|

市場調查報告書

商品編碼

1852103

電容器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Capacitor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

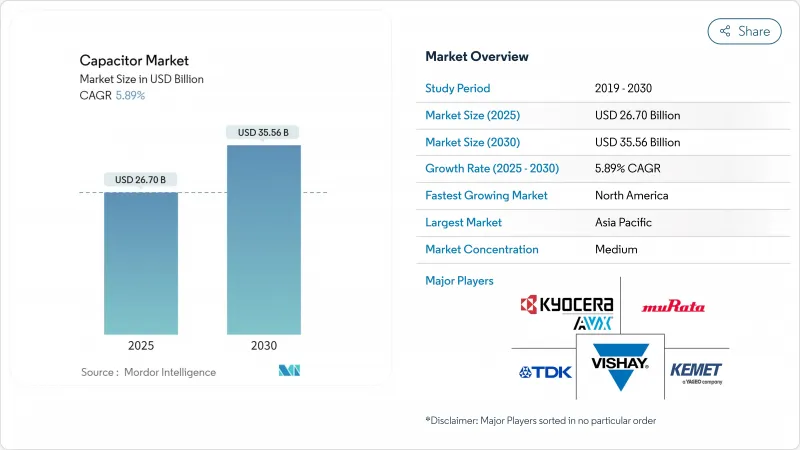

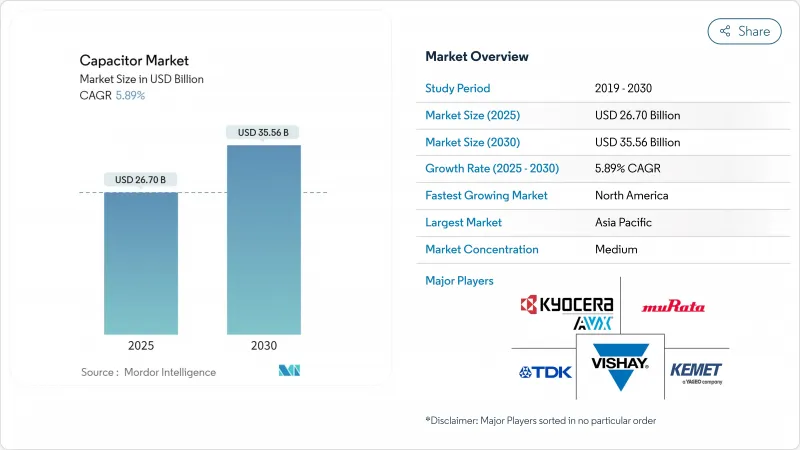

預計電容器市場規模將在 2025 年達到 267 億美元,在 2030 年達到 355.6 億美元,年複合成長率為 5.89%。

電動車、分散式能源和5G網路密集化的持續普及,構成了支撐產業成長前景的三大驅動力。陶瓷MLCC電容器憑藉其在寬溫範圍內優異的可靠性,將繼續保持其在設計插座領域的領先地位;而隨著公用事業公司試驗混合儲能拓撲結構,超級電容的收入成長速度將最快。人工智慧資料中心節點資本支出的活性化將進一步推動對超低ESR、高漣波電流電容器的需求,從而有效擺脫傳統智慧型手機銷售的季節性波動。對本地製造的同步投資將有助於降低地緣政治風險,並創造新的價格彈性需求,尤其是在北美電動車新興企業。政策制定者的採購獎勵將提高願意透過在地化供應鏈來換取稅額扣抵的企業的收入可見度。

全球電容器市場趨勢與洞察

電動汽車電力電子技術的應用日益廣泛

預計到2024年,電動車產量將達到1,730萬輛,比前一年成長25%,這將直接推動牽引逆變器用高壓薄膜電容器的需求成長。每輛純電動車包含超過15,000個MLCC(多層陶瓷電容器),是傳統燃油車型的四倍,而高階800V動力系統則需要具有更高電壓額定值和熱穩定性的裝置。獲得AEC-Q200認證的電容器供應商已成功實施多年設計方案,以應對消費性電子產品的波動性。 TDK的100V、10µF、3225封裝的MLCC就是一個很好的例子,它展示了產品藍圖如何在不增加封裝尺寸的情況下擴展效能範圍。這將導致每輛車的平均售價結構性成長,從而加強電氣化與電容器市場之間的正向驅動力。

5G/FTTx的快速部署推動了對高頻MLCC的需求

分析師預測,到2029年,全球75%的行動數據將透過5G基礎設施傳輸。大規模MIMO天線陣列需要頻率高於6GHz且介電損耗極低的電容器,傳統的陶瓷配方難以滿足此要求。三星馬達正將其最初為通訊基地台開發的技術應用於連網汽車平台,目標是實現汽車MLCC(多層陶瓷電容器)1兆韓元的銷售額。村田製作所的006003吋MLCC比傳統產品小75%,體現了在維持電氣性能指標的同時,不斷推進小型化進程。每個基地台無線電板都包含數萬個電容器,隨著5G部署的持續推進,電容器市場與全球頻寬消耗趨勢密切相關。

大批量陶瓷MLCC供應鏈的不穩定性

鈦酸鋇的短缺將使汽車級多層陶瓷電容器(MLCC)的前置作業時間延長至2024年,超過六個月,凸顯了中國在前驅體加工領域佔據主導地位所帶來的地理集中風險。符合AEC-Q200標準的電容器產量比率仍低於70%,一旦供應緊張,就會在汽車和電訊客戶之間造成分配衝突。設備升級使得製造更薄的介質層成為可能,但由於介質層厚度接近物理極限,因此需要超高純度的原料,這進一步加劇了供應限制。儘管西方製造商已宣布擴大產能,但新工廠的認證可能需要長達兩年的時間,這將延長目前的供需失衡。

細分市場分析

陶瓷電容器憑藉其優異的體積效率和耐高溫性能,預計到2024年將佔據電容器市場42.3%的佔有率,即使其他介質材料逐漸佔據一席之地,陶瓷電容器仍將保持營收主導。此領域的成長動能源自於層數的持續增加和晶粒精細化控制,例如村田製作所推出的006003吋MLCC,其尺寸縮小75%後仍能維持電容值。未來的成長將取決於鎳阻擋層端子的應用,這種端子可以降低銀鈀合金的成本,同時防止高溫下的遷移。

超級/超強電容器將成為所有類型電容器中成長最快的,複合年成長率將達到7.5%,這主要得益於將高壓鋰電池組與碳基功率緩衝器相結合的混合總線線路。鉭元件在醫療植入和航空電子模組領域仍將保持重要地位,其體積效率足以抵消成本溢價,但礦石供應將加劇價格波動。電解電容器將繼續在高壓電源插座領域佔有一席之地,因為在這些領域,突波電流能力比耐用性更為重要。聚丙烯薄膜電容器將在可再生能源轉換器領域獲得成長,而聚四氟乙烯(PTFE)基電容器則面臨與全氟烷基和多氟烷基物質(PFAS)相關的逐步淘汰要求。

低壓設備(≤100V)在2024年貢獻了49.1%的收入,主要得益於智慧型手機、穿戴式裝置和資訊娛樂系統。然而,由於800V電池電動車和串聯電容器組的普及,高壓設備(>1kV)預計將以6.4%的複合年成長率加速成長,這擴大了電網調節專用電容器的市場規模。隨著機器人技術和工廠自動化維修遷移到更高直流母線電壓以提高效率,中壓元件(100V至1kV)也呈現穩定成長。

設計人員正擴大採用電阻控制型高壓堆疊結構,這種結構結合了陶瓷和薄膜技術,用於抑制寬能能隙半導體開關中的振鈴現象。提供混合模組的供應商能夠獲得高價,這充分體現了能夠同時應對高漣波電流和局部放電抑制能力的解決方案的價值。結果是,隨著銷售量的成長,產品差異化程度更高,價格下降速度也更慢。

區域分析

亞太地區預計到2024年將佔全球銷售額的46.7%,主要得益於中國、日本和韓國垂直整合的供應鏈。成熟的陶瓷粉末燒結技術、自動化MLCC燒結製程以及接近性電子產品OEM叢集的優勢,帶來了規模經濟效益,鞏固了該地區在基準生產領域的領先地位。日本供應商利用小型化專利,即使人事費用較高,也能確保較高的平均售價;而韓國供應商則專注於生產符合AEC-Q200熱衝擊標準的汽車級產品。

預計到2030年,北美將以7.4%的複合年成長率成長,成為各大主要地區中成長最快的地區。聯邦政府在晶片和科學法案下的激勵措施鼓勵晶圓製造廠投資周邊被動元件的生產回流;新建電動汽車組裝廠利用在地採購來獲得潔淨汽車稅額扣抵;此外,隨著人工智慧加速器將電路板級產能預算提高約25%,資料中心營運商的需求也在不斷成長,從而推動了高可靠性陶瓷和聚合物鋁件價格的上漲多年。

歐洲在強勁的工業自動化需求與監管阻力之間尋求平衡,後者正在改變材料的選擇。 PFAS的逐步淘汰正迅速推動聚丙烯和Polyethylene Naphthalate薄膜的替代,而電池法規2023/1542引入了生產者延伸責任制,有利於能夠提供閉合迴路回收證明的供應商。南美和中東及非洲等新興市場由於可再生能源競標和電訊網路的擴張而出現暫時性成長,但由於基礎設施不足,絕對銷量仍然較低。整體而言,地理多元化有助於緩衝單一區域的衝擊,並促進電容器市場的長期擴張。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電動汽車電力電子技術的應用日益廣泛

- 5G/FTTx的快速部署推動了對高頻MLCC的需求

- 電網級電池部署

- 汽車區域電子電氣架構

- 需要超低ESR上限的能源採集物聯網節點

- 市場限制

- 高容量陶瓷MLCC供應鏈的變異性

- 固體電容器的技術訣竅差距

- PFAS逐步淘汰過渡到PTFE薄膜壓力電容器市場

- 鉭礦原料成本上漲

- 宏觀經濟因素的影響

- 產業供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按類型

- 陶瓷電容器

- 鉭電容器

- 電解電容器

- 薄膜電容器

- 超級/超強電容器

- 按電壓範圍

- 低電壓(100伏特或以下)

- 中壓(100伏-1千伏)

- 高壓(1千伏或以上)

- 以 Mount Style 為主題

- 表面貼裝

- 通孔

- 按最終用戶行業分類

- 車

- 產業

- 能源與電力

- 通訊/伺服器/數據存儲

- 消費性電子產品

- 航太/國防

- 醫療設備

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- KYOCERA AVX Components Corporation

- KEMET(Yageo Group)

- Vishay Intertechnology, Inc.

- Panasonic Holdings Corporation

- Samsung Electro-Mechanics Co., Ltd.

- Taiyo Yuden Co., Ltd.

- Walsin Technology Corporation

- Nippon Chemi-Con Corporation

- Rubycon Corporation

- Nichicon Corporation

- Cornell Dubilier Electronics, Inc.

- EPCOS AG(Infineon Technologies)

- Eaton Corporation plc(xEV capacitors)

- Maxwell Technologies, Inc.(UCAP)

- Skeleton Technologies Group OU

- LS Materials Co., Ltd.

- WIMA GmbH & Co KG

- Wurth Elektronik eiSos GmbH & Co KG

- Illinois Capacitor(Cornell Dubilier)

- Cap-XX Limited

- Lelon Electronics Corporation

- Samwha Electric Co., Ltd.

- Faratronic Co., Ltd.

- Elna Co., Ltd.

第7章 市場機會與未來展望

The capacitor market size stands at USD 26.7 billion in 2025 and is forecast to achieve USD 35.56 billion in 2030, advancing at a 5.89% CAGR.

Unabated electric-vehicle adoption, distributed-energy resources, and 5G densification form a durable three-pronged driver set that underpins the industry's growth outlook. Ceramic MLCCs retain design-socket dominance because of reliability across wide temperature ranges, whereas supercapacitors post the fastest revenue gains as utilities trial hybrid storage topologies. Heightened capital expenditure in artificial-intelligence data-center nodes further amplifies demand for ultra-low-ESR and high-ripple-current capacitors, effectively decoupling volumes from legacy smartphone seasonality. Parallel investments in localized production mitigate geopolitical risk and create new price-elastic demand pockets, especially among North American electric-mobility startups. Policymakers' procurement incentives strengthen the revenue visibility of companies willing to regionalize supply chains in exchange for tax credits.

Global Capacitor Market Trends and Insights

Growing Adoption of EV Power-Electronics

Electric-vehicle output rose to 17.3 million units in 2024, a 25% year-on-year surge that translates directly into higher demand for high-voltage film capacitors in traction inverters. Each battery-electric car now integrates more than 15,000 MLCCs, quadrupling the baseline content found in traditional combustion models, while premium 800 V drivetrains require devices with enhanced voltage ratings and thermal stability. Capacitor suppliers able to pass AEC-Q200 qualifications enjoy multi-year design wins that shield them from consumer-electronics volatility. TDK's 100 V, 10 µF MLCC in the 3225 case size exemplifies how product roadmaps stretch performance envelopes without enlarging footprint. The result is a structural uplift in average selling price per vehicle, reinforcing the positive flywheel between electrification and the capacitor market.

Rapid 5G/FTTx Roll-Outs Driving High-Frequency MLCC Demand

More than 300 network operators will activate commercial 5G service by late 2024, and analysts forecast that 75% of global mobile data will traverse 5G infrastructure by 2029.Massive-MIMO antenna arrays require capacitors with ultra-low dielectric loss at frequencies above 6 GHz, a specification that legacy ceramic formulations struggle to meet. Samsung Electro-Mechanics, therefore, targets KRW 1 trillion in automotive MLCC revenue, leveraging know-how originally developed for telecommunication base stations to serve connected-vehicle platforms. Murata's 006003-inch MLCC, 75% smaller than its predecessor, embodies the perpetual miniaturization race while safeguarding electrical performance metrics. With each base-station radio board hosting tens of thousands of capacitors, the upward trajectory of 5G deployments ensures that the capacitor market remains tightly coupled to global bandwidth-consumption trends.

Volatility in MLCC Supply Chain for High-Capacitance Ceramics

Barium titanate shortages pushed lead times for automotive-grade MLCCs beyond six months in 2024, underlining geographic concentration risks because China dominates precursor processing. Yield rates for capacitors that meet AEC-Q200 standards remain below 70%, creating allocation battles between automotive and telecom customers whenever supply tightens. Equipment upgrades that enable thinner dielectric layers exacerbate constraints by requiring ultrapure raw materials as layer thickness nears physical limits. Western manufacturers have announced capacity expansions, yet fresh factories need up to two years to qualify, prolonging near-term supply imbalances.

Other drivers and restraints analyzed in the detailed report include:

- Grid-Scale Battery Storage Deployment

- Automotive Zonal E/E Architectures

- Technical Know-How Gap for Solid-State Ultracapacitors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ceramic capacitors captured 42.3% of the capacitor market share in 2024 by balancing volumetric efficiency with rugged temperature tolerance, maintaining revenue leadership even as alternative dielectrics gain niche footholds. The segment's momentum stems from relentless layer-count increases and finer-grain control, as demonstrated by Murata's release of a 006003-inch MLCC that maintains capacitance despite a 75% footprint reduction. Future growth hinges on incorporating nickel-barrier terminations that reduce silver-palladium cost exposure while preventing migration at high temperatures.

Super-/ultracapacitors register a 7.5% CAGR, the fastest across all types, propelled by hybrid bus lines that pair high-voltage lithium packs with carbon-based power buffers. Tantalum parts sustain relevance in medical implants and avionics modules where volumetric efficiency offsets cost premiums, though ore sourcing adds price volatility. Aluminum electrolytics retain high-voltage power-supply sockets where surge current capability trumps endurance concerns. Film capacitors experience bifurcated demand: polypropylene films grow in renewable-energy converters, whereas PTFE-based variants face PFAS-related phase-down mandates.

Low-voltage devices (<=100 V) delivered 49.1% of 2024 revenue, anchored by smartphones, wearables, and infotainment consoles. Yet the high-voltage class (>1 kV) is projected to accelerate at a 6.4% CAGR as 800 V battery-electric vehicles and series-capacitor banks proliferate; together they are expanding the capacitor market size devoted to power-transmission conditioning. Medium-voltage parts (100 V-1 kV) grow steadily because robotics and factory-automation retrofits migrate to higher DC-bus levels for efficiency gains.

Designers increasingly demand impedance-controlled, high-voltage stacks that combine ceramic and film technologies to tame ringing in wide-band-gap semiconductor switches. Suppliers responding with hybrid modules capture premium pricing, demonstrating that value accrues to solutions able to handle both high ripple current and partial-discharge endurance. The resulting product differentiation keeps price erosion modest even as unit volumes rise.

The Capacitor Market Report is Segmented by Type (Ceramic, Tantalum, and More), Voltage Range (Low <=100 V, Medium 100 V-1 KV, High - Above 1 KV), Mounting Style (Surface-Mount, and Through-Hole), End-User Industry (Automotive, Industrial, Energy and Power, Consumer Electronics, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 46.7% of 2024 worldwide revenue thanks to vertically integrated supply chains in China, Japan, and South Korea. Mature ceramic-powder calcination, automated MLCC sintering, and proximity to electronics OEM clusters provide scale economies that reinforce the region's grip on baseline production. Japanese vendors leverage miniaturization patents to secure higher average selling prices despite labor-cost premiums, while South Korean lines specialize in automotive-grade lots that satisfy AEC-Q200 thermal-shock limits.

North America is forecast to record a 7.4% CAGR through 2030, the fastest across major regions. Federal incentives under the CHIPS and Science Act encourage passive-component reshoring adjacent to wafer-fab investments, and new EV assembly plants use localized sourcing to unlock clean-vehicle tax credits. Data-center operators also raise demand as AI accelerators inflate board-level capacitance budgets by about 25%, sustaining a multi-year uplift for high-reliability ceramic and polymer-aluminum devices.

Europe balances steady industrial-automation demand with regulatory headwinds that reshape material choices. PFAS phase-outs compel rapid substitution toward polypropylene and polyethylene naphthalate films, while Battery Regulation 2023/1542 introduces extended-producer-responsibility rules that favor suppliers able to document closed-loop recycling. Emerging markets in South America and the Middle East & Africa add episodic upside via renewable-energy auctions and telecom network expansions, yet infrastructure gaps keep absolute volumes small. Altogether, geographic diversification mitigates single-region shocks and reinforces long-run expansion for the capacitor market.

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- KYOCERA AVX Components Corporation

- KEMET (Yageo Group)

- Vishay Intertechnology, Inc.

- Panasonic Holdings Corporation

- Samsung Electro-Mechanics Co., Ltd.

- Taiyo Yuden Co., Ltd.

- Walsin Technology Corporation

- Nippon Chemi-Con Corporation

- Rubycon Corporation

- Nichicon Corporation

- Cornell Dubilier Electronics, Inc.

- EPCOS AG (Infineon Technologies)

- Eaton Corporation plc (xEV capacitors)

- Maxwell Technologies, Inc. (UCAP)

- Skeleton Technologies Group OU

- LS Materials Co., Ltd.

- WIMA GmbH & Co KG

- Wurth Elektronik eiSos GmbH & Co KG

- Illinois Capacitor (Cornell Dubilier)

- Cap-XX Limited

- Lelon Electronics Corporation

- Samwha Electric Co., Ltd.

- Faratronic Co., Ltd.

- Elna Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption of EV power-electronics

- 4.2.2 Rapid 5G/FTTx roll-outs driving high-frequency MLCC demand

- 4.2.3 Grid-scale battery storage deployment

- 4.2.4 Automotive zonal E/E architectures

- 4.2.5 Energy harvesting IoT nodes needing ultra-low-ESR caps

- 4.3 Market Restraints

- 4.3.1 Volatility in MLCC supply chain for high-capacitance ceramics

- 4.3.2 Technical know-how gap for solid-state ultracapacitor

- 4.3.3 PFAS phase-out pressure on PTFE film capacitor

- 4.3.4 Rising raw-material cost of tantalum ore

- 4.4 Impact of Macroeconomic Factors

- 4.5 Industry Supply Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Buyers

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Ceramic Capacitor

- 5.1.2 Tantalum Capacitor

- 5.1.3 Aluminum Electrolytic Capacitor

- 5.1.4 Film Capacitor

- 5.1.5 Super-/Ultra Capacitor

- 5.2 By Voltage Range

- 5.2.1 Low Voltage (<=100 V)

- 5.2.2 Medium Voltage (100 V-1 kV)

- 5.2.3 High Voltage (Above 1 kV)

- 5.3 By Mounting Style

- 5.3.1 Surface-Mount

- 5.3.2 Through-Hole

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Industrial

- 5.4.3 Energy and Power

- 5.4.4 Communications / Servers / Data Storage

- 5.4.5 Consumer Electronics

- 5.4.6 Aerospace and Defense

- 5.4.7 Medical Devices

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Murata Manufacturing Co., Ltd.

- 6.4.2 TDK Corporation

- 6.4.3 KYOCERA AVX Components Corporation

- 6.4.4 KEMET (Yageo Group)

- 6.4.5 Vishay Intertechnology, Inc.

- 6.4.6 Panasonic Holdings Corporation

- 6.4.7 Samsung Electro-Mechanics Co., Ltd.

- 6.4.8 Taiyo Yuden Co., Ltd.

- 6.4.9 Walsin Technology Corporation

- 6.4.10 Nippon Chemi-Con Corporation

- 6.4.11 Rubycon Corporation

- 6.4.12 Nichicon Corporation

- 6.4.13 Cornell Dubilier Electronics, Inc.

- 6.4.14 EPCOS AG (Infineon Technologies)

- 6.4.15 Eaton Corporation plc (xEV capacitors)

- 6.4.16 Maxwell Technologies, Inc. (UCAP)

- 6.4.17 Skeleton Technologies Group OU

- 6.4.18 LS Materials Co., Ltd.

- 6.4.19 WIMA GmbH & Co KG

- 6.4.20 Wurth Elektronik eiSos GmbH & Co KG

- 6.4.21 Illinois Capacitor (Cornell Dubilier)

- 6.4.22 Cap-XX Limited

- 6.4.23 Lelon Electronics Corporation

- 6.4.24 Samwha Electric Co., Ltd.

- 6.4.25 Faratronic Co., Ltd.

- 6.4.26 Elna Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment