|

市場調查報告書

商品編碼

1905993

石膏板:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Plasterboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

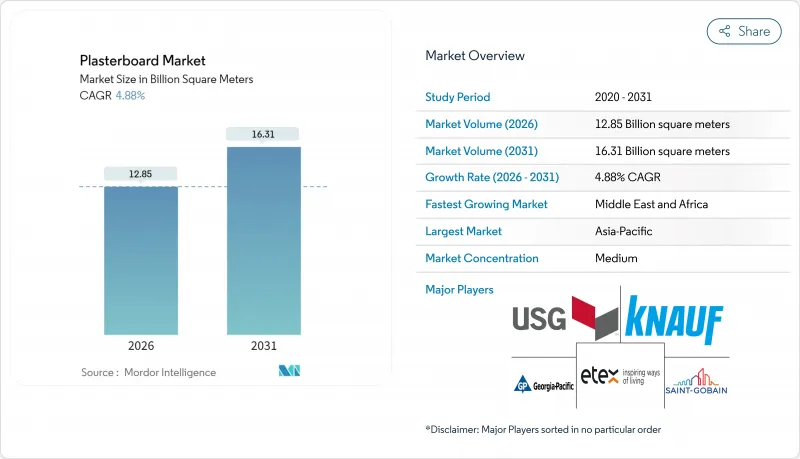

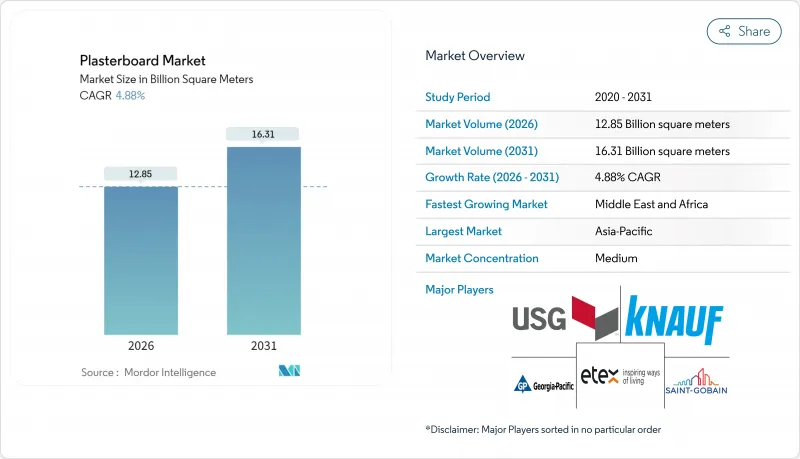

2025年石膏板市場價值為122.5億平方公尺,預計到2031年將達到163.1億平方公尺,而2026年為128.5億平方公尺。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.88%。

這一成長軌跡反映了乾式施工方法的加速普及、綠色建築法規的日益嚴格以及合成石膏供應鏈的擴張。為了加快施工進度,建築商傾向於選擇輕質板材以減少工時;監管機構也正在實施低揮發性有機化合物(VOC)排放標準,這有利於採用再生材料製成的石膏解決方案。亞太地區的快速都市化、沿岸地區的大型企劃以及北美和歐洲商業地產的復甦,都在擴大石膏板的潛在市場。來自煤炭依賴型經濟體排煙脫硫廠的合成石膏價格具有競爭力,降低了原料成本,從而鼓勵製造商擴大生產。隨著各大品牌實施閉合迴路回收系統以滿足掩埋限制並透過永續性實現差異化,預計市場競爭將更加激烈。

全球石膏板市場趨勢與洞察

快速從濕式施工方法過渡到乾式施工方法

承包商青睞石膏板系統,因為它施工效率高,工期可預測。沙烏地阿拉伯的大型開發計劃,例如NEOM,都指定使用標準化的石膏板組裝,以最大限度地減少現場維護延誤。建築規範認可石膏板品質穩定,且不易受潮。此外,安裝工具、接縫密封劑和飾面配件的需求也在不斷成長,從而擴大了石膏板市場。製造商正在開發更薄、尺寸更穩定的板材,使其與預製模組相容。

亞洲和海灣合作理事會地區規劃的大型住宅大型企劃將推動需求成長

印度、印尼和沙烏地阿拉伯的都市化政策正在推動大規模住宅建設計畫,而這些建設為與板材生產商簽訂長期供應協議奠定了基礎。印度的基礎建設計畫(預計到2035年投資額將達到1.4兆美元)正在支持區域製造商擴大產能。密集型發展縮短了物流距離,提高了板材規格的一致性,從而增強了規模經濟效益。

對潮濕的敏感性和黴菌風險會增加修復成本。

潮濕的石膏板會導致黴菌滋生,造成住宅平均1.5萬至5萬美元的保險索賠。沿海地區的建築管理部門現在指定使用防潮等級的石膏板,但這些產品的價格高出15%至25%。一些開發商在高風險地區改用纖維水泥板。新興地區缺乏技術純熟勞工,減緩了石膏板的市場普及速度。

細分市場分析

截至2025年,斜邊石膏板將佔石膏板市場61.42%的佔有率。其凹形邊緣簡化了接縫處理,已成為住宅室內裝修的標準配置。然而,隨著模組化建築的普及,斜邊石膏板的市場規模預計將低於整體需求成長。同時,由於建築師擴大採用外露接縫以配合物流設施和工業計劃的極簡主義設計,預計到2031年,方邊石膏板的市場將以5.03%的複合年成長率成長。

方邊石膏板可與工廠預製建築中使用的金屬框架和預製面板無縫銜接,減少了打磨和膩子的工作量。承包商認為,減少低技能工人的工時是其主要優勢之一。與此同時,住宅和室內維修仍然偏愛斜邊帶來的無縫外觀。製造商正在推出帶有微倒角邊緣的混合型石膏板,兼顧了速度和美觀性,徵兆石膏板市場在形狀偏好正在趨於融合。

石膏板市場報告按形狀(直角邊和斜角邊)、類型(標準型、防火型、隔熱型、防潮型、隔音型和抗衝擊型)、最終用途(住宅和非住宅)以及地區(亞太地區、北美地區、歐洲地區、南美地區以及中東和非洲地區)進行細分。市場預測以平方公尺為單位。

區域分析

亞太地區石膏板市場受益於持續的公共住宅政策以及以石膏板為標準建材的工廠化生產規模的擴大。來自區域發電廠的合成石膏有助於降低成本,從而支撐了價格競爭力。隨著各國政府實施抗震防火法規並提高板材厚度標準,每平方公尺的平均材料用量也增加。

在中東和非洲,由於沙烏地阿拉伯、科威特和埃及的大型計劃,板材消費量正在成長。惡劣的氣候條件和緊迫的工期推動了對防潮輕質板材的需求。當地製造商正與全球大型企業合作,促進技術轉移並建立聯合物流網路,以減少對進口的依賴。

歐洲正優先發展循環經濟,獎勵那些擁有回收計畫和近乎零廢棄物記錄的工廠。英國石膏公司(British Gypsum)的再生石膏板產品Soundblock符合嚴格的掩埋限制。北美正在投資興建以可再生能源為動力的電氣化工廠,將該地區打造成為零碳石膏板生產的試驗場。拉丁美洲的人均消費量雖然落後,但隨著商業建築的現代化,其消費量正穩定成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 快速從濕式施工方法過渡到乾式施工方法

- 亞洲和海灣合作理事會地區的大型企劃住宅規劃將推動需求成長

- 更嚴格的綠建築標準要求板材VOC含量低、再生材料含量高。

- 新興市場價格競爭力強的合成石膏供應量不斷擴大,將推動其應用。

- 歐洲和美國回收再生用石膏短缺,推動了對循環系統的投資。

- 市場限制

- 潮濕敏感性和黴菌滋生風險會增加修復成本。

- 石膏和能源價格的波動正在給生產商的利潤率帶來壓力。

- 嚴格的石膏廢棄物掩埋禁令增加了處置成本。

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按形式

- 方邊

- 錐形

- 按類型

- 標準

- 耐火性能

- 隔熱

- 防潮性能

- 隔音

- 抗衝擊性

- 透過使用

- 住宅

- 非住宅

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率/排名分析

- 公司簡介

- Ahmed Yousuf & Hassan Abdullah Co.(AYHACO)

- American Gypsum Company LLC

- AtIskan AlcI

- AWI Licensing LLC

- CSR Limited

- Etex Group

- Fletcher Building

- Georgia-Pacific

- GYPSEMNA CO LLC

- Gyptec Iberica

- Holcim

- Jason New Materials

- Knauf Group

- Mada Gypsum Company

- National Gypsum Services Company

- Saint-Gobain

- USG Boral

- VOLMA

第7章 市場機會與未來展望

The Plasterboard Market was valued at 12.25 Billion square meters in 2025 and estimated to grow from 12.85 Billion square meters in 2026 to reach 16.31 Billion square meters by 2031, at a CAGR of 4.88% during the forecast period (2026-2031).

This growth trajectory reflects the accelerating adoption of dry construction techniques, stricter green-building mandates, and the expansion of synthetic gypsum supply chains. Contractors seeking shorter project cycles are opting for lightweight boards that reduce labor hours, while regulators are implementing low-VOC requirements that favor gypsum solutions formulated with recycled content. Rapid urbanization in the Asia-Pacific, megaprojects in the Gulf, and commercial real-estate recovery in North America and Europe are widening the addressable plasterboard market. Price-competitive synthetic gypsum sourced from flue-gas desulfurization plants in coal-reliant economies is lowering raw material costs, encouraging manufacturers to scale up their output. Competitive intensity is poised to rise as leading brands deploy closed-loop recycling systems to comply with landfill restrictions and differentiate on sustainability.

Global Plasterboard Market Trends and Insights

Rapid Shift Toward Dry Construction Techniques Over Wet Methods

Builders favor dry systems for labor efficiency and predictable timelines. Saudi mega-developments, such as NEOM, specify standardized drywall assemblies to minimize on-site curing delays. Building codes now recognize drywall for its consistent quality and reduced moisture defects. Demand is spreading to installation tools, joint compounds, and finishing accessories, enlarging the plasterboard market. Manufacturers are engineering thinner, dimensionally stable boards compatible with prefabricated modules.

Residential Megaproject Pipelines in Asia and GCC Boost Volume Demand

Urbanization policies in India, Indonesia, and Saudi Arabia are driving mass housing programs that anchor long-term supply contracts with board producers. India's infrastructure plan valued at USD 1.4 trillion up to 2035 underpins capacity expansions by regional manufacturers. Clustered developments reduce logistics miles and promote consistent board specifications, reinforcing economies of scale.

Moisture Sensitivity and Mold Risk Increase Remediation Costs

Boards that remain damp can foster mold, triggering insurance claims that average USD 15,000-50,000 per dwelling. Building authorities in coastal zones now specify moisture-resistant grades, yet these products cost 15-25% more. Some developers switch to fiber cement in high-risk sites. Skilled labor for correct vapor-barrier installation is limited in emerging regions, which slows the uptake of plasterboard in the market.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Green-Building Codes Mandate Low-VOC, High-Recycled-Content Boards

- Price-Competitive Synthetic Gypsum Supply in Emerging Markets Widens Adoption

- Volatile Gypsum and Energy Prices Squeeze Producer Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tapered-edge boards commanded 61.42% of the plasterboard market share in 2025. Their recessed edges simplify joint finishing and remain the default for residential interiors. The plasterboard market size for tapered boards is expected to grow at a slower pace than overall demand as modular construction gains ground. Square-edge products are projected to advance at a 5.03% CAGR through 2031, as architects in logistics and industrial projects increasingly adopt exposed joints that align with minimalist design.

Square-edge boards integrate seamlessly with metal framing and pre-finished panels used in factory-built construction, reducing the need for sanding and compound use. Contractors cite lower-skilled labor hours as the chief gain. In contrast, homeowners and interior renovators still prefer the seamless appearance enabled by tapered edges. Manufacturers are marketing hybrid boards with micro-beveled edges that balance speed and aesthetics, a sign of converging form preferences within the plasterboard market.

The Plasterboard Market Report is Segmented by Form (Square-Edge and Tapered), Type (Standard, Fire-Resistant, Thermal-Insulated, Moisture-Resistant, Sound-Resistant, and Impact-Resistant), End-Use Sector (Residential and Non-Residential), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Square Meters).

Geography Analysis

The Asia-Pacific's plasterboard market benefits from sustained public housing initiatives and factory construction that adopts drywalling as the default. Synthetic gypsum sourced from regional power plants lowers costs and supports competitive pricing. Governments are adopting seismic and fire regulations that increase board thickness standards, pushing average material intensity per square meter higher.

The Middle East and Africa region is scaling board consumption through giga-projects in Saudi Arabia, Kuwait, and Egypt. Harsh climate conditions and rapid schedules make moisture-resistant and lightweight boards attractive. Local producers partner with global majors to facilitate technology transfer and establish joint logistics networks, thereby reducing import dependency.

Europe emphasizes circular economy objectives, rewarding plants with take-back schemes and near-zero-waste performance. British Gypsum's recycled-content SoundBloc line meets stringent landfill limits. North America invests in electrified factories sourcing renewable power, positioning the region as a testing ground for zero-carbon board production. Latin America lags in per-capita consumption but is seeing gradual growth tied to commercial interiors modernization.

- Ahmed Yousuf & Hassan Abdullah Co. (AYHACO)

- American Gypsum Company LLC

- AtIskan AlcI

- AWI Licensing LLC

- CSR Limited

- Etex Group

- Fletcher Building

- Georgia-Pacific

- GYPSEMNA CO LLC

- Gyptec Iberica

- Holcim

- Jason New Materials

- Knauf Group

- Mada Gypsum Company

- National Gypsum Services Company

- Saint-Gobain

- USG Boral

- VOLMA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid shift toward dry construction techniques over wet methods

- 4.2.2 Residential megaproject pipelines in Asia and GCC boost volume demand

- 4.2.3 Tightening green-building codes mandate low-VOC, high-recycled-content boards

- 4.2.4 Price-competitive synthetic gypsum supply in emerging markets widens adoption

- 4.2.5 Recycling-grade gypsum shortages in the West spur investment in closed-loop systems

- 4.3 Market Restraints

- 4.3.1 Moisture sensitivity and mould risk increase remediation costs

- 4.3.2 Volatile gypsum/energy prices squeeze producer margins

- 4.3.3 Stringent landfill bans on gypsum waste raise disposal costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Volume)

- 5.1 By Form

- 5.1.1 Square-edge

- 5.1.2 Tapered

- 5.2 By Type

- 5.2.1 Standard

- 5.2.2 Fire-resistant

- 5.2.3 Thermal-insulated

- 5.2.4 Moisture-resistant

- 5.2.5 Sound-resistant

- 5.2.6 Impact-resistant

- 5.3 By End-use Sector

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Nordic Countries

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Ahmed Yousuf & Hassan Abdullah Co. (AYHACO)

- 6.4.2 American Gypsum Company LLC

- 6.4.3 AtIskan AlcI

- 6.4.4 AWI Licensing LLC

- 6.4.5 CSR Limited

- 6.4.6 Etex Group

- 6.4.7 Fletcher Building

- 6.4.8 Georgia-Pacific

- 6.4.9 GYPSEMNA CO LLC

- 6.4.10 Gyptec Iberica

- 6.4.11 Holcim

- 6.4.12 Jason New Materials

- 6.4.13 Knauf Group

- 6.4.14 Mada Gypsum Company

- 6.4.15 National Gypsum Services Company

- 6.4.16 Saint-Gobain

- 6.4.17 USG Boral

- 6.4.18 VOLMA

7 Market Opportunities & Future Outlook

- 7.1 White-space and Unmet-need Assessment