|

市場調查報告書

商品編碼

1906072

家用殺蟲劑(農藥):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Household Insecticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

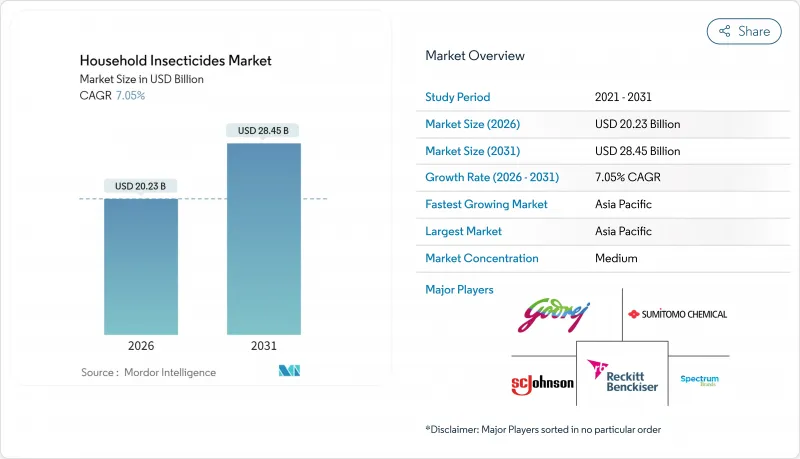

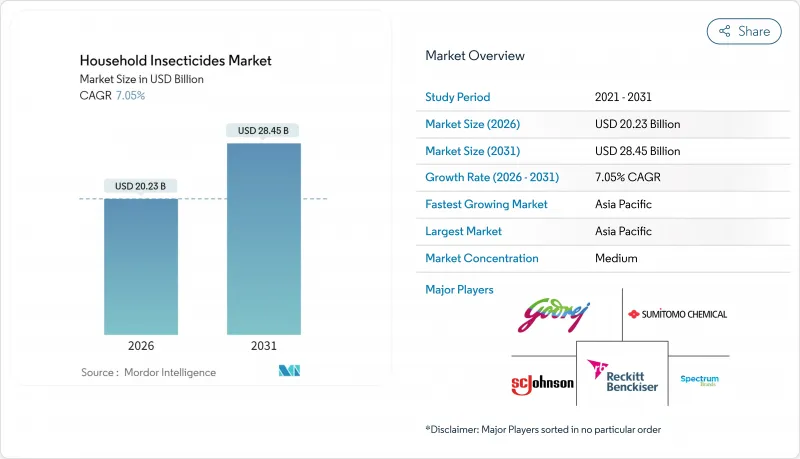

預計到 2026 年,家用殺蟲劑(農藥)市值將達到 202.3 億美元,高於 2025 年的 189 億美元,預計到 2031 年將達到 284.5 億美元。

預計從 2026 年到 2031 年,其複合年成長率將達到 7.05%。

媒介傳播疾病發生率上升、快速都市化以及監管機構對低毒活性成分的偏好,正在推動家用殺蟲劑(農藥)市場的擴張。登革熱病例激增,預計到2024年將達到1,240萬例,凸顯了公共衛生問題的迫切性,也推動了對蚊蠅控制解決方案的高階需求。監管機構正在加強對合成擬除蟲菊酯類殺蟲劑的審查,同時加快對生物基成分的核准,促使製造商加速開發天然衍生產品。亞太地區佔據家用殺蟲劑(農藥)市場40.0%的最大佔有率,主要歸因於人口密集的城市地區有利於媒介生物的滋生。該地區的企業正在推出專有分子以應對當地的抗藥性問題。同時,電子商務平台正在擴大其全球覆蓋範圍,並支援數據豐富的直接面對消費者的銷售模式,這有利於那些擁有強大數位互動能力的品牌。原料供應鏈的波動帶來了成本壓力,而高階戶外生活領域和智慧物聯網設備則開啟了新的收入來源。

全球家用殺蟲劑(農藥)市場趨勢及洞察

蟲媒疾病呈上升趨勢

由於登革熱、瘧疾和屈公病疫情的爆發遠超歷史水平,疾病預防已成為家用殺蟲劑(農藥)市場的主要購買促進因素。預計2023年至2024年間,全球登革熱發生率將激增230%,將促使消費者轉向價格分佈更高、藥效更持久的防護產品。氣候變遷正在延長蚊子的繁殖季節,並將埃及斑蚊的分佈範圍擴大到溫帶地區,從而在歐洲和北美創造了新的銷售機會。在登革熱疫情威脅經濟生產力的南美洲,各國政府正為弱勢族群提供噴霧劑和蚊香的補貼。隨著殺蟲劑從日常用品轉變為必需的健康防護用品,利用醫療建議和科學資訊進行訊息的品牌正在提高其在家庭中的滲透率。巴西創紀錄的登革熱疫情年份促使長效配方產品的研發,並強化了流行病學壓力與研發重點之間的關聯。

現代零售和電子商務通路的擴張

在家庭自給害蟲防治領域,數位平台正在超越傳統五金行。 2024年,亞馬遜在德國的害蟲防治產品銷售額達到13億美元,遠超專業零售商的銷售量。線上銷售提高了產品透明度,使新參與企業能夠憑藉豐富的產品資訊和評論與現有企業競爭。訂閱模式鎖定了補貨需求,提高了客戶終身價值,並平抑了家用殺蟲劑(農藥)市場的需求波動。從點選流和購買歷史中收集的數據指南精準的促銷活動,並最佳化了產品配方。這種通路轉變加速了跨國擴張,使品牌能夠繞過傳統批發商直接銷售。然而,複雜的標籤法規仍然要求進行本地化包裝。千禧世代和Z世代消費者是線上購物的主導,他們透過行動裝置購買驅蟲劑的頻率比年長消費者高出60%。

嚴格的國際和國內化學物質法規

主要供應商每年在REACH報名費用和測試方面的成本超過5000萬歐元(5400萬美元)。擬除蟲菊酯類農藥的重新評估導致部分產品上市延遲長達兩年。小型公司缺乏克服這些障礙所需的財力,這可能導致產業整合和創新多樣性降低。不同的國家法規迫使品牌維護多種配方,使得營運成本比統一管理體制下高出15-20%。預防原則加劇了不確定性,並增加了長期研發投資的風險。

細分市場分析

至2025年,蚊蠅防治產品將佔家用殺蟲劑(農藥)市佔率的33.62%。這主要受登革熱和瘧疾日益成長的擔憂所驅動,促使人們更多地使用長效噴霧劑和蚊香。隨著氣候變遷導致地方性流行病區域擴大,預計這些病媒控制產品將繼續保持主導地位。 Godrej公司推出的直接針對擬除蟲菊酯類抗性蚊子的氟氯菊酯產品,顯示病媒威脅如何引導研發重點。隨著旅遊需求的復甦加速了都市區蟲害的蔓延,預計臭蟲和甲蟲控制將以9.41%的複合年成長率成長,成為成長最快的市場。人口密集城市的房東正在購買殘留氣霧劑以防止租戶流失。白蟻防治在熱帶地區仍然具有重要意義,因為與防止財產損失相關的溢價仍然存在。雖然滅鼠工作一直保持穩定,但在高層建築群中,由於食物廢棄物收集滯後,滅鼠需求不斷增加,因此引入了混合誘餌和陷阱系統。

消費者的支出模式揭示了一種優先考慮健康而非財產保護的優先順序。即使有效成分成本相近,病媒控制產品也願意收取10-15%的溢價。行銷越來越強調疾病統計數據和緊迫性。隨著旅遊需求的復甦,便於攜帶的床蝨噴霧劑和洗衣添加劑開始進入大型量販店。高層公寓大樓的公用設施走廊是蟑螂和螞蟻的遷徙通道,這推動了對殘留殺蟲劑和智慧監測陷阱的需求,這些設備可以在蟲害蔓延至整棟大樓之前提醒管理人員。

區域分析

預計到2025年,亞太地區將佔全球家用殺蟲劑(農藥)市場的39.58%,年複合成長率達7.12%,主要得益於特大城市的擴張、疾病負擔沉重以及全年溫暖的氣候。印度在銷售方面領先全球市場,其中Godrej公司在本土活性成分的研發和利用普通零售通路建立廣泛的分銷網路方面主導。中國不斷壯大的中產階級正在增加對高階天然蚊香和智慧型設備的支出。同時,日本Earth公司憑藉其專利蟑螂餌劑持續維持市場主導地位,預計2024年銷售額將達到1,390億日圓(約9.3億美元)(EARTH.JP)。東南亞預計將成為成長最快的地區,這主要得益於政府開展的登革熱防控宣傳活動,該活動對氣霧劑的購買提供補貼。

在美國,日益嚴格的化學品監管導致天然系產品蠶食了合成產品的市場佔有率,而避蚊胺(DEET)在露營和健行領域仍然佔據著穩固的地位。加拿大嚴格的標籤法規減緩了新產品推出,但也增強了消費者對授權品牌的信任。由於登革熱疫情北移以及零售基礎設施的現代化,墨西哥已成為高成長地區。該地區電子商務滲透率超過40%,直接面對消費者的訂閱模式已成為都市區家庭的常態。

在歐洲市場,遵守REACH法規的負擔以及溫帶地區害蟲活動季節的縮短限制了其市場擴張。在南歐,從西班牙到希臘,夏季延長推動了人均使用量的增加。在德國,家居建材連鎖店和線上平台是銷量的主要主導,而英國市場在一系列關於氣喘風險的報導之後,正迅速轉向對寵物安全的無菸噴霧劑。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章:全球家用殺蟲劑(農藥)市場概況

第2章 引言

- 研究假設和市場定義

- 調查範圍

第3章調查方法

第4章執行摘要

第5章 市場情勢

- 市場概覽

- 市場促進因素

- 蟲媒疾病呈上升趨勢

- 現代零售和電子商務通路的擴張

- 快速的都市化和人口密度增加

- 監管政策轉向低毒性生物基活性成分

- 智慧/物聯網害蟲防治設備的出現

- 戶外生活趨勢推動了對庭院和花園解決方案的需求。

- 市場限制

- 嚴格的國際和國內化學品法規

- 健康和環境毒性問題

- 關稅導致原料供應鏈波動

- 昆蟲抗藥性增強,降低產品效力

- 技術展望

- 監管環境

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第6章 市場規模與成長預測

- 按昆蟲類型

- 蚊子和蒼蠅

- 老鼠和其他囓齒動物

- 白蟻

- 臭蟲和甲蟲

- 其他昆蟲類型

- 依化學類型

- 合成

- DEET

- 派卡瑞丁

- 其他合成化學品

- 自然的

- 香茅油

- 香葉醇油

- 其他天然油脂

- 合成

- 按形式

- 粉末和顆粒

- 液體

- 氣霧劑

- 線圈和霧化器

- 乳霜和乳液

- 其他形式

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 亞太其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 北美洲

第7章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- SC Johnson & Son, Inc.

- Reckitt Benckiser Group plc

- Godrej Consumer Products Ltd.

- Spectrum Brands Holdings, Inc.

- Sumitomo Chemical Co., Ltd.

- Henkel AG & Co. KGaA(Combat)

- Bayer AG

- BASF SE

- FMC Corporation

- Central Garden & Pet Company

- Rentokil Initial plc

- Rollins, Inc.

- Ecolab Inc.

- UPL Limited

- Dabur India Limited

第8章:市場機會與未來展望

The household insecticides market size in 2026 is estimated at USD 20.23 billion, growing from 2025 value of USD 18.9 billion with 2031 projections showing USD 28.45 billion, growing at 7.05% CAGR over 2026-2031.

Intensifying vector-borne disease outbreaks, rapid urbanization, and regulatory incentives for low-toxicity actives drive this expansion within the household insecticides market. Escalating dengue fever cases, which rose to 12.4 million in 2024, underscore the public health urgency that fuels premium demand for mosquito and fly control solutions. Regulatory agencies are expediting approvals for bio-based ingredients while tightening scrutiny on synthetic pyrethroids, prompting manufacturers to accelerate natural portfolio development. Asia-Pacific holds the largest household insecticides market share at 40.0% due to dense cities that favor vector breeding, and the region's players are debuting indigenous molecules to counter local resistance patterns. Meanwhile, e-commerce platforms widen global reach and enable data-rich, direct-to-consumer models that reward brands with strong digital engagement. Supply chain volatility in raw materials adds cost pressure, but premium outdoor living segments and smart IoT-enabled devices open new revenue pathways.

Global Household Insecticides Market Trends and Insights

Rising Prevalence of Insect-Borne Diseases

Dengue, malaria, and chikungunya outbreaks are surging far beyond historical baselines, making disease prevention the primary purchase trigger in the household insecticides market. Global dengue incidence jumped 230% from 2023 to 2024, propelling consumers toward continuous protection products that command premium price points. Climate change lengthens mosquito breeding seasons and expands Aedes aegypti into temperate zones, which opens new sales pockets in Europe and North America. Governments subsidize spray and coil purchases for vulnerable communities, especially in South America, where the dengue burden threatens economic productivity. Brands leveraging medical endorsements and scientific messaging enjoy stronger household penetration, as insecticides shift from convenience goods to essential health safeguards. Brazil's record dengue year drove innovation in long-lasting formulations, reinforcing the link between epidemiological pressure and research and development focus.

Expansion of Modern Retail and E-commerce Channels

Digital platforms now outpace traditional hardware stores for do-it-yourself pest control. Amazon alone moved USD 1.3 billion of pest control products in Germany during 2024, dwarfing specialty retail volumes. Online availability elevates product transparency, letting challengers compete with incumbents through content-rich listings and review engines. Subscription models lock in replenishment, increasing customer lifetime value and smoothing demand seasonality in the household insecticides market. Data captured from clickstream and purchase histories guides targeted promotions and informs formulation tweaks. The channel shift accelerates cross-border expansion because brands bypass legacy wholesalers, although complex labeling laws still require localized packaging. Millennial and Gen Z shoppers lead the online cohort, purchasing insect repellents 60% more often via mobile than older consumers.

Stringent Global and National Chemical Regulations

REACH registration fees and testing costs now exceed EUR 50 million (USD 54 million) annually for leading suppliers. Pyrethroid re-evaluations delay launches by up to two years. Smaller firms lack the capital to clear such hurdles, leading to potential consolidation and reduced innovation diversity. Divergent national rules force brands to maintain multiple formulations, pushing operational costs 15-20% higher than under harmonized regimes. The precautionary principle fuels uncertainty, making long-horizon research and development investments riskier.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Urbanization and Population Density Growth

- Regulatory Shift Toward Low-Toxicity Bio-based Actives

- Health and Environmental Toxicity Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mosquitoes and flies controlled 33.62% of the household insecticides market share in 2025, propelled by dengue and malaria fears and boosted by continuous spray and coil adoption. The household insecticides market size attributable to these vectors will maintain leadership as climate change widens endemic zones. Godrej's renofluthrin launch directly tackles pyrethroid-resistant mosquitoes and underscores how vector pressure guides research and development focus. Bedbugs and beetles climb fastest at 9.41% CAGR because resurgent travel accelerates urban infestations; landlords in dense cities purchase residual aerosols to avert tenant turnover. Termite treatments remain regionally important in the tropics, sustaining premium pricing tied to property damage prevention. Rodent control plateaus but gains incremental volume in high-rise complexes where food waste collection lags, prompting hybrid bait and snap systems.

Consumer spending patterns reveal a hierarchy that favors health protection over property preservation. Vector control products tolerate 10-15% price premiums even when active ingredient costs are similar. Marketing increasingly highlights disease statistics to reinforce urgency. As travel rebounds, luggage-compatible bedbug sprays and laundry additives enter big box chains. Utility corridors in apartment towers serve as superhighways for cockroaches and ants, elevating demand for residual formulations and smart monitoring traps that alert maintenance staff before infestations spread building-wide.

The Household Insecticides Market Report is Segmented by Insect Type (Termites, Bedbugs and Beetles, and More), Chemical Type (Synthetic and Natural), Form (Dust and Granules, Liquids, Aerosol Sprays, Creams and Lotions, and More), and Geography (North America, Europe, Asia-Pacific, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded a 39.58% share of the household insecticides market size in 2025 and is projected to rise at a 7.12% CAGR driven by megacity sprawl, high disease burden, and year-round warmth. India leads volume as Godrej pioneers indigenous actives and leverages vast distribution across general trade outlets. China's expanding middle class channels spending into premium natural coils and smart devices, while Japan's Earth Corporation sustains dominance through patented cockroach baits and recorded sales of JPY 139 billion (USD 930 million) in 2024 EARTH.JP. Southeast Asia shows the fastest incremental growth owing to government dengue campaigns that subsidize aerosol purchases.

The United States sees naturals encroaching on synthetic market share amid heightened chemical scrutiny, yet DEET remains entrenched for camping and hiking. Canada's stricter labeling laws slow new product launches but reinforce consumer trust in approved brands. Mexico emerges as a high-growth pocket as dengue spreads northward and retail infrastructure modernizes. Regional e-commerce penetration above 40% makes direct-to-consumer subscriptions the norm for urban households.

REACH compliance burdens and shorter pest seasons in temperate zones restrain Europe's market expansion. Southern Europe, from Spain to Greece, exhibits higher per-capita usage due to extended summers. Germany leads unit sales through DIY chains and online platforms, whereas the United Kingdom market pivots heavily toward pet-safe fume-free sprays following high press coverage of asthma concerns.

- SC Johnson & Son, Inc.

- Reckitt Benckiser Group plc

- Godrej Consumer Products Ltd.

- Spectrum Brands Holdings, Inc.

- Sumitomo Chemical Co., Ltd.

- Henkel AG & Co. KGaA (Combat)

- Bayer AG

- BASF SE

- FMC Corporation

- Central Garden & Pet Company

- Rentokil Initial plc

- Rollins, Inc.

- Ecolab Inc.

- UPL Limited

- Dabur India Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Table of Contents for Global Household Insecticides Market

2 Introduction

- 2.1 Study Assumptions and Market Definition

- 2.2 Scope of the Study

3 Research Methodology

4 Executive Summary

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Rising prevalence of insect-borne diseases

- 5.2.2 Expansion of modern retail and e-commerce channels

- 5.2.3 Rapid urbanization and population density growth

- 5.2.4 Regulatory shift toward low-toxicity bio-based actives

- 5.2.5 Emergence of smart/IoT-enabled insect-control devices

- 5.2.6 Outdoor living trend boosting demand for patio/yard solutions

- 5.3 Market Restraints

- 5.3.1 Stringent global and national chemical regulations

- 5.3.2 Health and environmental toxicity concerns

- 5.3.3 Tariff-driven volatility in raw-material supply chains

- 5.3.4 Rising pest resistance reducing product efficacy

- 5.4 Technological Outlook

- 5.5 Regulatory Landscape

- 5.6 Porter's Five Forces Analysis

- 5.6.1 Bargaining Power of Suppliers

- 5.6.2 Bargaining Power of Buyers

- 5.6.3 Threat of New Entrants

- 5.6.4 Threat of Substitute Products

- 5.6.5 Intensity of Competitive Rivalry

6 Market Size and Growth Forecasts

- 6.1 By Insect Type (Value)

- 6.1.1 Mosquitoes and Flies

- 6.1.2 Rats and Other Rodents

- 6.1.3 Termites

- 6.1.4 Bedbugs and Beetles

- 6.1.5 Other Insect Types

- 6.2 By Chemical Type (Value)

- 6.2.1 Synthetic

- 6.2.1.1 DEET

- 6.2.1.2 Picaridin

- 6.2.1.3 Other Synthetic Chemicals

- 6.2.2 Natural

- 6.2.2.1 Citronella Oil

- 6.2.2.2 Geraniol Oil

- 6.2.2.3 Other Natural Oils

- 6.2.1 Synthetic

- 6.3 By Form (Value)

- 6.3.1 Dust and Granules

- 6.3.2 Liquids

- 6.3.3 Aerosol Sprays

- 6.3.4 Coils and Vaporizers

- 6.3.5 Creams and Lotions

- 6.3.6 Other Forms

- 6.4 By Geography (Value)

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.1.3 Mexico

- 6.4.1.4 Rest of North America

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Russia

- 6.4.2.7 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 Singapore

- 6.4.3.6 Rest of Asia-Pacific

- 6.4.4 Middle East

- 6.4.4.1 Saudi Arabia

- 6.4.4.2 United Arab Emirates

- 6.4.4.3 Rest of Middle East

- 6.4.5 Africa

- 6.4.5.1 South Africa

- 6.4.5.2 Egypt

- 6.4.5.3 Rest of Africa

- 6.4.1 North America

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 7.4.1 SC Johnson & Son, Inc.

- 7.4.2 Reckitt Benckiser Group plc

- 7.4.3 Godrej Consumer Products Ltd.

- 7.4.4 Spectrum Brands Holdings, Inc.

- 7.4.5 Sumitomo Chemical Co., Ltd.

- 7.4.6 Henkel AG & Co. KGaA (Combat)

- 7.4.7 Bayer AG

- 7.4.8 BASF SE

- 7.4.9 FMC Corporation

- 7.4.10 Central Garden & Pet Company

- 7.4.11 Rentokil Initial plc

- 7.4.12 Rollins, Inc.

- 7.4.13 Ecolab Inc.

- 7.4.14 UPL Limited

- 7.4.15 Dabur India Limited