|

市場調查報告書

商品編碼

1906131

聯氨:市佔率分析、產業趨勢與統計、成長預測(2026-2031)Hydrazine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

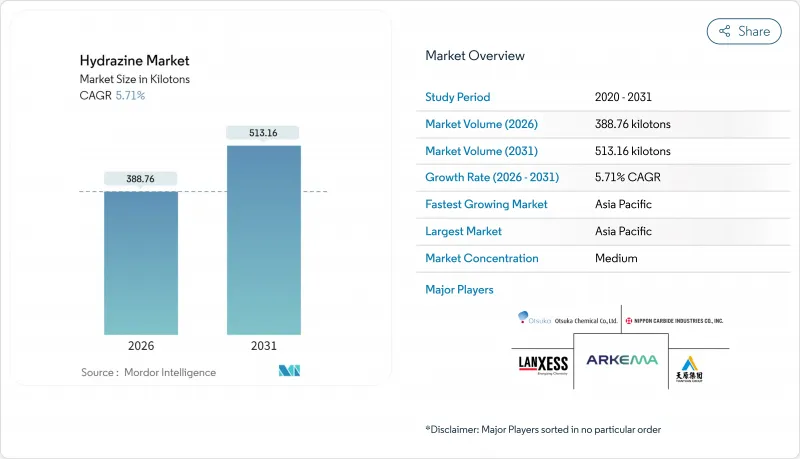

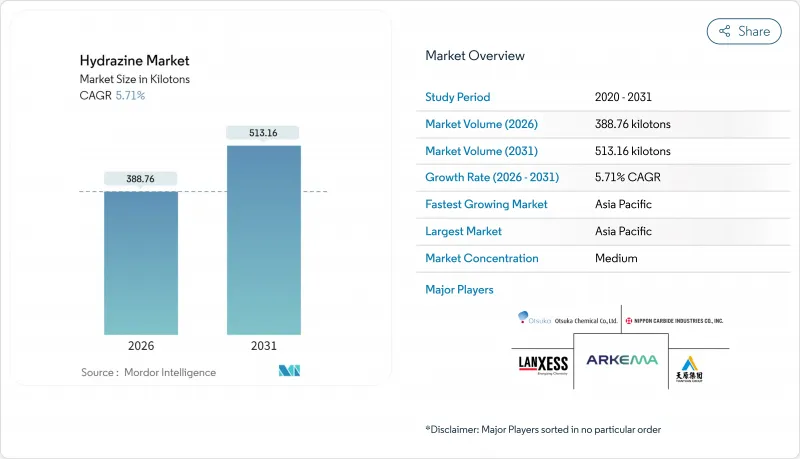

2025年聯氨市值為367.75千噸,預計從2026年的388.76千噸增加到2031年的513.16千噸。

預測期(2026-2031 年)的複合年成長率預計為 5.71%。

聯氨在殺蟲劑、防腐蝕、聚合物泡沫和新興能源系統中不可替代的作用,推動了其需求的韌性。歐洲和北美的監管審查持續加強,而亞太地區的產能擴張則抵消了其他地區潛在的產量下降。供應面的投資重點在於更安全的聯氨水合物生產流程,而下游的製藥和燃料電池技術用戶則正在開闢新的成長途徑。競爭優勢的關鍵在於垂直整合和長期契約,以確保原料供應並控制合規成本。

全球聯氨市場趨勢及展望

農業化學品產業需求不斷成長

中國、印度和巴西農業集約化程度的增加導致農藥消費量居高不下,而聯氨仍是馬來醯肼、異噁唑烷酮和其他植物生長調節劑活性成分的重要中間體。中國領先的生產商擁有超過20萬噸的專用產能,供應國內和出口通路,保障了製劑商的供應安全。奈米工程聯氨衍生物的研究表明,其有望以更低的劑量實現全面的害蟲防治,在維持藥效的同時減少對環境的影響。由於食品安全監管即時於環境法規,這些地區的聯氨市場依然保持穩定。

擴大其作為醫藥中間體的用途

聯氨骨架可用於選擇性合成抗結核、抗發炎和抗憂鬱劑藥物,近期製程創新已在溫和、溶劑高效的條件下實現了89-97%的產率。吡咯Hydrazone等臨床候選藥物在治療濃度下可抑制結核分枝桿菌,從而推動了美國和印度活性藥物原料藥(API)生產商的需求。為解決毒性問題,生產者正利用其特異性的親核性質,同時拓展間接合成路線,從而避免處理大量聯氨。因此,預計製藥業仍將是聯氨市場成長最快的用戶領域。

高毒性及更嚴格的監管

聯氨被列入歐洲化學品管理局的“高度關注物質清單”,並受到嚴格的授權要求和職業暴露限值限制。目前,合規要求包括封閉式輸送管線、洗滌器系統和持續空氣監測,這增加了德國、法國和美國配方商的營運成本。與肝毒性和致癌性相關的責任問題迫使保險公司提高保費,並阻礙了新進業者。雖然亞太地區的法規目前相對寬鬆,但隨著跨國客戶日益要求全球合規,全球範圍內正在逐步實施更高的安全標準。

細分市場分析

到2025年,聯氨將佔聯氨市場銷售量的60.17%,複合年成長率(CAGR)高達5.89%,位居該細分市場之頭。與無水肼相比,水合肼的蒸氣較低,ISO儲槽物流更便捷,且監理認證流程也較順暢,因此備受青睞。鍋爐水處理廠、聚合物發泡和原料藥合成廠正在建造專用的水合物儲存設施,以降低現場風險並提高需求穩定性。特種鹽,例如硫酸聯氨,則供應電子和分析應用等細分市場,這些領域對化學計量控制的要求更高。

監管機構目前明確建議盡可能使用水合物級產品,這促使供應商投資研發高純度、低金屬含量的配方,以滿足製藥業的合規要求。燃料電池開發商也傾向於使用一水合物作為液體載體原型,因為它兼具高功率密度和易揮發性控制,從而支持了需求的逐步成長。這些趨勢共同鞏固了聯氨的市場主導地位,使其免受即將訂定的無水肼監管規定的全面影響,並支撐了更廣泛的聯氨市場。

聯氨市場報告按類型(聯氨、硝酸聯氨、硫酸聯氨及其他)、應用(腐蝕抑制劑、炸藥、火箭燃料、醫藥原料等)、終端用戶產業(製藥、農業化學品等)和地區(亞太、北美、歐洲、南美、中東和非洲)進行細分。市場預測以噸為單位。

區域分析

預計亞太地區將引領聯氨市場,到2025年將佔據55.51%的市場佔有率,並預計在2031年之前以6.05%的複合年成長率實現最快成長。中國從氨原料到下游農業化學品的完整價值鏈具有成本優勢,而印度蓬勃發展的製藥業正在推動高純度水合肼的進口。儘管存在安全挑戰,但政府對特種化學品國內生產的激勵措施正在推動產能的進一步擴張。

北美市場成熟但仍在不斷發展。儘管監管合規推高了營運成本,但國防應用和防腐蝕合約支撐著聯氨的基本消費量。公司於2024年完成對Calca Solutions的私募股權收購,增強了投資者對其穩定的自由現金流以及下一代固體火箭引擎項目推動的未來需求成長的信心。

在REACH法規核准壓力日益增大的情況下,歐洲面臨最嚴峻的挑戰。一些中型製劑生產商正在縮減產能,或將原料轉移至土耳其和東歐的關聯公司,以避免核准延誤。整體而言,不同的管理體制造成了聯氨市場兩極化的局面:亞太地區加速發展,歐洲市場趨於整合,而北美則在風險管理和策略需求之間尋求平衡。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 農業化學品產業需求不斷成長

- 擴大其作為醫藥中間體的用途

- 擴大其作為聚合物泡沫膨鬆劑的用途

- 水處理基礎設施擴建

- 用於燃料電池系統的聯氨氫載體

- 市場限制

- 高毒性及更嚴格的監管

- 氨價格波動

- 太空領域向綠色單組元推進劑(HAN/H2O2)的過渡

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 聯氨

- 硝酸聯氨

- 硫酸聯氨

- 其他類型

- 透過使用

- 腐蝕抑制劑

- 霹靂

- 火箭燃料

- 醫藥原料

- 農藥前驅

- 發泡劑

- 其他用途

- 按最終用戶行業分類

- 製藥

- 殺蟲劑

- 產業

- 其他終端用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Acuro Organics Limited

- Arkema

- BroadPharm

- Calca Solutions(AE Industrial Partners)

- Gujarat Alkalies and Chemicals Limited

- HPL Additives Limited

- Lanxess

- Loba Chemie Pvt. Ltd.

- MERU CHEM PVT.LTD.

- Nippon Carbide Industries Co., Inc.

- Otsuka Chemical Co.,Ltd.

- Yibin Tianyuan Group

第7章 市場機會與未來展望

The Hydrazine Market was valued at 367.75 kilotons in 2025 and estimated to grow from 388.76 kilotons in 2026 to reach 513.16 kilotons by 2031, at a CAGR of 5.71% during the forecast period (2026-2031).

Demand resilience stems from hydrazine's irreplaceable role in agrochemicals, corrosion control, polymer foams, and emerging energy systems. Regulatory scrutiny in Europe and North America continues to tighten, yet capacity additions in Asia-Pacific offset potential volume losses elsewhere. Supply-side investments concentrate on safer production routes for hydrazine hydrate, while downstream users in pharmaceuticals and fuel-cell technology create fresh growth avenues. Competitive positioning focuses on vertical integration and long-term contracts to secure feedstock and manage compliance costs.

Global Hydrazine Market Trends and Insights

Rising Demand from Agrochemicals

Escalating agricultural intensification in China, India, and Brazil keeps pesticide consumption high, and hydrazine remains the indispensable intermediate for maleic hydrazide, isoxazolidinone, and other growth-regulator actives. Large Chinese producers report dedicated capacities above 200,000 tons that feed both domestic and export pipelines, supporting supply security for formulating companies. Research into nano-engineered hydrazine derivatives achieves full pest mortality at lower dosage, signaling potential for reduced environmental loading while preserving efficacy. Regulatory focus on food security in these regions outweighs immediate environmental bans, thus sustaining the hydrazine market.

Growing Use as Pharmaceutical Intermediate

Hydrazine scaffolds enable the selective synthesis of anti-tubercular, anti-inflammatory, and antidepressant molecules, and recent process innovations deliver 89-97% yields under mild, solvent-efficient conditions. Clinical candidates such as pyrrole hydrazones inhibit Mycobacterium tuberculosis at therapeutic concentrations, widening demand among active pharmaceutical ingredient (API) manufacturers in the United States and India. To tackle toxicity concerns, producers are scaling indirect routes that avoid bulk hydrazine handling, yet still leverage its unique nucleophilic profile. As a result, the pharmaceutical segment is expected to remain the fastest-growing user base within the hydrazine market.

Highly Toxic Nature and Tightening Regulations

Hydrazine features on the European Chemicals Agency's Substances of Very High Concern list, triggering strict authorization and occupational exposure limits. Compliance now demands sealed transfer lines, scrubber systems, and continuous air monitoring, pushing operating costs higher for formulators across Germany, France, and the United States. Liability linked to liver toxicity and carcinogenicity also forces insurers to raise premiums, discouraging new entrants. Although Asia-Pacific regulations are comparatively lenient today, multinational customers increasingly require global compliance, slowly extending higher safety standards worldwide.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption as Blowing Agent in Polymer Foams

- Expansion of Water-Treatment Infrastructure

- Shift Toward Green Monopropellants in Space

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydrazine hydrate accounted for 60.17% of 2025 volume within the hydrazine market and recorded the segment-leading 5.89% CAGR outlook. Preference for aqueous grades stems from lower vapor pressure, simplified ISO-tank logistics, and smoother regulatory certification versus anhydrous material. Boiler-water treatment, polymer foaming, and API synthesis plants install dedicated hydrate storage to reduce on-site risk profiles, reinforcing demand stability. Specialty salts such as hydrazine sulfate serve electronics and analytical niches where tighter stoichiometric control is essential.

Regulators now explicitly recommend hydrate grades when feasible, catalyzing supplier investments in high-purity, low-metal formulations engineered for pharmaceutical compliance. Fuel-cell developers also gravitate toward monohydrate for liquid-carrier prototypes that balance power density with managed volatility, sustaining incremental offtake. Collectively, these trends entrench hydrazine hydrate's leadership and shield the segment from the full force of impending restrictions on anhydrous forms, supporting the broader hydrazine market.

The Hydrazine Report is Segmented by Type (Hydrazine Hydrate, Hydrazine Nitrate, Hydrazine Sulfate, and Other Types), Application (Corrosion Inhibitor, Explosives, Rocket Fuel, Medicinal Ingredient, and More), End-User Industry (Pharmaceuticals, Agrochemicals, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominated the hydrazine market with a 55.51% hydrazine market share in 2025 and is forecast to post the fastest 6.05% CAGR through 2031. China's integrated value chain, from ammonia feedstock to downstream pesticides, confers cost leadership, while India's pharmaceutical build-out boosts high-purity hydrate imports. Government incentives for local specialty-chemical production stimulate further capacity additions despite safety headwinds.

North America remains a mature yet evolving arena. Regulatory compliance elevates operating costs, but defense applications and corrosion-control contracts sustain baseline hydrazine consumption. The 2024 private-equity acquisition of Calca Solutions underscores investor belief in steady free cash flow and future volume support from next-generation solid rocket motor programs.

Europe confronts the stiffest hurdles as REACH authorization pressures escalate. Several mid-tier formulators have trimmed capacity or shifted sourcing to affiliates in Turkey and Eastern Europe to circumvent licensing delays. Collectively, divergent regulatory regimes create a two-speed hydrazine market in which Asia-Pacific accelerates while Europe consolidates and North America balances between risk management and strategic necessity.

- Acuro Organics Limited

- Arkema

- BroadPharm

- Calca Solutions (AE Industrial Partners)

- Gujarat Alkalies and Chemicals Limited

- HPL Additives Limited

- Lanxess

- Loba Chemie Pvt. Ltd.

- MERU CHEM PVT.LTD.

- Nippon Carbide Industries Co., Inc.

- Otsuka Chemical Co.,Ltd.

- Yibin Tianyuan Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand from Agrochemicals

- 4.2.2 Growing Use as Pharmaceutical Intermediate

- 4.2.3 Increasing Adoption as Blowing Agent in Polymer Foams

- 4.2.4 Expansion of Water-Treatment Infrastructure

- 4.2.5 Hydrazine-Based Hydrogen Carrier for Fuel-Cell Systems

- 4.3 Market Restraints

- 4.3.1 Highly Toxic Nature and Tightening Regulations

- 4.3.2 Volatility in Ammonia Prices

- 4.3.3 Shift Toward Green Monopropellants (HAN/H2O2) in Space

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Hydrazine Hydrate

- 5.1.2 Hydrazine Nitrate

- 5.1.3 Hydrazine Sulfate

- 5.1.4 Other Types

- 5.2 By Application

- 5.2.1 Corrosion Inhibitor

- 5.2.2 Explosives

- 5.2.3 Rocket Fuel

- 5.2.4 Medicinal Ingredient

- 5.2.5 Precursor To Pesticides

- 5.2.6 Blowing Agent

- 5.2.7 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Pharmaceuticals

- 5.3.2 Agrochemicals

- 5.3.3 Industrial

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Acuro Organics Limited

- 6.4.2 Arkema

- 6.4.3 BroadPharm

- 6.4.4 Calca Solutions (AE Industrial Partners)

- 6.4.5 Gujarat Alkalies and Chemicals Limited

- 6.4.6 HPL Additives Limited

- 6.4.7 Lanxess

- 6.4.8 Loba Chemie Pvt. Ltd.

- 6.4.9 MERU CHEM PVT.LTD.

- 6.4.10 Nippon Carbide Industries Co., Inc.

- 6.4.11 Otsuka Chemical Co.,Ltd.

- 6.4.12 Yibin Tianyuan Group

7 Market Opportunities and Future Outlook

- 7.1 Hydrazine as hydrogen-rich liquid fuel for next-gen fuel cells

- 7.2 Bio-route production via anammox bacteria