|

市場調查報告書

商品編碼

1852056

苯乙烯嵌段共聚物(SBC):市場佔有率分析、產業趨勢、統計和成長預測(2025-2030)Styrenic Block Copolymers (SBCs) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

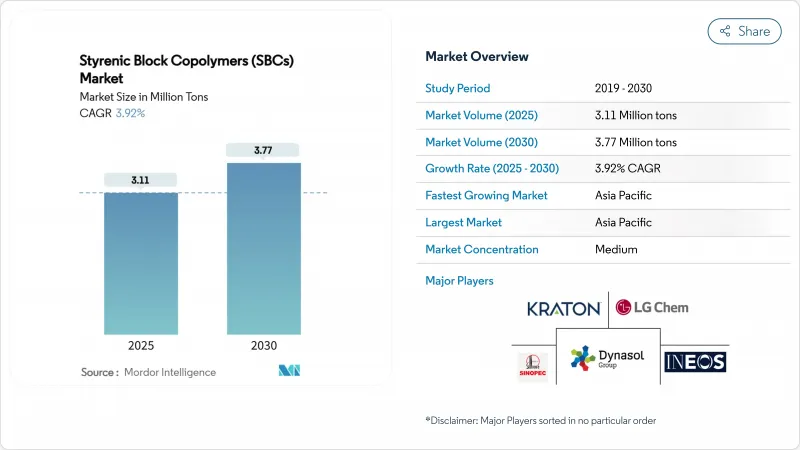

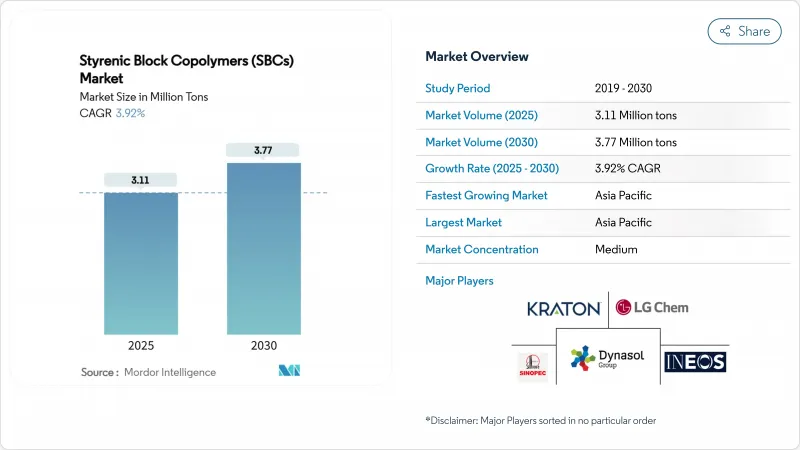

苯乙烯嵌段共聚物市場預計到 2025 年將達到 311 萬噸,預計到 2030 年將達到 377 萬噸,在預測期(2025-2030 年)內複合年成長率為 3.92%。

儘管需求基礎日益成熟,但苯乙烯嵌段共聚物市場仍受益於其廣泛的應用領域,從瀝青改質膜和防水膜到高價值介電薄膜,無所不包。多角化經營使生產商免受單一產業週期性波動的影響,而原料整合和接近性終端用戶的區域優勢則推動了其競爭優勢的形成。亞太地區仍然是成長引擎,各國政府在公路、鐵路和高層建築建築建設中大量投資,而這些建設都採用了聚合物改質瀝青和膜材。同時,氫化級苯乙烯嵌段共聚物專利到期為中端供應商帶來了機遇,而電動汽車電容器磺酸鹽化學的突破性進展預示著苯乙烯嵌段共聚物市場未來將出現高階細分市場。

全球苯乙烯嵌段共聚物(SBC)市場趨勢及洞察

強制性瀝青回收推動了性能要求。

歐盟和美國的立法者正在將最低再生材料含量標準納入道路建設標準,這促使設計人員傾向於選擇即使在用原生瀝青取代輪胎或塑膠衍生油的情況下也能保持機械完整性的聚合物體系。近期測試證實,在反覆凍融循環和氧化壓力作用下,SBS改質混合料的性能優於未改質瀝青。由於再生材料含量的變化會增加配方的複雜性,能夠根據高雜質含量客製化苯乙烯嵌段共聚物的供應商可以獲得溢價。雖然資金籌措機制加速了市場准入,但由於區域回收網路的差異和漫長的熱解裝置核准週期,短期供應仍然緊張。因此,隨著聯邦立法將回收要求逐步落實到市政採購,苯乙烯嵌段共聚物市場正經歷噸位成長。

亞太地區基礎建設熱潮推動了防水材料的需求。

中國、印度、越南和印尼的公共投資持續創下紀錄,刺激了橋樑、地鐵和多用戶住宅等建築對聚合物改質膜的需求。 SCG Chemicals公司位於龍山的工廠耗資7億美元維修,顯示一體化製造商正在轉向使用靈活的乙烷原料,以滿足瀝青和建築膜對SBS的結構性需求。區域承包商正在指定使用SBS改性黏合劑建造穿越熱帶、沙漠和高山氣候的高速公路,以確保低溫下的抗裂性和高溫下的抗車轍性。亞太地區毗鄰建築中心,前置作業時間更低,交貨週期更短,這將推動該地區在2024年佔據苯乙烯嵌段共聚物市場57%以上的佔有率。儘管勞動力短缺和授權延誤可能會影響計劃進度,但多年的政府預算為計劃在2030年前擴大產能的生產商提供了支持。

冷拌技術為傳統應用帶來了挑戰。

加拿大、德國和美國多個州的政府機構正在測試常溫固化、乳液型冷拌路面,這種路面能夠減少瀝青攪拌站的溫室氣體排放。早期現場試驗表明,不含聚合物的配方可以滿足鄉村和二級公路的規範要求,這可能會降低交通流量較小的地區對苯乙烯嵌段共聚物(SBS)的需求。然而,在交通繁忙的都市區高速公路上,SBS提供的抗車轍性能仍然不可或缺。推廣應用的障礙包括承包商的熟悉程度、長期耐久性檢驗以及特殊乳化劑供應有限。因此,儘管冷拌路面在某些細分市場正在逐漸普及,但苯乙烯嵌段共聚物市場仍是高性能路面的核心。

細分市場分析

到2024年,苯乙烯-丁二烯-苯乙烯共聚物(S-BDS)將繼續佔據苯乙烯類嵌段共聚物市場72.12%的主導佔有率,並在瀝青、鞋類和壓敏黏著劑領域展現出卓越的性價比。該聚合物成熟的供應鏈、豐富的加工技術和配方靈活性降低了其在大批量應用中被替代的風險。氫化級苯乙烯類嵌段共聚物(如SEBS和SEPS)雖然噸位較小,但預計到2030年將以4.53%的複合年成長率快速成長,因為汽車製造商、家電品牌以及電線電纜製造商對耐熱性、抗紫外線線性和耐油性的閾值越來越高。在專利相關費用的崩壞以及雲端CAE平台商業化加速等級選擇等因素的推動下,氫化級苯乙烯類嵌段共聚物市場規模預計在預測期內將成長約20萬噸。

同時,SIS在溶劑型壓敏黏著劑、造口護理產品和醫用敷料膠帶等領域也發揮重要作用。製造商正在最佳化氫化SIS,以減少熱熔加工過程中的氧化交聯,從而擴大其在衛生應用領域的適用性。原料混合的彈性,特別是優先選擇異戊二烯而非價格較高的丁二烯,為SIS製造商提供了抵禦原料價格波動的有效手段。綜上所述,這些動態表明,聚合物多樣化能夠保護苯乙烯嵌段共聚物市場免受宏觀經濟週期性波動的影響,同時支持長期的創新發展藍圖。

苯乙烯嵌段共聚物報告按聚合物類型(苯乙烯-丁二烯-苯乙烯 (SBS)、苯乙烯-異戊二烯-苯乙烯 (SIS)、氫化苯乙烯-丁二烯-苯乙烯 (HSBC))、應用領域(瀝青改質、鞋類、聚合物改質、黏合劑和密封劑、其他)以及歐洲地區(亞太地區、北美地區、中東地區和歐洲地區進行細分。市場預測以噸為單位。

區域分析

亞太地區在2024年佔據苯乙烯嵌段共聚物市場56.97%的主導地位,反映了其作為全球製造地和基礎設施熱點地區的雙重地位。中國沿海、韓國和東協煉油走廊沿線的資本密集型乙烯-丙烯聯合裝置提供了具有競爭力的原料,而國內承包商透過多年期的高速公路、港口和地鐵計劃確保了穩定的市場需求。越南決定維修其乙烷裂解產能,凸顯了該地區原料供應的靈活性,而印度快速的都市化將支撐對防水捲材的持續需求。預計到2030年,該地區的複合年成長率將達到4.29%,高於全球平均水平,這主要得益於政策主導的工業化、電子產業集群化以及汽車電氣化進程的加速——所有這些都將促進氫化苯乙烯嵌段共聚物的廣泛應用。

北美地區受益於一項聯邦基礎設施支出計劃,該計劃撥款數十億美元用於州際公路維修和機場跑道重鋪。由於英力士苯領公司永久關閉了位於薩尼亞的年產43萬噸的工廠,苯乙烯嵌段共聚物市場正面臨國內苯乙烯供應下降的困境。瀝青回收的強制性規定推動了黏合劑混合物中聚合物濃度的提高,而該地區新興的產業生態系統正在促進電動車電力電子領域基於苯乙烯嵌段共聚物的介電薄膜的發展。然而,與頁岩氣液和墨西哥灣沿岸颶風相關的原料價格波動造成了不確定性抑制了擴張計劃。

歐洲的苯乙烯嵌段共聚物市場成熟且技術先進,並將永續性和循環經濟放在首位。高昂的能源價格和嚴格的環境法規迫使生產商以最佳運轉率營運,這不僅促使工廠進行合理化改造,也推動了製程效率的提升。諸如「綠色交易」和「擴大生產者責任框架」等法規刺激了對可回收和可回收聚合物系統的需求,其中SEBS和磺酸鹽SBC在食品接觸材料和醫用導管應用領域備受青睞。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟和美國的瀝青回收強制令

- 亞太地區基礎建設熱潮(高速公路、防水材料)

- 疫情推動一次性衛生膜的興起

- 科騰公司匯豐銀行級專利到期,為新市場准入打開了大門。

- 用於下一代電動汽車電容器的磺酸鹽SBC

- 市場限制

- 粗鏈苯乙烯和丁二烯原料的變異性

- 無瀝青冷拌路面技術

- POE/POP彈性體取代SBC用於包裝

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按聚合物類型

- 苯乙烯-丁二烯-苯乙烯(SBS)

- 苯乙烯-異戊二烯-苯乙烯(SIS)

- 氫化SBC(HSBC)

- 透過使用

- 瀝青改質(鋪路和屋頂)

- 鞋類

- 聚合物改性

- 黏合劑和密封劑

- 其他用途(醫療設備、電線電纜)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 土耳其

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 奈及利亞

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、合資、產能)

- 市佔率(%)/排名分析

- 公司簡介

- Asahi Kasei Corporation

- Avient Corporation

- Dynasol Group

- Eni SpA

- INEOS

- Kraton Corporation

- Kuraray Co., Ltd.

- LCY

- LG Chem

- Sibur

- Sinopec

- TSRC

- ZEON Corporation

第7章 市場機會與未來展望

The Styrenic Block Copolymers Market size is estimated at 3.11 Million tons in 2025, and is expected to reach 3.77 Million tons by 2030, at a CAGR of 3.92% during the forecast period (2025-2030).

Despite a mature demand base, the styrenic block copolymers market continues to benefit from its wide application spread, ranging from asphalt modification and waterproofing membranes to high-value dielectric films. Diversification protects producers from single-sector cyclicality, while feedstock integration and regional proximity to end users increasingly dictate competitive advantage. The Asia-Pacific region remains the growth engine as governments channel capital toward expressways, rail links, and high-rise construction that specify polymer-modified bitumen and membranes. Simultaneously, patent expiries in hydrogenated grades open space for mid-tier suppliers, and breakthroughs in sulfonated chemistries for EV capacitors hint at future premium niches for the styrenic block copolymers market.

Global Styrenic Block Copolymers (SBCs) Market Trends and Insights

Asphalt-Recycling Mandates Drive Performance Requirements

Legislators in the EU and United States have embedded minimum recycled-content thresholds into road construction codes, prompting designers to favor polymer systems that preserve mechanical integrity when tire-derived or plastic-derived oils replace virgin bitumen. Recent trials confirm that SBS-modified mixes outperform unmodified asphalt under repeated freeze-thaw cycles and oxidative stress, thereby meeting tougher service-life criteria. Suppliers capable of tailoring styrenic block copolymers to higher impurity loads enjoy a pricing premium, because recyclate variability increases formulation complexity. Although funding mechanisms accelerate market pull, gaps in regional collection networks and lengthy permitting cycles for pyrolysis units keep short-term supply tight. Consequently, the styrenic block copolymers market secures incremental tonnage growth as recycling mandates cascade from federal statutes to municipal procurement.

APAC Infrastructure Boom Accelerates Waterproofing Demand

Record-level public spending across China, India, Vietnam, and Indonesia continues to stimulate consumption of polymer-modified membranes for bridges, subways, and mega-residential complexes. SCG Chemicals' USD 700 million upgrade at its Long Son complex illustrates how integrated producers pivot to flexible ethane feedstock in anticipation of structural demand for SBCs in asphalt and building membranes. Regional contractors specify SBS-modified binders for expressways that traverse tropical, desert, and alpine climates, thereby guaranteeing low-temperature crack resistance and high-temperature rutting stability. Proximity to construction centers lowers freight cost and shortens delivery lead times, advantages that push APAC's share of the styrenic block copolymers market beyond 57% in 2024. While labor shortages and permitting delays occasionally stall project timelines, multi-year government budgets underpin visibility for producers mapping capacity additions through 2030.

Cold-Mix Technologies Challenge Traditional Applications

Government agencies in Canada, Germany, and several U.S. states have trialed emulsion-based cold-mix pavements that cure at ambient temperature, reducing greenhouse-gas emissions from asphalt plants. Early-stage field performance suggests that polymer-free recipes can meet rural and secondary road specifications, potentially eroding SBS demand where traffic loads are modest. Nonetheless, heavy-traffic urban arterials still require the rutting resistance imparted by SBS. Implementation barriers include contractor familiarity, untested long-term durability, and limited supply of specialized emulsifiers. Hence, although cold-mix alternatives cap upside in certain subsegments, the styrenic block copolymers market retains its core in high-performance pavements.

Other drivers and restraints analyzed in the detailed report include:

- Pandemic-Driven Hygiene Film Applications Create New Demand Vectors

- Sulfonated SBCs Unlock High-Value EV Capacitor Space

- POE/POP Elastomers Replace SBCs in Flexible Packaging

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Styrene-Butadiene-Styrene retained a commanding 72.12% share of the styrenic block copolymers market in 2024, underscoring cost-aligned performance in asphalt, footwear, and pressure-sensitive adhesives. The polymer enjoys a well-established supply chain, broad processing familiarity, and formulation versatility that limit substitution risk in mass-volume applications. Hydrogenated members such as SEBS and SEPS contributed a smaller tonnage base but registered the fastest 4.53% CAGR to 2030 as automakers, consumer-electronics brands, and wire-and-cable producers specified higher thermal, UV, and oil-resistance thresholds. The styrenic block copolymers market size for hydrogenated grades is projected to increase by nearly 0.2 million tons during the forecast window, buoyed by the collapse of patent-related royalties and the commercialization of cloud-enabled CAE platforms that accelerate grade selection.

In parallel, SIS maintained a specialized role in solvent-borne pressure-sensitive adhesives, ostomy-care appliances, and medical drape tapes where intrinsic tack and bloom resistance outweigh price premiums. Producers have optimized hydrogenated SIS variants to cut oxidative cross-linking during hot-melt processing, broadening their fit for hygiene applications. Feedstock mix flexibility, especially the ability to favor isoprene over high-priced butadiene, gives SIS producers a hedge against raw-material volatility. Collectively, these dynamics ensure that polymer-type diversification shields the styrenic block copolymers market from macroeconomic cyclicality while anchoring long-term innovation roadmaps.

The Styrenic Block Copolymers Report is Segmented by Polymer Type (Styrene-Butadiene-Styrene (SBS), Styrene-Isoprene-Styrene (SIS), and Hydrogenated SBCs (HSBC)), Application (Asphalt Modification, Footwear, Polymer Modification, Adhesives and Sealants, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific's dominant 56.97% 2024 share of the styrenic block copolymers market reflects its combined status as a global manufacturing hub and infrastructure hot spot. Capital-intensive ethylene and propylene complexes along the Chinese coast, in South Korea, and within the ASEAN refinery corridor provide competitive feedstock; meanwhile, domestic contractors ensure stable off-take through multi-year freeway, port, and metro projects. Vietnam's decision to retrofit ethane cracking capacity underscores the region's flexibility in sourcing, while India's rapid urban migration underpins sustained waterproofing-membrane demand. The region's 4.29% projected CAGR to 2030 outpaces global averages thanks to policy-driven industrialization, electronics clustering, and accelerating vehicle electrification, all catalysts for hydrogenated SBC uptake.

North America is buoyed by federal infrastructure-spending packages that allocate billions toward Interstate rehabilitation and airport runway resurfacing. The styrenic block copolymers market faces reduced domestic styrene supply after INEOS Styrolution permanently idled its 430,000-ton Sarnia unit, tightening merchant monomer availability and advantaging vertically integrated players. Asphalt-recycling mandates drive higher polymer concentrations in binder blends, while the region's start-up ecosystem pushes SBC-based dielectric films for EV power electronics. However, feedstock volatility tied to shale gas liquids and hurricanes along the Gulf Coast introduces uncertainty that tempers expansion plans.

Europe commands a mature yet technologically sophisticated slice of the styrenic block copolymers market, prioritizing sustainability and circularity. High energy tariffs and strict environmental regulations compel producers to operate at optimized utilizations, leading to plant rationalizations but also encouraging process efficiency gains. Regulatory drivers such as the Green Deal and extended producer-responsibility frameworks stimulate demand for recyclable and recycled-compatible polymer systems, favoring SEBS and sulfonated SBCs in food-contact and medical tubing applications.

- Asahi Kasei Corporation

- Avient Corporation

- Dynasol Group

- Eni S.p.A.

- INEOS

- Kraton Corporation

- Kuraray Co., Ltd.

- LCY

- LG Chem

- Sibur

- Sinopec

- TSRC

- ZEON Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Asphalt-Recycling Mandates in EU and U.S.

- 4.2.2 APAC Infrastructure Boom (Expressways, Waterproofing)

- 4.2.3 Pandemic-Driven Rise in Single-Use Hygiene Films

- 4.2.4 Patent Expiry of Kraton's HSBC Grades Unlocking New Entrants

- 4.2.5 Sulfonated SBCs for Next-Gen EV Capacitors

- 4.3 Market Restraints

- 4.3.1 Volatility of Crude-Linked Styrene and Butadiene Feedstocks

- 4.3.2 Asphalt-Free Cold-Mix Road Technologies

- 4.3.3 POE/POP Elastomers Replacing SBCs in Packaging

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Polymer Type

- 5.1.1 Styrene-Butadiene-Styrene (SBS)

- 5.1.2 Styrene-Isoprene-Styrene (SIS)

- 5.1.3 Hydrogenated SBCs (HSBC)

- 5.2 By Application

- 5.2.1 Asphalt Modification (Paving and Roofing)

- 5.2.2 Footwear

- 5.2.3 Polymer Modification

- 5.2.4 Adhesives and Sealants

- 5.2.5 Other Applications (Medical devices and Wires and Cables)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Turkey

- 5.3.3.8 Nordic Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JV, Capacity)

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 Avient Corporation

- 6.4.3 Dynasol Group

- 6.4.4 Eni S.p.A.

- 6.4.5 INEOS

- 6.4.6 Kraton Corporation

- 6.4.7 Kuraray Co., Ltd.

- 6.4.8 LCY

- 6.4.9 LG Chem

- 6.4.10 Sibur

- 6.4.11 Sinopec

- 6.4.12 TSRC

- 6.4.13 ZEON Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment