|

市場調查報告書

商品編碼

1851903

生物辨識技術:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

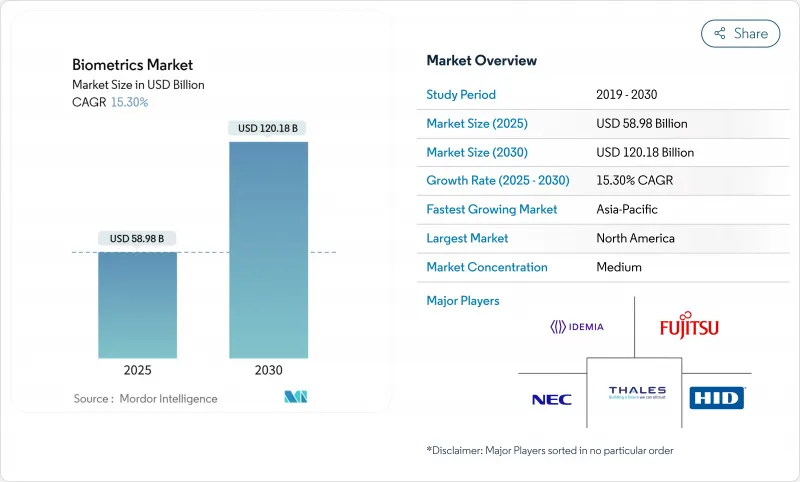

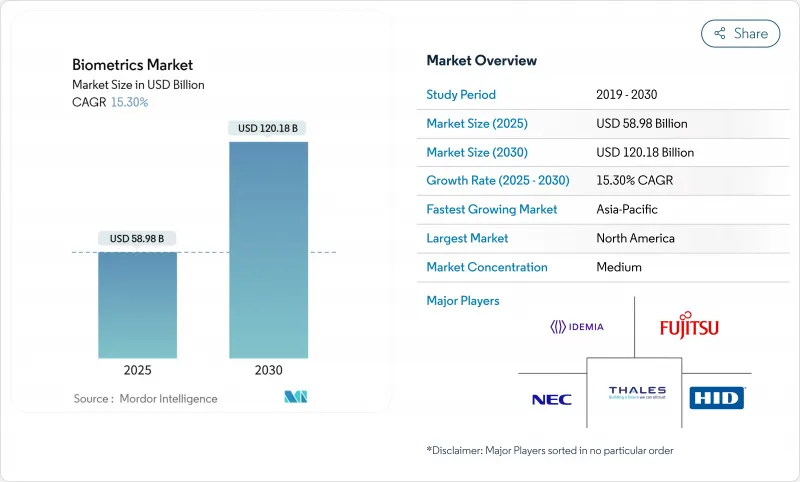

預計到 2025 年,生物辨識技術市場規模將成長至 589.8 億美元,到 2030 年將成長至 1,201.8 億美元,複合年成長率為 15.30%。

政府數位身分識別計劃、支付代幣化以及機場現代化建設的加速推動了這一成長,也催生了對無摩擦身份驗證的需求。儘管目前的部署仍以硬體為主,但隨著企業從點解決方案轉向平台模式,雲端軟體引擎正經歷最快的成長。中國和歐盟的新隱私法規在加強合規要求的同時,也鼓勵採用兼顧準確性和用戶授權管理的多模態架構。在北美,自2025年5月起實施的REAL ID引發了聯邦和州政府的緊急採購浪潮,用於在機場和陸路交通管理部門部署相關設備。在亞太地區,將生物辨識技術整合到超級應用、電子錢包和銀行電子KYC框架中,是推動長期需求成長的主要因素。

全球生物辨識市場趨勢與洞察

亞洲各國政府支持的國家電子識別計劃

亞洲各國政府正引領大規模數位身分轉型。韓國基於智慧型手機的居民登記卡以及越南決定在2025年7月前將生物識別身份擴展到外國人,為建造包容性生態系統樹立了標竿。印尼耗資2億美元的INA數位平台以及菲律賓8,950萬人的公民登記計劃,將使此前銀行帳戶銀行服務的成年人也能獲得金融服務。斯里蘭卡結合指紋、臉部和視網膜掃描的多模態計畫於2026年完成,顯示新興經濟體正在跨越傳統基礎設施的鴻溝。

EMVCo 和 ISO 標準先進指紋支付卡

隨著EMVCo和ISO標準的統一,生物辨識卡已從試點階段過渡到商業發行階段。英飛凌SECORA Pay Bio晶片和泰雷茲公司的全球試驗降低了誤報率,並提高了交易限額。萬事達卡的身份驗證和密碼支援功能可實現無縫認證,幫助發卡機構減少詐欺和扣回爭議帳款。供應商預測,到2028年,生物辨識卡的出貨量將達到1.133億張,因為銀行正在優先發展無需PIN碼的非接觸式支付體驗。

GDPR 和 BIPA 訴訟風險抑制推廣

2024年至2025年間,BIPA(伊利諾州生物辨識資訊隱私法案)的賠償總額將超過2億美元,其中包括Clearview AI支付的5,175萬美元。這表明,未經明確同意部署臉部認證的公司將面臨巨額賠償責任。 GDPR(歐盟通用資料保護規範)嚴格的資料最小化和本地處理規則將使每個歐洲安裝專案的合規成本增加5萬至20萬歐元(5.65萬至22.6萬美元),從而縮小小型計劃的潛在市場。美國聯邦貿易委員會(FTC)對Rite Aid的執法行動為美國演算法偏見審核樹立了先例,迫使供應商重新設計系統架構,以實現隱私保護。

細分市場分析

軟體引擎從輔助角色躍升為成長最快的元件,複合年成長率高達 16.6%,而硬體則維持了 42.5% 的收入佔有率。各組織正在評估雲端協作、基於人工智慧的活體偵測以及能夠持續適應不斷演變的詐欺行為的去中心化身分錢包。 Entrust 收購 Onfido 延續了這一發展趨勢,新增的深度造假防護功能可將身分防偽能力提升五倍。

在硬體領域,專用感測器對於向安全元件提供加密模板至關重要。英飛凌的汽車指紋識別晶片表明,量產級組件正在將生物識別市場拓展到移動出行和門禁領域。服務領域的規模雖然最小,但隨著整合商為受監管行業量身打造多模態部署方案,其應用也日益廣泛。

虹膜辨識將以18.2%的複合年成長率成長,這得益於液態透鏡光學技術的進步,該技術可降低材料成本並縮小外形規格。指紋辨識技術將持續發展壯大,智慧型手機、支付卡和考勤系統等應用將推動其普及,預計到2024年將佔據生物辨識市場37.0%的佔有率。臉部認證將穩定滲透到機場和體育場館等場所,而語音分析技術將在客服中心身份驗證領域佔據一席之地。

行為生物辨識技術,特別是步態和擊鍵動態特徵,增加了一層被動式安全防護,在不增加使用者操作負擔的情況下提升了安全性。成熟的指紋和臉部辨識解決方案正擴大與虹膜、手掌和語音模組相結合,形成多模態套件,從而實現收入來源多元化並降低單一模態辨識的風險。

隨著衛生和便利性逐漸取代傳統觀念,非接觸式辨識技術正以17.1%的複合年成長率快速成長。預計到2024年,非接觸式系統將佔據生物辨識市場37.0%的佔有率,但其成長動能正逐漸被醫療保健和零售領域部署的非接觸式指紋、臉部認證和虹膜辨識終端所取代。 ZKTeco 認為,非接觸式偏好是長期趨勢。

以大陸集團車載攝影機和雷射組合為代表的隱形感測技術,將生物辨識技術從門禁擴展到健康監測。憑藉先進的人工智慧技術,非接觸式辨識的精確度已接近接觸式辨識的標準,滿足了高安全保障領域的需求。

區域分析

2024年,北美將佔全球收入的30.7%,這主要得益於聯邦政府的資金支持和私人企業的廣泛應用。美國運輸安全管理局(TSA)加快擴容通道,以及國土安全部(DHS)為身分識別管理預留的2.508億美元預算,為供應商提供了多年穩定的市場需求。加拿大和墨西哥將對其陸地邊境的電子閘門進行現代化改造,以簡化貿易流程並增強其在北美大陸的影響力。

預計到2030年,亞太地區的複合年成長率將達到18.5%,成為成長最快的地區。韓國全國行動身分識別系統的建成、中國人臉部辨識規則的規範化以及印度與Aadhaar(印度居民身分識別系統)掛鉤的付費服務,將推動一個規模超過任何單一國家計畫的統一生物辨識市場的發展。該地區48億數位錢包用戶正在推動銀行和通訊業者將生物辨識KYC(了解你的客戶)流程從可選轉變為強制執行。

在 GDPR 的嚴格審查下,歐洲保持了穩步成長:歐盟邊境系統在申根國家推廣邊境生物識別技術,美國新的信任框架促進了私營部門憑證創新,北歐國家證明,設備端處理既能滿足隱私監管機構的要求,又不犧牲速度,從而塑造了整個歐洲大陸的採購標準。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲政府支持的國家電子識別計劃

- 北美和歐洲的EMVCo和ISO標準推進指紋支付卡

- 疫情後歐洲商業不動產對非接觸式實體存取的需求

- 美國運輸安全管理局藍圖推動聯邦採購激增

- 中國的「智慧機場2025」計畫加速推進人臉和語音生物辨識技術的應用

- 海灣合作理事會和非洲中央銀行的生物辨識KYC強制令

- 市場限制

- GDPR和BIPA訴訟風險阻礙了臉部認證的廣泛應用

- 演算法對深色人種的偏見引發採購暫停

- CMOS影像感測器短缺阻礙了指紋模組的供應。

- 南美零售連鎖店的整合與投資報酬率問題

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業相關利益者分析

- 投資與資金籌措分析

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體

- 服務

- 透過生物識別方式

- 生理生物辨識市場

- 指紋自動指紋辨識系統

- 非自動指紋辨識系統(AFIS)指紋識別

- 臉部辨識

- 虹膜辨識

- 其他(手掌、手部幾何形狀)

- 行為生物辨識市場

- 語音辨識

- 簽名檢驗

- 其他(步態分析、擊鍵動力學)

- 生理生物辨識市場

- 按聯繫類型

- 聯繫類型

- 非接觸式

- 混合

- 按身份驗證類型

- 單一因素

- 多因素

- 透過使用

- 物理和邏輯存取控制

- 考勤管理

- 支付和交易認證

- 電子護照和邊境管制

- 病患識別及電子病歷安全

- 客戶註冊(電子身份驗證)

- 公共監督與安全

- 車載和智慧車輛介面

- 按最終用途行業分類

- 政府和執法部門

- BFSI

- 衛生保健

- 消費性電子產品

- 商業和零售

- 旅行和移民

- 軍事/國防

- 車

- 教育

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- ASEAN

- 澳洲

- 紐西蘭

- 其他亞太地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 以色列

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Thales Group

- NEC Corporation

- IDEMIA France SAS

- Fujitsu Limited

- HID Global Corporation

- Assa Abloy AB

- Aware Inc.

- Suprema Inc.

- Synaptics Incorporated

- Bio-Key International Inc.

- Zwipe AS

- Fingerprint Cards AB

- M2SYS Technology

- Infineon Technologies AG

- Entrust Corporation

- ImageWare Systems Inc.

- Phonexia sro

- BioID AG

- Crossmatch Technologies Inc.

- Hitachi Ltd.

第7章 市場機會與未來展望

The biometrics market size is valued at USD 58.98 billion in 2025 and is forecast to expand to USD 120.18 billion by 2030, advancing at a 15.30% CAGR.

The expansion is underpinned by government digital-ID programs, rising payments tokenization, and surging airport modernization that collectively elevate the need for frictionless identity proofing. Hardware still dominates current deployments, yet cloud-ready software engines are scaling fastest as enterprises shift from point solutions to platform models. New privacy regulations in China and the European Union are tightening compliance requirements, simultaneously encouraging multi-modal architectures that balance accuracy with consent management. In North America, REAL ID enforcement from May 2025 is driving an urgent wave of federal and state procurements for airport and DMV roll-outs. Asia Pacific's integration of biometrics into super-apps, wallets, and bank e-KYC frameworks positions the region as the long-run demand accelerator.

Global Biometrics Market Trends and Insights

Government-backed National e-ID Programs Across Asia

Asian authorities are orchestrating large-scale digital identity transformations. South Korea's smartphone-based resident registration card and Vietnam's decision to extend biometric IDs to foreign nationals by July 2025 have set benchmarks for inclusive ecosystems. Indonesia's USD 200 million INA Digital platform and the Philippines' registration of 89.5 million citizens unlock financial services for previously unbanked adults. Sri Lanka's multi-modal program combining fingerprints, face, and retina scans targets completion in 2026, illustrating how emerging economies leapfrog legacy infrastructures.

EMVCo and ISO Standards Catalyzing Fingerprint Payment Cards

Harmonized EMVCo and ISO rules have moved biometric cards from pilots to commercial issuance. Infineon's SECORA Pay Bio silicon and Thales' global trials cut false-accept rates and allow higher transaction ceilings . Mastercard's Identity Check and passkey support promise frictionless authentication, helping issuers reduce fraud and chargebacks. Vendors forecast shipments of 113.3 million biometric cards by 2028 as banks prioritize PIN-free contactless experiences.

GDPR and BIPA Litigation Risks Curtailing Roll-outs

More than USD 200 million in BIPA settlements during 2024-2025, including Clearview AI's USD 51.75 million payment, signals material liability for enterprises deploying facial recognition without explicit consent. GDPR's strict data-minimization and local-processing rules add EUR 50,000-200,000 (USD 56,500-226,000) compliance cost per European installation, shrinking the addressable base for small projects. The FTC's enforcement against Rite Aid sets a U.S. precedent for algorithmic-bias audits, compelling vendors to redesign architectures for privacy by design.

Other drivers and restraints analyzed in the detailed report include:

- U.S. TSA Biometrics Road-map Driving Federal Procurement Surge

- China's "Smart Airport 2025" Policy Accelerating Face & Voice Biometrics

- Algorithmic Bias Triggering Procurement Moratoriums

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software engines grew from a supporting role to the highest-growth component at a 16.6% CAGR, even while hardware kept the 42.5 revenue share. Organizations value cloud orchestration, AI-based liveness detection, and decentralized identity wallets that continuously adapt to evolving fraud. Entrust's acquisition of Onfido aligns with this trajectory, adding deep-fake countermeasures that improved forged-ID prevention five-fold.

The hardware segment remains indispensable where specialized sensors deliver cryptographic templates to secure elements. Infineon's automotive-qualified fingerprint ICs illustrate how production-grade components expand the biometrics market into mobility and access domains. Services, while smallest, record consistent uptake as integrators customize multi-modal deployments for regulated industries.

Iris recognition posts an 18.2% CAGR, supported by liquid-lens optics that lower bill-of-material cost and shrink form factors. Fingerprint remains entrenched with 37.0% of biometrics market share in 2024, thanks to smartphones, payment cards, and time-clock systems. Facial recognition steadily penetrates airports and stadiums, while voice analytics gains footing in call-center authentication.

Behavioral biometrics, particularly gait and keystroke dynamics, add passive layers that elevate security without user friction. Mature fingerprint and facial solutions increasingly pair with iris, palm-vein, or voice modules in multi-modal kits, diversifying revenue and diluting single-modality risk.

Contactless modalities are scaling at 17.1% CAGR as hygiene and convenience trump legacy mindset. The biometrics market size for contact-based systems, despite a 37.0% share in 2024, is losing momentum to touchless fingerprint, face, and iris kiosks rolled out in healthcare and retail. ZKTeco identifies contactless preference as a long-term secular shift.

Invisible sensing, showcased by Continental's in-vehicle camera-laser combo, morphs biometrics beyond access into wellness monitoring. AI improvements cut false rejects, moving touchless accuracy closer to contact-based benchmarks and satisfying high-assurance sectors.

The Biometrics Market Report is Segmented by Component (Hardware, Software, Services), Biometric Modality (Physiological, Behavioral), Contact Type (Contact-Based, Contactless, Hybrid), Authentication Type (Single-Factor, Multi-Factor), Application (Access Control, Payment Authentication, and More), End-Use Industry (Government, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America produced 30.7% of global revenue in 2024, anchored by federal budgets and widespread private-sector adoption. TSA's accelerating lane expansions and DHS's USD 250.8 million line-item for identity management provide a multi-year demand floor for vendors . Canada and Mexico modernize land-border e-gates to streamline trade, reinforcing continental scale.

Asia Pacific records the steepest trajectory with an 18.5% CAGR forecast to 2030. South Korea's nationwide mobile-ID completion, China's codified face-recognition rules, and India's Aadhaar-linked pay services cultivate a unified biometrics market bigger than any single-country program. The region's 4.8 billion digital-wallet users push biometric KYC from optional to mandatory across banks and telecoms.

Europe's growth remains steady under strict GDPR oversight. The EU Entry/Exit System rolls out border biometrics across Schengen states, while the United Kingdom's new trust framework fosters private-sector credential innovation. Nordic pilots prove that on-device processing can satisfy privacy watchdogs without sacrificing speed, shaping procurement criteria across the continent.

- Thales Group

- NEC Corporation

- IDEMIA France SAS

- Fujitsu Limited

- HID Global Corporation

- Assa Abloy AB

- Aware Inc.

- Suprema Inc.

- Synaptics Incorporated

- Bio-Key International Inc.

- Zwipe AS

- Fingerprint Cards AB

- M2SYS Technology

- Infineon Technologies AG

- Entrust Corporation

- ImageWare Systems Inc.

- Phonexia s.r.o.

- BioID AG

- Crossmatch Technologies Inc.

- Hitachi Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government-backed National e-ID Programs Across Asia

- 4.2.2 EMVCo and ISO Standards Catalyzing Fingerprint Payment Cards in North America and Europe

- 4.2.3 Post-pandemic Demand for Touch-free Physical Access in European Commercial Real-estate

- 4.2.4 U.S. TSA Road-map Driving Federal Procurement Surge

- 4.2.5 China's "Smart Airport 2025" Policy Accelerating Face and Voice Biometrics

- 4.2.6 Biometric KYC Mandates by GCC and African Central Banks

- 4.3 Market Restraints

- 4.3.1 GDPR and BIPA Litigation Risks Curtailing Facial-Recognition Roll-outs

- 4.3.2 Algorithmic Bias Against Dark-Skin Demographics Triggering Procurement Moratoriums

- 4.3.3 CMOS Image-Sensor Shortages Constricting Fingerprint Module Supply

- 4.3.4 Integration and ROI Concerns in South-American Retail Chains

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industry Stakeholder Analysis

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Biometric Modality

- 5.2.1 Physiological Biometrics

- 5.2.1.1 Fingerprint AFIS

- 5.2.1.2 Fingerprint Non-AFIS (Automated Fingerprint Identification System)

- 5.2.1.3 Facial Recognition

- 5.2.1.4 Iris Recognition

- 5.2.1.5 Others (Palm Vein, Hand Geometry)

- 5.2.2 Behavioral Biometrics

- 5.2.2.1 Voice Recognition

- 5.2.2.2 Signature Verification

- 5.2.2.3 Others (Gait Analysis, Keystroke Dynamics)

- 5.2.1 Physiological Biometrics

- 5.3 By Contact Type

- 5.3.1 Contact-based

- 5.3.2 Contactless

- 5.3.3 Hybrid

- 5.4 By Authentication Type

- 5.4.1 Single-factor

- 5.4.2 Multi-factor

- 5.5 By Application

- 5.5.1 Physical and Logical Access Control

- 5.5.2 Time and Attendance Management

- 5.5.3 Payment and Transaction Authentication

- 5.5.4 e-Passport and Border Control

- 5.5.5 Patient Identification and EHR Security

- 5.5.6 Customer On-boarding (eKYC)

- 5.5.7 Public Surveillance and Safety

- 5.5.8 Automotive and Smart Vehicle Interfaces

- 5.6 By End-Use Industry

- 5.6.1 Government and Law Enforcement

- 5.6.2 BFSI

- 5.6.3 Healthcare

- 5.6.4 Consumer Electronics

- 5.6.5 Commercial and Retail

- 5.6.6 Travel and Immigration

- 5.6.7 Military and Defense

- 5.6.8 Automotive

- 5.6.9 Education

- 5.6.10 Others

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Nordics

- 5.7.3.7 Russia

- 5.7.3.8 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 South Korea

- 5.7.4.4 India

- 5.7.4.5 ASEAN

- 5.7.4.6 Australia

- 5.7.4.7 New Zealand

- 5.7.4.8 Rest of Asia Paccific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Israel

- 5.7.5.1.5 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Kenya

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global overview, market overview, core segments, financials, strategic information, market rank/share, products and services, recent developments)

- 6.4.1 Thales Group

- 6.4.2 NEC Corporation

- 6.4.3 IDEMIA France SAS

- 6.4.4 Fujitsu Limited

- 6.4.5 HID Global Corporation

- 6.4.6 Assa Abloy AB

- 6.4.7 Aware Inc.

- 6.4.8 Suprema Inc.

- 6.4.9 Synaptics Incorporated

- 6.4.10 Bio-Key International Inc.

- 6.4.11 Zwipe AS

- 6.4.12 Fingerprint Cards AB

- 6.4.13 M2SYS Technology

- 6.4.14 Infineon Technologies AG

- 6.4.15 Entrust Corporation

- 6.4.16 ImageWare Systems Inc.

- 6.4.17 Phonexia s.r.o.

- 6.4.18 BioID AG

- 6.4.19 Crossmatch Technologies Inc.

- 6.4.20 Hitachi Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment