|

市場調查報告書

商品編碼

1852205

腦機介面:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Brain-computer Interface - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

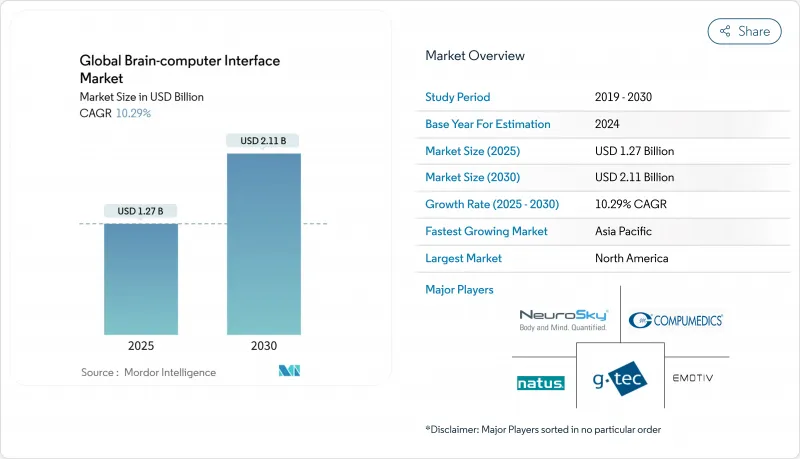

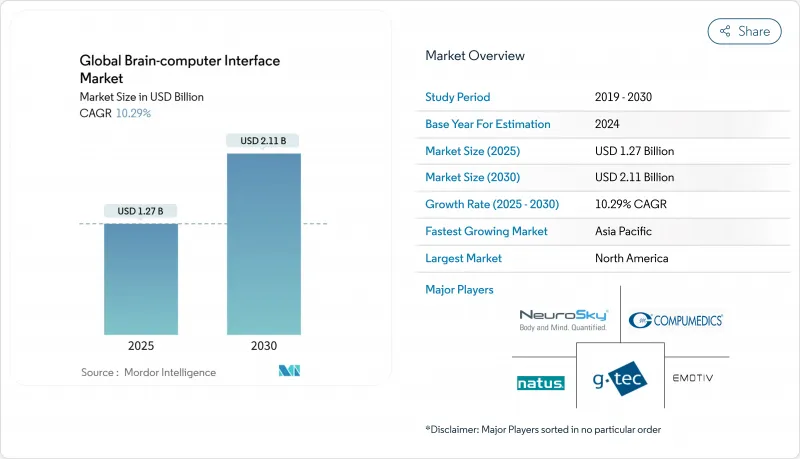

全球腦機介面市場預計到 2025 年價值 12.7 億美元,預計到 2030 年將達到 21.1 億美元,預測期(2025-2030 年)複合年成長率為 10.29%。

資本流入、硬體平台日趨成熟,以及神經解碼與先進人工智慧的結合,是推動這項擴張的關鍵因素。資金籌措持續縮短商業化進程,醫院加速採用植入式解決方案,而消費級頭戴裝置則將腦機介面市場拓展至遊戲、健康和人機共生等領域。混合訊號架構和軟體定義功能進一步推動產品差異化,而政府資助的臨床試驗則提升了安全性和倫理標準。在需求方面,神經退化性疾病的日益普遍以及人們對輔助溝通工具日益成長的需求,正將臨床使用者推向產生收入的核心地位。

全球腦機介面市場趨勢與洞察

對輔助通訊技術的需求迅速成長

一項由美國國立衛生研究院資助的研究使癱瘓患者的言語功能恢復清晰,詞語級準確率高達99%。 [2] 隨後,Syncron公司將其內建支架的植入植入與生成式人工智慧模型結合,使更多使用者能夠實現免手輸入。醫院報告稱,治療週期縮短,患者自主性評分提高,臨床適用族群也從肌萎縮側索硬化症(ALS)擴展到創傷性脊髓損傷和腦幹中風(使用者數據)。美國私人保險公司已開始考慮對語音解碼植入進行早期報銷,這表明支付方越來越認可其對患者生活品質的持久改善作用。歐洲的教學醫院目前正將語言模型增強型腦機介面(BCI)納入多學科神經復健計劃,從而促進了該技術在整個全部區域的中期應用。

腦電圖穿戴式頭戴裝置的快速普及

遊戲工作室、電競組織者和消費者健康品牌正在將乾電極頭戴裝置整合到互動遊戲、健身課程和冥想平台中。主播們正在展示透過神經輸入實現對遊戲的完全控制,而競技聯賽則在嘗試利用專注力和情緒狀態數據進行教練指導。這些應用正在不斷完善低延遲訊號提取演算法,加速設備小型化,並向非相關人員受眾普及腦機互動的日常益處。隨著出貨量的成長,規模經濟將開始降低單位成本,使供應商能夠捆綁訂閱式分析服務,並提高每位用戶的收入。

手術風險和監管障礙

植入式系統具有極佳的訊號保真度,但需要進行顱腦和血管手術,因此僅在少數醫療中心可用。電極移位、感染和設備召回的報告引起了臨床醫生和支付方的擔憂。監管機構要求長期的安全監測,這延長了產品上市時間並增加了試驗預算。這些障礙使得早期應用僅限於資金雄厚的教學醫院和富裕的自費患者,減緩了其廣泛普及。供應商已透過改進支架等輸送工具和開發可逆植入來應對這些挑戰,但他們仍需要經歷長達數年的核准途徑。

細分市場分析

非侵入式頭戴裝置和電極陣列將佔2024年收入的76.50%,凸顯了它們作為眾多腦機介面市場開發者的入門級產品的地位。採用乾電極和低功耗藍牙技術的產品推出,縮短了設定時間,提高了舒適度,並支援虛擬實境遊戲和遠端神經反饋等日常應用場景。醫院重視降低手術風險,而消費品牌則利用監管門檻低的優勢加快產品上架速度。儘管競爭日益激烈,價格下降和信噪比提高仍將持續支撐兩位數的成長。

軟體和演算法層正以12.10%的複合年成長率快速成長,超過了硬體的成長速度。基於變壓器的解碼器、遷移學習和自校準框架正推動資訊傳輸速率實現三位數的成長。這些進步正在催生一個新的SaaS細分市場,預計到2030年,該市場規模將從19億美元成長到51億美元。服務供應商為缺乏內部專業知識的臨床買家提供雲端儀錶板、電氣維護合約和合規性審核。這些業務活動維持了均衡的綜合收益,使供應商免受純硬體業務帶來的利潤擠壓。

到2024年,馬達/動力平台將佔總支出的50.90%,這反映了臨床上優先考慮恢復癱瘓患者遊標控制、輪椅導航和義肢控制的功能。非侵入式深度學習解碼器能夠實現亞秒響應時間,其成功演示已使其應用範圍擴展到加護病房之外。消費級開發者正在將這些突破性技術應用於擴增實境頭戴裝置和智慧家庭設備中的無手勢輸入,進一步推動了該領域的成熟。

結合腦電圖 (EEG)、肌電圖 (EMG)、功能性近紅外線光譜 (fNIRS) 或聚焦超音波的混合架構正以 13.56% 的複合年成長率 (CAGR) 成長。融合多種神經和周邊訊號可提高可靠性,並校正單模態系統常見的偽跡。在一項中風復健實驗室設備研究中,83% 的患者在接受兩週的混合腦肌訓練後,恢復了可測量的手部功能。隨著組件成本的下降,混合電路可望從實驗室走向模組化消費級配件市場。

區域分析

美國仍將是腦機介面市場的中心,預計到2024年將佔全球收入的48.54%。美國國立衛生研究院的資助、雄厚的創投資金以及專業的營運團隊,共同支持涵蓋語音解碼、互動式感官知覺和憂鬱症神經調控等領域的持續試驗。該地區受益於率先將報銷測試整合到臨床工作流程中的醫療保健系統,加速了支付方的接受度。隱私法正在快速發展,這不僅增加了合規成本,也為那些早期投資於安全資料架構的公司帶來了競爭優勢。

亞太地區將以12.56%的複合年成長率成為成長最快的地區,這主要得益於中國政府將腦機介面列為戰略產業。國家補貼正在推動產學研聯盟的發展,而新的標準化機構也致力於制定訊號擷取通訊協定和倫理準則。中國新興企業已在普通話語音解碼方面實現了71%的準確率,凸顯了該地區的強勁發展勢頭。日本的老齡化人口為神經退化性疾病的治療管理帶來了結構性需求促進因素,而韓國電子巨頭則在感測器小型化方面貢獻了其專業技術。

在歐洲,公共醫療保健系統為情緒改善試驗和中風復健計畫提供了大量資金。英國國家醫療服務體系(NHS)斥資650萬英鎊開展的基於超音波介面(BCI)試驗,進一步強化了政策層面對非藥物治療精神健康問題的承諾。即將訂定的歐盟人工智慧法案將把許多人工智慧醫療設備歸類為高風險產品,迫使供應商採用嚴格的網路安全和效能檢驗程序,這在其他地區可能成為競爭優勢。中東、非洲和南美洲正在投資遠距復健和遠端神經監測,充分利用行動連線和跨境培訓夥伴關係。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子競技和遊戲公司迅速採用基於腦電圖的穿戴式式耳機

- 在神經科技中心(矽谷、洛桑、維也納),高額資金籌措加速了產品商業化的進程。

- 政府活性化研發投入,以改善技術

- 日本和歐盟老化社會中神經退化性疾病盛行率的上升促使臨床試驗的進行

- 市場限制

- 手術風險和監管障礙限制了植入式腦機介面系統的應用。

- 關於神經資料收集的資料隱私問題

- 公共醫療保健系統中基於腦機介面的復健治療報銷代碼匱乏

- 大眾市場腦電圖設備中,頭髮和頭皮電阻導致訊號精度面臨挑戰。

- 供應鏈分析

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 替代品的威脅

- 買方的議價能力

- 供應商的議價能力

- 產業間競爭

第5章 市場規模與成長預測

- 按組件

- 硬體

- 侵入性

- 非侵入性

- 其他

- 軟體與演算法

- 服務

- 硬體

- 按介面類型

- 馬達/輸出 BCI

- 腦機通訊

- 被動式/監測式腦機介面

- 混合腦機介面

- 透過使用

- 神經假體和運動功能恢復

- 通訊與控制

- 其他

- 最終用戶

- 醫院和診所

- 研究和學術機構

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭格局

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- G-Tech醫療工程股份有限公司

- 貝萊德神經科技

- Emotive 公司

- NeuroSky公司

- 核心

- 平行賽跑

- 心靈迷宮 SA

- 認知

- CTRL-Labs(元平台)

- Next Mind(Snap 公司)

- 開放式腦機介面

- 同步

- 神經質

- BrainCo, Inc.

- 軸間(繆斯)

- BitBrain Technologies

- 賽博動力學

- 工業株式會社

- 電腦化醫療

- Alea 神經治療學

第7章 市場機會與未來展望

The Global Brain-computer Interface Market size is estimated at USD 1.27 billion in 2025, and is expected to reach USD 2.11 billion by 2030, at a CAGR of 10.29% during the forecast period (2025-2030).

Capital inflows, maturing hardware platforms, and the pairing of neural decoding with advanced artificial intelligence are the primary forces behind this expansion. Venture funding continues to shorten commercialization timelines, hospitals accelerate early adoption of implantable solutions, and consumer-facing headsets extend the reach of the Brain-Computer Interface market into gaming, well-being, and human-machine symbiosis. Hybrid signal architectures and software-defined features further support product differentiation, while government-funded clinical trials push forward standards for safety and ethics . On the demand side, rising prevalence of neuro-degenerative disorders and heightened expectations for assistive communication tools keep clinical users at the core of revenue generation.

Global Brain-computer Interface Market Trends and Insights

Surging demand for assistive communication technologies

National Institutes of Health-backed research restored intelligible speech for a paralyzed patient with 99% word-level accuracy [2]. Synchron subsequently paired its Stentrode implant with a generative-AI model, enabling hands-free texting for additional users. Hospitals report shorter caregiver cycles and higher patient-autonomy scores, expanding the clinical addressable pool beyond ALS to traumatic spinal-cord injury and brain-stem stroke (user data). Private insurers in the United States have begun reviewing early reimbursement cases for speech-decoding implants, indicating growing payer recognition of durable quality-of-life gains. European teaching hospitals now integrate language-model-enhanced BCIs in multidisciplinary neuro-rehabilitation programs, reinforcing mid-term adoption across the region.

Rapid adoption of EEG-based wearable headsets

Gaming studios, e-sports organizers, and consumer-wellness brands integrate dry-electrode headsets into interactive titles, fitness programs, and meditation platforms. Streamers demonstrate full-gameplay control with neural inputs, while competitive leagues trial concentration and emotional-state data for coaching. These deployments sharpen algorithms for low-latency signal extraction, accelerate miniaturization, and educate non-medical audiences on everyday benefits of brain-computer interaction. As shipments grow, economies of scale begin to lower unit costs, allowing vendors to bundle subscription-based analytics that deepen revenue per user.

Surgical risks and regulatory hurdles

Implantable systems deliver superior signal fidelity yet involve cranial or vascular procedures that few centers can perform. Reports of electrode migration, infection, and device retrieval create caution among clinicians and insurers. Regulatory agencies require lengthy safety monitoring, stretching time-to-market and inflating trial budgets. These obstacles confine early adoption to well-funded academic hospitals and wealthy self-pay patients, slowing broad penetration. Vendors respond by refining stent-like delivery tools and developing reversible implants but must still navigate multi-year approval pathways.

Other drivers and restraints analyzed in the detailed report include:

- High VC funding in neuro-tech hubs

- Rising R&D activities by government

- Data-privacy concerns over neural data collection

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-invasive headsets and electrode arrays generated 76.50% of 2024 revenue, underscoring their role as the entry point for many developers in the Brain-Computer Interface market. Product launches with dry electrodes and low-energy Bluetooth have reduced setup times and improved comfort, enabling everyday usage scenarios such as virtual-reality gaming and remote neurofeedback. Hospitals appreciate the avoidance of surgical risk, and consumer brands leverage lower regulatory hurdles to speed shelf placement. Price declines and improved signal-to-noise ratios continue to support double-digit growth despite intensifying competition.

Software and algorithm layers are expanding at a 12.10% CAGR, a pace that outstrips hardware because every incremental headset installation yields recurring licensing opportunities. Transformer-based decoders, transfer learning, and self-calibrating frameworks raise information-transfer rates by triple-digit percentages. These advances create an emergent SaaS sub-segment forecast to climb from USD 1.9 billion to USD 5.1 billion by 2030. Service providers follow close behind, offering cloud dashboards, electrode-maintenance contracts, and compliance audits to clinical buyers who lack in-house specialists. Together, these activities sustain a balanced revenue mix that shields vendors from pure hardware margin compression.

Motor/output platforms accounted for 50.90% of spending in 2024, reflecting clinical priorities around restoring cursor control, wheelchair navigation, and prosthetic manipulation for paralysis patients. Successful demonstrations of non-invasive deep-learning decoders capable of sub-second response rates have widened appeal beyond the intensive-care unit. Consumer developers adapt these breakthroughs to gesture-less input for augmented-reality headsets and smart-home devices, reinforcing the segment's maturity.

Hybrid architectures, combining EEG, electromyography, functional near-infrared spectroscopy, or focused ultrasound, are on course for 13.56% CAGR. They lift reliability by fusing multiple neural and peripheral signals, thereby compensating for artifacts that hamper single-modality systems. Experimental stroke-rehabilitation rigs illustrate the benefit: after two weeks of hybrid brain-muscle training, 83% of patients regained measurable hand function. As component costs fall, hybrid circuitry will migrate from the laboratory into modular consumer accessories.

The Brain Computer Interface Market Report Segments by Component (Hardware, Software & Algorithm and Services), by Interface (Motor BCI, Communication BCI, and More), by Application (Neuro-Prosthetics & Motor Restoration and More), by End User (Hospitals & Clinics, Research & Academic Institutes, and Others) and by Geography ( Northa America, Europe and More) the Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 48.54% of 2024 revenue and remains the anchor of the Brain-Computer Interface market. National Institutes of Health funding, deep venture pools, and specialized surgical teams underpin a continuous trial pipeline that spans speech decoding, bidirectional sensation, and neuromodulation for depression. The region benefits from early adopter health systems that integrate reimbursement studies into clinical workflows, accelerating payer acceptance. Privacy legislation is evolving rapidly, creating both compliance overhead and competitive advantage for firms that invest early in secure data architectures.

Asia-Pacific delivers the fastest 12.56% CAGR, propelled by Chinese government designation of brain-machine interfaces as a strategic industry. State grants encourage industrial-academic consortia, while new standards bodies tackle signal-acquisition protocols and ethical guidelines. Chinese start-ups have already demonstrated 71% accuracy in decoding Mandarin speech, underscoring regional momentum. Japan's aging demographics add a structural demand driver for neuro-degenerative disease management, and South-Korean electronics majors contribute sensor miniaturization expertise.

Europe holds a significant share, with public-health systems funding mood-enhancement trials and stroke-recovery programs. The National Health Service's GBP 6.5 million ultrasound-based BCI trial reinforces policy-level commitment to non-pharma approaches for mental-health conditions. The forthcoming EU AI Act classifies many AI-enabled medical devices as high-risk, compelling vendors to adopt rigorous cyber-security and performance-validation procedures that can become competitive differentiators in other regions. Smaller but growing markets in the Middle East, Africa, and South America invest in tele-rehabilitation and remote neuromonitoring, leveraging mobile connectivity and cross-border training partnerships.

- g.tec medical engineering

- Blackrock Neurotech

- Emotiv, Inc.

- NeuroSky, Inc.

- Kernel

- Paradromics, Inc.

- MindMaze SA

- Cognixion

- CTRL-Labs (Meta Platforms)

- NextMind (Snap Inc.)

- OpenBCI

- Synchron

- Neurable

- BrainCo, Inc.

- Interaxon Inc. (Muse)

- Bitbrain Technologies

- Cyberkinetics

- Nihon Kohden

- Compumedics

- Alea Neurotherapeutics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of EEG-based wearable headsets by eSports and gaming companies

- 4.2.2 High VC funding in neuro-tech hubs (Silicon Valley, Lausanne, Vienna) accelerating product commercialization timelines

- 4.2.3 Rising R&D Activities by Government to Improve the Technology

- 4.2.4 Rising prevalence of neuro-degenerative disorders in ageing populations of Japan and EU spurring clinical trials

- 4.3 Market Restraints

- 4.3.1 Surgical risks and regulatory hurdles limiting adoption of implantable BCI systems

- 4.3.2 Data-privacy concerns over neural data collection

- 4.3.3 Scarcity of reimbursement codes for BCI-based rehabilitation therapies in public healthcare systems

- 4.3.4 Signal accuracy challenges due to hair & scalp impedance in mass-market EEG devices

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Threat of Substitutes

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Bargaining Power of Suppliers

- 4.6.5 Industry Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Component (Value)

- 5.1.1 Hardware

- 5.1.1.1 Invasive

- 5.1.1.2 Non-invasive

- 5.1.1.3 Others

- 5.1.2 Software & Algorithms

- 5.1.3 Services

- 5.1.1 Hardware

- 5.2 By Interface Type (Value)

- 5.2.1 Motor / Output BCI

- 5.2.2 Communication BCI

- 5.2.3 Passive / Monitoring BCI

- 5.2.4 Hybrid BCI

- 5.3 By Application (Value)

- 5.3.1 Neuro-prosthetics & Motor Restoration

- 5.3.2 Communication & Control

- 5.3.3 Others

- 5.4 By End-User (Value)

- 5.4.1 Hospitals & Clinics

- 5.4.2 Research & Academic Institutes

- 5.4.3 Others

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia- Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 6. Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 g.tec medical engineering GmbH

- 6.4.2 Blackrock Neurotech

- 6.4.3 Emotiv, Inc.

- 6.4.4 NeuroSky, Inc.

- 6.4.5 Kernel

- 6.4.6 Paradromics, Inc.

- 6.4.7 MindMaze SA

- 6.4.8 Cognixion

- 6.4.9 CTRL-Labs (Meta Platforms)

- 6.4.10 NextMind (Snap Inc.)

- 6.4.11 OpenBCI

- 6.4.12 Synchron Inc.

- 6.4.13 Neurable

- 6.4.14 BrainCo, Inc.

- 6.4.15 Interaxon Inc. (Muse)

- 6.4.16 Bitbrain Technologies

- 6.4.17 Cyberkinetics

- 6.4.18 Nihon Kohden Corporation

- 6.4.19 Compumedics Ltd

- 6.4.20 Alea Neurotherapeutics