|

市場調查報告書

商品編碼

1851954

丙烯腈:市佔率分析、產業趨勢、統計、成長預測(2025-2030)Acrylonitrile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

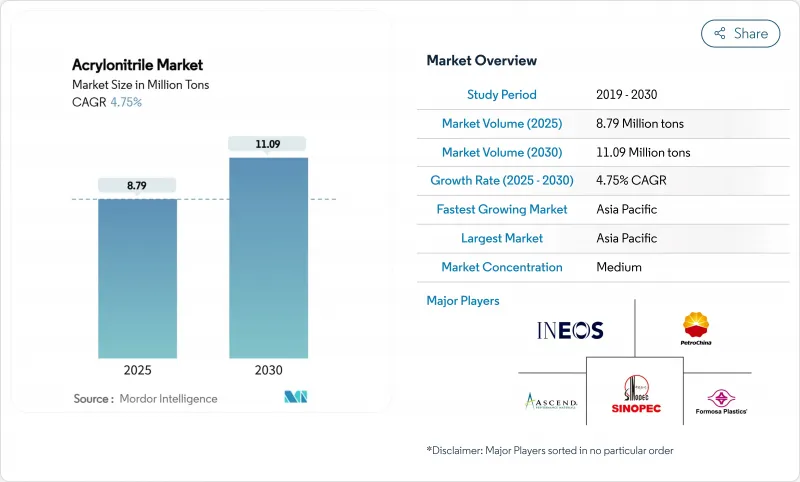

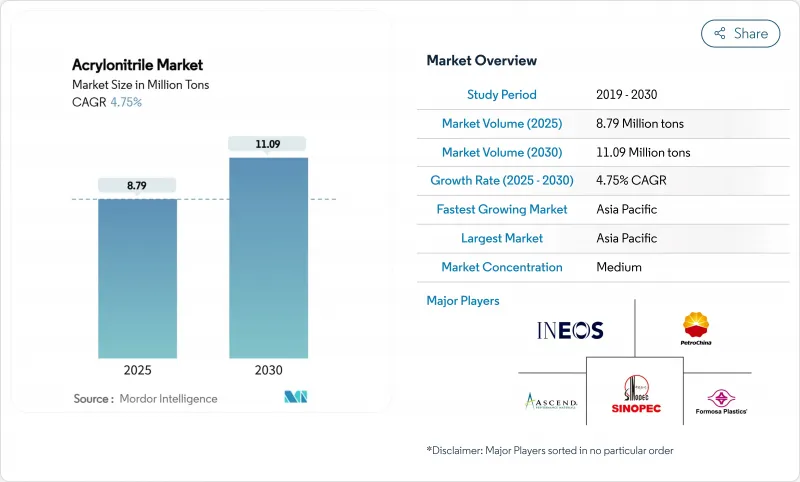

預計到 2025 年,丙烯腈市場規模將達到 879 萬噸,到 2030 年將達到 1,109 萬噸,預測期(2025-2030 年)複合年成長率為 4.75%。

下游應用領域的拓展,特別是ABS/SAN樹脂、丙烯酸纖維和聚丙烯醯胺的應用,持續推動丙烯腈銷售的成長。同時,美國環保署決定在2024年將丙烯腈列為高優先級物質,促使製造商採用更先進的排放法規並試行生物基生產路線。電動車產量的成長、水處理基礎設施的完善以及亞洲地區持續的基礎設施投資,也進一步支撐了對丙烯腈的需求。然而,由於東南亞蒸氣裂解裝置的停產暴露了丙烯原料的脆弱性,供應鏈正面臨日益加劇的不穩定性。

全球丙烯腈市場趨勢與洞察

汽車和建設產業對ABS的需求不斷成長

隨著汽車製造商在追求輕量化的同時保持抗衝擊性,對ABS的需求持續成長,這種富含丙烯腈的樹脂成為電池外殼和內飾件的理想選擇。 Trinseo的MAGNUM ECO+ ABS採用回收材料製成,將於2024年上市,可減少18%的碳足跡,這表明永續性如今已成為高階產品領域的一部分。預計在中期內,大型建築中ABS配件和裝飾面板的廣泛應用將推動永續丙烯腈的普及。

紡織業成長

亞太地區中產階級的壯大推動要素了腈綸市場的發展,他們對耐用、不褪色的腈綸纖維的需求日益成長,尤其是在功能性服裝和戶外織物領域。腈綸纖維具有抗紫外線和耐化學劣化的特性,因此非常適合用於運動服和家用紡織品,而這些領域的成長速度是傳統棉織物的兩倍。製程創新可減少40%的用水量,在滿足環保需求的同時,也提升了腈綸的競爭力。

毒性及監管力道加大

美國環保署 (EPA) 將該產品列入 2024 年優先清單,這將啟動一項為期多年的風險評估,該評估可能會限制某些用途並降低可接受的暴露水平。英國已將職場暴露限值設定為 2 ppm,但 EPA 估計每年的合規成本高達 1.69 億美元。小型生產商在維修脫硫裝置並加強監測以滿足更嚴格的職業和環境基準值的過程中,正面臨利潤壓力。

細分市場分析

預計到2024年,氨氧化法製備丙烯腈的市場規模將達到697萬噸,市佔率高達83%。由於成熟的催化劑技術和工廠瓶頸的消除,較低的現金成本支撐了到2030年5.1%的健康複合年成長率預測。美國國家再生能源實驗室(NREL)的生質能製丙烯腈路線在實驗室規模下實現了98%的產率,避免了氰化氫的產生,並降低了碳排放強度。美國國家可再生能源實驗室,“丙烯腈的可再生路線”,nrel.gov。 ISPA的等離子體化學概念展示了零石化燃料投入的潛力。儘管商業性應用仍處於起步階段,但試點數據表明,隨著可再生丙烯溢價的下降,該技術具有可行的經濟效益,預示著2030年後技術結構將重組。

區域分析

亞太地區將佔據70%的市場佔有率,預計複合年成長率為5.59%。中國完整的丙烯-ABS價值鏈將支撐投資,而電子製造業的規模將推動樹脂需求的穩定成長。政府對新增碳纖維產能的獎勵,例如榮盛石化與沙烏地阿美的合作,將確保長期滿足市場需求。

在北美,市場需求日趨成熟且富有韌性,這主要得益於Ascend公司位於德克薩斯的工廠生產的高純度丙烯腈,該產品廣泛應用於碳纖維和特種化學品領域。美國環保署(EPA)加強監管可能會限制淨成長,但也會促進技術升級,進而提高市場進入門檻。

歐洲正處於轉型期。生物基試點生產線正在利用「地平線歐洲」計畫的津貼和國家碳定價機制。參與企業將獲得進入汽車製造商供應鏈的優先權,這些汽車製造商的目標是減少範圍3的碳排放。拉丁美洲以及中東和非洲將透過對紡織品和水處理行業的投資,實現全球貿易多元化並增加貿易流量。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車和建築業對ABS的需求不斷成長

- 不斷發展的紡織業

- 增加丙烯醯胺的產量以用於水處理

- 歐盟生化獎勵加速可再生ACN試點項目

- 電子產業的擴張

- 市場限制

- 丙烯腈的毒性和監管

- 丙烯原料價格波動與蒸汽裂解裝置停產有關。

- 來自替代材料的競爭

- 價值鏈分析

- 供應概覽

- 監理展望

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產品概覽

- 生產成本概覽

- 價格概覽

- 丙烯腈市場價格概覽

- 原物料價格

第5章 市場規模與成長預測

- 透過工藝技術

- 氨氧化過程

- 其他生產過程

- 透過使用

- 丙烯酸纖維

- ABS/SAN

- 丙烯醯胺

- 丁腈橡膠

- 其他用途

- 按最終用戶行業分類

- 汽車與運輸

- 建築和基礎設施

- 電氣和電子

- 紡織服裝

- 其他終端用戶產業(例如水和污水處理、包裝和消費品)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- AnQore

- Asahi Kasei Corporation

- Ascend Performance Materials

- China Petrochemical Corporation

- Cornerstone Chemical

- Formosa Plastics Corporation

- INEOS

- Jiangsu Sailboat Petrochemical

- Jiangsu Shenghong Petrochemical

- LG Chem

- Mitsubishi Chemical Group Corporation.

- PetroChina

- Reliance Industries Limited.

- SABIC

- SGL Carbon

- Shanghai SECCO

- SOCAR(Petkim)

- Sumitomo Chemical Co., Ltd.

- Taekwang Industrial

- TONGSUH PETROCHEMICAL CORPORATION,LTD.

- Toray Industries

第7章 市場機會與未來展望

The Acrylonitrile Market size is estimated at 8.79 Million tons in 2025, and is expected to reach 11.09 Million tons by 2030, at a CAGR of 4.75% during the forecast period (2025-2030).

Expansion in downstream uses, most notably ABS/SAN resins, acrylic fibers, and polyacrylamide, remains the chief volume driver. Simultaneously, the U.S. Environmental Protection Agency's 2024 decision to list acrylonitrile as a High-Priority Substance has propelled manufacturers to adopt advanced emission controls and pilot bio-based routes. Demand within the Acrylonitrile Market is further supported by rising electric-vehicle production, growth in water-treatment infrastructure, and sustained infrastructure spending across Asia. Yet supply chains face heightened volatility after steam-cracker outages in Southeast Asia exposed propylene feedstock fragility.

Global Acrylonitrile Market Trends and Insights

Rising ABS demand in automotive and construction

ABS demand continues to climb as automakers pursue lighter vehicle components that preserve impact resistance, making acrylonitrile-rich resins ideal for battery housings and interior trim. Trinseo's 2024 rollout of recycled-content MAGNUM ECO+ ABS, showing an 18% carbon-footprint cut, illustrates how sustainability now commands a premium segment trinseo.com. Post-pandemic infrastructure programs in Asia are equally important; ABS pipe fittings and decorative panels gain traction in large-scale construction, locking in sustained acrylonitrile uptake over the medium term.

Growth of the Textile Sector

Middle-class expansion across Asia-Pacific fuels demand for durable, color-fast acrylic fibers in performance apparel and outdoor fabrics are the driving factors of ACN market. Acrylonitrile-derived fibers resist UV degradation and chemicals, which positions them for sportswear and home-textile markets growing at twice the pace of conventional cotton. Process innovations that trim water usage by 40% bolster competitiveness while addressing environmental scrutiny.

Toxicity and Tightening Regulations

The 2024 U.S. EPA High-Priority listing initiates a multi-year risk evaluation that could limit certain uses and ratchet permissible exposure levels. The UK already caps workplace exposure at 2 ppm, while the EPA estimates USD 169 million in annual compliance costs. Smaller producers face margin pressure as they retrofit scrubbers and bolster monitoring to meet stricter occupational and environmental thresholds.

Other drivers and restraints analyzed in the detailed report include:

- Higher Acrylamide use in Water Treatment

- EU Incentives for Renewable ACN Pilots

- Propylene Feedstock Volatility Tied to Cracker Outages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The acrylonitrile market size tied to ammoxidation reached 6.97 million tons in 2024, equal to 83% share. Robust catalyst know-how and plant debottlenecking keep cash costs low, supporting a healthy 5.1% CAGR outlook to 2030. NREL's biomass-to-acrylonitrile pathway achieved a 98% lab-scale yield, sidestepping hydrogen cyanide by-products and shrinking carbon intensity National Renewable Energy Laboratory, "Renewable Routes to Acrylonitrile," nrel.gov. Plasma-chemistry concepts under ISPA show promise for zero-fossil inputs. While commercial uptake remains modest, pilot data suggest viable economics once renewable-propylene premiums erode, foreshadowing a reshaped technology mix beyond 2030.

The Acrylonitrile Market Report Segments the Industry by Process Technology (Ammoxidation Process and Other Production Technologies), Application (Acrylic Fiber, Acrylamide, Nitrile-Butadiene Rubber, and More), End -User Industry (Automotive and Transportation, Construction and Infrastructure, Electrical and Electronics, and More) and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific dominated with a 70% acrylonitrile market share and a 5.59% CAGR projection. China's integrated propylene-to-ABS value chains anchor investment, while electronics manufacturing scales drive steady resin offtake. Government incentives for new carbon-fiber capacity, such as Rongsheng Petrochemical's tie-up with Saudi Aramco, ensure long-term captive demand rongsheng.com.

North America holds mature yet resilient demand, buoyed by high-purity acrylonitrile from Ascend's upgraded Texas unit that caters to carbon-fiber and specialty-chemical uses ascendmaterials.com. Stricter EPA oversight may cap net growth but encourages technology upgrades that raise cost barriers to entry.

Europe charts a transitional path. Bio-based pilot lines leverage Horizon Europe grants and national carbon-pricing signals. Early movers gain premium access to automaker supply chains targeting Scope 3 reductions. Latin America and the Middle East and Africa contribute incremental volumes through textile and water-treatment investments, diversifying global trade flows.

- AnQore

- Asahi Kasei Corporation

- Ascend Performance Materials

- China Petrochemical Corporation

- Cornerstone Chemical

- Formosa Plastics Corporation

- INEOS

- Jiangsu Sailboat Petrochemical

- Jiangsu Shenghong Petrochemical

- LG Chem

- Mitsubishi Chemical Group Corporation.

- PetroChina

- Reliance Industries Limited.

- SABIC

- SGL Carbon

- Shanghai SECCO

- SOCAR (Petkim)

- Sumitomo Chemical Co., Ltd.

- Taekwang Industrial

- TONGSUH PETROCHEMICAL CORPORATION,LTD.

- Toray Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Acrylonitrile Butadiene Styrene (ABS) in the Automotive and Construction Industries

- 4.2.2 Growing Textile Industry

- 4.2.3 Increased Acrylamide Production for Water Treatment

- 4.2.4 EU bio-chem incentives accelerating renewable ACN pilots

- 4.2.5 Expansion of the Electronics Industry

- 4.3 Market Restraints

- 4.3.1 Toxicity and Regulations of Acrylonitrile

- 4.3.2 Propylene feedstock price volatility tied to steam-cracker outages

- 4.3.3 Competition from Alternative Materials

- 4.4 Value Chain Analysis

- 4.5 Supply Overview

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Degree of Competition

- 4.9 Production Overview

- 4.10 Production Cost Overview

- 4.11 Pricing Overview

- 4.11.1 Pricing Overview Acrylonitrile

- 4.11.2 Raw Material Pricing

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Process Technology

- 5.1.1 Ammoxidation Process

- 5.1.2 Other Production Processes

- 5.2 By Application

- 5.2.1 Acrylic Fiber

- 5.2.2 ABS/SAN

- 5.2.3 Acrylamide

- 5.2.4 Nitrile-Butadiene Rubber

- 5.2.5 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Construction and Infrastructure

- 5.3.3 Electrical and Electronics

- 5.3.4 Textiles and Apparel

- 5.3.5 Other End-user Industries (Water and Waste-water Treatment, Packaging and Consumer Goods, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AnQore

- 6.4.2 Asahi Kasei Corporation

- 6.4.3 Ascend Performance Materials

- 6.4.4 China Petrochemical Corporation

- 6.4.5 Cornerstone Chemical

- 6.4.6 Formosa Plastics Corporation

- 6.4.7 INEOS

- 6.4.8 Jiangsu Sailboat Petrochemical

- 6.4.9 Jiangsu Shenghong Petrochemical

- 6.4.10 LG Chem

- 6.4.11 Mitsubishi Chemical Group Corporation.

- 6.4.12 PetroChina

- 6.4.13 Reliance Industries Limited.

- 6.4.14 SABIC

- 6.4.15 SGL Carbon

- 6.4.16 Shanghai SECCO

- 6.4.17 SOCAR (Petkim)

- 6.4.18 Sumitomo Chemical Co., Ltd.

- 6.4.19 Taekwang Industrial

- 6.4.20 TONGSUH PETROCHEMICAL CORPORATION,LTD.

- 6.4.21 Toray Industries

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Development of Bio-Based Acrylonitrile