|

市場調查報告書

商品編碼

1852191

歐洲焊接設備:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Europe Welding Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

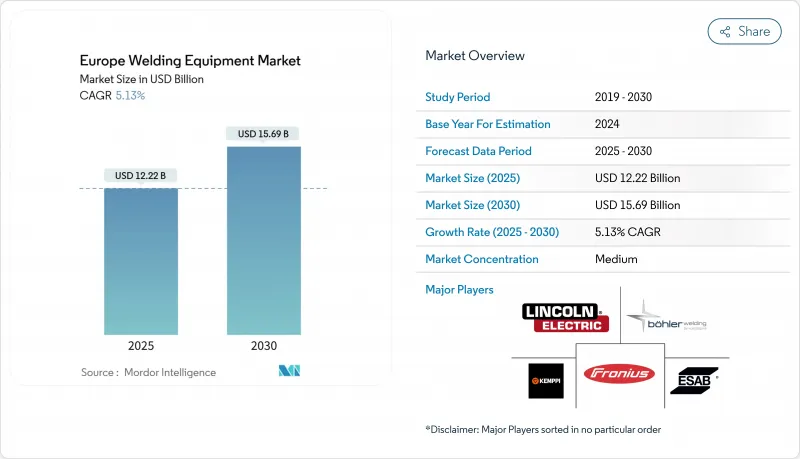

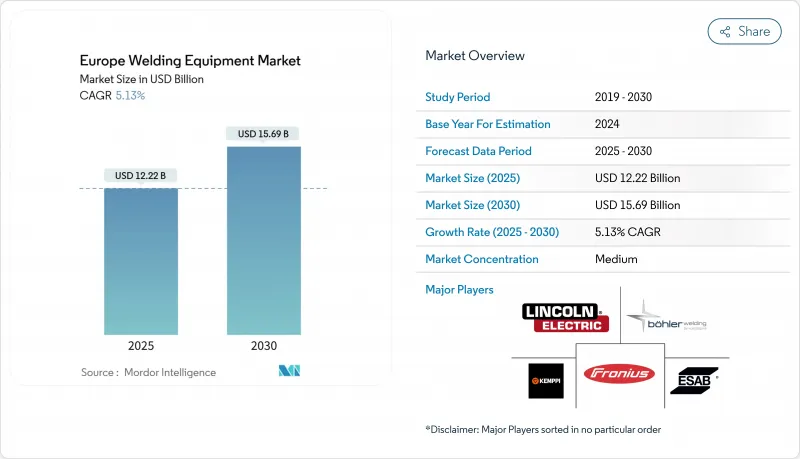

歐洲焊接設備市場預計到 2025 年將達到 122.2 億美元,到 2030 年將達到 156.9 億美元,年複合成長率為 5.13%。

市場擴張反映了設備現代化進程的加速,企業正朝著整合感測器、軟體和機器人技術的工業4.0生產單元邁進。電池組組裝和電動車輕型鋁材連接的需求成長最為迅速,而綠色交易基礎設施項目則支持公共部門採購大型焊接系統。供應商之間的競爭不再局限於價格,而是轉向製程創新、光束品質更高的雷射光源、電磁輻射更低的逆變式電源以及焊接數據分析平台。合格焊工的持續短缺推動了自動化投資的增加,中型企業紛紛採用協作機器人單元來應對勞動力市場波動。

歐洲焊接設備市場趨勢與洞察

自動化和機器人技術在歐洲生產線上的普及

歐洲各地的製造商正在部署機器人焊接單元,以填補30萬焊工的缺口並滿足ISO 3834品質要求。自適應控制演算法可即時調節電流和焊接速度,進而提高複雜接頭幾何形狀的輪胎邊緣一致性。一家德國汽車供應商報告稱,在整合與人類工人共用工作區域的協作機器人後,生產週期縮短了40%。數位雙胞胎可在部署前最佳化焊接路徑,從而縮短試運行週期並提高整體工廠效率。隨著模組化單元價格更加親民,並可透過三至五年的租賃方式融資,其應用正從一級OEM廠商逐步擴展到中級供應商。最終結果是:生產效率提高,勞動力短缺不再是瓶頸,而是現代化的催化劑。

電動車相關焊接需求快速成長

電池托盤和外殼的製造需要將鋁和鋼連接起來,同時也要限制熱影響區。工作波長為 1030 奈米的光纖雷射可實現超過 10 公尺/分鐘的熔深,取代了電阻點焊,並省去了 6000 系列擠壓件的後處理。這項轉變符合聯合國歐洲經濟委員會 (UN ECE) R100 安全法規對電池組公差的更高要求。隨著歐洲整合商提高生產線產能以滿足不斷成長的電動車產量,通快 (TRUMPF) 已延長了其多千瓦雷射系統的前置作業時間。製程監控模組可記錄熔池尺寸和能量輸入,從而建立對車輛認證審核至關重要的可追溯性記錄。因此,對雷射焊接的投資滿足了兩個基本要求:生產效率和合規性。

對先進雷射系統的大量資本投入

雷射焊接單元的單價在20萬至200萬歐元之間,配套的通風和防護設備可能使計劃總成本翻倍。儘管雷射焊接單元能顯著提高生產效率,但超過五年的投資回收期仍阻礙了中小企業購買。租賃公司對高功率雷射設備收取高額風險溢價,而這些設備的殘值難以確定,這進一步擴大了資金籌措缺口。每年高達5萬歐元的維護合約費用,用於光學元件、冷卻系統和軟體更新,也增加了總擁有成本。因此,即使精度要求更高,許多小型加工企業仍繼續使用半自動MAG焊接機,而忽略了雷射焊接方案的優勢。

細分市場分析

預計到2024年,電弧焊接將佔據歐洲焊接設備市場56.76%的佔有率,並在2030年之前以5.0%的複合年成長率成長。電弧焊市場主要應用於土木工程、造船和工廠維護等領域,這些領域對便攜性和厚截面的要求極高。雷射和等離子焊接系統在鋁製車身部件和薄板電子機殼銷量成長最為迅速,因為用戶追求更小的熱影響區和更快的焊接速度。受電子產品小型化和歷史建築修復的推動,歐洲其他焊接工藝(包括釬焊、硬焊和鍛焊)的市場規模正以7.99%的複合年成長率成長。耗材供應商正在推出用於異種金屬連接的鋁鎳合金填充材料,新興企業則在焊接設備中整合光學感測器,以記錄輪胎邊緣形狀並提供即時品質警報。限制焊接煙塵排放的法規正在推動焊接製程從氣焊轉向熔敷效率更高的逆變式MIG焊接設備。隨著積層製造技術的日益普及,電弧沉澱頭可以螺栓固定到現有的機器人上,從而無需更換整個單元即可增加收入。

第二代電弧電源採用多進程韌體,可在MIG、TIG和手工電弧焊接模式之間無縫切換,從而提高現場設備的靈活性。雖然遠端焊縫雷射焊接正在逐漸取代鋁製電池機殼中的一些工位,但電阻點焊在大批量汽車生產線中仍然佔據一席之地。等離子焊接在航太引擎專案中的應用日益廣泛,這些專案需要對鎳基高溫合金進行深度熔透且變形最小的焊接。製程多樣化反映了歐洲多元化的製造業基礎,涵蓋從重型鋼材加工到精密醫療設備的各個領域。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 自動化和機器人技術在歐洲生產線上的普及

- 電動車相關零件(電池托盤和輕質鋁材)的焊接需求迅速成長

- 歐盟綠色協議基礎設施更新支出

- 歐盟電磁輻射暴露指令 2013/35/EU 導致合規維修

- 手持式光纖雷射焊接機擴大被中小企業採用。

- 符合ESG審核的可追溯性平台(焊接數據分析)

- 市場限制

- 先進雷射系統需要高資本投入

- 合格焊工和培訓人員短缺

- 鋼鐵和鋁價格波動

- 遵守電磁波和煙霧暴露法規的成本不斷上升

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 產業吸引力:波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過流程

- 電弧焊接

- 電阻焊接

- 雷射焊接

- 等離子焊接

- 氣焊

- 其他工藝-焊接、硬焊、鍛造、焊接等。

- 最終用戶

- 建築與基礎設施

- 石油、天然氣和石化

- 能源與發電

- 汽車和運輸設備

- 重工業和工業設備

- 航太與國防

- 其他(特殊用途 - 小型製造研討會、維護與維修、客製化焊接服務)

- 按自動化級別

- 手動的

- 半自動

- 自動化/機器人

- 按地區

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Lincoln Electric Holdings Inc.

- ESAB Corp.

- Fronius International GmbH

- Kemppi Oy

- voestalpine Bohler Welding

- Carl Cloos SchweiBtechnik GmbH

- AMADA WELD TECH

- EWM AG

- Hobart Welders

- Denyo Co. Ltd

- WW Grainger Inc.

- Obara Corporation

- Polysoude SAS

- CEBORA SpA

- TRUMPF Group

- Air Liquide SA

- Panasonic Industry Europe GmbH

- Daihen Corp.

- IPG Photonics(EU operations)

- Plansee SE

第7章 市場機會與未來展望

The Europe welding equipment market size stood at USD 12.22 billion in 2025 and is forecast to reach USD 15.69 billion by 2030, advancing at a 5.13% CAGR.

Market expansion reflects accelerated equipment modernization as manufacturers migrate toward Industry 4.0 production cells that integrate sensors, software, and robotics Demand intensity rises most sharply in battery-pack assembly and lightweight aluminum joining for electric vehicles, while Green Deal infrastructure programs sustain public-sector procurement of heavy-duty welding systems. Suppliers compete on process innovations laser sources with higher beam quality, inverter-based power supplies with lower electromagnetic emissions, and weld-data analytics platforms rather than on pure pricing. Continued shortages of certified welders reinforce automation investments, and mid-sized enterprises adopt collaborative robot cells to hedge against labor volatility.

Europe Welding Equipment Market Trends and Insights

Automation & Robotics Penetration Across European Production Lines

Manufacturers across the continent install robot welding cells to offset the 300,000-worker welder gap and to meet ISO 3834 quality demands. Adaptive control algorithms adjust current and travel speed in real time, improving bead consistency on complex joint geometries. German automotive suppliers report 40% cycle-time reductions after integrating collaborative robots that share work zones with human operators. Digital twin simulations optimize weld paths before deployment, shrinking commissioning cycles and boosting overall equipment effectiveness. Adoption cascades from tier-one OEMs to mid-tier suppliers as modular cells become affordable and financeable on three- to five-year leases. The resulting productivity gains convert labor scarcity from a bottleneck into a catalyst for modernization.

Surge in EV-Related Welding Needs

Battery-tray and enclosure fabrication requires joining aluminum and steel while limiting heat-affected zones. Fiber-laser sources operating at 1,030 nm deliver penetration at speeds above 10 m/min, replacing resistance spot welding and eliminating post-processing on 6000-series extrusions. The transition supports tighter battery-pack tolerances demanded by UN ECE R100 safety rules. TRUMPF extended lead times for multi-kilowatt laser systems as European integrators ramp up lines to meet rising EV output. Process monitoring modules log melt-pool dimensions and energy input, generating traceability records essential for automotive homologation audits. Consequently, laser welding investments align with the twin imperatives of productivity and compliance.

High Capex for Advanced & Laser Systems

Laser welding cells cost EUR 200k - 2 million each, and ancillary ventilation or guarding can double project outlays. Payback horizons of five or more years deter SME buyers despite throughput benefits. Financing gaps widen as leasing companies apply higher risk premiums to high-power laser assets with uncertain residual values. Annual service contracts of EUR 50,000 for optics, chillers, and software updates inflate the total cost of ownership. Consequently, many small fabricators continue using semi-automatic MAG units even when precision demands favor laser solutions.

Other drivers and restraints analyzed in the detailed report include:

- EU Green Deal Infrastructure Spending

- Hand-Held Fiber-Laser Welders Gaining SME Adoption

- Shortage of Certified Welders & Trainers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Arc welding held 56.76% of the Europe welding equipment market share in 2024, and the segment is forecast to advance at a 5.0% CAGR through 2030. The arc category's scale is anchored in civil construction, shipbuilding, and plant-maintenance jobs where portability and thick-section capability remain essential. Laser and plasma systems capture the fastest revenue acceleration as users pursue narrow heat-affected zones and higher line speeds for aluminum body components and thin-gauge electronics housings. The European welding equipment market size tied to "other" processes soldering, brazing, forge welding posts a 7.99% CAGR on the back of electronics miniaturization and heritage-structure restoration. Consumable vendors respond with aluminum-nickel fillers for dissimilar-metal joints, while monitoring start-ups embed optical sensors that log bead geometry for real-time quality alerts. Regulations curbing welding fumes further motivate a shift from gas welding toward inverter-based MIG units that offer higher deposition efficiency. As additive manufacturing gains traction, wire-arc deposition heads bolt onto existing robots, unlocking incremental revenue without replacing the entire cell.

Second-generation arc power sources ship with multiprocess firmware that toggles seamlessly between MIG, TIG, and stick modes, boosting asset flexibility for job shops. Resistance spot welding preserves share within high-volume automotive lines, though remote-seam lasers begin to replace some stations for aluminum battery enclosures. Plasma welding's niche expands inside aerospace engine programs that require deep penetration in nickel super-alloys with minimal distortion. Process diversification, therefore, mirrors Europe's multi-speed manufacturing base, stretching from heavy steel fabrication to precision medical devices.

The Europe Welding Equipment Market Report is Segmented by Process (Arc Welding, Resistance Welding and More), by End-User (Construction & Infrastructure, Oil Gas & Petrochemicals and More), by Automation Level (Manual, Semi-Automatic and More), and by Geography (United Kingdom, Germany, France and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Lincoln Electric Holdings Inc.

- ESAB Corp.

- Fronius International GmbH

- Kemppi Oy

- voestalpine Bohler Welding

- Carl Cloos SchweiBtechnik GmbH

- AMADA WELD TECH

- EWM AG

- Hobart Welders

- Denyo Co. Ltd

- W.W. Grainger Inc.

- Obara Corporation

- Polysoude SAS

- CEBORA S.p.A

- TRUMPF Group

- Air Liquide SA

- Panasonic Industry Europe GmbH

- Daihen Corp.

- IPG Photonics (EU operations)

- Plansee SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automation & robotics penetration across European production lines

- 4.2.2 Surge in EV-related welding needs (battery trays & lightweight aluminium)

- 4.2.3 EU Green Deal infrastructure-renewal spending

- 4.2.4 Compliance retrofits triggered by EU EMF-exposure directive 2013/35/EU

- 4.2.5 Hand-held fibre-laser welders gaining SME adoption

- 4.2.6 Traceability platforms (weld-data analytics) aligned with ESG audits

- 4.3 Market Restraints

- 4.3.1 High capex for advanced & laser systems

- 4.3.2 Shortage of certified welders & trainers

- 4.3.3 Steel & aluminium price volatility

- 4.3.4 Rising compliance cost for EMF & fume-exposure limits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Values, In USD Billion)

- 5.1 By Process

- 5.1.1 Arc Welding

- 5.1.2 Resistance Welding

- 5.1.3 Leser Welding

- 5.1.4 Plasma Welding

- 5.1.5 Gas Welding

- 5.1.6 Others - Soldering & Brazing, Forge Welding, etc.

- 5.2 By End-user

- 5.2.1 Construction & Infrastructure

- 5.2.2 Oil, Gas & Petrochemicals

- 5.2.3 Energy & Power Generation

- 5.2.4 Automotive & Transportation

- 5.2.5 Heavy Engineering & Industrial Equipment

- 5.2.6 Aerospace & Defence

- 5.2.7 Others (Specialized Applications - Small-scale fabrication workshops, maintenance & repair, and custom welding services)

- 5.3 By Automation Level

- 5.3.1 Manual

- 5.3.2 Semi-automatic

- 5.3.3 Automatic / Robotic

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Lincoln Electric Holdings Inc.

- 6.4.2 ESAB Corp.

- 6.4.3 Fronius International GmbH

- 6.4.4 Kemppi Oy

- 6.4.5 voestalpine Bohler Welding

- 6.4.6 Carl Cloos SchweiBtechnik GmbH

- 6.4.7 AMADA WELD TECH

- 6.4.8 EWM AG

- 6.4.9 Hobart Welders

- 6.4.10 Denyo Co. Ltd

- 6.4.11 W.W. Grainger Inc.

- 6.4.12 Obara Corporation

- 6.4.13 Polysoude SAS

- 6.4.14 CEBORA S.p.A

- 6.4.15 TRUMPF Group

- 6.4.16 Air Liquide SA

- 6.4.17 Panasonic Industry Europe GmbH

- 6.4.18 Daihen Corp.

- 6.4.19 IPG Photonics (EU operations)

- 6.4.20 Plansee SE

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment