|

市場調查報告書

商品編碼

1852199

工業控制系統安全:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Industrial Control Systems Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

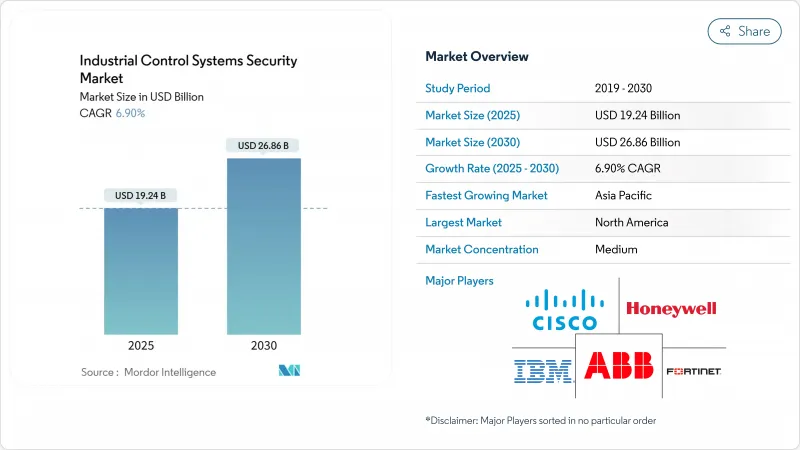

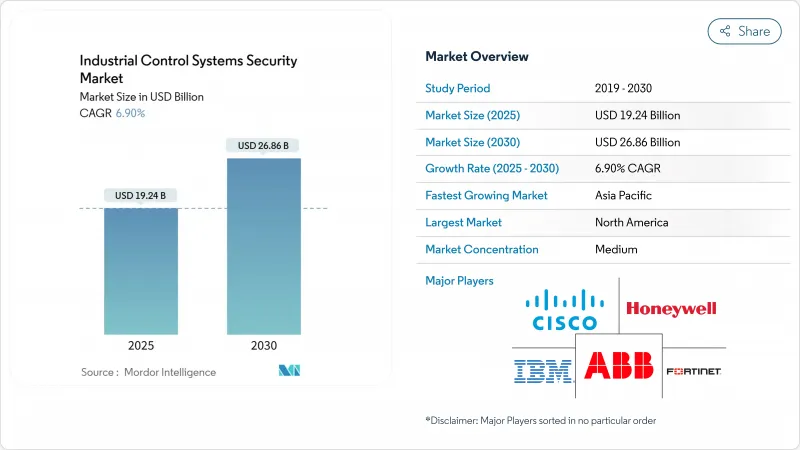

預計到 2025 年,工業控制系統安全市場規模將達到 192.4 億美元,到 2030 年將達到 268.6 億美元,預測期(2025-2030 年)複合年成長率為 6.90%。

董事會層級優先考慮操作技術網路彈性、IT-OT網路整合以及日益猖獗的勒索軟體活動,這些因素共同推動了持續的需求。北美憑藉NERC CIP-013和CIRCIA的快速事件通報要求等法規,維持領先地位。亞太地區正經歷快速成長,電力公司和離散製造業正在對其SCADA資產進行現代化改造,並大規模連接工業物聯網(IIoT)設備。儘管解決方案仍然是重要的收入促進因素,但託管安全服務也呈現兩位數的成長,這表明在OT技能人才日益短缺的情況下,企業正在轉向全天候外包監控。網路分段和深度封包檢測是目前部署的主流技術,而隨著託管歷史資料庫和遠端維護入口網站的興起,雲端/遠端存取保護也正在蓬勃發展。

全球工業控制系統安全市場趨勢與洞察

加速工業物聯網主導的營運技術連接,變革製造業安全

預計到2025年,全球將有750億連網型設備,其中三分之一將安裝在工廠內,這將使傳統生產線面臨前所未有的網路風險。歐洲和日本的離散製造企業正在整合視覺系統、機器人和預測性維護感測器,這需要進行東西向流量檢測和零信任分段。這種日益成長的資料流給傳統的邊界防禦帶來了壓力,迫使企業在乙太網路/IP、PROFINET和Modbus網路中部署通訊協定感知型偵測工具。供應商正在積極應對,推出適用於資源受限控制器的輕量級代理和深度檢測(DPI)感測器,這些感測器能夠在不中斷生產週期的情況下分析專有的工業框架。隨著IT和OT團隊共同管理資產,對能夠映射普渡安全等級0-3級並自動部署策略的統一儀錶板的需求日益成長。預算負責人正擴大將安全支出與整體設備效率(OEE)指標掛鉤,從而強化以避免停機為核心的投資回報率(ROI)評估。

監理合規推動關鍵基礎設施安全投資

北美NERC的CIP-013指令和歐盟的NIS2指令都規定了具有約束力的義務,涵蓋從供應鏈風險管理到72小時事件報告等各個面向。公共產業、交通網和化工廠正在加速採購,以避免可能超過年收入2%的罰款。這些法規也將網路安全討論從工程團隊提升到執行委員會層面,縮短了提供可審核報告和證據收集服務的供應商的銷售週期。整合商可以透過捆綁資產發現、配置監控和安全檔案傳輸功能,同時滿足兩項標準,並簡化跨司法管轄區的合規性。保險公司要求在保單續保前提供ICS分段證明,並降低保費,這進一步推動了ICS安全市場的發展動能。

舊有系統整合難題阻礙了安全實施

現代防火牆和異常檢測引擎必須適應已有20年歷史、缺乏加密韌體和基於角色的存取控制的PLC。改裝通常需要分階段停機,這會影響電力分配和合約規定的服務等級協議。 46%的資產所有者需要長達六個月的時間來修補關鍵漏洞,延長了漏洞暴露的時間窗口。成本效益的考量延緩了全面微隔離計劃,導致一些營運商轉向部分實施方案,例如只讀被動監控,這種方案雖然提供了可見性,但卻保留了寫入存取路徑。

細分市場分析

預計到2024年,解決方案將佔據68%的收入佔有率,市場規模將達到131億美元。防火牆、通訊協定感知型入侵防禦系統(IPS)、身分閘道器和漏洞掃描器構成了第一波普及浪潮的基石。隨著供應商縮短簽章更新周期並整合人工智慧分析技術以即時標記零日漏洞,相關支出正在穩步成長。工業控制系統安全市場目前正在湧現整合平台,這些平台能夠以普渡大學層級採集日誌,並添加上下文資訊以更快地進行根本原因分析。

服務板塊預計在2024年達到61億美元,並將在2030年之前維持11.2%的複合年成長率,成為成長最快的板塊。託管式偵測和回應服務將遠端一級故障排查與現場事件處理人員結合,使工廠能夠在滿足72小時報告義務的同時保持運作。整合和部署合作夥伴負責連接不同的供應商技術堆疊,將資產清單對應到ISA/IEC 62443區域,然後配置分層控制。諮詢團隊透過攻擊鏈模擬來評估成熟度,並制定與資本支出更新周期一致的分階段藍圖。支援和維護合約確保韌體更新和定期規則集調整,幫助一家受嚴格監管的能源公司將平均修補時間縮短30%以上。

到2024年,網路安全將佔收入的37%,營運商將優先考慮實體和虛擬隔離設備,這些設備能夠過濾通訊協定並將流量鏡像到被動收集器。零信任架構隔離人機介面 (HMI)、歷史資料庫和工程工作站,防止IT子網路之間的橫向移動。威脅情報源被注入到工業級入侵指標 (IOC) 中,幫助安全營運中心 (SOC) 團隊阻止惡意的營運技術 (OT) 特定命令序列。

隨著工廠採用數位孿生技術和供應商輔助維護門戶,雲端/遠端存取安全預計將以 12.5% 的複合年成長率 (CAGR) 實現最高成長。多因素身份驗證閘道器、即時會話仲介和持續態勢評估有助於應對網際網路暴露端點帶來的日益成長的風險。端點安全工具透過無代理監控來強化 PLC、RTU 和感測器,從而追蹤韌體狀態和記憶體完整性。應用層防禦利用動態程式碼分析來偵測 MES 和批次執行軟體中的不安全調用,而資料庫防火牆則保護時間序列運作資料免遭洩露。

區域分析

到2024年,北美將佔全球銷售額的33%。美國聯邦在重大資料外洩事件後加強了監管力度,敦促資產所有者採納美國網路安全和基礎設施安全局(CISA)的「Shield Up」建議,並在規定期限內提交漏洞報告。對人手不足的泵站和風電場進行安全遠端存取的投資正在加速。加拿大國家網路威脅評估警告稱,敵對國家可能會擾亂能源出口,並敦促各省監管機構與北美電力可靠性委員會(NERC)的網路安全改進計劃(CIP)框架保持一致。

亞太地區2025年至2030年的複合年成長率將達8.3%,位居全球之首。中國正將網路安全防護擴展到數千個變電站,將本土防火牆品牌與全球分析引擎結合。日本正在升級其機器人深度封包檢測。韓國正在利用其5G骨幹網,要求對控制指令進行毫秒加密和身分疊加。印度正在水力發電發電工程中更換串口轉乙太網路轉換器,並插入檢測分接器,為國家級安全營運中心(SOC)提供資料。隨著本地人才儲備的成熟,東協中小企業正依賴廠商託管的安全營運中心。

隨著NIS2將執法範圍擴大到中型關鍵營業單位,歐洲仍然是至關重要的市場。德國聯邦資訊安全局(BSI)推動跨行業漏洞諮詢資訊共用,而法國國家資訊安全局(ANSSI)則制定了分段檢查清單。英國公用事業公司正在試行基於人工智慧的預測異常引擎,以滿足英國天然氣和電力市場監管局(Ofgem)的彈性目標。西班牙和義大利可再生能源的成長推動了對認證仲介的需求,以管理逆變器原始設備製造商(OEM)的現場維護。拉丁美洲以及中東和非洲地區正在穩步採取防禦措施。巴西公用事業公司正在實施PLC韌體的供應鏈認證,而墨西哥灣沿岸的管道營運商正在部署欺騙電網以阻止偵察。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速離散製造業中工業物聯網主導的營運技術連結(歐盟和日本)

- 關鍵基礎設施營運商必須遵守NERC CIP-013和歐盟NIS2標準

- 亞洲電力和水務公司老舊SCADA/DCS資產現代化改造

- 美國和中東地區石油和天然氣管道遭受勒索軟體攻擊激增

- 分散式可再生能源的發展需要遠端存取保護

- 採用雲端託管歷史資料庫和遠端維護平台

- 市場限制

- 傳統PLC維修成本高且停機時間長

- 東協中型製造商缺乏營運技術技能和網路安全人才

- 專有工業通訊協定的互通性有限

- 重複的IT/OT工具棧會延誤採購(「安全疲勞」)

- 價值/供應鏈分析

- 監理與技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 防火牆和入侵防禦系統

- 身分和存取管理

- 防毒和反惡意軟體

- 安全和漏洞管理

- 預防資料外泄和恢復

- 其他解決方案

- 服務

- 諮詢與評估

- 整合與部署

- 支援與維護

- 託管安全服務

- 解決方案

- 按安全類型

- 網路安全

- 端點安全

- 應用程式安全

- 資料庫安全

- 雲端/遠端存取安全

- 按控制系統類型

- 監控與數據採集(SCADA)

- 分散式控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 其他控制系統

- 按最終用戶行業分類

- 車

- 化工/石油化工

- 電力與公用事業

- 石油和天然氣

- 食品/飲料

- 製藥

- 用水和污水

- 採礦和金屬

- 運輸/物流

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Honeywell International Inc.

- Cisco Systems Inc.

- IBM Corporation

- Fortinet Inc.

- ABB Ltd.

- Rockwell Automation Inc.

- Dragos Inc.

- Nozomi Networks Inc.

- Palo Alto Networks Inc.

- Check Point Software Technologies Ltd.

- Darktrace Holdings Limited

- Broadcom Inc.(Symantec)

- Trellix

- Schneider Electric SE

- Siemens AG

- Kaspersky Lab

- GE Vernova(GE Digital)

- Claroty Ltd.

- Trend Micro Inc.

- AhnLab Inc.

第7章 市場機會與未來展望

The Industrial Control Systems Security Market size is estimated at USD 19.24 billion in 2025, and is expected to reach USD 26.86 billion by 2030, at a CAGR of 6.90% during the forecast period (2025-2030).

Board-level prioritization of operational technology cyber-resilience, convergence of IT-OT networks, and escalating ransomware activity underpin sustained demand. North America retains leadership thanks to regulations such as NERC CIP-013 and the rapid incident-reporting mandate in CIRCIA. Asia-Pacific delivers the steepest growth as utilities and discrete manufacturers modernize SCADA assets and connect IIoT devices at scale. Solutions remain the revenue backbone, yet double-digit expansion of managed security services shows enterprises shifting toward 24/7 outsourced monitoring amid an acute OT-skilled labor shortage. Network segmentation and deep-packet inspection dominate current deployments, while cloud/remote-access protection gains momentum with the rise of hosted historians and remote maintenance portals.

Global Industrial Control Systems Security Market Trends and Insights

Accelerating IIoT-driven OT Connectivity Transforms Manufacturing Security

One-third of the 75 billion connected devices expected in 2025 will sit inside factories, exposing legacy production lines to unprecedented cyber risk. European and Japanese discrete manufacturers are integrating vision systems, robotics, and predictive-maintenance sensors that require east-west traffic inspection and zero-trust segmentation. This intensified data flow strains traditional perimeter defenses and forces deployment of protocol-aware detection tools inside Ethernet/IP, PROFINET, and Modbus networks. Vendors respond with lightweight agents for resource-constrained controllers and DPI sensors that parse proprietary industrial frames without disrupting cycle times. As IT and OT teams co-manage assets, demand rises for unified dashboards that map Purdue levels 0-3 and automate policy rollouts. Budget holders increasingly tie security spend to overall equipment effectiveness metrics, reinforcing ROI narratives around avoided downtime.

Regulatory Compliance Drives Critical-Infrastructure Security Investment

NERC CIP-013 in North America and the EU's NIS2 Directive impose binding obligations ranging from supply-chain risk management to 72-hour incident reporting. Utilities, transport networks, and chemical plants accelerate procurements to avoid fines that can exceed 2% of annual turnover. The regulations also elevate cyber discussions from engineering teams to executive committees, compressing sales cycles for vendors offering audit-ready reporting and evidence collection. Integrators bundle asset-discovery, configuration-monitoring, and secure-file-transfer capabilities to meet both standards concurrently, simplifying multi-jurisdiction compliance. Momentum in the ICS security market is further boosted by insurers demanding proof of ICS segmentation before renewing coverage or lowering premiums.

Legacy System Integration Challenges Hinder Security Implementation

Modern firewalls and anomaly-detection engines must adapt to 20-year-old PLCs that lack encrypted firmware or role-based access controls. Retrofitting often requires staged shutdowns that jeopardize output quotas and contractual service-level agreements. Forty-six percent of asset owners need up to six months to patch a critical vulnerability, prolonging exposure windows. Cost-benefit debates delay full micro-segmentation projects, pushing some operators toward partial implementations like read-only passive monitoring, which offers visibility yet leaves write-access pathways unguarded.

Other drivers and restraints analyzed in the detailed report include:

- Aging Infrastructure Modernization Creates Security Imperatives

- Ransomware Targeting Critical Infrastructure Drives Security Urgency

- Cybersecurity Talent Gap Constrains Security Implementation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, the industrial control systems security market size attributed USD 13.1 billion to solutions, equal to a 68% revenue share. Firewalls, protocol-aware IPS, identity gateways, and vulnerability scanners formed the backbone of first-wave deployments. Spending grows steadily as vendors embed artificial-intelligence analytics that cut signature-update cycles and flag zero-day behaviors in real time. The industrial control systems security market now witnesses converged platforms that ingest logs across Purdue levels, enriching context for quicker root-cause correlation.

The services segment, valued at USD 6.1 billion in 2024, records the fastest 11.2% CAGR through 2030. Managed detection and response offerings combine remote tier-1 triage and on-site incident-handlers, allowing plants to maintain uptime while meeting 72-hour reporting mandates. Integration and deployment partners bridge heterogeneous vendor stacks, mapping asset inventories against ISA/IEC 62443 zones before configuring layered controls. Consulting teams benchmark maturity via kill-chain simulations, then craft phased roadmaps tied to capex refresh cycles. Support and maintenance contracts secure firmware updates and periodic rule-set tuning, reducing mean time to patch by more than 30% in highly regulated energy utilities.

Network security anchors 37% of 2024 revenues as operators prioritize physical and virtual segmentation appliances that filter protocol commands and mirror traffic to passive collectors. Zero-trust architectures isolate HMIs, historians, and engineering workstations, preventing lateral movement from IT subnets. Threat-intelligence feeds inject industrial IOCs, helping SOC teams block malicious OT-specific command sequences.

Cloud/remote-access security posts a 12.5% forecast CAGR, the highest among categories, as plants adopt digital twins and vendor-assisted maintenance portals. Multi-factor identity gateways, just-in-time session brokers, and continuous posture assessment counter the heightened risk from internet-exposed endpoints. Endpoint security tools harden PLCs, RTUs, and sensors with agentless monitoring that tracks firmware states and memory integrity. Application-layer defenses use dynamic code analysis to spot unsafe calls within MES and batch-execution software, while database firewalls safeguard time-series operational data against exfiltration.

The Industrial Control Systems ICS Security Market Report is Segmented by Component (Solutions, Services), Security Type (Network Security, Endpoint Security, Application Security, and More), Control System Type (SCADA, Distributed Control System (DCS), and More), End-User Industry (Automotive, Chemical & Petrochemical, Power and Utilities, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 33% of 2024 global revenue. Federal scrutiny intensified after headline breaches, prompting asset owners to adopt CISA's Shields-Up advisories and submit vulnerability reports within stipulated windows. Investments accelerate around secure remote access for sparsely staffed pumping stations and wind farms. Canada's National Cyber Threat Assessment warns that hostile states could disrupt energy exports, pushing provincial regulators to align with NERC CIP frameworks.

Asia-Pacific records the highest 8.3% CAGR from 2025 to 2030. China scales cyber-hygiene across thousands of new substations, blending domestic firewall brands with global analytics engines. Japan upgrades robot-dense automotive lines, coupling deep-packet inspection appliances with OT-aware SIEM integrations. South Korea leverages its 5G backbone, necessitating encryption and identity overlays for millisecond-latency control commands. India replaces serial-to-Ethernet converters in hydro projects, inserting inspection taps that feed national-level SOCs. ASEAN SMEs rely on vendor-hosted SOCs as local talent pipelines mature.

Europe remains a pivotal market as NIS2 expands enforcement to medium-sized critical entities. Germany's BSI drives cross-sector vulnerability advisory sharing, while France's ANSSI prescribes segmentation checklists. United Kingdom utilities pilot AI-based predictive anomaly engines to meet Ofgem resilience targets. Renewable-energy growth in Spain and Italy sparks demand for authentication brokers that manage inverter OEMs during field maintenance. Latin America and Middle East & Africa steadily adopt defenses; Brazilian utilities implement supply-chain attestation for PLC firmware, and Gulf pipeline operators deploy deception grids to deter reconnaissance.

- Honeywell International Inc.

- Cisco Systems Inc.

- IBM Corporation

- Fortinet Inc.

- ABB Ltd.

- Rockwell Automation Inc.

- Dragos Inc.

- Nozomi Networks Inc.

- Palo Alto Networks Inc.

- Check Point Software Technologies Ltd.

- Darktrace Holdings Limited

- Broadcom Inc. (Symantec)

- Trellix

- Schneider Electric SE

- Siemens AG

- Kaspersky Lab

- GE Vernova (GE Digital)

- Claroty Ltd.

- Trend Micro Inc.

- AhnLab Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating IIoT-driven OT Connectivity in Discrete Manufacturing (EU and Japan)

- 4.2.2 Mandatory NERC CIP-013 and EU NIS2 Compliance for Critical Infrastructure Operators

- 4.2.3 Modernization of Ageing SCADA/DCS Assets in Asian Power and Water Utilities

- 4.2.4 Surge in Ransomware Attacks on Oil and Gas Pipelines (US and Middle East)

- 4.2.5 Growth of Distributed Renewables Requiring Remote-Access Protection

- 4.2.6 Adoption of Cloud-hosted Historians and Remote Maintenance Platforms

- 4.3 Market Restraints

- 4.3.1 High Retrofit Costs and Downtime for Legacy PLCs

- 4.3.2 OT-Skilled Cyber-Talent Shortage in Mid-size ASEAN Manufacturers

- 4.3.3 Limited Interoperability of Proprietary Industrial Protocols

- 4.3.4 Procurement Delays from IT/OT Tool-Stack Overlap ("Security Fatigue")

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Firewall and IPS

- 5.1.1.2 Identity and Access Management

- 5.1.1.3 Antivirus and Antimalware

- 5.1.1.4 Security and Vulnerability Management

- 5.1.1.5 Data Loss Prevention and Recovery

- 5.1.1.6 Other Solutions

- 5.1.2 Services

- 5.1.2.1 Consulting and Assessment

- 5.1.2.2 Integration and Deployment

- 5.1.2.3 Support and Maintenance

- 5.1.2.4 Managed Security Services

- 5.1.1 Solutions

- 5.2 By Security Type

- 5.2.1 Network Security

- 5.2.2 Endpoint Security

- 5.2.3 Application Security

- 5.2.4 Database Security

- 5.2.5 Cloud/Remote Access Security

- 5.3 By Control System Type

- 5.3.1 Supervisory Control and Data Acquisition (SCADA)

- 5.3.2 Distributed Control System (DCS)

- 5.3.3 Programmable Logic Controller (PLC)

- 5.3.4 Other Control Systems

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Chemical and Petrochemical

- 5.4.3 Power and Utilities

- 5.4.4 Oil and Gas

- 5.4.5 Food and Beverage

- 5.4.6 Pharmaceuticals

- 5.4.7 Water and Wastewater

- 5.4.8 Mining and Metals

- 5.4.9 Transportation and Logistics

- 5.4.10 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Cisco Systems Inc.

- 6.4.3 IBM Corporation

- 6.4.4 Fortinet Inc.

- 6.4.5 ABB Ltd.

- 6.4.6 Rockwell Automation Inc.

- 6.4.7 Dragos Inc.

- 6.4.8 Nozomi Networks Inc.

- 6.4.9 Palo Alto Networks Inc.

- 6.4.10 Check Point Software Technologies Ltd.

- 6.4.11 Darktrace Holdings Limited

- 6.4.12 Broadcom Inc. (Symantec)

- 6.4.13 Trellix

- 6.4.14 Schneider Electric SE

- 6.4.15 Siemens AG

- 6.4.16 Kaspersky Lab

- 6.4.17 GE Vernova (GE Digital)

- 6.4.18 Claroty Ltd.

- 6.4.19 Trend Micro Inc.

- 6.4.20 AhnLab Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment