|

市場調查報告書

商品編碼

1907287

鉬:市佔率分析、產業趨勢與統計、成長預測(2026-2031)Molybdenum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

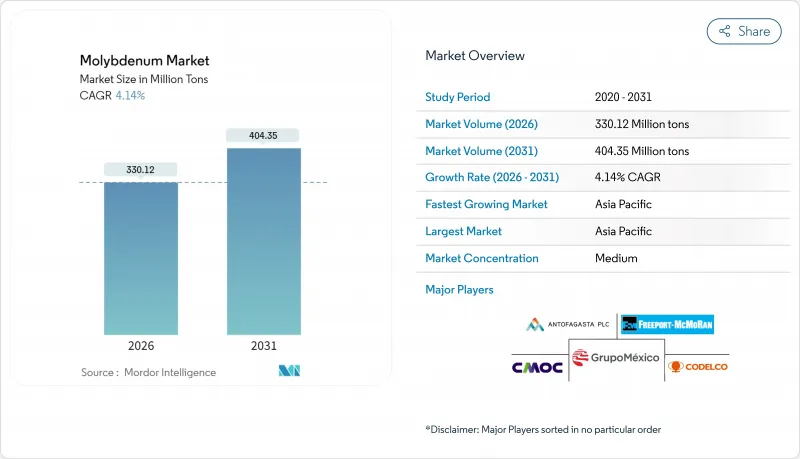

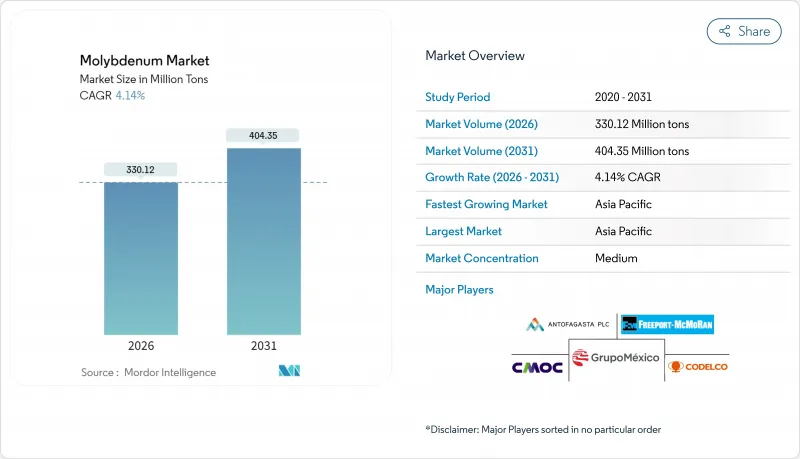

預計到 2025 年,鉬市場價值將達到 3.17 億噸,在預測期(2026-2031 年)內,將以 4.14% 的複合年成長率成長,從 2026 年的 3.3012 億噸成長到 2031 年的 4.0435 億噸。

鋼鐵製造仍然是主要應用領域,高強度低合金鋼(HSLA)在建築、汽車和能源基礎設施領域的應用日益廣泛。由於對無污染燃料催化劑、排放氣體控制和二氧化碳轉化等應用的需求不斷成長,化學應用也隨之擴展。中國於2025年2月宣布對包括鉬在內的關鍵礦產實施出口限制,這項政策轉變可能改變全球貿易路線和價格,加劇了地緣政治風險。供應受限的風險正促使鋼鐵製造商、油氣營運商、可再生能源設備製造商和電動車電力電子供應商重新評估其籌資策略,提高回收利用率,並投資研發不可替代的合金設計。

全球鉬市場趨勢與洞察

高強度低合金鋼需求快速成長

快速的基礎設施建設和對更輕、更強車輛的需求,正推動高強度低合金鋼(HSLA鋼)成為鉬市場成長的關鍵驅動力。添加0.5%至1%的鉬可使屈服強度提高高達20%,增強低溫韌性,並提高抗硫化物應力腐蝕開裂性能。這些優異的機械性質使得橋樑、隧道和高層建築的上部結構能夠採用更薄的鋼材厚度,並延長使用壽命。同時,汽車製造商正在採用HSLA鋼製造素車零件,以減輕車身重量、提高燃油經濟性並延長電動車的續航里程。最新研究證實,(Ti, Mo)C析出物在酸性環境中具有更強的抗裂性能,此特性深受管線業者的青睞。隨著世界各國政府大力推動交通基礎設施和可再生能源網路的獎勵策略,HSLA鋼在鋼鐵生產中的佔有率不斷成長,進一步推動了對鉬的潛在需求。

越來越多的可再生能源設施需要鉬基合金。

大型風力發電和水力發電設施採用含鉬馬氏體鋼和高溫合金來承受鹽霧、循環負荷和空化作用。離岸風力發電機塔筒和機艙內部組件必須在其25年的使用壽命內承受潮濕和氯化物侵蝕,而鉬合金鋼板和鑄件正是滿足這一需求的。 Mobarcar公司2024年的一項研究表明,經熱機械處理的含鉬鋼即使在長期暴露於海水中後仍能保持高強度和斷裂韌性。在電力轉換設備中,鉬散熱器的熱膨脹係數與矽相匹配,並為風電場逆變器中使用的絕緣柵雙極電晶體(IGBT)模組提供可靠的支撐。政府的清潔能源目標和創紀錄的離岸風力發電競標規模正在對此需求因素施加結構性上行壓力。

鉬高成本

價格波動擾亂了預算週期,促使企業盡可能地用鎢和鈮替代鉬,並迫使小規模買家支付風險溢價。中國限制造成的供應緊張加劇了這種影響,使小型鋼廠、鑄造廠和催化劑製造商的原料成本難以預測,從而衝擊鉬市場。

細分市場分析

鋼鐵業佔據鉬市場的大部分佔有率,預計到2025年將佔全球消費量的70.62%。高溫石油、液化天然氣和化學工廠需要添加2-4%鉬的鐵素體和奧氏體不銹鋼來抵抗氯化物裂解。酸性氣體管道規範通常要求添加高達1%的鉬,這樣可以減少壁厚並降低焊接成本。

儘管目前化學產業規模較小,但預計它將成為成長最快的需求來源,到2031年複合年成長率將達到4.62%。鈷鉬/氧化鋁基加氫脫硫(HDS)催化劑用於去除柴油和噴射機燃料中的硫,以滿足超低硫排放標準;而三氧化鉬則被添加到催化劑中,將二氧化碳和可再生原料轉化為合成燃料。這種成長動能將使化學產業在預測期後半段逐步蠶食鋼鐵業的市場佔有率,從而進一步拓展鉬市場。

本鉬市場報告按最終產品(鋼鐵、化工、鑄造等)、產品形態(鉬精礦、焙燒鉬、鉬鐵等)、最終用途行業(石油天然氣、化工及石化、汽車、工業、建築等)和地區(亞太、北美、歐洲、世界其他地區)進行細分。市場預測以噸為單位。

區域分析

到2025年,亞太地區將佔全球鉬加工量的53.60%,主要得益於中國、日本、韓國和印度鋼鐵生產、汽車組裝和先進電子製造業的擴張。該地區的複合年成長率(CAGR)為4.71%,主要驅動力來自「一帶一路」基礎設施、能源管道和造船業。北京於2025年2月實施的鉬出口許可證制度將下游買家置於配額監管之下,加速了庫存累積。

北美正充分利用美國的資源禀賦,預計2024年開採量將達3.3萬噸。 2025年3月的一項總統令旨在加快採礦許可核准,預計將提高北美的自給自足能力。歐洲目前面臨供不應求,但德國和義大利的不銹鋼廠和電動車零件工廠的需求仍然強勁。

歐盟委員會提出的再生鋼配額提案提案到2030年,新車用鋼的25%來自廢鋼,並鼓勵從汽車切碎機回收鉬。中東煉油廠進口鉬用於加氫處理催化劑,非洲斑狀銅礦計劃則生產鉬產品,並以現貨形式供應歐洲和亞洲。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 高強度低合金鋼(HSLA)需求快速成長

- 由於可再生能源設施的增加,對鉬合金的需求不斷成長。

- 深水油氣鑽探活動活性化了對耐腐蝕鉬合金的需求

- 用於電動汽車電力電子的高溫鉬元件

- 金屬3D列印中鉬粉的應用日益廣泛

- 市場限制

- 鉬高成本

- 政府對採礦業的監管

- 特種鋼中鎢和鈮的替代品。

- 由於回收基礎設施不發達,二次供應有限。

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 貿易分析

- 價格趨勢

第5章 市場規模與成長預測

- 最終產品

- 鋼

- 化學

- 晶圓代工廠

- 鉬金屬

- 鎳合金

- 按產品形式

- 鉬濃縮物

- 焙燒鉬(工業氧化鉬)

- 鉬鐵

- 鉬金屬粉末

- 鉬化學品

- 按最終用戶行業分類

- 石油和天然氣

- 化工和石油化工

- 車

- 產業

- 建築/施工

- 航太與國防

- 其他產業(能源產出和儲存、電子和半導體等)

- 按地區(生產分析)

- 中國

- 美國

- 智利

- 秘魯

- 墨西哥

- 亞美尼亞

- 其他生產國

- 按地區分類(消費分析)

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)分析

- 公司簡介

- Air Liquide

- Anglo American plc

- Antamina

- Antofagasta plc

- Centerra Gold Inc.

- China Molybdenum Co. Ltd.

- Codelco

- Freeport-McMoRan

- GRUPO MEXICO

- HONGDA GROUP

- Jiangxi Copper Corporation

- JINDUICHENG MOLYBDENUM CO.,LTD.

- KAZ Minerals

- KGHM

- Moltun International

- MOLYMET SA

- Multi Metal Development Limited

- Rio Tinto

第7章 市場機會與未來展望

The Molybdenum Market was valued at 317 million tons in 2025 and estimated to grow from 330.12 million tons in 2026 to reach 404.35 million tons by 2031, at a CAGR of 4.14% during the forecast period (2026-2031).

Steelmaking remained the primary outlet, as high-strength, low-alloy (HSLA) grades spread through construction, automotive, and energy infrastructure. Chemical uses advanced on the back of rising catalyst demand for clean fuels, emissions control, and CO2 conversion. Geopolitical exposure intensified after China's February 2025 export-control notice on critical minerals, including molybdenum, a policy shift that threatens to alter trade routes and price formation worldwide. Tight supply risk is prompting steelmakers, oil-and-gas operators, renewable-energy OEMs, and EV power-electronics suppliers to re-evaluate sourcing strategies, expand recycling, and invest in substitute-proof alloy designs.

Global Molybdenum Market Trends and Insights

Surge in High-Strength Low-Alloy Steel Demand

Rapid infrastructure rollouts and the push for lighter yet stronger vehicles have made HSLA steel a central growth lever for the molybdenum market. Adding 0.5-1% Mo boosts yield strength by up to 20%, enhances low-temperature toughness, and reduces susceptibility to sulfide stress corrosion. These mechanical gains allow thinner gauges and longer service life in bridges, tunnels, and high-rise superstructures. Automakers, meanwhile, use HSLA body-in-white parts to shave vehicle mass and raise fuel economy or EV range. New research on (Ti, Mo)C precipitation confirms improved resistance to cracking in sour environments, a property valued by pipeline operators. As governments channel stimulus into transport and renewable grids, HSLA grades are capturing a growing slice of steel output, magnifying baseline demand for molybdenum.

Increasing Renewable-Energy Installations Requiring Mo-Based Alloys

Utility-scale wind and hydropower assets use Mo-containing martensitic steels and superalloys to survive salt spray, cyclic loading, and cavitation. Offshore turbine towers and nacelle internals must tolerate humidity and chloride attack over 25-year lifecycles, a job handled by Mo-alloyed plate and castings. Mohrbacher's 2024 study showed that thermomechanically processed Mo-bearing steels sustain high strength and fracture toughness even after prolonged exposure to seawater. In power converters, molybdenum heatspreaders match silicon's thermal expansion, serving as reliable bases for insulated-gate bipolar transistor (IGBT) modules used in wind farm inverters. Government clean-energy targets and record auction volumes for offshore wind impose a structural uplift on this driver.

High Cost of Molybdenum

Price volatility disturbs budget cycles, prompts substitution with tungsten or niobium where feasible, and forces smaller buyers to pay risk premiums. Supply tightness linked to Chinese controls compounds the effect, keeping feedstock invoices unpredictable for steel minimills, foundries, and catalyst producers, influencing in the molybdenum market.

Other drivers and restraints analyzed in the detailed report include:

- Intensifying Deep-Water Oil and Gas Drilling Boosting Corrosion-Resistant Mo Alloys

- Adoption of High-Temperature Mo Components for Electric-Vehicle Power Electronics

- Government Regulations Concerning Mining

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Steel retained the lion's share of the molybdenum market, accounting for 70.62% of global offtake in 2025. High-temperature petroleum, LNG, and chemical plants demand ferritic and austenitic stainless varieties enriched with 2-4% Mo to resist chloride cracking. Linepipe specifications for sour gas routinely call for up to 1% Mo, allowing thinner walls and lower welding costs.

Chemicals, although smaller at present, represent the fastest-growing outlet at a 4.62% CAGR through 2031. Hydrodesulfurization (HDS) catalysts based on Co-Mo/Al2O3 remove sulfur from diesel and jet fuel to meet ultra-low sulfur directives, while MoO3 screws into catalysts that convert CO2 and renewable feedstock into synthetic fuels. This momentum positions chemicals to chip away share from steel in the latter half of the forecast window, lending depth to the molybdenum market.

The Molybdenum Market Report is Segmented by End Product (Steel, Chemical, Foundry, and More), Product Form (Molybdenum Concentrates, Roasted Molybdenum, Ferromolybdenum, and More), End-Use Industry (Oil & Gas, Chemical & Petrochemical, Automotive, Industrial, Building & Construction, and More), and Geography (Asia-Pacific, North America, Europe, Rest of the World). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific held 53.60% of global throughput in 2025 as China, Japan, South Korea, and India escalated steel output, vehicle assembly, and advanced-electronics fabrication. The region's 4.71% CAGR stems from Belt-and-Road infrastructure, energy pipelines, and shipbuilding. Beijing's February 2025 export-license regime for molybdenum puts downstream buyers on allocation watch and accelerates inventory build-ups.

North America is leveraging resource endowment in the United States, which mined 33,000 tons in 2024. A March 2025 executive order now seeks to fast-track mining permits, potentially lifting North American self-reliance. Europe, though supply-short, retains robust demand driven by German and Italian stainless mills and EV-component plants.

The European Commission's recycled-steel quotas propose that 25% of steel in new cars originate from scrap by 2030, stimulating molybdenum recovery from automotive shredders. Middle-East refiners import Mo for hydro-treating catalysts, while African copper porphyry projects contribute by-product molybdenum that feeds spot cargoes into Europe and Asia.

- Air Liquide

- Anglo American plc

- Antamina

- Antofagasta plc

- Centerra Gold Inc.

- China Molybdenum Co. Ltd.

- Codelco

- Freeport-McMoRan

- GRUPO MEXICO

- HONGDA GROUP

- Jiangxi Copper Corporation

- JINDUICHENG MOLYBDENUM CO.,LTD.

- KAZ Minerals

- KGHM

- Moltun International

- MOLYMET SA

- Multi Metal Development Limited

- Rio Tinto

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in High-Strength Low-Alloy (HSLA) Steel Demand

- 4.2.2 Increasing Renewable Energy Installations Requiring Mo-based Alloys

- 4.2.3 Intensifying Deep-water Oil and Gas Drilling Boosting Corrosion-Resistant Mo Alloys

- 4.2.4 Adoption of High-Temperature Mo Components for the Electric Vehicle Power Electronics

- 4.2.5 Increasing Usage of Molybdenum Powders for Metal 3-D Printing

- 4.3 Market Restraints

- 4.3.1 High Cost of Molybdenum

- 4.3.2 Government Regulations Concering Mining

- 4.3.3 Substitution by Tungsten and Niobium in Specialty Steels

- 4.3.4 Under-developed Recycling Infrastructure Limiting Secondary Supply

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Trade Analysis

- 4.7 Price Trends

5 Market Size and Growth Forecasts (Volume)

- 5.1 By End Product

- 5.1.1 Steel

- 5.1.2 Chemical

- 5.1.3 Foundry

- 5.1.4 Molybdenum Metal

- 5.1.5 Nickel Alloys

- 5.2 By Product Form

- 5.2.1 Molybdenum Concentrates

- 5.2.2 Roasted Molybdenum (Technical Oxide)

- 5.2.3 Ferromolybdenum

- 5.2.4 Molybdenum Metal Powder

- 5.2.5 Molybdenum Chemicals

- 5.3 By End-user Industry

- 5.3.1 Oil and Gas

- 5.3.2 Chemical and Petrochemical

- 5.3.3 Automotive

- 5.3.4 Industrial

- 5.3.5 Building and Construction

- 5.3.6 Aerospace and Defense

- 5.3.7 Other Industries (Energy Generation and Storage Electronics and Semiconductors, etc.)

- 5.4 By Geography (Production Analysis)

- 5.4.1 China

- 5.4.2 United States

- 5.4.3 Chile

- 5.4.4 Peru

- 5.4.5 Mexico

- 5.4.6 Armenia

- 5.4.7 Other Producer Countries

- 5.5 By Geography (Consumption Analysis)

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%) Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Air Liquide

- 6.4.2 Anglo American plc

- 6.4.3 Antamina

- 6.4.4 Antofagasta plc

- 6.4.5 Centerra Gold Inc.

- 6.4.6 China Molybdenum Co. Ltd.

- 6.4.7 Codelco

- 6.4.8 Freeport-McMoRan

- 6.4.9 GRUPO MEXICO

- 6.4.10 HONGDA GROUP

- 6.4.11 Jiangxi Copper Corporation

- 6.4.12 JINDUICHENG MOLYBDENUM CO.,LTD.

- 6.4.13 KAZ Minerals

- 6.4.14 KGHM

- 6.4.15 Moltun International

- 6.4.16 MOLYMET SA

- 6.4.17 Multi Metal Development Limited

- 6.4.18 Rio Tinto

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Rising Demand for Molybdenum-bearing Chemicals in Clean-fuel Processes