|

市場調查報告書

商品編碼

1852016

印度農業機械:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)India Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

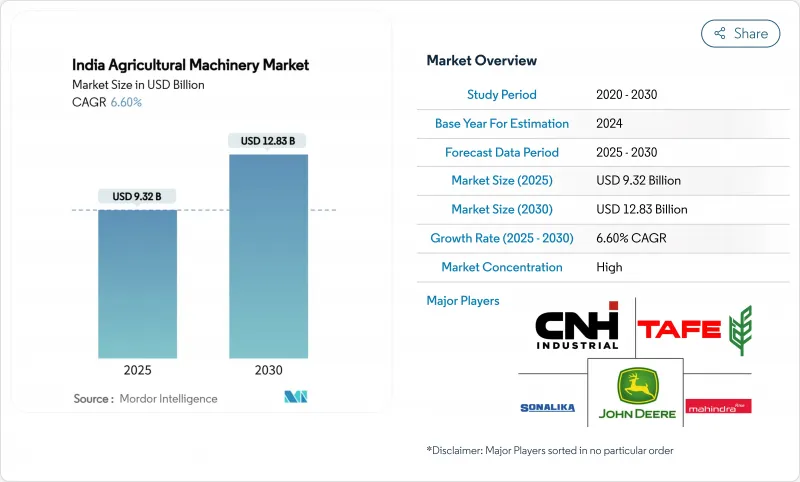

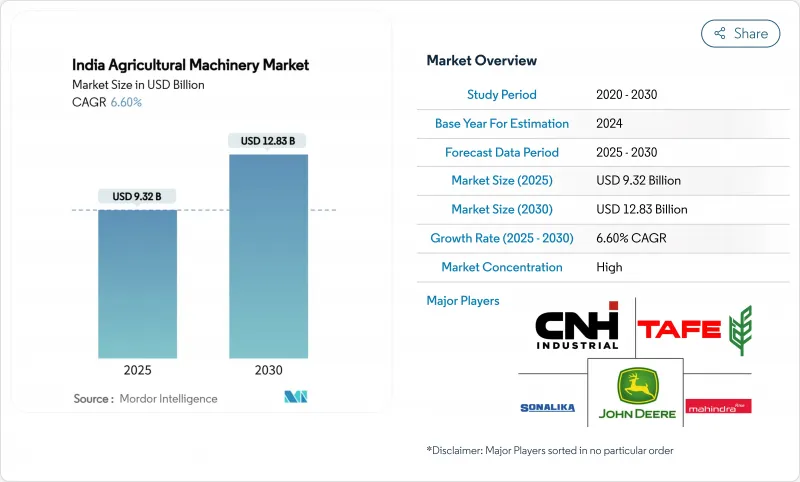

據估計,到 2025 年,印度農業機械市場規模將達到 181.5 億美元,預計到 2030 年將達到 272.9 億美元,預測期內複合年成長率為 8.5%。

強力的公共部門獎勵、持續的農村勞動力短缺以及快速的數位化正在推動全國範圍內的農機設備普及。農業機械化方案(SMAM)提供的補貼降低了曳引機、灌溉系統和精準農機設備的初始成本,而客製化的就業中心則擴大了小農戶的就業管道。隨著都市區化進程的加速和農業勞動力的減少,生產者正轉向能夠確保及時播種和收穫的機械化解決方案。同時,數位農業計畫正在建立農民登記系統和帶有地理標籤的作物資料庫,以支援精準農機設備的部署和數據主導貸款。排放氣體法規和針對低排放氣體的新激勵措施正在刺激對更清潔動力傳動系統的投資,使電動和混合模式成為新興但具有戰略意義的成長點。競爭對手之間的競爭日益激烈,前五名供應商佔據了81.5%的市場佔有率,這促使他們推出新產品並擴大中功率曳引機和智慧農具的產能。

印度農業機械市場趨勢與洞察

鼓勵引入機械化的政府體系

SMAM的政策干預措施為個人機械購置提供40%至50%的補貼,為客製化租賃中心提供高達80%的補貼。光是在北方邦,SMAM在2014年至2024年間就發放了656.6億印度盧比(約7.9億美元),分發了17.6萬台機械,並建立了1,0769個客製化租賃中心。諸如農民無人機補貼和國家糧食安全任務特定作物支援等配套舉措進一步擴大了對精準設備的需求。這些項目不僅最大限度地降低了前期成本,還加強了售後服務網路,促進了不同農業氣候區的永續機械化。

由於人口持續向都市區遷移,農村地區出現勞動力短缺。

根據家庭調查數據,僅有9%的主要收入來源者從事農業,遠低於歷史上超過50%的水準。季節性遷徙高峰出現在播種和收穫季節,加劇了勞動力短缺,但機械化可以透過及時耕作、播種和收割來彌補這一缺口。聯合收割機可減少高達30%的勞動力,並將收穫後損失降低2-4個百分點。透過客製化中心共用機械設備,可以進一步利用稀缺機械,從而在勞動力短缺地區維持作物集約化生產。

設備成本高且信貸管道有限

儘管政府提供了豐厚的補貼,但一台中型曳引機的售價仍超過60萬印度盧比(約7,200美元),這對許多小農戶來說遙不可及。正規貸款機構通常要求提供抵押品,且利率比優惠貸款高出200-300個基點,這抑制了大規模投資。雖然客製化的租賃中心可以降低成本,但其分佈極不均衡:印度東部每個地區不到12個租賃中心,而北部地區則超過45個,進一步加劇了區域間的差距。

細分市場分析

2024年,曳引機將維持40.5%的收入佔有率,凸顯其在各種種植系統中耕作和運輸的關鍵作用。在灌溉機械領域,微灌泵和滴灌系統是成長最快的細分市場,年複合成長率達10.5%,這主要得益於電費上漲,從而支持了抗旱計畫和精準灌溉。犁、耙和旋耕機等農機具將受益於小農戶機械化程度的提高,因為這些農具提供了入門級的機械化解決方案,且資本投入低於曳引機。隨著旺季勞動力短缺加劇,收割機械將保持穩定成長,聯合收割機和青貯收割機對於商業性農業生產及時收割作物至關重要。

將全球導航衛星系統與傳統農具結合的適配器,正在將傳統曳引機轉變為智慧機器,能夠以±2.5厘米的精度進行直線犁地和播種,從而減少6%至8%的投入浪費。電動旋耕機和電池驅動的果園噴霧器在果農中越來越受歡迎,他們優先考慮低噪音和零排放。印度的農業機械市場持續多元化發展,打包機、割草機和碎草機在旨在遏制露天焚燒的殘茬管理方案中發揮越來越重要的作用。市場領導正在透過模組化附件生態系統來應對這一需求,使單一曳引機底盤能夠支援20多種針對不同任務的農具,從而將擁有成本分攤到多個收入來源。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府計劃促進機械化應用

- 由於人口持續向都市區遷移,農村地區出現勞動力短缺。

- 農民生產組織和合約農業集群

- 提供貸款服務的數位信貸平台

- 獎勵可加速電氣設備普及

- 氣候保險有利於機械化農業

- 市場限制

- 高昂的資本成本和有限的信貸管道

- 所擁有土地分散限制了規模效益。

- 各州的排放法規各不相同。

- 熟練的遠端資訊處理技術人員短缺

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 聯結機

- 小於50馬力

- 50~75 HP

- 76~100 HP

- 101~150 HP

- 150馬力或以上

- 裝置

- 耕耘機

- 光環

- 旋耕機和耕耘機

- 播種施肥機

- 其他設備(挖坑機、電動除草機等)

- 灌溉機械

- 噴水灌溉

- 滴灌

- 其他灌溉設備(中心支軸式噴灌系統、微型噴灌等)

- 收割機

- 聯合收割機

- 青貯收割機

- 其他收割機械(甘蔗收割機、馬鈴薯收割機等)

- 乾草和飼料機械

- 割草機和壓扁機

- 打包機

- 其他乾草飼料機械(翻曬機、耙草機等)

- 聯結機

- 按最終用戶農場規模分類

- 小型農場(小於5公頃)

- 中型農場(5-20公頃)

- 大型農場(超過20公頃)

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mahindra & Mahindra Ltd

- TAFE Motors and Tractors Limited

- Deere & Company

- CNH Industrial NV

- International Tractors Limited(Sonalika)

- Escorts Kubota Limited

- VST Tillers Tractors Ltd.

- AGCO Corporation

- CLAAS KGaA mbH

- Yanmar Holdings Co., Ltd.

- SDF Group SpA

- Tirth Agro Technology Private Limited

- Kirloskar Group

- Jain Irrigation Systems Ltd.

第7章 市場機會與未來展望

The India Agricultural Machinery Market size is estimated at USD 18.15 billion in 2025 and is projected to reach USD 27.29 billion by 2030, at a CAGR of 8.5% during the forecast period.

Robust public-sector incentives, persistent rural labor shortages, and rapid digitalization are converging to accelerate equipment adoption nationwide. Subsidies under the Sub-Mission on Agricultural Mechanization (SMAM) lower the upfront cost of tractors, irrigation systems, and precision implements, while custom-hiring centers extend access to smallholder farmers. Rising urban migration reduces available farm labor, pushing growers toward mechanized solutions that can sustain timely planting and harvesting operations. In parallel, the Digital Agriculture Mission is creating a farmer registry and geotagged crop database that will underpin precision equipment deployment and data-driven financing. Emission regulations plus emerging incentives for low-emission tractors spur investment in cleaner powertrains, positioning electric and hybrid models as a nascent but strategic growth pocket. Competitive rivalry intensifies as the top five vendors command an 81.5% share, prompting new product launches and capacity expansions geared toward mid-power tractors and smart implements.

India Agricultural Machinery Market Trends and Insights

Government schemes boosting mechanization adoption

Policy interventions under SMAM provide 40%-50% subsidies on individual machinery purchases and up to 80% on custom-hiring centers. In Uttar Pradesh alone, SMAM disbursed INR 65.66 billion (USD 790 million) between 2014 and 2024, distributing 176,000 machines and establishing 10,769 custom-hiring centers, which collectively expand access to high-capacity equipment across smallholder communities. Complementary initiatives such as the Kisan Drone subsidy and crop-specific support under the National Food Security Mission channel further demand high-precision implements. These programs not only minimize upfront costs but also strengthen after-sales networks, thereby fostering sustained mechanization across diverse agro-climatic zones.

Rural labor shortage caused by sustained migration to urban centers

Household survey data indicate that only 9% of main income earners remain in farming, down from historic norms above 50%. Seasonal out-migration peaks during planting and harvesting, intensifying labor deficits that mechanization can bridge through timely tillage, sowing, and harvesting. Combine harvesters cut labor requirements by up to 30% and reduce post-harvest losses by 2-4 percentage points, making them indispensable in rice-wheat rotations. Equipment sharing through custom-hiring centers further leverages scarce machinery to maintain cropping intensities in labor-scarce districts.

High equipment cost and limited credit access

Despite generous subsidies, a mid-horsepower tractor still requires an outlay exceeding INR 600,000 (USD 7,200), a sum beyond the reach of many marginal growers. Formal lenders often demand collateral, and interest spreads remain 200-300 basis points above prime lending, deterring big-ticket investments. Custom-hiring centers cushion the cost hurdle but are unevenly distributed, eastern India hosts fewer than 12 centers per district versus 45-plus in parts of the north, perpetuating regional disparities.

Other drivers and restraints analyzed in the detailed report include:

- FPOs and contract farming aggregation

- Digital credit platforms enabling financing

- Fragmented landholdings limit scale efficiency

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors retained a 40.5% revenue share in 2024, underscoring their foundational role in tillage and haulage across diverse cropping systems. Irrigation Machinery is the fastest growing segment with micro-irrigation pumps and drip systems advancing at a 10.5% CAGR, propelled by drought-mitigation programs and rising electricity tariffs that favor precision watering. Equipment segments, including plows, harrows, and rotovators, benefit from the mechanization push in smallholder farming, where these implements provide entry-level mechanization solutions that require lower capital investment than tractors. Harvesting machinery experiences steady growth as labor shortages intensify during peak seasons, with combine harvesters and forage harvesters becoming essential for timely crop collection in commercial farming operations.

Adapters that merge global navigation satellite systems with traditional implements are converting conventional tractors into smart machines that execute straight-line plowing and seed placement within +-2.5 cm precision, reducing input waste by 6%-8%. Electric-assist rotovators and battery-powered orchard sprayers are gaining traction among fruit growers, where low noise and zero emissions are prized. The India agricultural machinery market continues to diversify as balers, mowers, and mulchers gain relevance in residue-management schemes aimed at curbing open-field burning. Market leaders respond with modular attachment ecosystems, allowing a single tractor chassis to support over 20 task-oriented implements, thereby spreading ownership cost over multiple revenue streams.

The India Agricultural Machinery Market Report is Segmented by Type (Tractors, Equipment, Irrigation Machinery, Harvesting Machinery, and More) and by End-User Farm Size (Smallholdings, Medium Farms, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mahindra & Mahindra Ltd

- TAFE Motors and Tractors Limited

- Deere & Company

- CNH Industrial N.V.

- International Tractors Limited (Sonalika)

- Escorts Kubota Limited

- VST Tillers Tractors Ltd.

- AGCO Corporation

- CLAAS KGaA mbH

- Yanmar Holdings Co., Ltd.

- SDF Group S.p.A.

- Tirth Agro Technology Private Limited

- Kirloskar Group

- Jain Irrigation Systems Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Schemes Boosting Mechanization Adoption

- 4.2.2 Rural labor shortage caused by sustained migration to urban centers

- 4.2.3 FPOs and Contract Farming Aggregation

- 4.2.4 Digital Credit Platforms Enabling Financing

- 4.2.5 Electric Equipment Incentives Accelerating Adoption

- 4.2.6 Climate Insurance Favoring Mechanized Cultivation

- 4.3 Market Restraints

- 4.3.1 High Equipment Cost and Limited Credit Access

- 4.3.2 Fragmented Landholdings Limit Scale Efficiency

- 4.3.3 Emission Norms Vary Across States

- 4.3.4 Lack of Skilled Telematics Technicians

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Tractors

- 5.1.1.1 Less than 50 HP

- 5.1.1.2 50 to 75 HP

- 5.1.1.3 76 to 100 HP

- 5.1.1.4 101 to 150 HP

- 5.1.1.5 Greater than 150 HP

- 5.1.2 Equipment

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Rotovators and Cultivators

- 5.1.2.4 Seed and Fertilizer Drills

- 5.1.2.5 Other Equipment (Post-Hole Diggers, Power Weeders, etc.)

- 5.1.3 Irrigation Machinery

- 5.1.3.1 Sprinkler Irrigation

- 5.1.3.2 Drip Irrigation

- 5.1.3.3 Other Irrigation Machinery (Center-Pivot Systems, Micro-Sprinklers, etc.)

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Other Harvesting Machinery (Sugarcane Harvesters, Potato Harvesters, etc.)

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers and Conditioners

- 5.1.5.2 Balers

- 5.1.5.3 Other Haying and Forage Machinery (Tedders, Rakes, etc.)

- 5.1.1 Tractors

- 5.2 By End-User Farm Size

- 5.2.1 Smallholdings (Less than 5 ha)

- 5.2.2 Medium Farms (5 to 20 ha)

- 5.2.3 Large Farms (Greater than 20 ha)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Mahindra & Mahindra Ltd

- 6.4.2 TAFE Motors and Tractors Limited

- 6.4.3 Deere & Company

- 6.4.4 CNH Industrial N.V.

- 6.4.5 International Tractors Limited (Sonalika)

- 6.4.6 Escorts Kubota Limited

- 6.4.7 VST Tillers Tractors Ltd.

- 6.4.8 AGCO Corporation

- 6.4.9 CLAAS KGaA mbH

- 6.4.10 Yanmar Holdings Co., Ltd.

- 6.4.11 SDF Group S.p.A.

- 6.4.12 Tirth Agro Technology Private Limited

- 6.4.13 Kirloskar Group

- 6.4.14 Jain Irrigation Systems Ltd.