|

市場調查報告書

商品編碼

1906115

梯子:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Ladder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

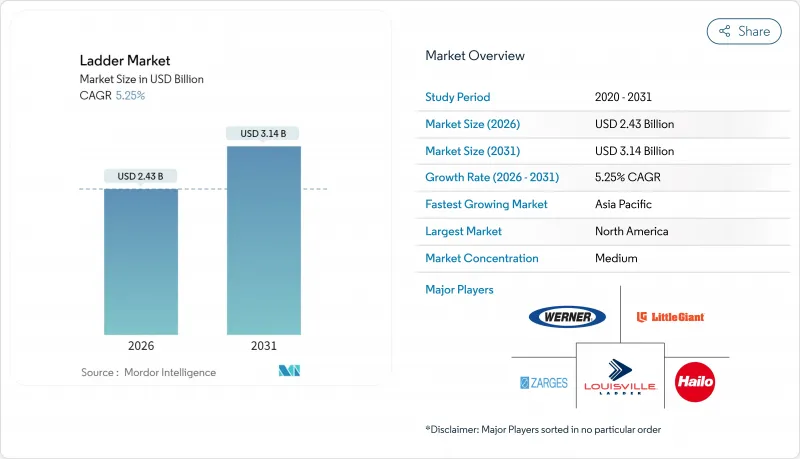

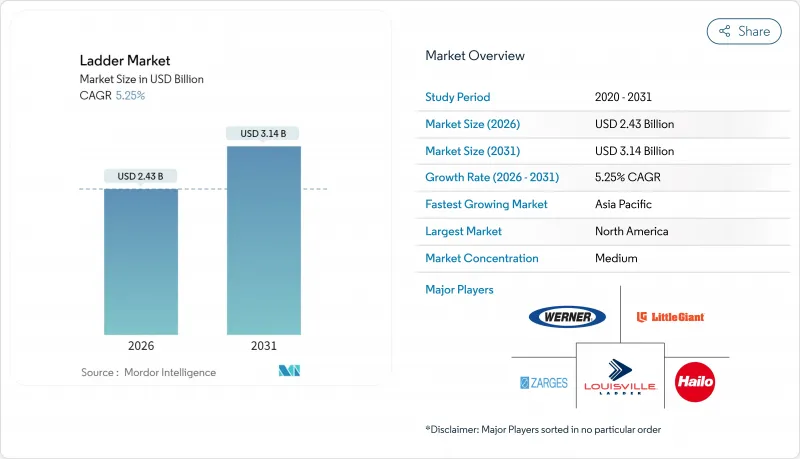

預計梯子市場規模將從 2025 年的 23.1 億美元成長到 2026 年的 24.3 億美元,到 2031 年將達到 31.4 億美元,2026 年至 2031 年的複合年成長率為 5.25%。

溫和成長反映出產品類型日趨成熟,並持續受益於住宅維修、美國基礎設施投資與就業法案帶來的基礎設施支出以及專業承包商不斷進行的設備更換。 ConstructConnect 預測,到 2025 年,美國建築總支出將成長 8.5%,這將支撐商業和公共場所對新型和替換梯子的需求。儘管鋁材因其強度重量比仍將佔據主導地位,但隨著公用事業公司採用非導電產品進行高壓維護,玻璃纖維產品將推動銷售成長。電子商務物流的擴張將促進倉庫營運商所需的緊湊型伸縮梯的銷售,而固定式通道系統的安全法規將推動用戶在 OSHA 2036 年合規期限之前提前購買替換產品。競爭依然適中,區域品牌憑藉其豐富的專業產品目錄和在地化的經銷網路,與大規模跨國公司競爭。

全球梯子市場趨勢與洞察

住宅維修與DIY文化的興起

美國住宅越來越重視重建。預計到2024年11月,住宅中位數將達到420,400美元,促使人們選擇維修房屋而非搬遷。千禧世代正值住宅高峰期,他們更傾向於自己計劃維修,這得益於網路教學和大型零售商提供的專業工具。社群媒體促進了點對點的技術共用,方便了室內粉刷、更換吊扇和購買閣樓梯等。遠距辦公和混合辦公模式的興起推動了家庭辦公室整修的需求,而折疊梯和多功能折疊梯正成為日常家用工具箱中的必備品。據經銷商稱,重量低於20磅的攜帶式梯子正在取代較重的梯子,因為消費者更注重便利性和儲存效率。即使住宅建設放緩,這也為梯子創造了穩定的需求基礎。

加強建築工地安全規章

美國職業安全與健康管理局 (OSHA) 修訂的「行走和工作表面規則」要求,超過 24 英尺(約 7.3 公尺)的新型固定梯必須配備防墜落系統,並呼籲在 2036 年前逐步淘汰籠式梯。承包商正在加快梯子更換計劃,以避免後期進行大規模維修,這推動了帶有整合電纜套管的無籠式垂直梯系統的銷售。歐洲 EN 131 標準針對專業和非專業梯子,根據性能等級和測試負荷進一步細分了梯子行業,促進了高階產品的普及。像 Turner Construction 這樣的大型建設公司正在實施「梯子是終點」的政策,要求使用可攜式梯子必須獲得書面授權,並將某些作業過渡到帶有護欄的平台梯。保險公司現在將工傷賠償保險費與梯子安全訓練記錄和設備劣化掛鉤,迫使雇主更快更換梯子。能夠使其產品通過 OSHA、ANSI 和 EN 標準的製造商,在企業發展享有競爭優勢。

原物料價格波動

預計2025年第二季度,倫敦金屬交易所鋁現貨價格將年增12%,反映出能源成本上漲正在擠壓冶煉廠的利潤空間。使用軋製成品捲材的梯子製造商通常受季度合約約束,因此現貨價格的突然上漲會立即導致毛利率下降。用於平台扶手和延伸支撐的鋼管也面臨類似的波動,因為地緣政治事件改變了全球貿易流向。新興市場的貨幣波動增加了依賴進口的組裝購買力的不確定性。雖然製造商會將部分成本轉嫁給經銷商,但價格過度上漲會抑制對價格敏感的住宅通路的需求。為了規避風險,跨國公司正在推動輕質結構聚合物的應用,但根據ANSI A14通訊協定對新材料進行認證可能需要18個月,這減緩了市場接受度。

細分市場分析

到2025年,梯子市場將佔最大佔有率,達到7.9億美元(佔全球收入的34.02%)。梯子因其四腳支撐的穩定性以及寬闊的踏板寬度,在油漆、裝飾和輕型作業等領域廣受歡迎。這種設計也非常適合採用玻璃纖維材質,既滿足了隔熱要求,又不影響便攜性。儘管梯子具有這些優勢,但由於緊湊型生活空間和移動辦公人員的增加,人們對可折疊工具的需求不斷成長,預計伸縮梯的年複合成長率將達到6.21%,因為折疊式工具便於存放於貨車或壁櫥中。

安全性的提升也推動了伸縮梯的成長。華納公司於2025年4月推出的新產品,配備了一鍵式回縮機構,可防止夾傷,並帶有可視鎖定指示器,用於確認正確展開,從而解決了此前困擾該類產品的EN 131-6合規性問題。承包商非常欣賞伸縮梯的延伸範圍,因為在最終現場檢查期間移動大型伸縮梯會浪費時間,從而增加成本。產品發展趨勢表明,雖然傳統的梯凳仍將在住宅市場佔有一席之地,但多功能、節省空間的型號將繼續擴大市場佔有率。採用專利梯凳和立柱連接件以及自鎖連接器的製造商能夠獲得更高的價格,並在專業用戶群中培養品牌忠誠度。

到2025年,鋁製梯子將佔據42.10%的市場佔有率,這得益於其優異的強度重量比,使其在住宅和商業建築中廣泛應用。鋁的耐腐蝕性和可回收性符合企業採購的永續性準則。同時,由於重量較重,玻璃纖維梯子預計將以6.78%的複合年成長率快速成長。這一成長主要受電力公司現場作業的推動,因為絕緣安全是電力產業的絕對要求。

在有電線路上作業的電力工人需要使用經認證可承受30kV電壓的非導電梯子。玻璃纖維增強聚合物(GFRP)層壓板不僅能提供這種保護,而且比塗漆鋁材具有更好的抗紫外線劣化性能。現場研究表明,用10英尺長的玻璃纖維梯子代替木製桿梯,可使作業車輛的有效載荷減少14%,從而滿足各州的軸重限制並降低燃油成本。同樣,在屋頂上旋轉5G天線的電信技術人員也指定使用玻璃纖維梯子,以避免高頻電弧的風險。供應鏈數據顯示,亞太地區玻璃纖維產品的訂單約佔材料成長的28%,顯示絕緣梯的規格正日益趨於全球標準化。

區域分析

北美將引領市場,預計到2025年將佔全球收入的31.85%,這主要得益於住宅維修需求的激增,以及在美國安全與健康管理局(OSHA)2036年監管截止日期前,人們提前用鋼索式防墜落系統替換固定籠式防墜落裝置。美國獨棟住宅的維修支出較去年同期成長3.5%,支撐了對鋁製梯子和玻璃纖維平台的需求。加拿大公共產業加快了網路加固計劃,指定使用28英尺長的絕緣伸縮梯,而墨西哥加工廠的擴張則推動了工業平台的訂單。預計2025年建設產業將成長8.5%,從而確保商業室內裝修和民用基礎設施建設所需的梯子供應穩定。

亞太地區是成長最快的地區,由於公共基礎設施項目的不斷擴張,預計到2031年將以5.62%的複合年成長率成長。印度計劃在2029會計年度之前投入1.45兆美元,將增加對可攜式高空作業設備的依賴,用於橋樑檢測和地鐵電氣化專案。在中國,儘管工地機械化程度不斷提高,但輕型高空作業解決方案仍然必不可少,因此對基本梯子的需求仍然強勁。高空作業平台的使用日益普及,此趨勢在相關工地也同樣適用。澳洲和日本的訂單量持續成長,這主要得益於港口現代化和老舊電力線路的更換以擴大產能。印尼等東南亞新興市場為中端品牌提供了機遇,這些品牌可以透過本地組裝來規避進口關稅。

歐洲擁有成熟且穩定的市場結構。德國和法國的維修項目優先考慮節能維修,這需要頻繁地進入閣樓和維修外牆,從而帶動了梯子的穩定銷售。 EN 131「專業級」標準要求梯子採用更粗的立柱和加固的橫檔,這也推高了梯子的平均售價。北歐國家正在整合環保標準,並為鋁含量超過70%可回收的梯子提供採購點。同時,中東和非洲地區在行業多元化規劃的推動下正經歷早期成長,但物流方面的挑戰阻礙了市場滲透。拉丁美洲的產品週期性改進正在推進,巴西不斷成長的農業產業帶動了用於糧倉維護的玻璃纖維梯子季節性進口量的成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 住宅維修與DIY文化的擴展

- 加強建築工地安全規章

- 擴大對新興經濟體的基礎建設投資

- 不斷擴大的電子商務倉儲網路

- 在高壓設備維護中引入玻璃纖維增強複合材料(GFRP)梯子

- 基於物聯網的租賃車隊使用情況分析

- 市場限制

- 原物料價格波動

- 與梯子相關的傷害促使人們需要替代方案

- 租賃模式蠶食了新銷售額

- 以無人機/移動式升降工作平台取代巡檢工作

- 產業價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察市場最新趨勢與創新

- 深入了解近期產業發展動態(新產品發布、策略性舉措、投資、合作、合資、擴張、併購等)

第5章 市場規模與成長預測

- 依產品類型

- 梯子

- 伸縮梯

- 平台梯

- 折疊式梯

- 伸縮梯

- 特殊/訂製梯子

- 材料

- 鋁

- 玻璃纖維

- 鋼

- 木頭

- 塑膠/複合材料

- 按最終用戶行業分類

- 住宅/DIY

- 建造

- 工業製造

- 公用事業和通訊

- 適用於商業和機構用途

- 運輸/物流

- 透過分銷管道

- 線下通路(家居建材商店、工業批發商)

- 線上(電子商務平台、直接面對消費者)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 秘魯

- 智利

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟

- 北歐國家

- 其他歐洲地區

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- WernerCo

- Louisville Ladder Inc.

- Little Giant Ladders(Wing Enterprises)

- Zarges GmbH

- Hailo Werk

- Altrex BV

- KRAUSE-Werk GmbH

- Youngman Group(Werner UK)

- Gorilla Ladders(Tricam)

- Tubesca-Comabi

- Telesteps AB

- Featherlite Ladders

- FACAL

- Hymer-Leichtmetallbau

- ABRU(Werner)

- Shanghai Ruiju Tools

- Zhejiang Yongkang Chuangxin

- Jinma Ladder

- Alinco Inc.

- Hermans

第7章 市場機會與未來展望

The Ladder market is expected to grow from USD 2.31 billion in 2025 to USD 2.43 billion in 2026 and is forecast to reach USD 3.14 billion by 2031 at 5.25% CAGR over 2026-2031.

Moderate growth reflects a maturing product category that continues to benefit from residential renovation, infrastructure outlays supported by the U.S. Infrastructure Investment and Jobs Act, and ongoing equipment renewal by professional trades. ConstructConnect projects 8.5% growth in total U.S. construction spending in 2025, a trend that underpins new and replacement ladder demand across commercial and institutional job sites. Aluminum remains the leading material owing to weight-to-strength advantages, while fiberglass leads unit growth as utilities adopt non-conductive products for high-voltage maintenance. E-commerce logistics expansion sustains sales of compact telescopic configurations sought by warehouse operators, and safety regulations on fixed access systems stimulate replacement purchases well before OSHA's 2036 compliance deadline. Competitive intensity stays moderate because regional brands counterbalance large multinationals through specialized catalog depth and localized distribution.

Global Ladder Market Trends and Insights

Rising Residential Renovation and DIY Culture

Homeowners in the United States prioritized remodeling as the median selling price reached USD 420,400 in November 2024, encouraging upgrades rather than relocations. Millennials entering peak ownership years prefer doing projects themselves, helped by online tutorials and wider access to pro-grade tools through big-box retailers. Social media visibility increases peer-to-peer skill sharing that boosts ladder purchases for interior painting, ceiling fan replacement, and attic access. Remote and hybrid work has heightened demand for home office conversions, pushing step ladders and multipurpose articulating designs into routine household toolkits. Distributors report that portable ladders under 20 lb are replacing heavier legacy units as consumers favor convenience and storage efficiency. The effect on the ladders market is a steady baseline of unit demand, even when new-build housing slows.

Heightened Safety Regulations in Construction

OSHA's revised Walking and Working Surfaces rule requires all new fixed ladders over 24 ft to include a fall-arrest system, phasing out cages by 2036. Contractors are accelerating replacement programs to avoid bulk retrofits later, spurring sales of cage-free vertical systems with integrated cable sleeves. European EN 131 Professional vs. Non-Professional classifications further segment the ladders industry by performance level and test loads, encouraging premium SKUs. Large builders such as Turner Construction enforce "ladders last" policies that mandate written permission for portable ladder use, shifting certain tasks to platform models with guardrails. Insurers now link workers' compensation premiums to documented ladder safety training and equipment age, nudging employers to refresh fleets sooner. Manufacturers able to certify products across OSHA, ANSI, and EN standards enjoy a competitive edge that aligns with global contractors' multi-region operations.

Volatility in Raw-Material Prices

London Metal Exchange aluminum cash prices climbed 12% year-over-year through Q2 2025, mirroring energy cost inflation that tightens smelter margins. Ladder producers consuming mill-finish coil are often locked into quarterly contracts, so spot surges translate to immediate gross-margin compression. Steel tube inputs used in platform railings and extension stiles face similar volatility as geopolitical events reshape global trade flows. Currency swings in emerging markets worsen purchasing-power unpredictability for import-reliant assemblers. Producers pass some costs to distributors, but excessive hikes dampen demand in price-sensitive residential channels. To hedge exposure, multinationals pursue lightweight structural polymers; however, certifying new materials under ANSI A14 protocols can take 18 months, slowing market uptake.

Other drivers and restraints analyzed in the detailed report include:

- Growing Infrastructure Spending in Emerging Economies

- Expansion of E-commerce Warehouse Networks

- Ladder-Related Injuries Prompting Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Step ladders generated the largest slice of the ladder market size at USD 0.79 billion in 2025, equal to 34.02% of global revenue. Their popularity in painting, decor, and light-duty trade tasks rests on inherent stability from four-leg contact and wide tread depth. The design also adapts easily to fiberglass construction, letting utilities meet dielectric requirements without sacrificing portability. Despite that dominance, telescopic ladders are on course for a 6.21% CAGR as compact living and mobile workforces seek collapsible tools that fit in vans or closets.

Safety upgrades underpin telescopic momentum. Werner's April 2025 launch introduced single-button retraction that prevents finger pinches, alongside visual lock indicators to certify proper extension. These features mitigate the EN 131-6 compliance gaps that previously tarnished the category. Contractors appreciate telescopic reach on job-site punch-lists where time penalties for moving bulky extension ladders add cost. Product evolution signals that multifunctional, space-saving formats will continue to gain share even as traditional step designs hold ground in household settings. Manufacturers leveraging patented rung-to-stile joints and automatic-locking couplers command premium pricing and foster brand loyalty across pro user communities.

Aluminum contributed 42.10% to the ladder market share in 2025, reflecting its optimal strength-to-weight ratio that supports widespread adoption across residential and commercial settings. Its corrosion resistance and recyclability align with sustainability guidelines in corporate procurement. Conversely, fiberglass, though heavier, is projected to log the fastest 6.78% CAGR, a pace attributed to electric utility field work where dielectric safety is non-negotiable.

Utility crews working on energized lines require non-conductive ladders certified to 30 kV ratings. Glass-fiber reinforced polymer (GFRP) laminates provide that protection while resisting UV degradation better than painted aluminum. Field studies show that replacing wood pole steps with 10 ft fiberglass variants cuts line-truck payload weight by 14%, letting fleets meet state axle limits and lower fuel costs. Telecommunications technicians rotating 5G antennas on rooftops similarly specify fiberglass to avoid RF arc hazards. Supply chain data indicates that fiberglass orders comprise almost 28% of material volume growth in Asia-Pacific, suggesting a global normalization of insulated ladder specifications.

The Ladder Market Report is Segmented by Product Type (Step Ladders, Extension Ladders, Platform Ladders, and More), Material (Aluminum, Fiberglass, Steel, and More, End-User Industry (Residential/DIY, Construction, Industrial Manufacturing, Utilities & Telecom, and More)), Distribution Channel (Offline, Online), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 31.85% of global revenue in 2025 after residential renovation surged and OSHA's forthcoming 2036 compliance deadline spurred early replacement of fixed cages with cable-based fall-arrest systems. U.S. single-family remodeling outlays rose 3.5% year-over-year, sustaining demand for aluminum stepladders and fiberglass podium units. Canadian utilities accelerated network-hardening programs that specify 28 ft insulated extensions, while Mexican maquiladora expansions drove industrial platform orders. Construction forecasts of 8.5% growth for 2025, cement expectations of steady ladder procurement across commercial interiors and civil infrastructure.

Asia-Pacific is the fastest-growing region, tracking a 5.62% CAGR to 2031 as public infrastructure pipelines ramp up. India's planned USD 1.45 trillion outlay through FY 2029 increases reliance on portable access equipment for bridge girder inspection and metro rail electrification. China's transition to mechanized job-site workflows keeps basic ladder demand resilient because finishing trades still require lightweight solutions for ceiling work, even where aerial lifts proliferate. Australia and Japan sustain orders by modernizing port facilities and replacing aging transmission lines with higher-capacity circuits. Southeast Asian growth markets such as Indonesia open opportunities for mid-tier brands that can localize assembly to avoid import duties.

Europe maintains a mature yet stable profile. Renovation stimulus programs in Germany and France prioritize energy-efficient retrofits that necessitate frequent attic access and facade repairs, translating to consistent ladder sales. EN 131's Professional category compels contractors to upgrade to thicker stiles and reinforced rungs, benefits that raise average selling prices. Nordic countries integrate environmental criteria, awarding procurement points for ladders with recyclable aluminum content above 70%. Meanwhile, the Middle East and Africa show early-stage growth tied to industrial diversification plans, though logistical hurdles constrain full market penetration. Latin American adoption follows commodity cycles, with Brazilian agribusiness expansions supporting seasonal spikes in fiberglass ladder imports for grain elevator maintenance.

- WernerCo

- Louisville Ladder Inc.

- Little Giant Ladders (Wing Enterprises)

- Zarges GmbH

- Hailo Werk

- Altrex B.V.

- KRAUSE-Werk GmbH

- Youngman Group (Werner UK)

- Gorilla Ladders (Tricam)

- Tubesca-Comabi

- Telesteps AB

- Featherlite Ladders

- FACAL

- Hymer-Leichtmetallbau

- ABRU (Werner)

- Shanghai Ruiju Tools

- Zhejiang Yongkang Chuangxin

- Jinma Ladder

- Alinco Inc.

- Hermans

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising residential renovation & DIY culture

- 4.2.2 Heightened safety regulations in construction

- 4.2.3 Growing infrastructure spending in emerging economies

- 4.2.4 Expansion of e-commerce warehouse networks

- 4.2.5 Adoption of GFRP ladders in high-voltage maintenance

- 4.2.6 IoT-enabled usage analytics in rental fleets

- 4.3 Market Restraints

- 4.3.1 Volatility in raw-material prices

- 4.3.2 Ladder-related injuries prompting alternatives

- 4.3.3 Rental model cannibalizing new sales

- 4.3.4 Drone/MEWP substitution for inspection tasks

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Step Ladders

- 5.1.2 Extension Ladders

- 5.1.3 Platform Ladders

- 5.1.4 Folding Ladders

- 5.1.5 Telescopic Ladders

- 5.1.6 Specialty/Custom Ladders

- 5.2 By Material

- 5.2.1 Aluminum

- 5.2.2 Fiberglass

- 5.2.3 Steel

- 5.2.4 Wood

- 5.2.5 Plastic/Composite

- 5.3 By End-User Industry

- 5.3.1 Residential / DIY

- 5.3.2 Construction

- 5.3.3 Industrial Manufacturing

- 5.3.4 Utilities & Telecom

- 5.3.5 Commercial & Institutional

- 5.3.6 Transportation & Logistics

- 5.4 By Distribution Channel

- 5.4.1 Offline (Home-Improvement Stores, Industrial Distributors)

- 5.4.2 Online (E-commerce Platforms, Direct-to-Consumer)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX

- 5.5.3.7 NORDICS

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South-East Asia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East & Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 WernerCo

- 6.4.2 Louisville Ladder Inc.

- 6.4.3 Little Giant Ladders (Wing Enterprises)

- 6.4.4 Zarges GmbH

- 6.4.5 Hailo Werk

- 6.4.6 Altrex B.V.

- 6.4.7 KRAUSE-Werk GmbH

- 6.4.8 Youngman Group (Werner UK)

- 6.4.9 Gorilla Ladders (Tricam)

- 6.4.10 Tubesca-Comabi

- 6.4.11 Telesteps AB

- 6.4.12 Featherlite Ladders

- 6.4.13 FACAL

- 6.4.14 Hymer-Leichtmetallbau

- 6.4.15 ABRU (Werner)

- 6.4.16 Shanghai Ruiju Tools

- 6.4.17 Zhejiang Yongkang Chuangxin

- 6.4.18 Jinma Ladder

- 6.4.19 Alinco Inc.

- 6.4.20 Hermans

7 Market Opportunities & Future Outlook

- 7.1 Multi-Functional and Space-Saving Ladder Solutions

- 7.2 Rising DIY Culture Boosting Household Ladder Demand

![階梯市場:趨勢、機會與競爭分析 [2024-2030]](/sample/img/cover/42/default_cover_5.png)