|

市場調查報告書

商品編碼

1852156

丙烯腈-丁二烯-苯乙烯(ABS)樹脂:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Acrylonitrile Butadiene Styrene (ABS) Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

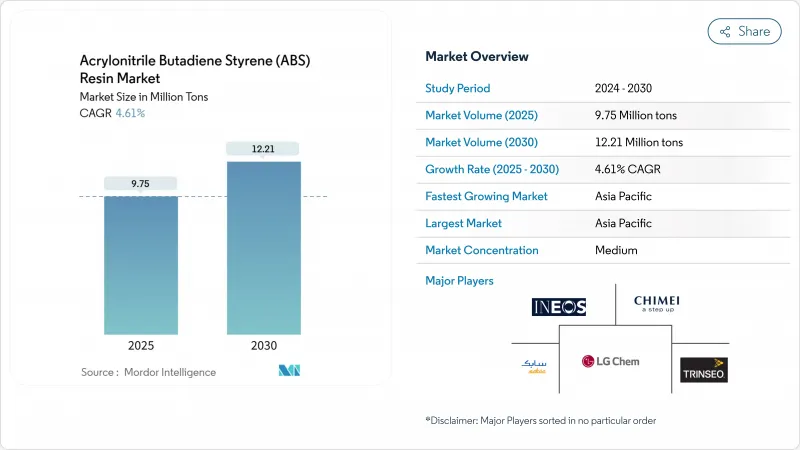

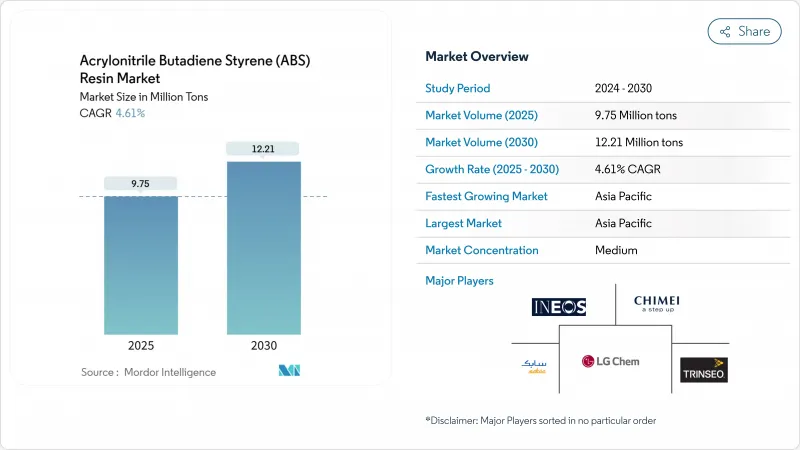

預計到 2025 年,丙烯腈丁二烯苯乙烯市場將達到 975 萬噸,到 2030 年將達到 1,221 萬噸,年複合成長率為 4.61%。

該樹脂的強度重量比、耐化學腐蝕性和易加工性推動了其穩定的市場需求,並持續吸引汽車、電子和建築等行業的大量用戶。電動車平台目前指定使用增強型ABS樹脂取代鋁製支架和外殼,在保持結構完整性的前提下,重量最多可減輕40%,成本最多可降低20%。此外,該樹脂與5G基礎設施建設的緊密聯繫,以及用於天線外殼的電鍍型ABS樹脂的應用,進一步拓展了其市場機會。

全球丙烯腈-丁二烯-苯乙烯(ABS)樹脂市場趨勢及洞察

電動交通平台的輕量化與金屬替代

隨著電動車設計師致力於減輕車重以增加續航里程,增強型ABS樹脂正在大規模取代金屬支架、管道和外殼。玻璃纖維增強型ABS樹脂的抗張強度超過75兆帕,重量卻比鋁輕40%,這與美國能源局提出的到2030年將輕型汽車重量減輕25%的目標相符。汽車製造商也指出,增強型ABS樹脂可以降低模具成本並縮短生產週期,從而縮短專案推出時間。隨著電池組製造商指定使用具有整合式緊固件和冷卻通道的樹脂外殼,丙烯腈-丁二烯-苯乙烯(ABS)市場也直接受益。

智慧家庭設備需要高光澤度和耐熱等級

連網家庭設備必須機殼,並能承受接近 100 度C 的持續高溫。家電製造商青睞光澤度高、耐熱性強的 ABS 配方,這種配方能夠保持尺寸精度,並在多年使用後仍能保持不變色。此外,該聚合物也適用於雷射蝕刻壓印,無需二次加工即可實現無縫背光標識。較短的產品更新周期保證了較高的基準需求,使配方師能夠加快配色服務。

電子元件中生物基聚合物的替代

家電品牌正擴大採用符合UL-94 V-0標準的無鹵生物聚合物混合物,但其碳足跡卻是ABS的七倍。歐洲的「永續性化學品策略」正在加強對石化衍生材料的審查,並引導採購指南朝著可再生材料的方向發展。美國品牌正在努力提升其ESG(環境、社會和治理)評分,提高了傳統ABS的准入門檻,除非其含有再生材料。丙烯腈-丁二烯-苯乙烯(ABS)市場在成本、加工性和供應可靠性方面仍保持優勢,但在高階市場佔有率正逐漸下降。

細分市場分析

至2024年,射出吹塑成型將佔總產量的48%,並持續維持5.15%的年成長率。薄壁成型技術使品牌商能夠在不影響性能的前提下減少樹脂用量,從而提升其永續發展績效。即時型腔壓力回饋和隨形冷卻插件可將生產週期縮短高達18%,進而提高生產線運轉率。

區域分析

到 2024 年,亞太地區將佔丙烯腈-丁二烯-苯乙烯市場的 75%,預計到 2030 年將以每年 5.17% 的速度成長。中國擁有世界一流的裂解裝置、豐富的混煉技術以及接近性高成長消費性電子中心的地理優勢,這些因素共同支撐著供需。

北美市場需求穩定,但正轉向高階產品。到2025年,平均每輛汽車將使用426磅塑膠,其中ABS將用於內裝、邊框和尾燈模組。在歐洲,永續性政策正在提高汽車聚合物的回收目標,引導汽車製造商實現ABS的循環利用。同時,日益嚴格的排放法規也促使北歐加工廠更加重視合規性。

巴西的家電和汽車產業將支撐該地區的消費,而阿根廷和哥倫比亞正在探索將電子組裝外包到近岸地區。波灣合作理事會國家將利用其原料優勢和93%的產能運轉率,從出口級原料轉向本地化的片材和複合材料生產。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場促進因素

- 電動交通平台的輕量化與金屬替代

- 需要高光澤度和耐熱性的智慧家庭設備

- 桌上型3D列印機在教育領域的快速普及

- 強制阻燃駕駛座部件

- 5G基礎設施推動電塗裝ABS的需求

- 市場限制

- 揮發性丙烯腈原料價格

- 電子元件中生物基聚合物的替代

- 北歐對加工廠的揮發性有機化合物(VOC)排放有嚴格的規定。

- 價值鏈分析

- 價格趨勢

- 監理展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過加工技術

- 注塑吹塑成型

- 擠出吹塑成型

- 拉伸吹塑成型

- 按ABS等級

- 一般

- 高影響力

- 電鍍

- 阻燃劑

- 耐熱性

- 按最終用戶行業分類

- 汽車與運輸

- 電子學

- 消費品/家用電器

- 建造

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 越南

- 馬來西亞

- 印尼

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 土耳其

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BEPL

- CHIMEI

- ELIX POLYMERS

- Eni SpA

- Formosa Plastics Group

- INEOS

- JSR Corporation

- KUMHO PETROCHEMICAL

- LG Chem

- LOTTE Chemical Corporation

- NIPPON A&L INC.

- PetroChina Company Limited

- SABIC

- Shandong INEOS-YPC

- Techno-UMG Co., Ltd.

- TORAY INDUSTRIES, INC.

- TotalEnergies

- Trinseo

第7章 市場機會與未來展望

The acrylonitrile butadiene styrene market stood at 9.75 million tons in 2025 and is forecast to reach 12.21 million tons by 2030, advancing at a 4.61% CAGR.

Consistent demand stems from the resin's strength-to-weight ratio, chemical resistance, and ease of processing, qualities that continue to attract high-volume users in automotive, electronics, and construction. Electric-vehicle platforms now specify reinforced ABS grades to replace aluminum brackets and housings, saving up to 40% in weight and 20% in cost while preserving structural integrity. Tight coupling between 5 G infrastructure build-outs and electroplatable ABS grades for antenna housings further widens the resin's opportunity set.

Global Acrylonitrile Butadiene Styrene (ABS) Resin Market Trends and Insights

Lightweighting and Metal Replacement in E-Mobility Platforms

Electric-vehicle designers target mass reduction to extend driving range, and reinforced ABS grades are replacing metal brackets, ducts, and enclosures at scale. Glass-fiber-modified grades achieve tensile strengths above 75 MPa yet weigh 40% less than aluminum, aligning with the U.S. Department of Energy's goal of trimming 25% off light-duty vehicle curb weight by 2030. Automakers also cite lower tooling costs and faster cycle times, which compress program launch schedules. The acrylonitrile butadiene styrene market benefits directly as battery-pack makers specify resin housings that integrate fasteners and cooling channels.

Smart-Home Appliances Requiring High-Gloss Heat-Resistant Grades

Connected home devices pack advanced processors into sleek casings that must withstand sustained temperatures near 100 °C. Appliance OEMs validate glossy, heat-stabilized ABS formulations that retain dimensional accuracy and resist discoloration over multi-year duty cycles. Brand owners also cite the polymer's compatibility with laser-etch debossing, enabling seamless back-lit logos without secondary operations. Short product-refresh cycles maintain high baseline demand and encourage formulators to accelerate color-match services.

Substitution by Bio-Based Polymers in Electronics

Consumer-electronics brands increasingly trial halogen-free biopolymer blends with carbon footprints seven times lower than ABS while still achieving UL-94 V-0 ratings. Europe's Chemicals Strategy for Sustainability tightens scrutiny on petrochemical-derived materials, nudging procurement guidelines toward renewable content. American brands pursue ESG scorecard improvements that raise evaluation hurdles for traditional ABS unless accompanied by recycled content. The acrylonitrile butadiene styrene market retains incumbency where cost, processability, and supply reliability still dominate, yet faces gradual displacement in premium segments.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Desktop 3-D Printers in Education

- Mandatory Flame-Retardant Cockpit Components

- Stringent Nordic VOC Limits on Processing Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Injection Blow Molding secured 48% of 2024 production volume and is growing 5.15% annually, reflecting its efficiency in turning pellets into complex parts with minimal post-processing. Thin-wall capability enables brand owners to cut resin usage without performance loss, supporting sustainability scorecards. Real-time cavity-pressure feedback and conformal-cooling inserts shave cycle times by up to 18%, translating into higher line uptime.

The Acrylonitrile Butadiene Styrene (ABS) Market Report Segments the Industry by Processing Technology (Injection Blow Molding, Extrusion Blow Molding, and More), ABS Grade (General-Purpose, High Impact, and More), End-User Industry (Automotive and Transportation, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominated the acrylonitrile butadiene styrene market with 75% volume in 2024 and will grow 5.17% annually through 2030. China anchors supply and demand by combining world-scale crackers, extensive compounding expertise, and proximity to high-growth consumer-electronics hubs.

North American demand is stable yet shifts toward premium grades. The average car built in 2025 contains 426 lb of plastics, with ABS supplying interior trims, bezels, and taillight modules. In Europe, policy-driven sustainability triggers higher recycled-content targets for automotive polymers, nudging OEMs toward circular ABS streams. Simultaneously, stricter emission controls in Nordic processing plants raise compliance.

Brazil's appliance and automotive sectors underpin regional consumption, while Argentina and Colombia explore near-shoring of electronics assembly. Gulf Cooperation Council states leverage feedstock advantage and a 93% capacity-utilization rate to pivot from export-grade feedstock to local sheet and compound production

- BEPL

- CHIMEI

- ELIX POLYMERS

- Eni S.p.A.

- Formosa Plastics Group

- INEOS

- JSR Corporation

- KUMHO PETROCHEMICAL

- LG Chem

- LOTTE Chemical Corporation

- NIPPON A&L INC.

- PetroChina Company Limited

- SABIC

- Shandong INEOS-YPC

- Techno-UMG Co., Ltd.

- TORAY INDUSTRIES, INC.

- TotalEnergies

- Trinseo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Lightweighting and Metal Replacement in E-Mobility Platforms

- 4.1.2 Smart-Home Appliances Requiring High-Gloss Heat-Resistant Grades

- 4.1.3 Rapid Adoption of Desktop 3-D Printers in Education

- 4.1.4 Mandatory Flame-Retardant Cockpit Components

- 4.1.5 5G Infrastructure Driving Electroplatable ABS Demand

- 4.2 Market Restraints

- 4.2.1 Volatile Acrylonitrile Feedstock Prices

- 4.2.2 Substitution by Bio-based Polymers in Electronics

- 4.2.3 Stringent Nordic VOC Limits on Processing Plants

- 4.3 Value Chain Analysis

- 4.4 Pricing Trends

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Processing Technology

- 5.1.1 Injection Blow Molding

- 5.1.2 Extrusion Blow Molding

- 5.1.3 Injection Stretch Blow Molding

- 5.2 By ABS Grade

- 5.2.1 General-Purpose

- 5.2.2 High-Impact

- 5.2.3 Electro-plating

- 5.2.4 Flame-Retardant

- 5.2.5 Heat-Resistant

- 5.3 By End-user Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Electronics

- 5.3.3 Consumer Goods and Appliances

- 5.3.4 Construction

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Vietnam

- 5.4.1.7 Malaysia

- 5.4.1.8 Indonesia

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Turkey

- 5.4.3.8 Nordics

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Egypt

- 5.4.5.5 South Africa

- 5.4.5.6 Nigeria

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BEPL

- 6.4.2 CHIMEI

- 6.4.3 ELIX POLYMERS

- 6.4.4 Eni S.p.A.

- 6.4.5 Formosa Plastics Group

- 6.4.6 INEOS

- 6.4.7 JSR Corporation

- 6.4.8 KUMHO PETROCHEMICAL

- 6.4.9 LG Chem

- 6.4.10 LOTTE Chemical Corporation

- 6.4.11 NIPPON A&L INC.

- 6.4.12 PetroChina Company Limited

- 6.4.13 SABIC

- 6.4.14 Shandong INEOS-YPC

- 6.4.15 Techno-UMG Co., Ltd.

- 6.4.16 TORAY INDUSTRIES, INC.

- 6.4.17 TotalEnergies

- 6.4.18 Trinseo

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Growing usage of PC-ABS Resin in Industrial Applications