|

市場調查報告書

商品編碼

1852061

雷射:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Lasers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

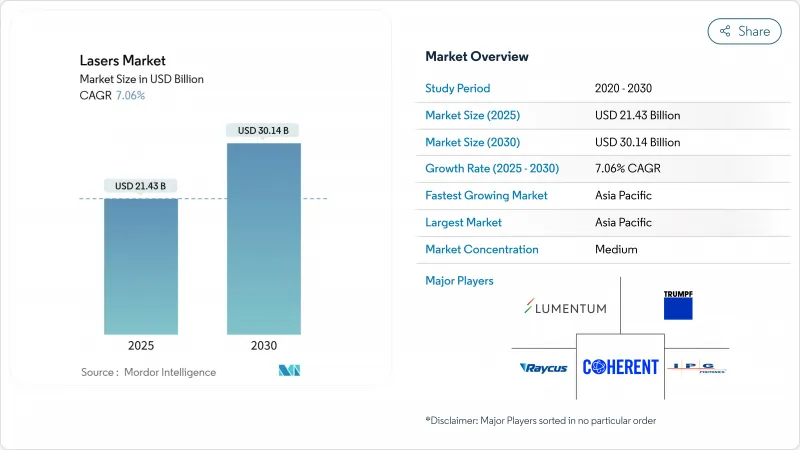

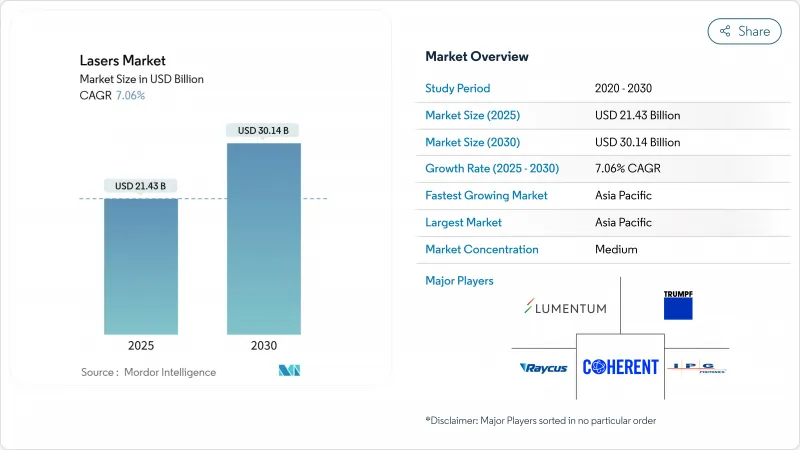

全球雷射市場預計到 2025 年將達到 214.3 億美元,到 2030 年將達到 301.4 億美元,同期複合年成長率為 7.06%。

這一擴張反映了精密微加工、積層製造、自動駕駛和下一代顯示器製造等領域的日益成長的應用需求。用於加工10奈米以下半導體特徵的超快脈衝光源和用於切割厚金屬板的千瓦級光纖系統正逐漸成為大批量工廠的主流應用。政府資助的光電叢集正在加速亞太地區的生態系統發展,而積層製造正在減少材料浪費並縮短航太零件的生產週期。鎵、鍺和磷化銦基板的供應鏈風險仍然是一個不利因素,但溫度控管和光束合成架構方面的創新不斷突破可實現功率輸出的上限。

全球雷射市場趨勢與洞察

半導體後端封裝領域對高精度微加工的需求快速成長

扇出型晶圓層次電子構裝和玻璃通孔製程指定使用飛秒雷射和準分子雷射光源,以實現小於10µm的特徵尺寸和脈衝間能量偏差小於1%的加工,從而確保在300mm晶圓上形成均勻的通孔。以雷射成型的微凸塊取代引線接合法可將互連電阻降低40%,為3D晶片堆疊鋪路。原位監測和同步光束整形模組可提高產量比率並降低大量生產工廠的廢品率。亞太地區的代工廠持續採購承包雷射工作站,其性能顯著優於超快光源供應商。隨著封裝生產線節拍時間的縮短,對更高重複頻率的需求預計將推高高階超快雷射的平均售價。

雷射技術在航太高溫合金零件積層製造的應用日益廣泛

目前,主要的航太製造商正在認證粉末層熔融光纖雷射器,用於加工鈦鋁合金和鎳基高溫合金,材料利用率超過95%,顯著優於減材製造製程。動態光束整形技術可將製造週期縮短40%,並將消費量降低60%。雷射列印零件現已明確納入AS9100標準修訂版,簡化了認證流程。美國和歐洲的引擎計畫擴大採用「列印優先」的零件形狀設計,這些形狀無法透過機械加工經濟地實現。這種轉變將雷射需求與寬體飛機的升級改造以及計劃在本十年後半期投入使用的超音速推進計劃緊密聯繫起來。

高等級砷化鎵/磷化銦外延片持續短缺

鎵和鍺的出口限制加劇了化合物半導體基板的短缺,而這些基板對於高功率雷射二極體至關重要。批次間熱導率的差異迫使雷射製造商進行漫長的重新認證週期,導致出貨速度減慢,庫存積壓增加。北美和歐洲的新興企業正在規劃新的晶體生長工廠,但設備前置作業時間和製程技術的限制將使大規模生產推遲到2027年及以後。高價基板導致材料成本出現兩位數的成長,尤其是對於工作在高結溫下的雷射雷達和電信雷射。製造商正在嘗試使用矽基中介層來擴大現有外延片的供應,但性能損失仍然十分顯著。

細分市場分析

光纖雷射器憑藉其穩定的光束品質、全光纖架構和極低的維護需求,將在2024年佔據全球雷射市場41.8%的佔有率。然而,隨著定向能量武器和核融合實驗對兆瓦級光鏈路的需求,固態雷射平台將在2030年前以9.3%的複合年成長率實現最快成長。預計到2030年,全球固態雷射器市場規模將超過50億美元,反映了國防資金的持續投入。混合配置,即把板狀增益介質熔接到鎧裝光纖傳輸線中,有助於突破單纖功率限制,同時保持亮度。二氧化碳雷射在厚截面切割領域仍佔據重要地位,而二極體雷射在泵浦陣列和直寫應用中不斷擴展。準分子雷射和紫外線雷射對於100奈米以下的半導體微影術至關重要,儘管代工廠資本支出存在週期性波動,但它們的需求仍然保持穩定。

對分散式增益架構的持續研究有望在不引起熱致模式不穩定性的情況下實現功率擴展。雖然自由電子和量子連鎖技術目前仍佔據著小眾光譜區域,但緊湊型加速器架構的突破最終可能使中紅外線的應用更加普及。 IEC 60825-1 的安全合規性將影響機殼設計,並進而影響高度自動化工廠的總土地成本。隨著應用邊界日益模糊,能夠將光纖的可靠性與固態元件的強大性能相結合的供應商將獲得顯著的市場佔有率。

至2024年,材料加工領域將維持在全球雷射市場30.5%的佔有率,涵蓋汽車、航太和一般工業領域的切割、焊接、鑽孔和積層製造流程。然而,以LiDAR和光譜模組為代表的感測器應用將在本十年末縮小這一差距,實現8.7%的複合年成長率。重工業訂單仍呈現週期性波動,但棕地工廠的改裝工程將維持基準產量。同時,醫療和美容領域的門診手術量正在增加,這些手術創傷小、恢復快。

微影術的投資依賴於頂級代工廠的先進節點燈,這些燈具在每個極紫外線掃描儀中整合了多個高重複頻率的準分子光源。下一代顯示器依靠超快速修復技術來維持產量比率,從而提高面板利潤率。軍方採購用於反無人機系統的高能系統不僅創造了可觀的收入來源,也增加了對基礎光學研究的公共資金投入。邊緣和雲端資料中心的激增推動了光互連需求的成長,進而推動了通訊雷射的銷量,並增強了全球雷射市場應用組合的多樣性。

區域分析

預計到2024年,亞太地區將佔全球雷射市場的46.9%,到2030年將以8.3%的複合年成長率成長。中國在先進微影術節點所需的準分子雷射和超快雷射供應方面處於領先地位,而日本則專注於對光束品質要求極高的精密加工應用。韓國的OLED和microLED生產線保持著較高的運轉率,從而獲得了持續的雷射服務合約。印度的生產連結獎勵計劃鼓勵工具機製造商實現雷射切割和焊接產能的本地化,從而擴大了潛在需求。台灣和新加坡分別憑藉其化合物半導體和精密工程產業叢集貢獻了部分市場佔有率。

北美位居第二,這主要得益於航太製造業的成長以及兆瓦級定向能系統的國防合約。美國「美國製造」(Manufacturing USA)旗下的光電)正在扶持整合光電和量子連鎖設計領域的新興企業公司。加拿大材料科學研究所(Materials Science Institute)正與當地機械加工廠合作,試驗雷射覆層和硬化技術;墨西哥電動車走廊(Electric Vehicle Corridor)則正在擴大用於電池托盤的光纖雷射焊接規模。美墨加協定(USMCA)的協調促進了跨境供應鏈的發展,但出口限制使得高功率元件難以出口到某些特定目的地。此外,環境監測法規也刺激了國內對中紅外線氣體檢測模組的需求。

歐洲憑藉德國領先的機械製造商和法國國防整合商對高能量研究的支持,在雷射技術領域佔據了顯著佔有率。英國正在利用雷射消熔技術進行航太複合材料加工,以最大限度地減少分層缺陷;而一家義大利超級跑車製造商則正在使用多千瓦級碟片雷射高效焊接鋁製底盤。歐盟範圍內的法規,包括《機械指令》和IEC 60825-1標準,促使出口級系統內建安全特性。像DioHELIOS這樣的合作計畫體現了歐洲對核融合能源賦能技術的重視,該聯盟匯集二極體雷射的專業知識,以推動成本效益高的規模化生產。綠色氫能舉措的興起進一步激發了全部區域對雷射板材切割和管道焊接技術的興趣。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 半導體封裝領域對高精度微加工技術的需求快速成長

- 雷射在積層製造的應用日益廣泛

- 增加LiDAR雷射的安裝量

- 超快雷射技術的拓展應用

- 政府資助的光電叢集推動區域製造業生態系發展

- 千瓦級光纖雷射的性價比快速提升

- 市場限制

- 高等級砷化鎵/磷化銦外延片持續短缺

- 限制向某些國家出口高功率雷射的出口管制制度

- 30kW以上功率的溫度控管挑戰限制了切割厚度藍圖

- 分散的安全標準增加了原始設備製造商的認證成本。

- 價值鏈分析

- 技術展望

- 監管環境

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依雷射類型

- 光纖雷射

- 二極體雷射

- 二氧化碳雷射

- 固態雷射

- 準分子雷射與紫外線雷射器

- 其他類型(量子連鎖、自由電子)

- 透過使用

- 材料加工(切割、焊接、鑽孔)

- 通訊和光互連

- 醫療美容

- 微影術和半導體計量

- 軍事/國防

- 顯示器(OLED、Micro-LED、投影)

- 感測器(LiDAR、光譜學)

- 印刷和標記

- 透過輸出

- 低功率(小於1千瓦)

- 中等功率(1-3千瓦)

- 高功率(超過3千瓦)

- 按操作模式

- 連續波(CW)

- 脈衝(奈秒、皮秒、飛秒)

- 按最終用戶行業分類

- 電子和半導體

- 車

- 工業機械

- 衛生保健

- 航太/國防

- 研究與學術

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 亞太其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Coherent Corp.

- IPG Photonics Corporation

- TRUMPF SE+Co. KG

- nLIGHT, Inc.

- Lumentum Holdings Inc.

- Jenoptik AG

- Novanta, Inc.

- Lumibird SA

- Wuhan Raycus Fiber Laser Technologies Co. Ltd

- Hans Laser Technology Industry Group Co., Ltd.

- Maxphotonics Co., Ltd.

- Keyence Corporation

- EKSPLA UAB

- MKS Instruments, Inc.(Spectra-Physics)

- Panasonic Corporation

- EdgeWave GmbH

- Civan Lasers Ltd.

- Synrad Laser Division

- Amonics Ltd.

- TOPTICA Photonics AG

第7章 市場機會與未來展望

The global lasers market size stood at USD 21.43 billion in 2025 and is forecast to reach USD 30.14 billion by 2030, posting a 7.06% CAGR through the period.

This expansion reflects rising deployment across precision micromachining, additive manufacturing, autonomous mobility, and next-generation display production. Ultrafast pulse sources that machine sub-10 nm semiconductor features and kW-class fiber systems that cut thicker metal sheets are now mainstream in high-volume factories. Government-funded photonics clusters accelerate ecosystem development in Asia-Pacific, while additive manufacturing lasers lower material waste in aerospace components and shorten production cycles. Supply chain risks around gallium, germanium, and indium phosphide substrates remain a headwind, yet innovations in thermal management and beam-combining architectures continue to raise attainable power ceilings.

Global Lasers Market Trends and Insights

Surging Demand for High-Precision Micromachining in Semiconductor Back-End Packaging

Fan-Out Wafer Level Packaging and Through-Glass Via processes specify femtosecond and excimer sources that deliver sub-10 µm features with under-1% pulse-to-pulse energy deviation, ensuring uniform via formation across full 300 mm wafers. Replacing wire bonding with laser-formed micro-bumps reduces interconnect resistance by 40% and opens the path to three-dimensional chip stacks. Beam-shaping modules synchronized with in-situ monitoring raise yield and lower scrap rates in high-volume fabs. Asia-Pacific foundries continue to procure turnkey laser stations, creating a substantial pull on ultrafast source suppliers. As packaging line takt times tighten, demand for even higher repetition rates is expected to lift average selling prices in the premium ultrafast tier.

Growing Adoption of Additive Manufacturing Lasers for Aerospace Super-Alloy Parts

Aerospace primes now qualify powder-bed-fusion fiber lasers that process titanium aluminide and nickel super-alloys at material utilization rates above 95%, sharply outperforming subtractive machining. Dynamic beam shaping shortens build cycles by 40% and lowers energy consumption by 60%, while maintaining microstructure integrity critical for flight hardware. AS9100 revisions explicitly reference laser-printed parts, simplifying certification workflows. U.S. and European engine programs increasingly design for "print-first" geometries that cannot be machined economically. The shift ties laser demand to wide-body fleet renewal and hypersonic propulsion projects scheduled for late-decade entry into service.

Persistent Shortages of High-Grade Gallium Arsenide/Indium Phosphide Epi-Wafers

Export curbs on gallium and germanium intensify the scarcity of compound semiconductor substrates vital for high-power laser diodes. Variability in thermal conductivity across lots forces laser makers into lengthy re-qualification cycles, delaying shipments and elevating inventory buffers. Start-ups in North America and Europe plan new crystal-growth fabs, but tooling lead times and process know-how push meaningful volumes past 2027. Premium substrate pricing inflates the bill of materials by double digits, particularly for LiDAR and telecom lasers operating at elevated junction temperatures. Manufacturers are experimenting with silicon-based interposers to stretch the existing epi-wafer supply, yet performance penalties remain non-trivial.

Other drivers and restraints analyzed in the detailed report include:

- Rising Installation of LiDAR Lasers in Autonomous Mobility Stacks

- Expanding Use of Ultrafast Lasers for Next-Gen OLED and Micro-LED Display Repair

- Export-Control Regimes Limiting High-Power Laser Shipments to Certain Countries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiber lasers held 41.8% of the global lasers market in 2024 thanks to robust beam quality, all-fiber architectures, and minimal service needs. Solid-state platforms, however, register the swiftest 9.3% CAGR to 2030 as directed-energy weapons and fusion experiments demand multi-megawatt optical chains. The global lasers market size for solid-state devices is projected to cross USD 5 billion by 2030, reflecting defense funding pipelines. Hybrid configurations that splice slab gain media into armored fiber delivery lines help transcend single-fiber power ceilings while preserving brightness. CO2 sources persist in thick-section cutting, whereas diode lasers expand in pump arrays and direct-write applications. Excimer and UV variants remain indispensable in sub-100 nm semiconductor lithography, anchoring steady demand despite cyclical foundry capex.

Ongoing research into distributed-gain architectures promises power scaling without thermally induced mode instabilities. Free-electron and quantum cascade technologies still occupy niche spectroscopy realms, but breakthroughs in compact accelerator structures could eventually democratize mid-infrared access. Safety compliance under IEC 60825-1 shapes enclosure designs, influencing total landed cost in high-automation factories. Vendors that fuse fiber reliability with solid-state punch position themselves to capture outsized share as application boundaries blur.

Materials processing retained a 30.5% share of the global lasers market in 2024, spanning cutting, welding, drilling, and additive build processes across automotive, aerospace, and general industry. Yet sensor deployments, notably LiDAR and spectroscopy modules, post an 8.7% CAGR, poised to narrow the gap by decade-end. Heavy-industry orders remain cyclical, but retrofit programs in brownfield plants sustain baseline volume. In parallel, medical and aesthetic lasers harvest incremental growth from outpatient procedures that favor low invasiveness and quick recovery.

Lithography expenditures hinge on advanced-node ramps at the top foundries, with each EUV scanner embedding multiple high-repetition excimer sources. Next-generation displays rely on ultrafast repair to maintain yield, unlocking higher panel profit margins. Military procurement of high-energy systems for counter-UAS duties injects lumpiness but also elevates public-sector funding for fundamental optics research. As edge and cloud data centers mushroom, optical interconnect demand boosts telecom laser volumes, reinforcing the application mix diversity within the global lasers market.

The Lasers Market Report is Segmented by Laser Type (Fiber Lasers, Diode Lasers, and More), Application (Materials Processing, and More), Power Output (Low-Power, Medium-Power, High-Power), Mode of Operation (Continuous-Wave, Pulsed), End-User Industry (Electronics and Semiconductor, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 46.9% of the global lasers market in 2024 and is projected to compound at 8.3% CAGR to 2030, propelled by dense semiconductor fabs, burgeoning display lines, and state-backed photonics parks. China leads excimer and ultrafast procurement for advanced lithography nodes, while Japan refines precision machining applications that demand superior beam quality. South Korea's OLED and micro-LED lines maintain high utilization, feeding sustained laser service contracts. India's Production-Linked Incentive schemes entice machine-tool makers to localize laser cutting and welding capacities, widening addressable demand. Taiwan and Singapore contribute niche volumes from compound semiconductor and precision engineering clusters, respectively.

North America ranks second, buoyed by aerospace build rates and defense contracts for megawatt-class directed-energy systems. U.S. photonics hubs under the Manufacturing USA umbrella foster start-up formation in integrated photonics and quantum cascade designs. Canada's materials-science institutes partner with local machine shops to trial laser cladding and hardening, while Mexico's electric-vehicle corridor scales fiber-laser welding for battery trays. Cross-border supply chains benefit from USMCA harmonization, though export controls constrain outbound shipments of high-power units to certain destinations. Environmental-monitoring mandates also spur domestic demand for mid-infrared gas-sensing modules.

Europe holds notable share through Germany's machinery giants and France's defense integrators that champion high-energy research lasers. The United Kingdom pursues aerospace composites processing with laser ablation to minimize delamination defects, and Italy's super-car makers adopt multi-kW disk lasers to weld aluminum chassis efficiently. EU-wide regulations, including the Machinery Directive and IEC 60825-1 alignment, shape safety features embedded in export-grade systems. Collaborative programs like DioHELIOS illustrate Europe's focus on fusion-energy enablers, with consortiums pooling diode-laser expertise to drive cost-effective scaling. Growing green-hydrogen initiatives further elevate interest in laser-based plate cutting and pipe welding across the region.

- Coherent Corp.

- IPG Photonics Corporation

- TRUMPF SE + Co. KG

- nLIGHT, Inc.

- Lumentum Holdings Inc.

- Jenoptik AG

- Novanta, Inc.

- Lumibird SA

- Wuhan Raycus Fiber Laser Technologies Co. Ltd

- Hans Laser Technology Industry Group Co., Ltd.

- Maxphotonics Co., Ltd.

- Keyence Corporation

- EKSPLA UAB

- MKS Instruments, Inc. (Spectra-Physics)

- Panasonic Corporation

- EdgeWave GmbH

- Civan Lasers Ltd.

- Synrad Laser Division

- Amonics Ltd.

- TOPTICA Photonics AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for high-precision micromachining in semiconductor back-end packaging

- 4.2.2 Growing adoption of additive manufacturing lasers

- 4.2.3 Rising installation of LiDAR lasers

- 4.2.4 Expanding use of ultrafast lasers

- 4.2.5 Government-funded photonics clusters driving regional manufacturing ecosystems

- 4.2.6 Rapid price/performance improvements in kW-class fiber lasers

- 4.3 Market Restraints

- 4.3.1 Persistent shortages of high-grade gallium arsenide/indium phosphide epi-wafers

- 4.3.2 Export-control regimes limiting high-power laser shipments to certain countries

- 4.3.3 Thermal-management challenges above 30 kW limiting cutting-thickness roadmap

- 4.3.4 Fragmented safety standards increasing certification costs for OEMs

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Laser Type

- 5.1.1 Fiber Lasers

- 5.1.2 Diode Lasers

- 5.1.3 CO2 Lasers

- 5.1.4 Solid-State Lasers

- 5.1.5 Excimer and Ultraviolet Lasers

- 5.1.6 Other Types (Quantum Cascade, Free-Electron)

- 5.2 By Application

- 5.2.1 Materials Processing (Cutting, Welding, Drilling)

- 5.2.2 Communications and Optical Interconnects

- 5.2.3 Medical and Aesthetic

- 5.2.4 Lithography and Semiconductor Metrology

- 5.2.5 Military and Defense

- 5.2.6 Displays (OLED, Micro-LED, Projection)

- 5.2.7 Sensors (LiDAR, Spectroscopy)

- 5.2.8 Printing and Marking

- 5.3 By Power Output

- 5.3.1 Low-Power (Less than 1 kW)

- 5.3.2 Medium-Power (1-3 kW)

- 5.3.3 High-Power (More than 3 kW)

- 5.4 By Mode of Operation

- 5.4.1 Continuous-Wave (CW)

- 5.4.2 Pulsed (ns, ps, fs)

- 5.5 By End-User Industry

- 5.5.1 Electronics and Semiconductor

- 5.5.2 Automotive

- 5.5.3 Industrial Machinery

- 5.5.4 Healthcare

- 5.5.5 Aerospace and Defense

- 5.5.6 Research and Academia

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Coherent Corp.

- 6.4.2 IPG Photonics Corporation

- 6.4.3 TRUMPF SE + Co. KG

- 6.4.4 nLIGHT, Inc.

- 6.4.5 Lumentum Holdings Inc.

- 6.4.6 Jenoptik AG

- 6.4.7 Novanta, Inc.

- 6.4.8 Lumibird SA

- 6.4.9 Wuhan Raycus Fiber Laser Technologies Co. Ltd

- 6.4.10 Hans Laser Technology Industry Group Co., Ltd.

- 6.4.11 Maxphotonics Co., Ltd.

- 6.4.12 Keyence Corporation

- 6.4.13 EKSPLA UAB

- 6.4.14 MKS Instruments, Inc. (Spectra-Physics)

- 6.4.15 Panasonic Corporation

- 6.4.16 EdgeWave GmbH

- 6.4.17 Civan Lasers Ltd.

- 6.4.18 Synrad Laser Division

- 6.4.19 Amonics Ltd.

- 6.4.20 TOPTICA Photonics AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment