|

市場調查報告書

商品編碼

1852159

二甲苯:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)Xylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

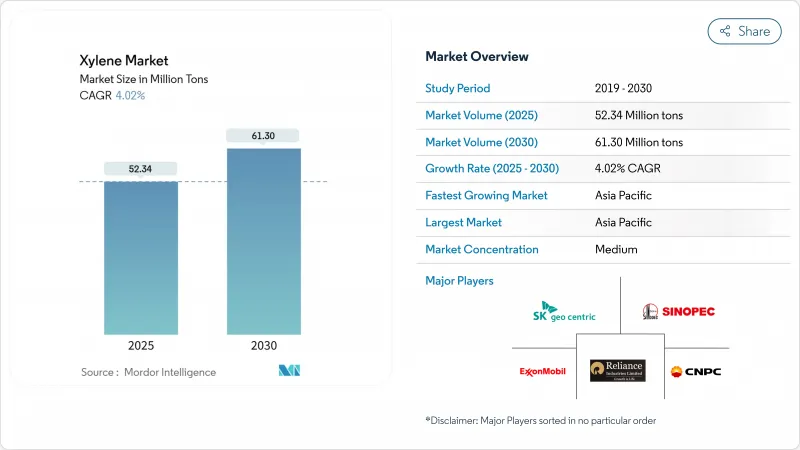

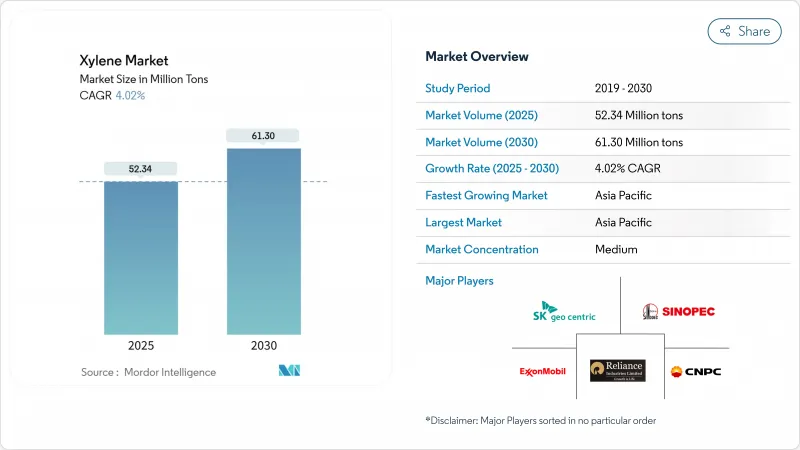

預計到 2025 年二甲苯市場規模將達到 5,234 萬噸,到 2030 年將達到 6,130 萬噸,年複合成長率為 4.02%。

對二甲苯在聚酯生產中的主導地位、亞洲和中東的大型芳烴一體化計劃以及北美對工程塑膠日益成長的需求,是推動成長的主要因素。中國和印度的綜合設施快速資本投資正在提升區域自給自足能力,而生物基化學品在日益成長的監管壓力和品牌所有者壓力下正獲得初步發展勢頭。儘管利潤前景受石腦油價格波動的影響,但擁有後向整合的製造商正在煉油、芳烴和衍生品產業鏈中獲取價值。競爭優勢正向那些能夠兼顧原料靈活性、數位最佳化和可靠的脫碳藍圖的公司傾斜。

全球二甲苯市場趨勢與洞察

亞洲PET樹脂需求激增,推動對二甲苯消費。

大規模聚酯生產正在重塑原料流向。中國計劃在2024年至2028年間大幅增加對二甲苯產能。此次擴產將確保對聚對苯二甲酸乙二醇酯(PTA)的供應,以滿足快速成長的聚對苯二甲酸乙二醇酯(PET)薄膜和瓶子生產的需求。生產商正在進行垂直整合以控制成本和物流,同時,不斷成長的石腦油進口正在填補亞洲的短缺。

中東和亞洲各地綜合芳烴聯合裝置的產能擴張

沙烏地阿美公司的阿米拉爾綜合體等計劃將煉油與下游芳烴生產相結合,從而節省原料成本並提高對二甲苯的產率。共享公用設施、先進催化劑和即時最佳化降低了單位成本,增強了區域出口競爭力。這些大型專案正在改變供應格局,迫使老舊的獨立裝置進行合理化改造和升級。

歐洲和北美嚴格的VOC法規限制了芳香族溶劑的使用。

監管機構正在擴大揮發性有機化合物(VOC)的限制範圍,涵蓋消費品塗料、清潔劑和室內裝飾產品。為了符合規定,生產商必須減少或重新配製產品中的化學成分,這限制了成熟經濟體的成長。為了維持市場進入,生產商正在轉向低芳烴或生物基混合物。

細分市場分析

由於對二甲苯在PTA和PET產業鏈中的關鍵作用,到2024年,對二甲苯將佔據二甲苯市場90%的佔有率。強大的下游一體化使主要煉油商能夠對沖利潤波動並確保強勁的需求。鄰二甲苯的市佔率遠小於對二甲苯,但其複合年成長率將達到4.09%,主要受鄰鄰苯二甲酐等軟性塑化劑需求的推動。間二甲苯主要面向小眾塗料和特殊樹脂領域,而混合二甲苯則可透過異構體分離提供多種供應選擇。催化劑和異構化裝置的進步使營運商能夠根據價格訊號微調產量,從而在商品化產品組合中提高盈利。這種適應性將使對二甲苯即使在衍生性商品交易格局改變的情況下,也能維持其核心地位。

亞洲生產商持續推動二甲苯萃取裝置的產能提升,以充分利用規模經濟效益,滿足不斷成長的寶特瓶訂單需求。北美供應商則著重生產用於薄膜應用的高附加價值產品,以滿足低乙醛產量的需求。歐洲煉油商正逐步從混合溶劑轉向氫化溶劑,以應對排放法規。到2030年,這一趨勢將催生對各種異構體的特定需求。

到2024年,技術級二甲苯將佔二甲苯市場的85%,因為被覆劑配方商、黏合劑配方商和工業清潔劑優先考慮成本、可得性和中等溶解度。從重整油和BTX池中提取的簡單生產路線可提供充足的供應和具有競爭力的價格。新興國家的大宗消費商在基礎設施和製造業快速擴張時期吸收了這些產品,從而鞏固了其核心地位。

相反,純度高達99.9%的高純度材料在半導體、製藥和高性能樹脂應用領域正以4.7%的複合年成長率成長。滿足其嚴格的規格要求需要複雜的結晶、蒸餾和線上分析技術,這構成了較高的市場准入門檻和可觀的淨利率。擁有整合實驗室服務和完善品質系統的生產商正利用這些專業管道,與大宗商品相比,獲得更高的每噸息稅折舊攤提前利潤(EBITDA)。

區域分析

到2024年,亞太地區將佔二甲苯市場55%的佔有率,並將在2030年前以每年4.51%的速度持續成長。預計到2028年,中國的對二甲苯產能將每年增加2500萬噸,從而支持區域自給自足;而印度的PET生產線將滿足強勁的飲料需求。東協主要國家正在進口混合二甲苯以彌補缺口,從而維持亞洲內部的貿易流動。日益激烈的競爭正在縮小價差,並促使下游企業結盟和簽署優惠貿易協定。

北美市場保持穩定,儘管成長緩慢。頁岩原料的經濟效益為煉油廠帶來了可觀的苯、甲苯、甲苯(BTX)產率。輕量化汽車法規的實施提高了工程塑膠的使用量,儘管塗料行業對揮發性有機化合物(VOC)的監管十分嚴格,但工程塑膠衍生品的需求仍然強勁。監管政策的明朗化,加上成熟的物流體系,將促使企業加大產能瓶頸的消除,而非新建工廠。

在永續性指令的推動下,歐洲成熟的市場需求環境正在重塑:德國化工產業叢集正致力於提升生產效率,英國和法國正在建造循環溶劑回收裝置,而歐盟範圍內的REACH法規則推動了低芳烴混合物的再製造。在政策獎勵的支持下,生物基試點計畫力求在可再生芳烴領域搶佔先機,其特色產品將瞄準高階塗料和電子產品市場。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- PET樹脂需求激增推動二甲苯生產

- 中東和亞洲芳烴聯合裝置產能擴張

- 汽車輕量化推動北美工程塑膠市場發展

- 二甲苯使用量增加

- 製藥公司在供應鏈中斷的情況下策略性地囤積溶劑

- 市場限制

- 歐洲和北美嚴格的VOC法規限制了芳香族溶劑的使用。

- 健康毒性問題促使人們轉向使用含氧溶劑

- 石腦油價格波動擠壓生產商利潤空間

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 鄰二甲苯

- 間二甲苯

- 對二甲苯

- 混合二甲苯

- 按年級

- 技術級

- 高純度等級(99.9)

- 按來源

- 石油基二甲苯

- 生物基二甲苯

- 透過使用

- 溶劑

- 單體

- 其他用途

- 按最終用戶行業分類

- 塑膠和聚合物

- 油漆和塗料

- 膠水

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Braskem

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- ENEOS Corporation

- Exxon Mobil Corporation

- Formosa Chemicals & Fibre Corp

- FUJAN REFINING & PETROCHEMICAL COMPANY LIMITED

- GS Caltex Corporation

- Indian Oil Corporation Ltd

- INEOS AG

- LOTTE Chemical Corporation

- Mangalore Refinery and Petrochemicals limited

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Mitsui Chemicals, Inc.

- Petro Rabigh

- PTT Global Chemical Public Company Limited

- QatarEnergy

- Reliance Industries Limited

- SK Geocentric Co., Ltd.

- S-OIL CORPORATION

- TotalEnergies

第7章 市場機會與未來展望

The xylene market size stands at 52.34 million tons in 2025 and is forecast to touch 61.3 million tons by 2030, advancing at a 4.02% CAGR.

Growth rests on para-xylene's dominant role in polyester production, large-scale integrated aromatics projects across Asia and the Middle East, and rising demand for engineering plastics in North America. Rapid equipment investments in Chinese and Indian complexes are lifting regional self-sufficiency, while bio-based chemistries gain early-stage momentum as regulatory and brand-owner pressures intensify. Margin outlook hinges on naphtha price volatility, yet backward-integrated producers capture value across refining, aromatics, and derivative chains. Competitive advantage is tilting toward firms that combine feedstock flexibility, digital optimization, and credible decarbonization roadmaps.

Global Xylene Market Trends and Insights

Surging PET Resin Demand Fueling Para-xylene Consumption in Asia

Massive polyester build-outs are realigning feedstock flows. China plans to massive para-xylene capacity between 2024-2028. The escalation secures PTA supply for rapidly growing PET film and bottle output. Producers are vertically integrating to manage cost and logistics exposure, while increasing naphtha imports backfill Asian shortfalls.

Capacity Expansions in Integrated Aromatics Complexes across Middle East and Asia

Projects such as Saudi Aramco's Amiral Complex couple refining with downstream aromatics to unlock feedstock savings and high para-xylene yields. Shared utilities, advanced catalysts, and real-time optimization cut unit costs and strengthen regional export competitiveness. These mega-sites are shifting supply balances and forcing older standalone plants to rationalize or upgrade.

Stringent VOC Norms Limiting Aromatic Solvent Use in Europe and North America

Regulators are extending VOC limits to consumer paints, cleaners, and indoor products. Compliance forces reformulators to cut xylene loadings or redesign entire chemistries, constraining growth in mature economies. Producers pivot toward low-aromatic or bio-based blends to retain market access.

Other drivers and restraints analyzed in the detailed report include:

- Automotive Lightweighting Driving Engineering Plastics in North America

- Growing Usage of Xylene as Solvents and Monomers

- Health-toxicity Concerns Prompting Shift to Oxygenated Solvents

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Para-xylene held 90% of xylene market share in 2024, anchored by its indispensable role in PTA and PET chains. Robust downstream integration lets leading refiners hedge margin swings and assure captive demand. Ortho-xylene, though much smaller, leads growth at 4.09% CAGR on the back of flexible plasticizer demand in phthalic anhydride. Meta-xylene addresses niche coatings and specialty resins, while mixed xylene offers supply optionality for isomer separation. Catalyst advances and isomerization units let operators fine-tune output to price signals, enhancing profitability within an otherwise commoditized slate. This adaptive capability sustains para-xylene's centrality even as derivative trade flows reorganize.

Producers continue debottlenecking para-xylene extraction units in Asia to exploit economies of scale and meet swelling PET bottle orders. North American suppliers emphasize value-added grades for film applications that demand low acetaldehyde formation. European refiners increasingly channel mixed streams toward hydrogenated solvents to comply with tightening emission rules, a trend set to carve out specialized demand niches for each isomer through 2030.

Technical grade captured 85% of the xylene market in 2024 as coatings formulators, adhesive blenders, and industrial cleaners prioritize cost, availability, and mid-range solvency. Its straightforward production route from reformate and BTX pools yields abundant supply and competitive pricing. Bulk consumers in emerging economies absorb this volume for infrastructure and manufacturing surge phases, reinforcing its central role.

Conversely, high-purity 99.9% material is growing at 4.7% CAGR on semiconductor, pharmaceutical, and high-performance resin applications. Meeting its exacting specifications demands advanced crystallization, distillation, and on-stream analytics, creating high entry barriers and attractive margins. Producers with integrated lab services and robust quality systems capitalize on this specialized lane, carving higher EBITDA per ton against commodity counterparts.

The Xylene Market Report Segments the Industry by Type (Ortho-Xylene, Meta-Xylene, and More), Grade (Technical Grade and High-Purity Grade (99. 9%)), Source (Petroleum-Based Xylene and Bio-Based Xylene), Application (Solvent, Monomer, and Other Applications), End-User Industry (Plastics and Polymers, Paints and Coatings, Adhesives, and Other End-User Industries), and Geography (Asia-Pacific, North America, and More).

Geography Analysis

Asia-Pacific controlled 55% of the xylene market in 2024 and is growing 4.51% yearly to 2030. Chinese para-xylene capacity expansions of 25 million tons/year through 2028 underpin regional self-sufficiency, while Indian PET lines supply booming beverage demand. Major ASEAN economies import mixed xylenes to backfill shortfalls, sustaining intra-Asian trade flows. Intensifying competition is compressing spreads, spurring alliances and downstream PTA linkages.

North America shows stable albeit lower growth. Shale-based feedstock economics give refiners advantaged BTX yields. Automotive lightweighting regulations elevate engineering plastic use, fortifying derivative demand despite stringent VOC curbs in paints. Regulatory clarity combined with established logistics encourage incremental debottlenecks rather than greenfield builds.

Europe's mature demand landscape is reshaping under sustainability mandates. Germany's chemical clusters refine high-efficiency processes, the United Kingdom and France deploy circular solvent recovery units, and EU-wide REACH classifications prompt reformulation into lower-aromatic blends. Bio-based pilots supported by policy incentives aim to cement early footholds in renewable aromatics, with niche grades targeting premium coating and electronics markets.

- Braskem

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- ENEOS Corporation

- Exxon Mobil Corporation

- Formosa Chemicals & Fibre Corp

- FUJAN REFINING & PETROCHEMICAL COMPANY LIMITED

- GS Caltex Corporation

- Indian Oil Corporation Ltd

- INEOS AG

- LOTTE Chemical Corporation

- Mangalore Refinery and Petrochemicals limited

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Mitsui Chemicals, Inc.

- Petro Rabigh

- PTT Global Chemical Public Company Limited

- QatarEnergy

- Reliance Industries Limited

- SK Geocentric Co., Ltd.

- S-OIL CORPORATION

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging PET Resin Demand Fueling Para-xylene Consumption in Asia

- 4.2.2 Capacity Expansions in Integrated Aromatics Complexes across Middle east and Asia

- 4.2.3 Automotive Lightweighting Driving Engineering Plastics in North America

- 4.2.4 Growing Usage of Xylene as Solvents and Monomers

- 4.2.5 Strategic Stockpiling of Solvents by Pharma amid Supply-chain Volatility

- 4.3 Market Restraints

- 4.3.1 Stringent VOC Norms Limiting Aromatic Solvent Use in Europe and North America

- 4.3.2 Health-toxicity Concerns Prompting Shift to Oxygenated Solvents

- 4.3.3 Volatile Naphtha Prices Compressing Producer Margins

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Ortho-xylene

- 5.1.2 Meta-xylene

- 5.1.3 Para-xylene

- 5.1.4 Mixed xylene

- 5.2 By Grade

- 5.2.1 Technical Grade

- 5.2.2 High-Purity Grade (99.9 %)

- 5.3 By Source

- 5.3.1 Petroleum-based Xylene

- 5.3.2 Bio-based Xylene

- 5.4 By Application

- 5.4.1 Solvents

- 5.4.2 Monomer

- 5.4.3 Other Applications

- 5.5 By End-user Industry

- 5.5.1 Plastics and Polymers

- 5.5.2 Paints and Coatings

- 5.5.3 Adhesives

- 5.5.4 Other End-user Industries

- 5.6 Geography

- 5.6.1 Asia-Pacific

- 5.6.1.1 China

- 5.6.1.2 India

- 5.6.1.3 Japan

- 5.6.1.4 South Korea

- 5.6.1.5 Rest of Asia-Pacific

- 5.6.2 North America

- 5.6.2.1 United States

- 5.6.2.2 Canada

- 5.6.2.3 Mexico

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Braskem

- 6.4.2 Chevron Phillips Chemical Company LLC

- 6.4.3 China Petrochemical Corporation

- 6.4.4 CNPC

- 6.4.5 ENEOS Corporation

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 Formosa Chemicals & Fibre Corp

- 6.4.8 FUJAN REFINING & PETROCHEMICAL COMPANY LIMITED

- 6.4.9 GS Caltex Corporation

- 6.4.10 Indian Oil Corporation Ltd

- 6.4.11 INEOS AG

- 6.4.12 LOTTE Chemical Corporation

- 6.4.13 Mangalore Refinery and Petrochemicals limited

- 6.4.14 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.15 Mitsui Chemicals, Inc.

- 6.4.16 Petro Rabigh

- 6.4.17 PTT Global Chemical Public Company Limited

- 6.4.18 QatarEnergy

- 6.4.19 Reliance Industries Limited

- 6.4.20 SK Geocentric Co., Ltd.

- 6.4.21 S-OIL CORPORATION

- 6.4.22 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Bio-based Xylene Commercialization