|

市場調查報告書

商品編碼

1852170

皮革化學品:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Leather Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

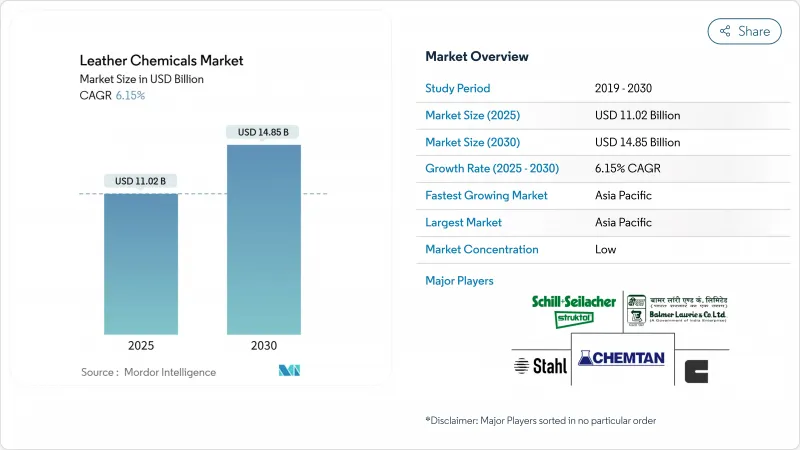

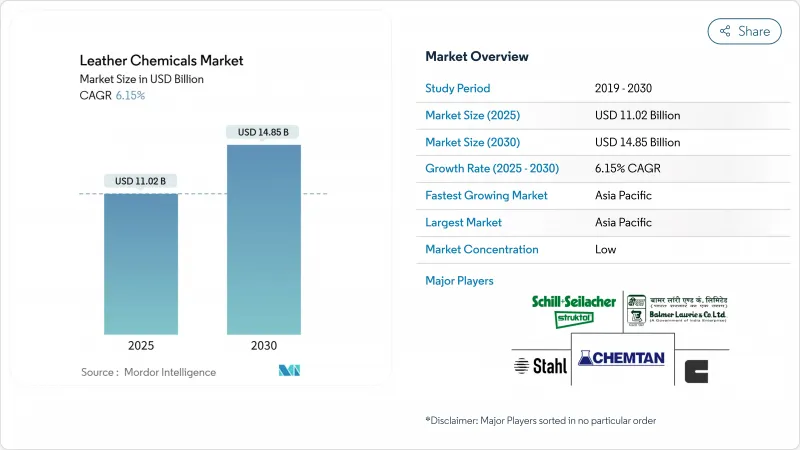

預計到 2025 年,皮革化學品市場規模將達到 110.2 億美元,到 2030 年將達到 148.5 億美元,預測期(2025-2030 年)複合年成長率為 6.15%。

這一上升趨勢主要受以下因素驅動:鉻基製革廠的穩定淘汰、高階鞋履和汽車內部裝潢建材需求的成長,以及生物基助劑的廣泛應用。無鉻化學品已佔據全球需求的大部分,而由於產品性能要求日益嚴格,無鉻整理劑配方也越來越受歡迎。亞太地區在產量和創新方面均處於領先地位,儘管近期推出了一些旨在兼顧規模和永續性的整合舉措,但競爭格局依然分散。

全球皮革化學品市場趨勢與洞察

無鉻和無金屬鞣革技術的普及

監管機構正在製定嚴格的鉻基準值,鼓勵製造商轉向使用有機和無礦物鞣劑。加州2023年《鍍鉻法案》禁止新建六價鉻設施,並逐步淘汰裝飾鍍鉻,這正在推動無鉻鞣劑的普及。像Gruppo Mastrotto這樣的生產商正在投資植物來源鞣劑,因為它們具有更優異的生物分解性和更低的碳排放。實驗室研究證實,生質基鞣劑的分解速度比鉻鹽更快,減輕了報廢處理的挑戰。 Stahl公司的Granofin Easy F-90 Liq採用了一種獨特的配方,既節約了水和能源,又消除了六價鉻殘留。

鞋類和紡織業的快速成長

在拉里奧哈進行的測試證實了鞋內化合物的有效殺菌率,抗菌性能現已成為常規應用。中國當地每年加工近40億立方英尺皮革,是皮革化學品市場中用於浸灰間和後整理化學品的最大單一客戶。紡織業透過在混合材料鞋面上使用類似的整理加工劑,也增加了對這類化學品的需求。巴西供應商迅速回應,隨著中國汽車用革產量的成長,巴西對華植物鞣革出口也隨之增加。

嚴格的六價鉻排放和污水標準

歐洲化學品管理局 (ECHA) 計劃每年阻止 17 噸六價鉻進入生態系統,這將迫使製革廠進行合規投資,從而擠壓其利潤空間。加州 65 號提案要求到 2025 年 12 月,所有皮革都必須經過 100% 無鉻認證,這迫使品牌商對其上游供應鏈進行審核。德國聯邦風險評估研究所報告稱,超過一半的受檢皮革產品六價鉻含量超過了 REACH 法規規定的 3 毫克/公斤限值,導致產品召回和法律糾紛。雖然對廢水處理廠進行改造,採用電化學氧化或芬頓製程可以減少用水量,但這需要數百萬美元的資本投資。如果小型製革廠無法承擔這些成本或獲得無鉻皮革生產技術,它們將面臨生存危機。

細分市場分析

從2025年到2030年,塗飾劑的複合年成長率將達到6.98% ,整理加工劑之首。其中,鞣製和染色劑在2024年將佔總銷售量的45.18%。製造商正在採用多功能面漆,這種面漆無需使用氟即可賦予材料耐磨性和抗菌性。活性絲素蛋白L1的研究表明,生物基聚合物可以取代溶劑型清漆,同時滿足光澤度指標。

在皮革鞣製行業,向植物和合成有機體系的過渡仍在繼續,這緩解了人們對六價鉻排放的擔憂,並提供了令人滿意的標籤認證。浸灰間的清潔劑正朝著酵素複合物的方向發展,這些複合物可在較低的pH值下進行清潔和脫脂,從而滿足減少污水排放的目標。這使得後最後加工供應商能夠獲得更高的利潤,也使水場工段設備供應商能夠利用可縮短製程週期的承包環保配方來豐富其產品組合。

皮革化學品報告按產品類型(鞣製和染色化學品、浸灰間品、整理化學品)、化學功能(鉻基、無鉻礦物、有機合成)、終端用戶行業(鞋類、家具、汽車、紡織和時尚、其他終端用戶行業)和地區(亞太地區、北美、歐洲、南美、中東和非洲)進行細分。

區域分析

預計到2024年,亞太地區將佔全球營收的48.77%,2025年至2030年的複合年成長率將達到6.85%。印度預計在2023會計年度將出口價值52.6億美元的皮革製品,並擁有442萬名從業人員,這將推動對浸灰間加工助劑和整理加工劑的需求。區域成本優勢、一體化的供應鏈以及不斷成長的國內消費,使亞太地區成為產能擴張的中心。日本和韓國的買家對合成鞣劑和麵漆的需求量較小,但純度更高,並且更傾向於選擇擁有ISO 14001認證工廠和不含揮發性有機化合物(VOC)配方的供應商。

北美和歐洲是成熟的價格分佈經銷店,合規支援往往比每公升折扣更具吸引力。在歐洲,最終產品中的鉻含量限制已收緊至3毫克/公斤或更低,這推動了義大利、西班牙和德國對無鉻產品的訂單成長。加州強制要求到2025年中期,75%的企業必須符合鉻安全標準,這將加快上游製程審核和綠色標籤認證的上游工程。這項法規將引導資金流向生物基合成樹脂、低霧度脂肪液和短週期回收系統。北美汽車內裝廠要求產品成分符合美墨加協定(USMCA)認證標準,並傾向選擇提供區域混合站的供應商。這兩個地區共同推動了對永續、高性能化學品的需求。

南美洲是全球生皮供應地,但日益注重在地化加工。外匯波動和歐盟可追溯性法規為成本結構帶來挑戰,但也促使當地投資建置自動化浸灰間線。中東的製革廠正利用石油化學原料生產特殊合成鞣劑,而非洲的新計畫則著眼於從濕藍皮出口轉向成品皮和精製革,從而擴大了綜合加工解決方案的基本客群。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 無鉻和無金屬鞣革技術的快速發展

- 鞋業和紡織業的快速成長

- 汽車和飛機內部裝潢建材的需求不斷成長

- 消費者對生物基脂肪液和合成鞣劑的偏好日益成長

- 數位雷射列印化學品將引領潮流

- 市場限制

- 嚴格的六價鉻排放和污水法規

- 高昂的能源和污水處理成本

- 合成皮革和人造皮革之間的競爭

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 鞣革和染色化學品

- 浸灰間化學

- 表面處理化學品

- 透過化學功能

- 鉻基

- 無鉻礦物

- 有機合成

- 按最終用戶行業分類

- 鞋類

- 家具

- 車

- 紡織與時尚

- 其他終端用戶產業(重型皮革、馬具等)

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AMIT

- Balmer Lawrie & Co. Ltd.

- Buckman

- Chemtan Company, Inc.

- CLARIANT

- Dyna Glycols

- DyStar Singapore Pte Ltd.

- Fashion Chemicals GmbH & Co. KG

- Indofil Industries Limited.

- SCHILL+SEILACHER GMBH

- Sisecam

- Stahl Holdings BV

- Syn-Bios SpA

- TEXAPEL SA

- TFL

- YILDIRIM Group Of Companies

- Zschimmer & Schwarz Chemie GmbH

第7章 市場機會與未來展望

The Leather Chemicals Market size is estimated at USD 11.02 billion in 2025, and is expected to reach USD 14.85 billion by 2030, at a CAGR of 6.15% during the forecast period (2025-2030).

The uptrend is driven by the steady replacement of chromium-based tanning, increased demand from premium footwear and automotive interiors, and wider adoption of bio-based auxiliaries. Chrome-free chemical functions already dominate global demand, while finishing formulations are gaining traction thanks to stricter product-performance requirements. Asia-Pacific leads in both output and innovation, and the competitive field remains fragmented despite recent consolidation initiatives that seek to pair scale with sustainability.

Global Leather Chemicals Market Trends and Insights

Surge in Chrome-Free and Metal-Free Tanning Technologies

Regulators are setting strict chromium thresholds, spurring manufacturers to shift toward organic and mineral-free tanning agents. California's 2023 Chrome Plating ATCM bans new hexavalent chromium facilities and phases out decorative chrome plating, adding momentum to chrome-free adoption. Producers such as Gruppo Mastrotto have invested in vegetable-based methods, citing better biodegradability and shrinking carbon footprints. Laboratory studies confirm that biomass-based agents deliver higher degradation rates than chromium salts, easing end-of-life treatment challenges. Stahl's Granofin Easy F-90 Liq showcases how proprietary formulations save water and energy while eliminating Cr(VI) residues.

Rapid Growth of Footwear and Textile Industries

Antibacterial performance features are now routine after testing in La Rioja confirmed effective microbe kill rates for in-shoe compounds. Mainland China processes nearly 4 billion ft2 of hides per year, making it the largest single customer of beam-house and finishing chemicals in the leather chemicals market. The textile sector adds a second demand stream by utilizing similar finishing agents on mixed material uppers. Brazil's supply reacted quickly, exporting more tanned hides to China as local auto leather volumes escalated.

Strict Chromium VI Emission and Wastewater Norms

ECHA plans to stop 17 tonnes of Cr(VI) from entering ecosystems each year, imposing compliance investments that strain tanners' margins. California's Proposition 65 requires 100% certified chrome-safe leather by December 2025, forcing brands to audit upstream supply chains. The German Federal Institute for Risk Assessment reported that more than half of the tested leather items exceed the 3 mg/kg REACH limit, sparking recalls and legal exposure. Upgrading effluent plants with electrochemical oxidation or Fenton processes can slash water draw-off, but it involves multimillion-dollar capital outlay. Smaller workshops face existential risks if they cannot absorb these costs or secure chrome-free expertise.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand for Automotive and Aviation Upholstery

- Rising Preference for Bio-Based Fatliquors and Syntans

- Competition from Synthetic and Vegan Leather Chemistries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Finishing chemicals registered the highest 6.98% CAGR between 2025 and 2030, while tanning and dyeing agents retained 45.18% of the 2024 volume. Manufacturers adopt multifunctional topcoats that grant abrasion resistance and antimicrobial traits without fluorinated inputs. Activated Silk L1 demonstrates how bio-based polymers can replace solvent-driven lacquers while matching gloss metrics.

The tanning segment continues to pivot toward vegetable and synthetic organic systems, easing Cr(VI) discharge worries and satisfying label certification schemes. Beam-house detergents have moved toward enzyme complexes that clean and degrease at lower pH, aligning with wastewater reduction goals. Finishing suppliers thus capture premium margins, while wet-end players strengthen portfolios with turnkey eco-recipes that shorten process cycles.

The Leather Chemicals Report is Segmented by Product Type (Tanning and Dyeing Chemicals, Beam-House Chemicals, and Finishing Chemicals), Chemical Function (Chrome-Based, Chrome-Free Mineral, and Synthetic Organic), End-User Industry (Footwear, Furniture, Automotive, Textile and Fashion, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific controlled 48.77% of 2024 revenue and is forecast to grow at a 6.85% CAGR during 2025-2030. India exported USD 5.26 billion worth of leather goods in FY 2023 and employs 4.42 million workers, amplifying demand for beam-house auxiliaries and finishing agents. Regional cost advantages, integrated supply pools, and rising domestic consumption keep APAC at the epicenter of new capacity expansions. Japanese and South Korean buyers, though smaller in volume, demand high-purity syntans and topcoats, favoring suppliers with ISO 14001 plants and VOC-free recipes.

North America and Europe present mature but premium-priced outlets where compliance support often outweighs per-liter discounts. Europe tightened chromium limits to below 3 mg/kg in finished goods, driving chrome-free orders in Italy, Spain, and Germany. California prescribed 75% compliance to chrome-safe standards by mid-2025, adding urgency for upstream audits and green-tag certificates. These rules channel spending into bio-based synthetics, low-fogging fatliquors, and short-cycle recycling systems. North American auto trim plants require USMCA-proven content and favor suppliers offering regional blending stations. Together, the two regions sustain demand for sustainable high-performance chemicals.

South America supplies raw hides globally yet is increasing local finishing. Currency swings and EU traceability rules challenge cost structures but also encourage investments in automated beam-house lines. Middle Eastern tanneries leverage petrochemical feedstocks for specialty syntans, while new African projects look to shift from wet-blue exports to crust or finished leather, widening the client base for comprehensive processing solutions.

- AMIT

- Balmer Lawrie & Co. Ltd.

- Buckman

- Chemtan Company, Inc.

- CLARIANT

- Dyna Glycols

- DyStar Singapore Pte Ltd.

- Fashion Chemicals GmbH & Co. KG

- Indofil Industries Limited.

- SCHILL+SEILACHER GMBH

- Sisecam

- Stahl Holdings B.V.

- Syn-Bios S.p.A.

- TEXAPEL S.A.

- TFL

- YILDIRIM Group Of Companies

- Zschimmer & Schwarz Chemie GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Chrome-Free and Metal-Free Tanning Technologies

- 4.2.2 Rapid Growth of Footwear and Textile Industries

- 4.2.3 Increasing Demand for Automotive and Aviation Upholstery

- 4.2.4 Rising Preference for Bio-Based Fatliquors and Syntans

- 4.2.5 Digital Leather Printing Chemicals Gaining Traction

- 4.3 Market Restraints

- 4.3.1 Strict Chromium VI Emission and Wastewater Norms

- 4.3.2 High Energy and Wastewater-Treatment Cost

- 4.3.3 Competition From Synthetic and Vegan Leather Chemistries

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Tanning and Dyeing Chemicals

- 5.1.2 Beam-house Chemicals

- 5.1.3 Finishing Chemicals

- 5.2 By Chemical Function

- 5.2.1 Chrome-based

- 5.2.2 Chrome-free Mineral

- 5.2.3 Synthetic Organic

- 5.3 By End-user Industry

- 5.3.1 Footwear

- 5.3.2 Furniture

- 5.3.3 Automotive

- 5.3.4 Textile and Fashion

- 5.3.5 Other End-user Industries (Heavy Leather and Saddlery, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AMIT

- 6.4.2 Balmer Lawrie & Co. Ltd.

- 6.4.3 Buckman

- 6.4.4 Chemtan Company, Inc.

- 6.4.5 CLARIANT

- 6.4.6 Dyna Glycols

- 6.4.7 DyStar Singapore Pte Ltd.

- 6.4.8 Fashion Chemicals GmbH & Co. KG

- 6.4.9 Indofil Industries Limited.

- 6.4.10 SCHILL+SEILACHER GMBH

- 6.4.11 Sisecam

- 6.4.12 Stahl Holdings B.V.

- 6.4.13 Syn-Bios S.p.A.

- 6.4.14 TEXAPEL S.A.

- 6.4.15 TFL

- 6.4.16 YILDIRIM Group Of Companies

- 6.4.17 Zschimmer & Schwarz Chemie GmbH

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment