|

市場調查報告書

商品編碼

1852142

氫氧化鋁:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Aluminum Hydroxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

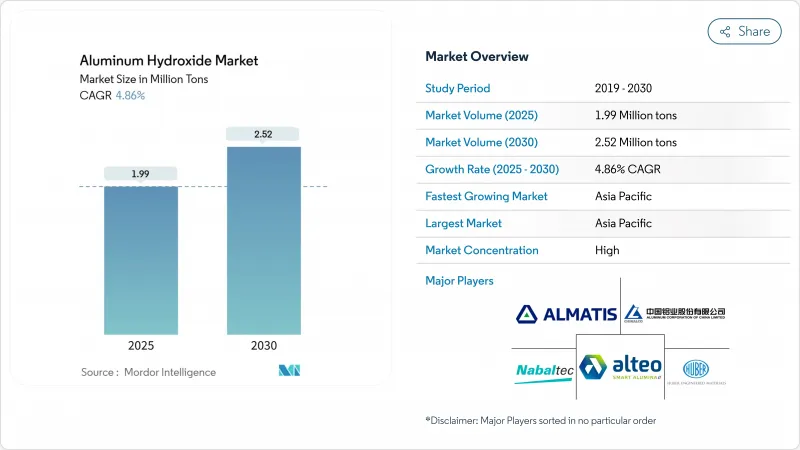

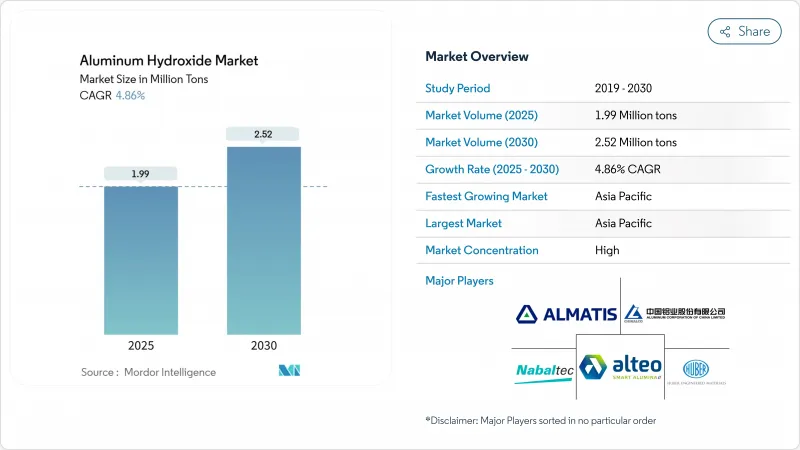

預計到 2025 年氫氧化鋁市場將達到 199 萬噸,到 2030 年將達到 252 萬噸,複合年成長率為 4.86%。

對消防安全的嚴格監管、對無鹵阻燃劑日益成長的需求以及不斷擴大的水處理基礎設施,共同塑造了氫氧化鋁市場的成長軌跡。儘管目前工業級消費量,但專為電動車電池客製化的特種級氫氧化鋁預示著下一波價值創造的到來。為應對日益嚴格的碳減排要求,生產商也優先考慮節能製程和回收解決方案。雖然與礬土供應相關的供應鏈脆弱性仍然是觀點,但下游在建築、汽車和製藥行業的持續投資,仍然為氫氧化鋁市場的成熟供應商和利基創新者提供了機會。

全球氫氧化鋁市場趨勢與洞察

消防安全法規推動聚烯電纜化合物的ATH應用。

歐洲建築材料法規和北美UL 94標準對低煙、無鹵電線材料提出了更高的要求。氫氧化鋁透過在180至200°C的溫度下釋放水蒸氣來滿足這些法規要求,從而抑制火焰燃燒且不產生有毒副產品。其在歐洲阻燃劑市場的市佔率已達38%。在電纜安全至關重要的領域,例如高層建築、隧道和鐵路車輛,氫氧化鋁的應用尤其突出。這一趨勢推動了對高純度氫氧化鋁的投資,其在聚烯中的添加量可達60%,在滿足嚴格的煙霧密度限制的同時,確保電氣性能。北美基礎設施的升級改造,尤其是在資料中心和交通運輸領域,也體現了同樣的合規邏輯,從而增強了對氫氧化鋁整體市場的中期需求。

電動車電池外殼對無鹵阻燃材料的需求

電動車產量的快速成長使得電池防火安全成為汽車設計的核心優先事項。黏度最佳化的氫氧化鋁產品兼具1-3 W/mK的導熱係數和UL 94 V0認證,可用於製造輕質複合材料外殼,進而抑制熱失控。這些產品已在中國電池供應鏈中大規模應用,類似的配方也正在歐洲和北美的超級工廠進行測試。汽車製造商正在評估能夠同時提供散熱和阻燃性能的單一添加劑方案,以簡化配方並減少對溴化物的依賴。電動車的持續普及將為電池級氫氧化鋁產品在中期內提供強勁的成長動力。

礬土供應不穩定

印尼2023年的出口限制以及關鍵地區間歇性的礦場停產導致氧化鋁原料供應趨緊。大型垂直整合加工商能夠彌補缺口,但簽訂現貨合約的小型加工商則面臨成本上升和生產中斷的困境。歐洲受到的衝擊最大,美國鋁業公司(Alcoa)位於聖西普里安的精煉廠停產引發了庫存主導的價格上漲。雖然從幾內亞和澳洲等替代來源採購在一定程度上緩解了供應緊張,但中期來看,物流挑戰意味著原料風險仍然是氫氧化鋁市場面臨的關鍵問題。

細分市場分析

到2024年,工業級氫氧化鋁將佔總供應量的64%,並繼續以5.01%的複合年成長率(CAGR)領先於其他等級,凸顯了其在消防安全、填料和水處理應用領域的關鍵作用。隨著建築、電線電纜和聚合物複合材料生產商指定使用無鹵解決方案,工業氫氧化鋁市場規模預計將穩定成長。粒徑最佳化和表面處理可改善分散性,使聚烯中的氫氧化鋁添加量達到40-60%,而不會影響其機械性能。

儘管醫藥級氫氧化鋁的需求量仍然較低,但隨著制酸劑和疫苗佐劑行業對老化效應和更嚴格的品質標準的出現,其需求正在成長。純度閾值高於99.7%以及微量金屬含量限制,使得製程控制更加嚴格,價格也更高。奈米級氫氧化鋁仍處於小眾市場,但前景廣闊。催化作用和高性能複合材料領域強調對形貌的精確控制,一些製造商正在試驗連續沉澱法,以生產尺寸小於100奈米的顆粒。隨著電動車電池和航太市場對輕質、熱穩定性高的填料的需求日益成長,這些特殊性能有望提升氫氧化鋁市場的價值。

氫氧化鋁市場按產品類型(工業、醫藥、其他)、應用領域(阻燃劑和抑煙劑、填料和顏料、其他)、終端用戶行業(塑膠和橡膠、醫藥、其他)以及地區(亞太、北美、歐洲、南美、中東和非洲)進行細分。市場預測以噸為單位。

區域分析

2024年,亞太地區將佔全球消費量的54%,維持最快成長速度,複合年成長率達5.2%。中國是電纜化合物、人造石材和鋰離子電池的主要製造地,推動了龐大的市場需求。印度的基礎設施建設計劃,特別是住房和市政供水項目,將進一步提升銷售量。自2024年起,印度將實施更嚴格的高層建築消防安全標準,將增強該地區氫氧化鋁市場的整體需求前景。

北美仍然是第二大買家,這主要得益於UL和NFPA嚴格的標準,這些標準支持在電線、電纜和建築材料中使用無鹵阻燃劑。檯面和地板材料維修的激增凸顯了該材料在美觀性和安全性方面的價值。根據美國《基礎建設投資和就業法案》,水處理廠的升級改造也提振了混凝劑的需求,並支撐了中期穩定的市場前景。該地區也正在進行用於電動車電池的高導熱性氫氧化鋁(ATH)的先進研究,這提升了特種等級產品的戰略重要性。

歐洲佔了相當大的市場佔有率,這得益於其利用環境法規加速淘汰溴化化學品。汽車電氣化是明顯的市場需求催化劑,因為汽車製造商(OEM)在電池機殼和內部線束中採用了富含氫氧化鋁的複合複合材料。德國、法國和英國是主要的進口國,而中歐和東歐擁有擠壓產能,可以滿足泛歐電纜市場的需求。氫氧化鋁市場受益於歐盟對循環經濟和低碳材料的重視,這促進了回收和綠色能源材料的生產。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場促進因素

- 消防安全法規推動聚烯電纜化合物的ATH應用。

- 電動車電池機殼對無鹵阻燃劑的需求

- 老化經濟中非處方制酸劑消費量不斷增加

- 快速採用ATH技術處理人造石材檯面

- 新興國家水處理基礎設施的擴建

- 市場限制

- 礬土供應波動

- 長期攝取鋁引起的健康問題

- 降水ATH生產的高能耗

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 產業

- 製藥

- 其他(專門食品奈米級、再生/回收級)

- 透過使用

- 阻燃/防煙

- 填料和顏料

- 制酸劑

- 水處理化學品

- 催化劑及其他

- 按最終用戶行業分類

- 塑膠和橡膠

- 製藥

- 油漆、被覆劑、黏合劑、密封劑(CASE)

- 其他(紙張等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Akrochem Corporation

- Almatis

- Alteo

- Aluminum Corporation of China Limited

- Hindalco Industries Ltd

- HONGHE CHEMICAL

- Huber Engineered Materials

- KC

- LKAB Minerals

- Martin Marietta Materials

- Nabaltec AG

- Nippon Light Metal Holdings Co., Ltd

- Resonac Holdings Corporation

- Sankyo Chemical Co. Ltd

- Sibelco

- Sumitomo Chemical Co. Ltd

- TOR Minerals

第7章 市場機會與未來展望

The aluminum hydroxide market is standing at 1.99 million tons in 2025 and is forecast to reach 2.52 million tons by 2030, registering a 4.86% CAGR.

Strong regulatory focus on fire safety, mounting demand for halogen-free flame retardants, and steady expansion of water-treatment infrastructure are shaping the growth curve. Industrial-grade material dominates current consumption thanks to its balance of purity and cost, while specialty grades tailored for electric-vehicle (EV) batteries signal the next wave of value creation. Producers are also prioritizing energy-efficient processes and recycling solutions in response to rising carbon-reduction mandates. Supply chain fragility linked to bauxite availability remains a watch point, yet sustained downstream investment in construction, automotive, and pharmaceuticals continues to unlock opportunity for both established suppliers and niche innovators across the aluminum hydroxide market.

Global Aluminum Hydroxide Market Trends and Insights

Fire-safety Regulations Driving ATH in Polyolefin Cable Compounds

European Construction Products Regulation and North American UL 94 standards have tightened requirements for low-smoke, halogen-free materials in wiring. Aluminum hydroxide meets these rules by releasing water vapor at 180-200 °C, suppressing flames without toxic by-products. Its share of the European flame-retardant pool has climbed to 38%. Significant uptake is visible in high-rise buildings, tunnels, and rolling stock, where cable safety is mission-critical. The trend has propelled investment in higher-purity grades capable of loading levels of 60% in polyolefins, ensuring electrical performance while meeting stringent smoke density limits. North American infrastructure upgrades, especially in data centers and transit, echo the same compliance logic, reinforcing mid-term demand across the aluminum hydroxide market.

Halogen-free Flame-retardant Demand in EV Battery Enclosures

Soaring EV output places battery fire safety at the center of automotive design priorities. Viscosity-optimized aluminum hydroxide grades now combine thermal conductivity values of 1-3 W/mK with UL 94 V0 ratings, enabling lightweight composite covers that mitigate thermal runaway. China's battery supply chain already deploys these grades at scale, while European and North American gigafactories are testing similar formulations. Automakers value the single-additive approach that delivers both heat dissipation and flame suppression, streamlining compound recipes and reducing reliance on brominated agents. Continued EV penetration underpins a resilient mid-term pull for battery-grade products within the aluminum hydroxide market.

Bauxite-supply Volatility

Indonesia's 2023 export curbs and intermittent mine shutdowns in key regions have tightened alumina feedstock availability. Vertically integrated majors can buffer shortfalls, yet smaller processors with spot contracts face elevated costs and production stoppages. Europe has felt the squeeze most acutely after curtailments at Alcoa's San Ciprian refinery, prompting inventory-driven price spikes. While alternative sourcing from Guinea and Australia offers partial relief, logistics challenges keep raw-material risk at the forefront for the aluminum hydroxide market during the medium term.

Other drivers and restraints analyzed in the detailed report include:

- Rising OTC Antacid Consumption in Ageing Economies

- Rapid Adoption of ATH in Solid-surface Countertops

- Health Concerns on Chronic Aluminum Intake

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial-grade material delivered 64% of total volume in 2024 and continues to outpace other grades at a 5.01% CAGR, underscoring its pivotal role across fire-safety, filler, and water-treatment applications. The aluminum hydroxide market size for industrial grade is projected to widen steadily as construction, wire-and-cable, and polymer compounders specify halogen-free solutions. Particle-size optimization and surface treatments improve dispersion, enabling 40-60% loading ratios in polyolefins without compromising mechanical performance.

Pharmaceutical-grade demand, though smaller in tonnage, benefits from the ageing-population effect and stricter quality norms in antacids and vaccine adjuvants. Purity thresholds above 99.7% and trace-metal limits impose tighter process controls, driving premium pricing. Nano-scale grades remain a niche yet promising frontier. Catalysis and high-performance composites value controlled morphology, and several producers are piloting continuous precipitation routes that can deliver sub-100 nm particles. As EV battery and aerospace markets seek lightweight, thermally stable fillers, these specialties will add incremental value within the aluminum hydroxide market.

The Aluminum Hydroxide Market is Segmented by Product Type (Industrial, Pharmaceutical, and Others), Application (Flame-Retardant and Smoke-Suppressant, Filler and Pigment, and More), End-User Industry (Plastics and Rubber, Pharmaceuticals, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia Pacific anchored 54% of worldwide consumption in 2024 and sustains the swiftest growth with a 5.2% CAGR. China's position as the core manufacturing hub for cable compounds, engineered stone, and lithium-ion batteries drives large-scale offtake. India's infrastructure programs, especially housing and municipal water schemes, add further volume traction. Stricter fire-safety codes for high-rise structures, introduced in 2024, reinforce demand visibility across the aluminum hydroxide market in the region.

North America remains the second-largest buyer, powered by rigorous UL and NFPA standards that favor halogen-free retardants in wire, cable, and building materials. A wave of countertop and flooring renovations underscores the material's dual aesthetic and safety value. Parallel upgrades in water-treatment plants under the U.S. Infrastructure Investment and Jobs Act boost coagulant demand, underpinning a stable mid-term outlook. The region also houses advanced research on high-thermal-conductivity ATH for EV batteries, cementing strategic importance for specialized grades.

Europe upholds a sizeable share, leveraging its environmental regulations to accelerate the transition away from brominated chemicals. Automotive electrification is a distinct demand catalyst as OEMs adopt ATH-rich composites for battery enclosures and onboard wiring. Germany, France, and the United Kingdom are key importers, while Central and Eastern Europe host extrusion and molding capacity that serves pan-European cable markets. The aluminum hydroxide market benefits from the bloc's emphasis on circularity and low-carbon materials, spurring recycling initiatives and green-energy feedstocks in production.

- Akrochem Corporation

- Almatis

- Alteo

- Aluminum Corporation of China Limited

- Hindalco Industries Ltd

- HONGHE CHEMICAL

- Huber Engineered Materials

- KC

- LKAB Minerals

- Martin Marietta Materials

- Nabaltec AG

- Nippon Light Metal Holdings Co., Ltd

- Resonac Holdings Corporation

- Sankyo Chemical Co. Ltd

- Sibelco

- Sumitomo Chemical Co. Ltd

- TOR Minerals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Fire-Safety Regulations Driving ATH in Polyolefin Cable Compounds

- 4.1.2 Halogen-Free Flame-Retardant Demand in EV Battery Enclosures

- 4.1.3 Rising OTC Antacid Consumption in Ageing Economies

- 4.1.4 Rapid Adoption of ATH in Solid-Surface Countertops

- 4.1.5 Water-Treatment Infrastructure Expansion in Emerging Nations

- 4.2 Market Restraints

- 4.2.1 Bauxite-Supply Volatility

- 4.2.2 Health Concerns on Chronic Aluminum Intake

- 4.2.3 High Energy Cost of Precipitated ATH Production

- 4.3 Value Chain Analysis

- 4.4 Porter's Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

5 Market Size and Growth Forecasts ( Volume)

- 5.1 By Product Type

- 5.1.1 Industrial

- 5.1.2 Pharmaceuticals

- 5.1.3 Others (Specialty Nano Grade and Reclaimed / Recycled Grade)

- 5.2 By Application

- 5.2.1 Flame-Retardant and Smoke-Suppressant

- 5.2.2 Filler and Pigment

- 5.2.3 Antacid

- 5.2.4 Water-Treatment Chemicals

- 5.2.5 Catalyst and Others

- 5.3 By End-User Industry

- 5.3.1 Plastics and Rubber

- 5.3.2 Pharmaceuticals

- 5.3.3 Paints, Coatings, Adhesives and Sealants (CASE)

- 5.3.4 Others (Paper and Others)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Akrochem Corporation

- 6.4.2 Almatis

- 6.4.3 Alteo

- 6.4.4 Aluminum Corporation of China Limited

- 6.4.5 Hindalco Industries Ltd

- 6.4.6 HONGHE CHEMICAL

- 6.4.7 Huber Engineered Materials

- 6.4.8 KC

- 6.4.9 LKAB Minerals

- 6.4.10 Martin Marietta Materials

- 6.4.11 Nabaltec AG

- 6.4.12 Nippon Light Metal Holdings Co., Ltd

- 6.4.13 Resonac Holdings Corporation

- 6.4.14 Sankyo Chemical Co. Ltd

- 6.4.15 Sibelco

- 6.4.16 Sumitomo Chemical Co. Ltd

- 6.4.17 TOR Minerals

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Rising Usage in Batteries and Chemicals