|

市場調查報告書

商品編碼

1851921

消磁系統:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Degaussing Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

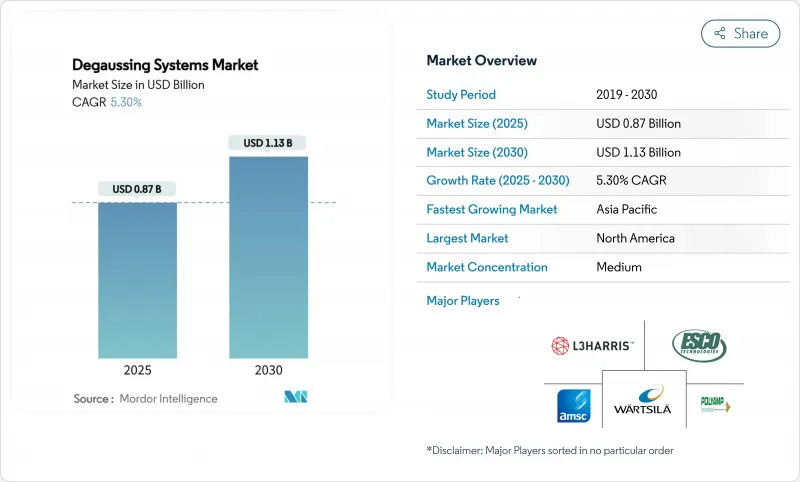

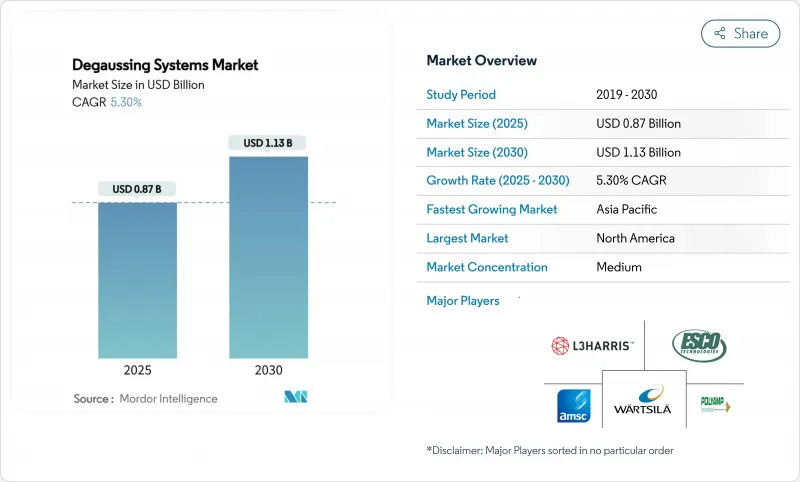

預計到 2025 年,消磁系統市場價值將達到 8.7 億美元,到 2030 年將達到 11.3 億美元,年複合成長率為 5.3%。

海軍開支不斷成長、磁性水雷技術日益複雜以及艦隊延壽計劃穩步推進,共同推動了電磁特徵控制技術的擴張。北美驅逐艦和巡洋艦的升級改造、歐洲掃雷艦的採購以及亞太地區潛艦艦隊的擴充,確保了電磁特徵控制技術擁有廣泛的基本客群。高溫超導(HTS)線圈和軟體定義控制單元加速了技術更新換代,而人工智慧(AI)演算法則透過即時調整線圈電流,不斷突破性能極限。由於海軍將特徵控制視為一種無需建造新艦即可延長艦艇壽命的經濟有效方式,因此改裝需求主導了合約簽訂活動。圍繞高溫超導帶材和稀土元素磁感測器的供應鏈壓力將在短期內限制市場成長,但擁有垂直整合組件生產線的頂級供應商將能夠緩解大部分中斷。

全球消磁系統市場趨勢與洞察

海軍現代化預算增加,推動了對消磁系統的投資。

國防預算的穩定成長正在推動一項為期多年的艦艇升級計畫。美國的驅逐艦延壽方案將維修特徵訊號管理作為其電子戰能力提升的核心組成部分。義大利的掃雷艦計畫將低磁聲學技術作為一項基礎功能。菲律賓和加拿大類似的採購計畫也鞏固了消磁系統市場的長期發展前景。

磁擾海底水雷部署規模的擴大將推動對磁訊號控制的需求。

現代水雷結合了磁性、聲學和壓力感測器,這提高了對精確磁場抑制的要求。印度多影響水雷的檢驗表明,海軍規劃人員必須應對日益成長的殺傷力。歷史損失數據顯示,水雷仍然是最具成本效益的反水面武器,凸顯了遠洋和近海艦艇配備可靠的消磁系統的必要性。

高昂的資本投入和長期的維護成本限制了其更廣泛的應用。

先進消磁系統前期投資龐大,且持續營運成本高昂,這成為其普及應用的一大障礙,尤其對於預算有限的小型海軍而言更是如此。一套完整的消磁系統安裝費用佔艦艇總建造成本的2%至5%,而基於高溫超導(HTS)技術的消磁組件比銅線圈方案的價格高出40%至60%。此外,包括低溫冷卻裝置、氦氣後勤保障和認證技術人員在內的專業全生命週期支持,將使一艘中型作戰艦艇十年的維護成本增加200萬至400萬美元。這些經濟因素往往迫使各國海軍將全頻譜特徵管理限制在航空母艦、潛艦和一線驅逐艦上,而接受低優先級艦艇上殘留的磁性特徵。因此,新興海事國家的市場滲透速度緩慢,因為高昂的資本成本擠佔了其他作戰系統的升級空間。

細分市場分析

細分市場總合凸顯了隱蔽平台如何推動支出成長。到2024年,潛艦將佔消磁系統市場收入的29.65%,而魚雷對抗艦艇將以7.89%的複合年成長率實現最快成長。這種性能差距反映了衝擊水雷構成的巨大威脅,以及在零下溫度和近岸位置隱藏的重要性。澳洲、印度和韓國的潛艦計畫在設計階段就整合了全船體線圈組,這與通常需要後期改裝的水面艦艇形成鮮明對比。魚雷掃雷艦已經採用低鐵氧體複合材料,但仍在增加分佈式微環以消除殘餘磁性。驅逐艦和護衛艦的中期升級與雷達和聲音吶的更新周期同步進行,這為消磁能力創造了協同效應,並維持了巨大的市場需求。

在分配預算時,海軍會考慮每艘艦艇獨特的風險敞口。潛水艇面臨持續的被動探測風險,因此需要使用高規格的專用材料。相反,輕型護衛艦採用模組化架構,使用針對當地磁場條件額定值的標準化線圈模組來分攤成本。這種細微差別迫使供應商提供無需重寫控制代碼即可配置的系統,這些系統適用於從30米無人艦艇到10萬噸級運輸艦的各種艦艇。

連續消磁系統佔2024年銷售額的60.90%,凸顯了其作為基準的適用性。儘管消磁仍然是核心技術,但隨著現代鋼材即使在反覆極地航行後仍能保持高剩磁,消磁的重要性再次凸顯。到2030年,6.12%的複合年成長率證實,海軍將定期消磁視為部署到易布雷咽喉要道前的關鍵保障措施。目前碼頭邊的消磁籠採用脈衝直流技術,能夠在傳統處理方式一半的時間內將磁通密度降低95.5%。此外,攜帶式消磁墊使護衛艦能夠在巡邏期間重置自身特徵訊號,而無需返回母港。

儘管應用領域較小,但測距設施透過提供實測磁場數據,形成了一個完整的回饋迴路。軟體分析將這些測量結果外推至線圈電流設定值,顯示即使是低收入領域也能帶動高利潤數位服務的開發。

區域分析

2024年,北美佔全球銷售額的34.17%。光是美國的驅逐艦和巡洋艦延壽合約就維持著數十億美元的訂單,這些訂單主要集中在國產線圈、磁力計和控制單元上。加拿大金斯頓級驅逐艦的消磁維修以及盟國的對外軍售(FMS)計畫進一步鞏固了該地區的地位。北美船廠擁有三個經認證的高溫超導(HTS)測試平台,是全球最先進的超導部署專案所在地。

至2030年,亞太地區將以8.80%的複合年成長率領先全球。不斷成長的國防預算和日益激烈的海上航道競爭將推動市場需求。日本正在擴大其最上級護衛艦的高溫超導(HTS)測試,澳洲的「奧庫斯」級潛艦試驗將採用超越傳統標準的磁性特徵管理技術。印度的魚雷項目,加上東南亞不斷壯大的近海艦隊,正加速無人平台微型消磁解決方案的普及應用。中國造船廠正在將人工智慧驅動的磁場調諧軟體應用於其新型054B型護衛艦,引領該地區的技術發展,並激勵其他國家迎頭趕上。

歐洲仍然充滿活力,北約在波羅的海和北極地區的部署為其註入了動力。義大利的掃雷計畫和法國的FDI護衛艦系列融合了驅逐艦和測距艦的功能,推動了系統級採購。英國的31型艦艇計畫現已將數位孿生檢驗的線圈佈局作為標準配置,凸顯了該地區對磁性衛星的重視。對極地科研破冰船的同步投資,不僅使收入來源擺脫了戰鬥機的束縛,也為消磁設備供應商開闢了民用海事領域的市場。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 海軍現代化預算增加,推動了對消磁系統的投資。

- 磁性水雷的部署日益增多,推動了對磁性特徵控制的需求。

- 擴大老舊水面艦艇的改裝舉措。

- 高溫超導(HTS)線圈技術的出現使得緊湊高效的系統成為可能。

- 整合人工智慧驅動的自適應演算法以實現即時簽章管理

- 對隱蔽式無人水面和水下航行器系統的需求不斷成長

- 市場限制

- 高昂的資本支出和長期的維護成本限制了其更廣泛的應用。

- 複雜的國防採購程序會延長採購週期。

- 將資源重新分配給新興的電磁軌道炮和定向能量武器系統會減少資金籌措的可能性。

- 高溫超導磁帶和稀土元素磁感測器的供應鏈脆弱性阻礙了生產擴充性。

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按船舶類型

- 航空母艦

- 驅逐艦

- 巡防艦

- 克爾維特

- 潛水艇

- 掃雷艦艇

- 其他船舶類型

- 透過解決方案

- 去古茲

- 脫葉

- 測距

- 按組件

- 控制單元(DCU)

- 功率放大器

- 線圈和電纜

- 磁力計和感測器

- 軟體與分析

- 按安裝類型

- 新成立

- 改裝

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲地區

- 南美洲

- 巴西

- 其他南美洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- L3Harris Technologies Inc.

- Wartsila Corporation

- Polyamp AB

- Larsen & Toubro Limited

- Exail SAS

- IFEN SpA

- American Superconductor Corporation(AMSC)

- Dayatech Merin Sdn Bhd

- DA Group

- Ultra Electronics Holdings Ltd.

- Babcock International Group

- Thales Group

- ESCO Technologies inc.

第7章 市場機會與未來展望

The degaussing systems market size is estimated at USD 0.87 billion in 2025 and is forecasted to reach USD 1.13 billion by 2030, advancing at a 5.3% CAGR.

Rising naval expenditure, the growing sophistication of magnetic-influence sea mines, and the steady pace of fleet-life-extension programs underpin this expansion. North American destroyer and cruiser upgrades, European mine-hunter procurement, and expanding Asia-Pacific submarine fleets ensure a broad customer base for electromagnetic signature control. High-temperature superconducting (HTS) coils and software-defined control units foster technology refresh cycles, while artificial-intelligence (AI) algorithms push performance thresholds by moderating coil currents in real time. Retrofit demand governs contract activity because navies view signature management as a cost-effective path to stretching ship life without new-build outlays. Supply-chain pressure around HTS tape and rare-earth magnetic sensors tempers short-term growth, yet tier-one vendors with vertically integrated component lines mitigate most disruption.

Global Degaussing Systems Market Trends and Insights

Rising Naval Modernization Budgets Accelerating Investment in Degaussing Systems

Steady growth in defense allocations keeps multi-year ship-upgrade pipelines active. The US Navy's destroyer life-extension package earmarks signature-management retrofits as core electronic-warfare enhancements. Italy's mine-hunter program embeds low-magneto-acoustic technologies as a baseline fit. Similar procurement blueprints in the Philippines and Canada cement a long runway for the degaussing systems market.

Increased Deployment of Magnetic-Influence Sea Mines Driving Demand for Magnetic Signature Control

Modern mines combine magnetic, acoustic, and pressure sensors, elevating precise field suppression requirements. The validation of India's multi-influence ground mine exemplifies the rising lethality that naval planners must counter. Historical loss figures reveal that mines remain the most cost-effective anti-surface weapon, anchoring the need for robust degaussing across blue-water and littoral vessels.

Elevated Capital Expenditure and Long-Term Maintenance Costs Limit Broader Adoption

The substantial upfront investment and ongoing operational expenses associated with advanced degaussing systems create adoption barriers, particularly for smaller naval forces with constrained budgets. Comprehensive degaussing installations can represent 2-5% of total vessel construction costs, and HTS-based packages command premiums that exceed copper-coil alternatives by 40-60%. Specialized lifecycle support-including cryogenic cooling plants, helium logistics, and certified technicians-adds USD 2-4 million over a 10-year maintenance horizon for a mid-sized combatant. These financial realities often force navies to confine full-spectrum signature management to aircraft carriers, submarines, and frontline destroyers while accepting residual magnetic footprints on lower-priority hulls. Consequently, market penetration among emerging maritime nations lags because capital charges crowd out other combat-system upgrades.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Retrofit Initiatives Targeting Older Surface Vessels for Degaussing Upgrades

- Emergence of High-Temperature Superconducting Coil Technology Enabling Compact and Efficient Systems

- Supply-Chain Vulnerabilities for HTS Tape and Rare-Earth-Based Magnetic Sensors Hinder Production Scalability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment totals underline how covert platforms anchor spending. The submarines category accounted for 29.65% of degaussing systems market revenue in 2024, while mine counter-measure ships will expand fastest at 7.89% CAGR. This performance differential mirrors the pronounced threat from influence mines and the strategic premium on under-ice and littoral concealment. Submarine programmes in Australia, India, and South Korea integrate full-hull coil sets at the design stage, contrasting with surface ships where retrofitting is the norm. Mine-hunter hulls already built with low-ferrite composites still add distributed micro-loops to crush residual magnetism. Destroyers and frigates maintain sizeable demand because mid-life upgrades coincide with radar and sonar refresh cycles, creating a multiplier effect for degaussing work scopes.

Navies weigh vessel-specific risk exposure when allocating budgets. Submarines face continuous passive detection risk and thus justify high-spec proprietary materials. Conversely, corvettes adopt modular architectures that spread costs using standardized coil modules rated for regional magnetic conditions. The nuanced mix obliges suppliers to field configurable systems ranging from 30-meter unmanned craft to 100,000-ton carriers without rewriting control code.

Continuous degaussing systems cornered 60.90% of 2024 revenue, highlighting their status as a baseline fit. Though degaussing remains core, deperming has re-emerged because modern steels retain higher remanence after repeated polar transits. A 6.12% CAGR through 2030 underscores how navies view periodic demagnetization as vital insurance before deployment into mined chokepoints. Contemporary pierside deperming cages employ pulsed direct current techniques capable of 95.5% flux-density reduction in half the legacy processing time. Additionally, portable deperming mats allow frigates to reset signatures during patrols without returning to home dock, raising operational readiness and underpinning a positive outlook for the deperming slice of the degaussing systems market.

Although a smaller niche, ranging facilities close the feedback loop by providing empirical magnetic-field data. Software analytics extrapolate these readings into coil-current setpoints, demonstrating that even lower-revenue segments create pull-through for higher-margin digital services.

The Degaussing Systems Market Report is Segmented by Vessel Type (Aircraft Carriers, Destroyers, Frigates, Corvettes, Submarines, and More), Solution (Degaussing, Deperming, and Ranging), Component (Control Units, Power Amplifiers, Coils and Cabling, and More), Installation Type (New-Build Installation and Retrofit), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 34.17% of 2024 revenue. The US Navy's destroyer and cruiser service-life-extension contracts alone sustain a multi-billion-dollar pipeline that favors domestically produced coils, magnetometers, and control units. Canada's Kingston-class degaussing refits and allied Foreign Military Sales (FMS) cases further reinforce the region's standing. With three qualified HTS testbeds, North American yards host the most advanced superconducting deployment programmes worldwide.

Asia-Pacific will post the highest 8.80% CAGR through 2030. Rising defense budgets and contested sea lanes propel demand. Japan extends HTS trials to its Mogami-class frigates, while Australia's AUKUS submarine endeavour integrates magnetic-signature management standards that exceed legacy benchmarks. India's mine programme, coupled with Southeast Asian littoral fleet expansion, accelerates the adoption of micro-degaussing solutions for unmanned platforms. Chinese shipyards embed AI-driven field-tuning software across new Type 054B builds, setting regional technology pace and prompting peers to keep up.

Europe remains pivotal, galvanized by NATO's Baltic and High North posture. Italy's mine-hunter initiative and France's FDI frigate series incorporate deperming and ranging combinations that drive systems-of-systems procurement. The United Kingdom's Type 31 programme specifies digital-twin-validated coil layouts as standard, underscoring regional commitment to magnetic hygiene. Parallel investments in polar research icebreakers introduce civil maritime niches for degaussing vendors, diversifying revenue streams beyond combatants.

- L3Harris Technologies Inc.

- Wartsila Corporation

- Polyamp AB

- Larsen & Toubro Limited

- Exail SAS

- IFEN S.p.A.

- American Superconductor Corporation (AMSC)

- Dayatech Merin Sdn Bhd

- DA Group

- Ultra Electronics Holdings Ltd.

- Babcock International Group

- Thales Group

- ESCO Technologies inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising naval modernization budgets accelerating investment in degaussing systems

- 4.2.2 Increased deployment of magnetic-influence sea mines driving demand for magnetic signature control

- 4.2.3 Expansion of retrofit initiatives targeting older surface vessels for degaussing upgrades

- 4.2.4 Emergence of high-temperature superconducting (HTS) coil technology enabling compact and efficient systems

- 4.2.5 Integration of AI-powered adaptive algorithms for real-time signature management

- 4.2.6 Growing requirement for systems in stealthy unmanned surface and underwater vehicles

- 4.3 Market Restraints

- 4.3.1 Elevated capital expenditure and long-term maintenance costs limit broader adoption

- 4.3.2 Extended acquisition timelines due to complex defense procurement procedures

- 4.3.3 Resource reallocation toward emerging railgun and directed-energy weapon systems reduces funding availability

- 4.3.4 Supply-chain vulnerabilities for HTS tape and rare-earth-based magnetic sensors hinder production scalability

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Vessel Type

- 5.1.1 Aircraft Carriers

- 5.1.2 Destroyers

- 5.1.3 Frigates

- 5.1.4 Corvettes

- 5.1.5 Submarines

- 5.1.6 Mine Countermeasure Vessels

- 5.1.7 Other Vessel Types

- 5.2 By Solution

- 5.2.1 Degaussing

- 5.2.2 Deperming

- 5.2.3 Ranging

- 5.3 By Component

- 5.3.1 Control Units (DCU)

- 5.3.2 Power Amplifiers

- 5.3.3 Coils and Cabling

- 5.3.4 Magnetometers and Sensors

- 5.3.5 Software and Analytics

- 5.4 By Installation Type

- 5.4.1 New-Build Installation

- 5.4.2 Retrofit

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 L3Harris Technologies Inc.

- 6.4.2 Wartsila Corporation

- 6.4.3 Polyamp AB

- 6.4.4 Larsen & Toubro Limited

- 6.4.5 Exail SAS

- 6.4.6 IFEN S.p.A.

- 6.4.7 American Superconductor Corporation (AMSC)

- 6.4.8 Dayatech Merin Sdn Bhd

- 6.4.9 DA Group

- 6.4.10 Ultra Electronics Holdings Ltd.

- 6.4.11 Babcock International Group

- 6.4.12 Thales Group

- 6.4.13 ESCO Technologies inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment