|

市場調查報告書

商品編碼

1852145

環氧乙烷:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Ethylene Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

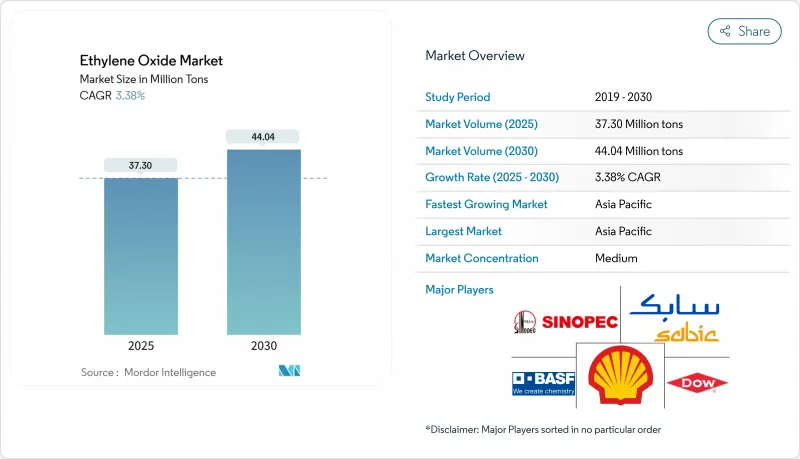

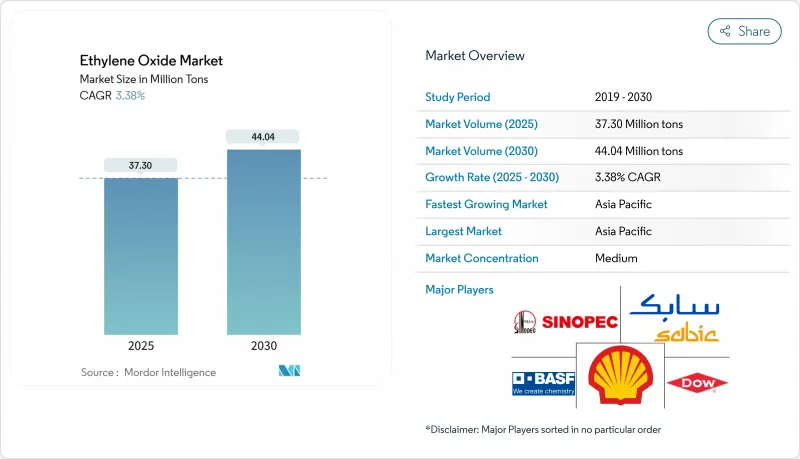

預計到 2025 年,環氧乙烷市場規模將達到 3,730 萬噸,到 2030 年將達到 4,404 萬噸,在預測期(2025-2030 年)內,複合年成長率將達到 3.38%。

PET作為化學中間體的多功能性是其需求的主要驅動力,其中聚酯纖維、PET樹脂、表面活性劑、乙醇胺和消毒劑等產品推動了消費成長。聚酯基紡織品的擴張、PET在輕質食品和飲料包裝領域的日益普及,以及醫療設備滅菌設施的主導投資,仍然是關鍵的促進因素。生物乙烯原料的快速普及、對排放技術投資的增加以及循環經濟計劃的推廣,正在重塑籌資策略並開闢新的收入來源。競爭動態有利於能夠平衡原料波動、遵守排放嚴格的排放法規並開發特種衍生品的垂直整合型製造商。

全球環氧乙烷市場趨勢及洞察

PET在食品飲料產業的應用日益廣泛

隨著品牌商青睞輕巧、可回收且能維持產品完整性的解決方案,PET包裝的普及速度正在加速。乙二醇(一種源自環氧乙烷的物質)佔PET聚合反應中乙二醇總量的近90%,直接帶動了上游需求。領先的樹脂生產商正在支援化學回收平台,這些平台能將消費後PET解聚合成單體,產率超過90%,從而穩定環氧乙烷的供應量,並實現循環供應鏈。像陶氏化學這樣的公司已經制定了到2030年每年數百萬噸的循環利用可再生塑膠專案。即使產品結構向再生塑膠轉變,這些努力也增強了長期需求前景。

對家居和個人保健產品的需求不斷成長

以乙氧基化物和乙醇胺配製的界面活性劑和清潔劑具有卓越的清潔效率,尤其是在硬水地區。消費者對環保成分的偏好促使像諾力昂這樣的製造商透過ISCC PLUS認證系統對其綠色環氧乙烷衍生物進行認證。從烷基酚轉向Fatty alcohol ethoxylated既符合即將推出的生物分解法規,又能維持清潔性能。隨著自有品牌清潔產品陸續上架,歐洲和北美地區的產能擴張旨在滿足不斷成長的市場需求。

高暴露對健康和環境的影響

由於環氧乙烷被列為致癌性,美國環保署 (EPA) 於 2025 年 1 月發布了一項暫定決定,擬將工人接觸環氧乙烷的限值從 2028 年的 0.5 ppm 降低至 2035 年的 0.1 ppm。要達到這項標準,需要投入大量資金進行工程控制、人員監控和設備升級。一些醫療器械製造商正在加快替代滅菌方法的認證,例如伽馬射線輻照、氣化過氧化氫和二氧化氮滅菌。雖然這些替代方法會減少部分產品的使用量,但對於具有複雜內部管腔的熱敏性醫療器械而言,環氧乙烷仍然是必不可少的。

細分市場分析

到2024年,乙二醇將主導環氧乙烷市場,佔75.57%的市場佔有率,這主要得益於亞太地區聚酯纖維和PET樹脂產量的擴張。上游供應中斷導致價格波動加劇,促使亞洲買家與一體化生產商簽訂長期合約。同時,品牌商對低碳包裝的需求推動了生物乙二醇(bioMEG)試點生產的激增。

乙醇胺的貢獻雖然會降低,但到2030年仍將維持最高的複合年成長率(CAGR),達到3.69%,主要得益於農業化學品、氣體處理和個人護理領域的需求成長。BASF在安特衛普的產能提升將使全球烷基乙醇胺產能提高近30%,達到每年14萬噸以上,凸顯了該領域的戰略價值。拉丁美洲和亞洲Glyphosate除草劑產量的成長將持續拉動單乙醇胺的需求,而三乙醇胺將在二氧化碳捕集溶劑領域找到新的發展機會。強大的下游多元化佈局使這類衍生物免受單一產業週期性波動的影響。

2024年,PET樹脂和聚酯纖維消耗了28.19%的環氧乙烷需求。隨著飲料生產商從玻璃和金屬瓶轉向更輕的寶特瓶,與PET相關的環氧乙烷市場規模預計將穩定成長。諸如使用碳酸二甲酯的甲醇解等創新解聚合路線,可使對苯二甲酸二甲酯的產率超過90%,從而開闢了高純度再生PET的來源。在預測期內,已開發國家對原生PET的需求將有所放緩,而快速成長但回收基礎設施低度開發的經濟體對原生PET的需求將會增加。

滅菌和燻蒸是成長最快的應用領域,複合年成長率達3.81%。約有5萬種醫療設備依賴環氧乙烷滅菌來保護無法承受伽瑪射線或電子束輻射的可溶性聚合物。儘管排放法規日益嚴格,但市場需求依然旺盛,因為其他滅菌方法往往無法穿透複雜的包裝或達到所需的無菌保證水準。對催化氧化器和連續排放監測的投資確保了合規營運,從而維持了這一細分領域的持續成長。

環氧乙烷市場報告按衍生物(乙二醇、乙氧基化物、乙醇胺等)、應用(聚酯纖維和PET樹脂、界面活性劑和清潔劑等)、終端用戶行業(汽車、殺蟲劑、食品和飲料等)、原料(石油基乙烯和生物乙烯)以及地區(亞太地區、北美、歐洲、南美、中東和非洲)進行細分。

區域分析

亞太地區仍將是2024年最大的環氧乙烷市場,佔全球需求的51.09%,並將在2030年之前以3.82%的複合年成長率引領該地區。中國是產能擴張的中心,BASF湛江整合生產基地計畫於2025年Start-Ups。印度的產量將隨著當地聚酯纖維產業的擴張而成長,這得益於政府的製造業誘因。儘管區域各國政府將收緊環境法規,但配備先進減排設施的一體化生產基地仍將保持競爭力。

北美受惠於頁岩氧化物基乙烷的經濟效益,其乙烯現金成本在全球範圍內處於較低水準。醫療設備滅菌領域的成長將推動國內消費量增加,而英力士(INEOS)於2024年收購利安德巴塞爾(LyondellBasell)的貝波特(Bayport)工廠將進一步鞏固這一全球最大單一市場的供應。為響應美國環保署(EPA)的排放法規,催化洗滌器和即時監測技術的投資將加速推進,從而樹立全球技術標竿。

歐洲面臨能源價格上漲和更嚴格的二氧化碳排放目標,導致2023年至2024年間,歐洲地區將關閉1,100萬噸化工產能。諸如科萊恩與OMV於2024年達成的低碳乙烯和環氧乙烷衍生物供應協議等合作項目,旨在保護市場佔有率免受進口衝擊。東歐憑藉著管道天然氣供應和成熟的聚酯下游資產,仍保持著一定的競爭力。

在中東,沙烏地阿拉伯的生產商正利用利潤豐厚的原料,透過建造綜合生產基地,瞄準亞洲出口市場。非洲國內產量有限,但清潔劑和殺蟲劑配方產品進口穩定。南美洲正在巴西推動一個生物乙烯計劃,該項目預計在未來十年內使南美洲成為這種低碳衍生物的淨出口地。

其他好處

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- PET在食品飲料產業的應用日益廣泛

- 對家用和個人保健產品的需求增加

- 擴大在醫療設備消毒的應用

- 紡織服裝產業需求不斷成長

- 農業領域的應用不斷擴大

- 市場限制

- 高暴露對健康和環境的影響

- 乙烯原料價格波動

- 高昂的生產成本

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 導數

- 乙二醇

- 單乙二醇(MEG)

- 二伸乙甘醇(DEG)

- 三甘醇(TEG)

- 乙氧基化物

- 乙醇胺

- 乙二醇醚

- 聚乙二醇

- 其他衍生性商品

- 乙二醇

- 透過使用

- 聚酯纖維/PET樹脂

- 界面活性劑和清潔劑

- 消毒和燻蒸

- 冷卻液和防凍液

- 藥用輔料

- 其他用途

- 按最終用戶行業分類

- 車

- 殺蟲劑

- 食品和飲料

- 纖維

- 個人護理

- 製藥

- 清潔劑

- 其他終端用戶產業

- 按原料

- 石油基乙烯

- 生物乙烯

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- BASF SE

- China Petrochemical Corporation

- Clariant

- Dow

- Huntsman International LLC

- India Glycols Limited

- Indorama Ventures Public Company Limited

- INEOS

- LOTTE Chemical Corporation

- NIPPON SHOKUBAI CO., LTD.

- Nouryon

- PETRONAS Chemicals Group Berhad

- Reliance Industries Limited

- SABIC

- Sasol Limited

- Shell plc

第7章 市場機會與未來展望

The Ethylene Oxide Market size is estimated at 37.30 Million tons in 2025, and is expected to reach 44.04 Million tons by 2030, at a CAGR of 3.38% during the forecast period (2025-2030).

Demand stems from its versatility as a chemical intermediate, with polyester fibers, PET resins, surfactants, ethanolamines, and sterilants underpinning consumption growth. Expansion of polyester-based textiles, wider adoption of PET for lightweight food and beverage packaging, and regulatory-driven investments in medical device sterilization facilities remain the core drivers. Rapid uptake of bio-ethylene feedstock, rising investment in emission-control technology, and the spread of circular-economy initiatives are reshaping sourcing strategies and opening new revenue pools. Competitive dynamics favor vertically integrated producers that can balance feedstock volatility, comply with tightening emission limits, and develop specialty derivatives.

Global Ethylene Oxide Market Trends and Insights

Growing Usage of PET in the Food and Beverage Industry

PET packaging adoption is accelerating because brand owners favor lightweight, recyclable solutions that preserve product integrity. Monoethylene glycol derived from ethylene oxide constitutes nearly 90% of the ethylene glycol pool used for PET polymerization, causing direct pull-through on upstream demand. Large resin producers are backing chemical-recycling platforms that depolymerize post-consumer PET into monomers with yields above 90%, enabling circular supply chains while keeping ethylene oxide volumes steady. Companies such as Dow have earmarked multi-million-metric-ton programs to deliver circular and renewable plastics annually by 2030. These initiatives strengthen long-term demand visibility even as the product mix shifts toward recycled grades.

Increasing Demand for Household and Personal Care Products

Surfactants and detergents formulated with ethoxylates and ethanolamines deliver superior cleaning efficiency, especially in hard-water regions. Consumer preference for eco-friendly ingredients is prompting producers such as Nouryon to certify green ethylene oxide derivatives under the ISCC PLUS scheme. Switching from alkylphenol to fatty-alcohol ethoxylates aligns with forthcoming biodegradability regulations while sustaining performance. Capacity additions in Europe and North America are timed to capture this demand uptick as private-label cleaning brands gain retail shelf space.

Health and Environmental Effects over High Exposure

Ethylene oxide is classified as carcinogenic, prompting the EPA's January 2025 interim decision that cuts worker exposure limits from 0.5 ppm by 2028 down to 0.1 ppm by 2035. Compliance demands costly engineering controls, personal monitoring, and capital upgrades. Some healthcare device makers are accelerating the qualification of alternative sterilization methods, including gamma radiation, vaporized hydrogen peroxide, and nitrogen dioxide. While these substitutes will erode specific volumes, ethylene oxide remains indispensable for heat-sensitive devices with intricate lumens.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Utilization in Medical Device Sterilization

- Growing Demand from Textile and Apparel Industry

- Volatility of Ethylene Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ethylene glycols formed the bedrock of the ethylene oxide market in 2024, capturing 75.57% share as polyester fiber and PET resin output scaled in Asia-Pacific. Price volatility has returned following upstream supply disruptions, pushing Asia-based buyers to secure long-term contracts with integrated producers. In parallel, bio-MEG pilots are gaining traction as brand owners seek lower-carbon packaging options.

Ethanolamines contribute a smaller volume but post the highest 3.69% CAGR to 2030, driven by agrochemicals, gas treatment, and personal-care demand. BASF's Antwerp debottlenecking raised global alkyl ethanolamine capacity by nearly 30% to more than 140,000 t per year, underscoring the segment's strategic value. Rising glyphosate herbicide volumes in Latin America and Asia sustain monoethanolamine pull-through, while triethanolamine sees new opportunities in CO2 capture solvents. Strong downstream diversification shields this derivative class from single-industry cyclicality.

PET resins and polyester fibers absorbed 28.19% of ethylene oxide demand in 2024. The ethylene oxide market size linked to PET is expected to grow steadily as beverage companies transition from glass and metal to lightweight PET bottles. Innovative depolymerization pathways such as dimethyl-carbonate-aided methanolysis enable greater than 90% dimethyl terephthalate yields, opening high-purity recycled PET streams. Over the forecast horizon, virgin demand moderates in developed regions yet expands in fast-growing economies where recycling infrastructure remains nascent.

Sterilization and fumigation ranked as the fastest-growing application at 3.81% CAGR. Approximately 50,000 distinct medical devices rely on ethylene oxide sterilization, preserving thermolabile polymers that cannot withstand gamma or electron-beam radiation. Even with stringent emissions limits, demand persists because alternative modalities often fail to penetrate complex packaging or achieve required sterility assurance levels. Investment in catalytic oxidation units and continuous emissions monitoring allows compliant operations, sustaining growth in this niche.

The Ethylene Oxide Market Report is Segmented by Derivative (Ethylene Glycols, Ethoxylates, Ethanolamines, and More), Application (Polyester Fiber and PET Resins, Surfactants and Detergents, and More), End-User Industry (Automotive, Agrochemicals, Food and Beverage, and More), Feedstock (Petro-Based Ethylene and Bio-Ethylene), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific remained the largest ethylene oxide market in 2024, supplying 51.09% of global demand and expanding at a region-leading 3.82% CAGR to 2030. China anchors capacity additions with BASF's Zhanjiang Verbund complex slated for start-up in 2025. India's production grows alongside local polyester fiber expansion, supported by government manufacturing incentives. Regional governments tighten environmental norms, but integrated complexes with advanced abatement maintain competitiveness.

North America benefits from shale-based ethane economics that yield some of the world's lowest ethylene cash costs. Medical device sterilization concentration elevates domestic consumption, and INEOS's 2024 acquisition of LyondellBasell's Bayport unit consolidates supply in the largest single market. Compliance with EPA emission rules accelerates investment in catalytic scrubbers and real-time monitoring, setting a global technology benchmark.

Europe confronts high energy prices and more stringent CO2 targets, prompting 11 million tons of regional chemical capacity closures during 2023-2024. Collaborations such as the 2024 Clariant-OMV agreement to supply lower-carbon ethylene and ethylene oxide derivatives aim to defend market share against imports. Eastern Europe retains selective competitiveness through access to pipeline gas and established downstream polyester assets.

The Middle East leverages advantaged feedstock at integrated complexes, with Saudi-based producers targeting export markets in Asia. Africa sees limited local production but steady imports for detergent and agrochemical formulations. South America advances bio-ethylene projects in Brazil, positioning the subcontinent as a potential net exporter of low-carbon derivatives over the next decade.

- BASF SE

- China Petrochemical Corporation

- Clariant

- Dow

- Huntsman International LLC

- India Glycols Limited

- Indorama Ventures Public Company Limited

- INEOS

- LOTTE Chemical Corporation

- NIPPON SHOKUBAI CO., LTD.

- Nouryon

- PETRONAS Chemicals Group Berhad

- Reliance Industries Limited

- SABIC

- Sasol Limited

- Shell plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Usage of PET in the Food and Beverage Industry

- 4.2.2 Increasing Demand for Household and Personal Care Products

- 4.2.3 Increasing Utilziation in Medical Device Sterilization

- 4.2.4 Growing Demand from Textile and Apparel Industry

- 4.2.5 Increasing Utilization from the Agriculture Sector

- 4.3 Market Restraints

- 4.3.1 Health and Environmental Effects over High Exposure

- 4.3.2 Volatility of Ethylene Feedstock Prices

- 4.3.3 High Production Cost

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Derivative

- 5.1.1 Ethylene Glycols

- 5.1.1.1 Monoethylene Glycol (MEG)

- 5.1.1.2 Diethylene Glycol (DEG)

- 5.1.1.3 Triethylene Glycol (TEG)

- 5.1.2 Ethoxylates

- 5.1.3 Ethanolamines

- 5.1.4 Glycol Ethers

- 5.1.5 Polyethylene Glycol

- 5.1.6 Other Derivatives

- 5.1.1 Ethylene Glycols

- 5.2 By Application

- 5.2.1 Polyester Fiber and PET Resins

- 5.2.2 Surfactants and Detergents

- 5.2.3 Sterilization and Fumigation

- 5.2.4 Coolant and Antifreeze

- 5.2.5 Pharmaceuticals Excipients

- 5.2.6 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Agrochemicals

- 5.3.3 Food and Beverage

- 5.3.4 Textile

- 5.3.5 Personal Care

- 5.3.6 Pharmaceuticals

- 5.3.7 Detergents

- 5.3.8 Others End user Industries

- 5.4 By Feedstock

- 5.4.1 Petro-based Ethylene

- 5.4.2 Bio-ethylene

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 BASF SE

- 6.4.2 China Petrochemical Corporation

- 6.4.3 Clariant

- 6.4.4 Dow

- 6.4.5 Huntsman International LLC

- 6.4.6 India Glycols Limited

- 6.4.7 Indorama Ventures Public Company Limited

- 6.4.8 INEOS

- 6.4.9 LOTTE Chemical Corporation

- 6.4.10 NIPPON SHOKUBAI CO., LTD.

- 6.4.11 Nouryon

- 6.4.12 PETRONAS Chemicals Group Berhad

- 6.4.13 Reliance Industries Limited

- 6.4.14 SABIC

- 6.4.15 Sasol Limited

- 6.4.16 Shell plc

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Usage of Bio-derived Ethylene over Petro-based Ethylene for Production