|

市場調查報告書

商品編碼

1906029

歐洲活性碳:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Europe Activated Carbon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

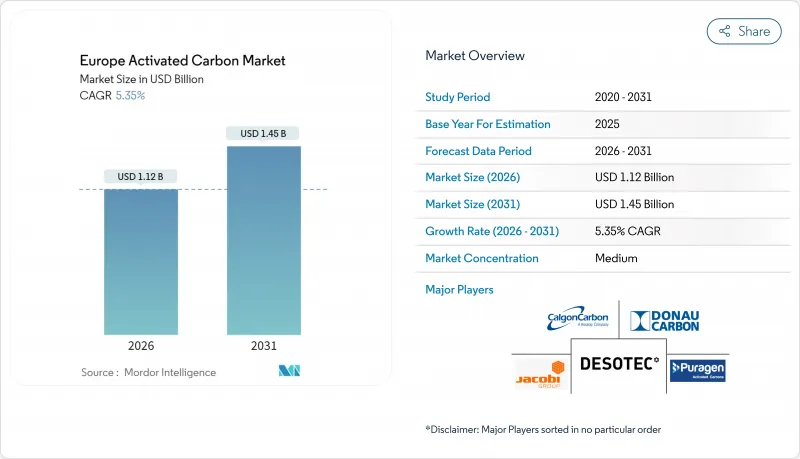

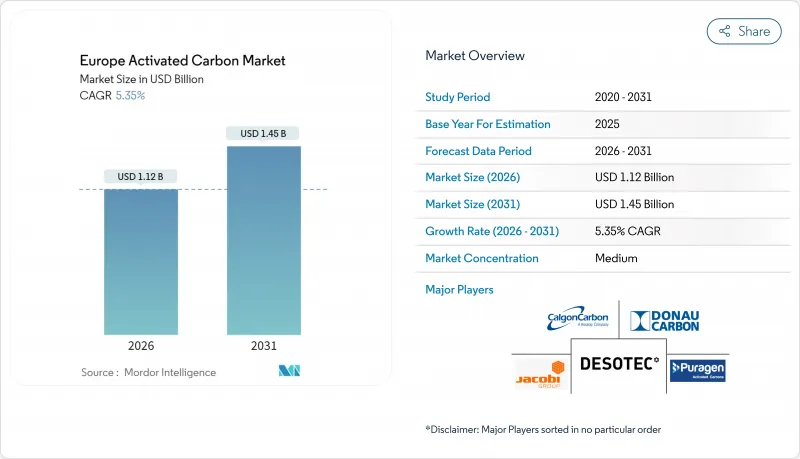

歐洲活性碳市場預計將從 2025 年的 10.6 億美元成長到 2026 年的 11.2 億美元,預計到 2031 年將達到 14.5 億美元,2026 年至 2031 年的複合年成長率為 5.35%。

這一成長是由多種因素共同推動的,包括更嚴格的環境法規、不斷提高的市政水質標準以及更嚴格的工業排放限制,這些因素共同推動了全部區域對可快速部署的吸附技術的需求。供水事業的強勁更新周期、即將到來的2026年PFAS合規期限以及工業排放指令2.0的擴展,都促使終端用戶簽訂長期供應契約,以確保價格和重新運作服務的可預測性。為了因應原料價格波動,歐洲活性碳市場正在將進口椰殼炭與當地的硬木和褐煤混合,同時投資於循環重新運作能力,從而降低處置成本,並幫助客戶減少範圍3排放。

歐洲活性碳市場趨勢與洞察

歐盟收緊工業排放法規

工業排放指令的修訂擴大了監管範圍,從大型燃燒裝置擴展到中型鍋爐、冶煉廠和鑄造廠,迫使數千家先前不受監管的設施遵守汞和粉塵排放限值。現有煙囪的排放限值為 1–4 μg/m³,新建設的排放限值為 1–2 μg/m³。官方最佳利用技術 (BAT) 參考文件指出,活性碳噴射是實現汞排放目標的主要手段。由於管道側噴射系統可在 18 個月內完成設計、訂購和試運行,而布袋除塵器改造和濕式洗滌器通常需要 50 個月以上的時間,因此工廠營運商擴大選擇粉末配方。歐盟凝聚基金承諾在 2027 年投入 1,470 億歐元用於實現清潔空氣目標,這降低了小規模排放的資金門檻。因此,歐洲活性碳市場對專為富硫廢氣設計的高碘 PAC 級活性碳的領先訂單增加。設備原始設備製造商 (OEM) 也報告稱,捆綁碳供應、筒倉租賃和報廢碳捕獲的服務合約激增,這反映出客戶更傾向於承包的監管合規方案,而不是零件採購。

供水事業需求快速成長

德國、法國、荷蘭和比利時的供水事業正面臨更嚴格的微量污染物去除標準,這導致顆粒活性碳(GAC)更換頻率增加,並催生了將濾料供應、容器維修和重新運作等內容整合到八年服務合約中的大規模競標。光是德國每年就消耗價值1.3億歐元的活性碳用於水淨化處理,相當於每年約5.5萬噸新的和再生的活性碳。修訂後的《都市廢水指令》引入的微量物質限制要求去除效率達到80-93%,而使用低灰椰殼或褐煤基顆粒活性碳結合生物活性過濾器通常可以達到此標準。採購記錄顯示,供水事業傾向於採用雙層過濾器設計,這種設計可以減少水頭損失,同時將濾料壽命延長18-24個月。

椰子殼和煤炭原料價格波動

東南亞椰子產區乾旱導致椰殼短缺,使得2024年第一季至2025年第三季期間,歐洲到岸價(CIF)上漲了38%。同時,東歐地緣政治緊張局勢限制了石油焦替代品的供應,迫使歐洲多家小規模窯爐在競標高峰期停產運作。儘管大規模生產商透過與菲律賓椰乾廠和哥倫比亞煤炭出口商簽訂長期供應合約降低了風險,但價格波動持續擠壓著未簽訂指數掛鉤合約的經銷商的利潤空間。公共產業和食品公司擴大要求將價格上漲幅度限制在每年5%以內,這不僅將部分波動風險轉移給了供應商,也加重了整個歐洲活性碳市場的營運資金負擔。雖然對歐洲硬木碳化計劃的投資提供了一定的緩衝,但其規模有限,生物基原料尚無法完全取代進口椰殼用於高純度應用。

細分市場分析

到2025年,粉末活性碳將佔歐洲活性碳市場47.63%的佔有率,這反映了其在褐煤和生質能鍋爐煙氣噴射系統中的成熟應用。隨著中型煙囪擴大納入工業排放指令的管轄範圍,預計粉末活性碳市場將以5.63%的複合年成長率成長。粉末活性碳粒徑小於45微米,並採用鹵素浸漬工藝,使其汞吸附能力達到1.8-2.4毫克汞/克碳,超過了基準煤基粉末活性碳。

受PFAS法規實施期限的推動,顆粒活性碳在水處理領域的支出佔比很高。擠壓活性碳在溶劑回收和製藥空氣淨化領域仍然至關重要,因為其圓柱形結構能夠降低壓力降,並能承受快速流化床的磨損。展望未來,顆粒活性碳供應商正在嘗試使用椰殼作為原料,椰殼具有低灰分和精細孔隙結構的優點,旨在捕集汞和戴奧辛,以期在燃煤發電廠退役後維持市場需求。這些創新將有助於防止歐洲活性碳市場商品化,並確保產品持續更新。

歐洲活性碳市場報告按類型(粉末活性碳、顆粒狀活性碳、擠壓或造粒活性碳)、應用(氣體淨化、水淨化、金屬提取、製藥及其他)和地區(德國、英國、法國、義大利、西班牙及歐洲其他地區)進行細分。市場預測以美元以金額為準。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟收緊工業排放法規

- 地方政府供水事業的需求迅速成長

- 限制煤炭和生質能混燒過程中汞的排放

- 提高飲料罐生產線的過濾能力

- 加強地下水中 PFAS 的移除要求

- 市場限制

- 椰子殼和煤炭原料價格波動

- 新興生物炭替代品的可用性

- 煤基汽油的碳足跡懲罰

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 激烈的競爭

- 供應情景

第5章 市場規模與成長預測

- 按類型

- 粉末活性碳(PAC)

- 顆粒活性碳(GAC)

- 擠壓或造粒活性碳

- 透過使用

- 氣體淨化

- 水處理

- 金屬提取

- 醫學領域

- 其他

- 按地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AdFiS products GmbH

- Albemarle Corporation

- Calgon Carbon Corporation(Kuraray)

- Carbon Activated Corporation

- CarboTech Group

- Desotec

- Donau Carbon GmbH

- Haycarb PLC

- Ingevity

- JACOBI CARBONS GROUP

- KUREHA CORPORATION

- Norit

- Puragen

第7章 市場機會與未來展望

The Europe Activated Carbon Market is expected to grow from USD 1.06 billion in 2025 to USD 1.12 billion in 2026 and is forecast to reach USD 1.45 billion by 2031 at 5.35% CAGR over 2026-2031.

This growth rests on converging environmental regulations, expanding municipal water quality mandates, and tightening industrial emission limits that collectively reinforce demand for rapid-deployment sorbent technologies across the region. Strong replacement cycles in water utilities, a looming PFAS compliance deadline in 2026, and the enlargement of the Industrial Emissions Directive 2.0 are pushing end users to lock in long-term supply contracts, securing predictable pricing and reactivation services. The European activated carbon market is also adapting to feedstock volatility by blending imported coconut shell char with regional hardwood or lignite sources, while simultaneously investing in circular reactivation capacity that cuts disposal fees and lowers scope-3 emissions for customers

Europe Activated Carbon Market Trends and Insights

Tightening EU Industrial Emissions Limits

Revisions to the Industrial Emissions Directive broaden compliance coverage from large combustion plants to mid-scale boilers, smelting and foundries, compelling thousands of facilities previously below threshold to meet mercury and dust caps. Emission ceilings now stand at 1-4 µg/m3 for existing stacks and 1-2 µg/m3 for new builds, and the official BAT reference document explicitly names activated carbon injection as the primary path to meet the mercury target. Plant operators gravitate toward powdered formulations because duct-side injection systems can be engineered, ordered, and commissioned within an 18-month window, whereas fabric filter retrofits or wet scrubbers often exceed 50 months. EU Cohesion Funds reserve EUR 147 billion for clean-air objectives through 2027, shaving capital hurdles for smaller emitters. Consequently, the European activated carbon market registers rising forward orders for high-iodine PAC grades tailored to sulfur-rich flue gas. Equipment OEMs also report a surge in service contracts bundling carbon supply, silo rental, and spent carbon haul-back, reflecting customers' preference for turnkey compliance over component procurement.

Surging Demand from Municipal Water Utilities

Utilities in Germany, France, the Netherlands, and Belgium confront stricter micropollutant removal thresholds, leading to more frequent GAC change-outs and larger bids that roll media supply, vessel refurbishments, and reactivation into eight-year service lots. Germany alone consumes activated carbon worth EUR 130 million annually for municipal water polishing, equating to roughly 55,000 tons of virgin and reactivated material per year. Trace-substance rules being transposed under the revised Urban Wastewater Directive require 80-93% removal efficiency, levels consistently achieved by low-ash coconut shell or lignite-based GAC in tandem with biologically active filters. Procurement records show utilities favor dual-bed filter designs that retain hydraulic head yet extend media life by 18-24 months.

Price Volatility of Coconut Shell and Coal Feedstock

Coconut growing regions in Southeast Asia witnessed drought-driven shell shortages, sending CIF Europe prices up 38% between Q1 2024 and Q3 2025. Simultaneously, geopolitical tension in Eastern Europe constrained petcoke alternatives, forcing several small European kilns to idle capacity for maintenance during peak tender season. Large multi-feedstock players mitigated risk through long-term offtake agreements with Philippine copra mills and Colombian coal exporters, but price whiplash still squeezes profit margins for distributors lacking index-linked contracts. Utilities and food companies increasingly request price escalation clauses capped at 5% per annum, transferring part of the volatility to suppliers and intensifying the working-capital load across the Europe activated carbon market. Investment in European hardwood char projects provides some buffer, yet limited scale means bio-feedstock cannot fully displace imported coconut shell in high-purity applications.

Other drivers and restraints analyzed in the detailed report include:

- Mercury Emissions Cap in Coal and Biomass Co-firing

- Growth of Beverage Can-Line Filtration Capacity

- Availability of Emerging Biochar Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powdered Activated Carbons jointly captured 47.63% Europe activated carbon market share in 2025, reflecting entrenched use in flue-gas injection systems across lignite and biomass boilers, and it is projected to grow at a 5.63% CAGR as more mid-scale stacks fall under the Industrial Emissions Directive. PAC's sub-45 µm particle size coupled with halogen impregnation elevates mercury uptake capacity to 1.8-2.4 mg Hg/g carbon, outperforming baseline coal-derived powders.

Granular Activated Carbons account for most water purification spending, driven by PFAS deadlines. Extruded carbons remain indispensable in solvent recovery and pharmaceutical air purification because their cylindrical geometry lowers pressure drop and resists attrition in high-velocity beds. Looking forward, PAC suppliers are experimenting with coconut-shell precursors that combine low ash content with micropore dominance, targeting both mercury and dioxin capture to stay relevant once coal plants retire. These innovations ensure the Europe activated carbon market maintains continuous product renewal rather than slipping into commoditization.

The Europe Activated Carbon Report is Segmented by Type (Powdered Activated Carbons, Granular Activated Carbons, and Extruded or Pelletized Activated Carbons), Application (Gas Purification, Water Purification, Metal Extraction, Medicine, and Others), and Geography (Germany, United Kingdom, France, Italy, Spain, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AdFiS products GmbH

- Albemarle Corporation

- Calgon Carbon Corporation (Kuraray)

- Carbon Activated Corporation

- CarboTech Group

- Desotec

- Donau Carbon GmbH

- Haycarb PLC

- Ingevity

- JACOBI CARBONS GROUP

- KUREHA CORPORATION

- Norit

- Puragen

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening EU industrial-emissions limits

- 4.2.2 Surging demand from municipal water utilities

- 4.2.3 Mercury-emissions cap in coal and biomass co-firing

- 4.2.4 Growth of beverage can-line filtration capacity

- 4.2.5 Rising PFAS removal mandates in groundwater

- 4.3 Market Restraints

- 4.3.1 Price volatility of coconut-shell and coal feedstock

- 4.3.2 Availability of emerging biochar substitutes

- 4.3.3 Carbon-footprint penalties on coal-based grades

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Rivalry

- 4.6 Supply Scenario

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Powdered Activated Carbons (PAC)

- 5.1.2 Granular Activated Carbons (GAC)

- 5.1.3 Extruded or Pelletized Activated Carbons

- 5.2 By Application

- 5.2.1 Gas Purification

- 5.2.2 Water Purification

- 5.2.3 Metal Extraction

- 5.2.4 Medicine

- 5.2.5 Others

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AdFiS products GmbH

- 6.4.2 Albemarle Corporation

- 6.4.3 Calgon Carbon Corporation (Kuraray)

- 6.4.4 Carbon Activated Corporation

- 6.4.5 CarboTech Group

- 6.4.6 Desotec

- 6.4.7 Donau Carbon GmbH

- 6.4.8 Haycarb PLC

- 6.4.9 Ingevity

- 6.4.10 JACOBI CARBONS GROUP

- 6.4.11 KUREHA CORPORATION

- 6.4.12 Norit

- 6.4.13 Puragen

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment