|

市場調查報告書

商品編碼

1852160

果汁濃縮液:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Fruit Concentrate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

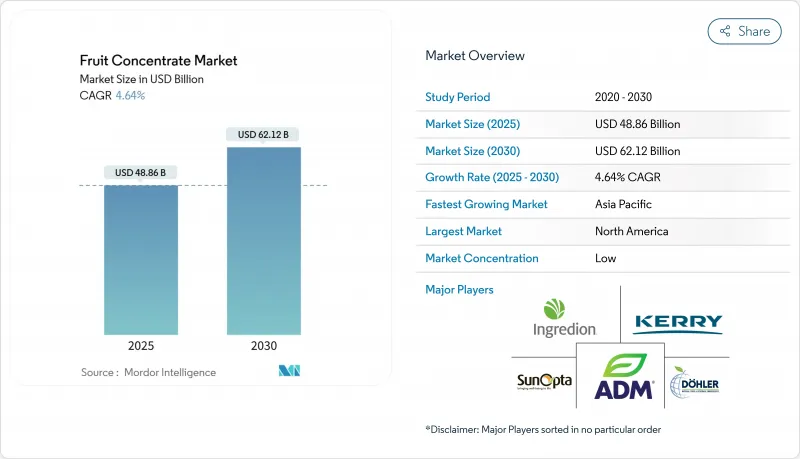

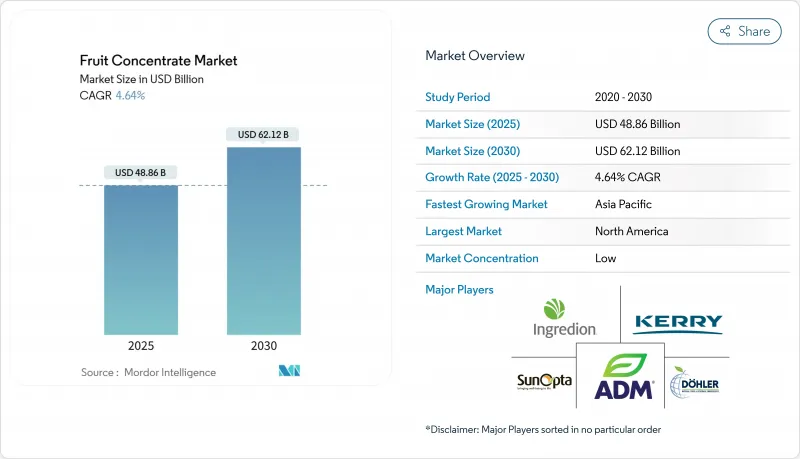

預計到 2030 年,水果濃縮汁市場規模將從 2025 年的 488.6 億美元成長到 621.2 億美元,複合年成長率為 4.64%。

受美國FDA更新「健康」定義和更嚴格的糖分限制(於2025年2月生效)的推動,果汁濃縮物市場穩步成長,這反映出市場正從以普通果汁為基礎的產品向高階功能性配料進行決定性轉變。消費者對天然成分日益成長的偏好、低能耗膜分離和冷凍濃縮技術的廣泛應用,以及消費者對增強免疫力飲料日益成長的興趣,都為加工商帶來了新的收入來源和更高的淨利率。供應鏈的不穩定性,例如巴西橙子產量在2024/25年度下降了27.4%(根據CEPEA(應用經濟高級研究中心)的數據),正在推動地域多元化和保存期限長的包裝形式的價值。在各個品類中,果汁濃縮物市場正在從以銷售主導的貿易模式轉型為以潔淨標示、營養和永續性解決方案為核心的平台。

全球果汁濃縮液市場趨勢與洞察

天然材料的需求不斷成長

Kerry 2025年的調查顯示,86%的消費者願意為功能性益處支付溢價,這凸顯了消費者對潔淨標示產品的需求正在推動果汁濃縮物規格的重大變革。這一趨勢不僅限於傳統應用領域,食品製造商擴大用果汁濃縮物取代人工香料,以滿足消費者對透明度的期望。加州食品安全法規進一步加速了這一轉變,促使許多品牌完全依賴天然色素和香料,從而持續推動對水果基替代品的需求。先進的穩定技術正在提升天然色素的性能,使果汁濃縮物成為以往由合成色素主導的應用領域的可行選擇。這種轉變反映的是市場的長期發展趨勢,而非暫時的潮流,因為法律規範將繼續支持天然解決方案。

機能飲料的成長

果汁濃縮物正日益成為增強免疫力配方中不可或缺的成分,51%的消費者關注皮膚護理,44%的消費者則將增強免疫力作為飲品偏好的首要考量。將果汁濃縮物與植物萃取物結合的適應原飲料日益流行,反映出其應用正從傳統的果汁用途轉向藥用級功能性用途。像Kelly這樣的公司,憑藉其Tasteense技術,正在研發出能夠提供特定健康益處並保持風味的特製濃縮果汁混合物,在不犧牲風味的前提下降低糖分。為了滿足消費者對低糖和有益腸道健康飲品日益成長的需求,該行業正在利用果渣和富含纖維的濃縮物。這一趨勢也體現在預計2025年益生元和益生菌飲料新品數量的成長。因此,果汁濃縮物的角色正在轉變,從一種基本的通用甜味劑轉變為一種優質的增值成分。

原物料價格不穩定

原物料價格波動始終是一個挑戰,尤其對於柑橘和熱帶水果而言更是如此。 2025年,受天氣影響導致巴西橙子減產,價格飆升至歷史新高。同時,鑑於美國提案進口商品徵收50%的關稅,歐洲買家尋求降低合約價格。這些因素導致巴西果汁庫存告罄,佛羅裡達州的橙子產量下降了20%。此外,原料的進出口也扮演重要角色。根據經濟複雜性觀測站2024年的數據,加拿大進口了價值9.66億美元的熱帶水果。這凸顯了多元化採購和靈活籌資策略的迫切性,正如應用經濟高級研究中心所強調的那樣。為此,企業正在投資合約農業和再生農業,以提高可追溯性和供應鏈韌性。此外,企業也正在探索精密農業和區塊鏈等先進技術,以提高供應鏈透明度並降低價格波動帶來的風險。預計這些措施將在確保柑橘和熱帶水果市場的長期永續性和穩定性方面發揮關鍵作用。

細分市場分析

預計到2024年,柑橘類水果將佔據飲料和食品加工市場37.23%的佔有率,凸顯其在飲料和食品加工領域的關鍵作用。柑橘類水果廣泛用於果汁、調味品和加工食品中,鞏固了其在行業中的領先地位。然而,熱帶水果正經歷快速成長,預計到2030年將以6.12%的複合年成長率成長,這主要得益於消費者對異國風味日益成長的需求以及東南亞和拉丁美洲供應鏈的不斷完善。芒果、鳳梨和木瓜等加工熱帶水果(如果食物泥和冷凍製品)的日益普及進一步推動了這一成長。雖然紅色水果和覆盆子等水果的供應量相對較少,但它們擴大被用於功能性和高階產品中,以滿足注重健康的消費者的需求。這些水果,包括草莓、覆盆子和藍莓,正擴大被添加到產品中,以彰顯其抗氧化和營養價值。

「其他」類別,包括蘋果、梨和核果,正受益於合約農業和永續性措施的進步,尤其是有機和可追溯採購。這些措施有助於建立消費者信任,並滿足消費者對符合道德標準的農產品日益成長的需求。此外,美國食品藥物法律規範,在水果選擇和產品定位方面發揮關鍵作用。遵守這些法規可確保透明度,並影響消費者的購買決策,進而進一步影響市場動態。

區域分析

到2024年,北美將佔據31.50%的市場佔有率,這得益於其完善的加工基礎設施、清晰的監管環境以及消費者對機能飲料飲料和潔淨標示飲料的強勁需求。然而,該地區強大的供應鏈正面臨氣候變遷的挑戰,尤其是在柑橘和櫻桃的生產方面,這凸顯了投資多元化採購和尖端加工技術的緊迫性。

亞太地區將成為成長最快的地區,預計2025年至2030年的複合年成長率將達到6.45%。這一成長主要得益於中階的崛起、加工能力投資的增加以及本土和區域品牌的興起。中國柑橘產量的不斷成長和越南對先進速凍(IQF)加工技術的應用,凸顯了該地區對產量和品質的雙重重視。同時,印度和印尼也在大力發展加工廠和合約種植項目,以確保國內需求和出口機會的原料穩定供應。

歐洲市場正積極應對嚴格的監管環境和日益成長的永續性需求。 2023/2024年度,歐盟柑橘生產因乾旱和氣溫上升而面臨挑戰。然而,消費者對成分透明度和環境責任的強烈需求,使歐洲在潔淨標示和有機認證方面處於領先地位。南美洲和非洲正逐漸成為熱帶水果和柑橘濃縮汁的主導供應國。巴西和加納憑藉其成本優勢和靠近主要進口市場的地理優勢,引領著這一趨勢。然而,這些地區也並非沒有挑戰,由於天氣變化和關稅波動,它們的供應鏈面臨著巨大的脆弱性。為此,當地已明顯加強了加工和出口基礎建設。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 天然材料的需求不斷成長

- 機能飲料的成長

- 生產和加工方面的技術進步

- 健康主導糖替代品

- 新興市場成長加速

- 穩定的保存期限,推動需求成長

- 市場限制

- 原物料價格波動

- 嚴格的政府法規

- 季節性和供應鏈問題

- 採用替代甜味劑和配料創新

- 供應鏈分析

- 監理展望

- 波特五力模型

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依水果種類

- 柑橘

- 紅色水果和漿果

- 熱帶水果

- 其他

- 按產品形式

- 濃縮液

- 濃縮粉末

- 其他

- 透過使用

- 飲料

- 果汁和飲料

- 軟性飲料和碳酸飲料

- 酒精飲料

- 麵包和烘焙產品

- 糖果甜點

- 糖果和軟糖

- 果凍和水果糖果甜點

- 水果棒和零食

- 其他

- 乳製品和冷凍食品

- 其他

- 飲料

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 荷蘭

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 印尼

- 韓國

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市場排名分析

- 公司簡介

- Archer Daniels Midland Company

- Dohler GmbH

- Kerry Group plc

- Ingredion Incorporated

- SunOpta Inc.

- AGRANA Beteiligungs-AG

- Tree Top Inc.(Northwest Naturals)

- China Haisheng Juice Holdings Co. Ltd.

- Royal Cosun(SVZ)

- FruitSmart Inc.

- Louis Dreyfus Company Juice

- Sucocitrico Cutrale Ltda.

- Citrosuco SA

- Diana Food(Symrise)

- SVZ International BV

- Welch Foods Inc.

- Mysore Fruit Products Ltd

- LemonConcentrate SLU

- Vie-Del Company

- Capullo Fruit Concentrates

第7章 市場機會與未來展望

The fruit concentrates market size stood at USD 48.86 billion in 2025 and is forecast to expand to USD 62.12 billion by 2030, advancing at a 4.64% CAGR.

This steady climb reflects a decisive shift from commodity juice bases toward premium functional ingredients, encouraged by the U.S. FDA's updated "healthy" definition that took effect in February 2025 and tightened limits on added sugars. Heightened consumer preference for natural components, wider adoption of low-energy membrane and freeze-concentration technologies, and greater interest in immunity-supporting beverages are giving processors new revenue streams and higher margins. Meanwhile, supply-chain volatility-exemplified by Brazil's 27.4% drop in 2024/25 orange output-has amplified the value of geographic diversification and shelf-stable formats, according to the CEPEA - Center for Advanced Studies on Applied Economics. Department of Economy, Administration and Sociology. Across categories, the fruit concentrates market is transforming from volume-led trading into a platform for clean-label, nutritional, and sustainability solutions.

Global Fruit Concentrate Market Trends and Insights

Rising Demand for Natural Ingredients

Kerry's 2025 research reveals that 86% of consumers are ready to pay a premium for functional benefits, underscoring a major shift in fruit concentrate specifications driven by the demand for clean-label products. This trend extends beyond traditional applications, as food manufacturers increasingly replace artificial flavors with fruit concentrates to meet transparency expectations. The California Food Safety Act has further accelerated this transition, prompting many brands to rely solely on natural colors and flavors, thereby driving sustained demand for fruit-based alternatives. Advanced stabilization techniques are improving the performance of natural colors, making fruit concentrates a practical option in applications previously dominated by synthetic alternatives. This change reflects a permanent evolution in the market rather than a temporary trend, as regulatory frameworks continue to favor natural ingredient solutions.

Growth in Functional Beverages

Fruit concentrates are increasingly vital in immunity-boosting formulations, with 51% of consumers focusing on skin support and 44% prioritizing immune benefits in their beverage preferences. The growing popularity of adaptogenic beverages, which combine fruit concentrates with botanical extracts, reflects a shift from traditional juice applications to pharmaceutical-grade functionality. Companies, such as Kerry with its Tastesense technology, are creating specialized concentrate blends that provide specific health benefits while preserving taste, achieving sugar reduction without compromising flavor. To meet the rising demand for low-sugar and gut-health beverages, the industry is utilizing fruit pomace and fiber-rich concentrates. This trend is evident in the increasing number of prebiotic and probiotic drink launches anticipated in 2025. Consequently, the role of fruit concentrates is transforming, moving from basic commodity sweeteners to premium, value-added ingredients.

Volatile Raw Material Prices

Raw material price volatility poses a consistent challenge, especially for citrus and tropical fruits. In 2025, weather-induced production declines led to record-high Brazilian orange prices. Simultaneously, European buyers sought reduced contract prices in light of a proposed 50% U.S. tariff on imports. Such disruptions resulted in Brazil's juice stocks hitting zero and a 20% reduction in Florida's orange crop. Additionally, import-export of raw material plays a significant role. According to the Observatory of Economic Complexity data from 2024, Canada imported USD 966 million worth of tropical fruits. This underscores the urgency for diversified sourcing and adaptable procurement strategies, as highlighted by the Center for Advanced Studies on Applied Economics. In response, companies are channeling investments into contract farming and regenerative agriculture, aiming to bolster traceability and supply resilience. Additionally, businesses are exploring advanced technologies, such as precision agriculture and blockchain, to enhance supply chain transparency and mitigate risks associated with price fluctuations. These measures are expected to play a crucial role in ensuring long-term sustainability and stability in the citrus and tropical fruit markets.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Production and Processing

- Health-driven Sugar-replacement Adoption

- Stringent Government Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, citrus fruits commanded a dominant 37.23% share of the market, underscoring their pivotal role in beverage and food processing. Their widespread use in juices, flavoring agents, and processed foods highlights their entrenched position in the industry. Yet, tropical fruits are surging ahead, boasting a 6.12% CAGR through 2030, fueled by a growing consumer appetite for exotic flavors and bolstered supply chains in Southeast Asia and Latin America. The increasing availability of tropical fruits, such as mangoes, pineapples, and papayas, in processed forms like purees and frozen products is further driving their growth. While red berries and fruits occupy a smaller volume, their rising prominence in functional and premium products caters to the health-conscious demographic. These fruits, including strawberries, raspberries, and blueberries, are increasingly incorporated into products marketed for their antioxidant and nutritional benefits.

The "others" category, encompassing apples, pears, and stone fruits, is reaping rewards from contract farming advancements and sustainability drives, especially in organic and traceable sourcing. These initiatives are enhancing consumer trust and meeting the growing demand for ethically sourced produce. Furthermore, the FDA and USDA's regulatory oversight, particularly concerning juice content and labeling, plays a pivotal role in shaping fruit selection and product positioning. Compliance with these regulations ensures transparency and influences consumer purchasing decisions, further impacting market dynamics.

The Fruit Concentrates Market Report is Segmented by Fruit Type (Citrus Fruits, Red Fruits and Berries, Tropical Fruits, Others), Product Form (Liquid Concentrate, Powder Concentrate, Others), Application (Beverages, Bread and Bakery Products, Confectionery, and More), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America commanded a dominant 31.50% market share, bolstered by its established processing infrastructure, clear regulations, and a robust consumer appetite for functional and clean-label beverages. However, the region's strong supply chain grapples with climate-induced challenges, especially in citrus and cherry production, highlighting the urgent need for investments in diverse sourcing and cutting-edge processing technologies.

Asia Pacific is poised to be the fastest-growing region, projecting a 6.45% CAGR from 2025 to 2030. This growth is driven by a burgeoning middle class, heightened investments in processing capabilities, and the rise of both local and regional brands. China's expansion in citrus production, coupled with Vietnam's embrace of advanced IQF processing, underscores the region's commitment to both volume and quality. Meanwhile, India and Indonesia are making strides with new processing plants and contract farming initiatives, ensuring a steady raw material supply for domestic needs and export opportunities.

Europe's market is navigating a stringent regulatory landscape and an increasing focus on sustainability. The 2023/2024 season saw the EU's citrus production grappling with challenges posed by droughts and elevated temperatures. Yet, Europe stands at the forefront of clean label and organic certifications, driven by a robust consumer push for ingredient transparency and environmental stewardship. South America and Africa are carving out their niches as pivotal suppliers of tropical and citrus concentrates. Brazil and Ghana, capitalizing on their cost advantages and closeness to major import markets, are leading the charge. Yet, these regions aren't without challenges; they contend with significant supply chain vulnerabilities stemming from weather fluctuations and tariff shifts. In response, there's a noticeable pivot towards bolstering local processing and export infrastructures.

- Archer Daniels Midland Company

- Dohler GmbH

- Kerry Group plc

- Ingredion Incorporated

- SunOpta Inc.

- AGRANA Beteiligungs-AG

- Tree Top Inc. (Northwest Naturals)

- China Haisheng Juice Holdings Co. Ltd.

- Royal Cosun (SVZ)

- FruitSmart Inc.

- Louis Dreyfus Company Juice

- Sucocitrico Cutrale Ltda.

- Citrosuco S.A.

- Diana Food (Symrise)

- SVZ International B.V.

- Welch Foods Inc.

- Mysore Fruit Products Ltd

- LemonConcentrate SLU

- Vie-Del Company

- Capullo Fruit Concentrates

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Natural Ingredients

- 4.2.2 Growth in Functional Beverages

- 4.2.3 Technological Advancements in production and processing

- 4.2.4 Health-driven sugar-replacement adoption

- 4.2.5 Rising Growth in Emerging Markets

- 4.2.6 Stable Shelf Life, Driving the Demand

- 4.3 Market Restraints

- 4.3.1 Volatile Raw Material Prices

- 4.3.2 Stringent Government Regulations

- 4.3.3 Seasonality and Supply Chain Issues

- 4.3.4 Adoption of Alternative Sweeteners and Ingredient Innovations

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST

- 5.1 By Fruit Type (Value)

- 5.1.1 Citrus Fruits

- 5.1.2 Red Fruits & Berries

- 5.1.3 Tropical Fruits

- 5.1.4 Others

- 5.2 By Product Form (Value)

- 5.2.1 Liquid Concentrate

- 5.2.2 Powder Concentrate

- 5.2.3 Others

- 5.3 By Application (Value)

- 5.3.1 Beverages

- 5.3.1.1 Fruit Juices and Drinks

- 5.3.1.2 Soft Drinks and Carbonated Beverages

- 5.3.1.3 Alcoholic Beverages

- 5.3.2 Bread and Bakery Products

- 5.3.3 Confectionery

- 5.3.3.1 Candies and Gummies

- 5.3.3.2 Jellies and Fruit Pastilles

- 5.3.3.3 Fruit Bars and Snacks

- 5.3.3.4 Others

- 5.3.4 Dairy and Frozen Products

- 5.3.5 Others

- 5.3.1 Beverages

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Dohler GmbH

- 6.4.3 Kerry Group plc

- 6.4.4 Ingredion Incorporated

- 6.4.5 SunOpta Inc.

- 6.4.6 AGRANA Beteiligungs-AG

- 6.4.7 Tree Top Inc. (Northwest Naturals)

- 6.4.8 China Haisheng Juice Holdings Co. Ltd.

- 6.4.9 Royal Cosun (SVZ)

- 6.4.10 FruitSmart Inc.

- 6.4.11 Louis Dreyfus Company Juice

- 6.4.12 Sucocitrico Cutrale Ltda.

- 6.4.13 Citrosuco S.A.

- 6.4.14 Diana Food (Symrise)

- 6.4.15 SVZ International B.V.

- 6.4.16 Welch Foods Inc.

- 6.4.17 Mysore Fruit Products Ltd

- 6.4.18 LemonConcentrate SLU

- 6.4.19 Vie-Del Company

- 6.4.20 Capullo Fruit Concentrates