|

市場調查報告書

商品編碼

1906003

歐洲化妝品包裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Europe Cosmetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

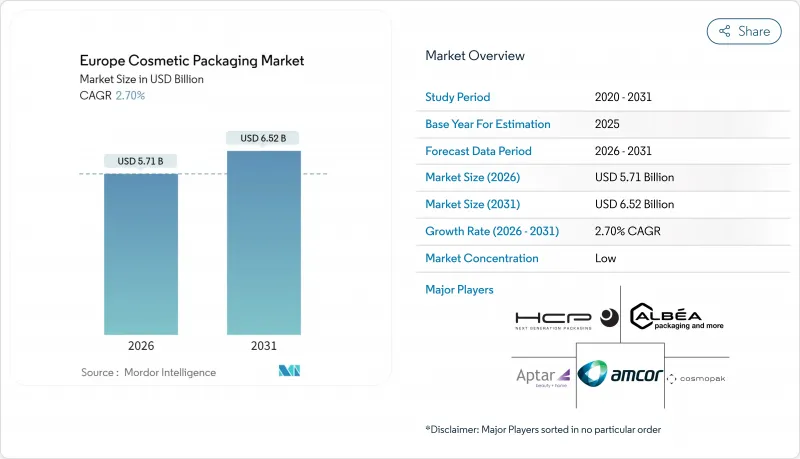

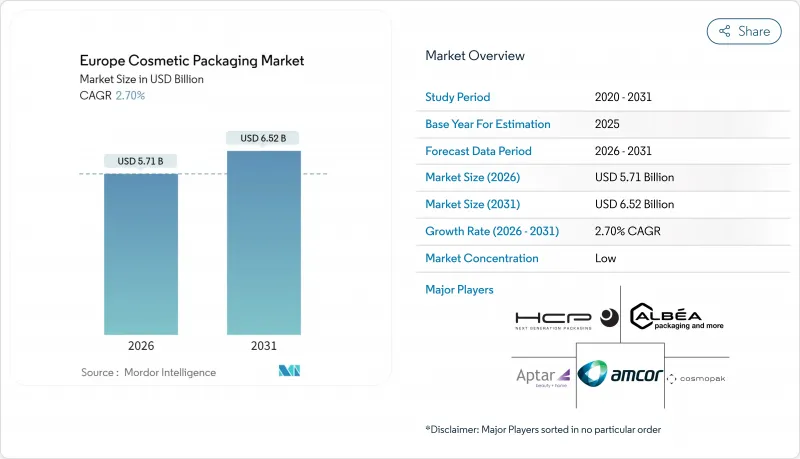

據估計,到 2026 年,歐洲化妝品包裝市場價值將達到 57.1 億美元。

這代表著從 2025 年的 55.6 億美元成長到 2031 年的 65.2 億美元,2026 年至 2031 年的複合年成長率為 2.7%。

溫和的銷售成長掩蓋了更廣泛的結構性變化,歐盟包裝和包裝廢棄物法規強制要求轉向可回收形式,引入最低再生材料含量標準,並加速向單一材料和可重複填充解決方案的轉型。需求模式也受到電子商務履約要求、偏好極簡主義美學的年輕消費群以及用於驗證產品真實性和收集行為數據的智慧功能的快速整合等因素的影響。隨著材料創新、人工智慧驅動的設計工具以及報廢回收基礎設施資金籌措方面規模經濟的重要性日益凸顯,競爭日益激烈。再生PET供應鏈的瓶頸和生物基聚合物的成本溢價限制了市場前景,同時也為垂直整合和專業化公司創造了新的機會。

歐洲化妝品包裝市場趨勢與洞察

可填充和可重複使用形式的普及

在歐洲主要市場,隨著品牌展現高階美學和低碳足跡,補充裝產品的銷售量成長了62%。 Lumson的XTAG無氣系統在維持高階外觀和觸感的同時,與傳統包裝相比,可減少38%的二氧化碳排放。嬌韻詩與Albéa合作推出了首款可補充裝玻璃瓶,標誌著奢侈品牌開始廣泛採用這種包裝形式。消費者態度積極,64%的受訪者認為可補充裝產品真正環保,而非妥協之舉。一項技術創新:FASTEN BV的再生聚丙烯玻璃瓶採用可堆疊式內嵌件,可減少70%的材料用量。補充裝模式能夠創造持續的收入來源,並透過增加與消費者的直接接觸來增強品牌忠誠度。

促進包裝和包裝廢棄物法規(PPWR)

2024年12月最終確定的《包裝和包裝廢棄物法規》(PPWR)設定了2030年實現100%可回收包裝和最低消費後回收成分含量的目標。歐洲化妝品協會(Cosmetics Europe)雖然承認統一法規帶來的成本節約機會,但也對可能影響視覺差異化的創意限制表示擔憂。迷你化妝品瓶的禁令迫使企業重新設計產品,改變了商店陳列方式。實施成本對大型企業更有利,推動了產業整合,例如Quadpac和Texen的合併。統一的生產者延伸責任制可以減少監管碎片化,但對於受歐盟以外不同法規約束的全球品牌而言,會增加監管的複雜性。

生物基聚合物高成本

儘管原油價格上漲,聚乳酸和生物基PET的價格仍比化石基同類產品高出30-50%,這使得無法利用規模經濟的中小品牌難以進入市場。由於亞洲產能擴張,歐洲在全球生物聚合物生產中的佔有率已從13%下降至10%。原料供應限制也是一個因素,因為糖和澱粉作物與食品市場有競爭。生物基產品可能還需要阻隔塗層和穩定劑,這會使回收過程變得複雜並增加配方調整成本。因此,許多加工商優先考慮再生材料含量策略,而不是生物基材料,以更低的成本滿足PPWR(塑膠包裝廢棄物)的要求。

細分市場分析

塑膠包裝憑藉其多功能性、透明度和低廉的單位成本,預計將在2025年佔據歐洲化妝品包裝市場61.78%的佔有率。同時,可生物分解和可堆肥包裝雖然目前規模較小,但預計到2031年將以4.42%的複合年成長率成長,這反映了技術進步和監管利好因素(基於將於2028年生效的PPWR工業堆肥法規)。注塑拉伸吹塑成型的投資持續推動著這一領域的發展,該技術能夠在不犧牲抗衝擊性的前提下製造出更薄的壁厚。然而,樹脂構成比正在改變。物料平衡生物基PET和機械回收PET的商店佔有率正在上升,尤其是在高階護膚系列中,這些產品需要一定的溢價。玻璃憑藉其奢華的形象,在香水和高階精華液領域保持著強大的市場地位,而鋁製容器則因其無限循環利用的特性,在固態護髮產品中越來越受歡迎。

儘管塑膠仍保持著規模優勢,但主要加工商已宣布將研發預算重點放在材料循環利用。 AINIA 的穀物基生物管採用食品級材料,展現了商業性可行性,並符合堆肥要求。多層阻隔材料正逐步取代單一材料解決方案,例如 Albéa 的聚丙烯口紅盒。隨著材料選擇更加重視在性能和生命週期結束時的環境影響之間取得平衡,那些已建立生物基直接替代和閉合迴路樹脂認證的加工商有望獲得更大的市場佔有率。

2025年,瓶罐包裝佔總收入的36.10%,而隨著分銷管道向線上轉移,預計到2031年,軟包裝袋和小袋的年複合成長率將達到5.02%。立式袋比硬PET容器輕70%,從而減少了運輸排放和配送成本。小袋多包裝兼具分量控制和節省空間的優點,對數位履約中心極具吸引力。軟管包裝以其精準的計量噴嘴,仍然是彩妝品和防曬油產品的核心包裝形式。瓶蓋和施用器正朝著單一聚合物設計方向發展,以提高可回收性,例如Albéa的聚丙烯「Breizhstick」產品。

以往僅限於低價產品的軟性包裝結構,如今已融入了適用於高解析度柔版印刷和高階睡眠眼罩的無鋁氣體阻隔層。加工商正在推廣小批量數位印刷,以支援限量版網紅合作產品。可折疊紙盒將繼續作為禮品包裝使用,同時重量更輕,並取消了塑膠窗口。產品組合經理會評估保護性(剛性)和最後一公里配送負載之間的權衡,並透過虛擬跌落測試進行最佳化。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 可重複填充和可重複使用容器的激增

- 推廣歐盟包裝和包裝廢棄物法規(PPWR)

- 電子商務主導的對防護和美觀的需求

- 用於原產地證明和防偽的智慧/互聯包裝

- Z世代偏好極簡主義、單一材質的設計

- 人工智慧驅動的設計最佳化可縮短產品上市時間

- 市場限制

- 生物基聚合物高成本

- 歐盟再生PET(rPET)供不應求

- 國家層級綠色稅收體系的片段化

- 因「漂綠」訴訟帶來的品牌風險

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 依材料類型

- 塑膠

- 玻璃

- 金屬

- 紙和紙板

- 可生物分解/可堆肥

- 依產品類型

- 瓶子和罐子

- 管狀棒

- 折疊紙箱

- 幫浦、分配器、滴管

- 瓶蓋、封口、施用器

- 軟包裝袋和小袋

- 依化妝品類型

- 護膚

- 護髮

- 彩妝品

- 香味

- 其他化妝品類型

- 透過分銷管道

- 銷售管道

- 間接銷售管道

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Albea SA

- AptarGroup Inc.

- Amcor Plc

- Silgan Holdings Inc.

- Gerresheimer AG

- Quadpack Industries, SA

- Berlin Packaging LLC

- International Paper Company

- Smurfit WestRock

- Hcp Packaging Co., Ltd.

- Coverpla SAS

- Cosmopak USA LLC

- Huhtamaki Oyj

- Graham Packaging Company

- Mondi Group

- Sealed Air Corporation

- Rexam Plc(Ball Corporation)

- Raepak Ltd.

- Stoelzle Glass Group

第7章 市場機會與未來展望

The Europe cosmetic packaging market size in 2026 is estimated at USD 5.71 billion, growing from 2025 value of USD 5.56 billion with 2031 projections showing USD 6.52 billion, growing at 2.7% CAGR over 2026-2031.

Moderate top-line growth masks far-reaching structural change as the EU Packaging and Packaging Waste Regulation compels a pivot to recyclable formats, pushes minimum recycled content thresholds, and accelerates the shift toward mono-material and refillable solutions. Demand patterns are also shaped by e-commerce fulfillment requirements, a younger consumer base favoring minimalist aesthetics, and the rapid integration of smart features that authenticate products and capture behavioral data. Competitive intensity increases as scale economies become critical for financing material innovation, AI-enabled design tools, and end-of-life collection infrastructure. Supply chain bottlenecks for recycled PET and the cost premium on bio-based polymers temper the outlook yet simultaneously create white-space opportunities for vertically integrated or specialty players.

Europe Cosmetic Packaging Market Trends and Insights

Surge in Refillable and Reusable Formats

Sales of refill solutions increased 62% across major European markets as brands validate luxury aesthetics and lower carbon footprints. Lumson's XTAG airless system delivers a 38% CO2 reduction versus traditional formats while retaining a premium look and feel. Clarins introduced its first refillable jar with Albea, signaling mainstream adoption among prestige brands. Consumer sentiment is supportive, with 64% viewing refill products as genuinely eco-friendly rather than compromise solutions. Technical breakthroughs, such as FASTEN BV's recycled polypropylene jar cut material use by 70% through stackable inserts. The refill model also creates recurring revenue streams and strengthens brand loyalty by increasing direct interaction frequency.

Packaging and Packaging Waste Regulation (PPWR) Push

Final adoption of the Packaging and Packaging Waste Regulation in December 2024 introduces binding targets for 100% recyclable packaging and minimum post-consumer recycled content by 2030. Cosmetics Europe acknowledged opportunities in cost savings from harmonized rules, yet expressed concern about creative restrictions that could impact visual differentiation. The ban on miniature cosmetic bottles compels redesigns that reshape the on-shelf presence. Implementation costs favor larger players, driving consolidation as seen in the Quadpack-Texen merger. Harmonized Extended Producer Responsibility schemes reduce regulatory fragmentation but add complexity for global brands managing divergent non-EU rules.

High Cost Differential for Bio-Based Polymers

Prices for polylactic acid and bio-PET run 30% to 50% above fossil-based equivalents despite higher crude prices, locking out smaller brands that lack scale leverage. Europe's share of global bio-polymer output slipped from 13% to 10% as Asian capacity ramped faster. Feedstock constraints add volatility because sugar and starch crops compete with food markets. Reformulation costs also mount, as bio-based grades sometimes need barrier coatings or stabilizers, complicating recycling streams. Consequently, many converters prioritize recycled content strategies over bio-feedstocks to attain PPWR mandates at lower cost.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce-Led Demand for Protective Aesthetics

- Smart or Connected Packaging for Provenance and Anti-counterfeit

- Intra-EU rPET Supply Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic formats captured 61.78% share of the European cosmetic packaging market in 2025 on the back of versatility, clarity, and low unit cost. At the same time, biodegradable and compostable options, though small today, are set to post a 4.42% CAGR to 2031, reflecting technical advances and regulatory tailwinds anchored in the PPWR industrial compostability provision effective 2028. The segment continues to benefit from injection-stretch-blow investments that achieve thin-wall reductions without compromising impact resistance. Yet the resin mix is shifting. Mass-balance bio-PET and mechanically recycled PET are gaining shelf presence, especially among premium skin-care lines that accept moderate price premiums. Glass retains a loyal niche in fragrances and high-end serums due to perceived luxury, whereas aluminum containers win favor in solid haircare bars thanks to infinite recyclability.

Although plastics maintain a scale advantage, every major converter has announced R&D budgets focusing on material circularity. AINIA's cereal-based biotube demonstrates commercial feasibility with food-grade inputs and addresses compostability requirements. Multilayer barriers are gradually giving way to mono-material solutions such as Albea's polypropylene lipstick case. As material decision-making balances performance with end-of-life outcomes, converters that master drop-in bio-based grades or closed-loop resin certification stand to capture share.

Bottles and jars contributed 36.10% of 2025 revenue, yet flexible pouches and sachets are projected to log a 5.02% CAGR to 2031 as the channel mix tilts online. Stand-up pouches reduce weight by up to 70% versus rigid PET, trimming freight emissions and parcel costs. Sachet multi-packs combine portion control with space efficiency, traits attractive to digital fulfillment nodes. Tubes remain a core platform for color cosmetics and sun protection owing to precision dosing nozzles. Caps and applicators move toward single-polymer designs that aid recyclability, evidenced by Albea's Breizhstick, built entirely from polypropylene.

Flexible structures formerly limited to economy lines now feature high-definition flexo graphics and aluminum-free gas barriers suitable for prestige overnight masks. Converters push digital printing for small batch runs aligned with limited-edition influencer collaborations. Folding cartons keep a role in gifting but undergo weight reduction and removal of plastic windows. Portfolio managers weigh the trade-off between protective rigidity and last-mile shipping stress, optimizing through virtual drop tests.

The Europe Cosmetic Packaging Market Report is Segmented by Material Type (Plastic, Glass, Metal, and More), Product Type (Bottles and Jars, Tubes and Sticks, Folding Cartons, Pump, Dispenser and Droppers, and More), Cosmetic Type (Skin Care, Hair Care, Color Cosmetics, and More), Distribution Channel (Direct Sales Channel, and Indirect Sales Channel), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Albea SA

- AptarGroup Inc.

- Amcor Plc

- Silgan Holdings Inc.

- Gerresheimer AG

- Quadpack Industries, S.A.

- Berlin Packaging L.L.C.

- International Paper Company

- Smurfit WestRock

- Hcp Packaging Co., Ltd.

- Coverpla S.A.S

- Cosmopak USA LLC

- Huhtamaki Oyj

- Graham Packaging Company

- Mondi Group

- Sealed Air Corporation

- Rexam Plc (Ball Corporation)

- Raepak Ltd.

- Stoelzle Glass Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in refillable and reusable formats

- 4.2.2 EU Packaging and Packaging-Waste Regulation (PPWR) push

- 4.2.3 E-commerce - led demand for protective aesthetics

- 4.2.4 Smart/connected packaging for provenance and anti-counterfeit

- 4.2.5 Gen-Z preference for minimalist, mono-material designs

- 4.2.6 AI-enabled design optimization lowering time-to-market

- 4.3 Market Restraints

- 4.3.1 High cost differential for bio-based polymers

- 4.3.2 Intra-EU rPET supply shortages

- 4.3.3 Country-level green-tax fragmentation

- 4.3.4 Brand risk from green-washing litigation

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper and Paperboard

- 5.1.5 Bio-degradable/Compostable

- 5.2 By Product Type

- 5.2.1 Bottles and Jars

- 5.2.2 Tubes and Sticks

- 5.2.3 Folding Cartons

- 5.2.4 Pump, Dispenser and Droppers

- 5.2.5 Caps, Closures and Applicators

- 5.2.6 Flexible Pouches and Sachets

- 5.3 By Cosmetic Type

- 5.3.1 Skin Care

- 5.3.2 Hair Care

- 5.3.3 Color Cosmetics

- 5.3.4 Fragrances

- 5.3.5 Other Cosmetic Types

- 5.4 By Distribution Channel

- 5.4.1 Direct Sales Channel

- 5.4.2 Indirect Sales Channel

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Albea SA

- 6.4.2 AptarGroup Inc.

- 6.4.3 Amcor Plc

- 6.4.4 Silgan Holdings Inc.

- 6.4.5 Gerresheimer AG

- 6.4.6 Quadpack Industries, S.A.

- 6.4.7 Berlin Packaging L.L.C.

- 6.4.8 International Paper Company

- 6.4.9 Smurfit WestRock

- 6.4.10 Hcp Packaging Co., Ltd.

- 6.4.11 Coverpla S.A.S

- 6.4.12 Cosmopak USA LLC

- 6.4.13 Huhtamaki Oyj

- 6.4.14 Graham Packaging Company

- 6.4.15 Mondi Group

- 6.4.16 Sealed Air Corporation

- 6.4.17 Rexam Plc (Ball Corporation)

- 6.4.18 Raepak Ltd.

- 6.4.19 Stoelzle Glass Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment