|

市場調查報告書

商品編碼

1852176

離子交換樹脂:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Ion Exchange Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

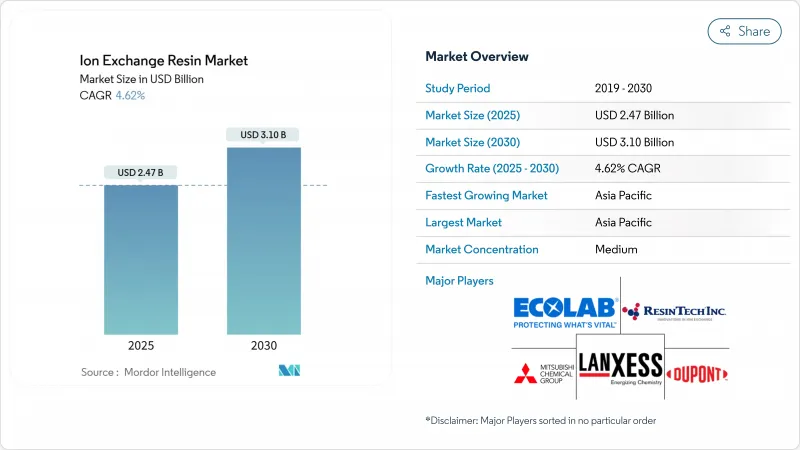

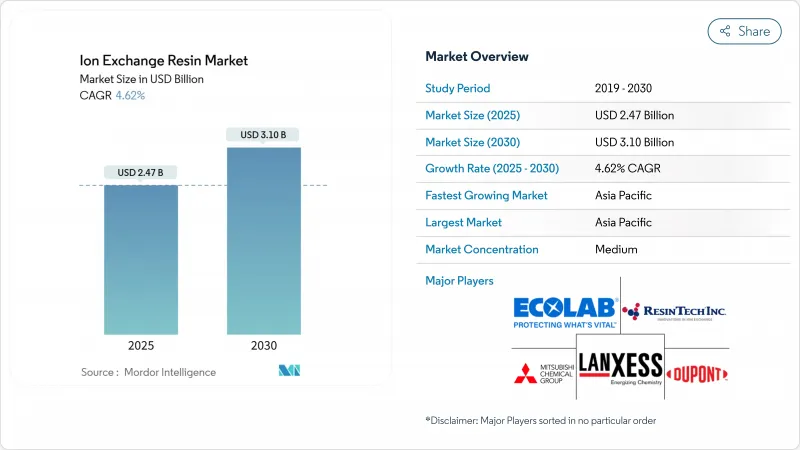

預計到 2025 年,離子交換樹脂市場規模將達到 24.7 億美元,到 2030 年將達到 31 億美元,預測期(2025-2030 年)的複合年成長率為 4.62%。

全球水質法規日益嚴格、半導體產能快速擴張以及製藥生產對超高純度製程的需求不斷成長,推動了市場需求的成長。監管的複雜性提高了終端用戶對產品性能的要求,促使供應商提供離子選擇性窗口更窄、運行週期更長、再生化學品需求量更低的樹脂。海水淡化、工業污水處理和資源回收計劃中零液體排放(ZLD) 系統的資本投資,也催生了對混合床級和螯合級樹脂的二次需求。同時,原料成本(尤其是苯乙烯和丙烯酸單體)的波動,促使企業轉向垂直整合的採購模式,並尋求生物基替代品,從而重塑長期籌資策略。這些因素共同作用,加劇了市場競爭,並促使大型化學企業、設備整合商和區域專家夥伴關係,以符合區域規範。

全球離子交換樹脂市場趨勢及洞察

亞太地區對半導體級超純水的需求

台灣、韓國和中國當地的晶片製造廠已通過認證,其離子交換樹脂床能夠去除低至兆分之一濃度的硼和微量金屬。採用諸如2025 Sievers Boron Ultra之類的分析儀,可以連續檢測如此低濃度的硼,從而最佳化了樹脂更換時機並減少了化學廢料。 Organo公司已在2024年至2026年間為超純水資本累計1,750億日圓,其中包括提升樹脂產能以滿足市場需求。由於半導體產量比率損失會直接轉化為數百萬美元的機會成本,因此採購決策優先考慮性能而非樹脂價格波動。因此,即使在整體製造業放緩的情況下,離子交換樹脂市場也受益於半導體供應的穩定性,從而使供應商免受其他地區景氣衰退。

PFAS和重金屬排放法規推動北美螯合樹脂的發展

美國環保署 (EPA) 2024 年發布的臨時指南將大多數 PFAS 列為持久性有害物質,並要求飲用水取水口的去除目標低於 4 ng/L。市政和工業污水廠正在試驗使用與短鏈和長鏈 PFAS 相容的樹脂進行離子交換處理,現場研究報告顯示,單一途徑處理去除率超過 90%。朗盛的 Lewatit MDS TP 108 樹脂的穿透循環次數是傳統大孔陰離子交換樹脂的兩倍,在降低總處理成本的同時,也符合廢介質處置限制。日益嚴厲的 PFAS 超標監管處罰正在推動公用事業採購,並促使離子交換樹脂市場轉向利潤更高的螯合型樹脂,這些樹脂具有更高的選擇性和更長的使用壽命。

揮發性苯乙烯和丙烯酸單體價格

由於原物料價格波動,尤其是苯乙烯和丙烯酸單體價格波動,離子交換樹脂生產商面臨巨大的利潤壓力,這直接影響了價值鏈。 2024年5月,美國環保署修訂了有機合成化學品生產的排放標準,增加了單體生產商的合規成本,進一步加劇了價格波動。中國常青新材料科技有限公司正投資14億美元用於精細化學品生產,包括原料,並計劃透過垂直整合來降低供應鏈風險。大型樹脂生產商正利用規模經濟和長期供應合約來應對價格波動,而小型生產商則面臨利潤壓縮和價格上漲的雙重壓力,這不僅可能導致客戶流失,還會加速市場整合。

細分市場分析

到2024年,商品級樹脂將佔全球銷量的74%,這充分證明了市政水軟化和鍋爐海水淡化對樹脂的強勁需求,這些領域優先考慮的是單價和成熟的再生通訊協定。印度和東南亞地區持續推動的水利基礎建設是離子交換樹脂市場的主要驅動力。供應商透過整合抗氧化交聯劑和LewaPlus等雲端基礎設計工具來延長樹脂的使用壽命,從而幫助公用事業公司合理配置樹脂柱庫存並減少鹽的使用量。儘管商品級樹脂市場規模龐大,但隨著苯乙烯價格的上漲,其利潤空間受到擠壓,迫使生產商尋求ISCC PLUS等綠色認證。

用於對選擇性、萃取物含量和生物製藥要求較高的應用領域的特種樹脂,預計到2030年將以5.3%的複合年成長率成長,儘管基數較小,但仍將超過整個離子交換樹脂市場的成長速度。杜邦公司將於2025年推出的AmberChrom TQ1,透過在連續處理過程中將寡核苷酸結合能力提高一倍,同時將柱壓降降低一半,進一步推動了這一趨勢。由於該樹脂的穩定性能夠減少停機時間、確保符合法規要求並保證批次產量,高階生物製藥和微電子用戶願意接受比普通樹脂高出三到五倍的價格分佈。隨著監管審查範圍擴大到每公升納克級污染物,對分子印跡和大孔螯合級樹脂的需求將加速成長,從而使更廣泛的離子交換樹脂市場的收入結構更加多元化。

區域分析

預計到2024年,亞太地區將佔全球營收的36%,複合年成長率(CAGR)為5.4%。中國長榮新材料集團正投資14億美元建造苯乙烯聯合企業,以確保區域樹脂生產商的原料供應,這標誌著供應鏈本地化過程的推進,有助於保護離子交換樹脂市場免受跨太平洋物流中斷的影響。台灣和韓國的晶片代工廠持續試運行新的超純水系統,迫使Organo和Purolite等製造地,以縮短前置作業時間並遵守原產地採購法規。印度新建的Roha工廠預計到2027年將使國內產能翻倍,凸顯了在地採購要求如何重塑全球供應鏈格局。

北美市場環境成熟且創新主導,環境合規和製藥生產對樹脂規格有重要影響。馬薩諸塞州、北卡羅來納州和魁北克省的生物製藥產業集中度推動了層析法基質的持續需求,杜邦公司計劃於2025年在北美推出AmberChrom TQ1,這將進一步強化這一趨勢。儘管通用樹脂的銷售量可能趨於平穩,但由於北美消費者願意為經過檢驗的性能買單,該地區在全球離子交換樹脂市場中的重要性日益凸顯。

歐洲仍以監管為中心,在化學品限制和綠色氫能獎勵之間尋求平衡,從而推動了對膜級全氟磺酸(PFSA)的需求。歐盟對廢棄舊樹脂的掩埋限制促進了先進再生通訊協定的研發,這些技術可將樹脂使用壽命延長20-30%,從而提升了綜合解決方案供應商的服務合約收入。加之都市廢水處理指令的持續實施,儘管歐洲在離子交換樹脂市場的佔有率相對較小,但其價值加權影響力仍保持穩定。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞太地區對半導體級超純水的需求

- 北美PFAS和重金屬排放法規推動螯合樹脂的發展

- 中東海水淡化和零排放計劃推動混合床樹脂的應用

- 歐洲氫電解廠採用PFSA離子交換膜的獎勵

- 拉丁美洲糖脫色產業的蓬勃發展帶動了對食品級樹脂的需求。

- 市場限制

- 揮發性苯乙烯和丙烯酸單體價格

- 生物基吸附劑威脅樹脂經濟

- 歐盟關於廢棄樹脂掩埋的法規

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 產業間競爭

第5章 市場規模與成長預測

- 按類型

- 通用樹脂

- 特種樹脂

- 按最終用途行業分類

- 水處理

- 電力

- 食品和飲料

- 製藥

- 化學處理

- 採礦和冶金

- 其他終端用戶產業

- 透過使用功能

- 軟化和脫鈣

- 超純水生產

- 重金屬去除和 PFAS 減排

- 催化與分離(非水相)

- 糖漂白和食品飲料精煉

- 貴金屬回收與濕式冶金

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Anhui Sanxing Resin Co., Ltd.

- Bio-Rad Laboratories, Inc.

- DOSHION POLYSCIENCE PVT. LTD.

- DuPont

- Ecolab

- Eichrom Technologies, LLC

- IEI

- JACOBI CARBONS GROUP

- LANXESS

- Mitsubishi Chemical Group Corporation

- Polymex

- Pure Resin Co., Ltd.

- ResinTech, Inc.

- Samyang Corporation

- Sunresin New Materials Co.Ltd.

- Suqing Group

- Suzhou bojie resin technology Co.,Ltd

- Thermax Limited

- Xylem

第7章 市場機會與未來展望

The Ion Exchange Resin Market size is estimated at USD 2.47 billion in 2025, and is expected to reach USD 3.10 billion by 2030, at a CAGR of 4.62% during the forecast period (2025-2030).

Demand growth is anchored in tightening global water-quality rules, rapid semiconductor capacity additions, and expanding pharmaceutical production that all require ultrapure process streams. Regulatory complexity is expanding the performance envelope that end users expect, pushing suppliers to deliver resins with narrower ionic selectivity windows, longer operating cycles, and lower regeneration chemical demand. Capital spending on zero-liquid-discharge (ZLD) systems in desalination, industrial wastewater, and resource-recovery projects is creating secondary pull for mixed-bed and chelating grades. Meanwhile, raw-material cost swings-especially for styrene and acrylic monomers-are catalyzing a shift toward vertically integrated sourcing and the exploration of bio-based alternatives that could reshape long-term procurement strategies. Collectively, these drivers are keeping competitive intensity high and encouraging partnerships between chemical majors, equipment integrators, and regional specialists to keep pace with localized specifications.

Global Ion Exchange Resin Market Trends and Insights

Semiconductor-grade Ultrapure Water Demand in Asia Pacific

Chip-fabs in Taiwan, South Korea, and Mainland China are qualifying ion-exchange beds that remove boron and trace metals to single-digit parts-per-trillion, a specification codified by foundries chasing sub-3 nm node geometries. The adoption of analyzers such as the 2025 Sievers Boron Ultra, which allows continuous boron detection at those levels, has improved resin change-out timing and reduced chemical waste. Organo Corporation has earmarked JPY 175 billion in ultrapure-water capital outlays for 2024-2026, including resin capacity debottlenecking to capture this captive demand. Because semiconductor yield losses translate directly into multi-million-dollar opportunity costs, purchasing decisions emphasize proven performance over resin price volatility. Consequently, the ion exchange resin market benefits from resilient semiconductor procurement even during broader manufacturing slowdowns, insulating suppliers from cyclical downturns elsewhere.

PFAS and Heavy-Metal Discharge Limits Boosting Chelating Resins in North America

The 2024 U.S. EPA interim guidance classifies most PFAS as persistent hazardous constituents, requiring removal targets below 4 ng/L for drinking-water intakes. Municipalities and industrial dischargers have responded by piloting ion-exchange trains featuring resins tailored for short- and long-chain PFAS, with field studies reporting more than 90% removal efficiencies in single-pass operation. LANXESS's Lewatit MDS TP 108 extends breakthrough cycles two-fold compared with conventional macroporous anion resins, lowering total cost of treatment while complying with disposal restrictions on spent media. Because regulatory penalties escalate rapidly for PFAS exceedances, utilities are accelerating procurement, pushing the ion exchange resin market toward higher-margin chelating grades engineered for selectivity and longer operational life.

Volatile Styrene and Acrylic Monomer Prices

Ion exchange resin manufacturers face significant margin pressures due to raw material price volatility, particularly styrene and acrylic monomers, impacting the value chain. In May 2024, the Environmental Protection Agency's amended emission standards for the Synthetic Organic Chemical Manufacturing Industry added compliance costs for monomer producers, further destabilizing prices. China's Evergreen New Material Technology's USD 1.4 billion investment in fine chemicals production, including ion exchange resin raw materials, aims to mitigate supply chain risks through vertical integration. Larger resin manufacturers leverage economies of scale and long-term supply agreements to manage volatility, while smaller players face margin compression or price hikes, risking customer loss and accelerating market consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Desalination and ZLD Projects in the Middle East Elevating Mixed-Bed Resin Uptake

- Europe Hydrogen Electrolyzer Incentives Lifting PFSA Ion-Exchange Membranes

- Bio-based Adsorbents Undercutting Resin Economics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Commodity grades anchored 74% of global revenue in 2024, a testament to entrenched municipal water-softening and boiler-demineralization demand that prioritize unit cost and proven regeneration protocols. The ion exchange resin market is driven by ongoing water-infrastructure buildouts across India and Southeast Asia. Suppliers are stretching lifetimes by integrating oxidative-stable cross-linkers and cloud-based design tools such as LewaPlus, which let utilities right-size column inventories and cut salt usage. Despite their scale, commodity resins face margin compression when styrene prices spike, compelling producers to seek green certifications, such as ISCC PLUS, that justify modest price premiums with verified carbon-emission reductions.

Specialty resins, though accounting for a smaller base, will outpace overall ion exchange resin market growth at 5.3% CAGR through 2030 as applications demand higher selectivity, lower extractables, and compatibility with biologics. The 2025 release of AmberChrom TQ1 by DuPont underscores this trend, doubling oligonucleotide binding capacity while halving column pressure losses during continuous processing. Premium bio-pharma and microelectronics users accept price points 3-5 times those of commodity beads when resin stability reduces downtime, ensures regulatory compliance, and shields batch yields. As regulatory scrutiny widens to nanogram-per-liter contaminants, demand for molecularly imprinted and macroporous chelating grades will accelerate, diversifying the revenue mix within the broader ion exchange resin market.

The Ion Exchange Resins Market Report Segments the Industry by Type (Commodity Resins and Specialty Resins), End-Use Industry (Water Treatment, Power, Pharmaceutical, and More), Application Function (Softening and Demineralization, Ultrapure Water Production, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific dominates with 36% 2024 revenue and the highest forecast 5.4% CAGR, reflecting rapid industrialization alongside national mandates for advanced wastewater treatment. China's Evergreen New Material is channeling USD 1.4 billion into a styrenics complex designed to lock in feedstock security for regional resin producers, demonstrating supply-chain localization that shields the ion exchange resin market from trans-Pacific logistic disruptions. Taiwanese and South Korean chip foundries continue to commission new ultrapure-water systems, compelling Organo and Purolite to expand manufacturing footprints in the region to shorten lead times and comply with country-of-origin procurement rules. India's upcoming Roha greenfield plant will double domestic capacity by 2027, underscoring how local content requirements are reshaping global flow patterns.

North America presents a mature yet innovation-led environment where environmental compliance and pharmaceutical production shape resin specifications. Biopharma clustering in Massachusetts, North Carolina, and Quebec is driving sustained demand for chromatography matrices, a trend reinforced by DuPont's 2025 North America launch of AmberChrom TQ1. While commodity resin volumes may plateau, the region's willingness to pay for validated performance cements its relevance within the global ion exchange resin market.

Europe remains regulation-centric, balancing chemical-restriction measures with green-hydrogen incentives that elevate membrane-grade PFSA demand. EU landfill constraints on spent resins are fueling research and development on advanced regeneration protocols capable of extending service life by 20-30%, thereby lifting service-contract revenue for integrated solution providers. Coupled with ongoing enforcement of the Urban Wastewater Treatment Directive, Europe maintains steady, value-weighted influence over the ion exchange resin market despite its comparatively modest volume share.

- Anhui Sanxing Resin Co., Ltd.

- Bio-Rad Laboratories, Inc.

- DOSHION POLYSCIENCE PVT. LTD.

- DuPont

- Ecolab

- Eichrom Technologies, LLC

- IEI

- JACOBI CARBONS GROUP

- LANXESS

- Mitsubishi Chemical Group Corporation

- Polymex

- Pure Resin Co., Ltd.

- ResinTech, Inc.

- Samyang Corporation

- Sunresin New Materials Co.Ltd.

- Suqing Group

- Suzhou bojie resin technology Co.,Ltd

- Thermax Limited

- Xylem

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Semiconductor-grade Ultrapure Water Demand in Asia Pacific

- 4.2.2 PFAS and Heavy-Metal Discharge Limits Boosting Chelating Resins in North America

- 4.2.3 Desalination and ZLD Projects in Middle East Elevating Mixed-Bed Resin Uptake

- 4.2.4 Europe Hydrogen Electrolyzer Incentives Lifting PFSA Ion-Exchange Membranes

- 4.2.5 LATAM Sugar-Decolorization Boom Raising Food-Grade Resins Demand

- 4.3 Market Restraints

- 4.3.1 Volatile Styrene and Acrylic Monomer Prices

- 4.3.2 Bio-based Adsorbents Undercutting Resin Economics

- 4.3.3 EU Land-fill Restrictions on Spent Resins

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Commodity Resins

- 5.1.2 Specialty Resins

- 5.2 By End-Use Industry

- 5.2.1 Water Treatment

- 5.2.2 Power

- 5.2.3 Food and Beverage

- 5.2.4 Pharmaceutical

- 5.2.5 Chemical Processing

- 5.2.6 Mining and Metallurgy

- 5.2.7 Other End-user Industries

- 5.3 By Application Function

- 5.3.1 Softening and Demineralization

- 5.3.2 Ultrapure Water Production

- 5.3.3 Heavy-Metal Removal and PFAS Mitigation

- 5.3.4 Catalysis and Separation (Non-Water)

- 5.3.5 Sugar Decolorization and Food and Beverage Purification

- 5.3.6 Precious-Metal Recovery and Hydrometallurgy

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Anhui Sanxing Resin Co., Ltd.

- 6.4.2 Bio-Rad Laboratories, Inc.

- 6.4.3 DOSHION POLYSCIENCE PVT. LTD.

- 6.4.4 DuPont

- 6.4.5 Ecolab

- 6.4.6 Eichrom Technologies, LLC

- 6.4.7 IEI

- 6.4.8 JACOBI CARBONS GROUP

- 6.4.9 LANXESS

- 6.4.10 Mitsubishi Chemical Group Corporation

- 6.4.11 Polymex

- 6.4.12 Pure Resin Co., Ltd.

- 6.4.13 ResinTech, Inc.

- 6.4.14 Samyang Corporation

- 6.4.15 Sunresin New Materials Co.Ltd.

- 6.4.16 Suqing Group

- 6.4.17 Suzhou bojie resin technology Co.,Ltd

- 6.4.18 Thermax Limited

- 6.4.19 Xylem

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growing Demand For Fuel Cells