|

市場調查報告書

商品編碼

1852064

針狀焦:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)Needle Coke - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

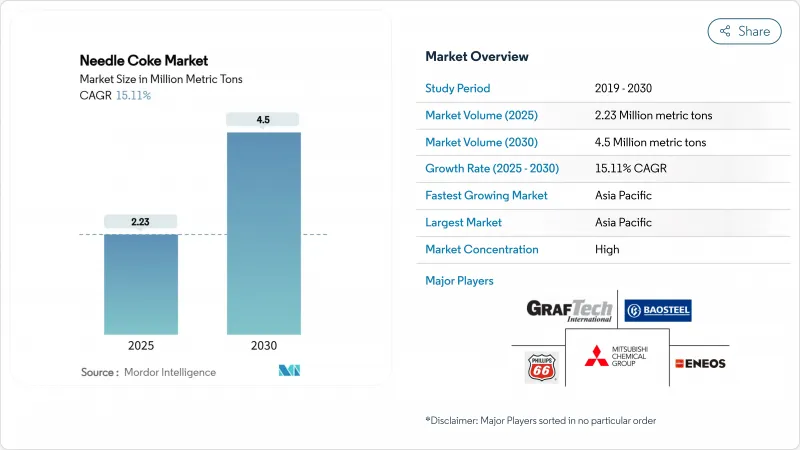

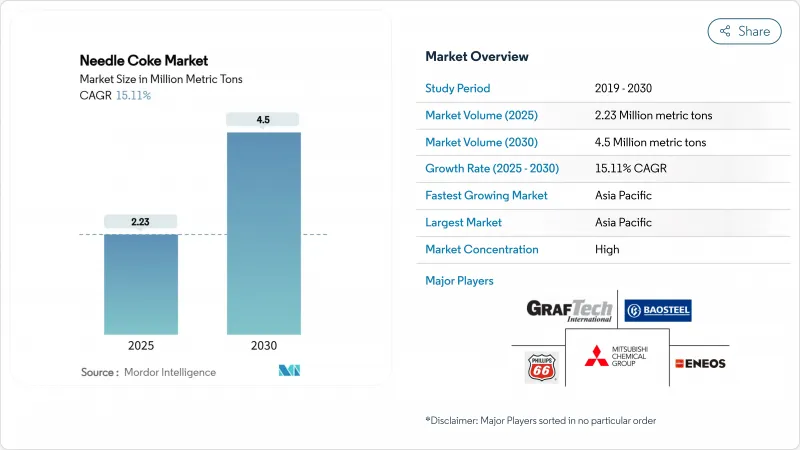

預計到 2025 年針狀焦市場規模為 223 萬噸,到 2030 年將達到 450 萬噸,預測期(2025-2030 年)複合年成長率為 15.11%。

這項快速成長主要得益於電弧爐煉鋼和鋰離子電池製造的同步發展,這兩個產業共同重塑了全球碳材料的需求模式。鋼鐵業向電弧爐技術的轉型推動了對高功率石墨電極的需求,而電動車的蓬勃發展則擴大了對合成石墨負極的需求。原料供應緊張、生產集中在特定地區以及新的貿易限制,導致針狀焦市場持續面臨供應緊張,並加劇了價格上漲趨勢。擁有穩定油源和先進延遲焦化設備的生產商仍然掌握定價權。

全球針焦市場趨勢與洞察

增加對電弧爐煉鋼產能的投資

全球鋼鐵生產商正加速從高爐煉鋼轉向電弧爐煉鋼,以減少二氧化碳排放並提高原料靈活性。電弧爐煉鋼目前已佔全球鋼鐵產量的30%,並佔2025年下半年計畫新增產能的43%。印度的國家鋼鐵政策目標是到2030年將電弧爐煉鋼的產量佔比提高到40%,而中國則計劃在2025年將這一比例提高到15%。因此,鋼鐵業的脫碳直接增加了整個市場對針狀焦的需求。雖然電弧爐計劃的資本投資主要集中在亞太地區,但北美鋼鐵生產商也在增建電弧爐,以實現永續性目標並利用豐富的廢鋼供應。這一趨勢正促使綜合焦炭生產商透過多年承購協議來擴大產能。

電動車用鋰離子電池產量快速成長

鋰離子電池的生產擴張速度遠超預期。 2023年,全球電動車電池工廠將消耗超過63萬噸石墨,預計到本世紀中期,隨著新的超級工廠投入營運,這一數字將翻倍。合成石墨在快速充電穩定性和純度方面具有顯著的性能優勢,從而推動了高能量密度負極材料的日益普及。為了確保供應,汽車製造商正與針狀焦基合成石墨供應商簽訂長期契約,例如Panasonic能源與NOVONIX達成的協議,預計將於2025年開始交付。負極材料需求的激增正將石油基針狀焦從傳統的鋼鐵客戶手中奪走,導致全球原料供應趨緊,並提高了針狀焦市場合格生產商的利潤率。

延遲焦化中的勞工和環境危害。

美國環保署2024年焦爐新規強制要求使用零洩漏爐門並進行連續苯監測,迫使業者維修其排放法規。 40 CFR第63部分規定的類似措施將加強煉油廠焦炭槽的監測,增加遵循成本和停機風險。這些強制性規定可能會對近期產量造成壓力,抑制產能擴張,並將新增產能轉移到監管相對寬鬆的地區。供應限制的出現速度可能快於需求緩解速度,加劇針狀焦市場的波動。

細分市場分析

2024年,石油基材料佔針狀焦市場佔有率的85.73%,預計到2030年將以16.34%的複合年成長率成長。此細分市場受益於完善的延遲焦化基礎設施、可靠的FCC脫渣油供應以及優異的晶體取向,從而滿足高功率電極的精度要求。預計到2025年,市場規模將成長至約191萬噸,到2030年將超過380萬噸,這印證了石油針狀焦在更廣泛的碳材料價值鏈中市場規模的不斷擴大。儘管合成石墨陽極的採用將進一步推動市場成長,但美國和西歐煉油廠的合理化改造正在造成區域性原料短缺。亞洲煉油廠的軟性焦裝置仍在運作,部分緩解了其他地區的供不應求。

煤焦油瀝青基產品佔據剩餘市場佔有率,是電極和電池製造商實現多元化發展的重要途徑。儘管面臨技術挑戰,兩家商業化煤針焦工廠在2024年之前仍維持了穩定的產量。在鋼鐵週期有利的情況下,與冶金焦爐的上游整合可為營運商帶來成本優勢。瀝青供應有限限制了成長潛力,但逐步消除瓶頸措施使該領域保持了重要性。對催化劑輔助石墨化的持續研究有望提高煤針焦的質量,並擴大其在針狀焦市場的潛在佔有率。

針狀焦市場報告按產品類型(石油基針狀焦和煤焦油瀝青基針狀焦)、應用領域(石墨電極、鋰離子電池及其他應用)和地區(亞太地區、北美地區、歐洲地區、南美地區以及中東和非洲地區)進行細分。市場預測以數量(公噸)為單位。

區域分析

亞太地區佔針狀焦市場88.31%的佔有率,預計到2030年將以15.72%的複合年成長率成長。中國預計2023年粗鋼產量將超過9億噸,並擁有全球最大的電池負極材料產能,在針狀焦的供需兩端都扮演重要角色。北京於2023年底推出高純度石墨出口許可證制度,導致其海外出貨量年減91%,引發了西方買家對供應鏈的擔憂。印度計劃在2035年實現年產2.4億至2.6億噸鋼鐵,並計劃將電弧爐煉鋼普及率提高到40%,這很可能成為推動針狀焦需求成長的因素之一。

北美市場規模雖小,但正透過本地化策略提升其戰略地位。美國提案對中國石墨徵收93.5%的關稅,凸顯了華盛頓對自主研發的重視。歐洲市場維持溫和的銷售成長,這得益於支持循環經濟鋼鐵生產和電池回收的政策。斯道拉恩索在芬蘭的木質素石墨工廠體現了其對低碳負極材料的承諾。

其他地區,例如南美洲和中東及非洲,雖然仍處於應用初期,但對特種焦的興趣日益濃厚。沙烏地阿拉伯已授予雪佛龍全球許可公司一份年產7.5萬噸針狀焦的生產許可證,該許可證將於2024年投產,標誌著中東首次大規模涉足特種焦領域。同時,埃及和巴西等新興鋼鐵產業叢集正在尋求本地電極供應,以減少進口依賴。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 增加對電弧爐煉鋼產能的投資

- 電動車用鋰離子電池產量快速成長

- 中國和歐盟的廢鋼法規

- 煉油廠升級提升低硫卸油供應

- 閉合迴路石墨回收計劃

- 市場限制

- 延遲焦化過程中的職業和環境危害。

- 原料價格波動(蒸餾油、煤焦油)

- 生物基硬碳陽極材料的前景

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 價格概覽

第5章 市場規模與成長預測

- 依產品類型

- 石油基針狀焦市場

- 煤焦油瀝青基針狀焦市場

- 透過使用

- 石墨電極

- 鋰離子電池

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Baosteel Group

- China National Petroleum Corporation

- ENEOS Corporation

- GrafTech International

- Indian Oil Corporation

- Mitsubishi Chemical Group Corporation

- Nippon Steel Corporation

- PetroChina

- Phillips 66 Company

- POSCO Future M

- Shandong Yida New Materials Co., Ltd.

- Shanxi Hongte Coal Chemical Co Ltd

- Sinopec

- Tokai Carbon Co., Ltd

第7章 市場機會與未來展望

The Needle Coke Market size is estimated at 2.23 million metric tons in 2025, and is expected to reach 4.5 million metric tons by 2030, at a CAGR of 15.11% during the forecast period (2025-2030).

This rapid upswing stems from the parallel rise of electric-arc-furnace (EAF) steelmaking and lithium-ion battery manufacturing, two sectors that together reshape global carbon material demand. The steel industry's move toward EAF technology is intensifying the call for ultra-high-power graphite electrodes, while the electric-vehicle boom is expanding synthetic-graphite anode requirements. Tight feedstock availability, geographic concentration of production, and new trade controls are creating persistent supply tension that reinforces upward pricing trends across the needle coke market. Producers with secure decant-oil supply and advanced delayed-coking assets continue to control pricing power.

Global Needle Coke Market Trends and Insights

Increasing Investments in EAF Steel Capacity

Global steelmakers are accelerating the shift from blast furnaces to EAF technology to cut carbon emissions and improve raw-material flexibility. EAF installations already contribute 30% of world steel output and account for 43% of planned capacity additions slated for late 2025. India's National Steel Policy targets an EAF share of up to 40% by 2030, while China seeks a 15% EAF contribution by 2025. Each new furnace requires ultra-high-power electrodes that rely on premium petroleum-needle coke, so steel decarbonization directly enlarges overall needle coke market demand. Capital spending on EAF projects remains focused in Asia-Pacific, yet North American steel majors are also adding arc furnaces to meet sustainability goals and capitalize on abundant scrap supply. The trend locks in multi-year offtake commitments and encourages integrated coke producers to expand capacity.

Soaring Li-ion Battery Production for EVs

Lithium-ion battery manufacturing is scaling at a pace that exceeds earlier forecasts. Global EV battery plants consumed more than 630,000 tons of graphite in 2023, a figure expected to multiply by mid-decade as new giga-factories begin operations. Synthetic graphite holds critical performance advantages in fast-charge stability and purity, underpinning rising penetration rates within high-energy-density anodes. To secure supply, automotive OEMs have struck long-term agreements with needle-coke-based synthetic-graphite suppliers such as Panasonic Energy's pact with NOVONIX that commences deliveries in 2025. The surge in anode demand draws petroleum-based needle coke away from traditional steel customers, tightening the global feedstock pool and supporting elevated margins for qualified producers inside the needle coke market.

Occupational and Environmental Hazards in Delayed Coking

The U.S. Environmental Protection Agency's 2024 coke-oven rule mandates zero leaking doors and continuous benzene monitoring, pushing operators to retrofit emission controls. Similar measures under 40 CFR Part 63 tighten oversight of refinery coking drums, escalating compliance spend and downtime risk. These obligations strain output in the near term, curb expansion appetite, and may shift new capacity to regions with less stringent frameworks. For the needle coke market, supply constraints materialize faster than demand moderation, amplifying volatility.

Other drivers and restraints analyzed in the detailed report include:

- Scrap-Steel Mandates in China and EU

- Refinery Upgrades Boosting Low-Sulphur Decant-Oil Supply

- Raw-Material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Petroleum-based material captured 85.73% of the needle coke market share in 2024 and is forecast to advance at a 16.34% CAGR to 2030. The segment benefits from established delayed-coking infrastructure, reliable FCC decant-oil supply, and superior crystalline orientation that meets ultra-high-power electrode tolerances. It grew to roughly 1.91 million tons in 2025 and should exceed 3.80 million tons by 2030, underscoring the rising petroleum needle coke market size within the larger carbon-materials value chain. Adoption of synthetic-graphite anodes injects additional momentum, but refinery rationalization in the United States and Western Europe introduces regional feed shortages. Asian refiners continue to commission flexi-coker units, offsetting partial supply loss elsewhere.

Coal-tar-pitch-based products occupy the remaining volume but supply an important diversification lever for electrode and battery producers. Despite technical hurdles, the two commercial coal-needle plants maintained stable output through 2024. Upstream integration with metallurgical coke ovens gives operators incremental cost advantages when steel cycles are favorable. Growth potential stays capped by limited pitch availability, yet incremental debottlenecking keeps the segment relevant. Ongoing research into catalyst-assisted graphitization may elevate coal-needle quality, broadening its addressable share in the needle coke market.

The Needle Coke Market Report is Segmented by Product Type (Petroleum-Based Needle Coke and Coal-Tar Pitch-Based Needle Coke), Application (Graphite Electrodes, Lithium-Ion Batteries, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Metric Tons).

Geography Analysis

Asia-Pacific leads with 88.31% of the needle coke market and is projected to preserve a 15.72% CAGR through 2030. China anchors both supply and demand, producing more than 900 million tons of crude steel in 2023 and operating the world's largest battery-anode capacity. Beijing's export license requirement for high-purity graphite introduced in late 2023 reduced outbound shipments by 91% year on year, a development that heightened supply-chain vigilance among Western buyers. India emerges as a demand multiplier as it targets 240-260 million tons of annual steel by 2035 and intends to lift EAF penetration to 40%.

North America accounts for a smaller base yet gains strategic relevance through localization. Tariff proposals of 93.5% on Chinese graphite underscore Washington's focus on self-reliance. Europe holds moderate volume growth as policy favors circular-economy steel production and battery recycling. Stora Enso's lignin-graphite plant in Finland signals commitment to lower-carbon anode material.

Other territories such as South America, the Middle East, and Africa are at earlier adoption stages but record growing interest. Saudi Arabia awarded Chevron Lummus Global a 75,000 TPA needle-coke complex license in 2024, marking the Middle East's first large-scale entry into specialty coke, while emerging steel clusters in Egypt and Brazil explore local electrode supply to reduce import exposure.

- Baosteel Group

- China National Petroleum Corporation

- ENEOS Corporation

- GrafTech International

- Indian Oil Corporation

- Mitsubishi Chemical Group Corporation

- Nippon Steel Corporation

- PetroChina

- Phillips 66 Company

- POSCO Future M

- Shandong Yida New Materials Co., Ltd.

- Shanxi Hongte Coal Chemical Co Ltd

- Sinopec

- Tokai Carbon Co., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Investments in EAF Steel Capacity

- 4.2.2 Soaring Li-Ion Battery Production for Evs

- 4.2.3 Scrap-Steel Mandates in China and EU

- 4.2.4 Refinery Upgrades Boosting Low-Sulphur Decant Oil Supply

- 4.2.5 Closed-Loop Graphite Recycling Initiatives

- 4.3 Market Restraints

- 4.3.1 Occupational and Environmental Hazards in Delayed Coking

- 4.3.2 Raw-Material Price Volatility (Decanter Oil, Coal Tar)

- 4.3.3 Prospect of Bio-Based Hard-Carbon Anode Materials

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Price Overview

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Petroleum-based Needle Coke

- 5.1.2 Coal-tar Pitch-based Needle Coke

- 5.2 By Application

- 5.2.1 Graphite Electrodes

- 5.2.2 Lithium-ion Batteries

- 5.2.3 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Baosteel Group

- 6.4.2 China National Petroleum Corporation

- 6.4.3 ENEOS Corporation

- 6.4.4 GrafTech International

- 6.4.5 Indian Oil Corporation

- 6.4.6 Mitsubishi Chemical Group Corporation

- 6.4.7 Nippon Steel Corporation

- 6.4.8 PetroChina

- 6.4.9 Phillips 66 Company

- 6.4.10 POSCO Future M

- 6.4.11 Shandong Yida New Materials Co., Ltd.

- 6.4.12 Shanxi Hongte Coal Chemical Co Ltd

- 6.4.13 Sinopec

- 6.4.14 Tokai Carbon Co., Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment