|

市場調查報告書

商品編碼

1852147

奈米碳管:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Carbon Nanotubes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

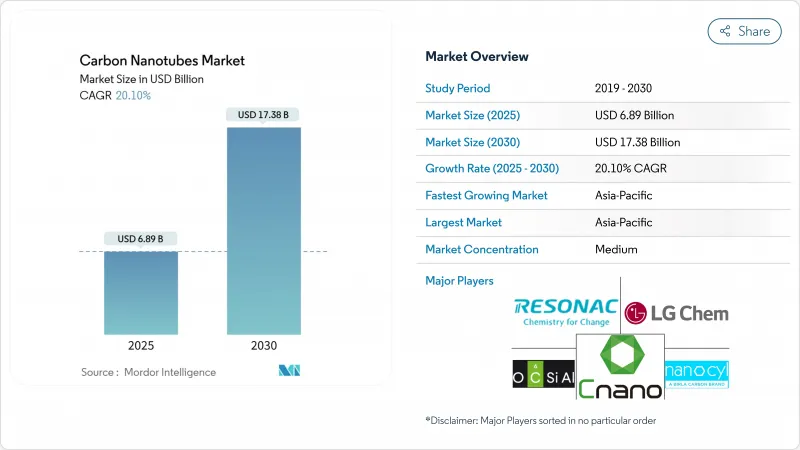

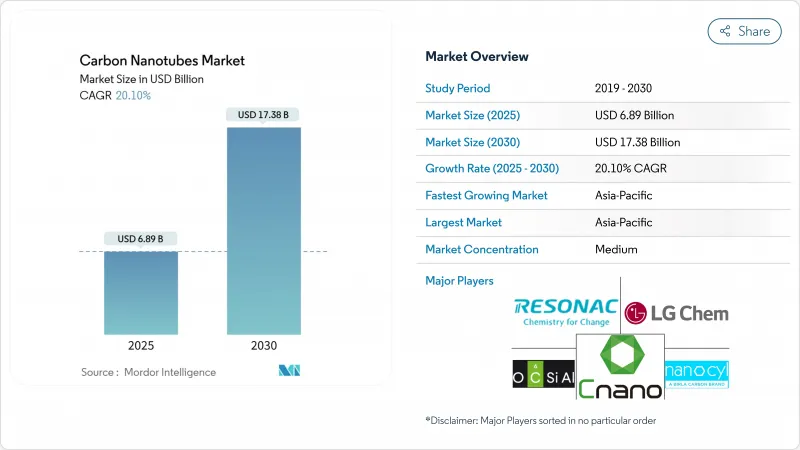

預計到 2025 年,奈米碳管市場規模將達到 68.9 億美元,到 2030 年將達到 173.8 億美元,預測期(2025-2030 年)的複合年成長率為 20.10%。

積極的市場前景反映了該材料在電池、航太複合材料、醫療器材和水溶液等領域的快速應用。多壁奈米碳管仍具有成本效益,促使生產商在追求更高純度和均勻性的同時,擴大生產規模。亞太地區在需求和產能方面持續佔據主導地位,這主要得益於電動車和電子產業叢集的發展。 OCSiAl收購Zyvex Technologies增強了其在單壁奈米碳管領域的規模和智慧財產權實力。

全球奈米碳管市場趨勢與洞察

電動交通的蓬勃發展推動了對碳奈米管的需求

奈米碳管即使在矽含量接近 20% 的情況下也能確保導電性和機械穩定性,從而實現 300Wh/kg 的鋰離子電池組,有效緩解里程焦慮。汽車製造商也指定使用填充碳奈米管的熱感墊片來散發電力電子設備產生的熱量,陶氏化學和 Carby 公司在 2024 年的合作正是為了滿足這一需求。同樣的導電優勢也為匯流排和電池組屏蔽層的應用開啟了新的可能性。生產矽-碳奈米管複合陽極的新興企業正在吸引創業投資資金,凸顯了它們的商業性信心。隨著電池製造商供應鏈的本地化,更多的碳奈米管產能正被安置在超級工廠附近,進一步將材料與電池生產整合起來。

高能量密度儲存推動技術進步

電網儲能和航太應用需要更輕、更安全的電池。採用奈米碳管管支架的鋰硫電池能夠固定硫並抑制多硫化物穿梭效應。扭曲的單壁奈米碳管繩可儲存2.1 MJ/kg的機械能,其能量密度超過鋰離子電池,同時避免了使用易燃電解液。超級電容製造商正在採用多層電極來實現低等效串聯電阻,這對於快速充放電至關重要。這些進步帶來了對高導電等級電池和分散式服務的穩定訂單。

職業毒理學和監管強化

由於其纖維狀形態與石棉類似,西方當局正在製定吸入暴露限值。學術團體正在改進劑量測定方法,以建立空氣中顆粒質量和長寬比與肺部反應之間的關係。合規性要求推動了對全封閉式反應器和自動化包裝線的投資,從而增加了新參與企業的資本支出。擁有安全加工記錄的公司正在汽車和航太項目中贏得契約,這些項目非常重視企業永續性指標。

細分市場分析

到2024年,多壁奈米碳管將佔據90%的市場佔有率,這反映出化學氣相沉積生產過程的成熟以及其與塊狀添加劑相同的價格分佈。預計到2030年,該細分市場將以20.51%的複合年成長率成長,佔奈米碳管市場成長的三分之二以上。顆粒工程師正在提高外徑公差,並將金屬催化劑的含量降低到100 ppm以下,以滿足電子和醫療設備的閾值。這些改進將推動導電漿料、行動電話揚聲器和超級電容器電極等領域的應用,從而鞏固其市場領先地位。

單壁奈米碳管的市佔率仍不足10%,但在量子和半導體等特定應用領域仍維持較高的溢價。靜電催化技術目前已能製備出直徑0.95奈米、純度高達99.92%的半導體,因此可在軟式電路板上製造薄膜電晶體。對受限碳炔的研究預示著未來可用於光電的一維導體的發展前景。隨著特定元件的商業化,奈米碳管市場可望在不擠壓多層碳奈米管整體需求的前提下,逐步獲得更高的效益。

區域分析

亞太地區將持續維持主導,到2024年將佔全球需求的54%,複合年成長率達21.51%。中國完善的電池供應鏈生態系統正推動本土奈米管製造商根據長期合約向超級工廠供貨。日本企業正專注於生產用於顯示器的超潔淨單層奈米管,充分利用「超高速生長」製程的高長寬比和高取向品質。韓國和印度的政府獎勵措施將進一步擴大產能,直到2027年,進而鞏固該地區的成本優勢。

北美市場對總銷售額貢獻顯著。在美國,諸如能源部向卡博特公司(Cabot Corporation)撥款5000萬美元用於其在密西根州的生產等舉措,正使國內電池和國防客戶的供應更加安全。航太複合材料和高頻連接器是關鍵的需求支柱,這得益於國家實驗室強大的研發實力。在加拿大,一座專注於利用奈米管產品差異化進行甲烷-氫氣熱解的試點工廠已投入運作,將氣候政策與製造業政策緊密結合。

歐洲也佔據了全球汽車銷售的相當大佔有率。德國和法國的汽車製造商要求嚴格的材料可追溯性,並敦促供應商證明其從搖籃到大門的排放符合標準。在英國奈米製造中心的支持下,英國的大學正在孵化專注於半導體互連技術的企業。同時,中東的海水淡化機構和非洲的通訊塔安裝商正在評估奈米管薄膜和導電塗層,以應對水資源和能源挑戰,從而釋放新的市場需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電動交通的蓬勃發展將加速碳奈米管的需求。

- 在高能量密度鋰離子電池和超級電容生產方面取得飛躍式發展

- 推動航太領域超輕型結構複合材料的發展

- 在中東、非洲和亞洲推廣海水淡化和環境感測器

- 導電絲的積層製造整合

- 市場限制

- 歐洲和美國的職業毒理學和奈米技術監管

- 石墨烯和氮化硼奈米管在熱應用領域競爭

- 專利陷阱,授權成本集中於此。

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 專利分析

第5章 市場規模及成長預測(價值及數量)

- 按類型

- 多壁奈米碳管市場

- 單壁奈米碳管市場

- 其他類型(扶手椅式、之字形、雙層牆式)

- 透過製造方法

- 化學氣相沉積(CVD)

- 高壓一氧化碳(HiPco)

- 電弧閃光

- 雷射消熔

- 按最終用途行業分類

- 電氣和電子

- 能源

- 車

- 航太/國防

- 衛生保健

- 其他行業(紡織、建築、塑膠、複合材料)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Applied Nanostructures, Inc.

- Arkema

- Cabot Corporation

- Carbon Solutions, Inc.

- CHASM

- Cheap Tubes

- Chengdu Organic Chemicals Co., Ltd.

- CNT Co., Ltd.

- FutureCarbon GmbH

- Hanwha Group

- Hyperion Catalysis International

- Jiangsu Cnano Technology Co., Ltd.

- Kumho Petrochemical

- LG Chem

- Meijo Nano Carbon Co.,Ltd

- Nano-C

- Nanocyl SA

- OCSiAl

- Raymor Industries Inc.

- Resonac Holdings Corporation

- Thomas Swan & Co., Ltd.

- Toray Industries, Inc.

- Zyvex Technologies

第7章 市場機會與未來展望

The Carbon Nanotubes Market size is estimated at USD 6.89 billion in 2025, and is expected to reach USD 17.38 billion by 2030, at a CAGR of 20.10% during the forecast period (2025-2030).

The strong outlook reflects the material's rapid adoption in batteries, aerospace composites, healthcare devices and water solutions. Multi-walled variants remain cost-efficient, so producers are scaling output while pursuing higher purity and uniformity. Asia-Pacific continues to dominate both demand and production capacity, helped by the region's electric-vehicle and electronics clusters. Consolidation among leading suppliers is gathering pace, illustrated by OCSiAl's purchase of Zyvex Technologies, which strengthened single-walled carbon nanotube scale and intellectual-property depth.

Global Carbon Nanotubes Market Trends and Insights

E-mobility boom accelerating CNT demand

Rising electric-vehicle output is lifting graphite anode silicon content, and carbon nanotubes ensure conductivity and mechanical stability at silicon loads near 20%, enabling 300 Wh/kg lithium-ion packs that reduce range anxiety. Automakers also specify nanotube-filled thermal interface pads that dissipate heat generated by power electronics, a need addressed by Dow and Carbice's 2024 alliance. The same conductivity advantage opens opportunities in busbars and battery-pack shielding. Start-ups producing silicon-CNT composite anodes have attracted venture funding, underscoring commercial confidence. As cell makers localize supply chains, nanotube capacity additions are being colocated near gigafactories, tightening integration between materials and battery production.

High-energy-density storage pushing technical frontiers

Grid storage and aerospace sectors require lighter, safer cells. Lithium-sulfur batteries using carbon-nanotube scaffolds anchor sulfur and suppress polysulfide shuttling, which is central to Lyten's 200 MWh plant targeted for 2025 ramp-up. Twisted single-walled carbon nanotube ropes store 2.1 MJ/kg as mechanical energy, exceeding lithium-ion energy density while avoiding flammable electrolytes. Supercapacitor makers employ multi-walled electrodes to deliver low equivalent-series resistance, ideal for rapid charge-discharge duty. Together, these advances translate to steady orders for high-conductivity grades and dispersion services.

Occupational toxicology and tightening regulation

European and U.S. agencies are drafting inhalation-exposure limits, citing fiber-like dimensions comparable with asbestos. Academic groups are refining dosimetry to link airborne mass and aspect ratio to pulmonary response. Compliance drives investment in fully enclosed reactors and automated bagging lines, raising capex for newcomers. Companies with documented safe-handling records secure contracts in automotive and aerospace programs where corporate sustainability metrics weigh heavily.

Other drivers and restraints analyzed in the detailed report include:

- Aerospace composites raising performance bar

- Desalination & sensor innovations aiding water-stressed regions

- Competition from graphene and boron-nitride nanotubes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Multi-walled carbon nanotubes accounted for 90% of 2024 share, reflecting mature chemical vapor deposition output and price points aligned with bulk additives. The segment is forecast to log a 20.51% CAGR, underpinning more than two-thirds of the carbon nanotubes market size expansion through 2030. Particle engineers are narrowing outer-diameter tolerance and reducing metal catalysts below 100 ppm, meeting electronics and medical-device thresholds. These improvements encourage adoption in conductive pastes, cell-phone speakers and supercapacitor electrodes, reinforcing volume leadership.

Single-walled carbon nanotubes remain under 10% by share yet command premium pricing in quantum and semiconductor niches. Electrostatic catalysis now yields 99.92% semiconducting purity at 0.95 nm diameter, enabling thin-film transistors on flexible substrates. Research on confined carbyne suggests future one-dimensional conductors for photonics. As niche devices commercialize, the carbon nanotubes market will capture incremental high-margin revenue without displacing multi-walled bulk demand.

The Carbon Nanotubes Market Report Segments the Industry by Type (Multi-Walled Carbon Nanotubes, Single-Walled Carbon Nanotubes, and Other Types), Manufacturing Method (Chemical Vapor Deposition (CVD), High-Pressure Carbon Monoxide (HiPco), and More), End-Use Industry (Electrical and Electronics, Energy, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa).

Geography Analysis

Asia-Pacific held 54% of global demand in 2024, and its 21.51% CAGR will sustain leadership. China's integrated battery-supply ecosystem catalyzes local nanotube manufacturers that supply gigafactories under long-term contracts. Japanese firms specialize in ultra-clean single-walled grades for displays, leveraging the "super-growth" method's high aspect ratios and alignment quality. Government incentives across South Korea and India further expand capacity through 2027, widening the regional cost advantage.

North America contributed a significant share to the total revenue. U.S. initiatives, including a USD 50 million Department of Energy grant to Cabot Corporation for Michigan production, shift supply security closer to domestic battery and defense customers. Aerospace composites and high-frequency connectors are key demand pillars, drawing on national labs' R&D strengths. Canada hosts pilot plants focused on methane-to-hydrogen pyrolysis with nanotube coproducts, linking climate and manufacturing policies.

Europe also contributed a significant share to the overall sales. German and French automakers require stringent material traceability, pushing suppliers to certify cradle-to-gate emissions. British universities spin out ventures targeting semiconductor interconnects, supported by national nanofabrication hubs. At the periphery, Middle East desalination agencies and African telecom tower installers evaluate nanotube-coated membranes and conductive coatings to tackle water and energy challenges, fostering pockets of emerging demand.

- Applied Nanostructures, Inc.

- Arkema

- Cabot Corporation

- Carbon Solutions, Inc.

- CHASM

- Cheap Tubes

- Chengdu Organic Chemicals Co., Ltd.

- CNT Co., Ltd.

- FutureCarbon GmbH

- Hanwha Group

- Hyperion Catalysis International

- Jiangsu Cnano Technology Co., Ltd.

- Kumho Petrochemical

- LG Chem

- Meijo Nano Carbon Co.,Ltd

- Nano-C

- Nanocyl SA

- OCSiAl

- Raymor Industries Inc.

- Resonac Holdings Corporation

- Thomas Swan & Co., Ltd.

- Toray Industries, Inc.

- Zyvex Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-mobility Boom Accelerating CNT Demand

- 4.2.2 Leap in High-Energy-Density Li-ion and Supercapacitor Production

- 4.2.3 Aerospace Push for Ultra-light Structural Composites

- 4.2.4 Desalination and Environmental Sensors Adoption in MEA and Asia

- 4.2.5 Additive Manufacturing Integration for Conductive Filaments

- 4.3 Market Restraints

- 4.3.1 Occupational Toxicology and Nano-regulation in Europe and United States

- 4.3.2 Competition from Graphene and Boron-Nitride Nanotubes in Thermal Apps

- 4.3.3 Patent Thickets Concentrating Licensing Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Patent Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Type

- 5.1.1 Multi-Walled Carbon Nanotubes

- 5.1.2 Single-Walled Carbon Nanotubes

- 5.1.3 Other Types (Armchair, Zigzag, Double-Walled)

- 5.2 By Manufacturing Method

- 5.2.1 Chemical Vapor Deposition (CVD)

- 5.2.2 High-Pressure Carbon Monoxide (HiPco)

- 5.2.3 Arc Discharge

- 5.2.4 Laser Ablation

- 5.3 By End-Use Industry

- 5.3.1 Electrical and Electronics

- 5.3.2 Energy

- 5.3.3 Automotive

- 5.3.4 Aerospace and Defense

- 5.3.5 Healthcare

- 5.3.6 Other Industries (Textiles, Construction, Plastics and Composites)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Applied Nanostructures, Inc.

- 6.4.2 Arkema

- 6.4.3 Cabot Corporation

- 6.4.4 Carbon Solutions, Inc.

- 6.4.5 CHASM

- 6.4.6 Cheap Tubes

- 6.4.7 Chengdu Organic Chemicals Co., Ltd.

- 6.4.8 CNT Co., Ltd.

- 6.4.9 FutureCarbon GmbH

- 6.4.10 Hanwha Group

- 6.4.11 Hyperion Catalysis International

- 6.4.12 Jiangsu Cnano Technology Co., Ltd.

- 6.4.13 Kumho Petrochemical

- 6.4.14 LG Chem

- 6.4.15 Meijo Nano Carbon Co.,Ltd

- 6.4.16 Nano-C

- 6.4.17 Nanocyl SA

- 6.4.18 OCSiAl

- 6.4.19 Raymor Industries Inc.

- 6.4.20 Resonac Holdings Corporation

- 6.4.21 Thomas Swan & Co., Ltd.

- 6.4.22 Toray Industries, Inc.

- 6.4.23 Zyvex Technologies

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increasing Demand for Energy Storage Devices