|

市場調查報告書

商品編碼

1852121

電腦輔助製造:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Computer Aided Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

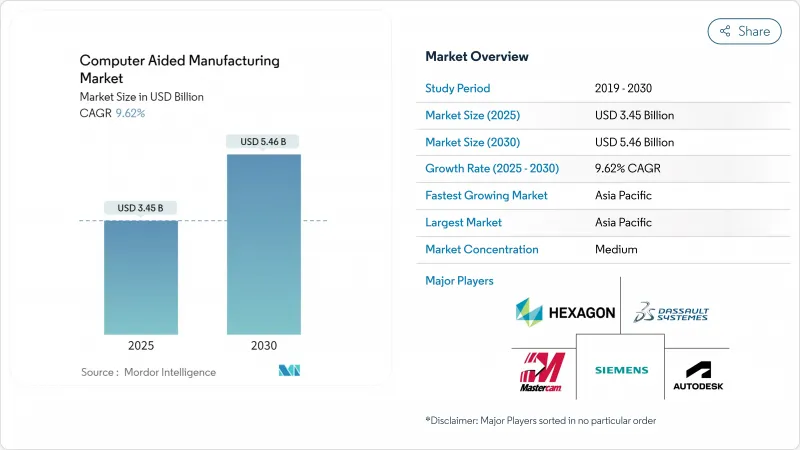

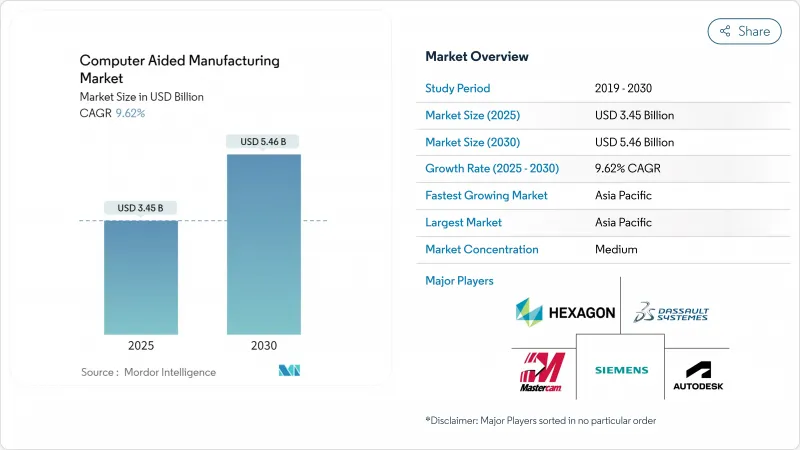

預計到 2025 年,電腦輔助製造市場規模將達到 34.5 億美元,到 2030 年將擴大到 54.6 億美元,複合年成長率為 9.62%。

成長的驅動力來自減材-增材混合生產單元的轉型、人工智慧與刀具路徑生成的融合,以及政府鼓勵國產半導體封裝和電動車零件的再共享激勵措施。能夠將雲端原生協作與本地安全相結合的供應商,正受益於橫跨多個大洲且遵循國防級智慧財產權通訊協定的航太專案。西門子、歐特克和達梭系統正在將即時機器分析整合到其設計到製造的套件中,為用戶提供超越純粹編程速度的預測性維護洞察,並增強平台整合。

全球電腦輔助製造市場趨勢與洞察

混合加工中心的興起改變了生產經濟格局

混合系統將雷射或定向能量沉澱和高速精加工整合於同一機殼內,無需二次裝夾,並將原料浪費減少高達 40%。西門子 NX 現在可自動執行輪胎邊緣沉澱和精加工刀具路徑,僅在需要的地方沉澱材料,即可達到航太級表面光潔度,從而將複雜鈦零件的整體加工週期縮短 25-30%。該技術的實際應用依賴於經過培訓的操作人員,他們能夠在微秒級的精度內同步增材和減材加工操作——而這種技能在大多數機械加工車間都非常稀缺。

工業4.0數位線程賦能預測性製造

此閉合迴路平台將CAM編程參數與即時主軸功率、振動和刀具磨損感測器連接起來。 Hexagon的演算法能夠提前15到20分鐘偵測到即將發生的刀具故障,並自動調整進給速度,從而將表面品質保持在公差範圍內,減少易碎航太合金的廢品率。這些解決方案需要密集的感測器網路和高吞吐量的分析,因此限制了它們在零件價值足以支撐資本支出的加工車間中的應用。

開放原始碼CAM挑戰商業定價模式

FreeCAD PathWorkbench 現在可以輸出 2.5 軸 G 代碼,無需任何許可費用,使其成為學校和小型研討會可靠的入門級選擇。商業供應商透過捆綁功能來展開競爭,這些功能超越了大多數社群計劃的運算能力,例如 AI 驅動的最佳化和雲端協作,但他們必須防止其基礎模組被同質化。

細分市場分析

雲端託管套件目前在整個電腦輔助製造市場中所佔佔有率仍然較小,但其到2030年的複合年成長率(CAGR)高達10.9%,顯示這一趨勢不可逆轉。一家在三大洲擁有工廠的航太集團利用基於瀏覽器的刀具路徑編輯技術實現隔夜交付,將前置作業時間縮短了20%至25%。由於ITAR法規要求在現場維護資料主權,國防承包商對全面遷移持抵制態度。因此,將本地後處理器與雲端求解器連接的混合堆疊構成了一座橋樑。邊緣閘道器可以改裝到沒有OPC-UA或MTConnect的舊機器上,從而在不更換控制器的情況下實現加密資料流傳輸。訂閱模式將成本從資本預算轉移到營運支出。雲端分析還使供應商能夠對匿名化的全機主軸利用率進行基準測試,並將其輸入到預測性維護儀表板中,從而減少非計劃性停機時間。隨著零信任架構的成熟,即使是較保守的行業也計劃在2027年前進行試點遷移,這表明電腦輔助製造市場將在下一個預算週期內跨越雲端採用的心理門檻。

儘管如此,對於採用空氣間隙網路或專有合金配方的工廠而言,本地部署基礎設施仍然至關重要。供應商透過授權數位線程模組來贏得這些客戶,這些模組可以將選定的元資料同步到雲端,供遠端專家訪問,同時仍保留在防火牆內。這種雙軌策略既能穩定授權續約,也能隨著顧客轉向混合分析而增加經常性收入。隨著時間的推移,不同部署模式之間的單獨定價可能會消失,因為平台訂閱層級只需簡單地啟用或停用雲端處理額度即可。網路保險費現在反映了工具機網路的風險敞口,財務長們也正在將安全認證納入整體擁有成本的考慮範圍。因此,電腦輔助製造市場正在從雲端和本地部署的二元選擇演變為靈活的部署期限模式。

汽車產業是更廣泛的電腦輔助製造 (CADM) 市場的核心組成部分,佔 2024 年總收入的 36.2%。然而,從內燃機 (ICE) 零件加工到電動車 (EV) 零件加工的轉變,對沿用已久的刀具路徑庫提出了挑戰。電池托盤銑削需要採用薄壁加工策略來控制振動,同時保持高矽鋁加工效率。同時,航太和國防領域雖然規模較小,但對五軸加工和複合材料加工的高級許可需求也日益成長。醫療設備製造商正在採用人工智慧驅動的參數調整來滿足 ISO 13485 可追溯性要求,從而能夠在單人操作單元中實現亞 10μm 的公差,而無需手動編輯。電子和半導體封裝製程需要採用熱感知鑽孔定序,以防止在 100,000 rpm 的鑽孔過程中出現銅層剝離。醫療設備製造商正在複製航太領域的表面處理流程,而汽車製造商則從電池模組晶圓廠引進清潔通訊協定,這些都擴大了 CADM 的潛在市場。

汽車製造業的多元化同樣引人注目。結構件的千兆鑄造工藝省去了數十個沖壓件,但也引入了鋁晶粒件的大規模數控精加工,這要求極高的材料去除率和可靠的刀具壽命模型。投資此類生產單元的供應商要求軟體能夠自動補償20小時無人值守輪班期間的刀具磨損漂移。相較之下,一家專注於碳纖維裝飾件的小眾超級跑車製造商則使用五軸銑床,並在每個生產週期中根據探針更新路徑。這種差異意味著單一垂直行業可能需要多個CAM軟體授權級別,從而確保即使整車產量趨於穩定,電腦輔助製造市場仍保持強勁成長。

區域分析

亞太地區47.1%的市佔率凸顯了其製造業的實力,但該地區仍面臨數控通訊協定片段化的問題,這使得即插即用的互通性變得複雜。中國的政策鼓勵自主研發的CAM演算法和國產控制器,從而催生了一個平行生態系統,全球供應商必須透過雙語後處理器和開放API工具庫來連接這個生態系統。日本工具機OEM廠商正在將CAM直接整合到控制韌體中,從而縮短刀具路徑載入時間,但客戶卻被鎖定在專有軟體堆疊中。印度的「生產關聯激勵計畫」(Production Linked Incentive program)透過補貼CAM授權費用來促進勞動力技能提升,這有望幫助供應商在新興的中端市場站穩腳跟,這些市場到2030年可能足以與傳統巨頭匹敵。

隨著《晶片製造和整合法案》(CHIPS Act)向區域晶圓廠注入520億美元資金,北美用戶在雲端技術應用方面處於領先地位。歐洲則更傾向於節能加工,強制要求減少壓縮空氣消耗和工具重複使用,CAM策略模擬器現在能夠以每零件的千瓦時為單位進行建模。資料主權規則雖然造成了一些摩擦,但一級供應商正在接受本地化的資料湖,以換取跨工廠的最佳化演算法。這些區域差異使得電腦輔助製造市場能夠保持廣泛的多樣性,並緩解區域經濟衰退的影響。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 混合式(減材+增材)加工中心的興起

- 工業4.0數位線程的應用日益普及

- 先進包裝生產線對超精密零件的需求

- 需要靈活的生產方式來實現電動車平台的本地化

- 轉向雲端原生CAM以實現多站點協作

- 政府對戰略部門的激勵措施再分配

- 市場限制

- 開放原始碼/低成本CAM替代方案的興起

- NC程式設計和後處理方面持續存在的技能差距

- 國防企業在採用雲端運算時面臨智慧財產權安全的擔憂。

- 細分的工具機控制器標準

- 產業價值鏈分析

- 監管環境

- 技術展望

- 宏觀經濟因素的影響

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按部署模式

- 本地部署

- 雲端基礎的

- 按最終用戶行業分類

- 航太/國防

- 車

- 醫療設備

- 能源與公共產業

- 電子和半導體

- 工業機械

- 按組件

- 軟體

- 服務

- 透過製造程序

- 銑削

- 轉彎

- 挖掘

- 多軸/5軸

- 積層製造

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Autodesk Inc.

- Siemens Digital Industries Software(Siemens AG)

- Dassault Systemes SE

- Hexagon AB(Hexagon Manufacturing Intelligence)

- CNC Software LLC(Mastercam)

- HCL Technologies Ltd.

- OPEN MIND Technologies AG

- SolidCAM Ltd.

- Cimatron Ltd.

- NTT Data Engineering Systems Corp.

- BobCAD-CAM Inc.

- MecSoft Corporation

- PTC Inc.

- ZWSOFT Co. Ltd.

- SmartCAMcnc Inc.

- GibbsCAM(3D Systems Corp.)

- Hypertherm Inc.

- SprutCAM Tech Ltd.

第7章 市場機會與未來展望

The Computer Aided Manufacturing market size reached USD 3.45 billion in 2025 and is forecast to expand to USD 5.46 billion by 2030, registering a 9.62% CAGR.

Growth stems from the shift to hybrid subtractive-plus-additive production cells, the fusion of artificial intelligence with tool-path generation, and government re-shoring incentives that favor domestic semiconductor packaging and electric-vehicle components. Vendors able to blend cloud-native collaboration with on-premises security benefit from aerospace programs that span multiple continents while respecting defense-grade intellectual-property protocols. Platform consolidation is intensifying as Siemens, Autodesk, and Dassault Systemes embed real-time machine analytics inside their design-to-manufacturing suites, giving users predictive maintenance insight that trumps pure programming speed.

Global Computer Aided Manufacturing Market Trends and Insights

Rise in Hybrid Machining Centers Transforms Production Economics

Hybrid systems integrate laser or directed-energy deposition with high-speed finishing inside one enclosure, eliminating secondary setups and cutting raw-material waste by up to 40%. Siemens NX now automates bead-on-wall deposition and finishing toolpaths so manufacturers deposit material only where needed before achieving aerospace-grade surface finish, reducing overall cycle time for complex titanium parts by 25-30%. Real-world rollouts still hinge on operators trained to synchronize additive and subtractive motions within microsecond windows, a skill set in short supply across most job shops.

Industry 4.0 Digital Threads Enable Predictive Manufacturing

Closed-loop platforms connect CAM programming parameters to real-time spindle power, vibration, and tool-wear sensors. Hexagon algorithms detect impending tool failure 15-20 minutes in advance and auto-adjust feed rates to hold surface quality within tolerance, mitigating scrap on fragile aerospace alloys. These solutions require dense sensor networks and high-throughput analytics, restricting adoption to plants where part value justifies the capital outlay.

Open-Source CAM Alternatives Challenge Commercial Pricing Models

FreeCAD PathWorkbench now outputs 2.5-axis G-code at no license cost, making it a credible entry-level choice for schools and micro-workshops. Commercial vendors counter by bundling AI-driven optimization and cloud collaboration, features that exceed the computing means of most community projects, yet must guard against basic modules edging toward commoditization.

Other drivers and restraints analyzed in the detailed report include:

- Ultra-Precision Packaging Lines Drive CAM Innovation

- EV Platform Localization Accelerates Precision Machining Demand

- Skills Gap in CNC Programming Constrains Market Expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud-hosted suites still represent a minority of the overall Computer Aided Manufacturing market, but their 10.9% CAGR through 2030 underscores an irreversible direction. Aerospace groups with plants on three continents rely on browser-based toolpath editing to hand off jobs overnight, trimming lead times by 20-25%. Defense contractors resist full migration because ITAR rules demand onsite data sovereignty; consequently, hybrid stacks local post-processors linked to cloud solvers form the bridge. Edge gateways retrofit older machines lacking OPC-UA or MTConnect, letting them stream encrypted data without controller replacement. Subscription models shift costs from capital budgets to operating expenses, a boon for small shops that previously deferred software upgrades. Cloud analytics also enable vendors to benchmark spindle utilization across an anonymized fleet, feeding predictive-maintenance dashboards that slash unscheduled downtime. As zero-trust architectures mature, even conservative sectors plan pilot migrations by 2027, suggesting the Computer Aided Manufacturing market will cross a psychological cloud-adoption threshold within the next budget cycle.

The on-premises base nevertheless remains indispensable for plants with air-gapped networks and proprietary alloy formulations. Vendors court these accounts by licensing digital-thread modules that reside behind the firewall yet sync selected metadata to a cloud vault for remote experts. This twin-track strategy stabilizes license renewals while boosting recurring revenue as customers graduate to hybrid analytics. Over time, discrete pricing between deployment modes may vanish as platform subscription tiers simply toggle cloud compute credits on or off. With cyber-insurance premiums now reflecting machine-tool network exposure, CFOs increasingly factor security accreditation into total cost of ownership. Consequently, the Computer-Aided Manufacturing market is evolving toward flexible tenancy rather than binary cloud-versus-on-site choices.

Automotive held 36.2% revenue in 2024, making it the anchor segment of the broader Compute Aided Manufacturing market. Yet the shift from internal-combustion machining to electric-vehicle parts challenges long-standing toolpath libraries. Battery tray milling demands thin-wall strategies that manage chatter while sustaining throughput in high-silicon aluminum. Meanwhile, aerospace and defense, though smaller, command premium licenses for 5-axis and composite machining. Medical-device firms adopt AI-assisted parameter tuning to meet ISO 13485 traceability, letting single-operator cells hit sub-10 µm tolerances without manual edits. Electronics and semiconductor packaging operators require thermal-aware drill sequencing to prevent copper delamination during 100,000-rpm via drilling, a niche that the latest CAM modules fulfill through physics solvers. Cross-pollination is rising: medical device shops replicate aerospace surface-finish routines, while automotive tiers import wafer-fab cleanliness protocols for battery modules, expanding the total addressable market of Computer Aided Manufacturing.

Diversification inside automaking is equally profound. Gigacasting of structural components eliminates dozens of stamped parts, but introduces massive CNC finishing of die-cast aluminum, requiring high material-removal rates and robust tool-life models. Suppliers investing in these cells demand software that auto-compensates for tool-wear drift across 20-hour unmanned shifts. In contrast, niche hypercar builders focus on carbon-fiber trim, using 5-axis routers and probe-based path updates each production cycle. Such divergence means one vertical now spans multiple CAM license tiers, ensuring that the Computer Aided Manufacturing market retains depth even if overall car volumes level off.

The Computer Aided Manufacturing Market Report is Segmented by Deployment Model (On-Premises, and Cloud-Based), End-User Industry (Aerospace and Defense, Automotive, Medical Devices, and More), Component (Software, and Services), Manufacturing Process (Milling, Turning, Drilling, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 47.1% share underscores its manufacturing heft, yet the region still wrestles with CNC protocol fragmentation that complicates plug-and-play interoperability. Chinese policy favors indigenous CAM algorithms tied to homegrown controllers, spurring parallel ecosystems that global vendors must bridge through dual-language post-processors and open-API tool libraries. Japan's machine OEMs integrate CAM directly into control firmware, shortening toolpath load times but locking customers into proprietary stacks. India's Production Linked Incentive schemes subsidize CAM licenses if tied to workforce upskilling, giving vendors a foothold in an emerging mid-market that could rival traditional giants by 2030.

North American users lead in cloud adoption, partly because the CHIPS Act funnels USD 52 billion into regional fabs that require distributed programming sooner than brick-and-mortar capacity is completed. Europe champions energy-efficient machining, mandating compressed-air reduction and tool reuse targets that CAM strategy simulators now model in kilowatt-hours per part. Data-sovereignty rules add friction, but tier-one suppliers accept localized data lakes in exchange for cross-plant optimization algorithms. These regional nuances ensure the Computer Aided Manufacturing market maintains broad diversification, cushioning it against localized downturns.

- Autodesk Inc.

- Siemens Digital Industries Software (Siemens AG)

- Dassault Systemes SE

- Hexagon AB (Hexagon Manufacturing Intelligence)

- CNC Software LLC (Mastercam)

- HCL Technologies Ltd.

- OPEN MIND Technologies AG

- SolidCAM Ltd.

- Cimatron Ltd.

- NTT Data Engineering Systems Corp.

- BobCAD-CAM Inc.

- MecSoft Corporation

- PTC Inc.

- ZWSOFT Co. Ltd.

- SmartCAMcnc Inc.

- GibbsCAM (3D Systems Corp.)

- Hypertherm Inc.

- SprutCAM Tech Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in hybrid (subtractive + additive) machining centres

- 4.2.2 Expanding adoption of Industry 4.0-ready digital threads

- 4.2.3 Demand for ultra-precision parts in advanced packaging lines

- 4.2.4 Agile production needs for EV platform localisation

- 4.2.5 Shift toward cloud-native CAM for multi-site collaboration

- 4.2.6 Government re-shoring incentives for strategic sectors

- 4.3 Market Restraints

- 4.3.1 Proliferation of open-source / low-cost CAM alternatives

- 4.3.2 Persistent skills gap in NC programming and post-processing

- 4.3.3 IP-security concerns with cloud adoption in defence firms

- 4.3.4 Fragmented machine-tool controller standards

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 On-Premises

- 5.1.2 Cloud-Based

- 5.2 By End-User Industry

- 5.2.1 Aerospace and Defence

- 5.2.2 Automotive

- 5.2.3 Medical Devices

- 5.2.4 Energy and Utilities

- 5.2.5 Electronics and Semiconductor

- 5.2.6 Industrial Machinery

- 5.3 By Component

- 5.3.1 Software

- 5.3.2 Services

- 5.4 By Manufacturing Process

- 5.4.1 Milling

- 5.4.2 Turning

- 5.4.3 Drilling

- 5.4.4 Multi-Axis / 5-Axis

- 5.4.5 Additive Manufacturing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Autodesk Inc.

- 6.4.2 Siemens Digital Industries Software (Siemens AG)

- 6.4.3 Dassault Systemes SE

- 6.4.4 Hexagon AB (Hexagon Manufacturing Intelligence)

- 6.4.5 CNC Software LLC (Mastercam)

- 6.4.6 HCL Technologies Ltd.

- 6.4.7 OPEN MIND Technologies AG

- 6.4.8 SolidCAM Ltd.

- 6.4.9 Cimatron Ltd.

- 6.4.10 NTT Data Engineering Systems Corp.

- 6.4.11 BobCAD-CAM Inc.

- 6.4.12 MecSoft Corporation

- 6.4.13 PTC Inc.

- 6.4.14 ZWSOFT Co. Ltd.

- 6.4.15 SmartCAMcnc Inc.

- 6.4.16 GibbsCAM (3D Systems Corp.)

- 6.4.17 Hypertherm Inc.

- 6.4.18 SprutCAM Tech Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment