|

市場調查報告書

商品編碼

1852112

基油:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Base Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

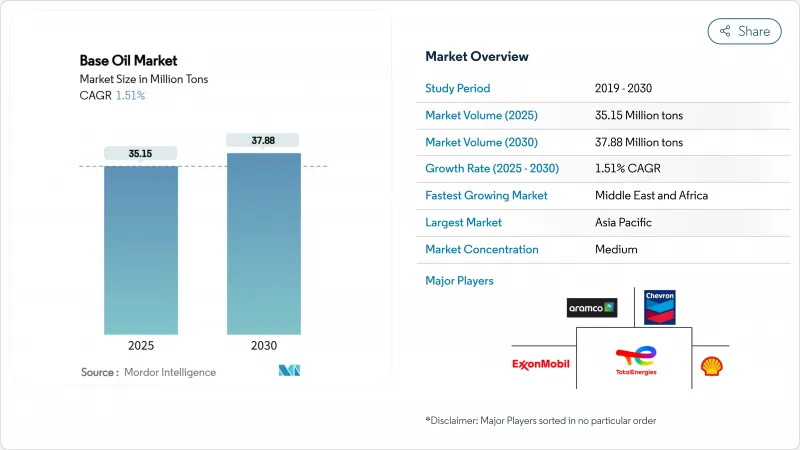

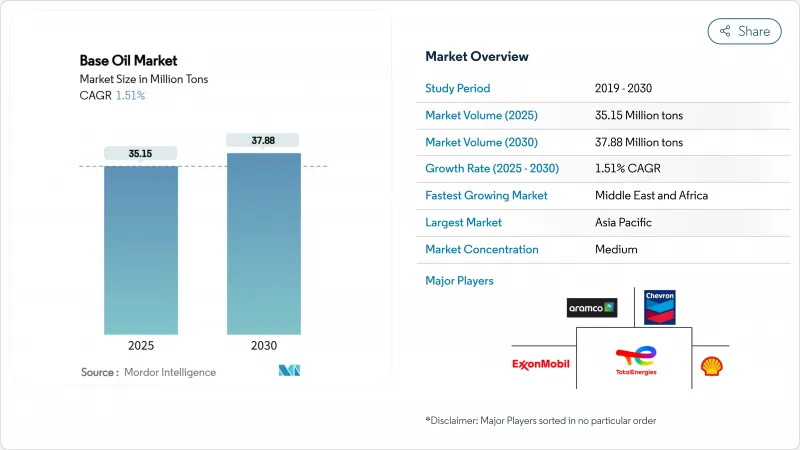

預計到 2025 年,基油市場規模將達到 3,515 萬噸,到 2030 年將達到 3,788 萬噸,預測期(2025-2030 年)的複合年成長率為 1.51%。

基油市場成長主要受三大因素驅動:一是基礎油市場從I類到高性能II類和III類基礎油的轉變;二是全球排放法規日益嚴格;三是合成配方在電動車(EV)動力系統中的應用日益廣泛。亞太地區銷售量領先,但中東和非洲地區的成長速度最快,顯示供應鏈正逐步向原油供應集中的地區調整。由於布蘭特原油與杜拜原油價差收窄以及閉合迴路。

全球基油市場趨勢與洞察

亞太地區生產群集的快速工業化

亞太地區製造業的蓬勃發展正支撐著基油市場需求成長的大部分。預計到2024年,中國原油日加工量將達到1,480萬桶,將對金屬加工液和液壓油產生強勁的需求。日益壯大的煉油和石化一體化綜合體網路將提升營運彈性,使生產商能夠將產量比率轉向盈利最高的基料等級。馬來西亞國家石油公司(PETRONAS)在其2025-2027年的展望中預測,其基礎油日產量將達到200萬桶油當量(BOE),併計劃在2028年通過生物煉製廠Start-Ups的啟動,大力拓展下游特種化學品業務。這些投資將鞏固該地區在基油市場的主導地位,並加速傳統I類基礎油產能的更新換代。

更嚴格的歐7和國七排放標準將提振對III/IV類車輛的需求。

歐盟7排放標準的實施要求汽車製造商在所有輕型汽油引擎上安裝顆粒物過濾系統,推動了對超低揮發性III類潤滑油的需求。中國的「中國七」排放標準也將加劇對低SAPS(硫磷灰石-磷灰石-苯乙烯類)潤滑油的需求,同時,2022年至2026年間核准的44個煉油計劃可望增強本地供應。將於2025年3月31日生效的ILSAC GF-7標準要求燃油經濟性提高10%,促使調和商轉向使用更高品質的基礎油。 [ORONITE.COM] 這導致對加氫裂解裝置和加氫異構化裝置的資本投資增加,加速了基油市場的優質化。

布倫托夫/越南原油價差波動壓力裕度

布蘭特原油與杜拜原油的價差最快可能在2024年轉為負值,這預示著中型含硫原油(VGO基油供應的關鍵原料)將出現短缺。科威特、阿曼和奈及利亞新建煉油廠帶來的全球產能提升,壓低了煉油廠利潤率,並導致一些營運商(例如朗德爾巴塞爾休士頓煉油廠)在2025年初退出煉油廠業務。基油市場的獨立煉油商被迫縮減營運規模或關閉老舊資產。

細分市場分析

2024年,II類基油將以42.89%的市佔率持續維持領先地位,這主要得益於其均衡的性能成本比和完善的經銷網路。殼牌公司在韋瑟林(Wesseling)的30萬噸產能轉化,也凸顯了對加氫裂解油的持續信心。 III類基礎油雖然目前絕對規模較小,但預計到2030年將以4.22%的複合年成長率成長,這主要得益於歐7排放標準和電動車冷卻系統對超低揮發性和高抗氧化性的要求。因此,在預測期內,III類基礎油的市場規模預計將比其他任何等級的基礎油成長更快。

雖然在一些需要溶解性的領域,例如橡膠加工液和金屬加工液,I類基礎油仍然存在,但由於經濟效益下降,其市場佔有率正在逐漸萎縮。 V類基礎油憑藉其多樣化的化學特性,包括用於生物潤滑劑的仲多元醇酯,為創新鋪平了道路。整體而言,基油市場正朝著更高的API等級發展,以滿足更嚴格的OEM規格和永續性目標。

基油報告按基料類型(I類、II類、III類、IV類及其他)、應用領域(引擎油、變速箱及齒輪油、金屬加工液、液壓油、潤滑脂及其他應用)和地區(亞太地區、北美地區、歐洲地區、南美地區、中東和非洲地區)進行細分。市場預測以百萬噸為單位。

區域分析

亞太地區預計到2024年將佔全球銷售量的46.78%,這主要得益於中國原油日產量創紀錄的1480萬桶,以及印度計劃於2025年前完成的190億至220億盧比的擴建項目。基油市場正受益於垂直整合的綜合設施,這些設施可以根據淨利率在燃料、化學品和基料之間靈活切換。日本和韓國將為電子產品的溫度控管提供精密合成技術,而東南亞國家將增加產能以滿足該地區的工業需求。

到2030年,中東和非洲的複合年成長率將達到3.48%,位居全球之首。阿布達比國家石油公司(ADNOC)投資35億美元的魯瓦伊斯原油靈活化計畫將可加工更重的含硫原油,並最佳化II類和III類原油的生產。歐洲致力於壓縮利潤率和脫碳策略,其中包括在2026年前將道達爾能源公司的格拉姆皮茨油田改造為零原油平台。

北美正投資於特種PAO和III類計劃,這主要得益於頁岩油的經濟效益。雪佛龍帕薩迪納油田的升級改造將使每日處理能力提升至12.5萬桶,同時提高噴射機燃料的靈活性。南美受益於巴西石化一體化帶來的適度成長,但宏觀經濟的波動限制了大規模投資。整體而言,地域動態反映出產能正逐步向石油豐富、需求旺盛的地區擴散。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞太地區生產群集的快速工業化

- 更嚴格的歐7和國七排放標準將提振對III/IV類車輛的需求。

- 電動汽車溫度控管系統推動了對高性能潤滑油的需求

- 資料中心浸沒式冷卻劑(新型合成基料)的擴展

- 循環經濟模式下閉合迴路煉油的經濟學

- 市場限制

- 快速替換I類產能

- 布蘭特原油與杜拜原油價差的波動對利潤率帶來壓力。

- 歐盟即將把聚醯胺氧化物(PAOs)歸類為微塑膠(歐洲化學品管理局)

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依基料

- 第一組

- 第二組

- 第三組

- 第四組

- 其他

- 透過使用

- 機油

- 變速箱/齒輪油

- 金屬加工油

- 油壓

- 潤滑脂

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 印尼

- 越南

- 泰國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- ADNOC

- Chevron Corporation

- China Petrochemical Corporation(SINOPEC)

- CNOOC Limited

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- Gazprom Neft PJSC

- GS Caltex Corporation

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd

- LUKOIL

- Nynas AB

- Petrobras

- PetroChina

- PETRONAS Lubricants International

- Philips 66 Company

- Repsol

- Saudi Arabian Oil Co.

- Sepahan Oil Company

- Shandong Qingyuan Group Co. Ltd.

- Shell plc

- SK Innovation Co. Ltd.

- TotalEnergies

第7章 市場機會與未來展望

The Base Oil Market size is estimated at 35.15 million tons in 2025, and is expected to reach 37.88 million tons by 2030, at a CAGR of 1.51% during the forecast period (2025-2030).

The measured growth of the base oil market is underpinned by three forces: the migration from Group I to higher-performance Group II and III stocks, tightening global emission rules, and the expanding role of synthetic formulations in electric-vehicle (EV) drivetrains. Asia-Pacific commands volume leadership, yet the Middle East and Africa records the fastest expansion, signaling a gradual realignment of supply chains toward crude-advantaged regions. Competitive positioning hinges on hydroprocessing technology, while refiners confront margin pressure from compressed Brent-Dubai spreads and rising capital outlays for catalyst upgrades. Opportunities emerge in immersion-cooling fluids for data centers and closed-loop re-refining initiatives that meet circular-economy targets.

Global Base Oil Market Trends and Insights

Rapid Industrialization Across APAC Production Clusters

Asia-Pacific's manufacturing boom underpins a significant share of incremental base oil market demand. China processed 14.8 million barrels per day of crude in 2024, creating robust pull for metal-working and hydraulic fluids. An expanding network of integrated refinery-petrochemical complexes increases operational flexibility, enabling producers to shift yields toward the most profitable base-stock grades. PETRONAS projects 2 million barrels of oil-equivalent output per day in its 2025-2027 outlook, with a downstream push into specialty chemicals supported by a biorefinery startup in 2028. These investments solidify the region's pre-eminence in the base oil market and accelerate the displacement of legacy Group I capacity.

Stricter Euro 7 and China VII Emission Norms Boosting Group III/IV Demand

The adoption of Euro 7 standards obliges automakers to fit particulate-filter systems across all light-duty gasoline engines, upping demand for ultra-low-volatility Group III stocks. China's parallel China VII framework intensifies the requirement for low-SAPS lubricants, while forty-four refining projects approved between 2022-2026 are poised to reinforce local supply. ILSAC GF-7, effective 31 March 2025, calls for a 10% fuel-economy gain, nudging blenders toward higher-quality base oils [ORONITE.COM]. Hydrocracking and hydro-isomerization units thus attract capital, accelerating the premiumization of the base oil market.

Volatile Brent-Dubai Crude Differentials Squeezing Margins

The Brent-Dubai spread turned negative at times in 2024, signaling scarce medium-sour barrels crucial for VGO-based base-oil feed. New Kuwait, Oman, and Nigeria refineries lifted global capacity, depressing margins and driving some operators, such as LyondellBasell Houston, to exit refining by early 2025. The crunch pressures independent players in the base oil market to trim runs or shutter older assets.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for High-Performance Lubricants in EV Thermal-Management Systems

- Expansion of Data-Center Immersion-Cooling Fluids

- Impending Micro-Plastic Classification of PAOs in the EU

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Group II maintained leadership with 42.89% of the base oil market share in 2024, owing to its balanced performance-cost equation and established distribution networks. Shell's 300,000-ton conversion at Wesseling underscores sustained confidence in hydrocracked stocks. Group III, though smaller on an absolute basis, advances at a 4.22% CAGR to 2030, buoyed by Euro 7 and EV-cooling mandates that call for ultra-low volatility and high oxidation resistance. The base oil market size for Group III is thus poised to expand faster than any other grade during the forecast horizon.

Group I endures in select rubber-processing and metal-working fluids requiring solvency, yet closures continue as economics deteriorate. Group V's diverse chemistries, including secondary polyol esters for bio-lubricants, round out innovation pathways. Altogether, the base oil market is migrating toward higher API groups to meet stricter OEM specifications and sustainability goals.

The Base Oil Report is Segmented by Base-Stock Type (Group I, Group II, Group III, Group IV, and Others), Application (Engine Oils, Transmission and Gear Oils, Metalworking Fluids, Hydraulic Fluids, Greases, and Other Applications), and Geography ( Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Million Tons).

Geography Analysis

Asia-Pacific generated 46.78% of 2024 volume, underpinned by China's record 14.8 million barrels-per-day crude runs and India's INR 1.9-2.2 lakh crore expansion program slated for completion by 2025. The base oil market benefits from vertically integrated complexes able to toggle between fuels, chemicals, and base stocks as margins dictate. Japan and South Korea supply precision synthetic technology for electronics thermal management, while Southeast Asian nations add capacity to serve regional industrial demand.

The Middle East and Africa posts a 3.48% CAGR to 2030, the fastest globally. ADNOC's USD 3.5 billion Ruwais Crude Flexibility Project enables processing heavier sour crudes, optimizing Group II and III output. Europe contends with margin compression and decarbonization pivots such as TotalEnergies' Grandpuits conversion into a zero-crude platform by 2026.

North America, bolstered by shale-oil economics, invests in specialty PAO and Group III projects; Chevron's Pasadena upgrade lifts throughput to 125,000 barrels per day while raising jet-fuel flexibility. South America enjoys moderate upside from Brazil's petrochemical integration, although macro volatility dampens large-scale investments. Collectively, geographic dynamics reflect a gradual diffusion of capacity into crude-advantaged and demand-rich locales while traditional centers adapt through specialization.

- ADNOC

- Chevron Corporation

- China Petrochemical Corporation (SINOPEC)

- CNOOC Limited

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- Gazprom Neft PJSC

- GS Caltex Corporation

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd

- LUKOIL

- Nynas AB

- Petrobras

- PetroChina

- PETRONAS Lubricants International

- Philips 66 Company

- Repsol

- Saudi Arabian Oil Co.

- Sepahan Oil Company

- Shandong Qingyuan Group Co. Ltd.

- Shell plc

- SK Innovation Co. Ltd.

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid industrialisation across APAC production clusters

- 4.2.2 Stricter Euro 7 and China VII emission norms boosting Group III/IV demand

- 4.2.3 Rising demand for high-performance lubricants in EV thermal-management systems

- 4.2.4 Expansion of data-centre immersion-cooling fluids (novel synthetic base-stocks)

- 4.2.5 Closed-loop re-refining economics under circular-economy mandates

- 4.3 Market Restraints

- 4.3.1 Rapid substitution away from Group I capacities

- 4.3.2 Volatile Brent-Dubai crude differentials squeezing margins

- 4.3.3 Impending micro-plastic classification of PAOs in the EU (ECHA)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Base-Stock Type

- 5.1.1 Group I

- 5.1.2 Group II

- 5.1.3 Group III

- 5.1.4 Group IV

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Engine Oils

- 5.2.2 Transmission and Gear Oils

- 5.2.3 Metalworking Fluids

- 5.2.4 Hydraulic Fluids

- 5.2.5 Greases

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Indonesia

- 5.3.1.7 Vietnam

- 5.3.1.8 Thailand

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 South Africa

- 5.3.5.6 Nigeria

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ADNOC

- 6.4.2 Chevron Corporation

- 6.4.3 China Petrochemical Corporation (SINOPEC)

- 6.4.4 CNOOC Limited

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Formosa Petrochemical Corporation

- 6.4.7 Gazprom Neft PJSC

- 6.4.8 GS Caltex Corporation

- 6.4.9 Hindustan Petroleum Corporation Limited

- 6.4.10 Indian Oil Corporation Ltd

- 6.4.11 LUKOIL

- 6.4.12 Nynas AB

- 6.4.13 Petrobras

- 6.4.14 PetroChina

- 6.4.15 PETRONAS Lubricants International

- 6.4.16 Philips 66 Company

- 6.4.17 Repsol

- 6.4.18 Saudi Arabian Oil Co.

- 6.4.19 Sepahan Oil Company

- 6.4.20 Shandong Qingyuan Group Co. Ltd.

- 6.4.21 Shell plc

- 6.4.22 SK Innovation Co. Ltd.

- 6.4.23 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Renewable/Bio-based PAO commercial scale-up

- 7.3 Integrated re-refining and virgin-base-oil hubs