|

市場調查報告書

商品編碼

1851912

扭力感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Torque Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

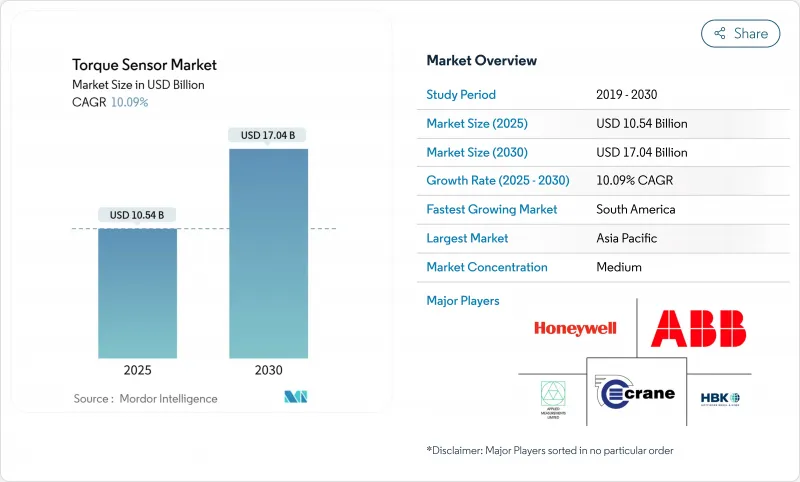

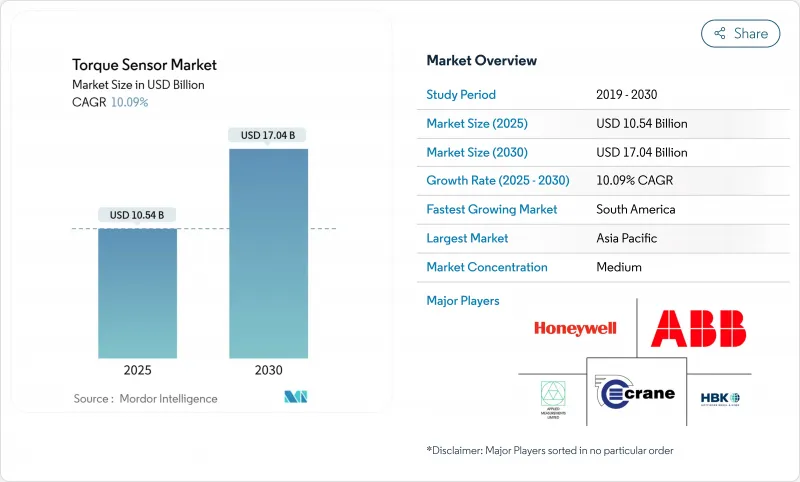

全球扭力感測器市場預計到 2025 年將達到 105.4 億美元,到 2030 年將達到 170.4 億美元,年複合成長率為 10.09%。

這一發展勢頭主要得益於汽車動力傳動系統的快速電氣化、工業自動化程度的不斷提高,以及基礎設施、能源和醫療設備領域日益嚴格的精密測量要求。隨著扭力回饋成為電動方向盤、傳動系統控制和進階駕駛輔助功能的關鍵要素,車輛電氣化持續支撐著市場需求。協作機器人的同步發展、單車感測器數量的增加,以及電動自行車和其他微型出行平台的普及,為大規模生產和降低成本創造了更多機會。供應商的差異化策略也從單純的精度轉向了抗電磁干擾能力、無線遠端檢測以及與預測分析平台的整合。印度和南美洲的區域採購舉措旨在降低對中國稀土的依賴,但供應鏈對高等級磁彈性合金的依賴仍然是一個限制。

全球扭力感測器市場趨勢與洞察

電動動力方向盤轉向系統(EPS)

即使在經濟放緩時期,電動方向盤的強制性扭矩監測也提振了市場需求。將於2024年發布的歐洲法規強制要求持續提供轉向扭矩回饋以支援自動駕駛,並要求所有電動輔助轉向系統單元至少整合一個感測器。為了滿足功能安全目標,原始設備製造商 (OEM) 採用了雙冗餘設計,有效地將每輛車的感測器數量增加了一倍。像Vitesco這樣的供應商認為,電動輔助轉向系統的扭矩感測是實現半自動車道維持和駕駛意圖預測的核心技術。相同數據通道還可用於無線分析,從而提高了整合商的終身服務收入。隨著傳統液壓轉向平台的衰落,現有車輛的主流已不可逆轉地轉向電動輔助轉向系統架構。

製造業自動化與協作機器人的崛起

協作機器人需要瞬時扭矩感測以符合 ISO 10218 安全限值,這使得協作機器人的出貨量與感測器單元之間存在一一對應的關係。到 2024 年,協作機器人的全球銷售將超過傳統工業機器人,從而推動用於電子、食品和輕型組裝的抗電磁干擾多軸扭矩感測器的快速成長。認證指南要求採用冗餘感,這實際上提高了每個機器人的組件成本。預計到 2024 年,波蘭中小企業的滲透率將僅為 26%,凸顯了歐洲製造業的巨大潛力。長期影響不僅限於單一自動化設備,智慧工作單元在紡織和農產品加工廠的普及也將進一步擴大其影響範圍。

汽車生產項目中的價格敏感性

原始設備製造商 (OEM) 的成本削減目標已將主要電動車平台上的感測器價格限制在每件近 50 美元,迫使供應商移除輔助功能。為了抵消電池組成本,所有動力傳動系統零件都受到更嚴格的審查,而平台標準化則推動了規格的商品化。 2024 年稀土磁鐵供應中斷加劇了這一困境,迫使印度和南美的汽車製造商考慮使用替代材料,但代價是精度降低。供應商的應對措施是採用模組化電子元件,為高階車型提供可選的調整板,同時為入門車型保留成本更低的核心零件。

細分市場分析

到2024年,旋轉式扭力感測器將在傳動系統、風力發電機和製程控制領域佔據65.5%的扭力感測器市場。旋轉式扭矩感測器可提供連續的現場測量,支援電動車和渦輪機的閉合迴路控制。反作用式扭力感測器的市佔率從較小的基數成長至11.8%,這主要得益於機械加工和電池封裝製程中自動化測試台的普及。數位遙測技術透過取消滑環改進了旋轉式扭力感測器的設計,使其在嚴苛的工業環境中更加可靠。

旋轉式感測器已發展成為邊緣運算節點,將資料傳輸到雲端儀表板,用於預測性維護。在線加工採用反作用單元來捕捉指示刀具磨損的扭矩峰值,從而推進航太結構銑削加工的零缺陷目標。隨著原始設備製造商 (OEM) 對舊組裝維修以符合可追溯性要求,扭力感測器市場也從中受益,確保這兩類感測器能夠持續同步成長。

應變計在成本優勢和久經考驗的可靠性的支撐下,預計2024年將維持48.3%的銷售成長率。然而,聲表面波(SAW)感測器將實現13.2%的複合年成長率,並在電磁干擾抑制和無線數據傳輸至關重要的領域佔據市場佔有率。光纖感測器則主要面向實驗室和航太校準應用,在這些領域,納弧度級的解析度足以支撐其更高的價格。

2024年,聲表面波(SAW)技術的創新實現了1000°C的耐溫性和10µm的位移解析度。這些優勢為燃氣渦輪機和深井鑽探等極端環境應用領域開闢了市場。因此,扭矩感測器市場正經歷技術分化:低成本應變計用於大眾化的汽車轉向系統應用,而高價值的SAW或光學單元則用於關鍵或任務關鍵型應用。

區域分析

亞太地區持續保持主導,預計2024年將佔全球銷售額的36.3%,主要得益於汽車組裝、半導體製造和機器人領域的高密度封裝需求。中國引領EPS生產,日本供應高精度應變計基板,韓國電子巨頭則在電池和顯示器生產線中引入了高解析度扭力回饋技術。印度大力推動稀土磁鐵國產化,目標是到2026年實現年產500噸的產能,預計有助於降低全部區域的原料風險。

北美地區憑藉其高階市場地位,在航太和國防整合商採用高溫光學感測器進行引擎測試方面佔有一席之地。美國電動車新興企業利用軸向電機,需要先進的扭矩控制迴路,從而推動了對錶面聲波(SAW)和磁彈性元件的需求。墨西哥作為汽車出口中心的地位日益提升,帶動了對成本敏感的中等批量轉向和傳動系統感測裝置訂單的成長。

在歐洲,監管機構逐步將扭力測量納入協作機器人安全標準和自動駕駛車輛就緒規則。德國自動化供應商將感測器閘道整合到可程式邏輯控制器中,法國核能維護承包商則採用無線扭力頭來加快停電期間的檢修速度。在巴西的引領下,南美洲的扭力測量需求成長最為迅速,年複合成長率達到11.4%,這主要得益於原始設備製造商(OEM)安裝了需要大量測試台儀器的新型沖壓和動力傳動系統線。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電動動力方向盤轉向系統(EPS)

- 製造業自動化和協作機器人的興起

- 電動自行車和微型移動工具生產激增

- 軸流式馬達在電動車傳動系統的應用日益廣泛

- 智慧風力發電機的車載扭力監測

- 市場限制

- 汽車銷售計劃中的價格敏感性

- 電磁干擾下的可靠度問題

- 高等級磁彈性合金供應瓶頸

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素的影響

- 產業價值鏈分析

第5章 市場規模與成長預測

- 依產品類型

- 反應

- 旋轉/迴轉

- 透過技術

- 應變計

- 磁彈性

- 光學

- SAW(表面聲波)

- 其他

- 透過使用

- 車

- 航太/國防

- 工業製造與機器人

- 醫療保健

- 能源與電力

- 按最終用戶行業分類

- OEM測試台和品質保證

- 流程監控

- 研究與開發

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd

- Honeywell International Inc.

- Hottinger Bruel & Kjaer(HBK-Spectris plc)

- TE Connectivity Ltd

- Kistler Instrumente AG

- Infineon Technologies AG

- Norbar Torque Tools Ltd

- Crane Electronics Ltd

- S. Himmelstein & Company Inc.

- Datum Electronics Ltd(Indutrade AB)

- Applied Measurements Ltd

- PCB Piezotronics Inc.(MTS)

- MagCanica Inc.

- Futek Advanced Sensor Technology Inc.

- Forsentek Co. Ltd

- Bota Systems AG

- ATI Industrial Automation(Novanta)

- Althen Sensors & Controls GmbH

- Sensor Technology Ltd(TorqSense)

- Burster Prazisionsmesstechnik GmbH

- Transense Technologies plc(SAWSense)

- Interface Inc.

- Mountz Inc.

- KTR Kupplungstechnik GmbH

- OPKON Optik Elektronik Kontrol San. AS

第7章 市場機會與未來展望

The global torque sensor market size stood at USD 10.54 billion in 2025 and is forecast to reach USD 17.04 billion by 2030, advancing at a 10.09% CAGR.

Momentum has been underpinned by the rapid electrification of vehicle powertrains, deepening industrial automation, and stricter precision-measurement requirements in infrastructure, energy and medical equipment. Automotive electrification continued to anchor demand as torque feedback became integral to electric power-steering, drivetrain control and advanced driver-assistance functions. Parallel growth in collaborative robots increased the sensor content per machine, while e-bike and other micromobility platforms multiplied high-volume, low-cost opportunities. Vendors shifted differentiation away from raw accuracy toward electromagnetic-interference resilience, wireless telemetry, and integration with predictive-analytics platforms. Supply chain exposure to high-grade magnetoelastic alloys remained a limiting factor, although regional sourcing initiatives in India and South America sought to ease dependence on Chinese rare-earth metals.

Global Torque Sensor Market Trends and Insights

Electrification of Power-Steering (EPS) Systems

Mandated torque monitoring for electric power-steering hardened demand even during economic slow-downs. European regulations issued in 2024 required continuous steering-torque feedback for autonomous-readiness, obligating every EPS unit to embed at least one sensor. OEMs adopted dual-redundant designs to satisfy functional-safety targets, effectively doubling sensor volumes per vehicle. Suppliers such as Vitesco cited EPS torque sensing as a core enabler for semi-autonomous lane-keeping and driver-intention prediction. The same data channel is reused in over-the-air analytics, increasing lifetime service revenue for integrators. As legacy hydraulic steering platforms sunset, the addressable automotive base shifted irreversibly toward EPS architectures.

Rising Automation and Cobots in Manufacturing

Collaborative robots required instantaneous torque detection to comply with ISO 10218 safety limits, creating a one-to-one relationship between cobot shipments and sensor units. Global cobot sales outpaced conventional industrial robots in 2024, inducing a steep ramp in EMI-resistant, multi-axis torque sensors destined for electronics, food and light-assembly lines. Certification guidelines enforced redundant sensing, effectively raising bill-of-materials value for each robot. Penetration remained only 26% among Polish SMEs in 2024, illustrating vast latent upside across European manufacturing. Long-term impact spans beyond discrete automation as smart work-cells propagate into textile and agri-processing plants.

Price Sensitivity in Volume Automotive Programs

OEM cost-down targets capped sensor pricing near USD 50 per unit in mainstream EV platforms, pressuring suppliers to strip auxiliary features. The need to offset battery-pack costs heightened scrutiny of every drivetrain component, with platform standardization further commoditizing specifications. Rare-earth magnet supply disruptions in 2024 exacerbated the dilemma, forcing Indian and South American automakers to weigh substitute materials that risked lower precision. Suppliers countered with modular electronics, allowing optional conditioning boards for premium trims while preserving a low-cost core for entry variants.

Other drivers and restraints analyzed in the detailed report include:

- Surge in E-Bike and Micromobility Production

- Growing Use in Axial-Flux Motors for EV Drivetrains

- Reliability Issues under Electromagnetic Interference

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rotational units captured 65.5% of torque sensor market share in 2024 on the strength of drivetrain, wind-turbine and process-control deployments. They offered continuous, in-situ measurement that supported closed-loop control in EVs and turbines. Reaction types, while smaller in base, posted an 11.8% CAGR as automated test-stands proliferated across machining and battery-cell wrap processes. Digital telemetry elevated rotational designs by removing slip rings, boosting reliability in harsh industrial settings.

Rotational sensors evolved into edge-computing nodes, streaming data to cloud dashboards for predictive maintenance. In-process machining adopted reaction units to catch torque spikes indicative of tool wear, advancing zero-defect programs in aerospace structural milling. The torque sensor market benefits as OEMs retrofit older assembly lines to meet traceability mandates, ensuring both sensor categories sustain parallel growth.

Strain-gauges retained 48.3% revenue in 2024, favored for cost and proven ruggedness. Yet, SAW sensors recorded a 13.2% CAGR and gained share where EMI immunity and wireless data mattered most. Magnetoelastic variants served sealed, non-contact duties in pump shafts, whereas optical fibers targeted lab and aerospace calibration where nano-radian resolution justified premium pricing.

SAW innovations in 2024 achieved temperature tolerance to 1,000 °C and 10 µm displacement resolution. Such capabilities unlocked extreme-environment markets like gas turbines and deep-well drilling. The torque sensor market thus witnessed technology bifurcation: low-cost strain-gauges for commoditized automotive steering, and high-value SAW or optical units for hazardous or mission-critical niches.

The Global Torque Sensor Market Report is Segmented by Product Type (Reaction Torque Sensors, Rotational/Rotary Torque Sensors), Technology (Strain-Gauge, Magnetoelastic, and More), Application (Automotive, Aerospace and Defense, and More), End-User Industry (OEM Test-Stand and QA, In-Process Monitoring, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 36.3% of 2024 revenue and sustained leadership through dense automotive assembly, semiconductor fabrication and robotics adoption. China led EPS volumes, Japan supplied precision strain-gauge substrates, and South Korea's electronics majors deployed high-resolution torque feedback in battery and display lines. India's push to localize rare-earth magnet production, with 500-tonne annual capacity targeted by 2026, promised to moderate raw-material risk across the region.

North America maintained its premium niche as aerospace and defense integrators employed high-temperature optical sensors for engine testing. US EV start-ups leveraged axial-flux motors requiring sophisticated torque control loops, bolstering demand for SAW and magnetoelastic devices. Mexico's growing role as an automotive export hub amplified mid-volume, cost-sensitive orders for steering and drivetrain sensing.

Europe advanced steadily on regulatory mandates that embedded torque measurement into collaborative robot safety standards and vehicle autonomous-readiness rules. Germany's automation vendors integrated sensor gateways into programmable-logic controllers, while France's nuclear maintenance contractors adopted wireless torque heads to accelerate outage turnarounds. South America, led by Brazil, posted the fastest 11.4% CAGR as OEMs installed new stamping and powertrain lines requiring extensive test-stand instrumentation.

- ABB Ltd

- Honeywell International Inc.

- Hottinger Bruel & Kjaer (HBK - Spectris plc)

- TE Connectivity Ltd

- Kistler Instrumente AG

- Infineon Technologies AG

- Norbar Torque Tools Ltd

- Crane Electronics Ltd

- S. Himmelstein & Company Inc.

- Datum Electronics Ltd (Indutrade AB)

- Applied Measurements Ltd

- PCB Piezotronics Inc. (MTS)

- MagCanica Inc.

- Futek Advanced Sensor Technology Inc.

- Forsentek Co. Ltd

- Bota Systems AG

- ATI Industrial Automation (Novanta)

- Althen Sensors & Controls GmbH

- Sensor Technology Ltd (TorqSense)

- Burster Prazisionsmesstechnik GmbH

- Transense Technologies plc (SAWSense)

- Interface Inc.

- Mountz Inc.

- KTR Kupplungstechnik GmbH

- OPKON Optik Elektronik Kontrol San. A.S.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification of Power-Steering (EPS) systems

- 4.2.2 Rising Automation and Cobots in Manufacturing

- 4.2.3 Surge in E-bike and Micromobility Production

- 4.2.4 Growing Use in Axial-Flux Motors for EV Drivetrains

- 4.2.5 On-board Torque Monitoring in Smart Wind Turbines

- 4.3 Market Restraints

- 4.3.1 Price Sensitivity in Volume Automotive Programs

- 4.3.2 Reliability Issues under Electromagnetic Interference

- 4.3.3 Supply Bottlenecks for High-Grade Magnetoelastic Alloys

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors

- 4.9 Industry Value-Chain Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Reaction

- 5.1.2 Rotational / Rotary

- 5.2 By Technology

- 5.2.1 Strain-Gauge

- 5.2.2 Magnetoelastic

- 5.2.3 Optical

- 5.2.4 SAW (Surface Acoustic Wave)

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Industrial Manufacturing and Robotics

- 5.3.4 Medical and Healthcare

- 5.3.5 Energy and Power

- 5.4 By End-User Industry

- 5.4.1 OEM Test-Stand and QA

- 5.4.2 In-Process Monitoring

- 5.4.3 Research and Development

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Honeywell International Inc.

- 6.4.3 Hottinger Bruel & Kjaer (HBK - Spectris plc)

- 6.4.4 TE Connectivity Ltd

- 6.4.5 Kistler Instrumente AG

- 6.4.6 Infineon Technologies AG

- 6.4.7 Norbar Torque Tools Ltd

- 6.4.8 Crane Electronics Ltd

- 6.4.9 S. Himmelstein & Company Inc.

- 6.4.10 Datum Electronics Ltd (Indutrade AB)

- 6.4.11 Applied Measurements Ltd

- 6.4.12 PCB Piezotronics Inc. (MTS)

- 6.4.13 MagCanica Inc.

- 6.4.14 Futek Advanced Sensor Technology Inc.

- 6.4.15 Forsentek Co. Ltd

- 6.4.16 Bota Systems AG

- 6.4.17 ATI Industrial Automation (Novanta)

- 6.4.18 Althen Sensors & Controls GmbH

- 6.4.19 Sensor Technology Ltd (TorqSense)

- 6.4.20 Burster Prazisionsmesstechnik GmbH

- 6.4.21 Transense Technologies plc (SAWSense)

- 6.4.22 Interface Inc.

- 6.4.23 Mountz Inc.

- 6.4.24 KTR Kupplungstechnik GmbH

- 6.4.25 OPKON Optik Elektronik Kontrol San. A.S.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment