緩的影響。

以巴西為首的南美洲正崛起為重要的出口樞紐。政府對關鍵礦產開採的支持以及接近性大西洋航線的地理優勢,都促進了高嶺土在巴西國家礦業生產中的貢獻。巴伊亞州正在建造的世界最大活性黏土廠之一,將利用當地的高嶺土原料生產低碳水泥添加劑。對北美和歐洲具有競爭力的交付成本進一步鞏固了巴西的戰略地位。

中東和非洲地區持續成長,儘管規模較小。沙烏地阿拉伯的「2030願景」旨在向重工業多元化發展,南非計劃擴大其陶瓷磚產業,這些都是推動需求成長的關鍵因素。摩洛哥和埃及正在評估高嶺土資源,用於耐火材料,這表明未來上游開發具有潛力。由於國內選礦能力有限,高嶺土中間產品和成品仍需持續進口,從而維持了高嶺土市場的國際貿易流量。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞太地區衛浴設備和瓷磚製造業快速成長

- 北美和歐洲轉向使用高亮度包裝紙

- 煅燒高嶺土在鋰離子電池隔膜塗層中的快速應用

- 造紙和橡膠產業的需求不斷成長

- 化妝品和個人護理行業的成長

- 市場限制

- 烘焙過程能耗高、成本不斷上漲

- 歐洲和北美對礦場有嚴格的環境許可要求

- 以其他替代品替代

- 價值鏈分析

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按形式

- 生高嶺土

- 加工高嶺土

- 按年級

- 水合高嶺土

- 煅燒高嶺土

- 前往角質高嶺土

- 其他

- 透過使用

- 陶瓷

- 水泥

- 紙

- 耐火材料

- 油漆和塗料

- 塑膠

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- 20 Microns

- Active Minerals International LLC(JM Huber Corporation)

- Ashapura Group

- BASF SE

- Burgess Pigment Company

- EICL

- Gebruder Dorfner GmbH & Co.

- Imerys

- I-Minerals Inc.

- KaMin LLC./CADAM

- Kaolin AD

- Keramost as

- LASSELSBERGER Group GmbH

- LB MINERALS, Ltd.

- Quarzwerke GmbH

- Sibelco

- Thiele Kaolin Company

- Tokai Clay Industry Co., Ltd.

第7章 市場機會與未來展望

The Kaolin Market market is expected to grow from 47.59 Million tons in 2025 to 49.57 Million tons in 2026 and is forecast to reach 60.76 Million tons by 2031 at 4.16% CAGR over 2026-2031.

Demand is widening from traditional ceramics into battery separators, specialty papers, and clean-label cosmetics, all of which prize kaolin's brightness, chemical inertness, and low electrical conductivity. Capacity additions in Asia Pacific, a push for premium packaging grades in North America and Europe, and investments in calcined products for electric-vehicle batteries are reinforcing the positive outlook. Producers with integrated mining, energy-efficient calcination, and application-specific processing technologies are securing multi-year supply agreements. Short-term cost pressure from rising fuel prices and complex mine-site permitting in mature regions is tempering the overall growth trajectory, yet most end-use segments continue to substitute toward kaolin where it offers demonstrable performance advantages.

Global Kaolin Market Trends and Insights

Booming Sanitary-ware & Tile Manufacturing in Asia Pacific

Rising urbanization and residential upgrades are stimulating vast new tile and sanitary-ware output across China, India, Vietnam, and Indonesia. Domestic producers are scaling kilns capable of firing large-format porcelain panels that require high-whiteness kaolin to achieve consistent aesthetic standards. Regional manufacturers also favor local supply chains to limit input costs and shorten delivery cycles, spurring long-term offtake pacts with kaolin mines in Guangxi, Fujian, and Gujarat. Modern tunnel-kiln designs improve firing uniformity but raise specification thresholds for rheology and thermal stability, supporting the premiumization of kaolin grades. Governments encouraging housing starts and public infrastructure are further underpinning the ceramics pipeline, ensuring steady pull-through demand across the kaolin market.

Shift to High-Brightness Packaging Paper in North America & Europe

Brand owners are differentiating e-commerce parcels with unbleached kraft outers paired with bright white or pastel inner liners that elevate the unboxing experience. This design trend increases the consumption of ultra-fine kaolin as a coating pigment that delivers high opacity without impairing recyclability. Paper mills are debottlenecking blade-coater sections and upgrading dispersion systems to handle finer particle distributions. Consolidation activities-such as International Paper's agreement to acquire DS Smith-demonstrate a strategic pivot toward value-added packaging niches and reinforce tight supply relationships with specialty kaolin producers. Mills unable to source consistent high-brightness grades risk yield losses and coating defects, cementing kaolin's central role in premium board production.

High Energy Intensity & Cost Inflation in Calcination Operations

Calcination requires temperatures from 650 °C to 1 200 °C, making fuel costs a major input. European natural gas prices surged in 2024-2025, swelling cash-cost curves for regional producers by double digits. FlashCalx and RotaCalx firing designs cut residence time by up to 30% and recover sensible heat, yet capital budgets near USD 15 million per line limit adoption to integrated majors. Calix Limited has piloted electric-powered indirect calcination that reduces CO2 intensity by 30%, but commercial throughput remains under evaluation. Smaller miners without low-cost fuel or process innovation risk margin compression, encouraging consolidation within the kaolin market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Calcined Kaolin in Li-ion Battery Separator Coatings

- Growing Demand from Paper and Rubber Industries

- Stringent Mine-Site Environmental Permitting in Europe and North America

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Processed kaolin captured 69.35% of the kaolin market in 2025, underpinning its indispensability in premium ceramics, high-gloss papers, and engineered polymers. Beneficiation stages-screening, magnetic separation, flotation, and chemical bleaching-lift brightness above 90 ISO and pare down titania and iron impurities. End-users pay a premium for these attributes, reflecting the superior performance threshold relative to crude clay. The kaolin market size for processed grades is forecast to climb alongside deeper penetration in battery separator coatings and in thermal-insulation mortars used in energy-efficient construction.

Crude/unprocessed clay is projected to advance at 4.72% CAGR through 2031 thanks to ceramic clusters in Asia outsourcing trimming and micronizing to local toll processors. Producers in Thailand and Malaysia are co-locating rudimentary washing plants near deposits to control logistics costs. As regional processors invest in column flotation and high-gradient magnetic separators, a share of crude supply will progressively shift to semi-finished and finished material, reinforcing a gradual migration up the value chain within the kaolin market.

The Kaolin Market Report is Segmented by Form (Crude/Unprocessed Kaolin and Processed Kaolin), Grade (Hydrous Kaolin, Calcined Kaolin, Delaminated Kaolin, and Others), Application (Ceramics, Cement, Paper, Refractories, Paints and Coatings, Plastics, and Others) and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia Pacific commanded 42.55% of the kaolin market in 2025 and is on track for 4.70% CAGR through 2031. China anchors regional demand with its integrated tile corridors in Guangdong and Shandong, while India scales sanitary-ware clusters in Morbi and Rajasthan. Government infrastructure programs and steady export orders sustain kiln utilization rates, ensuring consistent pull for hydrous and calcined grades. Southeast Asian capacity additions, notably in Vietnam and Indonesia, deepen intra-regional trade and reinforce Asia's leading position.

North America constitutes a mature yet technologically advanced hub. The United States mined 7.11 million tons of kaolin in 2025, largely from Georgia's Cretaceous deposits. Investments in battery-grade calcined kaolin plants leverage existing rail and port infrastructure, targeting domestic gigafactories eager to localize critical mineral supply. Environmental regulations elevate baseline operating costs, prompting producers to adopt regenerative thermal oxidizers and closed-loop water circuits to safeguard operating permits.

Europe offers high-purity reserves in the Czech Republic and United Kingdom. Tightening carbon policy under the EU Emissions Trading System accelerates the search for low-energy processing methods. Producers explore partial electrification of dryers and the use of biomass in burner lines. Specialty applications-advanced refractories, filtration media, and green cement-offset headwinds from conventional paper demand.

South America, led by Brazil, is emerging as a pivotal export base. Government incentives for critical mineral extraction and proximity to Atlantic shipping lanes underpin kaolin's contribution to national mining output. The world's largest activated clay plant under construction in Bahia will tap local kaolin feedstock to produce low-carbon cement additives. Competitive delivered-cost positions into North America and Europe reinforce Brazil's strategic relevance.

The Middle East and Africa remain smaller but growing. Saudi Arabia's Vision 2030 heavy-industrial diversification and South Africa's ceramic tile ambitions underpin incremental demand. Morocco and Egypt evaluate kaolin resources for white cement and refractories, hinting at future upstream development. Limited domestic beneficiation drives imports of intermediate or finished grades, sustaining global trade flows within the kaolin market.

- 20 Microns

- Active Minerals International LLC (J.M. Huber Corporation)

- Ashapura Group

- BASF SE

- Burgess Pigment Company

- EICL

- Gebruder Dorfner GmbH & Co.

- Imerys

- I-Minerals Inc.

- KaMin LLC. / CADAM

- Kaolin AD

- Keramost a.s.

- LASSELSBERGER Group GmbH

- LB MINERALS, Ltd.

- Quarzwerke GmbH

- Sibelco

- Thiele Kaolin Company

- Tokai Clay Industry Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Booming Sanitary-ware and Tile Manufacturing in Asia Pacific

- 4.2.2 Shift to High-Brightness Packaging Paper in North America and Europe

- 4.2.3 Rapid Adoption of Calcined Kaolin in Li-ion Battery Separator Coatings

- 4.2.4 Growing Demand from Paper and Rubber Industries

- 4.2.5 Cosmetics and Personal Care Industry Growth

- 4.3 Market Restraints

- 4.3.1 High Energy Intensity and Cost Inflation in Calcination Operations

- 4.3.2 Stringent Mine-Site Environmental Permitting in Europe and North America

- 4.3.3 Replacement by Other Subsitutes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Form

- 5.1.1 Crude/Unprocessed Kaolin

- 5.1.2 Processed Kaolin

- 5.2 By Grade

- 5.2.1 Hydrous Kaolin

- 5.2.2 Calcined Kaolin

- 5.2.3 Delaminated Kaolin

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Ceramics

- 5.3.2 Cement

- 5.3.3 Paper

- 5.3.4 Refractories

- 5.3.5 Paints and Coatings

- 5.3.6 Plastics

- 5.3.7 Others

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 20 Microns

- 6.4.2 Active Minerals International LLC (J.M. Huber Corporation)

- 6.4.3 Ashapura Group

- 6.4.4 BASF SE

- 6.4.5 Burgess Pigment Company

- 6.4.6 EICL

- 6.4.7 Gebruder Dorfner GmbH & Co.

- 6.4.8 Imerys

- 6.4.9 I-Minerals Inc.

- 6.4.10 KaMin LLC. / CADAM

- 6.4.11 Kaolin AD

- 6.4.12 Keramost a.s.

- 6.4.13 LASSELSBERGER Group GmbH

- 6.4.14 LB MINERALS, Ltd.

- 6.4.15 Quarzwerke GmbH

- 6.4.16 Sibelco

- 6.4.17 Thiele Kaolin Company

- 6.4.18 Tokai Clay Industry Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Growing Demand for Sanitary Ceramics