|

市場調查報告書

商品編碼

1852144

潤滑脂:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Grease - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

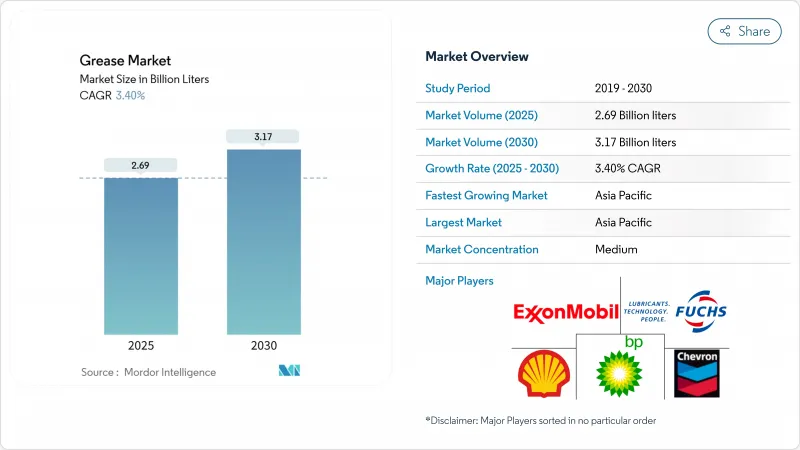

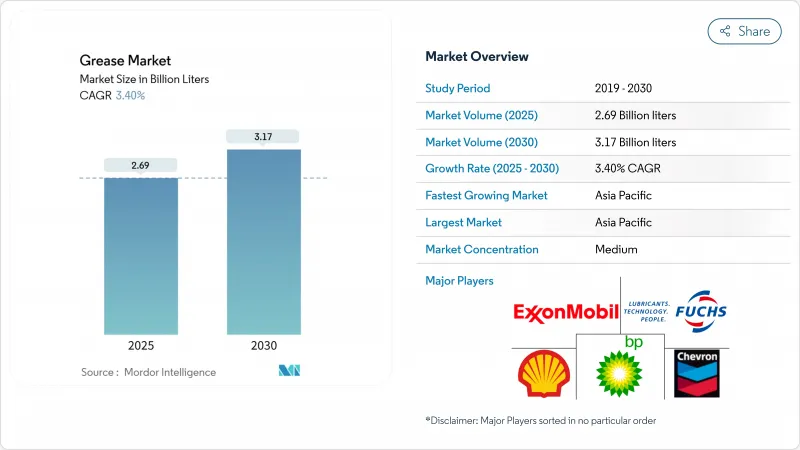

預計到 2025 年,潤滑脂市場規模將達到 26.9 億公升,到 2030 年將達到 31.7 億公升,在預測期(2025-2030 年)內,複合年成長率將達到 3.40%。

增稠劑成分的變化更為活躍,鈣基產品以9.10%的複合年成長率快速成長,開始動搖鋰長期以來的主導地位。碳酸鋰價格的波動、日益嚴格的環境法規以及電動車(EV)的技術需求,都在同時重塑買家的優先事項和供應商的產品組合。亞太地區憑藉著蓬勃發展的施工機械市場和全球成長最快的電動車製造基地,持續保持需求中心的地位。隨著機械設計不斷突破軸承、齒輪和密封件的傳統應用範圍,高溫和極壓等級的增稠劑正日益受到關注。

全球潤滑脂市場趨勢與洞察

歐盟和北美加工生產線中衛生食品級潤滑劑的普及情況

隨著加工商遵守FDA 21 CFR 178.3570和ISO 21469標準,對NSF H1認證潤滑脂的需求正在加速成長。各工廠正轉向「全H1」潤滑脂方案,以消除交叉污染的風險;同時,合成基礎油正在取代礦物油,以實現更高的耐溫性(高達500°F)和更長的潤滑週期。這一趨勢在歐洲的麵包房、酪農和飲料廠尤為明顯,這些工廠自2024年起將加強合規性檢查。能夠同時提供產品成分和工廠衛生認證的供應商正在贏得多廠區契約,從而確保穩定的供貨量。

亞太地區電動車動力傳動系統總成軸承採用鋰基複合潤滑脂和磺酸鈣潤滑脂

中國、韓國和印度電動車生產的快速發展正在重塑潤滑脂配方要求。曾經轉速為10,000轉/分的軸承,如今轉速已超過20,000轉/分,並承受超過150 度C的熱應力。實驗室測試表明,磺酸鈣潤滑脂在接近600°F的溫度下仍能保持穩定性,其性能比鋰基複合潤滑脂高出20%,同時還具有低電電阻。 2024年發布的OEM規範已將磺酸鈣列為多款大眾市場車型前後軸軸承的預設潤滑脂。擁有穩定磺酸鹽鈣供應鏈的潤滑脂生產商正抓住這一機遇,爭取簽訂多年期批量合約。

電池產業競爭導致碳酸鋰成本波動

2021年至2024年,碳酸鋰現貨價格上漲。調查數據顯示,鋰精礦產量佔全球總產量的比例在兩年內從70%下降至60%,生產商目前正利用聚脲或鈣基技術進行避險,以保障淨利率。受季度潤滑脂價格調整影響的買家正在尋求供應商多元化,以緩解現貨短缺問題。一些汽車製造商正在預先核准磺酸鈣潤滑脂,以避免因鋰基準價格波動而產生的合約中期附加稅。

細分市場分析

到2024年,鋰基潤滑脂將佔潤滑脂市場的66%,而鈣基潤滑脂的銷售量將以9.10%的複合年成長率成長。這種市場格局的轉變源自於兩大動態:鋰價上漲以及鈣基潤滑脂優異的耐高溫性能。製造商正在改造反應器生產線,以實現鋰基和鈣基潤滑脂批次間的靈活切換,在降低原料風險的同時,確保產品代碼核准客戶要求。鋁基複合潤滑脂在船舶和造紙廠等應用領域,尤其是在防水潤滑脂方面,仍佔有重要地位。聚脲潤滑脂通過去除金屬皂來降低電阻,因此在對噪音敏感的電動車軸承應用中越來越受歡迎。由於聚脲潤滑脂與傳統鋰基潤滑脂不相容,終端用戶對其廣泛應用仍持謹慎態度,但OEM填充設備為快速提升銷售提供了途徑。

現場證據表明,中國風力發電機主軸承的潤滑週期延長了30%,這進一步支持了磺酸鈣潤滑脂的廣泛應用。與鋰基複合潤滑脂的比較測試證實,磺酸鈣潤滑脂具有更低的油水分離率和更優異的滴點性能,這對於在70°C以上峰值太陽輻射下運行的風力發電機而言是一項關鍵優勢,即使機艙溫度低於-20°C。生產商強調,鈣的天然去污能力降低了添加劑的加工速度,從而節省了成本,部分抵消了磺酸鹽成本的上漲。最終,增稠劑市場正日益細分為多種化學成分的產品組合,鋰、鈣、鋁和聚脲等增稠劑各自在潤滑脂市場中佔據獨特的性能優勢。

預計到2024年,礦物油潤滑脂將佔據潤滑脂市場75%的佔有率,而合成潤滑脂預計將以4.90%的複合年成長率成長。聚α烯烴(PAO)基潤滑脂因其氧化穩定性和寬廣的溫度範圍,在合成潤滑脂領域佔據主導地位。美孚航空潤滑脂SHC 100的使用溫度範圍為-54 度C至177 度C,其性能優勢已獲得航太原始設備製造商(OEM)的認可。生物植物來源酯類潤滑脂在ASTM標準測試中,其抗氧化壽命已可與III類礦物油相媲美。

礦物油潤滑脂能夠滿足底盤潤滑和工業開式齒輪傳動等對價格敏感的應用領域的需求,並符合NLGI(美國國家潤滑脂協會)的建議標準。然而,現代高速生產線不斷變化的運行溫度要求,使得買家即使在中等應用領域也開始指定使用合成油和半合成油。了解PAO和酯類潤滑脂中複雜添加劑溶解性的供應商,能夠在特種潤滑脂和食品級潤滑脂市場中獲得高於平均的利潤。

區域分析

到2024年,亞太地區將佔全球銷售量的49%,年複合成長率達4.32%,是歐洲成長率的兩倍。中國的製造業群聚、印度快速發展的基礎設施以及東南亞的電動車零件產業群聚均保持著較高的運轉率。殼牌決定將其位於泰國的潤滑脂工廠產能提高三倍,達到每年1.5萬噸,這充分體現了該地區的強勁發展勢頭。預計到2030年,亞太地區在全球潤滑脂市場的佔有率將達到52%,進一步鞏固在該領域的領先地位。

北美地區在全球潤滑油需求中佔據很大佔有率,這主要得益於蓬勃發展的食品加工業和蓬勃發展的可再生能源項目。風電場的建造推動了對輪轂高度超過100公尺、維護週期為五年的合成潤滑油的需求。監管機構對環保潤滑油的重視,促使五大湖區和沿海航線的船舶業者將貨物絞車點更換為符合EAL認證標準的潤滑脂。

歐洲佔了較大的銷售量,但也面臨最嚴格的監管挑戰。 PFAS法規已促使汽車、航太和機械設備原始設備製造商(OEM)對供應商審核。能夠提供不含PFAS且不犧牲可靠性的替代方案的供應商有望保持其市場佔有率。預計到2024年,南美洲以及中東和非洲的需求佔有率將較小。自動潤滑系統的低普及率將推高單位消費量,但資金限制正在減緩技術升級。提供改裝方案的服務供應商可以利用這種銷售不平衡,加速潤滑脂市場這些新興領域的成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 食品級衛生潤滑劑在歐盟和北美加工生產線上的普及

- 電動車動力傳動系統總成軸承向鋰基複合潤滑脂和磺酸鈣潤滑脂過渡

- 在深海鑽井中使用防水潤滑脂。

- 印度和東協的施工機械熱潮推動了極壓潤滑脂的需求。

- 電力業投資強勁成長

- 市場限制

- 電池產業競爭導致碳酸鋰成本波動

- 歐盟REACH法規對PFAS和氮化硼添加劑的限制

- 自動潤滑系統在非洲和南美洲的普及率較低

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模和成長預測(價值和數量)

- 透過增稠劑

- 鋰基

- 鈣基

- 鋁底座

- 聚脲

- 其他增稠劑

- 依產品類型

- 礦物油

- 合成油

- 生物基油

- 按表現等級

- 高溫潤滑脂

- 低溫和極地級潤滑脂

- 極壓/高負荷潤滑脂

- 按最終用戶行業分類

- 汽車和其他交通工具

- 發電(風能、水力、火力)

- 重型機械

- 食品/飲料

- 冶金/金屬加工

- 化學製造

- 其他行業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 馬來西亞

- 泰國

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Ampol Limited

- Axel Christiernsson AB

- BECHEM Lubrication Technology LLC

- BP plc

- Chevron Corporation

- China Petrochemical Corporation

- DuPont

- ENEOS Corporation

- ETS Oil & Gas Ltd.

- Exxon Mobil Corporation

- FUCHS

- Gazprom

- Gulf Oil International Ltd

- Idemitsu Kosan Co.,Ltd.

- Kluber Lubrication SE

- LUKOIL

- Morris Lubricants

- Orlen Oil

- Penrite Oi

- Petromin

- Petronas Lubricants International

- Saudi Arabian Oil Co.

- Shell Plc

- TotalEnergies

第7章 市場機會與未來展望

The Grease Market size is estimated at 2.69 Billion liters in 2025, and is expected to reach 3.17 Billion liters by 2030, at a CAGR of 3.40% during the forecast period (2025-2030).

Volume growth is steady rather than spectacular, yet the change in thickener mix is far more dynamic, with calcium-based products expanding at 9.10% CAGR and starting to chip away at lithium's long-held dominance. Price volatility for lithium carbonate, tightening environmental regulation and the technical needs of electric vehicles (EVs) are simultaneously reshaping buyer priorities and supplier portfolios. Asia Pacific maintains its role as the fulcrum of demand, propelled by construction equipment activity and the world's fastest-growing EV production base. High-temperature and extreme-pressure grades are capturing increasing attention as machinery designs push bearings, gears and seals far beyond traditional service envelopes.

Global Grease Market Trends and Insights

Hygienic Food-Grade Lubrication Uptake in EU & North America Processing Lines

Demand for NSF H1-registered greases is accelerating as processors align with FDA 21 CFR 178.3570 and ISO 21469 standards. Facilities are migrating to "all-H1" programs to eliminate the risk of cross-contamination, and synthetic base fluids are replacing mineral oils to achieve higher temperature resilience-up to 500 °F continuous service-and longer relubrication intervals. The trend is most evident in European bakeries, dairies and beverage plants, where compliance checks have tightened since 2024. Suppliers able to certify both product composition and plant hygiene are winning multi-site contracts that secure recurring volume.

EV e-Powertrain Bearing Shift to Lithium-Complex & Calcium-Sulfonate Greases in APAC

Rapid EV output in China, Korea and India is reshaping formulation requirements. Bearings that once ran at 10,000 rpm now exceed 20,000 rpm, pushing thermal loads beyond 150 °C. Laboratory tests show calcium-sulfonate greases sustaining consistency at dropping points near 600 °F, a 20% margin over lithium-complex alternatives, while also exhibiting lower electrical impedance. OEM specification sheets published in 2024 already list calcium-sulfonate as the default for front-and-rear e-axle bearings in several mass-market models. Grease producers with secure calcium sulfonate supply chains are using this window to lock in multi-year volume contracts.

Lithium Carbonate Cost Volatility Due to Battery-Sector Competition

Lithium carbonate spot prices climbed between 2021 and 2024. Survey data show lithium thickeners dropped from 70% of global output to 60% in two years, and producers now hedge with polyurea or calcium technologies to protect margins. Grease buyers exposed to quarterly price resets have diversified suppliers to mitigate spot shortages. Some automotive lines are pre-approving calcium-sulfonate greases to avoid mid-contract surcharges tied to lithium benchmarks.

Other drivers and restraints analyzed in the detailed report include:

- Offshore Deep-Water Drilling Boosting Water-Resistant Marine Greases

- Construction Equipment Boom in India & ASEAN Driving Extreme-Pressure Greases

- EU REACH Tightening on PFAS & Boron-Nitride Additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium-based products still accounted for 66% of the grease market in 2024, but calcium-based volumes are advancing at a 9.10% CAGR. This realignment is rooted in the dual dynamics of lithium price spikes and superior high-temperature resilience offered by calcium chemistries. Manufacturers are recalibrating reactor lines to flex between lithium and calcium batches, mitigating feedstock risk while preserving customer-approved product codes. Aluminum complex greases retain relevance in marine and paper-mill water-resistance niches. Polyurea grades gain traction in noise-sensitive EV bearing applications where the absence of metal soaps reduces electrical impedance. End users remain cautious about widespread polyurea adoption due to incompatibility with legacy lithium greases, but OEM-filled units present a fast-track pathway to volume growth.

Calcium-sulfonate's acceptance is further boosted by field evidence showing a 30% extension in relubrication intervals on wind turbine main bearings in China. Benchmark testing against lithium-complex rivals confirmed lower oil separation and superior drop-point performance-a critical advantage in turbines operating at nacelle temperatures below -20 °C yet experiencing sun-exposed peaks above 70 °C. Producers emphasize that calcium's natural detergency properties lower additive treat rates, yielding cost savings that partially offset higher sulfonate acid costs. Ultimately, the thickener landscape is fragmenting into multi-chemistry portfolios in which lithium, calcium, aluminum and polyurea each defend distinct performance niches within the grease market.

Mineral-oil greases represented 75% of the grease market share in 2024 and the synthetic grades is forecast to rise at 4.90% CAGR. Polyalphaolefin (PAO) bases dominate the synthetic pool thanks to oxidation stability and broad temperature envelopes. Mobil Aviation Grease SHC 100, qualified from -54 °C to 177 °C, exemplifies the performance advantage recognized by aerospace OEMs. Bio-based oils enjoy legislative tailwinds from EAL mandates and voluntary ESG programs. Vegetable-derived esters blended with antioxidant packages now rival Group III mineral oils on oxidative life in standard ASTM tests.

Mineral-oil greases keep price-sensitive applications such as chassis lubrication and industrial open-gear drives aligned with NLGI-recommended practices. However, the operating temperature swing required by modern high-speed production lines is pushing buyers to spec synthetics or semi-synthetics even in mid-range duty. Suppliers that master complex additive solubility in PAO and ester packages are positioned to capture above-average margins across specialty and food-grade segments of the grease market.

The Grease Market Report Segments the Industry by Thickener (Lithium-Based, Calcium-Based, and More), Product Type (Mineral Oil, Synthetic Oil, and More), Performance Grade (High-Temperature Greases, Low-Temperature and Arctic-Grade Greases, and More), End-User Industry (Automotive and Other Transportation, Power Generation, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia Pacific retained 49% of global volume in 2024 and is expanding at a 4.32% CAGR, twice the pace of Europe. China's manufacturing complex, India's infrastructure surge and Southeast Asia's EV component clustering keep utilization rates high. Shell's decision to triple grease plant capacity in Thailand to 15,000 tonnes per year underscores the region's pull. The region's share of the grease market size is expected to touch 52% by 2030, cementing its structural leadership.

North America holds a significant share of the total volume, supported by robust food processing and a booming renewable power pipeline. Wind farm buildout has lifted demand for synthetics that can last five-year maintenance cycles at hub heights above 100 m. Regulatory emphasis on environmentally acceptable lubricants is pushing marine operators on the Great Lakes and coastal routes to convert cargo-winch points to EAL-certified greases.

Europe holds a significant share of the volume but faces the most stringent regulatory challenges. The PFAS restriction docket has triggered supplier audits across automotive, aerospace and machinery OEMs. Suppliers that demonstrate PFAS-free alternatives without sacrificing reliability are poised to keep share. South America and the Middle East & Africa together contribute a small share of 2024 demand. Low penetration of automatic lubrication systems raises per-unit grease consumption, but capital constraints slow technology upgrades. Service providers with retrofit solutions can leverage the volume imbalance to fast-track growth in these frontier segments of the grease market.

- Ampol Limited

- Axel Christiernsson AB

- BECHEM Lubrication Technology LLC

- BP p.l.c.

- Chevron Corporation

- China Petrochemical Corporation

- DuPont

- ENEOS Corporation

- ETS Oil & Gas Ltd.

- Exxon Mobil Corporation

- FUCHS

- Gazprom

- Gulf Oil International Ltd

- Idemitsu Kosan Co.,Ltd.

- Kluber Lubrication SE

- LUKOIL

- Morris Lubricants

- Orlen Oil

- Penrite Oi

- Petromin

- Petronas Lubricants International

- Saudi Arabian Oil Co.

- Shell Plc

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Hygienic Food-Grade Lubrication Uptake in EU and North-America Processing Lines

- 4.2.2 EV e-Powertrain Bearing Shift to Lithium-Complex and Calcium-Sulfonate Grease

- 4.2.3 Offshore Deep-Water Drilling Boosting Water-Resistant Marine Grease

- 4.2.4 Construction Equipment Boom in India and ASEAN Driving Extreme-Pressure Grease

- 4.2.5 Robust Growth of Investments in the Power Generation Sector

- 4.3 Market Restraints

- 4.3.1 Lithium Carbonate Cost Volatility Due to Battery-Sector Competition

- 4.3.2 EU REACH Tightening on PFAS and Boron-Nitride Additives

- 4.3.3 Low Penetration of Auto-Lubrication Systems in Africa and South America

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Thickener

- 5.1.1 Lithium-based

- 5.1.2 Calcium-based

- 5.1.3 Aluminum-based

- 5.1.4 Polyurea

- 5.1.5 Other Thickeners

- 5.2 By Product type

- 5.2.1 Mineral Oil

- 5.2.2 Synthetic Oil

- 5.2.3 Bio-based Oil

- 5.3 By Performance Grade

- 5.3.1 High-Temperature Grease

- 5.3.2 Low-Temperature and Arctic-Grade Grease

- 5.3.3 Extreme-Pressure and Heavy-Load Grease

- 5.4 By End-user Industry

- 5.4.1 Automotive and Other Transportation

- 5.4.2 Power Generation (Wind, Hydro, Thermal)

- 5.4.3 Heavy Equipment

- 5.4.4 Food and Beverage

- 5.4.5 Metallurgy and Metalworking

- 5.4.6 Chemical Manufacturing

- 5.4.7 Other Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Indonesia

- 5.5.1.6 Malaysia

- 5.5.1.7 Thailand

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Turkey

- 5.5.3.8 Russia

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Ampol Limited

- 6.4.2 Axel Christiernsson AB

- 6.4.3 BECHEM Lubrication Technology LLC

- 6.4.4 BP p.l.c.

- 6.4.5 Chevron Corporation

- 6.4.6 China Petrochemical Corporation

- 6.4.7 DuPont

- 6.4.8 ENEOS Corporation

- 6.4.9 ETS Oil & Gas Ltd.

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 FUCHS

- 6.4.12 Gazprom

- 6.4.13 Gulf Oil International Ltd

- 6.4.14 Idemitsu Kosan Co.,Ltd.

- 6.4.15 Kluber Lubrication SE

- 6.4.16 LUKOIL

- 6.4.17 Morris Lubricants

- 6.4.18 Orlen Oil

- 6.4.19 Penrite Oi

- 6.4.20 Petromin

- 6.4.21 Petronas Lubricants International

- 6.4.22 Saudi Arabian Oil Co.

- 6.4.23 Shell Plc

- 6.4.24 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growing Usage of Polyurea Greases