|

市場調查報告書

商品編碼

1906054

工業空氣壓縮機:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Industrial Air Compressors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

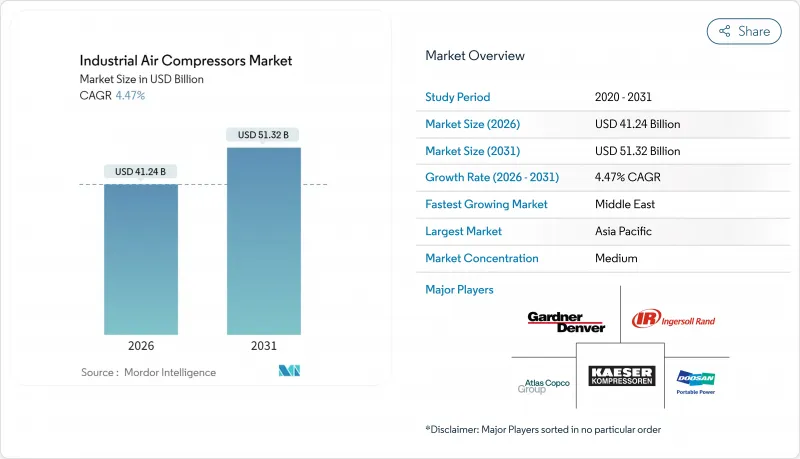

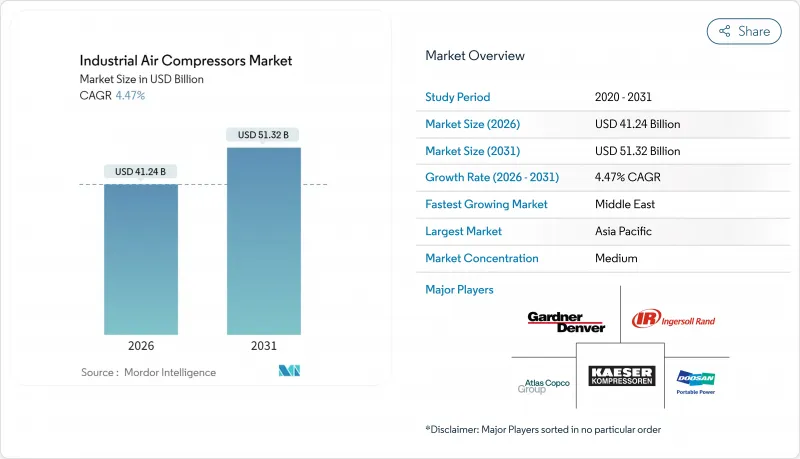

預計到 2026 年,工業空氣壓縮機市場規模將達到 412.4 億美元,高於 2025 年的 394.8 億美元。

預計到 2031 年將達到 513.2 億美元,2026 年至 2031 年的複合年成長率為 4.47%。

對節能生產線的投資不斷增加、液化天然氣基礎設施的快速擴張以及日益嚴格的污染標準,正在改變主要終端用戶產業的消費偏好。隨著工廠營運商在排放法規和整體擁有成本目標之間尋求平衡,變速技術、無油架構和物聯網監控平台正日益受到青睞。從區域來看,亞太地區發展勢頭最為強勁,而中東地區則憑藉大型天然氣計劃實現了最快成長。同時,歐洲原料價格波動和更嚴格的噪音法規正在擠壓利潤空間並延長投資回收期,促使設計改變,以減少鋼材用量並提高聲學性能。工業空氣壓縮機市場透過產品創新與脫碳政策和產業結構轉型相契合,持續展現強大的韌性。

全球工業空氣壓縮機市場趨勢與洞察

亞洲節能製造設施的擴建

半導體產業的蓬勃發展推動台灣固定資產投資在2024年第四季成長了69%。電子工廠正採用0級無油系統以防止污染。可降低高達35%能耗的變頻驅動裝置已成為新生產線的標準配備。跨國公司也積極拓展中國和印度的機器人和積層製造業務,以支撐工業空氣壓縮機市場的長期需求。

食品和飲料加工行業對無油壓縮機的需求不斷成長

ISO 8573-1 0級標準已從最佳實踐轉變為許多地區的監管要求,促使加工商轉向無油螺桿式和渦捲式壓縮機。日立環球空氣動力公司推出的DS280-450 kW壓縮機滿足了市場對高功率無油壓縮機的需求。維護成本的降低和潤滑油處理的減少抵消了較高的初始成本,推動了其在已開發市場的普及。

鋼材價格波動推高壓縮機零件成本結構

鋼材成本佔壓縮機生產成本的50%之多,導致價格飆漲時OEM廠商的利潤率出現波動。由於能源成本反映在鋼材採購價格中,歐洲製造商在2024年多次調整了產品目錄價格。儘管設計上的考慮因素包括減薄鋼板厚度和改用複合材料,但認證障礙阻礙了成本的廣泛降低。

細分市場分析

到2025年,容積式壓縮機技術將佔據工業空氣壓縮機市場的75.40%佔有率,這反映了其在從一般製造業到採礦業等廣泛應用領域的通用性。旋轉螺桿式壓縮機兼具效率和可維護性,因此市場需求穩定。雖然離心式壓縮機的規模較小,但由於液化天然氣工廠和鋼鐵廠需要穩定壓力下的高流量,預計其市場將以6.69%的複合年成長率成長。

受能源效率法規的推動,2026年至2031年間,離心式工業空氣壓縮機市場預計將成長27.3億美元。物聯網控制器和預測分析技術正被應用於壓縮機和離心式空氣壓縮機中,以減少非計劃性停機時間。阿特拉斯·科普柯等原始設備製造商(OEM)目前正將Optimizer 4.0模組與其壓縮機組捆綁銷售,該模組可追蹤負載曲線並推薦節能模式。

至2025年,油浸式設計仍將維持其成本優勢,佔62.30%的市場佔有率;而由於製藥和食品業對污染接受度較低,無油系統將以6.33%的複合年成長率成長。預計到2031年,無油螺桿式工業空氣壓縮機的市場規模將超過154億美元,主要得益於其生命週期維護和處置成本的降低。

全新兩級乾式螺桿擠出機比以往型號節能高達13.5%,縮短了投資回收期。 0級認證的推廣正在影響採購決策,越來越多的飲料裝瓶商在競標文件中明確提出此項要求。

區域分析

到2025年,亞太地區將佔全球收入的41.70%,這主要得益於中國自動化技術的快速發展以及印度生產連結獎勵計畫計畫(PLI)推動了企業內部空氣生產的發展。工廠營運商傾向於選擇配備能源回收模組的整合式空氣站,這一趨勢正在改變資本設備競標的模式。本地組裝正與跨國原始設備製造商(OEM)建立技術授權合作關係,以進一步擴大工業空氣壓縮機市場。

在北美,製造業回流和美國能源局) 的能源效率法規正在推動老舊固定速壓縮機組的更新換代。美國墨西哥灣沿岸的液化天然氣出口終端正在訂購兆瓦級離心式壓縮機組,這進一步鞏固了該地區在高壓應用領域的優勢。加拿大對低碳氫化合物計劃的重視也進一步推動了對無油螺桿式壓縮機組的需求。

中東地區以5.72%的複合年成長率 (CAGR) 領跑,主要受天然氣儲存、石化產品多元化以及大型煉油廠升級改造的推動。歐洲儘管面臨原物料價格上漲帶來的成本壓力,但由於終端用戶優先考慮噪音法規和碳減排,市場需求仍保持穩定。拉丁美洲和非洲的需求則呈現間歇性波動,與採礦和基礎設施建設週期密切相關,租賃設備填補了計劃間的空檔,從而推動了工業空氣壓縮機市場的擴張。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲節能製造設施的擴建

- 食品和飲料加工行業對無油壓縮機的需求不斷成長

- 對液化天然氣基礎設施投資的快速成長,需要高壓壓縮機

- 政府對工業能源審核的激勵措施促進了變速壓縮機的發展

- 利用乾式螺桿壓縮機快速擴建電動車電池超級工廠

- 中東地區石化工廠棕地維修的趨勢日益成長

- 市場限制

- 鋼材價格波動推高了壓縮機零件的成本結構

- 與低壓應用中的鼓風機替代方案相比:投資回收期更長

- 歐洲嚴格的噪音排放標準推高了機殼的成本。

- 新興市場熟練維修人員短缺導致停機時間增加

- 價值/供應鏈分析

- 監管或技術環境

- 投資分析

- 關鍵案例研究和部署場景

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按壓縮機類型

- 正位移

- 旋轉螺桿

- 往復式(活塞式)

- 捲動

- 動態的

- 離心

- 軸向

- 正位移

- 潤滑劑

- 油浸式

- 無油

- 按額定壓力

- 0~20 bar

- 21~100 bar

- 超過100巴

- 驅動系統/電源

- 電

- 柴油引擎

- 氣體

- 額定功率

- 100千瓦或以下

- 101~500 kW

- 超過500千瓦

- 按最終用途行業分類

- 製造業

- 一般製造業

- 金屬和採礦

- 電子裝置和半導體

- 石油和天然氣

- 上游部門

- 中游(管道/液化天然氣)

- 下游產業(煉油)

- 發電

- 化工/石油化工

- 食品/飲料

- 製藥

- 建造

- 其他(醫療、紡織)

- 製造業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Atlas Copco AB

- Ingersoll Rand Inc.

- Kaeser Kompressoren SE

- Sullair LLC(Hitachi Group)

- Gardner Denver Holdings Inc.

- Siemens Energy AG

- Bauer Kompressoren GmbH

- Doosan Portable Power

- ELGi Equipments Ltd.

- Quincy Compressor LLC

- Fusheng Industrial Co. Ltd.

- Kobe Steel Ltd.

- Hanwha Power Systems

- Boge Kompressoren Otto Boge GmbH & Co. KG

- Aerzen Maschinenfabrik GmbH

- CompAir(UK)Ltd.

- Chicago Pneumatic

- VMAC Global Technology Inc.

- Shanghai Screw Compressor Co. Ltd.

- Kobelco KNW(Industrial Air Compressors)

第7章 市場機會與未來展望

Industrial Air Compressors market size in 2026 is estimated at USD 41.24 billion, growing from 2025 value of USD 39.48 billion with 2031 projections showing USD 51.32 billion, growing at 4.47% CAGR over 2026-2031.

Rising investments in energy-efficient production lines, rapid LNG infrastructure build-outs and stricter contamination standards are reshaping product preferences in every major end-use sector. Variable-speed technology, oil-free architectures and IoT-enabled monitoring platforms are gaining traction as plant operators balance emission mandates with total cost-of-ownership goals. Regional momentum remains strongest in Asia-Pacific, while the Middle East delivers the fastest growth on the back of large-scale gas projects. At the same time, raw-material price volatility and tighter European noise rules are compressing margins and extending payback periods, prompting redesigns that lower steel content and improve acoustic performance. The Industrial Air Compressors market continues to demonstrate resilience by aligning product innovation with decarbonization policies and shifting industrial footprints.

Global Industrial Air Compressors Market Trends and Insights

Expansion of Energy-Efficient Manufacturing Facilities in Asia

The semiconductor boom lifted Taiwan's fixed-asset spending by 69% in Q4 2024, with electronics plants adopting Class 0 oil-free systems to guard against contamination. Variable-speed drives that trim energy use up to 35% are now baseline specifications across new lines. Multinationals scaling robotics and additive manufacturing in China and India mirror this focus, anchoring long-term volume for the Industrial Air Compressors market.

Rising Demand for Oil-Free Compressors in Food & Beverage Processing

ISO 8573-1 Class 0 has moved from best practice to regulatory requirement in many jurisdictions, pushing processors toward oil-free screws and scrolls. Hitachi Global Air Power's DS280-450 kW launch addresses requests for higher-power oil-free options. Lower maintenance and avoided lubricant disposal are offsetting the upfront premium, reinforcing adoption across developed markets.

Volatile Steel Prices Inflating Compressor BOM Cost Structures

Steel accounts for up to 50% of compressor production cost, exposing OEMs to margin swings when prices spike. European makers implemented multiple list-price rises in 2024 as energy costs fed into steel inputs. Design efforts to cut plate thickness and switch to composites are under evaluation, yet certification hurdles delay widespread relief.

Other drivers and restraints analyzed in the detailed report include:

- Surging Investments in LNG Infrastructure Requiring High-Pressure Compressors

- Government Incentives for Industrial Energy Audits Favoring Variable-Speed Compressors

- Stringent Noise Emission Norms Escalating Enclosure Costs in Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Positive displacement technology held 75.40% of the Industrial Air Compressors market share in 2025, reflecting its versatility from general manufacturing to mining. Demand remains stable as rotary screw units balance efficiency and maintenance needs. Dynamic centrifugal compressors, although smaller in volume, are expanding at a 6.69% CAGR as LNG plants and steel mills seek higher flow at consistent pressure.

The Industrial Air Compressors market size for centrifugal units is projected to increase by USD 2.73 billion between 2026 and 2031, supported by energy-efficiency mandates. IoT-enabled controllers and predictive analytics are being embedded across both technologies to lower unplanned downtime. OEMs such as Atlas Copco now bundle Optimizer 4.0 modules with compressor packages to track load profiles and recommend energy-saving modes.

Oil-flooded designs retained cost leadership and 62.30% share in 2025, yet oil-free systems are advancing at 6.33% CAGR as contamination tolerance narrows in pharmaceuticals and food. The Industrial Air Compressors market size for oil-free screws is on course to climb beyond USD 15.4 billion by 2031, aided by lower lifecycle maintenance and disposal savings.

Newer two-stage dry screws trim energy use as much as 13.5% versus prior models, improving payback windows. Class 0 certification marketing is influencing purchasing decisions, and beverage bottlers often specify it outright in bid documents.

The Industrial Air Compressor Market Report is Segmented by Compressor Type (Positive Displacement and More), Lubrication (Oil-Flooded, Oil-Free), Pressure Rating (0-20 Bar, 21-100 Bar, Above 100 Bar), Driver/Power Source (Electric and More), Power Rating (>500 KW and More), End-Use Industry (Manufacturing and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 41.70% of global revenue in 2025, anchored by China's automation surge and India's PLI inducements that encourage in-house air generation. Plant operators favor integrated air stations with energy-recovery modules, a trend reshaping capital-equipment bids. Local assemblers partner with multinational OEMs for technology licensing, further expanding the Industrial Air Compressors market.

North America benefits from reshoring and DOE efficiency rules that spur replacement of legacy fixed-speed fleets. LNG export terminals along the U.S. Gulf Coast order multi-megawatt centrifugal lines, reinforcing regional dominance in high-pressure applications. Canada's focus on low-carbon hydrogen projects adds incremental volume for oil-free screw packages.

The Middle East registers the fastest 5.72% CAGR, driven by gas storage, petrochemical diversification and mega-refinery upgrades. Europe maintains steady demand as end-users prioritize noise compliance and carbon reduction, despite cost pressures from material inflation. Latin America and Africa offer episodic demand tied to mining and infrastructure cycles, with rental fleets bridging project gaps and enlarging the Industrial Air Compressors market footprint.

- Atlas Copco AB

- Ingersoll Rand Inc.

- Kaeser Kompressoren SE

- Sullair LLC (Hitachi Group)

- Gardner Denver Holdings Inc.

- Siemens Energy AG

- Bauer Kompressoren GmbH

- Doosan Portable Power

- ELGi Equipments Ltd.

- Quincy Compressor LLC

- Fusheng Industrial Co. Ltd.

- Kobe Steel Ltd.

- Hanwha Power Systems

- Boge Kompressoren Otto Boge GmbH & Co. KG

- Aerzen Maschinenfabrik GmbH

- CompAir (UK) Ltd.

- Chicago Pneumatic

- VMAC Global Technology Inc.

- Shanghai Screw Compressor Co. Ltd.

- Kobelco KNW (Industrial Air Compressors)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Energy-Efficient Manufacturing Facilities in Asia

- 4.2.2 Rising Demand for Oil-Free Compressors in Food and Beverage Processing

- 4.2.3 Surging Investments in LNG Infrastructure Requiring High-Pressure Compressors

- 4.2.4 Government Incentives for Industrial Energy Audits Favoring Variable-Speed Compressors

- 4.2.5 Rapid Growth of EV Battery Gigafactories Utilizing Dry Screw Compressors

- 4.2.6 Uptick in Brownfield Revamps of Petrochemical Plants in Middle East

- 4.3 Market Restraints

- 4.3.1 Volatile Steel Prices Inflating Compressor BOM Cost Structures

- 4.3.2 Longer Payback Period Versus Blower Alternatives for Low-Pressure Applications

- 4.3.3 Stringent Noise Emission Norms Escalating Enclosure Costs in Europe

- 4.3.4 Skilled Maintenance Labor Shortages Increasing Downtime in Emerging Markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Investment Analysis

- 4.7 Key Case Studies and Implementation Scenarios

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Compressor Type

- 5.1.1 Positive Displacement

- 5.1.1.1 Rotary Screw

- 5.1.1.2 Reciprocating (Piston)

- 5.1.1.3 Scroll

- 5.1.2 Dynamic

- 5.1.2.1 Centrifugal

- 5.1.2.2 Axial

- 5.1.1 Positive Displacement

- 5.2 By Lubrication

- 5.2.1 Oil-Flooded

- 5.2.2 Oil-Free

- 5.3 By Pressure Rating

- 5.3.1 0-20 bar

- 5.3.2 21-100 bar

- 5.3.3 Above 100 bar

- 5.4 By Driver/Power Source

- 5.4.1 Electric

- 5.4.2 Diesel

- 5.4.3 Gas

- 5.5 By Power Rating

- 5.5.1 <=100 kW

- 5.5.2 101-500 kW

- 5.5.3 >500 kW

- 5.6 By End-use Industry

- 5.6.1 Manufacturing

- 5.6.1.1 General Manufacturing

- 5.6.1.2 Metal & Mining

- 5.6.1.3 Electronics & Semiconductors

- 5.6.2 Oil and Gas

- 5.6.2.1 Upstream

- 5.6.2.2 Midstream (Pipeline/LNG)

- 5.6.2.3 Downstream (Refining)

- 5.6.3 Power Generation

- 5.6.4 Chemical and Petrochemical

- 5.6.5 Food and Beverage

- 5.6.6 Pharmaceutical

- 5.6.7 Construction

- 5.6.8 Others (Healthcare, Textiles)

- 5.6.1 Manufacturing

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Nordics

- 5.7.3.7 Rest of Europe

- 5.7.4 Middle East and Africa

- 5.7.4.1 United Arab Emirates

- 5.7.4.2 Saudi Arabia

- 5.7.4.3 South Africa

- 5.7.4.4 Rest of Middle East and Africa

- 5.7.5 Asia-Pacific

- 5.7.5.1 China

- 5.7.5.2 India

- 5.7.5.3 Japan

- 5.7.5.4 South Korea

- 5.7.5.5 Australia

- 5.7.5.6 Rest of Asia-Pacific

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Atlas Copco AB

- 6.4.2 Ingersoll Rand Inc.

- 6.4.3 Kaeser Kompressoren SE

- 6.4.4 Sullair LLC (Hitachi Group)

- 6.4.5 Gardner Denver Holdings Inc.

- 6.4.6 Siemens Energy AG

- 6.4.7 Bauer Kompressoren GmbH

- 6.4.8 Doosan Portable Power

- 6.4.9 ELGi Equipments Ltd.

- 6.4.10 Quincy Compressor LLC

- 6.4.11 Fusheng Industrial Co. Ltd.

- 6.4.12 Kobe Steel Ltd.

- 6.4.13 Hanwha Power Systems

- 6.4.14 Boge Kompressoren Otto Boge GmbH & Co. KG

- 6.4.15 Aerzen Maschinenfabrik GmbH

- 6.4.16 CompAir (UK) Ltd.

- 6.4.17 Chicago Pneumatic

- 6.4.18 VMAC Global Technology Inc.

- 6.4.19 Shanghai Screw Compressor Co. Ltd.

- 6.4.20 Kobelco KNW (Industrial Air Compressors)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need