|

市場調查報告書

商品編碼

1852173

有機過氧化物:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Organic Peroxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

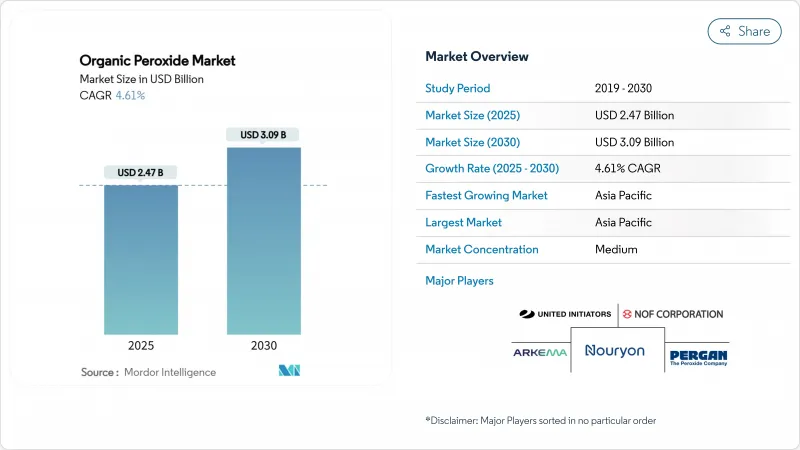

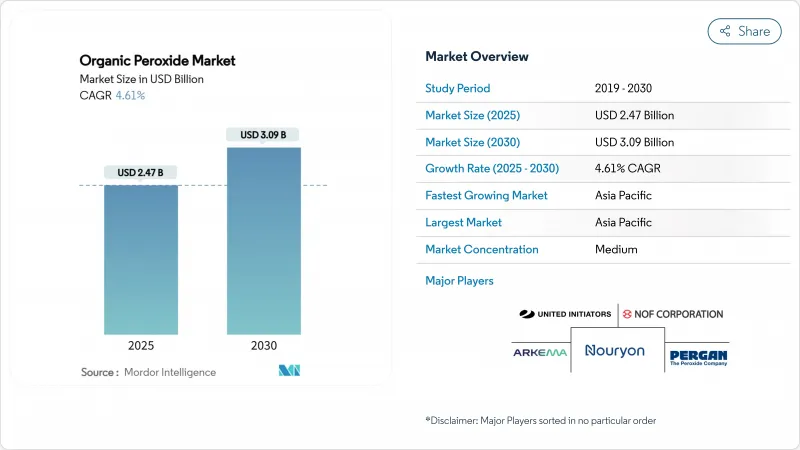

預計有機過氧化物市場規模將在 2025 年達到 24.7 億美元,到 2030 年達到 30.9 億美元,在預測期(2025-2030 年)內複合年成長率為 4.61%。

需求成長主要受以下因素驅動:先進聚乙烯和聚丙烯等級產品的使用日益增多、EVA太陽能電池封裝的快速普及以及向無VOC粉末塗料系統的轉變。生產商正在亞太地區擴大產能,以滿足聚合物和複合材料客戶嚴格的規格控制要求,同時,注重安全性的膏狀和乳液型塗料也越來越受歡迎。同時,原物料價格波動和倉儲設施保險成本上漲持續擠壓淨利率,促使製造商轉向可再生原料和更安全的處理方案。亞太地區是銷售量和需求成長的主要驅動力,而北美和歐洲的永續性法規正在加速產品替代。

全球有機過氧化物市場趨勢與洞察

轉向使用更高階的PE和PP牌號

亞太地區對流變控制聚丙烯和高熔點聚丙烯(PP)的需求不斷成長,推動了包裝和汽車零件產業對有機過氧化物的消費。利安德巴塞爾的目標是到2024年將其再生和可再生聚合物的產量提高65%,達到20萬噸以上,到2030年達到每年200萬噸,這促使人們需要使用有機過氧化物來精細調節分子量和支化度。加工商報告稱,使用過氧化二異丙苯作為斷鍊劑可使PP的加工效率提高18%,而使用Perkadox和Trigonox®牌號的支化PP則可使其發泡性能提高30%。隨著區域樹脂生產商不斷拓展其專業化能力,有機過氧化物市場的需求基礎正在穩定成長。

有機過氧化物在EVA太陽能電池封裝的應用

快速發展的太陽能發電產業正在使用過氧化物交聯的EVA封裝片材(例如Luperox TBEC)來提高凝膠含量至75%以上,從而增強組件的耐久性。中國是EVA片材的主要生產國,歐洲組件製造商也正在升級到高純度過氧化物系統以降低功率損耗。這些趨勢將在短期內推動有機過氧化物市場銷售穩定成長,尤其是對於具有窄分解曲線的高壓聚合級產品而言。

倉儲設施保險費

修訂後的ADR框架將於2025年1月1日生效,屆時有機過氧化物倉庫的分類和檢查將更加嚴格。歐洲保險公司正在提高大型倉庫的保費,增加營運成本,並推遲擴建計劃。生產商則透過最佳化存量基準和投資建設小型衛星倉庫來應對,但不斷上漲的固定成本正在限制有機過氧化物市場的利潤成長。

細分市場分析

預計到2024年,過氧化苯甲醯將佔有機過氧化物市場收入的24%。自由基聚合仍然是苯乙烯類和丙烯酸類化合物的高通量聚合方法,工業級產品佔據銷售量主導地位。然而,人們越來越關注某些消費品中苯的污染問題,促使產品配方進行調整。

過碳酸鹽是一種環境友善清潔劑,應用廣泛,是成長最快的細分市場,複合年成長率達4.74%。基於過碳酸鹽的高階氧化製程在污水淨化領域的商業化應用,將拓寬客戶群,並協助未來市場佔有率的擴張。

2024年,聚合反應起始劑佔有機過氧化物市場的65%,預計到2030年將以5.22%的複合年成長率成長。由於叔丁基過氧-2-乙基己酸酯等特性明確的引髮劑具有可預測的分解速率,因此高通量LDPE和PP生產設施更傾向於使用此類引髮劑。交聯劑是第二大類,廣泛應用於電線電纜護套、發泡隔熱材料以及需要在高溫下保持尺寸穩定性的複合材料零件。固化劑和硬化劑雖然用量較小,但在用於3D列印和高壓RTM複合材料的先進樹脂化學領域中,其重要性日益凸顯。

區域分析

到 2024 年,亞太地區將佔有機過氧化物市場的 39%,複合年成長率為 4.89%。中國是該地區的主要需求國,諾力昂公司計劃於 2024 年 11 月在寧波擴建工廠,將其 Perkadox 14 和 Trigonox 101 的產量加倍,達到 6,000 噸,凸顯了中國市場對可控流變改質劑的需求。

北美地區汽車複合材料、醫療保健、高純度半導體聚合物等領域的需求成熟且具有附加價值。製造商們正致力於研發更安全的配方,一些製造商推出了符合運輸部關於過氧化物散裝運輸嚴格規定的乳液型引發劑。

歐洲緊隨其後,其主要驅動力是限制揮發性有機化合物(VOC)排放和強制執行更安全的危險品運輸的環保法規。將於2025年生效的澳洲危險品運輸法規(ADR)更新版將提出更嚴格的儲存隔離和培訓要求,這將增加營業成本,但同時也將鼓勵採用糊狀和聚合物黏合型危險品。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞太地區對聚合物的需求轉向先進的PE和PP等級

- 有機過氧化物的快速擴散

- 歐洲無VOC紫外光固化粉末塗料的成長

- 汽車輕量化,纖維增強複合材料的廣泛應用

- 塗料應用領域的使用量迅速成長

- 市場限制

- 歐盟大型倉儲設施的保險費很高

- 原料供應緊張

- 有機過氧化物成本上漲

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方/消費者的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 二醯基過氧化物

- 二烷基過氧化物

- 過氧化酮

- 過氧化氫

- 過碳酸鹽

- 過氧化苯甲醯

- 過氧酯

- 其他

- 按功能

- 聚合反應起始劑

- 交聯劑

- 硬化劑

- 按形式

- 液體

- 固體的

- 膏狀/乳液

- 透過使用

- 聚合物和橡膠

- 塗料和黏合劑

- 紙張和紡織品

- 化妝品

- 衛生保健

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、合資、產能擴張)

- 市佔率(%)/排名分析

- 公司簡介

- ADEKA CORPORATION

- AKPA Kimya

- Arkema

- BASF

- Dow

- Evonik Industries AG

- Hanwha Group

- Jiangsu qiangsheng chemical co. LTD

- Kawaguchi Chemical Industry Co., LTD.

- Lianyungang Hualun Chemical Co.,Ltd.

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- MPI Chemie BV

- NOF CORPORATION

- Nouryon

- Novichem Sp. z oo

- PERGAN GmbH

- Plasti Pigments Pvt. Ltd.

- Shenzhen Bailingwei Technology Co., Ltd.

- Solvay

- United Chemicals

- United Initiators GmbH

第7章 市場機會與未來展望

The Organic Peroxide Market size is estimated at USD 2.47 billion in 2025, and is expected to reach USD 3.09 billion by 2030, at a CAGR of 4.61% during the forecast period (2025-2030).

The rising use of advanced polyethylene and polypropylene grades, rapid uptake of EVA solar encapsulants, and the shift toward VOC-free powder coating systems underpin demand growth. Producers are scaling capacity in Asia Pacific to serve polymer and composites customers that require tight specification control, while safety-focused paste and emulsion formats gain wider acceptance. At the same time, volatile feedstock pricing and higher insurance premiums for storage facilities continue to pressure margins, steering manufacturers toward renewable feedstocks and safer handling solutions. Asia Pacific anchors both volume and incremental demand, followed by steady but more specialized growth in North America and Europe, where sustainability regulations accelerate product substitution.

Global Organic Peroxide Market Trends and Insights

Shift Toward Advanced PE and PP Grades

Rising requirements for controlled rheology polypropylene and high-melt-strength PP in packaging and automotive parts lift organic peroxide consumption across Asia Pacific. LyondellBasell raised recycled and renewable-based polymer output by 65% in 2024 to more than 200,000 t, with a target of 2 million t annually by 2030, increasing the need for organic peroxides that fine-tune molecular weight and branching. Processors report an 18% jump in PP processing efficiency when dicumyl peroxide is applied as a chain breaker, while branched PP made with Perkadox and Trigonox(R) grades delivers 30% better foam properties. As regional resin producers expand specialty capacity, the organic peroxide market gains a stable demand base.

Adoption of Organic Peroxides in EVA Solar Encapsulants

Fast-growing photovoltaic installations rely on EVA encapsulation sheets cross-linked with peroxides such as Luperox TBEC to reach gel contents above 75%, thereby enhancing module durability. China dominates EVA sheet output, and European module makers are also upgrading to higher-purity peroxide systems to curb power loss. These trends translate into steady incremental volumes for the organic peroxide market in the near term, especially for high-pressure polymerization grades that offer narrow decomposition profiles.

Insurance Premiums for Storage Facilities

Implementation of the revised ADR framework on 1 January 2025 elevates classification and inspection rigor for organic peroxide warehousing. European underwriters have lifted premiums for large-volume sites, raising operating costs and delaying expansion projects. Producers are responding by optimizing inventory levels and investing in smaller satellite depots, yet higher fixed costs constrain margin expansion for the organic peroxide market.

Other drivers and restraints analyzed in the detailed report include:

- Growth of VOC-Free Powder Coatings in Europe

- Automotive Lightweighting Drives Composite Applications

- Feedstock Supply Tightness

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Benzoyl peroxide retained a 24% revenue share of the organic peroxide market in 2024, reflecting its dual usage in polymer initiation and topical dermatology. Industrial grade volumes dominate because free-radical polymerization remains a high-throughput route for styrenics and acrylics. Nevertheless, concerns over benzene contamination in certain consumer products have raised scrutiny, spurring product reformulation.

Percarbonates, propelled by eco-friendly credentials and broad cleaning-agent appeal, are the fastest-growing sub-segment at a 4.74% CAGR. Commercialization of percarbonate-based advanced oxidation processes for wastewater remediation broadens the customer mix and supports future share gains.

Polymerization initiators captured 65% of the organic peroxide market share in 2024 and are forecast to post a 5.22% CAGR to 2030. High throughput LDPE and PP facilities favor well-characterized initiators such as tert-butyl peroxy-2-ethylhexanoate owing to predictable decomposition kinetics. Cross-linking agents are the next-largest category, used in wire-and-cable jacketing, foam insulation, and composite parts that need dimensional stability at elevated temperatures. Curing and hardening agents, though smaller in volume, gain importance in advanced resin chemistries for 3D printing and high-pressure RTM composites.

The Organic Peroxide Market Report Segments the Industry by Type (Diacyl Peroxides, Dialkyl Peroxides, Ketone Peroxides, and More), Function (Polymerization Initiators, and More), Form (Liquid, Solid, and Paste/Emulsion), Application (Polymers and Rubber, Coatings and Adhesives, Paper and Textile, Cosmetics, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia Pacific held 39% of the organic peroxide market in 2024 and is growing at a 4.89% CAGR, supported by robust downstream plastics and elastomer capacity additions. China dominates regional demand, and Nouryon's November 2024 expansion in Ningbo doubled the output of Perkadox 14 and Trigonox 101 to 6,000 tons, underscoring local appetite for controlled rheology modifiers.

North America is characterized by mature but value-added demand in automotive composites, healthcare, and high-purity semiconductor polymers. Producers emphasize safer formulations, and several have introduced emulsion-based initiators that align with stricter Department of Transportation guidelines on bulk peroxide transport.

Europe trails closely, with growth driven by environmental legislation that restricts VOC emissions and mandates safer carriage of dangerous goods. The ADR update, effective in 2025, imposes tighter storage segregation and training requirements, increasing operating costs but encouraging the adoption of paste and polymer-bound forms.

- ADEKA CORPORATION

- AKPA Kimya

- Arkema

- BASF

- Dow

- Evonik Industries AG

- Hanwha Group

- Jiangsu qiangsheng chemical co. LTD

- Kawaguchi Chemical Industry Co., LTD.

- Lianyungang Hualun Chemical Co.,Ltd.

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- MPI Chemie BV

- NOF CORPORATION

- Nouryon

- Novichem Sp. z o.o.

- PERGAN GmbH

- Plasti Pigments Pvt. Ltd.

- Shenzhen Bailingwei Technology Co., Ltd.

- Solvay

- United Chemicals

- United Initiators GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Polymer Demand Shift toward Advanced PE and PP Grades in Asia-Pacific

- 4.2.2 Rapid Adoption of Organic Peroxide

- 4.2.3 Growth of VOC-free, UV-curable Powder Coatings in Europe

- 4.2.4 Automotive Lightweighting, Elevated Use in Fiber-Reinforced Composites

- 4.2.5 Surging Utilization in Coating Applications

- 4.3 Market Restraints

- 4.3.1 High Insurance Premiums for Large-Scale Storage Facilities in EU

- 4.3.2 Supply Tightness of Feedstock

- 4.3.3 Rising Cost of Organic Peroxide

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Diacyl Peroxides

- 5.1.2 Dialkyl Peroxides

- 5.1.3 Ketone Peroxides

- 5.1.4 Hydro-Peroxides

- 5.1.5 Percarbonates

- 5.1.6 Benzoyl Peroxide

- 5.1.7 Peroxyesters

- 5.1.8 Others

- 5.2 By Function

- 5.2.1 Polymerization Initiators

- 5.2.2 Cross-Linking Agents

- 5.2.3 Curing/Hardening Agents

- 5.3 By Form

- 5.3.1 Liquid

- 5.3.2 Solid

- 5.3.3 Paste/Emulsion

- 5.4 By Application

- 5.4.1 Polymers and Rubber

- 5.4.2 Coatings and Adhesives

- 5.4.3 Paper and Textiles

- 5.4.4 Cosmetics

- 5.4.5 Healthcare

- 5.4.6 Other Application

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JVs, Capacity Expansions)

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 ADEKA CORPORATION

- 6.4.2 AKPA Kimya

- 6.4.3 Arkema

- 6.4.4 BASF

- 6.4.5 Dow

- 6.4.6 Evonik Industries AG

- 6.4.7 Hanwha Group

- 6.4.8 Jiangsu qiangsheng chemical co. LTD

- 6.4.9 Kawaguchi Chemical Industry Co., LTD.

- 6.4.10 Lianyungang Hualun Chemical Co.,Ltd.

- 6.4.11 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.12 MPI Chemie BV

- 6.4.13 NOF CORPORATION

- 6.4.14 Nouryon

- 6.4.15 Novichem Sp. z o.o.

- 6.4.16 PERGAN GmbH

- 6.4.17 Plasti Pigments Pvt. Ltd.

- 6.4.18 Shenzhen Bailingwei Technology Co., Ltd.

- 6.4.19 Solvay

- 6.4.20 United Chemicals

- 6.4.21 United Initiators GmbH

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growing Demand for Light-Weight Materials