|

市場調查報告書

商品編碼

1852091

貨物追蹤解決方案:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Track And Trace Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

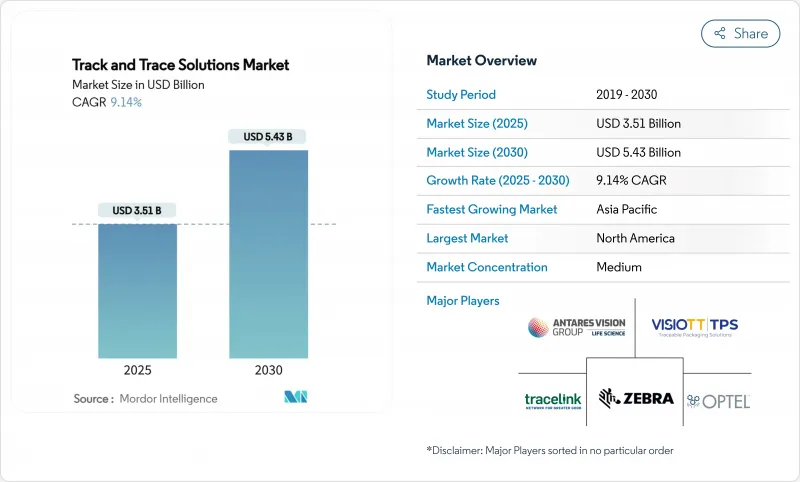

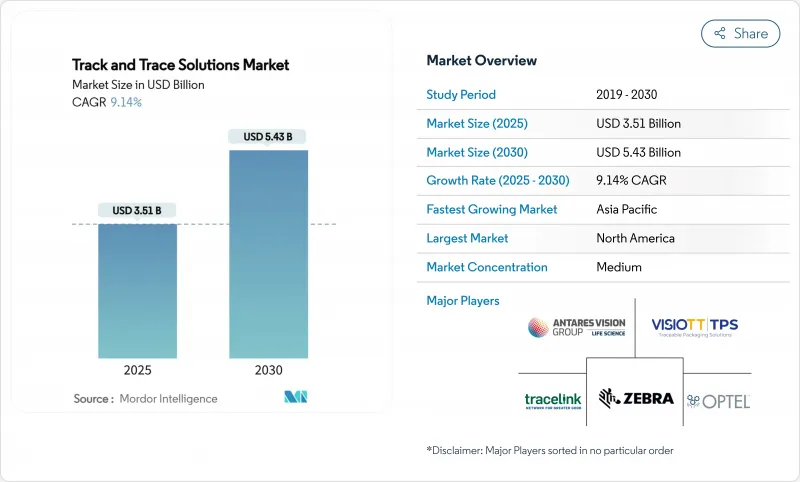

預計到 2025 年,貨物追蹤解決方案市場價值將達到 35.1 億美元,到 2030 年將達到 54.3 億美元,複合年成長率為 9.14%。

藥品供應鏈監管壓力日益增大,正將序列化從合規挑戰轉變為策略差異化因素,促使企業投資更複雜、數據更豐富的平台。隨著序列化和聚合向雲端架構融合,供應商在探索資料貨幣化新途徑的同時,也面臨新的網路安全風險。同時,規模較小的貨物追蹤解決方案供應商正在新興地區擴大市場佔有率,模組化雲端架構使他們無需建立全球銷售網路也能參與競爭。

全球貨物追蹤解決方案市場趨勢與洞察

全球藥品可追溯性監理趨同

標準協調的趨勢日益增強,迫使企業設計能夠透過一次部署滿足多個司法管轄區要求的系統。因此,供應商正大力投資於靈活的資料模型,將國家代碼映射到通用核心,從而悄悄降低跨國工廠的生命週期整合成本。一個顯著的成果是,製造商開始發布全球提案,而非區域性競標,這集中了採購權並加速了供應商整合。這種監管趨同還有助於縮短部署週期、加快投資回收期,並釋放預算用於進階分析,因為配置取代了自訂編碼。

假藥威脅日益加劇,凸顯了保障病人安全的重要性。

隨著造假網路日益複雜,品牌擁有者不得不超越簡單的序列化,採用多層安全防護措施,結合防篡改包裝、認證演算法和即時認證入口網站。透過在層級構造包裝中嵌入唯一標識符,企業可以阻礙力防止未經授權的重新包裝,並在發生事故時最大限度地減少召回範圍。醫療機構將打擊仿冒品產品與提高治療依從性聯繫起來,這推動了政府對更嚴格的序列化審核的支持。因此,解決方案供應商報告稱,市場對行動測試應用程式的需求不斷成長,這些應用程式允許現場工作人員每次都檢驗程式碼。

各國時間表的差異會造成投資不確定性。

監管時間表的不統一迫使企業謹慎分配資金,為了保障收入來源,企業往往優先考慮出口市場而非國內市場。財務團隊擴大採用實物選擇權分析來評估產品序列化計劃,將區域推廣視為一系列順序選擇權,而非確定性計劃。解決方案供應商則透過提供模組化許可來應對這項挑戰,這種許可僅在各國截止日期臨近時才激活,這種定價創新縮短了銷售週期。

細分市場分析

至2024年,軟體將佔貨運追蹤解決方案市場規模的52.64%,預計到2030年將以8.63%的複合年成長率成長。這種加速成長反映出企業正在從序列化資料中挖掘價值,尋求營運洞察而非僅僅記錄合規資訊。平台供應商擴大將專業服務捆綁銷售,以彌補技能差距,並提高中型製造商的轉換成本。值得注意的是,成功的實施往往始於資料管治研討會,這顯示製藥公司中IT和品質職能正在融合。

儘管硬體目前仍能滿足初步合規需求,但到2030年資本週期完成後,其在追蹤解決方案領域的市佔率預計將超過29.77%。列印、影像檢查和防篡改模組仍然至關重要,供應商正透過模組化設計來減少改裝期間的生產線停機時間,從而實現差異化競爭。在硬體領域,RFID印表機和印表機上檢驗的需求成長最快,反映出包裝生產線上感測器的逐步普及。同時,第二代印表機的二手市場流動性增強,降低了新興國家後入者的進入門檻。

到2024年,條碼將佔據貨物追蹤解決方案市場55.76%的佔有率,但RFID解決方案預計將穩步縮小差距,到2030年將以9.90%的複合年成長率成長。製藥倉庫為了減少人工掃描,目前正在試行混合標籤方案,即為高價值生技藥品配備RFID標籤,而為學名藥保留2D條碼,這種混合方案兼顧了成本和產能。 RFID托盤的即時位置資料會輸入到倉庫管理系統(WMS)演算法中,從而縮短揀貨時間,這一優勢在大型配銷中心悄悄抵銷了標籤的成本。

條碼技術的韌性,得益於掃描器的普及和監管機構的持續認可,將確保該技術在可預見的未來保持其相關性。然而,被動式超高頻(UHF)嵌體價格的下降表明,無線射頻識別(RFID)技術的廣泛應用即將迎來曲折點。多個國家醫療服務機構對醫院物流中RFID的需求日益成長,這便是例證,並在供應鏈中產生了拉動效應。這種日益成長的偏好正促使包裝生產線原始設備製造商(OEM)將RFID通道整合到標準設備中。

區域分析

北美仍將是最大的區域市場,預計到2024年將佔據貨物追蹤解決方案市場42.24%的佔有率。這主要得益於《藥品供應鏈安全法案》(Drug Supply Chain Security Act)的要求,該法案規定到2025年8月必須實現藥品單元層級的可追溯性。因此,即使是小型學名藥公司也在加快計劃以避免供應中斷,從而推動了對檢驗服務的短期需求。該地區成熟的電子健康記錄基礎設施能夠將序列化數據與臨床結果關聯起來,形成反饋迴路,為基於價值的合約提供資訊。這種關聯也促使保險公司增加對分析技術的投資,以檢驗病患在接受特殊治療時的依從性。大型批發商正在將序列化技術與機器人技術結合,以減少人工病例處理,並重新調整物流中心的勞動力分配。

亞太地區將呈現最快的成長軌跡,預計複合年成長率將達到10.29%,這主要得益於中國強力的仿冒品宣傳活動和印度的出口激勵政策。各國政府通常會將在地化內容法規與可追溯性津貼結合,鼓勵國內IT企業與全球解決方案提供者合作。跨國製造商選擇可設定的雲端平台,以便在規則成熟後,在緊迫的時間節點內切換特定國家的模組。同樣的架構也支援語言在地化,這對於語言多樣化的地區而言,是一個微妙但至關重要的成功因素。電子商務的快速發展正迫使監管機構加強小包裹層級的檢驗,進一步加速了可追溯性技術的普及。

歐洲依然是關鍵所在,隨著《反假藥指令》的日趨完善,藥品檢驗已下放到藥局櫃檯。各國藥品檢驗機構的資料庫已投入運行,支援涵蓋幾乎所有配藥點的密集掃描網路。製造商正透過在紙盒中嵌入防篡改封條來應對這項挑戰,這項設計選擇提高了全球消費者的期望。環境永續性是該地區的下一個關注點,相關人員在探索如何利用序列化數據來支持碳足跡報告,這展現了追蹤基礎設施的多方面潛力。

其他好處

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全球藥品可追溯性法規的趨同(世衛組織、國際標準化組織)

- 假藥威脅日益加劇:保障病人安全刻不容緩。

- 直接面向患者和電子商務管道的激增需要端到端的可視性。

- 醫藥供應鏈數位化及雲端原生SaaS的採用

- 轉向個人化、低劑量治療和靈活的治療連續性是必要的。

- 品牌聲譽和避免召回成本是推動T&T分析投資的促進因素。

- 市場限制

- 各國時間表的差異會造成投資不確定性。

- 傳統MES/ERP和包裝生產線的高昂資本和整合成本

- 網路化溯源平台中的資料隱私與網路安全風險

- 低利潤學名藥生產商的投資報酬率有限。

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按組件

- 硬體系統

- 印刷和標記設備

- 監控與檢驗系統

- 標籤和防篡改解決方案

- 其他硬體

- 軟體解決方案

- 工廠級管理套件

- 線路控制器軟體

- 捆包/托盤追蹤軟體

- 企業及雲端平台

- 專業及管理服務

- 硬體系統

- 透過技術

- 條碼/2D資料矩陣

- RFID和NFC

- 先進的物聯網感測器和藍牙低功耗信標

- 透過使用

- 序列化解決方案

- 瓶子序列化

- 泡殼和條狀包裝序列化

- 紙箱和包裝箱序列化

- 資料矩陣/QR碼序列化

- 聚合解決方案

- 捆綁聚合

- 病例匯總

- 調色板聚合

- 序列化解決方案

- 最終用戶

- 製藥公司

- 合約製造組織/CPO

- 醫療設備製造商

- 醫療保健分銷商和批發商

- 其他生命科學相關利益者(非處方藥、營養保健品、化妝品、合法大麻)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 市佔率分析

- 公司簡介

- OPTEL Group

- TraceLink Inc.

- Antares Vision SpA

- SEA Vision SRL

- Syntegon Technology GmbH

- Zebra Technologies Corp.

- Mettler-Toledo International Inc.

- Korber Medipak Systems GmbH

- ACG Worldwide

- VISIOTT

- Uhlmann

- Sato Holdings Corporation

- 74Software

- Siemens

- Brother Industries, Ltd.(Domino Printing Sciences plc)

- Dover Corporation(Markem-Imaje)

- Wipotec-OCS GmbH

- Veralto Corporation(Videojet Technologies Inc.)

- Coesia SpA

第7章 市場機會與未來展望

The track & trace solutions market is valued at USD 3.51 billion in 2025 and is projected to reach USD 5.43 billion by 2030, translating into a 9.14% compound annual growth rate (CAGR).

Heightened regulatory pressure across pharmaceutical supply chains is turning serialization from a compliance chore into a strategic differentiator, prompting companies to invest in more sophisticated, data-rich platforms. As serialization and aggregation converge on cloud architectures, vendors are eyeing fresh data-monetization avenues while simultaneously confronting new cybersecurity risks. Meanwhile, the Track & Trace Solutions market share of smaller niche vendors is expanding in emerging regions because modular cloud architecture allows them to compete without a global sales footprint.

Global Track And Trace Solutions Market Trends and Insights

Convergence of Global Pharmaceutical Traceability Mandates

Momentum toward harmonized standards is compelling firms to design systems that satisfy multiple jurisdictions in a single deployment. Vendors therefore invest heavily in flexible data models that map country codes to a common core, which quietly reduces lifetime integration costs for multinational plants. One evident consequence is that manufacturers now issue global requests for proposal instead of region-specific tenders, concentrating purchasing power and accelerating vendor consolidation. This regulatory convergence simultaneously shortens rollout cycles because configuration replaces custom coding, allowing quicker payback periods and freeing budgets for advanced analytics.

Escalating Counterfeit Drug Threat Elevating Patient-Safety Imperatives

The rising sophistication of counterfeit networks forces brand owners to look beyond serialization and adopt multi-layer security that joins tamper-evident packaging, authentication algorithms, and real-time verification portals. By embedding unique identifiers inside layered packaging, companies are discouraging illicit repackaging, a fresh deterrent that also minimizes recall scope when an incident occurs. Health agencies publicly link counterfeit suppression to improved therapy adherence, which drives political endorsement of stricter serialization audits. As a direct result, solution vendors report an uptick in demand for mobile inspection apps that allow frontline staff to validate codes at every hand-off.

Divergent Country-Level Timelines Generating Investment Uncertainty

Uneven regulatory calendars compel firms to stage capital allocations carefully, often prioritizing export markets over domestic ones to protect revenue streams. Finance teams increasingly evaluate serialization projects through real-options analysis, treating each regional rollout as a sequential option rather than a deterministic plan, a mindset shift that influences vendor contracting terms. Solution providers respond by offering modular licensing that activates only when a country deadline approaches, a pricing innovation that shortens sales cycles.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Direct-to-Patient and E-commerce Channels Requiring End-to-End Visibility

- Digitalization of Pharma Supply Chains and Cloud-Native SaaS Adoption

- High Capital and Integration Costs with Legacy MES, ERP, and Packaging Lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software claimed a 52.64% track and trace solutions market size in 2024 and is projected to grow at a 8.63% CAGR through 2030. The acceleration reflects a shift toward value extraction from serialization data as firms seek operational insights and not just compliance records. Platform vendors increasingly bundle professional services, which offsets the skills gap in mid-tier manufacturers and increases switching costs. A notable pattern is that successful deployments now start with a data-governance workshop, illustrating the convergence of IT and quality functions inside pharmaceutical firms.

Hardware still anchors initial compliance, yet its track and trace solutions market share will likely be above 29.77% by 2030 as capital cycles complete. Printing, vision inspection, and tamper-evidence modules remain essential, and vendors differentiate through modularity that reduces line downtime during retrofits. Demand for RFID printers and on-printer verification grows fastest inside the hardware basket, mirroring the gradual sensorization of packaging lines. A secondary effect is that resale markets for second-generation printers gain liquidity, lowering entry barriers for late adopters in emerging economies.

Barcodes held a commanding 55.76% track and trace solutions market share in 2024, yet RFID solutions are forecast to expand at 9.90% CAGR until 2030, closing the gap steadily. Pharmaceutical warehouses, eager to cut manual scans, now pilot mixed tagging schemes in which high-value biologics carry RFID while generics retain 2D codes, demonstrating a hybrid approach that balances cost and capability. Real-time location data from RFID pallets feeds WMS algorithms that slash pick times, a benefit that quietly offsets tag costs in large distribution centers.

The resilience of barcodes stems from ubiquitous scanners and consistent regulatory acceptance, keeping the technology relevant for the foreseeable future. However, the falling price of passive UHF inlays suggests that the inflection point for wider RFID adoption is drawing nearer. As proof, several national health services request RFID for hospital logistics, creating a pull effect back up the supply chain. This developing preference nudges packaging-line OEMs to embed RFID tunnels in standard equipment offerings.

The Track and Trace Solutions Market is Segmented by Component (Hardware Systems [Printing & Marking Equipment, and More], Software Solutions, and More), Technology (Barcode / 2-D DataMatrix, and More), Application (Serialization Solutions and Aggregation Solutions), End User (Pharmaceutical Manufacturers, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, with 42.24% Track & Trace Solutions market share in 2024, remains the largest region because of the Drug Supply Chain Security Act that mandates unit-level traceability by August 2025. A notable consequence is that even small generics firms accelerate projects to avoid supply interruptions, which inflates near-term demand for validation services. The region's mature electronic health-record infrastructure enables linkage between serialization data and clinical outcomes, providing a feedback loop that informs value-based contracting. This linkage also stimulates analytics investments by insurers aiming to verify adherence in specialty therapies. Large-scale wholesalers integrate serialization with robotics, reducing manual case handling and reshaping labor allocation across distribution centers.

Asia-Pacific shows the fastest trajectory at a forecast 10.29% CAGR, underpinned by aggressive anti-counterfeit campaigns in China and export incentives in India. Governments often couple local content rules with traceability grants, encouraging domestic IT firms to partner with global solution providers. Multinational manufacturers, confronted with compressed timelines, select configurable cloud platforms that can flip on country modules as rules mature. The same architecture supports language localization, a subtle yet critical success factor across a linguistically diverse region. Rapid e-commerce expansion forces regulators to tighten parcel-level verification, injecting further urgency into adoption.

Europe retains a significant position due to the mature Falsified Medicines Directive, which pushes verification down to the pharmacy counter. National medicine verification organization databases, already operational, anchor a dense scanning network that covers nearly every dispensing point. Manufacturers adapt by embedding tamper-evident seals on cartons, a design choice that raises consumer expectations globally. The region's next focus is environmental sustainability, and stakeholders explore how serialization data can support carbon-footprint reporting, demonstrating the multi-dimensional potential of track and trace infrastructure.

- OPTEL Group

- TraceLink

- Antares Vision SpA

- SEA Vision SRL

- Syntegon Technology

- Zebra Technologies

- Mettler Toledo

- Korber

- ACG Worldwide

- VISIOTT

- Uhlmann

- Sato Holdings Corporation

- 74Software

- Siemens Healthineers

- Brother Industries, Ltd. (Domino Printing Sciences plc)

- Dover Corporation (Markem-Imaje)

- Wipotec-OCS GmbH

- Veralto Corporation (Videojet Technologies Inc.)

- Coesia S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convergence of Global Pharmaceutical Traceability Mandates (WHO, ISO)

- 4.2.2 Escalating Counterfeit Drug Threat Elevating Patient?Safety Imperatives

- 4.2.3 Surge in Direct-to-Patient & E-commerce Channels Requiring End-to-End Visibility

- 4.2.4 Digitalization of Pharma Supply Chains and Cloud-native SaaS Adoption

- 4.2.5 Transition to Personalized & Small-Batch Therapies Necessitating Flexible Serialization

- 4.2.6 Brand Reputation & Recall Cost Avoidance Driving Investment in Track & Trace Analytics

- 4.3 Market Restraints

- 4.3.1 Divergent Country-level Timelines Generating Investment Uncertainty

- 4.3.2 High Capital & Integration Costs with Legacy MES/ERP and Packaging Lines

- 4.3.3 Data Privacy & Cyber-security Risks in Networked Traceability Platforms

- 4.3.4 Limited Per-unit ROI for Low-margin Generic Manufacturers

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Hardware Systems

- 5.1.1.1 Printing & Marking Equipment

- 5.1.1.2 Monitoring & Verification Systems

- 5.1.1.3 Labeling & Tamper-evident Solutions

- 5.1.1.4 Other Hardware

- 5.1.2 Software Solutions

- 5.1.2.1 Plant-level Management Suites

- 5.1.2.2 Line Controller Software

- 5.1.2.3 Bundle / Pallet Tracking Software

- 5.1.2.4 Enterprise & Cloud Platforms

- 5.1.3 Professional & Managed Services

- 5.1.1 Hardware Systems

- 5.2 By Technology

- 5.2.1 Barcode / 2-D DataMatrix

- 5.2.2 RFID & NFC

- 5.2.3 Advanced IoT Sensors & BLE Beacons

- 5.3 By Application

- 5.3.1 Serialization Solutions

- 5.3.1.1 Bottle Serialization

- 5.3.1.2 Blister & Strip Serialization

- 5.3.1.3 Carton & Case Serialization

- 5.3.1.4 Data-Matrix / QR Serialization

- 5.3.2 Aggregation Solutions

- 5.3.2.1 Bundle Aggregation

- 5.3.2.2 Case Aggregation

- 5.3.2.3 Pallet Aggregation

- 5.3.1 Serialization Solutions

- 5.4 By End User

- 5.4.1 Pharmaceutical Manufacturers

- 5.4.2 Contract Manufacturing & Packaging Organizations (CMOs/CPOs)

- 5.4.3 Medical Device Manufacturers

- 5.4.4 Healthcare Distributors & Wholesalers

- 5.4.5 Other Life-science Stakeholders (OTC, Nutraceuticals, Cosmetics, Legal Cannabis)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 OPTEL Group

- 6.3.2 TraceLink Inc.

- 6.3.3 Antares Vision SpA

- 6.3.4 SEA Vision SRL

- 6.3.5 Syntegon Technology GmbH

- 6.3.6 Zebra Technologies Corp.

- 6.3.7 Mettler-Toledo International Inc.

- 6.3.8 Korber Medipak Systems GmbH

- 6.3.9 ACG Worldwide

- 6.3.10 VISIOTT

- 6.3.11 Uhlmann

- 6.3.12 Sato Holdings Corporation

- 6.3.13 74Software

- 6.3.14 Siemens

- 6.3.15 Brother Industries, Ltd. (Domino Printing Sciences plc)

- 6.3.16 Dover Corporation (Markem-Imaje)

- 6.3.17 Wipotec-OCS GmbH

- 6.3.18 Veralto Corporation (Videojet Technologies Inc.)

- 6.3.19 Coesia S.p.A.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment