|

市場調查報告書

商品編碼

1906045

環氧樹脂:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Epoxy Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

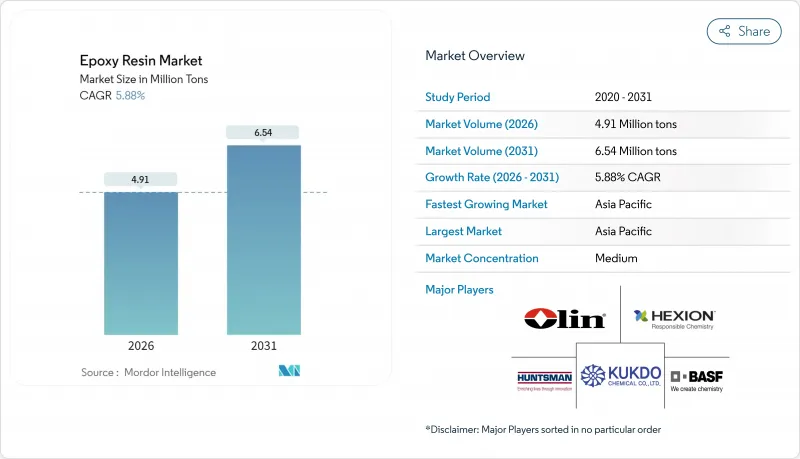

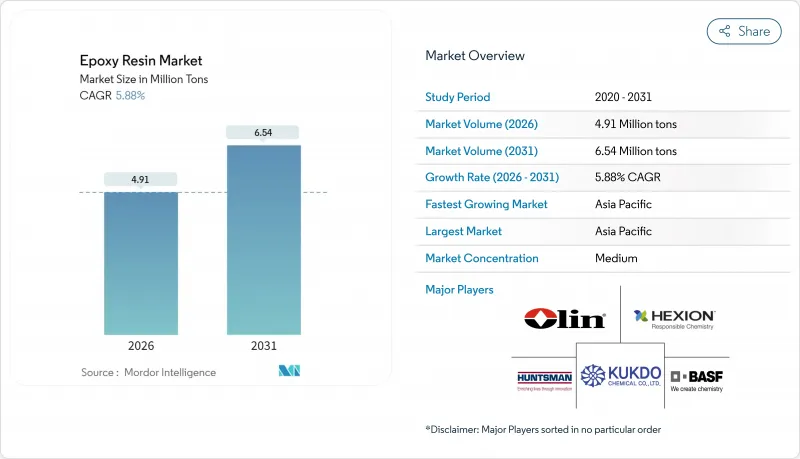

預計到 2026 年,環氧樹脂市場規模將達到 491 萬噸,高於 2025 年的 464 萬噸。

預計到 2031 年將達到 654 萬噸,2026 年至 2031 年的複合年成長率為 5.88%。

持續的需求源自於其卓越的機械、化學和熱性能,這些性能支持從風力發電機葉片到半導體封裝等關鍵應用。對雙酚A (BPA) 和揮發性有機化合物 (VOC) 的監管日益嚴格,正在加速水基、生物可回收和低VOC化學技術的發展。新興市場可再生能源基礎設施的擴張、電氣化趨勢和基礎設施投資正在推動需求成長,而不斷上漲的貿易關稅和原料價格波動則為採購行業帶來了短期不確定性。儘管環氧樹脂市場集中度仍然適中,但對可再生和植物來源配方的突破性研發正在為現有企業和專業領域的新興參與企業拓展機會。

全球環氧樹脂市場趨勢與洞察

油漆和塗料領域的需求不斷成長

塗料產業仍將是環氧樹脂的主要應用領域,預計到2024年將佔環氧樹脂市場佔有率的60.15%。東南亞和非洲基礎設施項目以及船舶和包裝應用對高阻隔阻隔性和耐腐蝕性塗料的特定需求正在推動市場成長。 Westlake公司計劃於2025年推出的生物再生樹脂EpoVIVE,正是供應商如何在永續性和性能之間取得平衡的典範。量子點催化光化學技術正在推動低VOC配方的普及,該技術無需使用昂貴的紫外線阻隔劑即可提高樹脂的耐光穩定性。諸如Amerlock 400之類的船用級系統能夠延長船舶的停靠間隔,並降低船隊運營商的全生命週期成本。這使得塗料產業在整個環氧樹脂市場中,無論在銷量或創新方面,都將發揮關鍵作用,預計到2030年,其複合年成長率將達到6.51%。

擴大複合材料在風力發電機葉片中的應用

離岸風力發電的興起、更大的轉子直徑以及碳纖維和玻璃纖維混合結構的設計,正在推動對環氧樹脂性能的要求不斷提高。全球風力發電理事會預測,新增裝置容量將以每年8.8%的速度成長,這將支撐樹脂的長期需求。到2025年,TPI Composites的基本客群將供應美國88%的陸上風力發電機葉片,凸顯了製程技術在整合採購方面的重要性。西門子歌美颯已將可在弱酸性條件下剝離的可回收環氧樹脂葉片商業化,從而緩解了處置難題。基於機器學習的葉片固化製程最佳化進一步減少了廢棄物和能源消耗,鞏固了環氧樹脂作為風力發電價值鏈基材的主導地位。

原物料價格波動

2024年上半年,中國雙酚A(BPA)產能成長12.31%,達到每年548萬噸,但運轉率下降,區域價格較上季下跌4.6%。國都化工廠爆炸等突發事件導致BPA價格一度翻倍,使下游複合材料生產商面臨利潤風險。極端天氣引發的不可抗力聲明進一步加劇了供應的不確定性。因此,多家大型環氧樹脂生產商正在建造專用的環氧氯丙烷和BPA生產設施,以確保原料供應並對沖價格波動風險。

細分市場分析

作為風力渦輪機葉片和汽車複合材料的領先等級,DGBEA樹脂預計在2025年將保持36.35%的環氧樹脂市場佔有率。儘管仍是市場擴張的關鍵因素(複合年成長率達6.32%),但客戶的審核正迫使生產商證明其BPA(雙酚A)供應可追溯且低碳。為此,歐洲、美國和日本的供應商正在試行物料平衡會計和生物回收原料,以維持DGBEA在環氧樹脂市場的地位。

特種樹脂填補了不同的性能空白。 DGBEF樹脂可實現低黏度,適用於船舶維護塗料;酚醛樹脂則為爐襯提供耐熱衝擊性能;脂肪族環氧樹脂具有建築建築幕牆所需的紫外線穩定性;縮水甘油胺類樹脂在電子機殼中具有優異的金屬黏合性。生物基和環脂族樹脂(歸類為其他原料)預計將成為成長最快的細分市場,到2031年將佔據環氧樹脂市場的重要佔有率,因為循環回收和碳核算正日益受到股東的關注。

環氧樹脂市場報告按原料(雙酚A和ECH、雙酚F和ECH、酚醛樹脂(甲醛和苯酚)、脂肪族(脂肪醇)、縮水甘油胺(芳香胺和ECH)、其他)、應用(油漆和塗料、黏合劑和密封劑、複合材料、電氣和電子設備、北美、歐洲、其他地區進行分析。

區域分析

亞太地區仍將是環氧樹脂市場的中心,預計到2025年將佔全球需求的47.55%,並有望在2031年之前以6.08%的複合年成長率成長。由於美國對中國樹脂出口徵收高達354.99%的反傾銷稅,中國不得不轉向地理上更加多元化的基本客群,其中包括DCM Shriram在印度新建的價值1.25億美元的工廠。泰國和越南正在新增印刷基板(PCB)和風力渦輪機葉片的生產能力,而日本和韓國則在大力推進用於半導體和海上風電應用的超高玻璃化轉變溫度(Tg)和可再生化學品的研發。

北美正利用製造業回流、基礎設施投資和可再生能源稅額扣抵抵免來緩解進口樹脂供應的波動。 1.01%至547.76%不等的反補貼稅鼓勵國內製造商運作暫停中反應器並投資新的原料資產。加拿大風電場開發商指定使用適用於北極環境的環氧樹脂體系,美國的汽車產業叢集正在加速對結構性黏著劑的需求。美國國家再生能源實驗室(NREL)的可再生植物來源環氧樹脂研究進一步鞏固了該地區在永續性。

歐洲正努力在嚴格的雙酚A(BPA)法規與尖端研發之間尋求平衡。一家德國汽車供應商正與一家當地樹脂生產商合作開發導熱型EMC(電磁相容材料)。英國離岸風電的蓬勃發展推動了環氧塗層單樁25年使用壽命的要求,而法國核能產業則在推廣耐輻射等級的產品。斯科特·巴德公司斥資3000萬英鎊擴建其在英國的生產能力,凸顯了其在全球物流波動的情況下對本地供應的承諾。北歐地區在循環經濟政策方面已領先,正在歐盟資助的計畫下推動閉合迴路環氧樹脂回收試驗。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 油漆和塗料行業需求不斷成長

- 複合材料在風力發電機葉片中的應用

- 電氣和電子設備產業需求不斷成長

- 基礎建設主導黏合劑需求成長

- 採用環氧光敏聚合物進行3D列印

- 市場限制

- 原物料價格波動

- 加強對揮發性有機化合物(VOCs)和雙酚A(BPA)的監管

- 反傾銷稅對貿易流量的影響

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場規模和成長預測(價值和數量)

- 按原料

- DGBEA(雙酚A和ECH)

- DGBEF(雙酚F和ECH)

- 酚醛樹脂(甲醛和苯酚)

- 脂肪族(脂肪醇)

- 縮水甘油胺(芳香胺和ECH)

- 其他原料(脂環族、生物基環氧樹脂)

- 依實體形態

- 液體

- 固體的

- 解決方案

- 水性分散體

- 透過使用

- 油漆和塗料

- 黏合劑和密封劑

- 複合材料

- 電氣和電子設備

- 風力發電機

- 海洋

- 其他用途(建築、3D列印用光敏聚合物等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)排名分析

- 公司簡介

- Atul Ltd

- Bodo Moller Chemie GmbH

- Cardolite Corporation

- Chang Chun Group

- DIC Corporation

- Dow

- Grasim Industries Limited

- Hexion Inc.

- Huntsman International LLC

- Jiangsu Sanmu Group Co., Ltd.

- Kolon Industries

- Kukdo Chemical Co., Ltd

- Mitsui Chemicals, Inc.

- Nama

- Nan Ya Plastics Corporation

- Olin Corporation

- Robnor ResinLab Ltd,

- Sika AG

- Sinochem Holdings Corporation Ltd.

- Association for Chemical and Metallurgical Production(SPOLCHEMIE)

- Westlake Corporation

第7章 市場機會與未來展望

Epoxy Resin Market size in 2026 is estimated at 4.91 Million tons, growing from 2025 value of 4.64 Million tons with 2031 projections showing 6.54 Million tons, growing at 5.88% CAGR over 2026-2031.

Sustained demand is rooted in the material's unmatched mechanical, chemical, and thermal performance that underpins critical uses ranging from wind-turbine blades to semiconductor packaging. Innovation is accelerating as stricter regulations on bisphenol A (BPA) and volatile organic compounds (VOCs) advance waterborne, bio-circular, and low-VOC chemistries. Expanding renewable-energy infrastructure, electrification trends, and infrastructure spending in emerging economies add positive volume momentum, while escalating trade duties and raw-material price swings present near-term uncertainties for procurement teams. The epoxy resins market remains moderately concentrated, yet breakthrough work on recyclable and plant-derived formulations is widening the opportunity set for both incumbents and specialist newcomers.

Global Epoxy Resin Market Trends and Insights

Increasing Demand from Paints and Coatings

Paints and coatings continued to dominate the epoxy resins market with a 60.15% revenue share in 2024. Growth is reinforced by infrastructure programs in Southeast Asia and Africa and by marine and packaging niches that depend on high-barrier, corrosion-resistant finishes. Westlake's 2025 launch of EpoVIVE bio-circular resins illustrates how suppliers are balancing sustainability with performance. The shift to low-VOC formulations is aided by quantum-dot-catalyzed photochemistry that improves sunlight stability without costly UV blockers Marine-grade systems such as Amerlock 400 lengthen dry-dock cycles, lowering total lifecycle cost for fleet operators.The resulting 6.51% CAGR to 2030 positions coatings as both volume and innovation anchors for the broader epoxy resins market.

Wind-Turbine Blade Composites Uptake

Growing offshore wind installations, larger rotor diameters, and hybrid carbon-glass designs are raising epoxy performance thresholds. The Global Wind Energy Council forecasts 8.8% annual growth in new capacity, which underpins long-run resin demand. TPI Composites' customer base supplied 88% of 2025 US onshore blades, underscoring how process know-how consolidates purchasing. Siemens Gamesa has already commercialized recyclable epoxy blades that de-bond under mild acidic conditions, easing end-of-life challenges. Machine-learning optimization of blade cure schedules further cuts waste and energy use, reinforcing epoxy's position as the matrix of choice in the wind energy value chain.

Raw-Material Price Volatility

China expanded BPA capacity by 12.31% in H1 2024 to 5.48 million t pa, yet utilization dipped and regional prices fell 4.6% quarter-on-quarter. Disruptions such as the Guodu Chemical plant explosion temporarily doubled BPA prices, exposing downstream formulators to margin risk. Force-majeure declarations following extreme weather events added further supply uncertainty. Several epoxy majors are therefore building captive epichlorohydrin and BPA units to secure feedstock and hedge volatility.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand from Electrical and Electronics

- Growing Infrastructure-Led Adhesive Demand

- Stricter VOC and BPA Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

DGBEA resins retained 36.35% epoxy resin market share in 2025 as the workhorse grade for wind-energy blades and automotive composites. At a 6.32% CAGR they remain integral to market expansion, yet customer audits are pushing producers to demonstrate traceable, lower-carbon BPA supply. In response, Western and Japanese suppliers are piloting mass-balance accounting and bio-circulating feedstocks to preserve DGBEA's position in the epoxy resins market.

Specialty resins fill clear performance gaps. DGBEF offers lower viscosity for marine maintenance coatings, while novolac chemistries withstand thermal shock inside furnace linings. Aliphatic epoxies deliver UV stability essential for architectural facades. Glycidylamine versions provide superior metal adhesion in electronics housings. Bio-based and cycloaliphatic chemistries, grouped under other raw materials, are projected to be the fastest movers and could capture a measurable slice of the epoxy resins market by 2031 as closed-loop recycling and carbon accounting gain shareholder focus.

The Epoxy Resin Market Report is Segmented by Raw Material (DGBEA (Bisphenol A and ECH), DGBEF (Bisphenol F and ECH), Novolac (Formaldehyde and Phenols), Aliphatic (Aliphatic Alcohols), Glycidylamine (Aromatic Amines and ECH), and More), Application (Paints and Coatings, Adhesives and Sealants, Composites, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific remained the epicenter of the epoxy resin market, securing 47.55% of 2025 demand and pointing to a 6.08% CAGR through 2031. China's resin exports face US anti-dumping duties as high as 354.99%, prompting ventures like DCM Shriram's USD 125 million Indian greenfield unit to serve a more regionally diversified customer base. Thailand and Vietnam capture fresh PCB and wind-blade capacity, while Japan and South Korea push ultra-high-Tg and recyclable chemistries for semiconductors and offshore wind applications.

North America leverages reshoring, infrastructure investment, and renewable-energy tax credits to buffer volatility in imported resin flows. Countervailing duties ranging from 1.01% to 547.76% spur domestic producers to reactivate idled reactors and invest in new feedstock assets. Canadian wind-farm developers specify Arctic-grade epoxy systems, and Mexico's automotive clusters accelerate demand for structural adhesives. NREL's plant-derived epoxy research underscores the region's sustainability leadership.

Europe balances stringent BPA rules with cutting-edge R&D. German automotive suppliers co-engineer thermally conductive EMCs with local resin formulators. The United Kingdom's offshore wind boom sustains 25-year service life requirements for epoxy-primed monopiles, and France's nuclear sector pushes radiation-resistant grades. Scott Bader's GBP 30 million UK capacity addition highlights commitments to local supply amid global logistics flux. The Nordic region, already well advanced in circular-economy policy, pilots closed-loop epoxy recycling trials under EU-funded programs.

- Atul Ltd

- Bodo Moller Chemie GmbH

- Cardolite Corporation

- Chang Chun Group

- DIC Corporation

- Dow

- Grasim Industries Limited

- Hexion Inc.

- Huntsman International LLC

- Jiangsu Sanmu Group Co., Ltd.

- Kolon Industries

- Kukdo Chemical Co., Ltd

- Mitsui Chemicals, Inc.

- Nama

- Nan Ya Plastics Corporation

- Olin Corporation

- Robnor ResinLab Ltd,

- Sika AG

- Sinochem Holdings Corporation Ltd.

- Association for Chemical and Metallurgical Production (SPOLCHEMIE)

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from Paints and Coatings

- 4.2.2 Wind-Turbine Blade Composites Uptake

- 4.2.3 Increasing Demand from Electrical and Electronics

- 4.2.4 Growing Infrastructure-Led Adhesive Demand

- 4.2.5 3-D Printed Epoxy Photopolymers Adoption

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility

- 4.3.2 Stricter VOC and BPA Regulations

- 4.3.3 Anti-Dumping Duties Disrupting Trade Flows

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Raw Material

- 5.1.1 DGBEA (Bisphenol A and ECH)

- 5.1.2 DGBEF (Bisphenol F and ECH)

- 5.1.3 Novolac (Formaldehyde and Phenol)

- 5.1.4 Aliphatic (Aliphatic Alcohols)

- 5.1.5 Glycidylamine (Aromatic Amines and ECH)

- 5.1.6 Other Raw Materials (Cycloaliphatic, Bio-based Epoxies)

- 5.2 By Physical Form

- 5.2.1 Liquid

- 5.2.2 Solid

- 5.2.3 Solution

- 5.2.4 Waterborne Dispersion

- 5.3 By Application

- 5.3.1 Paints and Coatings

- 5.3.2 Adhesives and Sealants

- 5.3.3 Composites

- 5.3.4 Electrical and Electronics

- 5.3.5 Wind Turbines

- 5.3.6 Marine

- 5.3.7 Other Applications (Construction, 3-D Printing Photopolymers, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%) Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Atul Ltd

- 6.4.2 Bodo Moller Chemie GmbH

- 6.4.3 Cardolite Corporation

- 6.4.4 Chang Chun Group

- 6.4.5 DIC Corporation

- 6.4.6 Dow

- 6.4.7 Grasim Industries Limited

- 6.4.8 Hexion Inc.

- 6.4.9 Huntsman International LLC

- 6.4.10 Jiangsu Sanmu Group Co., Ltd.

- 6.4.11 Kolon Industries

- 6.4.12 Kukdo Chemical Co., Ltd

- 6.4.13 Mitsui Chemicals, Inc.

- 6.4.14 Nama

- 6.4.15 Nan Ya Plastics Corporation

- 6.4.16 Olin Corporation

- 6.4.17 Robnor ResinLab Ltd,

- 6.4.18 Sika AG

- 6.4.19 Sinochem Holdings Corporation Ltd.

- 6.4.20 Association for Chemical and Metallurgical Production (SPOLCHEMIE)

- 6.4.21 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment